Economy

Related: About this forumWeekend Economists Make Their Marx, May 18-20, 2012

As promised, a brief look at the Marx family...Groucho, Chico, Harpo, Zeppo, Gummo, and Karl....

I'm sure all the Marx were related, as all of us are related in some fashion to every other human---something amazing and appalling to contemplate. I swear, I'd pay good money to have no relationship whatsoever to W....but unless he's from another planet (a distinct possibility), we must claim him as estranged (and strange) kin....AnneD has first-hand knowledge of the vagaries of DNA, and she bears up. So must we all.

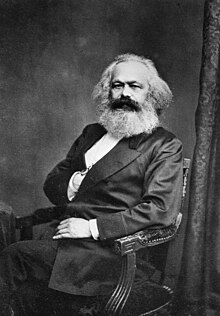

Anyway, about Karl:

Karl Heinrich Marx (5 May 1818 – 14 March 1883) was a German philosopher, economist, sociologist, historian, journalist, and revolutionary socialist. His ideas played a significant role in the development of social science and the socialist political movement. He published various books during his lifetime, with the most notable being The Communist Manifesto (1848) and Capital (1867–1894); some of his works were co-written with his friend and fellow German revolutionary socialist, Friedrich Engels.

Born into a wealthy middle class family in Trier, formerly in Prussian Rhineland now called Rhineland-Palatinate, Marx studied at both the University of Bonn and the University of Berlin, where he became interested in the philosophical ideas of the Young Hegelians. In 1836, he became engaged to Jenny von Westphalen, marrying her in 1843. After his studies, he wrote for a radical newspaper in Cologne, and began to work out his theory of dialectical materialism. Moving to Paris in 1843, he began writing for other radical newspapers. He met Engels in Paris, and the two men worked together on a series of books. Exiled to Brussels, he became a leading figure of the Communist League, before moving back to Cologne, where he founded his own newspaper. In 1849 he was exiled again and moved to London together with his wife and children. In London, where the family was reduced to poverty, Marx continued writing and formulating his theories about the nature of society and how he believed it could be improved, and also campaigned for socialism—he became a significant figure in the International Workingmen's Association.

Marx's theories about society, economics and politics—collectively known as Marxism—hold that all societies progress through the dialectic of class struggle: a conflict between an ownership class which controls production and a lower class which produces the labour for such goods. Heavily critical of the current socio-economic form of society, capitalism, he called it the "dictatorship of the bourgeoisie", believing it to be run by the wealthy classes purely for their own benefit, and predicted that, like previous socioeconomic systems, it would inevitably produce internal tensions which would lead to its self-destruction and replacement by a new system, socialism. He argued that under socialism society would be governed by the working class in what he called the "dictatorship of the proletariat", the "workers state" or "workers' democracy". He believed that socialism would, in its turn, eventually be replaced by a stateless, classless society called communism. Along with believing in the inevitability of socialism and communism, Marx actively fought for the former's implementation, arguing that both social theorists and underprivileged people should carry out organised revolutionary action to topple capitalism and bring about socio-economic change.

Revolutionary socialist governments espousing Marxist concepts took power in a variety of countries in the 20th century, leading to the formation of such socialist states as the Soviet Union in 1922 and the People's Republic of China in 1949. Many labor unions and worker's parties worldwide were also influenced by Marxist ideas. Various theoretical variants, such as Leninism, Stalinism, Trotskyism and Maoism, were developed. Marx is typically cited, with Émile Durkheim and Max Weber, as one of the three principal architects of modern social science. Marx has been described as one of the most influential figures in human history...

What did he say? As one who didn't study any of these fields, I will have to look it all up and get back to you over this weekend. And I shall.

But as to what people did with this man's ideas....well, we'll look into that, too.

But when the going gets too heavy, there's always the OTHER side of the family:

Duck Soup is a 1933 Marx Brothers anarchic comedy film written by Bert Kalmar and Harry Ruby, with additional dialogue by Arthur Sheekman and Nat Perrin, and directed by Leo McCarey. First released theatrically by Paramount Pictures on November 17, 1933, it starred what were then billed as the "Four Marx Brothers" (Groucho, Harpo, Chico, and Zeppo) and also featured Margaret Dumont, Raquel Torres, Louis Calhern and Edgar Kennedy. It was the last Marx Brothers film to feature Zeppo, and the last of five Marx Brothers movies released by Paramount.

Compared to the Marx Brothers' previous Paramount films, Duck Soup was a box-office disappointment, although it was not a "flop" as is sometimes reported. The film opened to mixed reviews, although this by itself did not end the group's business with Paramount. Bitter contract disputes, including a threatened walk-out by the Marxes, crippled relationships between them and Paramount just as Duck Soup went into production. After the film fulfilled their five-picture contract with the studio, the Marxes and Paramount agreed to part ways.

While critics of Duck Soup felt it did not quite meet the standards of its predecessors, critical opinion has evolved and the film has since achieved the status of a classic. Duck Soup is now widely considered to be a masterpiece, and the Marx Brothers' finest film.

In 1990 the United States Library of Congress deemed Duck Soup "culturally, historically, or aesthetically significant" and selected it for preservation in the National Film Registry.

Plot

The wealthy Mrs. Teasdale (Margaret Dumont) insists that Rufus T. Firefly (Groucho Marx) be appointed leader of the small, bankrupt country of Freedonia before she will continue to provide much-needed financial backing. Meanwhile, neighboring Sylvania is attempting to take over the country. Sylvanian ambassador Trentino (Louis Calhern) tries to foment a revolution, woos Mrs. Teasdale, and attempts to dig up dirt on Firefly by sending in spies Chicolini (Chico Marx) and Pinky (Harpo Marx).

