Economy

Related: About this forumWeekend Economists Lost in Space (and Time) May 11-13, 2012

Does anybody remember what I was going to do this weekend? Sigh. I checked back through several postings, and couldn't find it. The last two weeks have been so non-routine that my brains are scrambled. The Kid hasn't been helping, either. The more I do for her amusement, the more she demands. No gratitude.

Well, the latest bomb went off this week. Two bombs, actually, maybe 4 if you count Spain and France. Greece and JPMorgan still take the spotlight, though. There's a word for this situation, and it isn't a nice one.

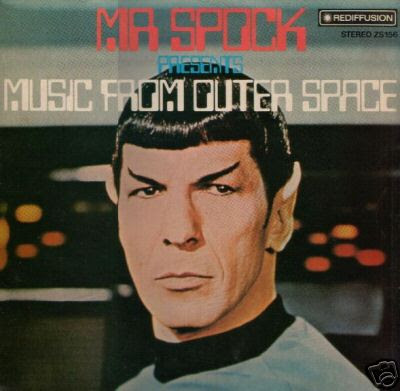

So let's escape this weekend--as far as the mind can go! That's right, outer space...way way out.

This is a Kurt Weill classic tune, sung by a not-so-classic singer...

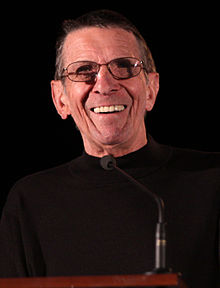

Leonard Simon Nimoy (play /ˈniːmɔɪ/ NEE-moy; born March 26, 1931) is an American actor, film director, poet, musician and photographer. Nimoy's most famous role is that of Spock in the original Star Trek series (1966–1969), and in multiple film, television, and video-game sequels.

Early life

Nimoy was born in Boston, Massachusetts in the West End, to Yiddish-speaking Orthodox Jewish immigrants from Iziaslav, Soviet Union (now Ukraine). His father, Max Nimoy, owned a barbershop in the Mattapan section of the city. His mother, Dora Nimoy (née Spinner), was a homemaker. Nimoy began acting at the age of eight in children's and neighborhood theater. His parents wanted him to attend college and pursue a stable career, or even learn to play the accordion—which, his father advised, Nimoy could always make a living with—but his grandfather encouraged him to become an actor. His first major role was at 17, as Ralphie in an amateur production of Clifford Odets' Awake and Sing!. Nimoy took drama classes at Boston College in 1953 but failed to complete his studies, and in the 1970s studied photography at the University of California, Los Angeles. He has an MA in Education from Antioch College and an honorary doctorate from Antioch University in Ohio.

Nimoy served as a sergeant in the U.S. Army from 1953 through 1955, alongside fellow actor Ken Berry and architect Frank Gehry.

Nimoy began his career in his early twenties, teaching acting classes in Hollywood and making minor film and television appearances through the 1950s, as well as playing the title role in Kid Monk Baroni. In 1953, he served in the United States Army. In 1965, he made his first appearance in the rejected Star Trek pilot, "The Cage", and would go on to play the character of Mr. Spock until 1969, followed by seven feature films and guest slots in various sequels. His character of Spock had a significant cultural impact and garnered Nimoy three Emmy Award nominations; TV Guide named Spock one of the 50 greatest TV characters. After the original Star Trek series, Nimoy starred in Mission: Impossible for two seasons, hosted the documentary series In Search of..., and narrated Civilization IV, as well as making several well-received stage appearances.

Nimoy's fame as Spock is such that both his autobiographies, I Am Not Spock (1977) and I Am Spock (1995) detail his existence as being shared between the character and himself.

Tansy_Gold

(18,167 posts)I don't do recs.

rfranklin

(13,200 posts)I do recs!

Demeter

(85,373 posts)Why has the Obama administration so aggressively protected the financial industry from legal accountability?

YOU DON'T BITE THE HAND THAT FEEDS YOU?

Of all the ignominious actions of the Obama administration, the steadfast, systematic shielding of Wall Street from criminal liability is probably the most corrupt in the traditional sense of that word. In Newsweek this week, Peter Boyer and Peter Schweizer have an excellent examination of what happened and why, tying together crucial threads. First they lay out the basic facts, including the core deceit of the President’s campaigning for re-election like he’s some sort of populist crusader:

Obama came into office vowing to end business as usual, and, in the gray post-crash dawn of 2009, nowhere did a reckoning with justice seem more due than in the financial sector. . . . Two months into his presidency, Obama summoned the titans of finance to the White House, where he told them, “My administration is the only thing between you and the pitchforks.” . . .

Candidate Obama had been their guy, accepting vast amounts of Wall Street campaign money for his victories over Hillary Clinton and John McCain (Goldman Sachs executives ponied up $1 million, more than any other private source of funding in 2008). Obama far outraised his Republican rival, John McCain, on Wall Street–around $16 million to $9 million. As it turned out, Obama apparently actually meant what he said at that White House meeting–his administration effectively would stand between Big Finance and anything like a severe accounting. To the dismay of many of Obama’s supporters, nearly four years after the disaster, there has not been a single criminal charge filed by the federal government against any top executive of the elite financial institutions.

“It’s perplexing at best,” says Phil Angelides, the Democratic former California treasurer who chaired the bipartisan Financial Crisis Inquiry Commission. “It’s deeply troubling at worst.”

The Newsweek reporters note that “financial-fraud prosecutions by the Department of Justice are at 20-year lows”; in fact, such prosecutions under Obama “are just one third of what they were during the Clinton administration” — even though the 2008 financial crisis was drowning in financial fraud. Contrast that with the reaction of George H.W. Bush to the much less severe Savings & Loan crisis of the 1980s:

The Newsweek article offers two well-grounded theories for why Wall Street has been so aggressively protected by the DOJ. The first is that Obama filled his highest level Cabinet positions with Wall Street-subservient officials, beginning with Attorney General Eric Holder, who had been working as a highly-paid corporate lawyer for the law firm Covington & Burling, which represents “Goldman Sachs, JPMorgan Chase, Citigroup, Bank of America, Wells Fargo, and Deutsche Bank.” The other top-tier DOJ positions were similarly filled with corporate lawyers from large law firms closely tied to and depended upon the financial industry. The problem is obvious:

Why would top DOJ officials — with bulging bank accounts from prior Wall Street service and, with their elevated status as top DOJ officials, future plans for even more bulging bank accounts upon returning — possibly alienate the very industry that will enrich them by prosecuting its top-level criminals? The full-scale immunity bestowed on Wall Street provides the answer. Then there’s the reliance on Wall Street money for President Obama’s re-election effort. Newsweek notes the multiple investigations that documented numerous criminal acts leading to the financial crisis, including some explicitly incriminating top Wall Street firms such as Goldman Sachs. Anticipating possible indictments, “Goldman executives, including the firm’s chief executive officer, Lloyd Blankfein, started hiring defense lawyers.” Moreover, Black “says the conduct could well have violated federal fraud statutes–’securities fraud for false disclosures, wire and mail fraud for making false representations about the quality of the loans and derivatives they were selling, bank fraud for false representations to the regulators.’” Beyond the Wall-Street-subservient officials, why have those led to no prosecutions?

Justice insists that political operations such as fundraising are kept strictly distanced from the department, in order to avoid even the appearance of political influence. But the attorney general and his team are not unfamiliar with the process; Holder was himself an Obama bundler–a fundraiser who collected large sums from various donors–in 2008, as were several other lawyers who joined him at Justice.

It would be a leap to infer these Goldman contributions were made–or received–as quid pro quo for dropping a criminal investigation. Still, the situation constitutes what one Justice veteran acknowledged is a “bad set of facts.”

STILL MORE AT LINK

UPDATE: In comments, Montecarlo recalls this amazing New York Times article from March, which I wrote about at the time, lamenting the extreme levels of corruption in Afghanistan’s ruling class (“a narrow business and political elite defined by its corruption”), made all the worse by this: “Despite years of urging and oversight by American advisers, Mr. Karzai’s government has yet to prosecute a high-level corruption case.” It was that phrase “despite years of urging and oversight by American advisers” — as though the U.S. is a beacon of accountability for ruling class corruption — that was really quite remarkable.

bread_and_roses

(6,335 posts)Just as when I was listening to the professor (Black?) on AR the other day - we know it, but everytime I read it or hear it I still feel gut-punched.

