Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 2 May 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 2 May 2012[font color=black][/font]

SMW for 1 May 2012

AT THE CLOSING BELL ON 1 May 2012

[center][font color=green]

Dow Jones 13,279.32 +65.69 (0.50%)

S&P 500 1,405.82 +7.91 (0.57%)

Nasdaq 3,050.44 +4.08 (0.13%)

[font color=red]10 Year 1.94% +0.04 (2.11%)

30 Year 3.14% +0.05 (1.62%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)but I'm grumpy like that...

Did bad performers really get pulled off stage by a hook or dropped through trapdoors back in vaudeville times?

Answer:yep

http://wiki.answers.com/Q/Did_bad_performers_really_get_pulled_off_stage_by_a_hook_or_dropped_throgh_trapdoors_back_in_vaudeville_times

Demeter

(85,373 posts)The following are from a report published last week by the European Union’s Institute for Security Studies (ISS). They’re projections that assume today’s trends will continue in one direction only — which may not be the case.

1. India will have more people than China.

?9d7bd4

?9d7bd4

2. The richest nations will see their middle classes decline, while the middle classes of all other regions increase.

?9d7bd4

?9d7bd4

3. There will be less oil used and more use of gas & renewables.

?9d7bd4

?9d7bd4

4. The Millennium Development Goals will not be reached on schedule, but poverty will still decline.

?9d7bd4

?9d7bd4

5. Water continues to run dry.

?9d7bd4

?9d7bd4Demeter

(85,373 posts)http://www.nakedcapitalism.com/2012/04/morgan-sandquist-finance-in-denial-the-addiction.html

http://www.nakedcapitalism.com/2012/04/morgan-sandquist-finance-in-denial-an-intervention.html

http://www.nakedcapitalism.com/2012/04/morgan-sandquist-finance-in-denial-conclusion.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

CHOICE BITS:

The largest banks in America–Citibank, Bank of America, Wells Fargo, and others–are probably insolvent. I learned of this from my companions in Occupy Wall Street’s Alternative Banking Working Group. It seems that, based on a host of legal and accounting irregularities, the banks have been able to conceal real and potential losses far larger than their capital reserves. But this has been difficult to confirm.

Isn’t that strange? Wouldn’t the possible insolvency of the core of our banking industry be a matter of nearly universal importance? Shouldn’t we be trying to figure out if this is in fact so, how it came to be, what we’re going to do about it, and how we can prevent its happening again?

Anyone investigating the true health of the banking industry, apparently including regulators, is faced with opacity, complexity, and even outright hostility that stymies all but the most savvy and persistent. Fortunately, people within OWS, including the Occupy the SEC Working Group, are that savvy and persistent. But the reaction of the industry and its partisans to such efforts has included the not-so-subtle suggestion that inquiring into the well-being of the banking industry will somehow cause problems to arise that wouldn’t otherwise exist if we would all just mind our own business....

HIS THEME...BANKING AS AN ADDICTION

Whether or not its participants are thinking in these terms, Occupy Wall Street, to the extent that it can coherently be referred to as an entity, is in many respects functioning as an intervention into the banking industry’s increasingly untenable addiction to money and debt.

The movement’s core values of transparency, sustainability, and nonviolence reflect the clarity, patience, and compassion needed for an effective intervention.

This is not to say that all of the efforts directed at banks by the movement have been magnanimous or constructive. We have to remember the terrible suffering that has been inflicted upon so many and offer that clarity, patience, and compassion not just to the addict, but also to ourselves as intervenors and to everyone who has been affected by the banking industry....Rather than repeating once again our expectations and the banking industry’s failure to meet them, rather than pleading with it to live up to its obligations and do what’s fair, we can speak of the mundane practical details of our life and our children’s lives after its eventual demise, of the specific process by which everything around us will be sold to pay the ruinous debts for which its insurance will prove woefully inadequate.

We can make of the inevitability something tangible, rather than a vague, abstract threat. We can catalog the likely disposition of all of the banking industry’s prized possessions and family heirlooms, the eventual owners of everything it values. We won’t engage in a debate over whether the inevitable will occur, nor will we revel in the justice of it, because we’ll all suffer....

FOR MORE INFORMATION ON THE PHENOMENON OF ADDICTION, I HIGHLY RECOMMEND

ANNIE WILSON-SHAEF'S BOOKLIST, ESPECIALLY WOMEN'S REALITY AND WHEN SOCIETY BECOMES AN ADDICT.

http://www.amazon.com/Anne-Wilson-Schaef/e/B001H6RZ90

ONE LAST BIT

Gil Scott-Heron famously said, “the revolution will not be televised.” I take this to mean that any real, fundamental change to the workings of our society, won’t be an entertainment offered by revolutionaries to the rest of us. It won’t be achieved if we sit home waiting for someone on television, or now the Internet, to present us with a number we can call or text, a petition we can sign, or a ballot we can fill out. Our opinions will effect nothing, and our agreement is neither solicited nor required.

Demeter

(85,373 posts)A significant number of investors are preparing to confront the management of UBS on Thursday by voting against the Swiss bank’s 2011 pay award and denying executives formal approval of their actions

Read more >>

http://link.ft.com/r/J0VG55/30RJAV/OFBYP/979A9J/ZG9FJD/E4/t?a1=2012&a2=5&a3=1

Demeter

(85,373 posts)Ann Arbor was pretty quiet. The graduation cycle started last weekend, so the town is emptying out. And with the construction all around, that's a good thing.

snot

(11,586 posts)Demeter

(85,373 posts)Is that creepy, or what? Sure, advertise that you are available at Death so some sick slob murders you just so he can get your liver or other organ....

Did anybody think this through?

Fuddnik

(8,846 posts)I refuse to visit it.

Tansy_Gold

(18,167 posts)It's just the people on it are weird. ![]()

I resisted the "temptation" for many many months, then finally signed up a year or so ago for business reasons. I found it boring and stupid. How anyone with any semblance of a life could blow hours and hours and hours on it -- as friends of mine reported they did -- was totally incomprehensible.

(I looked for a video of Joanne Worley's "BORING" but couldn't find one. Those who remember, you know what I'm talkin' about. Those who don't, oh well.)

Fuddnik

(8,846 posts)The first thing that popped up was a list of people I might want to be friends COMPLETE WITH PICTURES!!!! And some of them didn't even have Facebook accounts! And how the fuck did they know that I even knew these people? Did they send a bot through my address book?

I closed that account right away. Which they make very, very hard to do. They want you to deactivate the account so that it stays there. It's a much longer process to delete the account.

Screw them. If I want to share all of my personal information with the world, I'll rent a billboard.

TalkingDog

(9,001 posts)with a gmail account. And list yourself as being from somewhere interesting, like...say.... Antarctica.

I contact folks I WANT to friend, explain that I have privacy "issues" and ask them to friend me on facebook. Given that I'm a hermit who likes it that way, but still wants to know if my relatives are healthy and living, it's a good thing.

Or, at the very least, a less bad thing.

DemReadingDU

(16,002 posts)and got an error message that It didn't sound like a real person. LOL

But I could contact Facebook if it truly was real name and they might allow it.

TalkingDog

(9,001 posts)that sounds, though I'm sure somebody somewhere is named Apples. Sioux Tailor is another. RedDirt LoveGoddess is the least real sounding of all; but then again, that might just be "her"![]() ?) real name.

?) real name.

What bird did you try to sign up under?

Demeter

(85,373 posts)her legal name was (I'd better not mention it) Suffice it to say, it was probably a nut tree.

DemReadingDU

(16,002 posts)I think this is a recent Facebook change that only real people names can be setup.

P.S.

I tried to sign up under the town where I live for my first name and the picture of my avatar for my last name.

TalkingDog

(9,001 posts)First a Gmail account...

Then Facebook....

Nope, no problem. Audi Chiffon now has a facebook account.

So.... something offbeat but not too obvious.