After failing to collect worthwhile information about Firefly, Chicolini and Pinky infiltrate the government when Chicolini is appointed Secretary of War after Firefly sees him on the street selling peanuts. Meanwhile, Firefly's personal assistant, Bob Roland (Zeppo Marx) suspects Trentino's questionable motives, and counsels Firefly to "get rid of that man at once" by saying "something to make him mad, and he'll strike you, and we'll force him to leave the country." Firefly agrees to the plan, but after a series of personal insults exchanged between Firefly and Trentino, the plan backfires and Firefly slaps Trentino instead. As a result, the two countries reach the brink of war. Adding to the international friction is the fact that Firefly is also wooing Mrs. Teasdale, and likewise hoping to get his hands on her late husband's wealth.

Trentino learns that Freedonia's war plans are in Mrs. Teasdale's possession and orders Chicolini and Pinky to steal them. Chicolini is caught by Firefly and put on trial, during which war is officially declared, and everyone is overcome by war frenzy, breaking into song and dance. The trial put aside, Chicolini and Pinky join Firefly and Bob Roland in anarchic battle, resulting in general mayhem.

The end of the film finds Trentino caught in makeshift stocks, with the Brothers pelting him with fruit. Trentino surrenders, but Firefly tells him to wait until they run out of fruit. Mrs. Teasdale begins singing the Freedonia national anthem in her operatic voice and the Brothers begin hurling fruit at her instead.

So, let's contrast what either side of the Marx family has to say about government, while we catch up on the anarchy of the day.

Demeter

(85,373 posts)WELL, IT HAD TO BE THIS WEEKEND, THEY CAN'T AFFORD TO MESS UP MEMORIAL DAY...

Alabama Trust Bank, National Association, Sylacauga, Alabama, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Southern States Bank, Anniston, Alabama, to assume all of the deposits of Alabama Trust Bank, National Association.

The sole branch of Alabama Trust Bank, National Association will reopen during its normal business hours beginning Saturday as a branch of Southern States Bank...As of March 31, 2012, Alabama Trust Bank, National Association had approximately $51.6 million in total assets and $45.1 million in total deposits. In addition to assuming all of the deposits of the failed bank, Southern States Bank agreed to purchase essentially all of the assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.9 million. Compared to other alternatives, Southern States Bank's acquisition was the least costly resolution for the FDIC's DIF. Alabama Trust Bank, National Association is the 24th FDIC-insured institution to fail in the nation this year, and the first in Alabama. The last FDIC-insured institution closed in the state was Superior Bank, Birmingham, on April 15, 2011.

Demeter

(85,373 posts)NO, THEY MEAN ECONOMIC BUSTS....BANKRUPTCIES AND OOPSES....GET YOUR MINDS OUT OF THE GUTTER, NOW!

http://www.nybooks.com/articles/archives/2011/jul/14/busts-keep-getting-bigger-why/?pagination=false

Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present

by Jeff Madrick

Knopf, 464 pp., $30.00

Suppose we describe the following situation: major US financial institutions have badly overreached. They created and sold new financial instruments without understanding the risk. They poured money into dubious loans in pursuit of short-term profits, dismissing clear warnings that the borrowers might not be able to repay those loans. When things went bad, they turned to the government for help, relying on emergency aid and federal guarantees—thereby putting large amounts of taxpayer money at risk—in order to get by. And then, once the crisis was past, they went right back to denouncing big government, and resumed the very practices that created the crisis.

What year are we talking about?

We could, of course, be talking about 2008–2009, when Citigroup, Bank of America, and other institutions teetered on the brink of collapse, and were saved only by huge infusions of taxpayer cash. The bankers have repaid that support by declaring piously that it’s time to stop “banker-bashing,” and complaining that President Obama’s (very) occasional mentions of Wall Street’s role in the crisis are hurting their feelings. But we could also be talking about 1991, when the consequences of vast, loan-financed overbuilding of commercial real estate in the 1980s came home to roost, helping to cause the collapse of the junk-bond market and putting many banks—Citibank, in particular—at risk. Only the fact that bank deposits were federally insured averted a major crisis. Or we could be talking about 1982–1983, when reckless lending to Latin America ended in a severe debt crisis that put major banks such as, well, Citibank at risk, and only huge official lending to Mexico, Brazil, and other debtors held an even deeper crisis at bay. Or we could be talking about the near crisis caused by the bankruptcy of Penn Central in 1970, which put its lead banker, First National City—later renamed Citibank—on the edge; only emergency lending from the Federal Reserve averted disaster.

You get the picture. The great financial crisis of 2008–2009, whose consequences still blight our economy, is sometimes portrayed as a “black swan” or a “100-year flood”—that is, as an extraordinary event that nobody could have predicted. But it was, in fact, just the most recent installment in a recurrent pattern of financial overreach, taxpayer bailout, and subsequent Wall Street ingratitude. And all indications are that the pattern is set to continue.

Jeff Madrick’s Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present is an attempt to chronicle the emergence and persistence of this pattern. It’s not an analytical work, which, as we’ll explain later, sometimes makes the book frustrating reading. Instead, it’s a series of vignettes—and these vignettes are both fascinating and, taken as a group, deeply disturbing. For they suggest not just that we’re seeing a repeating cycle, but that the busts keep getting bigger. And since it seems that nothing was learned from the 2008 crisis, you have to wonder just how bad the next one will be.

I'M SURE KARL WOULD HAVE A BOOK OR TWO TO SAY ABOUT IT....

THIS REVIEW IS PROBABLY MORE INFORMATIVE THAN THE BOOK, IT'S DEFINITELY SHORTER--MUST READ!