Seems to me that all that means is that no one is on tape saying "I am going to give you this money so you don't prosecute me/us."

As if the words have to be said.

Demeter

(85,373 posts)Two years ago, when he signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, President Barack Obama bragged that he'd dealt a crushing blow to the extravagant financial corruption that had caused the global economic crash in 2008. "These reforms represent the strongest consumer financial protections in history," the president told an adoring crowd in downtown D.C. on July 21st, 2010. "In history." This was supposed to be the big one. At 2,300 pages, the new law ostensibly rewrote the rules for Wall Street. It was going to put an end to predatory lending in the mortgage markets, crack down on hidden fees and penalties in credit contracts, and create a powerful new Consumer Financial Protection Bureau to safeguard ordinary consumers. Big banks would be banned from gambling with taxpayer money, and a new set of rules would limit speculators from making the kind of crazy-ass bets that cause wild spikes in the price of food and energy. There would be no more AIGs, and the world would never again face a financial apocalypse when a bank like Lehman Brothers went bankrupt.

Most importantly, even if any of that fiendish crap ever did happen again, Dodd-Frank guaranteed we wouldn't be expected to pay for it. "The American people will never again be asked to foot the bill for Wall Street's mistakes," Obama promised. "There will be no more taxpayer-funded bailouts. Period." Two years later, Dodd-Frank is groaning on its deathbed. The giant reform bill turned out to be like the fish reeled in by Hemingway's Old Man – no sooner caught than set upon by sharks that strip it to nothing long before it ever reaches the shore. In a furious below-the-radar effort at gutting the law – roundly despised by Washington's Wall Street paymasters – a troop of water-carrying Eric Cantor Republicans are speeding nine separate bills through the House, all designed to roll back the few genuinely toothy portions left in Dodd-Frank. With the Quislingian covert assistance of Democrats, both in Congress and in the White House, those bills could pass through the House and the Senate with little or no debate, with simple floor votes – by a process usually reserved for things like the renaming of post offices or a nonbinding resolution celebrating Amelia Earhart's birthday.

The fate of Dodd-Frank over the past two years is an object lesson in the government's inability to institute even the simplest and most obvious reforms, especially if those reforms happen to clash with powerful financial interests. From the moment it was signed into law, lobbyists and lawyers have fought regulators over every line in the rulemaking process. Congressmen and presidents may be able to get a law passed once in a while – but they can no longer make sure it stays passed. You win the modern financial-regulation game by filing the most motions, attending the most hearings, giving the most money to the most politicians and, above all, by keeping at it, day after day, year after fiscal year, until stealing is legal again. "It's like a scorched-earth policy," says Michael Greenberger, a former regulator who was heavily involved with the drafting of Dodd-Frank. "It requires constant combat. And it never, ever ends."

That the banks have just about succeeded in strangling Dodd-Frank is probably not news to most Americans – it's how they succeeded that's the scary part. The banks followed a five-point strategy that offers a dependable blueprint for defeating any regulation – and for guaranteeing that when it comes to the economy, might will always equal right.

CLICK ON LINK IF YOU REALLY WANT TO KNOW

Demeter

(85,373 posts)The Obama administration saw its first monthly budget surplus in April, with the federal government recording $58 billion, according to figures released by the Congressional Budget Office.

MarketWatch reports:

The surplus -- the first of Barack Obama’s presidency -- was the result of both increased tax collection and lower government spending.

Prior to April, the federal government's last surplus dates back to September 2008.

Pressuring Congress, President Barack Obama is laying out an election year "to do" list Tuesday that urges lawmakers to take another look at economic proposals to promote job creation and help families refinance their mortgages...Obama's wish list includes a number of proposals that he has outlined previously but have failed to gain traction in Congress. They include eliminating tax incentives for companies that ship jobs overseas and promoting new tax credits for small businesses and for companies to develop clean energy. For veterans, Obama planned to press Congress to pass legislation creating a Veterans Job Corps to help service members returning home from Iraq and Afghanistan find work as police officers and firefighters.

And to address the housing crisis, Obama was expected to press anew on a measure designed to help homeowners refinance their homes at lower interest rates....Republicans said they had a lengthy list of their own in the form of bills that have cleared the GOP-led House but remained bogged down by Senate Democrats. They accused Obama of recycling old ideas.

"We've passed nearly 30 jobs bills to increase American competitiveness, expand domestic energy production and rein in the red tape that is burdening small businesses. Democrats are blocking every one of them," said Brendan Buck, a spokesman for House Speaker John Boehner, R-Ohio.

Demeter

(85,373 posts)Bank of America says they have begun mailing notices to their borrowers about principal reduction opportunities under the foreclosure fraud settlement. You may recall that BofA inked a side deal on the settlement that would allow them to extinguish an additional $850 million of the cash penalties by reducing loan balances more deeply than called for in the settlement. At the time it was announced, the thinking was that BofA could avoid that $850 million by reducing balances on loans it didn’t actually own.

Some fund managers feel it is unfair for banks, which serviced mortgages on behalf of investors, to use those same loans to meet their obligations under the settlement. “The fact that a servicer has done a poor job has already impacted borrowers and our investors,” said BlackRock Managing Director Randy Robertson, who declined to speak specifically about the Bank of America agreement. “To ask investors to pay for banks’ fines in any form seems inappropriate and incorrect—we have very serious issues with that.”

So whom did BofA reach out to today?

To be eligible for the principal reductions, however, homeowners will have to meet certain criteria, including: having a loan owned or serviced by Bank of America; owing more on the mortgage than their property is worth; and being at least 60 days behind on payments as of the end of January.

Owned OR serviced. In other words, this is exactly as we suspected; BofA will try to extinguish cash penalties by modifying principal on loans they service but don’t own. And they’re trying to load up on the modifications with those loans.

Earlier the bank said that the average principal reduction would be in the range of $100,000. According to their new statement, the reductions could average as high as $150,000. That means that, one, fewer borrowers will benefit, for it takes fewer borrowers at an average of $150,000 to reach their target number; and two, they’re probably trying to load up on more homes where the loan isn’t owned by them, reducing lots of principal on those homes. These are probably late-bubble models that Countrywide appraised way too high, where bringing down to market value costs a ton of money. They’ll pick and choose the special cases and “pay” their debt to the government with someone else’s money.

Demeter

(85,373 posts)Nimoy's film and television acting career began in 1951, but after receiving the title role in the 1952 film Kid Monk Baroni, a story about a street punk turned professional boxer, he played more than 50 small parts in B movies, TV shows such as Dragnet, and serials such as Republic Pictures' Zombies of the Stratosphere (1952). To support his family Nimoy often worked other jobs, such as delivering newspapers in the morning.[17]

He played an Army sergeant in the 1954 science fiction thriller, Them!, a professor in the 1958 science fiction movie The Brain Eaters, and had a role in The Balcony (1963), a film adaptation of the Jean Genet play. Together with Vic Morrow, he produced a 1966 version of Deathwatch, an English language film version of Genet's play Haute Surveillance, adapted and directed by Morrow and starring Nimoy.

On television Nimoy appeared as "Sonarman" in two episodes of the 1957–1958 syndicated military drama, The Silent Service, based on actual events of the submarine section of the United States Navy. He had guest roles in the Sea Hunt series from 1958 to 1960 and had a minor role in The Twilight Zone episode "A Quality of Mercy" in 1961. He also appeared in Highway Patrol. Throughout the 1960s Nimoy appeared in a number of other TV series including Bonanza (1960),The Rebel (1960), Two Faces West (1961), Rawhide (episode, Incident Before Black Pass. 1961), The Untouchables (1962), The Eleventh Hour (1962), Combat! (1963, 1965), The series Daniel Boone, and Perry Mason (1963), The Outer Limits (1964), The Virginian (1965) and Get Smart (1966). He appeared again in the 1995 Outer Limits series, again in the episode "I, Robot".

On the stage, Nimoy played the lead-role alien of a short run of Gore Vidal's A Visit to a Small Planet in 1968, shortly before the end of the Star Trek series. This play was staged at the now-folded Pheasant Run Playhouse in St. Charles, Illinois.[18]

Nimoy as Spock with William Shatner as Kirk, 1968.