DemReadingDU

(16,002 posts)Demeter

(85,373 posts)AnneD

(15,774 posts)but I am with you on that one Fudd. I refuse to use Google as much as possible too. I don't want my voice recognized, my where about know, or any other information known. My business and life are my own. I can make my own friends thank you very much. That's like giving up home cooked food for fast food-and one fast food place at that. Thanks but no thanks.

I just love to take the battery out of my cell phone. The more complicated the plumbing, the easier it is to stop up the drain.

Look for me to go off the grid when I retire.

Warpy

(114,506 posts)because my searches are so incredibly oddball--sometimes just looking for the correct spelling of a really obscure word--that they don't know if I'm male or female. They suspect an interest in politics but that's about it.

If I had a cell phone, the thing would sit without its battery unless I were taking a long road trip.

Po_d Mainiac

(4,183 posts)What FarceBook does with your info is even creepier.

hamerfan

(1,404 posts)But this one ain't bad:

Fuddnik

(8,846 posts)Demeter

(85,373 posts)did somebody actually pay money to broadcast that?

Demeter

(85,373 posts)Goldman Sachs, the most powerful investment bank on Wall Street, is getting into the social media game. In a job posting on the company website, the bank said the ideal candidate will be responsible for “monitoring online conversations and participating in those conversations to build brand visibility and thought leadership.” It’s just the latest step in an image campaign launched by newly-installed PR honcho Jake Siewert designed to rehabilitate the company’s image after years of public scorn in the wake of the financial crisis.

Last week, Goldman CEO Lloyd Blankfein (above) hit the business news circuit for the first time in two years, with appearances on CNBC and Bloomberg TV. Blankfein, who was paid $16.2 million last year, acknowledged that Goldman Sachs needs to burnish its public relations outreach. “Obviously it’s occurred to us that we haven’t gotten anything, er, everything right with respect to how we, how we’ve dealt with the public,” Blankfein told CNBC in comments cited by the New York Post.

It’s been a rough few months for Goldman. Six weeks ago, a young Goldman Sachs employee named Greg Smith wrote a scathing resignation op-ed in The New York Times decrying his firm’s “toxic culture,” and alleging that senior Goldman bankers had disparaged clients — supposedly the company’s number one priority — by calling them “muppets,” a pejorative terms used in Britain to describe stupid people. Speaking to CNBC, Blankfein said an internal investigation hadn’t uncovered any examples of client-abuse, and added that “we wouldn’t have the clients we have if we were anti-client.”

(More: Former Wall Street Data Scientist: “I felt like I was doing something immoral.”)

Siewert, a former Treasury Department official and Alcoa executive, was hired in March to replace Goldman’s legendary, outgoing PR chief Lucas van Praag. Siewert clearly has his work cut out for him, and social media is a good place to start — as any communications pro knows, it’s become an essential tool for brand-management and public outreach. According to the job description, first noticed by the FT‘s Alphaville blog, the successful candidate will, “Create and maintain Content Calendars, including writing Facebook Status Updates, Twitter posts, and LinkedIn group management.” Goldman’s new social media manager is going to have to get up to speed quickly — the bank hasn’t even sent one tweet from its official account yet — so we’ve taken the liberty of suggesting some Twitter accounts for the successful applicant to follow.

Read more: http://business.time.com/2012/05/01/7-twitter-accounts-goldman-sachs-new-social-guru-must-follow/#ixzz1tiO3PmYW

Warpy

(114,506 posts)You can murder somebody who looks just like you and end up with an organ that would kill you if they tried to transplant it into you. Tissue matching is a lot more complicated than just blood type.

Killing somebody for their organs doesn't work unless you've managed to sample their blood and DNA for a match some months before and that's not easy to do.

The whole FB thing is to get people to change their status on their driver's licenses through peer pressure. It's a creepy way to do something good.

(It would serve somebody right if they killed me for my liver. My liver (or any other organ or tissue) would pretty efficiently kill them within a year)

Demeter

(85,373 posts)There are no limits anymore.

DemReadingDU

(16,002 posts)I am thinking at my next driver-license renewal to remove the organ status symbol.

Warpy

(114,506 posts)It's more likely to go to someone with viral cardiomyopathy.

Please keep yourself in the donor pool if you can.

My frustration is that I'm a corneal transplant recipient but absolutely cannot donate any organs or tissues, myself.

Po_d Mainiac

(4,183 posts)They get the Chronic Lymphoma at no extra charge!![]()

Po_d Mainiac

(4,183 posts)Warpy

(114,506 posts)Po_d Mainiac

(4,183 posts)Warpy

(114,506 posts)and it's done through the organ registry with all parties tissue typed beforehand. However, it does decrease the waiting time for organs if you can find someone willing to give up a kidney or lobe of their liver for you.

Tissue typing takes time, in other words, and lends itself poorly to murder for organs since it must be done through channels.

BTW, Cheney was not part of an organ swap. You have to be nearly dead to donate a heart.

Darn the luck.

Po_d Mainiac

(4,183 posts)FarceBook ain't confined to the US.

http://news.upickreviews.com/8-countries-where-human-organs-are-harvested

Warpy

(114,506 posts)Demeter

(85,373 posts)For all the handwringing at the time, Nato’s assault on Muammar Gaddafi came off pretty well. In the end, the allies pushed Libya’s megalomaniacal strongman from power without a single US or European casualty, and compared with the wars in Iraq and Afghanistan, it didn’t cost very much, writes Ian Bremmer.

Read more >>

http://link.ft.com/r/DHGUVV/XHIYHF/CWSVD/7AEVEQ/XHEJYI/QR/t?a1=2012&a2=5&a3=1

TOO BAD GADDAFI PUT HIS FRANCS ON SARKOMA; TALK ABOUT A KNIFE IN THE BACK!

Demeter

(85,373 posts)Bolivia is nationalizing the local assets of Spain’s Red Electrica Corp. (REE), giving the government control of the Andean nation’s power grid two weeks after neighboring Argentina seized its biggest oil company. President Evo Morales signed the decree today, saying the Alcobendas, Spain-based company’s local investment was inadequate and energy should be controlled by the government, according to a statement on the presidential website. Bolivia generated 45.7 million euros ($60.4 million) in revenue for Red Electrica in 2011, less than 3 percent of total company sales.

Morales, a 52-year-old ally of Venezuelan President Hugo Chavez, is echoing Argentine President Cristina Fernandez de Kirchner in citing underinvestment and strategic reasons for nationalizing the company. Fernandez seized oil producer YPF SA on April 16 from Madrid-based Repsol YPF SA. (YPFD) Since taking office in 2006, Morales has taken over gas fields, oil refineries, pension funds, telecommunications companies and a tin smelter to increase state control of the $20 billion economy.

“A sovereign move to seize private assets often doesn’t happen in isolation,” Lawrence Goodman, a former U.S. Treasury official and president of the Center for Financial Stability, a research firm, said by phone from New York. “The energy sector is often an industry that gets targeted for expropriation and we’ve seen it across a wide range of countries.”

...Red Electrica bought the Bolivian company, Transportadora de Electricidad SA, in 2002 from Union Fenosa SA, Spain’s No. 3 generator. Fenosa had bought 69 percent of the Bolivian company in 1997 in a state asset sale. Transportadora de Electricidad serves 85 percent of the Bolivian power market.

“This company was ours before and we are nationalizing what was ours before,” Morales said in the government statement. He ordered the military to stand guard over the company’s assets.

MORE

SO LATIN AMERICA, STEP BY STEP, UNDOES THE IMF-IMPOSED ASSET SALES. SOMEDAY, GREEDY CORPORATIONS WILL LOOK THE IMF GIFT HORSE IN THE MOUTH, AND PASS.

Tansy_Gold

(18,167 posts)Hmmmmmmm.......