Roland99

(53,345 posts)Roland99

(53,345 posts)Oil extends losses, slips under $92 a barrel

Crude futures at lowest since late October; natural gas rallies

http://www.marketwatch.com/story/oil-extends-losses-to-sixth-day-2012-05-18?dist=afterbell

Investors also parsed out news that a U.S. pipeline reversal, seen as instrumental in alleviating the glut in oil hub Cushing, Okla., is to start this weekend.

...

Prices ended the week 4.8% lower, their third week on the red. The Friday‘s settlement was also the lowest since Oct. 26.

“We have not had any good news in two weeks; everything continues to erode” with investors looking at the euro zone problems casting a pall over global demand for oil, and concerned about the oversupply in the U.S., said Tom Bentz, managing director at BNP Paribas in New York.

Demeter

(85,373 posts)A DOWN ON THE GROUND LOOK AROUND--MUST READ!

bread_and_roses

(6,335 posts)Ghost Dog

(16,881 posts)and reckon he probably spent most of his time watching english-language TV in his hotel room.

Superficial, very.

Demeter

(85,373 posts)As I’ve noted in previous articles, politics, not economics, rule Europe. What I mean by this is that most major decisions in Europe are determined by political agendas that ignore economic and financial realities.

This is at the core of the “welfare state” mentality that permeates Europe as a whole. The EU in general is comprised of an aging population that is more concerned about receiving the pensions/ health benefits/ social payouts that were promised to them by the system than anything else.

As a result of this, EU voters, who determine EU elections, don’t take action until what has promised to them comes under threat.

For this reason, EU political leaders will maintain their agendas regardless of whether said agendas go against financial or economic realities (or common sense for that matter) until these agendas begin to have real negative consequences for their political careers...

MORE

Roland99

(53,345 posts)Chairman Ben S. Bernanke on April 25 said he was prepared to take further action to aid the economy if necessary, even as he signaled that he didn’t see an immediate need to add stimulus with inflation near the Fed’s goal and unemployment falling. The minutes from the Fed’s April meeting showed several policy makers said additional action could be necessary if the recovery slips.

“If there were scope to do another twist of some type it would be prudent to consider it, especially in the scenario where things are worse and the Fed feels like it needs to move,” said Nathan Sheets, Global Head of International Economics at Citigroup Inc. in New York. Until August, Sheets was the Fed’s top international economist.

Economists such as Sheets and Credit Suisse Securities’ Dana Saporta say the Fed’s $400 billion program to extend the maturity of bonds has been just as effective as earlier programs to expand its balance sheet, known as quantitative easing. That may make another version of the maturity extension, which is dubbed Operation Twist and is set to expire in June, preferable because it doesn’t risk the same political backlash.

Demeter

(85,373 posts)Demeter

(85,373 posts)FHA insured loans have been a big booster for the current market. Historically FHA insured loans made up roughly 8 to 12 percent of all mortgage originations but in 2009 they hit 30 percent. For first time home buyers it was a stunning 50 percent showing that most people can only purchase a home today with a very small down payment. Yet small down payments create instant negative equity positions if the market moves sideways or pops lower (aka our current market). For example, the 3.5 percent standard FHA down payment is wiped away by the 5 to 6 percent selling costs. What is interesting with this is that the FHA insured loan market is fully backed by the government (i.e., you) so any losses will be completely shouldered by the public. The move to increase premiums recently was no fluke. One piece of data that stood out to me was of the number of homes in negative equity, how large the FHA numbers grew.

FHA insured loans 1 out of 4 underwater mortgages

A very troubling point showing a morphing of the current market is the number of underwater mortgages backed by FHA insured loans. As stated before, many of these loans were originated after the bubble popped in 2006 and 1 million originated only in the last two years: GRAPHIC PORN AT LINK

Demeter

(85,373 posts)You: doing more with less. Corporate profits: going strong. The dirty secret of the jobless recovery.

Editors' note, 4/17/2012: The big economic news of the past couple of weeks brought a study in contrasts: Hiring has slowed down dramatically, with few people coming off the unemployment rolls, while corporate profits keep climbing. How could this be? Here's how.

On a bright spring day in a wisteria-bedecked courtyard full of earnest, if half-drunk, conference attendees, we were commiserating with a fellow journalist about all the jobs we knew of that were going unfilled, being absorbed or handled "on the side." It was tough for all concerned, but necessary—you know, doing more with less.

"Ah," he said, "the speedup."

His old-school phrase gave form to something we'd been noticing with increasing apprehension—and it extended far beyond journalism. We'd hear from creative professionals in what seemed to be dream jobs who were crumbling under ever-expanding to-do lists; from bus drivers, hospital technicians, construction workers, doctors, and lawyers who shame-facedly whispered that no matter how hard they tried to keep up with the extra hours and extra tasks, they just couldn't hold it together. (And don't even ask about family time.)

Webster's defines speedup as "an employer's demand for accelerated output without increased pay," and it used to be a household word. Bosses would speed up the line to fill a big order, to goose profits, or to punish a restive workforce. Workers recognized it, unions (remember those?) watched for and negotiated over it—and, if necessary, walked out over it....

MORE

Demeter

(85,373 posts)Mark Roe, a professor at Harvard Law School and a renowned expert on securities law and financial markets, focuses on corporate bankruptcy and finance. He is the author of pioneering studies of the impact of politics on corporate organization and corporate governance around the world.

****************************************************************************************

If capitalism’s border is with socialism, we know why the world properly sees the United States as strongly capitalist. State ownership is low, and is viewed as aberrational when it occurs (such as the government takeovers of General Motors and Chrysler in recent years, from which officials are rushing to exit). The government intervenes in the economy less than in most advanced nations, and major social programs like universal health care are not as deeply embedded in the US as elsewhere. But these are not the only dimensions to consider in judging how capitalist the US really is. Consider the extent to which capital – that is, shareholders – rules in large businesses: if a conflict arises between capital’s goals and those of managers, who wins?