Nimoy and William Shatner first worked together on an episode of The Man from U.N.C.L.E., "The Project Strigas Affair" (1964). Their characters were from either side of the Iron Curtain, though with his saturnine looks, Nimoy was predictably the villain, with Shatner playing a reluctant U.N.C.L.E. recruit.

Nimoy first worked with DeForest Kelley in an episode of The Virginian from season two titled "Man of Violence", with Kelley as the doctor and Nimoy as the patient.

Demeter

(85,373 posts)On both sides of the Atlantic, the social ties that bind our political, legal and corporate forces lie exposed...

Shortly after Mitt Romney's failed 2008 campaign for the Republican nomination his son Tagg set up a private equity fund with the campaign's top fundraiser. One of the first donors was his mum, Anne. Next came several of his dad's financial backers. Tagg had no experience in the world of finance, but after two years in the middle of a deep recession the company had netted $244m from just 64 investors.

Tagg insists that neither his name nor the fact that his father had made it clear he would run for the presidency again had anything to do with his success. "The reason people invested in us is that they liked our strategies,'' he told the New York Times.

Class privilege, and the power it confers, is often conveniently misunderstood by its beneficiaries as the product of their own genius rather than generations of advantage, stoutly defended and faithfully bequeathed. Evidence of such advantages is not freely available. It is not in the powerful's interest for the rest of us to know how their influence is attained or exercised. But every now and then a dam bursts and the facts come flooding forth.

The Leveson inquiry has provided one such moment. It was set up last year to look into the specific claims about phone hacking at the News of the World, alleged police corruption and the general culture and ethics of the British media. But every time it probes harder into the Murdoch empire it draws blood from the heart of our body politic, telling us a great deal about how Britain's political class in particular and ruling class in general collude, connive and corrupt both systemically and systematically...

Demeter

(85,373 posts)As readers likely know by now, Jamie Dimon hastily arranged an after hours conference call THURSDAY, in which he admitted to $2 billion in losses in the last six weeks from a trade by the “London Whale”, Bruno Michel Iksil in the bank’s Chief Investment Office, with as much as another potential $1 billion in losses in the offing. The position was a hedge involving credit default swaps, a product in which the firm has touted its expertise...Bloomberg reported on the story in early April, noting that Iskil’s postions were so large that he was driving prices. This is generally a sign of a basic failure in risk management. You never want to take a bet too large in a market if you might want or need to exit quickly, and highly leveraged firms in general are not in a great position to ride out adverse price moves, even if they believe the trade will work out in the end. This same mistake felled LTCM and Amaranth. Even more telling, Dimon made clear this trade was not a hot idea to begin with, repeatedly calling it poorly conceived, poorly executed, and not sufficiently monitored (update: Felix Salmon says he believes the trade was a cash-basis trade).

So much for JP Morgan’s vaunted risk acumen. As we’ve noted, one of the big reasons it wasn’t as badly hit in the crisis was that it took big CDS losses in 2005 on the Delphi bankruptcy (yes this is a rumor, but it is as pretty widespread rumor, and the sources are credible). The bank got cautious just as the subprime market was entering its toxic phase. So JP Morgan may have dodged the bullet at least in part by getting a wake-up call earlier than its peers. But other issues seems even more important. First is that Dimon consistently misrepresented the seriousness of the exposures as soon as the press was onto it. Both Bloomberg and the Wall Street Journal were digging, and Dimon was dismissive, calling the concerns a “tempest in a teapot”. JPM shares were down over 5% in aftermarket trading. The CEO misled investors, but no one seems to care much about niceties like accurate and timely disclosure these days. This is the disclosure in the first quarter 10Q:

Since March 31, 2012, CIO has had significant mark-to-market losses in its synthetic credit portfolio, and this portfolio has proven to be riskier, more volatile and less effective as an economic hedge than the Firm previously believed. The losses in CIO’s synthetic credit portfolio have been partially offset by realized gains from sales, predominantly of credit-related positions, in CIO’s AFS securities portfolio. As of March 31, 2012, the value of CIO’s total AFS securities portfolio exceeded its cost by approximately $8 billion. Since then, this portfolio (inclusive of the realized gains in the second quarter to date) has appreciated in value.

The Firm is currently repositioning CIO’s synthetic credit portfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is being effected in a manner designed to maximize economic value, CIO may hold certain of its current synthetic credit positions for the longer term.

The last comment would appear to imply that if they can’t unwind this trade at acceptable losses, they’ll move some of it into a hold to maturity book, where they aren’t required to mark to market. Charming.

Second is that, as Dimon himself volunteered, is that this failure of supervision strengthens the case for the Volcker Rule, although he also argued the strategy was Volcker rule complaint. Ahem, that says a lot about how Volcker’s prescription was translated into regulations. Banks that are backstopped by the public should not be taking proprietary trading bets, period. Hedge funds are the format for that sort of activity. And the idea that it’s too hard to figure out the difference between the two is nonsense. Traders can be required to flatten positions within a specified, short period, say three or four days at most. Although Value at Risk has a lot of shortcomings, it isn’t a bad metric for this sort of thing. Bear Stearns had a similar rule when Ace Greenberg was in charge (and remember Bear was an investment bank and a risk seeking one at that): traders we not allowed to hold positions longer than three weeks. Greenberg monitored them and required them to be closed out.

The real upside is that this may be the first real dent to Dimon’s image. The firm has gotten off scot free for dubious tactics during the Lehman and MF Global failures, and Dimon has taken to bullying central bankers and regulators (I’ve heard of incidents beyond the press reports of him browbeating Bernanke and later his Canadian analogue, Mark Carney). Dimon’s hyperaggression may simply by apparent success stoking an already overly large ego, or it may be the classic “the best defense is a good offense” strategy, of dissuading overly close scrutiny of JP Morgan’s health and practices. We’ll have a better basis for judging as the year progresses, since difficult trading markets will continue to test all the major dealers.

DemReadingDU

(16,002 posts)Tinfoil hat on

Think back to MF Global and Corzine. It is said that wild speculations resulted using money in customer accounts. And that $1.2 billion 'vaporized' to supposedly JPMorgan. And no one went to jail. See how easy that was.

So now there is JPMorgan/Bruno also engaged in wild speculations. Where did the money come from for that $2 Billion 'loss'... customer saving accounts? Perhaps it too 'vaporized' to ???

Does anyone else think our money is openly being stolen from us for the elites pockets? And one of these days, we will wake up and find all our money is gone because the elites have stolen it all, and then the system crashes.

Tinfoil hat off

westerebus

(2,978 posts)It is not out of the realm of possibility the whale was longish oil and didn't see what was about to hit him before he could off load.

Hugin

(37,623 posts)When I saw a $12 bbl drop in two days I started thinking someone was going to get an oil tanker dropped on them... Looks like it was JPMorgan. ![]()

Anyway, someone is going to get a twofer out of this, whoever it was has got a heap of JPMorgan's loot and now they're going to blame the newly elected, but, haven't even taken office yet, Socialists in Greece and France. Sad thing is, people will buy it. Especially, the Right Wingers here in the US.

westerebus

(2,978 posts)JPM was betting they could raise the price of gasoline with your tax dollars to make a profit for themselves. ![]()

AnneD

(15,774 posts)JPM was one of the last cash transfers that MFG did, I took note. When I heard the London Whale was with JPM, I thought that was suspicions. The announcement Friday about JPM's losses only further validated my suspicions. I try to maintain an innocent until proven guilty, but so far I have seen no innocence on the part of JPM. Until a bank gets nationalized, the too big to fail are broken up or some bankers start wearing orange jumpsuits-it will continue because the banker's just don't see themselves as engaging in criminal conduct, only 'misjudging the market'.

Demeter

(85,373 posts)I think it was a case of greed overwhelming common sense.

Demeter

(85,373 posts)Shadow economies – sometimes called the black market or informal economy – exist in every country. But how big are they? This column presents some new approaches to estimating their size and uses them to compare shadow economies across rich and poor countries over the last 60 years....

In order to observe the variation of the shadow economy size in different group of countries over time, we divided the world into six different groups. These are OECD-EU, Latin American and Caribbean, post-Socialist (Transition), Middle East and North African, sub-Saharan African, and Asian-Oceanian countries.