Demeter

(85,373 posts)A little less than two years ago, the people of the United Kingdom made an implicit deal with the people of the United States. They installed a government that committed itself to an austerity package as the best way to deal with the ongoing effects of the recession. Rather than trying to boost demand with increased spending or lower taxes, the Conservative-led coalition government committed itself to an agenda of spending cuts and tax increases. The argument was that the financial markets would be impressed by the UK's commitment to reducing its budget deficit. This would supposedly lead to lower interest rates which would help to boost investment, housing and consumption. Lower interest rates should also reduce the value of the pound relative to other currencies. That would make imports more expensive for people in the UK, leading to fewer imports. It would also make exports cheaper for people in other countries, thereby increasing exports. Fewer imports and more exports would provide a further boost to demand. The commitment to deficit reduction was also supposed to instill confidence in business. They would see that the UK had a responsible government in power that would ensure that the debt would not get out of control. This would encourage them to invest, since they could be assured that the UK had a stable future and there was no reason to fear a Greek-style debt crisis.

We have now had almost two years to evaluate the effects of the UK's austerity policy, which is longer than most governments get to test the results of their policy experiments. After all, President Obama got his head handed to him in the November 2010 elections, which were just 20 months after the passage of his stimulus package...It sure looks like the austerity critics won this one. While interest rates have remained low in the UK, this has been true of every wealthy country with its own currency, regardless of whether or not it was pursuing an austerity path...The UK economy does not appear to have done any better in terms of the rest of the picture. If austerity boosted business leaders' animal spirits, it is not showing up in the data. Nearly every component of the private sector has contracted over the past two quarters with construction leading the way, falling at a 0.8 per cent annual rate in the fourth quarter of 2011 and a 12.0 per cent rate in the first quarter of this year.

When taxes rise and government spending falls, and there is no offsetting boost from investment, our old friend Mr Arithmetic tells us that the economy contracts. And that is what is happening now in the UK. The economy shrank for the second consecutive quarter, pushing it back into recession. While the UK economy was growing rapidly at the time the Conservatives came to power in May of 2010, the economy is now smaller than it was in the summer of that year. This is all very bad news for people living in the United Kingdom. There has been no job growth since the summer of 2010 and the unemployment rate has risen from 7.7 per cent to 8.1 per cent in the most recent data. It seems certain to rise more in the months ahead. If anything, the situation is likely to worsen over the course of the year as more of the spending cuts take effect.

But the bad news for the British people can be good news for the United States. Thanks to their generous offer to experiment with austerity, people in the United States can now see more clearly than ever that austerity does not work....But there are many people in positions of power who want to push austerity for reasons that have nothing to do with economic growth - and they are prepared to lie, cheat, and steal to advance this agenda. For this reason, however much we may sympathise with the people of the UK for their suffering, we should be thankful that they have given us such a beautiful example of how austerity wrecks an economy.

******************************************************************

Dean Baker is co-director of the Centre for Economic and Policy Research, based in Washington, DC. He is the author of several books, including Plunder & Blunder: The Rise and Fall of the Bubble Economy, The Conservative Nanny State: How the Wealthy Use the Government to Stay Rich, Get Richer, The United States Since 1980 and The End of Loser Liberalism: Making Markets Progressive. Follow him on Twitter: @DeanBaker13

Demeter

(85,373 posts)I wonder what today will bring?

Demeter

(85,373 posts)The villagers of Halliberu in southern India are on the crest of an electricity revolution. Bangalore-based Simpa Networks Inc. has been installing solar power equipment in their non-electrified houses. From the poorest parts of Africa and Asia to the most-developed regions in the U.S. and Europe, solar units and small-scale wind and biomass generators promise to extend access to power to more people than ever before....In October, Bangalore-based Simpa Networks Inc. installed a solar panel on Anand’s whitewashed adobe house along with a small metal box in his living room to monitor electricity usage. The 25-year-old rice farmer, who goes by one name, purchases energy credits to unlock the system via his mobile phone on a pay-as-you-go model. When his balance runs low, Anand pays 50 rupees ($1) -- money he would have otherwise spent on kerosene. Then he receives a text message with a code to punch into the box, giving him about another week of electric light. When he pays off the full cost of the system in about three years, it will be unlocked and he will get free power.

Before the solar panel arrived, Anand lit his home with kerosene lamps that streaked the walls with smoke and barely penetrated the darkness of the village, which lacks electrification. Twice a week, he trudged 45 minutes to a nearby town just to charge his phone. “Things are much easier now,” Anand says, describing how he used to go through 5 liters (1 gallon) of fuel a month, almost half of it bought from the black market at four times the price of government kerosene rations. “There was never enough.” Anand is on the crest of an electricity revolution that’s sweeping through power markets and threatening traditional utilities’ dominance of the world’s supply. Across India and Africa, startups and mobile phone companies are developing so-called microgrids, in which stand- alone generators power clusters of homes and businesses in places where electric utilities have never operated.

In Europe, cooperatives are building their own generators and selling power back to the national or regional grid while information technology developers and phone companies are helping consumers reduce their power consumption and pay less for the electricity they do use. The revolution is just beginning, says Jeremy Rifkin, a professor at the Wharton School of the University of Pennsylvania and author of The Third Industrial Revolution (Palgrave Macmillan, 2011). Disruptive to the economic status quo, the transformation opens up huge opportunities to consumers who may find themselves trading power in the future much as they swap information over the Internet today, he says.

“This is power to the people,” says Rifkin, who was once best known as a leading opponent of the Vietnam War....India has 30 gigawatts of mainly diesel generators that could be replaced by cheaper solar power tomorrow, says Tarun Kapoor, joint secretary at the Ministry of New and Renewable Energy. (One gigawatt is enough energy to power about 200,000 U.S. homes.)...Within a decade, installing photovoltaic panels may be cheaper for many families than buying power from national grids in much of the world, including the U.S., Japan, Brazil and the U.K., according to data from Bloomberg New Energy Finance. The ultimate losers in this shifting balance of power may be established utilities. They’ve invested billions of dollars in centralized networks that are slowly being edged out of markets they’ve dominated. “Over the next decade, utilities are going to be under a lot of pressure,” says Gerard Reid, a partner and energy banker at London-based investment adviser Alexa Capital. Reid predicts that power prices will come down across Europe as new entrants that create electricity from renewable sources break up traditional utilities’ oligopoly....MORE

Demeter

(85,373 posts)Last edited Wed May 2, 2012, 05:30 AM - Edit history (1)

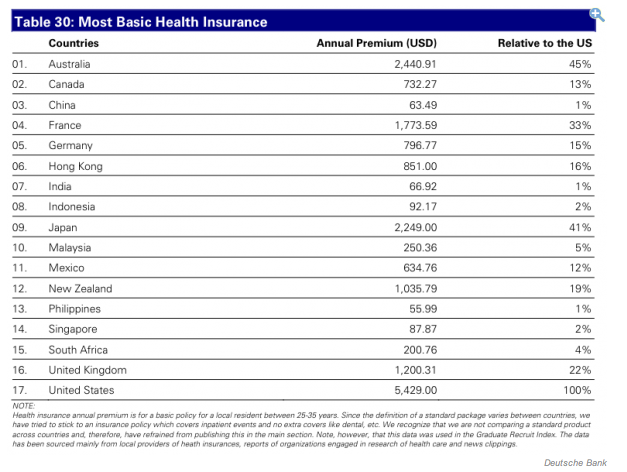

http://www.nakedcapitalism.com/2012/04/how-overpriced-is-us-health-insurance.html

Demeter

(85,373 posts)U.S. consumers and employers will receive about $1.3 billion in rebates from insurance companies this year, according to a new study quantifying a key early benefit of the health care law that President Barack Obama signed in 2010. That will translate to anywhere between a few dollars and more than $150 for nearly 16 million consumers nationwide, the report by the nonprofit Kaiser Family Foundation found.

Obama's health care law requires insurers to spend a minimum portion of customers' premiums on medical care. The provision was championed by consumer groups concerned that companies were hiking premiums to pay for executive salaries, shareholder dividends and other expenses unrelated to customers' care. Starting last year, if insurers fail to meet these targets, known as medical loss ratios, they are required to pay rebates the following year. In some cases, the rebates will go only to employers, which may pass them on to employees as rebate checks.