Looked at in this way, America’s capitalism becomes more ambiguous. American law gives more authority to managers and corporate directors than to shareholders. If shareholders want to tell directors what to do – say, borrow more money and expand the business, or close off the money-losing factory – well, they just can’t. The law is clear: the corporation’s board of directors, not its shareholders, runs the business. Someone naïve in the ways of US corporations might say that these rules are paper-thin, because shareholders can just elect new directors if the incumbents are recalcitrant. As long as they can elect the directors, one might think, shareholders rule the firm. That would be plausible if American corporate ownership were concentrated and powerful, with major shareholders owning, say, 25% of a company’s stock – a structure common in most other advanced countries, where families, foundations, or financial institutions more often have that kind of authority inside large firms.

But that is neither how US firms are owned, nor how US corporate elections work. Ownership in large American firms is diffuse, with block-holding shareholders scarce, even today. Hedge funds with big blocks of stock are news, not the norm.

Corporate elections for the directors who run American firms are expensive. Incumbent directors typically nominate themselves, and the company pays their election expenses (for soliciting votes from distant and dispersed shareholders, producing voting materials, submitting legal filings, and, when an election is contested, paying for high-priced US litigation). If a shareholder dislikes, say, how GM’s directors are running the company (and, in the 1980’s and 1990’s, they were running it into the ground), she is free to nominate new directors, but she must pay their hefty elections costs, and should expect that no one, particularly not GM, will ever reimburse her. If she owns 100 shares, or 1,000, or even 100,000, challenging the incumbents is just not worthwhile....

Warpy

(114,547 posts)who breezed in and told us we had to do more with less. It was a critical care unit! We were putting our licenses on the line every night we went in, while the hospital blithely said they'd budgeted for lawsuits. We hadn't been able to budget for them on our smaller paychecks, thanks, and would have been much happier with adequate help, adequate supplies, and fewer SUITS.

It was a good thing I had to leave when I did, or I'd still be in jail for killing one of them.

I think when people look back on Reaganism, the one thing that will strike them is the Great Speedup, with people working more hours and producing so much more for wages that remained flat or even declined in purchasing power, insurance care that wasn't worth the ink on the contracts, and pensions that were converted to bogus stock plans for ten cents on the dollar. They're going to wonder why we weren't burning corporate offices down to the steel I-beams and I keep wondering the same myself. I guess we were just too tired after being worked all those extra hours.

It's too late for me and most older Boomers, but I hope the pendulum starts to swing the other way and that safeguards at the constitutional level are instituted to keep future workers from getting the screw job we did.

Demeter

(85,373 posts)Residents of one Canadian town are engaged in a David and Goliath-style battle over the dirtiest oil project ever known...The small town of Fort Chipewyan in northern Alberta is facing the consequences of being the first to witness the impact of the Tar Sands project, which may be the tipping point for oil development in Canada.

The local community has experienced a spike in cancer cases and dire studies have revealed the true consequences of "dirty oil".

Gripped in a Faustian pact with the American energy consumer, the Canadian government is doing everything it can to protect the dirtiest oil project ever known. In the following account, filmmaker Tom Radford describes witnessing a David and Goliath struggle....

Demeter

(85,373 posts)I got a faceful of teargas just now. There was a manif outside the European Parliament, with hundreds of angry young Lefties – one can’t properly call them anarchists since most of them depend on the state for their living – yowling and gibbering like stricken apes. The EU’s response to the Greek crisis was a disgrace, they screamed. The workers of Europe were being sacrificed appease to the speculators. And d’you know what? They’re right.

When the credit crunch hit in 2008, governments around the world turned to the one set of people who, by definition, couldn’t give them disinterested advice, namely bankers. Predictably enough, the bankers solemnly assured the ministers that, unless they received colossal sums, the entire economy would collapse. I’m sure that if governments contracted out their policy on subsidising bakeries to bakers, they would also be told that handouts were vital. The bakers might even half-believe it themselves. But they would be wrong, just as the bankers were wrong. Proof of just how wrong can be found in Iceland, which was in no position to assume private bank liabilities, and which consequently – despite being far worse hit by the collapse than any EU state – is now in healthier shape than many eurozone countries. Don’t take my word for it: even Paul Krugman, guru to statists and Keynesians everywhere, has noticed.

The 2008 bailout round failed spectacularly in its declared effect, namely to ward off recession. Britain, the United States and other Western countries gave unprecedented sums of money to their banks. We know where the money came from but, three years on, we have little notion of where it went, or who has it now. It is beginning to dawn on some of our political leaders that perhaps they were panicked into a bad decision. Yet, unbelievably, they now propose to repeat their mistake.

The eurozone bailouts are, in essence, another transfer of wealth from the poor to the rich. As this blog never tires of pointing out, the bailout money isn’t going to the people of Greece, Ireland or Portugal; it is going to bankers and bondholders who made bad investments. The repayment, however, will indeed come from the people of these unhappy lands. No wonder they are out on the streets....

**************************************************************************************

Daniel Hannan is a writer and journalist, and has been Conservative MEP for South East England since 1999. He speaks French and Spanish and loves Europe, but believes that the European Union is making its constituent nations poorer, less democratic and less free.

Demeter

(85,373 posts)...Republicans in Congress have now proposed cutting and radically restructuring the Supplemental Nutrition Assistance Programme (Snap) – the programme more commonly known as food stamps – despite record numbers of people presently on the rolls. Without question, these cuts and changes would prove devastating for many of those to whom food stamps represent a last line of defence against hunger.

Food stamps were first instituted in 1939 at the tail end of the Great Depression, but were discontinued in 1943. It was more than two decades later that the programme was established on a permanent basis with the Food Stamp Act of 1964 – as a part of President Lyndon B Johnson's "Great Society". Since then, it has undergone some changes but remains essentially intact.