As looking at unweighted series may be a misleading way of calculating the shadow economy size in a group, in Table 1 we report the descriptive statistics of GDP-weighted series in different groups of countries. Note that these are regional descriptive statistics for the whole 1950-2009 period.

Table 1. GDP-weighted shadow economy as percentage of GDP

Region ---------Mean -----Median -----Minimum -----Maximum -----Std. dev.

OECD-EU ------17.84 -----17.82 -------13.97 --------21.99 ---------2.64

Latin -----------41.98 -----38.44 -------35.54 --------55.51---------6.29

Post-Socialist---37.37 -----34.98 -------28.18 --------55.67 ---------7.83

MENA ----------31.50 -----25.61 -------22.61 --------86.79 --------12.30

Sub-Saharan ---43.06 -----39.90 ------ 36.84 --------55.25 ---------5.64

Asia ------------32.84 -----33.06 -------18.05 --------51.83 ---------9.40

World-----------22.67 -----21.84 -------18.54 --------27.74 ---------2.98

Investigating Table 1 reveals two crucial points:

First, judging from the standard deviations, the size of the shadow economy experienced a significant variation both across groups and within groups.

Second, Latin American and sub-Saharan economies have significantly larger shadow economies than the other groups of countries, while the OECD-EU group has a significantly smaller shadow economy.

Next, in Table 2, we report the evolution of the shadow economy size in different groups over time in approximately 10-year intervals. In line with Table 2, Figure 1 presents the GDP-weighted shadow economy size on an annual basis. For almost all country groups (except for the post-Socialist one), we observe a declining trend over time. However, the pace of the reduction seems to lose some momntum in the last decade. Somewhat more interestingly, we observe a spike staring in 2007. Considering the emergence of the global economic crisis, this could give further support for the hypothesis that the size of the shadow economy is countercyclical, as suggested by Roca et al (2001) and Elgin (2012).

Table 2. Regional trends over time

Region ----------1960-1970 ------1971-1980 -------1981-1990 -------1991-2000 ------2001-2009

OECD-EU ----------20.32 -----------17.89 -------------16.51 -------------15.939 ----------14.56

Latin ---------------47.50 -----------40.86 -------------36.88 -------------36.59 -----------36.19

Post-Socialist ---------------------------------------------------------------34.13 -----------35.95

MENA --------------34.58 -----------27.00 --------------24.77 ------------23.93 -----------23.51

Sub-Saharan -------48.71 ----------41.74 --------------37.44 ------------38.68 -----------39.00

Asia ---------------39.40 ----------34.39 --------------29.63 -------------23.97 -----------19.85

World---------------25.75 ----------22.56 --------------20.76 -------------20.02 -----------21.67

Figure 1. GDP-weighted shadow economy size (as % of GDP) over time

http://www.voxeu.org/sites/default/files/image/FromApr2012/elginfig1(1).gif

In Figure 2, we group countries with respect to GDP per-capita and then report the average GDP-weighted shadow economy size in each group. Here, we divide the countries into five categories – poorest, second, third, fourth and the richest 20%. Not surprisingly, richer countries tend to have a smaller shadow economy; however, Figure 2 shows that this relationship is not exactly linear, especially in a cross-country sense. Even though further research is required, this might be considered as a support for informality dimension of the Kuznets Curve hypothesis.

Figure 2. Evolution of the shadow economy in different income groups

Demeter

(85,373 posts)King World News spoke with Citi technical analyst Tom Fitzpatrick who is predicting that global stock markets are set to plummet 27%.

And he thinks it could happen in a little as four or five months.

Here's what he told King World News he thinks could happen:

“So our bias is to think that (we will head down to the 200 day moving average), in a similar fashion to what we saw last year. That is down quite a bit below present levels, at around 1277 (on the S&P). This would translate into 700+ points (lost) on the Dow, to the region of around 12,000."

And here's the very scary he presented to King.

So this most closely fits the markets and the underlying backdrop of what we see today. If we look at that overlay, we sense that we may have already put in the peak here, the suggestion is that the next down-move would be in the region of 27%. This could be a very quick move, in as little as four or five months.”

Fitzpatrick reiterated his bullish position on gold, which calls for the yellow metal spiking to $2,400 in 12 months.

Demeter

(85,373 posts)U.S. stocks may plunge in the second half of the year “like in 1987” if the Standard & Poor’s 500 Index (SPX) climbs without further stimulus from the Federal Reserve, said Marc Faber, whose prediction of a February selloff in global equities never materialized.

“I think the market will have difficulties to move up strongly unless we have a massive QE3,” Faber, who manages $300 million at Marc Faber Ltd., told Betty Liu on Bloomberg Television’s “In the Loop” from Zurich today, referring to a third round of large-scale asset purchases by the Fed. “If it moves and makes a high above 1,422, the second half of the year could witness a crash, like in 1987.”

The Dow Jones Industrial Average plunged 23 percent on Oct. 19, 1987 in the biggest crash since 1914, triggering losses in stock-market values around the world. The Standard & Poor’s 500 Index plummeted 20 percent. The Dow still closed 2.3 percent higher in 1987, and the S&P 500 advanced 2 percent.

“If the market makes a new high, it will be a new high with very few stocks pushing up and the majority of stocks having already rolled over,” Faber said. “The earnings outlook is not particularly good because most economies in the world are slowing down.”

MORE

Demeter

(85,373 posts)Simon Johnson is the Ronald A. Kurtz Professor of Entrepreneurship at the M.I.T. Sloan School of Management and co-author of “White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You.”

****************************************************************************************/*

Almost exactly two years ago, at the height of the Senate debate on financial reform, a serious attempt was made to impose a binding size constraint on our largest banks. That effort — sometimes referred to as the Brown-Kaufman amendment — received the support of 33 senators and failed on the floor of the Senate....On Wednesday, Senator Sherrod Brown, Democrat of Ohio, introduced the Safe, Accountable, Fair and Efficient Banking Act, or SAFE Banking Act, which would force the largest four banks in the country to shrink. (Details of this proposal, similar in name to the original Brown-Kaufman plan, are in this briefing memo for a Senate banking subcommittee hearing on Wednesday, available through Politico, and in this news release)...SEE ORIGINAL POST FOR LINKS...His proposal, while not likely to become law immediately, is garnering support from across the political spectrum — and more support than essentially the same ideas received two years ago.

The proposition is simple: Too-big-to-fail banks should be made smaller, and preferably small enough to fail without causing global panic. This idea had been gathering momentum since the fall of 2008 and, while the Brown-Kaufman amendment originated on the Democratic side, support was beginning to appear across the aisle. But big banks and the Treasury Department both opposed it, and parliamentary maneuvers ensured there was little real debate. (For a compelling account of how the financial lobby works, both in general and in this instance, look for a forthcoming book by Jeff Connaughton, former chief of staff to former Senator Ted Kaufman of Delaware.) The issue has not gone away. And while the financial sector has pushed back with some success against various components of the Dodd-Frank reform legislation, the idea of breaking up very large banks has gained momentum. In particular, informed sentiment has shifted against continuing to allow very large banks to operate in their current highly leveraged form, with a great deal of debt and very little equity. There is increasing recognition of the huge and unfair costs that these structures impose on the rest of the economy.

The implicit subsidies provided to too-big-to-fail companies allow them to increase compensation by hundreds of millions of dollars. But the costs imposed on the rest of us are in the trillions of dollars. This is a monstrously unfair and inefficient system, and sensible public figures are increasingly pointing this out. American Banker, a leading trade publication, recently posted a slide show, “Who Wants to Break Up the Big Banks?” Its gallery included people from across the political spectrum, with a great deal of financial sector and public policy experience, along with quotations that appear to support either Senator Brown’s approach or a similar shift in philosophy with regard to big banks in the United States. (The slide show is available only to subscribers.) According to American Banker, we now have in the “break up the banks” corner (in order of appearance in that feature): Richard Fisher, president of the Federal Reserve Bank of Dallas; Sheila Bair, former chairwoman of the Federal Deposit Insurance Corporation; Thomas Hoenig, a board member of the Federal Deposit Insurance Corporation and former president of the Federal Reserve Bank of Kansas City; Jon Huntsman, former Republican presidential candidate and former governor of Utah; Senator Brown; Mervyn King, governor of the Bank of England; Senator Bernard Sanders, an independent of Vermont; and Camden Fine, president of the Independent Community Bankers of America. (I am also on the American Banker list.) Anat Admati of Stanford and her colleagues have led the push for much higher capital requirements — emphasizing the particular dangers around allowing our largest banks to operate in their current highly leveraged fashion. This position has also been gaining support in the policy and media mainstream, most recently in the form of a powerful Bloomberg View editorial. (You can follow her work and related discussion on this Web site; on Twitter she is @anatadmati.)