...The Kaiser study found 486 health plans nationwide that will be required to pay rebates, with the largest number in the so-called individual market serving people who do not get health coverage through work. The report did not identify individual insurers. Nearly a third of all consumers in this market, which is widely seen as more problem-plagued than the market serving employers, will be eligible for a rebate. About a quarter of consumers in the small group insurance market and less than a fifth of consumers in the large group market qualified for rebates. Employers that self-insure are not subject to the new rebate requirement.

The average rebate for enrollees in all individual plans is $127 per person...

Read more here: http://www.mcclatchydc.com/2012/04/26/146914/health-reform-law-to-yield-13.html#storylink=cpy#storylink=cpy

Po_d Mainiac

(4,183 posts)They also have the highest drug pricing..NZ and USA

Demeter

(85,373 posts)Ally Financial Inc, the U.S. government-owned lender, said its mortgage unit could file for bankruptcy, in the company's most direct statement so far about its plans for the struggling business. Ally Chief Executive Michael Carpenter said its Residential Capital LLC unit has been examining options that range from "staying the course" to bankruptcy.

"We think that the single most important thing that we can do to preserve and enhance shareholder value is to distance Ally from the mortgage business," Carpenter said on a conference call with investors after the company posted quarterly earnings.

Sources have told Reuters that bankruptcy was an option for ResCap, possibly as early as mid-May, but the company had previously only hinted at the possibility. An executive said Ally failed a recent test from regulators for soundness in distressed economic situations, known as the Federal Reserve's "stress test," in large part because of liabilities linked to the mortgage business. Ally, which was originally the lending arm of General Motors, said it learned on Wednesday that Chrysler Group LLC was not renewing a preferred lending agreement that will now expire next year, but executives downplayed the importance of that loss on the call.

Ally is 73.8 percent owned by the U.S. Treasury after a series of bailouts spurred by its ballooning mortgage losses. The lender hoped to repay taxpayers through an initial public stock offering, but last year it shelved those plans as problems mounted at ResCap and market conditions deteriorated during the European debt crisis. As in the past, Carpenter emphasized that Ally and ResCap are separate entities and that a ResCap bankruptcy decision would be made by the mortgage unit's board, not Ally's. Sources familiar with the matter said Ally is preparing for a possible bankruptcy filing for ResCap, and that there is pressure to get the filing completed before mid-May, when unsecured notes come due for the unit.

On the conference call, Jeff Brown, Ally's finance and corporate planning executive, said the bank would offer a new capital plan to the Federal Reserve in the next 90 days, after failing the stress test. Ally has two secured lending facilities with ResCap that had $1.2 billion outstanding at the end of 2011, but the parent company feels confident about getting repaid, Brown said. This month, Ally did not renew a $500 million unsecured credit line with ResCap as part of its efforts to reduce mortgage risk, he said....Ally has made progress in shrinking its portfolio of troubled mortgage loans, reducing total assets to $10.5 billion at the end of March from about $19 billion at the end of 2009. But it still faces a slew of lawsuits and other claims related to mortgage-backed securities sold to investors during the housing boom, making it difficult to quantify potential losses. Ally in the first quarter moved to resolve one of its mortgage-related problems by joining four other lenders in a $25 billion settlement over foreclosure abuses. As part of the pact, Ally paid $110 million in penalties and agreed to provide $200 million in loan modifications to struggling borrowers. Ally took a $270 million charge for the settlement in the fourth quarter.

happyslug

(14,779 posts)I have a 680 credit score, and yet Ally bank (Formerly GMAC) gave me a $21,000 loan so I could purchase a new four door Chevrolet Cruze Eco. The computer on the Cruze gives me three ways to look at my fuel consumption, 38 miles to the gallon since the car was new, 40 mpg since my last fill up and 44 mpg over the last 500 miles (I also can look at the last 50 and last 25 miles, but I prefer the last 500 miles).

Any of those mpg standards is better then my old Dodge Dakota and its 18-20 mpg so i have a nice view of Ally Bank (for now, I have faith in banks to do what is NOT in my best interest).

Side note on the Cruze, when Toyata came out with the Prius, the Japanese Government provided funding so the car could be marketable. The reason for this is traditional auto engines use hydraulics to power the power steering, air conditioning etc. In an electric car or a hybrid that sometimes runs on its batteries, you have to use other methods. In the Prius electrical powered power steering was developed along with electrical powered Air conditioning (the money from the Japanese Government help developed these products).

Honda and Ford did NOT have access to government funding for their hybrids, so they used existing models as the base instead of a completely new design like the Prius. Thus forced both to developed the needed electrical A/C and Power Steering to fit inside a body designed for an engine using hydraulics. Can be done, but it is better to design the body and even the engine for such power source shift.

GM, decided to take a third option. Instead of using an existing body for its electrical car (the Volt) GM decided to design a body that could use BOTH a traditional engine and transmission AND an hybrid system. On top of that, to spread out the cost of developing and building an electrical Air Conditioning unit and a Electrical Power Steering unit, GM decided that not only the Volt shall use an electrical Air Conditioning Unit and an electrical Power Steering unit, so would the Conventional powered car.

Thus was born the Cruze. The body designed to take a conventional engine and its hydraulics, but also electrical powered Steering and Air Conditioning. The Cruze LT and LS use a "Conventional" 1.8 liter engine. The Cruze Eco, used a turbo powered 1.4 liter engine. All three have the Electrical Power Steering of the Volt (and I suspect electrical Air Conditioning but I have NOT found confirmation of that). The Eco also has the low resistance tires that are standard on the Volt (California has required all cars to have low resistance tires, the tires on the Eco and the Volt not only match that requirement but exceeded them by a good bit).

Yes, I am a kid with a new toy, but I have to brag about it somewhere,

Demeter

(85,373 posts)How many hours did you devote to this research?

happyslug

(14,779 posts)I know what key words to use and not use when I research what I know something about. I can also dismiss a lot of search results based on past searches (i.e. I can dismiss a lot of net search engine results just by the google snippets). Like anything else the more you do something, the better you get at it.

For example I know auto makers have been looking at electrical power steering and Air Conditioning for at least 20 years, just to take the hydraulics run by the engine off the engine (i.e. reduce the engine more and more to a generator and leave the battery fill in any extra power needed). Hybrids are just electric cars with a gasoline generator (Through you have to careful, I have done enough research to know that the term "Hybrid" has been used for a conventional engine and transmission with an add on electric motor to provide extra power to the conventional engine and transmission). Fancy terms are used for these different forms of "Hybrids" for example:

Parallel hybrid: A hybrid that uses the battery (or other electrical source) to assist the conventional engine and transmission. This gives superior fuel economy on the open highway, but lower fuel economy in urban areas with its stop and go traffic. Honda and Ford (Explorer) hybrids were of this type.

Series Hybrid:A hybrid that uses the battery (or other electrical source) as its primary drive system and any gasoline or diesel engine is just a generator to provide the electrical power. Given that its gasoline or diesel engine can be turned off, its gives better performance in stop and go traffic, but given the greater demand from the gasoline or diesel engine worse performance then a Parallel hybrid system. The Prius and the Volt are of this type.

Both Series Hybrids and Parallel Hybrids are called "Full Hybrids" for both use electrical power to propel the Vehicle.

"Mild Hybrid" is a hybrid that uses its battery to power electrical parts of the car and engine whenever the engine is shut down. GM uses this is their 2007 pick up trucks. The savings in fuel is 10% compared to a conventional pick up (In this system the engine shuts down when NOT needed but the battery is NOT used to drive the car). With a "Mild Hybrid" you do NOT get the fuel savings you get with a "Full Hybrid". but the cost to produce is a lot less (i.e. actually may pay for itself over the life of the vehicle, which is questionable for full Hybrids).

These are just some of the terms used when it come to Hybrid automobiles. One has to be careful. I first ran across the concept in the early 1990s, but then the push was to develop an electric truck with a diesel generator to replace conventional trucks used for deliveries in Tokyo. The pollution in Tokyo was so bad, it was view as a way to reduce pollution by reducing how much fuel was used to propel such trucks in Tokyo. Thus the Japanese interest in Hybrids was and is more a concern directed at pollution then fuel economy (Through the Japanese. accepts the idea that both are related). Pollution is such a concern in Japan (The major concern before the nuclear disaster of last year) that Japan has looked at other ways to reduce emissions, for example a battery powered bus that re-charges itself at every bus stop. An interesting concept, but I suspect conventional Trolly-buses and their overhead wire is more cost efficient.