And it is a good thing it has.

In March 2011, a record 44.5 million Americans received food stamps, which was an 11.1% increase over the year before. Even more illustrative of the profound impact the economic recession has had on poor and working-class Americans is the fact that this represents a 64% increase over the number of recipients in March 2008.

Faced with this evidence of increased need, on 31 May, the House appropriations committee nevertheless approved the fiscal year 2012 agricultural appropriations bill, which includes $71bn for Snap – $2bn less than President Obama's recommendation. On 16 June, the bill was just barely approved with a 217-203 vote in the House...

Po_d Mainiac

(4,183 posts)A child of five would understand this. Send someone to fetch a child of five.

Age is not a particularly interesting subject. Anyone can get old. All you have to do is live long enough.

Either this man is dead or my watch has stopped.

From the moment I picked up your book until I laid it down, I was convulsed with laughter. Some day I intend reading it.

Go, and never darken my towels again.

I could dance with you until the cows come home. On second thought I'd rather dance with the cows until you come home.

I find television very educating. Every time somebody turns on the set, I go into the other room and read a book.

I never forget a face, but in your case I'll be glad to make an exception.

I sent the club a wire stating, PLEASE ACCEPT MY RESIGNATION. I DON'T WANT TO BELONG TO ANY CLUB THAT WILL ACCEPT ME AS A MEMBER

I've had a perfectly wonderful evening. But this wasn't it.

It isn't necessary to have relatives in Kansas City in order to be unhappy.

Military intelligence is a contradiction in terms.

Military justice is to justice what military music is to music.

Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy.

My mother loved children -- she would have given anything if I had been one.

Outside of a dog, a book is man's best friend. Inside of a dog it's too dark to read.

She got her looks from her father. He's a plastic surgeon.

Those are my principles, and if you don't like them... well, I have others.

Time flies like an arrow. Fruit flies like a banana.

Women should be obscene and not heard.

I don't have a photograph, but you can have my footprints. They're upstairs in my socks.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)THE FAMOUS MIRROR SCENE FROM DUCK SOUP

In the "mirror scene," Pinky, dressed as Firefly, pretends to be Firefly's reflection in a missing mirror, matching his every move—including absurd ones that begin out of sight—to near perfection. In one particularly surreal moment, the two men swap positions, and thus the idea of which is a reflection of the other. Eventually, and to their misfortune, Chicolini, also disguised as Firefly, enters the frame and collides with both of them.

This scene has been recreated many times; for instance, in the Bugs Bunny cartoon Hare Tonic, the Mickey Mouse cartoon Lonesome Ghosts, in the 1944 The Three Stooges short subject Idle Roomers, in The Pink Panther, in the 1966 TV series Gilligan's Island ("Gilligan vs. Gilligan"

Although its appearance in Duck Soup is the best known instance, the concept of the mirror scene did not originate in this film. Charlie Chaplin used it in The Floorwalker (1916) and Max Linder included it in his 1921 silent film Seven Years Bad Luck, where a man's servants have accidentally broken a mirror and attempt to hide the fact by imitating his actions in the mirror's frame.

Demeter

(85,373 posts)The New York Fed is refusing to tell investigators how many billions of dollars it shipped to Iraq during the early days of the US invasion there, the special inspector general for Iraq reconstruction told CNBC Tuesday. The Fed's lack of disclosure is making it difficult for the inspector general to follow the paper trail of billions of dollars that went missing in the chaotic rush to finance the Iraq occupation, and to determine how much of that money was stolen.

The New York Fed will not reveal details, the inspector general said, because the money initially came from an account at the Fed that was held on behalf of the people of Iraq and financed by cash from the Oil-for-Food program. Without authorization from the account holder, the Iraqi government itself, the inspector general's office was told it can't receive information about the account.

The problem is that critics of the Iraqi government believe highly placed officials there are among the people who may have made off with the money in the first place. And some think that will make it highly unlikely the Iraqis will sign off on revealing the total dollar amount.

“My frustration is not with the New York Fed, it is with the Iraqis,” said Stuart Bowen Jr., the Special Inspector General for Iraq reconstruction (SIGIR). “They haven’t been sufficiently responsive.”

MORE

As for the New York Fed’s position of secrecy about the total amount transferred to Iraq, Bowen said, “We understand it in the sense that it's a foreign account and the account holder, according to their own rules, must provide permission.”

Demeter

(85,373 posts)This is the first in a two-part essay on the origins of the sovereign debt crisis. Here the emphasis is on Germany’s central role in the last century and a half of European history and in the formation of the euro.

I met a traveler from an antique land

Who said: Two vast and trunkless legs of stone

Stand in the desert. Near them, on the sand,

Half sunk, a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them, and the heart that fed;

And on the pedestal these words appear:

“My name is Ozymandias, king of kings:

Look upon my works, ye Mighty, and despair!”

Nothing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away.

It is indeed ironic that at the time the euro faces its greatest existential crisis, the European Central Bank has broken ground on its new headquarters in Frankfurt. This is when the core design flaw at the heart of the European monetary union has become manifest to a number of leading market observers, practitioners, economists and journalists. What was once deemed the fantasy of a few extreme euro-skeptics has now become respectable mainstream opinion. A fiscal/monetary half-way house divided cannot stand. That seems to be clear, and the prophetic warnings of the great English Romantic poet, Percy Bysshe Shelley, are more relevant than ever.

So how does the European Economic and Monetary Union (EMU) avoid the fate of the great Ozymandias?