...No one is suggesting that making JPMorgan Chase, Bank of America, Citigroup and Wells Fargo smaller would be sufficient to ensure financial stability. But this idea continues to gain traction, as a measure complementary to further strengthening and simplifying capital requirements and generally in support of other efforts to make it easier to handle the failure of financial institutions. Watch for the SAFE Banking Act to gain further support over time.

Demeter

(85,373 posts)hamerfan

(1,404 posts)By much of anything....

http://spockisnotimpressed.tumblr.com/

Demeter

(85,373 posts)How did you find it? And why did you go looking for it?

hamerfan

(1,404 posts)Pink Floyd. Time:

hamerfan

(1,404 posts)Chicago. Does Anybody Really Know What Time It Is:

TalkingDog

(9,001 posts)I've done a lot, God knows I've tried

To find the truth, I've even lied

But all I know is down inside I'm bleeding.

And Super Heroes come to feast

To taste the flesh not yet deceased

And all I know is still the beast is feeding.

And crawling on the planet's face

Some insects called the human race

Lost in time, lost in space

And meaning.

Po_d Mainiac

(4,183 posts)US Federal Reserve = European controlled private bank.

Central Bank = Counterfeiting Ring Leader

Nobel Prize Winning Economists = Banking Shill Propaganda Puppets, by and large, awarded with Ivy League tenure, that a 3rd-grader well schooled in monetary truths can generally discredit.

Criminal Underworld Currency Counterfeiters = Competitors that must be arrested and jailed.

Savings Account = Devaluation Account, Cash Advance for Gambling Division

Gambling = Banking Primary Business Line

Fraud = Banking Secondary Business Line

Las Vegas, Macau, Atlantic City = Model for running business operations.

Inflation = Currency Devaluation through anti-free market manipulation of interest rates.

Fractional Reserve System = Fractional Expansion Citizen Bankruptcy System, BSE (Biggest Scam Ever)

Futures Markets = Manipulation Casino, SkyNet Three-Card Monte Scam

Pablo Escobar, Joaquín 'El Chapo' Guzmán, The Ochoa Hermanos, Yakuza = Cash Cows

El Subcomandante Marcos aka Delegado Zero = Anti-poverty activist that must be wacked and shut up

Independent Media = Terrorist

Mass Media = Allies

Allen Stanford, Bernie Madoff = Occasional Patsies and Necessary Fall Guys to appease the public’s ire at us.

Stock Markets = Manipulation Casino, SkyNet Three-Card Monte Scam

Commercial Investment Firm Rating of “Buy” and Hold” = Contrarian Indicator to SELL!

Commercial Investment Firm Rating of “Sell” = Contrarian Indicator to “BUY!”

Barbarous Relic = USD, Euro, Yen

Beta = Empty Statistic meant to impress naïve investors

Insider Trading = Mechanism we can utilize to build wealth and remain immune from proesecution but for which we will send common peasants to jail.

Diplomatic Immunity = Not a United Nations privilege but a privilege given to all of us to commit as much fraud and crime as possible without the slightest hint of ever being sent to jail.

Loan = Usury

Credit Card = Debt accumulation card

USD, Euro, Yen, etc. = Fantasy Digital Idea made real by banksters to control humanity

Women’s Liberation Movement = Expansion of Tax Base from only men to men AND women

Income Taxes = Wealth Transfer from citizens to owners of central banks.

Gold = Bankster Kryptonite

Silver = Bankster Kryptonite

Truth = Banker Kyrptonite

Rising Gold & Silver Prices = Hated situation that makes it difficult to manipulate asset prices and that must therefore be controlled.

Lies & Deception = Bankster Standard M.O.

Free Markets = Fairytale story like Santa Claus, Easter Bunny and Tooth Fairy to be taught in business schools worldwide.

Drug Lords and Underground Crime Syndicates = Provider of global banking liquidity and huge year-end bonuses

Parasite = Favorite insect

Capitalism = Dead system that was killed by Central Banking but false scapegoat we can blame when we cause economic crashes and despair

Miscellaneous Charges = Small Monthly Charges to siphon off money from bank accounts that customers will never notice or complain about

Computer = Vehicle to rig all stock markets and commodity markets with HFT programs that execute trades not possible if executed by humans and if executed in a clear and transparent market.

Boom = Unsustainable price distortions caused by interest-rate manipulation and market rigging.

Bust = Opportunity to make money twice as quickly as in a boom!

Market Crash = Engineered event to ensure the peasants will never accumulate enough wealth to rebel against us.

Rising Markets on Mondays or Tuesdays into OpEx Fridays: Ruse to sucker more people to go long in order to fleece them by the time Friday arrives.

Declining Markets on Mondays or Tuesdays into OpEx Fridays: Ruse to sucker more people to go short in order to fleece them by the time Friday arrives.

Presidents and PMs = Best puppet and marionette allies to be rewarded handsomely after they leave office (see Tony Blair and the current POTUS)

Superior Judges, SCOTUS = Made Men

War = Double Bonus! Opportunity to devalue money at faster rate than during peace time and opportunity to accumulate more wealth from interest charged on war appropriations.

Universities, Colleges and MBA programs = Re-education camps to indoctrinate students into fairytales of non-existent free markets, non-existent capitalism, and lies about how stock markets, real estate markets and economic cycles really work. Alternative meaning = best mechanism to bury young adults in a mountain of debt before their work life even begins so we can control them.

Economic Journals and University Tenure = Carrot dangled in front of economic professors to ensure that they repeat to the world the “official” party line.

Key Economic Indicators = False manipulated statistics designed to dumb down citizens into believing economy is recovering even as we increase their economic suffering

Ben Bernarnke = Shakespearean clown.

Conspiracy = Best Word to Discredit Truth about the global monetary system when the truth somehow escapes our censorship algorithms and makes it to the mainstream media we control.

Machiavelli = Role Model

Ivy League Schools = Indoctrination Camps for media representatives and professors we will send to brainwash other global regions into believing our propaganda

CNBC = The Cartoon Network.

Goldman Sachs = Rookie Farm Camp for global criminal banking syndicate.

World Bank & IMF = Banks used by Western countries to impose crushing debt on developing nations to stunt their growth.

Bailout = Transfer of Wealth from citizens to us.

TBTF = Lie used to ensure we can perpetuate fraud and to pass legislation that would never pass under normal circumstances unless we use the TBTF threat.

Quantitative Easing = Currency Devaluation.

Fiat Currency = Worst Possible Idea

Propaganda = Daily Financial News Feed

ATM Machine = Only banking invention in the last century that has improved peoples' lives instead of making them worse.

Debt Forgiveness = PsyOps Term that makes it appear we are being benificient towards humanity when in reality, the amount of debt forgiveness probably could not equal the amount of money we have stolen from humanity through inflation, currency devaluation, income taxes, and other unjust taxes meant to transfer wealth to us.

Compartamentalization = Process to keep good people working as cogs in the machine within the banking industry ignorant of the fact that they are inflicting massive harm upon society.

westerebus

(2,978 posts)What is a saws-all? A battery operated hand held cutting device. Properly named a reciprocating saw. With the proper blade will

cut the body off a vehicle's frame or the tail off a jet or a door thru a wall or a wall off a house.

Where to get one? Your local hardware vendor carries several models.

Price? Depending on the model $100 and up. Better model $150.

Please check on line for things that need to be avoided while removing parts as you do not want to injure yourself by hitting fuel lines which may ignite. Avoid rear mounted engines on aircraft and open the canopy roof line in this design. On vehicles remove the roof pillars first to gain access to the passenger compartment.

This information is for rescue personnel and those who may attempt a rescue operation at some time in the future. A saws-all is not a firearm. It does not require a license to operate. It may be considered a bladed weapon if used in such a manner which should be avoided. It is not a toy and should not be left unattended. Remove the battery to avoid accidental injury when not in use.