Just comments on why it took me only about an hour, I have been doing it on the net for almost 15 years, and before that I constantly went to the library and did similar research in the library. I have always (even in grade school) read about various topics, just to keep abreast of those topics and the world as a whole. The constant reading helps my research, for its gives me the background to know what to look for and what to disregard when I am doing research (Helps we when I go to Wikipedia to see if the Wikipedia topic is accurate, most times it is, but sometimes it is not, more do to lack of subject matter then any deliberate error). Thus the reading, including reading what on DU, helps my research, which in turns hopefully helps my comments on DU being helpful to others.

Plus I have been looking for a new car for about five years, my 1995 Jeep Wrangler died in 2011 (Inspection time, to pass inspection it needed $2000 in repairs to pass inspection, for a vehicle with an excellent engine and transmission but with wear and tear, a 250,000 miles on the odometer and up to another $2000 in repairs needed to get it up to "Good Condition" through this second set of $2000 in repairs were NOT needed to pass inspection). I had wanted to trade it in in 2008 under the Cash for Clunkers program, but no one would approve me for a loan, so kept the Wrangler till it died in 2011. Since that time I have been driving a 2007 Dodge Dakota which gets 17 mpg. Thus when I went on line and Ally Bank APPROVED me for a loan I went for it. I have been looking for something that could do better then 18mpg since 2008 and thus the Cruze Eco was on on short list. When approved I jumped. The dealer was surprised that Ally bank would approved someone with a Credit Score of 680, but Ally bank (Formerly GMAC) did and I have a new car.

DemReadingDU

(16,002 posts)Demeter

(85,373 posts)Sweatshop labor is back with a vengeance. It can be found across broad stretches of the American economy and around the world. Penitentiaries have become a niche market for such work. The privatization of prisons in recent years has meant the creation of a small army of workers too coerced and right-less to complain. Prisoners, whose ranks increasingly consist of those for whom the legitimate economy has found no use, now make up a virtual brigade within the reserve army of the unemployed whose ranks have ballooned along with the U.S. incarceration rate. The Corrections Corporation of America and GEO, two prison privatizers, along with a third smaller operator, G4S (formerly Wackenhut), sell inmate labor at subminimum wages to Fortune 500 corporations like Chevron, Bank of America, AT&T, and IBM. These companies can, in most states, lease factories in prisons or prisoners to work on the outside. All told, nearly a million prisoners are now making office furniture, working in call centers, fabricating body armor, taking hotel reservations, working in slaughterhouses, or manufacturing textiles, shoes, and clothing, while getting paid somewhere between 93 cents and $4.73 per day.

Rarely can you find workers so pliable, easy to control, stripped of political rights, and subject to martial discipline at the first sign of recalcitrance — unless, that is, you traveled back to the nineteenth century when convict labor was commonplace nationwide. Indeed, a sentence of “confinement at hard labor” was then the essence of the American penal system. More than that, it was one vital way the United States became a modern industrial capitalist economy — at a moment, eerily like our own, when the mechanisms of capital accumulation were in crisis.

A Yankee invention

What some historians call “the long Depression” of the nineteenth century, which lasted from the mid-1870s through the mid-1890s, was marked by frequent panics and slumps, mass bankruptcies, deflation, and self-destructive competition among businesses designed to depress costs, especially labor costs. So, too, we are living through a twenty-first century age of panics and austerity with similar pressures to shrink the social wage. Convict labor has been and once again is an appealing way for business to address these dilemmas. Penal servitude now strikes us as a barbaric throwback to some long-lost moment that preceded the industrial revolution, but in that we’re wrong. From its first appearance in this country, it has been associated with modern capitalist industry and large-scale agriculture. And that is only the first of many misconceptions about this peculiar institution. Infamous for the brutality with which prison laborers were once treated, indelibly linked in popular memory (and popular culture) with images of the black chain gang in the American South, it is usually assumed to be a Southern invention. So apparently atavistic, it seems to fit naturally with the retrograde nature of Southern life and labor, its economic and cultural underdevelopment, its racial caste system, and its desperate attachment to the “lost cause.”...As it happens, penal servitude — the leasing out of prisoners to private enterprise, either within prison walls or in outside workshops, factories, and fields — was originally known as a “Yankee invention.” First used at Auburn prison in New York State in the 1820s, the system spread widely and quickly throughout the North, the Midwest, and later the West. It developed alongside state-run prison workshops that produced goods for the public sector and sometimes the open market.

A few Southern states also used it. Prisoners there, as elsewhere, however, were mainly white men, since slave masters, with a free hand to deal with the “infractions” of their chattel, had little need for prison. The Thirteenth Amendment abolishing slavery would, in fact, make an exception for penal servitude precisely because it had become the dominant form of punishment throughout the free states. Nor were those sentenced to “confinement at hard labor” restricted to digging ditches or other unskilled work; nor were they only men. Prisoners were employed at an enormous range of tasks from rope- and wagon-making to carpet, hat, and clothing manufacturing (where women prisoners were sometimes put to work), as well coal mining, carpentry, barrel-making, shoe production, house-building, and even the manufacture of rifles. The range of petty and larger workshops into which the felons were integrated made up the heart of the new American economy. Observing a free-labor textile mill and a convict-labor one on a visit to the United States, novelist Charles Dickens couldn’t tell the difference. State governments used the rental revenue garnered from their prisoners to meet budget needs, while entrepreneurs made outsized profits either by working the prisoners themselves or subleasing them to other businessmen.

AND HISTORY IS REPEATING ITSELF...MUCH MORE AT LINK

Demeter

(85,373 posts)More than 1 million Americans who have taken out mortgages in the past two years now owe more on their loans than their homes are worth, and Federal Housing Administration loans that require only a tiny down payment are partly to blame. That figure, provided to Reuters by tracking firm CoreLogic, represents about one out of 10 home loans made during that period. It is a sobering indication the U.S. housing market remains deeply troubled, with home values still falling in many parts of the country, and raises the question of whether low-down payment loans backed by the FHA are putting another generation of buyers at risk.

As of December 2011, the latest figures available, 31 percent of the U.S. home loans that were in negative equity - in which the outstanding loan balance exceeds the value of the home - were FHA-insured mortgages, according to CoreLogic. Many borrowers, particularly since late 2010, thought they were buying at the bottom of a housing market that had already suffered steep declines, but have been caught out by a continued fall in prices in wide swaths of America. Even for loans taken out in December - less than four months ago and the last month for which data is available - nearly 44,000 borrowers, or about 7.5 percent of the total, now find themselves under water.

"The overwhelming majority of the U.S. is still seeing home prices decline," said CoreLogic senior economist Sam Khater. "Many borrowers continue to be quickly wiped out."

The problem is not uniform around the country. In some areas, such as Washington, D.C., Miami and parts of northern California, prices are on the rise. CoreLogic predicts the overall U.S. housing market will finally bottom out this year. And the number of homeowners falling under water each month has decreased significantly since the peak of the financial crisis in 2008 and early 2009.

......

CoreLogic says a significant factor causing recent home loans to slide under water has been the availability of government-insured mortgages that require only a small down payment. These loans, insured by the FHA, require a down payment of as little as 3.5 percent of the purchase price, providing only a small cushion of protection against a drop in home prices that could drive a borrower into negative equity.

"This is creating a new wave of underwater borrowers," said Gary Shilling, a veteran financial analyst and well-known housing market bear. "We have all three branches of government trying to keep people in four bedroom houses who can't afford chicken coops."

Po_d Mainiac

(4,183 posts)Which have all been wrong to date.

Simple math: Average home prices cannot hold a sustained level above 3.5X average yearly income

AnneD

(15,774 posts)we cannot have true price discovery. And without true price discovery, there is no free market.