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)It feels as if Europe has rolled the clocks back to 2011 as the effects of the ECB’s LTRO have now well and truly warn off and the markets appear to have reconnected with idea that the fundamental issues of the Eurozone have never been addressed. Spain is 55% through its debt schedule for the year but, as the shadow of emergency operations passes over, yields are rising quickly:

The bond maturing July 30, 2015 sold 1.0 billion euros, had a yield of 4.876 percent compared to 4.037 percent May 3 and was 3 times subscribed following a bid-to-cover ratio of 2.9 percent at the last auction.

The bond maturing April 30, 2016 sold 1.1 billion euros with an average yield of 5.106 percent, higher than 3.374 percent March 15. Demand was lower than previously, with the bond 2.4 times subscribed after 4.1 times at the March auction.

But that wasn’t Spain’s only problem overnight:

“It is not true that there’s a deposit flight,” Deputy Finance Minister Fernando Jimenez Latorre told a news conference to discuss the country’s economic outlook. “Depositors are safer now than they were a couple of weeks ago.” He also dismissed the notion that Spanish banking sector could face massive deposit withdrawals.

Bankia’s stock fell as much as 29% early in the session, before recovering some of the ground and ending down 14% on the day.

And then this morning Moody’s took a blowtorch to the rest of the banking system:

The debt and deposit ratings declined by one notch for five banks, by two notches for three banks and by three notches for nine banks. The short-term ratings for 13 banks have also been downgraded between one and two notches, triggered by the long-term ratings changes.

The outlooks on the debt and deposit ratings for ten of the 17 banks downgraded today are now negative. For the remaining seven banks affected by today’s actions, their ratings remain on review for further downgrade, for reasons specific to each bank

It is now quite apparent that the sovereign and banking system in Spain are so intertwined that they are coming to be seen a one thing by the CRAs. The problem is this looks like a downwards spiral for both with no apparent solution to addressing the country’s underlying economic problems. Spain’s broader equities market was down another 1.1% overnight and 35% for the year, while yields continue to rise back towards their November 2011 peaks.

But it isn’t just Spain having trouble with banking deposits, and banking stability more generally. Greece is most certainly struggling from the same, but with the added issue that the ECB is refusing to work directly with a number of Greek banks:

At the same time, the ECB has apparently now said that it won’t directly lend to some Greek banks that it judges to be technically “insolvent”. These are banks that have holes in their balance sheets, because, thanks to the restructuring of Greek sovereign debt, they can’t now expect to get back all of the money that they lent to the government.

That sounds bad, but the banks that have lost access to direct ECB funding can almost certainly still get money from the Greek central bank, which, of course, is ultimately, getting its cash from the ECB (though unlike the more direct form of ECB liquidity support, all the risk implicit in this so-called ELA lending is, formally at least, borne by the Greeks alone)...

MORE

Demeter

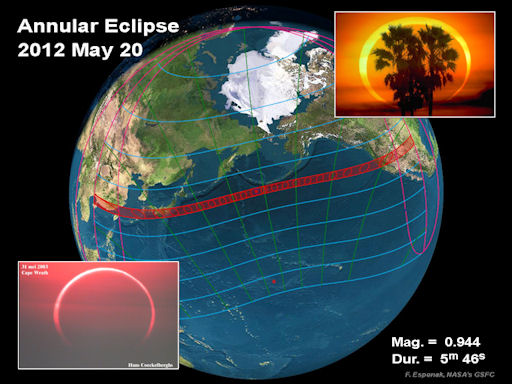

(85,373 posts)On Sunday, May 20th, the Moon will pass in front of the Sun, producing an annular solar eclipse visible across the Pacific side of Earth. The path of annularity, where the sun will appear to be a "ring of fire," stretches from China and Japan to the middle of North America:

An animated eclipse map prepared by Larry Koehn of ShadowandSubstance.com shows the best times to look. In the United States, the eclipse begins at 5:30 pm PDT and lasts for two hours. Around 6:30 pm PDT, the afternoon sun will become a luminous ring in places such as Medford, Oregon; Chico, California; Reno, Nevada; St. George, Utah; Albuquerque, New Mexico, and Lubbock, Texas. Outside the narrow center line, the eclipse will be partial. Observers almost everywhere west of the Mississippi will see a crescent-shaped sun as the Moon passes by off-center.

http://shadowandsubstance.com/

Because this is not a total eclipse, some portion of the sun will always be exposed. To prevent eye damage, use eclipse glasses, a safely-filtered telescope, or a solar projector to observe the eclipse. You can make a handy solar projector by criss-crossing your fingers waffle-style. Rays of light beaming through the gaps will have the same shape as the eclipsed sun. Or look on the ground beneath leafy trees for crescent-shaped sunbeams and rings of light.

Hugin

(37,760 posts)Also, time for a little reminder: DO NOT LOOK DIRECTLY AT THE SUN!!!!

It will cause permanent eye damage and blindness. EVEN WITH REGULAR SUNGLASSES!!!

So, if you're like me and you don't have an Arc Welding helmet handy.

Make yourself a Pinhole Projector...

All it takes is two sheets of paper and a pinhole. Simply poke a very small hole on one sheet of the paper. (Yes, you may use stiff paper or a lightweight cardboard.) Turn your back to the Sun and hold the Holed Paper so that the light of the Sun shines through the hole onto the second sheet of paper as a screen. You may have to move the two sheets back and forth a bit to acheive the best focus. I've viewed several Eclipses through this device and not only does it please the cheapskate in me, but, it does a great job of letting you see the event without eye damage.

One more time... DO NOT LOOK DIRECTLY AT THE SUN!!!!

DemReadingDU

(16,002 posts)My 30-something daughter had her dad send her the glass from his welding helmet so she could view the eclipse. It will be interesting to find out how much we will be able to see here in Ohio compared to western U.S. where the eclipse is reported will be very good.

I remember the last eclipse that we saw, appx 18 years ago, during the mid-day. I was working then, but if I recall, the day grew darker as if dusk was approaching. And then the day got brighter again.