Given that a break down in municipal services that may occur as money is shifted to crime prevention and away from fire/rescue operations, taking the time to familiarize yourself with this tool may save a life.

When building a community model of mutual support this is a user friendly hands on device adults should have available in their preparation kits.

Po_d Mainiac

(4,183 posts)So if I have to cut your ass outa your ride when you wrap it around a tree, do it within 200ft of an outlet.

It's also one of the few power saws in me arsenal that hasn't bit me...yet.

westerebus

(2,978 posts)Just nod your head yes or no..

this meeting will come to order....

Po_d Mainiac

(4,183 posts)Tansy_Gold

(18,167 posts)Non DIYers never appreciate. . . . . .

Po_d Mainiac

(4,183 posts)westerebus

(2,978 posts)unless you're on the wrong end of a chainsaw....

Po_d Mainiac

(4,183 posts)while I was w8ing for rigormortis to set up in me big toe, after putting the chainsaw through me foot and severing the tendon that used to drive said same digit---I used duct tape to fuse the dead toe to its neighbor...

I'm pullin 4 u.

westerebus

(2,978 posts)They got spares at the lodge ya know?

May be it's thumbs?

I'll get to lookin soon as i hook this propane tank up to the gas generator... gas is gas,right?

*not enough caffeine yet

Po_d Mainiac

(4,183 posts)and see if you have any trojans without leaks. (sheepshins won't work) Used are OK. Glo-in-the-dark are even better

If you have to, patch a couple up with duct tape...no need to worry about color, silver goes with everything.

Fill the rascal wrappers with propane and tie off the end.

Wrap a strip of magnesium foil around the knot, and leave about 4ins hanging down.

Light the end of the strip of foil.

You really want to let the pecker parka go now....

Did I mention this should be done outside with no obstacles overhead?

ps....maybe the foil should 8ins long ![]()

pps..Save those empty propane cylinders. They come in real handy when sighting in a rifle.

I'll be home right after the meeting

westerebus

(2,978 posts)Demeter

(85,373 posts)The FDIC gets Mother's Day off....how sweet of them!

xchrom

(108,903 posts)

westerebus

(2,978 posts)xchrom

(108,903 posts)

Supporters of the extreme right party Golden Dawn hold flares during election results in the northern Greek port city of Thessaloniki last weekend. Photograph: Nikolas Giakoumidis/AP

Walter Benjamin once said that "every fascism is an index of a failed revolution". In that sense, the election of 21 members of the neo-Nazi party Golden Dawn to the Greek parliament could be characterised as the revolutionary failure of the century. Progressive forces in Greece have indisputably been unable to stop the wave of neoliberal austerity measures imposed by the "troika" (the IMF, European Central Bank and EU).

Leftwing politicians and academics predicted the debt crisis and even proposed radical solutions including default and bank nationalisation – but they failed to mobilise Greek society. Their voice was muzzled by the mainstream media, distorted by government officials and, most importantly, nullified by foolish internal antagonisms.

Nevertheless, the frightening revival of fascism in Greece cannot be attributed solely to failures of the anti-memorandum forces. It was the main political parties of Pasok and New Democracy who opened the parliament's door to rightwing extremism. Their austerity frenzy not only destroyed the main pillars of Greek society but also legitimised deeply undemocratic procedures. The constitution was circumvented several times to allow for non-elected officials to implement policies limiting workers' rights.

"It was the main political parties of Pasok and New Democracy who opened the parliament's door to rightwing extremism. Their austerity frenzy not only destroyed the main pillars of Greek society but also legitimised deeply undemocratic procedures. The constitution was circumvented several times to allow for non-elected officials to implement policies limiting workers' rights."

And the same asinine policies with the same predictable results are going on closer to home.

If there is a beneficent god/dess, s/he will smite down the Predator Drone and his minions before the country goes through hell in the handbasket he's been carefully constructing.

They think we are idiots and unaware. Well, not all of us.

xchrom

(108,903 posts)It has been a banner quarter for some international brands: Apple’s record profits nearly doubled from a year ago. Adidas’s profits were up 38 percent. BMW saw earnings rise 19 percent; Starbucks, 18 percent.

These companies share more than standout quarterly earnings. Their success comes, in large part, from a surge in sales in China. That’s good news, as long as Chinese consumers keep buying, but with that nation’s economy slowing, these companies face a troubling question from skeptical investors: Are they too reliant on China for growth?

The answer is nuanced. It depends on investors' time horizon, of course. The short-term picture gloomier than the long-term outlook. It also depends on the sector. Industrial companies with heavy exposure to China are not faring well. Consumer companies, by contrast, especially those with recognizable global brands, are going gangbusters. Some analysts see this dichotomy as evidence that China is beginning to make its long-awaited transition to a consumer economy.

“It’s risky to extrapolate from a few examples,” warns Nicholas Lardy, senior fellow at the Peterson Institute for International Economics in Washington. “It’s a $7 trillion economy and only $2 trillion is consumer-based. However, urban income, in real terms after tax and after inflation is growing at a rate of 9.8 percent vs. 8.1 percent [for] GDP” or gross domestic product, which measures a nation's overall output. Since three-quarters of consumption takes place in China’s urban areas, that's a telling statistic.

Demeter

(85,373 posts)In their frenzy to get rid of unions, the multinationals born in the USA embraced Chinese Crony Capitalist Communism, and all the limitations that implies.

In their desire to destroy the rule of law, they are embracing lawlessness and fraud as a business plan.

FRSP is too good for them. Give them a well-deserved stay in Gitmo for a decade or so, and then they will BEG for FRSP.

Fuddnik

(8,846 posts)These suckers are going on the grill shortly. The cocktails are mixed. Poolside pandemonium is starting. The 50's are going out with a boom!

Frita Cubana – The Original Cuban Hamburger

By Three Guys From Miami

Prep time: 15 minutes

Cook time: 10 minutes

Total time: 25 minutes

Yield: 6-8 generous patties

Enjoy this authentic Cuban recipe for the ultimate Cuban hamburger.

INGREDIENTS:

Burgers:

1 pound ground beef

3/4 pound ground pork

4 cloves garlic, mashed and finely minced

1/3 cup onion,grated

2 tablespoons ketchup

3/4 teaspoon ground cumin

1 1/2 teaspoons sweet Spanish paprika

Salt & pepper cooked patties to taste

6-8 American-style hamburger or steak buns

Topping:

6-8 cups freshly fried shoestring potatoes

raw onion, sliced(optional)

Glenn's Not-So-Secret Sauce (MANDATORY - see recipe below)

Use a food processor with a chopping blade to grind together the meats, the minced garlic, and the onion. Blend in the ketchup, cumin, and paprika.

Remove the meat mixture from the food processor and form by hand into round thin patties. Cook on a flat griddle or in a frying pan.

Fritas should be cooked to medium well done, but don't overcook – they should still be nice and juicy. When the frita is just about cooked through, reduce heat to medium low, squirt on some secret sauce, and let the patties cook just a minute longer.

While the fritas are frying, use a deep fat fryer or frying pan with a couple inches of vegetable oil to fry the shoestring potatoes. Drain on paper towels and lightly salt. Keep warm.

Serve each frita on a traditional American hamburger bun.

IMPORTANT:

Splash plenty of "Glenn's Not-So-Secret Sauce" on the bun and the patty. The sauce is an ESSENTIAL ingredient in this recipe!

Place the patty on the bun, cover with some sliced onion (if you like), and pile high with fresh, hot, shoe-string style fried potatoes – yes, inside the bun, ON TOP of the meat! Splash a little extra secret sauce on the fries, you'll be glad you did!

Serve with additional fries on the plate.

Glenn's Not-So-Secret Frita Sauce

Glenn Lindgren: This is my take on the "Secret Sauce" at my favorite Miami frita restaurant.

Raúl Musibay: A frita is NOT a frita without the secret sauce. Most of the flavor of a frita cubana comes from the sauce!

Jorge Castillo: The other thing that makes the frita cubana great is the crispy fried shoestring potatoes that are served right on top of the hamburger patty.

