Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Wisconsin

Related: About this forumScott Walker's budget actually increased taxes and fees

Con artist!!

Scott Walker's budget actually increased taxes and fees! http://jakehasablog.blogspot.com/2015/08/outside-of-super-rich-few-wisconsinites.html?spref=tw … #Wipolitics #wiunion #p2 #Walker16

Tuesday, August 18, 2015

Outside of super-rich, few Wisconsinites will get tax, fee breaks

Even though the state budget was signed over a month ago, there are still recent releases that are putting some of the last-minute tax moves into perspective. The Legislative Fiscal Bureau recently put out its report on tax and fee changes in the 2015-17 state budget, and you will find that Walker’s budget actual did raise net taxes and fees, albeit by a small amount in a total budget of more than $73 billion.

In summary, the changes included in Act 55 [the state budget] would increase net taxes by $19,205,000 ($30,145,000 in 2015-16 and -$10,940,000 in 2016-17) and would increase net fees by $10,046,600 ($4,057,500 in 2015-16 and $5,989,100 in 2016-17). In addition, it is estimated that measures included in AB 21to enhance the collection of current taxes would generate an additional $124,710,000 ($35,270,000 in 2015-16 and $89,440,000 in 2016-17).

The largest share of the fee increases come from $7.7 million in raised admission fees to State Parks, Forests and Trails, along with higher camping fees on those lands. The budget bill also has $1.45 million in additional surcharges/fines that are slapped onto refunds of fraudulent unemployment payments, as well as $1.41 million from a $50 additional surcharge for DUI convictions, which will go to the state’s Safe-Ride Program. Also noteworthy is the largest decrease, a $2.1 million reduction due to a cut of $75 on the fee assessed to health care providers to give data to the Department of Health Services.

As for the $19.2 million in tax "increases" - most of it is actually made up of limitations of certain corporate tax cuts. One is a pause in the Manufacturing and Agriculture Credit, which puts off a cut in that tax rate by 0.501% for this tax year, and adds $16.8 million in revenue for this fiscal year (but has a larger cut coming to make up for it in 2016). Another is $21.8 million resulting from a 2-year delay in a 2014 bill that allowed lenders to get refunds of sales taxes paid in cases of bad debt (seems like a very narrow giveaway). Very few areas in this budget have actual increases in tax rates compared to prior years, but instead are modifications from previous giveaways that have blown such a hole in current and future budgets.

.....................

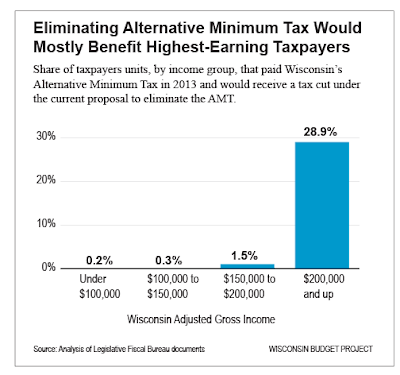

Of course, this AMT tax cut was the fallout from prior WisGOP tax cuts which reduced the rates on upper-income Wisconsinites, forcing many more of these richer Wisconsinites to be susceptible to the AMT. Both I and the Wisconsin Budget Project have previously noted that this “make-up” bill on the AMT ends up almost exclusively helps Wisconsinites who make over $200,000.

1 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Scott Walker's budget actually increased taxes and fees (Original Post)

riversedge

Aug 2015

OP

Angry Dragon

(36,693 posts)1. kick