5/17/12 Solar Eclipse 2012

Click to see map of U.S. for best states for viewing

http://www.wjla.com/blogs/weather/2012/05/solar-eclipse-2012-15528.html

Hugin

(37,760 posts)At the peak, all of the tree leaves were working like pinhole projectors and casting odd crescent shaped shadows on the ground.

Amazing!

If I recall that eclipse happened around noon where I was living. I was at work when it occurred.

hamerfan

(1,404 posts)Groucho. Lydia The Tattooed Lady:

Love it...

Fuddnik

(8,846 posts)

Po_d Mainiac

(4,183 posts)Now warning lights are flashing down at Quality Control

Somebody threw a spanner, they threw him in the hole

There's rumors in the loading bay and anger in the town

Somebody blew the whistle and the walls came down

There's a meeting in the boardroom, they're trying to trace the smell

There's a leakin' in the washroom, there's a sneakin' personnel

Somewhere in the corridors someone was heard to sneeze

Goodness me, could this be industrial disease ?'

Caretaker was crucified for sleeping at his post

Refusing to be pacified, it's him they blame the most

Watchdog's got rabies, the foreman got the fleas

Everyone's concerned about industrial disease

There's panic on the switchboard, tongue is in knots

Some come out in sympathy, some come out in spots

Some blame the management, some the employees

Everybody knows it's the industrial disease

Yeah, now the work force is disgusted down tools and walks

Innocence is injured, experience just talks

Everyone seeks damages and everyone agrees

That these are classic symptoms of a monetary squeeze

On ITV and BBC they talk about the curse

Philosophy is useless, theology is worse

History boils over, there's an Economics freeze

Sociologists invent words that mean industrial disease

Doctor Parkinson declared, "I'm not surprised to see you here

You've got smokers cough from smoking

Brewer's droop from drinking beer

I don't know how you came to get the Bette Davis wheeze

But worst of all young man you've got industrial disease"

He wrote me a prescription he said, "You are depressed

I'm glad you came to see me to get this off your chest

Come back and see me later, next patient please

Send in another victim of industrial disease"

And I go down to speaker's corner, I'm a thunderstruck

They got free speech, tourists, police in trucks

Two men say they're Jesus, one of them must be wrong

There's a protest singer, he's singing a protest song, he says

They wanna have a war to keep their factories

They wanna have a war to keep us on our knees

They wanna have a war to stop us buying Japanese

They wanna have a war to stop industrial disease

They're pointing out the enemy to keep you deaf and blind

They wanna sap your energy, incarcerate your mind

Give you Rule Brittania, gassy beer, page three

Two weeks in Espania and Sunday striptease

Meanwhile the first Jesus says, "I'll cure it soon

Abolish Monday mornings and Friday afternoons"

The other one's out on hunger strike, he's dying by degrees

How come Jesus gets industrial disease?

Demeter

(85,373 posts)

Marx's birthplace in Trier, Rhineland-Palatinate, which is now a museum devoted to him.

Karl Heinrich Marx was born on 5 May 1818 at 664 Brückergasse in Trier, a town located in the Kingdom of Prussia's Province of the Lower Rhine.

His ancestry was Ashkenazi Jewish, with his paternal line having supplied the rabbis of Trier since 1723, a role that had been taken up by his own grandfather, Meier Halevi Marx; Meier's son and Karl's father would be the first in the line to receive a secular education.

His maternal grandfather was a Dutch rabbi.

Karl's father, Herschel Marx, was middle-class and relatively wealthy: the family owned a number of Moselle vineyards; he converted from Judaism to the Protestant Christian denomination of Lutheranism prior to his son's birth, taking on the German forename of Heinrich over Herschel. In 1815, he began working as an attorney and in 1819 moved his family from a five-room rented apartment into a ten-room property near the Porta Nigra.

A man of the Enlightenment, Heinrich Marx was interested in the ideas of the philosophers Immanuel Kant and Voltaire, and took part in agitation for a constitution and reforms in Prussia, which was then governed by an absolute monarchy.

Karl's mother, born Henrietta Pressburg (20 July 1788-30 November 1863), was a Dutch Jew who, unlike her husband, was only semi-literate. She claimed to suffer from "excessive mother love", devoting much time to her family, and insisting on cleanliness within her home. She was from a prosperous business family. Her family later founded the company Philips Electronics: she was great-aunt to Anton and Gerard Philips, and great-great-aunt to Frits Philips. Her brother, Marx's uncle Benjamin Philips (1830-1900), was a wealthy banker and industrialist, who Karl and Jenny Marx would later often come rely upon for loans, while they were exiled in London.

Heinrich Marx converted to Lutheran Protestantism in 1816 or 1817 in order to continue practicing law after the Prussian edict denying Jews to the bar. Karl was born in 1818 and baptized in 1824, but his mother, Henriette, did not convert until 1825, when Karl was 7. There is no evidence that the Marx family actually embraced Lutheranism, although there is no evidence they were practicing Jews. Marx identified himself as an atheist.

Little is known about Karl Marx's childhood. He was privately educated until 1830, when he entered Trier High School, whose headmaster Hugo Wyttenbach was a friend of his father. Wyttenbach had employed many liberal humanists as teachers; this angered the government so that the police raided the school in 1832, discovering what they labelled seditious literature espousing political liberalism being distributed amongst the students. In 1835, Karl, then aged seventeen, began attending the University of Bonn, where he wished to study philosophy and literature, but his father insisted on law as a more practical field of study. He was able to avoid military service when he turned eighteen because he suffered from a weak chest. Being fond of alcoholic beverages, at Bonn he joined the Trier Tavern Club drinking society (Landsmannschaft der Treveraner) and at one point served as its co-president. Marx was more interested in drinking and socialising than studying law, and because of his poor grades, his father forced him to transfer to the far more serious and academically oriented University of Berlin, where his legal studies became less significant than excursions into philosophy and history.