And until wages and real estate reach (and hold) the affordability ratio, no one can accurately call in the bottom.

AnneD

(15,774 posts)and those buying homes will still risk being fleeced.

Demeter

(85,373 posts)Avoid those two pitfalls, and toxic waste sites, and you're probably going to do all right.

AnneD

(15,774 posts)1) Clear title with title insurance.

2) Water close by and water rights. Good amount of rainfall helpful and moderate temp.

3) Site history-No toxic waste, no fracking close to aquifer.

4) Surrounded by National Forest- in my dreams.

We are saving up to pay cash out right or by from titled individual to skirt any problems with the banks. If financing is needed, we go through the Credit Union but only after I ask lots of questions

Demeter

(85,373 posts)Come join the Youpers! I already have a sweatshirt for it!

Po_d Mainiac

(4,183 posts)As long as an occassinal -35degF is within your "moderate temp" range.

In this part of the world, there ain't no such things as water rights. If it's inside your boundary footprint, it belongs to you.

Demeter

(85,373 posts)As student loan debt passed the $1 trillion mark, President Obama, speaking at Chapel Hill yesterday, called the upcoming interest rate hike on student loans a tax. He didn’t tell the half of it. Congress’ dirty secret is that the government makes a huge annual profit on student loans. According to the scrupulously nonpartisan Congressional Budget Office, $37 billion will flow IN to Treasury from student loans made this fiscal year at the 3.4% rate (on a net present value basis and net of about $1.5 billion to administer them.) The President’s current dispute with Congressional Republicans is about whether to increase this annual profit next year. The interest rate that students pay on the basic “subsidized” loan is slated to rise from 3.4% this year to 6.8% next year, unless the lower rate is extended by Congress.

How does the government profit from student loans? In two words, yield spread.

Treasury can borrow money at 0.5% or less, and lends it to students at 3.4%. Administrative costs are well below 1%. Prepayment risk is minimal; repayment stretches over many, many years, and the yield spread just keeps on coming. Interest rate risk is also minimal, given that Treasury can issue debt in a range of maturities.

What about the credit losses, you ask? While many loans go into default (about 10% projected for 2013 loans), credit losses are relatively modest. The Education Department assumes it will collect between 75% and 80% of defaulted loans (on a discounted NPV basis), using its supercreditor powers, especially wage garnishment and tax refund intercepts. There is no statute of limitations on student loans, and even bankruptcy discharge is difficult. The $37 billion Treasury profit for FY2012 is after allowing for estimated credit losses in the $5 billion range.

Treasury even profits on the loans made by banks and guaranteed by the government, although bank loans are costlier and less efficient than direct loans. Guaranteed student loans generate revenue because the guarantee fees paid by lenders to Uncle Sam greatly exceed losses net of recoveries. In other words, if student loan interest rates were set on a break-even basis, they would be much lower, perhaps around 1.5%, albeit rising as Treasury rates rise. Recently adopted loan forgiveness programs, and the expansion of income-based repayment, may increase the cost (or reduce the profit) of the student loan program in the long run, but so far CBO scores those loan modification costs as minimal....

Interest rate policy has huge consequences for the American middle class. Charging an above-cost rate in order to fund Pell grants for low-income students, for example, is justifiable on a theory akin to equity financing of human capital. It is a cross-subsidy from successful college grads to needy college students whose future success is uncertain. A similar case can be made for expanded subsidy and loan forgiveness programs for college graduates in low-paying but socially necessary occupations. On the other hand, the rationale to tax student loan borrowers to fund tax cuts for the wealthy, subsidies for energy and agriculture or other unrelated federal expenditures, is less clear.

Demeter

(85,373 posts)The Trustees Report came out again this week.

And all the newspeople told us again that we are doomed. Doomed.

"Social Security is running out of money!"

Except it isn't.

And all the Professional Defenders of Social Security rushed out to

tell us, "We can save Social Security: just make the rich pay for it!"

Except they won't.

And they really shouldn't. And we shouldn't want them to. Most

workers understand that Their Social Security is Their money. They

paid for it. They need to know that IT'S NOT WELFARE.

But all the paid experts and politicians, and all the high end

newssources can only think in terms of welfare. So the Bad Cop says

we got to cut it. And the Good Cop says we got to make the rich pay

for it.

But actually all we really need to do is just pay for it ourselves...

as we always have.

It wont cost much. An additional 40 cents per week each year will

pay for the whole "shortfall."

You don't have to take my word for it. The Congressional Budget

Office says the same thing. A CBO Study: Social Security Policy

Options, July 2010, Option 2 (page 17) says "Increase the Payroll

Tax Rate by 2 Percentage Points Over 20 years... this option would

raise the combined payroll tax rate gradually, by 0.1 percentage

point (0.05 percentage points each for employers and employees) every

year from 2012 to 2031... This option would extend the trust fund

exhaustion date to 2083."

Please note that while the tax would be increasing at one tenth of

one percent per year... combined... wages would be increasing over

one full percent per year. So in today's terms the tax for the

employee would increase by 40 cents per week (and another 40 cents

for the employer), while wages are going up eight dollars per week

each year.

CBO Option 3 would Increase the Payroll Tax Rate by 3 Percentage

Points Over 60 years. This would be a twenty cents per week increase

in the tax each year for the employee and the employer.

With both of these Options it is likely that a similar increase would

need to be enacted at the end of the twenty, or sixty, year period.

This is unlikely to be a problem after people have seen that a

gradual increase is not a "burden." In fact it is unlikely they will

even notice it. Nor will the increases continue forever. The

Trustees Projection is that the need for increases will flatten and

fall to essentially zero after life expectancies stabilize between

2050 and 2070 or so.

Remember it is not a tax going into a government black hole. It is

You saving your own money, protected by "pay as you go with wage

indexing," so that if all else fails you can retire when you need

to. You get your money back with interest in an annuity that will

last the rest of your life. No matter what.

Now here is the hard part for you.

You need to think about this and make sure you understand it. Then I

am going to ask you to sign a petition. Yes, I hate petitions too.

But it's the only way I can think of to spread the word to the people

that they can save their own Social Security for pennies per week.

And not have to turn it into welfare by "raising the cap," or make

it worthless as retirement insurance by cutting benefits, means

testing, or raising the retirement age.

The petition calls for enactment of CBO Option 2 or 3. It is not so

important exactly which of these is enacted, or some variation. What

is important is that people learn how cheap it would be for them to

save their own Social Security. They won't learn it from the media,

the politicians, or the experts.

Please visit http://signon.org/sign/fix-social-security-with?

source=s.em.cp&r_by=4120788 and sign the petition. Then, and I know

this is an imposition, ask your friends to read this and talk about

it, and sign the petition.

Thanks!

EXCELLENT COMMENTS AT LINK, TOO

Demeter

(85,373 posts)President Barack Obama made an unannounced visit to Kabul to put pen to a deal on keeping US forces in the country until 2024

Read more >>

http://link.ft.com/r/TWK799/16SJ0O/Z87P0/SPCNCQ/DWGC5B/FW/t?a1=2012&a2=5&a3=2

THERE YOU HAVE IT, FOLKS.

TWELVE MORE YEARS! TWELVE MORE YEARS!

Demeter

(85,373 posts)NOT FOR THE FAINT OF STOMACH

Demeter

(85,373 posts)http://www.correntewire.com/we_have_the_most_vile_and_degraded_political_discourse_in_the_history_of_the_world#more

From Pravda, the headline:

Obama strategy of taking credit for Osama bin Laden killing risky, observers say

And why, you ask?

President Obama has placed the killing of Osama bin Laden at the center of his reelection effort in a way that is drawing criticism for turning what he once described as an American victory into a partisan political asset.

OH GAWD! I CAN'T TAKE IT! I WANT TO CLAW OUT MY EYEBALLS!

Not that killing an unarmed man was evil, no no.

Not that killing an unarmed man was stupid, because putting him on trial would have been better, no no.

Not that killing an unarmed man is stupid and evil, because killing Bin Laden, unarmed, and then dumping his body into the ocean created more Bin Ladens and made the country less safe, no no.