INGREDIENTS:

1 (6-ounce) can tomato paste

1 1/2 cups water

1 teaspoon ground cumin

1 1/2 teaspoons sweet Spanish paprika

1 teaspoon garlic powder

1/4 cup sugar

1/4 cup white vinegar

1 teaspoon salt

Mix all of the ingredients together in a two-quart saucepan.

Bring to a boil stirring constantly.

Reduce heat to low and simmer, stirring occasionally, for 10 to 15 minutes.

Remove from heat and let cool. Use generously in the Frita Cubana recipe above.

Demeter

(85,373 posts)and I'm too tired to post. Gardening is not for the out-of-shape. And I wasn't even digging.

Or maybe it's all catching up with me...Fuddnik isn't the only one aging.

Demeter

(85,373 posts)http://www.nytimes.com/2012/05/12/business/jpmorgan-chase-fought-rule-on-risky-trading.html

Soon after lawmakers finished work on the nation’s new financial regulatory law, a team of JPMorgan Chase lobbyists descended on Washington. Their goal was to obtain special breaks that would allow banks to make big bets in their portfolios, including some of the types of trading that led to the $2 billion loss now rocking the bank. Several visits over months by the bank’s well-connected chief executive, Jamie Dimon, and his top aides were aimed at persuading regulators to create a loophole in the law, known as the Volcker Rule. The rule was designed by Congress to limit the very kind of proprietary trading that JPMorgan was seeking.

Even after the official draft of the Volcker Rule regulations was released last October, JPMorgan and other banks continued their full-court press to avoid limits. In early February, a group of JPMorgan executives met with Federal Reserve officials and warned that anything but a loose interpretation of the trading ban would hurt the bank’s hedging activities, according to a person with knowledge of the meeting. In the past, the bank argued that it needed to hedge risk stemming from its large retail banking business, but it has also said that it supported portions of the Volcker Rule...

JPMorgan officials declined to comment for this article. But in the company’s annual report, Mr. Dimon wrote: “If the intent of the Volcker Rule was to eliminate pure proprietary trading and to ensure that market making is done in a way that won’t jeopardize a financial institution, we agree.” He added: “We, however, do disagree with some of the proposed specifics because we think they could have huge negative unintended consequences for American competitiveness and economic growth.” JPMorgan wasn’t the only large institution making a special plea, but it stood out because of Mr. Dimon’s prominence as a skilled Washington operator and because of his bank’s nearly unblemished record during the financial crisis. “JPMorgan was the one that made the strongest arguments to allow hedging, and specifically to allow this type of portfolio hedging,” said a former Treasury official who was present during the Dodd-Frank debates.

Those efforts produced “a big enough loophole that a Mack truck could drive right through it,” Senator Carl Levin, the Michigan Democrat who co-wrote the legislation that led to the Volcker Rule, said Friday after the disclosure of the JPMorgan loss. The loophole is known as portfolio hedging, a strategy that essentially allows banks to view an investment portfolio as a whole and take actions to offset the risks of the entire portfolio. That contrasts with the traditional definition of hedging, which matches an individual security or trading position with an inversely related investment — so when one goes up, the other goes down. Portfolio hedging “is a license to do pretty much anything,” Mr. Levin said. He and Senator Jeff Merkley, an Oregon Democrat who worked on the law with Mr. Levin, sent a letter to regulators in February, making clear that hedging on that scale was not their intention. “There is no statutory basis to support the proposed portfolio hedging language,” they wrote, “nor is there anything in the legislative history to suggest that it should be allowed.” While the banks lobbied furiously, they were in some ways pushing on an open door. Officials at the Treasury Department and the Federal Reserve, the main overseer of the banks, as well as the Comptroller of the Currency, also wanted a loose set of restrictions, according to people who took part in the drafting of the Volcker Rule who spoke on the condition of anonymity because no regulatory agencies would officially talk about the rule on Friday. The Fed and the Treasury’s views prevailed in the face of opposition from both the Securities and Exchange Commission and the Commodity Futures Trading Commission, which regulate markets and companies’ reporting of their financial positions. Both commissions and the Federal Deposit Insurance Corporation, which insures bank deposits, pushed for tighter restrictions, the people said. Even some of those who have said the Volcker Rule is fatally flawed agree that, in its current form, the rule would have allowed JPMorgan Chase to do what it did.

MORE WHINING

Demeter

(85,373 posts)When will Wall Street stop springing these types of nasty surprises?

Every big bank has risk controls. Teams of executives are assigned to manage and review trades to ensure the bank’s safety and health. Yet trading debacles happen with surprising regularity. Last year, losses at two big institutions rocked the financial world. MF Global went out of business after making an ill-timed bet on European debt. Before that, a UBS trader in London lost the firm $2.3 billion. The 2008 financial crisis was the result of major risk miscalculations that brought down several big financial institutions, including Bear Stearns, Lehman Brothers and the American International Group. Now, JPMorgan Chase faces its own mess.

While JPMorgan has long been regarded as one of the nation’s strongest banks, the circumstances surrounding its $2 billion trading loss look depressingly familiar. Once again, a bank with large trading operations allowed a mixture of incompetence, risk-taking, hubris and complexity lead to an embarrassing and costly blowup.

“This underscores the fallacy of thinking the best-managed banks are somehow infallible,” said Sheila C. Bair, the former chairwoman of the Federal Deposit Insurance Corporation, a bank regulator.

MORE REGRETS

Demeter

(85,373 posts)The economic, political and social outlook for the second decade of the 21st century is profoundly negative. The almost universal consensus, even among mainstream orthodox economists, is pessimistic regarding the world economy.

Although, even here, their predictions understate the scope and depth of the crises, there are powerful reasons to believe that beginning in the second decade of this century, we are heading toward a steeper decline than what was experienced during the Great Recession of 2008 – 2009. With fewer resources, greater debt and increasing popular resistance to shouldering the burden of saving the capitalist system, the governments cannot revive the economic system.

Many of the major institutions and economic relations which were cause and consequence of world and regional capitalist expansion over the past three decades are in the process of disintegration and disarray. The previous economic engines of global expansion, the US and the European Union, have exhausted their potentialities and are in open decline. The new centers of growth, China, India, Brazil, Russia, which provided a new impetus for world growth during the first decade are de-accelerating rapidly and will continue to do so throughout the new decade.

The political and military outlook is equally bleak, especially in the Middle East and South Asia where the US and the EU are engaged in prolonged colonial wars, either directly or through proxies. Imperial wars are deepening the economic crises, draining resources, rather than extracting wealth, and in particular with regard to US-Israeli war preparations against Iran threatening to provoke a major economic depression...

GLOBAL DIAGNOSIS AND ANALYSIS FOLLOWS

bread_and_roses

(6,335 posts)In myth and magic, to name a thing is to have power over it. Good to see it laid out - TPTB, our Lords and Masters, the self-proclaimed Masters of the Universe, are intent on "saving the capitalist system" and are encountering (thank the goddess) "increasing popular resistance" - about time, since it is a system that has never offered anything to the vast majority of the populace but at best scraps and at worst death and starvation.

Even in the vaunted '50's of nostalgic fame, the "broad prosperity" of the middle was built on the brutal exploitation, the grinding misery of millions around the globe, not to mention the maintenance of a pool of excess labor in the pool of people of color, migrant workers, the rural poor, etc.

"They" want to "save the capitalist system." We want a life.

Demeter

(85,373 posts)...I’m still not entirely clear on what the trades by Bruno Iksil, the so-called "London Whale," were exactly. According to the excellent Felix Salmon at Reuters, Iksil had taken a massive long position on corporate CDS, and when word of this leaked out, the market turned on him and beat his brains out. From Salmon’s piece:

If you’re wondering why you should care if some idiot trader (who apparently has been making $100 million a year at Chase, a company that has been the recipient of at least $390 billion in emergency Fed loans) loses $2 billion for Jamie Dimon, here’s why: because J.P. Morgan Chase is a federally-insured depository institution that has been and will continue to be the recipient of massive amounts of public assistance. If the bank fails, someone will reach into your pocket to pay for the cleanup. So when they gamble like drunken sailors, it’s everyone’s problem.