NO! WHACKING OBL AND THEN TURNING IT INTO A CAMPAIGN TALKING POINT IS WRONG, BECAUSE IT ISN'T BIPARTISAN!!!!

I'm gonna have a stroke before this campaign is over, I'm tellin ya. I just hope I go quickly.

Fuddnik

(8,846 posts)I usually catch a couple of political shows in the evening. Then I woke up last Tuesday night having nightmares of Mitt Romney sound bites. If that wasn't bad enough, that afternoon, two Mormons showed up on my doorstep. They scurried off when I proclaimed "Praise Satan! The dog food has arrived!". That night, more nightmares.

So, the last few nights, I've cuddled up with a bottle of vodka, and the Tansy Gold recommended "Idiot America", which had been gathering dust on my bookshelf for over a year.

Demeter

(85,373 posts)I hope you gave them some extra love for such a vile threat!

Po_d Mainiac

(4,183 posts)DemReadingDU

(16,002 posts)Tansy_Gold

(18,167 posts)A long-ago friend used to tell the proselytizers that he was a Reformed Druid. When asked what the "Reformed" entailed, he replied, "Oh it means we no longer practice human sacrifice -- unless absolutely necessary."

bread_and_roses

(6,335 posts)Demeter

(85,373 posts)The groups have criticised a plan to limit banks’ exposure to each other, warning it could cost up to 300,000 US jobs and roil Japanese bond markets

Read more >>

http://link.ft.com/r/H60H77/0899QJ/06MUC/JELYLZ/ORMKFR/36/t?a1=2012&a2=5&a3=2

ANYBODY HAVE ANY IDEA WHAT THIS IS ABOUT?

Demeter

(85,373 posts)The culture of Wall Street is pervasive and contagious. I drank the Kool Aid. I'm out of it now. But I'd like to tell you what it was like....Before I occupied Wall Street, Wall Street occupied me. What started as a summer internship led to a seven-year career. During my time on Wall Street, I changed from a curious college student full of hope for my future into a cynical, bitter, depressed, and exhausted "knowledge worker" who felt that everyone was out to screw me over... When you are wealthy and successful, you have a choice. You can believe your success stems from luck and privilege, or you can believe it stems from hard work. Very few people like to view their success as a matter of luck. And so, perhaps understandably, most people on Wall Street believe they have earned their jobs, and the money that follows. While there are many on Wall Street who come from wealthy backgrounds, there are also many people from very humble backgrounds. In my experience, it is often those who do not come from privilege who are the system's fiercest defenders.

When I was a summer intern, we met with various executives who'd tell us about their careers and pitch us on the firm. The aim was to sell the firm to everyone, even though only a few of us would ultimately be offered full-time positions. There was an element of redundancy to it, since we were clearly already interested in the firm, or we wouldn't be there at all. The effect of these talks, then, was to make a competitive situation even more competitive. Welcome to Wall Street. One executive described the firm as a "Golden Springboard." If we began our careers there, his reasoning went, there wasn't anywhere we couldn't go. The executive was right. Background becomes irrelevant once you have "made it" to Wall Street. Once you've gotten in the door, you're one of "us."

Once hired, the cultural indoctrination begins in earnest, especially for those recent grads who begin their careers in "analyst training programs." These programs are exclusively for college and graduate students, are often several months long, and are custom-tailored to the department you'll ultimately join. The Sales & Trading analyst program is more competitive than, say, the Technology training program. And while most of the training is job-specific, there is also an air of finishing school. A trader friend of mine was instructed not only in the mathematics of the financial markets, but also in wine tasting and golf. You are trained, but you are also groomed. The grooming is not all fun and games and country clubs. Most of the message revolves around how hard everyone works, and how hard you are expected to work in turn. Wall Street views its own work ethic as legendary. Sixty-hour weeks are standard. An ex-boss of mine used to brag that for one six-year stretch he never took a sick day or a vacation. The streak ended when he contracted strep throat, refused to go to the doctor, and eventually had to be hospitalized (at least so he claimed). While not everyone was as manic as my boss (Wall Street has more than its fair share of laziness and incompetence), even those who feel less committed to the job still buy into a concept of "face time." It's not right to leave your desk before a certain time. An ex-colleague of mine used to ask anyone who'd pass by his cubicle before 7pm on their way out the door, "Oh, half day today?"

This dueling masochism/machismo brings with it a tremendous superiority complex. People on Wall Street truly believe they work harder than anyone else. When confronted with the stark reality of, for example, a single mom working two jobs, the response is usually some variant of, "Well, if they'd only worked as hard as I did in school...."...If they didn't know it going in, Wall Street employees quickly learn that even their company is an enemy. To the firm, employees are a cost to be minimized, or a producer to be exploited. You also learn that you must never show gratitude for your bonus. To appear satisfied with your compensation is to admit that they paid you more than they had to, so you must feign outrage no matter what. What happens to a culture that discourages gratitude? But most people on Wall Street do not feel gratitude anyway. It does not matter that their compensation is enormous compared to the average American's--that is not who a Wall Street worker is comparing herself to. She is looking at the compensation of the top sales person, the top trader, or, at the very top, the CEO....

Demeter

(85,373 posts)I was able to leave once I decided that my happiness was more valuable than money. This is no great revelation to anyone at Occupy, but to someone who lived and breathed the idea that money was everything for seven years, it was not so easy. The true key to getting out was taking off my blinders: meeting others who were outside Wall Street's bubble. This was a long process that involved a lot of psyching myself up in order to quit. Wall Street is not an easy place to walk away from. But after a year of planning, I finally submitted my resignation. I now teach computer programming at several venues, including Girl Develop It, which is a group that provides low-cost classes to women (men are welcome, too) in an environment that strives to be non-intimidating.

It is hard to contrast the joy of community I feel at Occupy Wall Street with the isolation I felt on Wall Street. It's hard because I cannot think of two more disparate cultures. Wall Street believes in, and practices, a culture of scarcity. This breeds hoarding, distrust and competition. As near as I can tell, Occupy Wall Street believes in plenty. This breeds sharing, trust and cooperation. On Wall Street, everyone was my competitor. They'd help me only if it helped them. At Occupy Wall Street, I am offered food, warmth and support because it's the right thing to do, and because joy breeds joy.

I was privileged enough to make it in the door on Wall Street, and to get bonuses during my time there. But I never felt as fortunate, or as joyful, as I did the night after the eviction of Occupy Wall Street from Liberty Square, when we had our first post-raid general assembly; when the thousands of supporters who filled the park necessitated three waves of the people's mic; when our voices together echoed not just down the park, but up into the sky as the buildings caused the sound to ricochet off their glass walls.

And so I say to my friends who still dwell behind the Wall: come join us. The spoils of money can never match the joys of community. When you're ready, we'll be here.

Demeter

(85,373 posts)...Switzerland ‘the banking center’ is not the same as Switzerland ‘the nation’ or the Swiss people and their other businesses and lives. And this is the Midas lesson the Swiss people are only now really having to face. As money keeps pouring in to Switzerland, the currency is no longer moving as much as it did before, but prices are. Not a problem for the banks and their super wealthy clients. But becoming a serious problem for everyone else. In some of the wealthies parts of Switzerland, like Zurich and Lugano, a strange thing is happening. It is becoming too expensive for the Swiss. Local consumer and serivce businesses are dying in Switzerland.

Even large industries are finding it hard to stay. Nestle, a name synonymous with Switzerland, ( EDIT – I previously INCORRECTLY wrote..” now headquartered in Luxembourg.” This is not true. It is Nestle Finance International, Nestles’ corporate financing arm which is incorporated in Luxembourg) Last year I think it was, Novartis cut 2000 jobs and moved most of them to China. Rumour is that more will go soon. Yesterday Merck announced it was leaving Geneva.

Switzerland has the Midas Touch and is choking on it. Small businesses, particularly those which cater for tourists are finding there are fewer. Sure, the super rich are still coming. In the exclusive hotels there are often more Russian conversations than Swiss ones. But outside the charmed circle, businesses which catered for more ordinary tourists and more ordinary businessmen and women are finding those people just can’t afford to spend in Switzerland. Even the Swiss find it cheaper to shop over the border.

Capital flight to Switzerland is begining to have seriously negative effects on the more ordinary Swiss and on the rest of the Swiss economy. Perhaps even the Swiss, those not sucking on the global banking teet, will come to realize as we already have, that bailing out Europe’s big banks, when the cost is austerity for the rest of us and for the economy we actually live in and depend upon for food and clothes and employment, is not going to save the rest of us. It is and will continue to impoverish us and destroy the real worth of everything it touches....

THE US, HOME OF THE DOLLAR, HAS SIMILAR PROBLEMS...IT'S JUST THAT WE HAVE SO MANY OTHER PROBLEMS GETTING IN THE WAY OF SEEING THIS ONE...

Demeter

(85,373 posts)Well, I’ve got a suggestion for how to make up for “drop in mail volume due to e-mail” :

- I would like it if the US Post Office could set up an email server with the same privacy guarantees that we have with the US Mail.

- Require warrants to open and access messages, attachments and contact lists (for starters).

- Forbid harvesting messages, attachments and contact lists (for starters) for marketing research.

- I would pay a reasonable price for this service.

And this is just the start. They could provide VoIP, video & instant messaging. The Post Office could be the department that manages and maintains a high grade Public Internet. They could provide cell phone service. They could provide printing and delivery services — messages or attachments could be printed on postcards or some kind of security stationary at the Post Office closest to destination and then delivered in hard copy to the recipient — bridging the distance between traditional mail and email. And, hey! They already have the delivery part covered, don’t they?

The key element to all of these services is that just as with the physical documents delivered by the Post Office our digital documents would be protected by the sort of privacy we grew up expecting — and have been denied until now with our digital communication.

I never understood why public Internet services had to be delivered and controlled by private corporations — ESPECIALLY email. Now is the perfect time to start making our United States Postal Service relevant, useful AND profitable.

AND THAT, MY DEAR, IS YOUR PROBLEM...YOU KNOW NEITHER BIG BUSINESS NOR BIG GOVERNMENT IS WILLING TO GIVE UP THAT MUCH POWER OVER THE PEOPLE AND THEIR LIVES AND POCKETBOOKS! IT'S ALL ABOUT POWER, AS IN, WE DON'T USE WHAT WE HAVE, AND SO WE ARE LOSING IT. THE ELITES HAVE DECIDED: THE PEOPLE (99%) ARE TO HAVE NEITHER PROFITS NOR PRIVACY.

THIS IS AN EXCELLENT PROJECT FOR THE OCCUPYING FORCE, BY THE WAY

Demeter

(85,373 posts)Wen Jiabao, China's premier, said recently that 'our banks earn profit too easily—because a small number of large banks have a monopoly position'. But his comments are not really about weaknesses in the financial system but about how China’s economic system secures and channels resources to serve the state. And the state appears increasingly out of sync with what is needed to serve the private sector.

Read more >>

http://link.ft.com/r/IOCBMM/KQVA13/CWSVD/WTZHEK/JEVWEC/PJ/t?a1=2012&a2=5&a3=2

BUT, BUT , BUT...IT'S THE AMERICAN WAY! CIRCA 2000, THAT IS.

Demeter

(85,373 posts)THIS IS AN EXPLORATION OF ECONOMICS IN ACTION...PRESENTED IN A CHILD'S FABLE FORM

IT'S VERY LONG, AND SOMETIMES A BIT BORING, BUT IF YOU HAVE THE TIME TO GET THROUGH IT, THERE'S SOMETHING TO LEARN.

http://neweconomicperspectives.org/2012/04/the-astonishing-case-of-the-impenetrable-zero-bound.html

xchrom

(108,903 posts)

only i'd probably spell it Sonny Mourning.

Demeter

(85,373 posts)xchrom

(108,903 posts)It's what the weather is like.

Although - now that you mention it - I have friends who describe me as a Bitter Queen.

I of course take Dramatic Umbrage to that description

I am a Reality Based Queen.

xchrom

(108,903 posts)The Spanish IBEX 35 is getting absolutely destroyed this morning, after starting the day on a positive note.

It's now down nearly 2.6 percent. The Italian FTSE MIB is not far behind, down nearly 2 percent. Surprisingly, the CAC 40 is holding onto early gains despite some dismal PMI numbers—it's still in the green for the day at 0.5 percent higher.

Check out the IBEX 35 so far today:

UPDATE: The IBEX 35 extended losses right after today's dismal U.S. ADP jobs report, and is now off a full 3 percent.

Both the CAC 40 and the German DAX remain in the green.

Read more: http://www.businessinsider.com/spain-is-getting-destroyed-2012-5#ixzz1tiP2fr5M

Read more: http://www.businessinsider.com/spain-is-getting-destroyed-2012-5#ixzz1tiOoJaG6

Tansy_Gold

(18,167 posts)

xchrom

(108,903 posts)DemReadingDU

(16,002 posts)Not sure, but maybe he closed it down. I can't find anything about it on the web

Hugin

(37,622 posts)The local area McD's have recently begun sponsoring a decidedly Right Wing radio propaganda (in the guise of "news"![]() "break" in the mornings on a local radio station. (A radio station that is primarily music, BTW.)

"break" in the mornings on a local radio station. (A radio station that is primarily music, BTW.)

As a regular customer and a stock holder... I'm going to call them on it.

They SHOULD.STAY.OUT.OF.PARTISAN.POLITICS. It's bad for business.

A little deeper look into this "news break" has shown it's unquestionably a Koch operation. I thought McD's was moving away from ALEC. Apparently, not.

![]()

Demeter

(85,373 posts)I think that applies to the 99%. We can take the punches from the 1%, and come back for more, and more, and more...until we get serious...

A guy works in the circus, following the elephants with a pail and shovel. One day, his brother comes to see him. He says, “Sam, I’ve got great news. I’ve got you a job in my office. You’ll wear a suit and tie, work regular hours, and start at a nice salary. How about it? Sam says, “What? And give up show business?"

As long as people search for El Dorado, they will destroy Reality.

xchrom

(108,903 posts)Roland99

(53,345 posts)Is there like a DU activist corps up here. I know the old DU had something like that...

Was more of a listing of resources for how to get the word out.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)IMO, THEY ALL ARE. IT JUST DEPENDS WHICH ONE THE GREAT WHITE SHARK (JPMORGAN) DECIDES TO EAT FIRST...AND THE LITTLE REMORA (OR VAMPIRE QUID) GETS TO EAT THE CRUMBS....

http://www.nakedcapitalism.com/2012/05/is-wells-fargo-a-lehman-in-the-making.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Banking maven Chris Whalen has a must-read piece on the reckless real estate risk taking underway at Wells Fargo, the sanctimonious #4 bank. While I sometimes take issue with Chris on his readings on capital markets related businesses, he is solid on his knowledge of traditional banking and also has access to very good intelligence in that arena.

Thanks to the crisis just past, we tend to think of banks as creating danger to bystanders via their over-the-counter trading operations: securitizations, CDOs, derivatives, all that stuff that is now loosely termed as “shadow banking.” But the US crisis prior to that was the S&L and the less widely recognized LBO debt meltdown of the early 1990s, both traditional bank lending. Even though economists airily wave it away as damaging but not catastrophic, it didn’t look that way at the time. Citibank nearly failed and the entire banking sector was really wobbly. Greenspan engineered an extremely steep yield curve to help banks earn their way out of the hole faster.

Wells is in the awkward position of being a monster traditional bank, when its big retail bank competitors, Citi, Bank of America, JP Morgan Chase, also have substantial capital markets businesses. Citi has long had a leading foreign exchange and money markets business, and has a corporate cash management operation which in and of itself makes it too complicated to fail. Bank of America absorbed Merrill. JP Morgan, in addition to having a large investment banking business, also has a huge derivatives/tri party repo clearing business. That means they have more diversified sources of earnings.