Activity like this is exactly what the Volcker rule, which effectively banned risky proprietary trading by federally insured institutions, was designed to prevent. It will be argued that this trade was a technically a hedge, and therefore exempt from the Volcker rule. Not only does that explanation sound fishy to me (as Salmon notes, for Iksil’s trade to be a hedge, this would mean Chase had an equally giant and insane short bet on against corporate debt, which seems unlikely), but it's sort of immaterial anyway: whether or not this bet technically violated the Volcker rule, it definitely violated the spirit of the law. Hedge or no hedge, we don’t want big, federally-insured, too-big-to-fail banks making giant nuclear-powered derivatives bets....

Demeter

(85,373 posts)Jamie Dimon, the chief executive of JPMorgan Chase, can be clear as a bell when he denounces financial reform. But on an emergency conference call with analysts on Thursday to announce the bank’s stunning $2 billion trading loss, his message was frustratingly vague. The loss, according to Mr. Dimon, was in the bank’s “synthetic credit portfolio,” which presumably means it involved the same type of complex derivatives that played such a destructive role in the financial crisis. And Mr. Dimon said that sloppiness, bad judgment and stupidity — his own and his colleagues’ — had led to the loss. It was a stunning admission from a man who led JPMorgan through the crisis relatively unscathed, but it doesn’t explain what actually went wrong.

What Mr. Dimon did not say is that the loss also occurred because of a continued lack, nearly four years after the crisis, of rules and regulators up to the task of protecting taxpayers and the economy from the excesses of too big to fail banks; and, yes, of protecting the banks from their executives’ and traders’ destructive risk-taking.

The fact that JPMorgan’s loss — which Mr. Dimon has warned could “easily get worse” — is not enough to topple the bank, is not the point. What matters is that JPMorgan, like the nation’s other big banks, is still engaged in activities that can provoke catastrophic losses. If policy makers do not strengthen reform, then luck is the only thing preventing another meltdown. Bank regulators should start by adopting a forceful Volcker Rule. Proposed by Paul Volcker, the former Federal Reserve chairman and included in the Dodd-Frank reform law, the rule would curtail risky and speculative trading with the banks’ own capital. Banks hate the Volcker Rule, because less gambling means lower profits and lower bonuses for executives and traders. Mr. Dimon has been especially contemptuous, saying at one point that “Paul Volcker by his own admission has said he doesn’t understand capital markets. He has proven that to me.” Early versions of the restrictions have been ambiguous and toothless.

Dodd-Frank also calls for new rules on derivatives — including transparent trading and requirements for banks to back their trades with collateral and capital. If such rules were in place, JPMorgan’s trades could not have escaped notice by regulators and market participants. In the face of heavy lobbying, the derivatives’ rules have also been delayed or watered down. There are now several bills in the House, with bipartisan support, to weaken the Dodd-Frank law on derivatives. One of those would let the banks avoid Dodd-Frank regulation by conducting derivatives deals through foreign subsidiaries. The JPMorgan loss was incurred in its London office, which doesn’t lessen the effect here. Mitt Romney has called for repealing Dodd-Frank. That may win him Wall Street cash, but it is profoundly dangerous. President Obama and Congressional Democrats can take credit for Dodd-Frank, but they have not done enough to ensure that the rules are strong enough. The force of Mr. Dimon’s critique of Dodd-Frank has rested on his personal reputation for smarts and on JPMorgan’s sheen of invincibility. His own admitted fallibility and the bank’s shocking stumble are the best argument in favor of strong regulation. Now politicians and regulators need to stand up to the banks.

THE GRAY LADY IS GETTING ALL HOT AND BOTHERED

Demeter

(85,373 posts)“It plays right into the hands of a bunch of pundits out there,” sighed Jamie Dimon, the chief executive of JPMorgan Chase, on Thursday....yes, he’s right: The giant loss, which involved credit default swaps — the same derivatives that had done so much damage during the financial crisis — does, indeed, play into the hands of the pundits. As well it should.

For much of the last three years, as the Obama administration and Congress have grappled with how to rein in a financial system that had lost both its moorings and its ethical compass, no one has been more vocal in his opposition to a more regulated banking system than Dimon. He has complained repeatedly about higher capital requirements. He has said that some proposed regulations were “anti-American.” He has consistently flayed the Dodd-Frank financial reform legislation, which was ultimately Congress’s attempt to prevent another Lehman Brothers-style meltdown.

As for derivatives, Dimon took the view that most of what Dodd-Frank proposes to do — such as make derivatives more transparent, while eliminating the ability of banks to make proprietary trades, thanks to the so-called Volcker Rule — was unnecessary if not downright counterproductive...in his hubris, Dimon was never willing to acknowledge that just because he had sidestepped yesterday’s problems didn’t mean he was going to sidestep tomorrow’s. Or that institutions that are ultimately backstopped by the taxpayer have a special responsibility to the country to stay out of trouble. Even if it means a lower share price. Or a smaller pay package. Or less risk-taking. Keeping banks from harming themselves is exactly what Dodd-Frank is intended to do. One clever pundit has described the criticism heaped on Dimon ever since he announced the big trading loss as “Dimonfreude.”

MORE DIMONFREUDE AT LINK

hamerfan

(1,404 posts)Van Halen. Jamie's Crying:

Demeter

(85,373 posts)The results of the elections in France and Greece have made it abundantly clear that there is a tremendous backlash against the austerity approach that Germany has been pushing. All over Europe, prominent politicians and incumbent political parties are being voted out. In fact, Nicolas Sarkozy has become the 11th leader of a European nation to be defeated in an election since 2008. We have seen governments fall in the Netherlands, the UK, Spain, Ireland, Italy, Portugal and Greece. Whenever they get a chance, the citizens of Europe are using the ballot box to send a message that they do not like what is going on. It turns out that austerity is extremely unpopular. But if newly elected politicians all over Europe begin rejecting austerity, this puts Germany in a very difficult position. Should Germany be expected to indefinitely bail out all of the members of the eurozone that choose to live way beyond their means? If Germany pulled out of the euro tomorrow, the euro would absolutely collapse, bond yields for the rest of the eurozone would skyrocket to unprecedented heights, and without German bailout money troubled nations such as Greece would be headed directly for default. The rest of the eurozone is absolutely and completely dependent on Germany at this point. But as we have seen, much of the rest of the eurozone is sick and tired of taking orders from Germany and is rejecting austerity. A lot of politicians in Europe apparently believe that they should be able to run up gigantic amounts of debt indefinitely and that the Germans should be expected to always be there to bail them out whenever they need it. Will the Germans be willing to tolerate such a situation, or will they simply pick up their ball and go home at some point?

Over the past several years, German Chancellor Angela Merkel and French President Nicolas Sarkozy have made a formidable team. They worked together to push the eurozone on to the path of austerity, but now Sarkozy is out. Francois Hollande, the new French president, has declared that the financial world is his "greatest enemy". He may regret making that statement...One of the primary reasons why Hollande was elected was because he clearly rejected the austerity approach favored by the Germans. Shortly after winning the election in France, he made the following statement....

"Europe is watching us, austerity can no longer be the only option"

Hollande says that he wants to "renegotiate" the fiscal pact that European leaders agreed to under the leadership of Merkel and Sarkozy. But Merkel says that is not going to happen. The following Merkel quotes are from a recent CNBC article....

"We in Germany are of the opinion, and so am I personally, that the fiscal pact is not negotiable. It has been negotiated and has been signed by 25 countries," Merkel told a news conference.

"We are in the middle of a debate to which France, of course, under its new president will bring its own emphasis. But we are talking about two sides of the same coin — progress is only achievable via solid finances plus growth," she added.

So instead of being on the same page, Germany and France are now headed in opposite directions. But if the French do not get their debt under control, they could be facing a huge crisis of their own very quickly. The following is from a recent article by Ambrose Evans-Pritchard....

“They absolutely must cut public spending and control the debt,” said Marc Touati from Global Equities in Paris. “It will soon be clear that we are in deep recession. If they don’t act fast, interest rates will shoot up and we will have a catastrophe by September,” he said.

Without German help, France is not going to be able to handle its own financial problems - much less bail out the rest of Europe. Germany is holding all of the cards, but much of the rest of the eurozone does not seem afraid to defy Germany at this point. In Greece, anti-bailout parties scored huge gains in the recent election. None of the political parties in Greece were able to reach 20 percent of the vote, and there is a tremendous amount of doubt about what comes next......Citibank analysts are saying that there is now a 50 to 75 percent chance that Greece is going to be forced to leave the euro....