Hegelianism and early activism: 1836–1843

In 1836, Marx became engaged to Jenny von Westphalen, a beautiful baroness of the Prussian ruling class—"the most desirable young woman in Trier" —who broke off her engagement with a young aristocratic second lieutenant to be with him. Their eventual marriage was controversial for breaking two social taboos of the period: it was a marriage between a woman of a noble background and a man of Jewish origin, as well as being between a member of the upper class (aristocracy) and a member of the middle class, respectively. Such issues were lessened by Marx's friendship with Jenny's father, Baron Ludwig von Westphalen, a liberal thinking aristocrat. Marx dedicated his doctoral thesis to him. The couple married seven years later, on 19 June 1843, at the Pauluskirche in Bad Kreuznach.

Marx became interested in, but critical of, the work of the German philosopher G.W.F Hegel (1770–1831), whose ideas were widely debated amongst European philosophical circles at the time. Marx wrote about falling ill "from intense vexation at having to make an idol of a view I detested." He became involved with a group of radical thinkers known as the Young Hegelians, who gathered around Ludwig Feuerbach and Bruno Bauer. Like Marx, the Young Hegelians were critical of Hegel's metaphysical assumptions, but still adopted his dialectical method in order to criticise established society, politics and religion. Marx befriended Bauer, and in July 1841 the two scandalised their class in Bonn by getting drunk, laughing in church, and galloping through the streets on donkeys. During that period, Marx concentrated on his criticism of Hegel and certain other Young Hegelians.

A contemporary drawing of Karl Marx as a young man.

Marx also wrote for his own enjoyment, writing both non-fiction and fiction. In 1837, he completed a short novel, Scorpion and Felix; a drama, Oulanem and some poems, none of which were published. In 1971, Marx's one act play Oulanem was made available in English by author Robert Payne. According to Payne, the title Oulanem is an anagram for "Manuelo" which is a variant of "Emmanuel" meaning "God is with us". He soon gave up writing fiction for other pursuits, including learning English and Italian.

He was deeply engaged in writing his doctoral thesis, The Difference Between the Democritean and Epicurean Philosophy of Nature, which he finished in 1841. The essay has been described as "a daring and original piece of work in which he set out to show that theology must yield to the superior wisdom of philosophy", and as such was controversial, particularly among the conservative professors at the University of Berlin. Marx decided to submit it instead to the more liberal University of Jena, whose faculty awarded him his PhD based on it.

From considering an academic career, Marx turned to journalism. He moved to the city of Cologne in 1842, where he began writing for the radical newspaper Rheinische Zeitung, where he expressed his increasingly socialist views on politics. He criticised the governments of Europe and their policies, but also liberals and other members of the socialist movement whose ideas he thought were ineffective or outright anti-socialist. The paper eventually attracted the attention of the Prussian government censors, who checked every issue for potentially seditious material before it could be printed. Marx said, "Our newspaper has to be presented to the police to be sniffed at, and if the police nose smells anything un-Christian or un-Prussian, the newspaper is not allowed to appear." After the paper published an article strongly criticising the monarchy in Russia, the Russian Tsar Nicholas I, an ally of the Prussian monarchy, requested that the Rheinische Zeitung be banned. The Prussian government shut down the paper in 1843. Marx wrote for the Young Hegelian journal, the Deutsche-Französische Jahrbücher, in which he criticised the censorship instructions issued by Prussian King Friedrich Wilhelm IV. His article was censored and the newspaper closed down by the authorities shortly after.

In 1843, Marx published On the Jewish Question, in which he distinguished between political and human emancipation. He also examined the role of religious practice in society. That same year he published Contribution to Critique of Hegel's Philosophy of Right, in which he dealt more substantively with religion, describing it as "the opiate of the people". He completed both works shortly before leaving Cologne.

Demeter

(85,373 posts)By the Alternative Banking Working Group of Occupy Wall Street

Dear Jamie Dimon:

We, the Alternative Banking Working Group of Occupy Wall Street, are staging an intervention on your behalf. Unlike many in the financial industry and press, we will not be deceived by attempts at misdirection and we are not intimidated by complexity. Your days of gambling with taxpayers’ money and pressuring the regulators to let business go on as usual are over. It’s not good for you, it’s not good for us, and it’s not good for our country.

It’s been a good ride, and we’ve been impressed with how long you have managed to keep it up. The incredible complexity of the financial system helped, of course, just as it helped obscure countless other crimes and frauds.

It’s truly a work of art how you and your enablers have created a system that nobody fully understands. It’s the perfect cover for your continuing addiction to risk, power, and money, and it keeps everyone confused just long enough, well past any statute of limitation for criminal prosecution.

Now your addiction is out of control. Rather than quitting while you and JPMorgan Chase were ahead (if you ever were), you’ve been driven to inhale every last dollar, no matter the risks involved for you and for all of us. What has really worked for you personally, and has allowed you to remain credible for so long, is your intense denial as to the underlying question of what year it is.

You seem to live in a time warp where it is still 2004, the housing market is booming, along with the associated securities market, and you and your friends are printing money with no downside in sight. But it turns out that ’04 model was a bit of a lemon — or, to borrow your words, “poorly conceived, poorly vetted, and poorly executed.”

Here is some sobering news: You are, in fact, living in 2012, leading an enormous, too-big-to-fail bank, which is being continuously bailed out by the Fed’s unlimited loans at 0% interest, on the taxpayers’ dime. In a reasonable world, under these conditions, JPMorgan Chase would be a utility bank focused on the public good, and you would be merely its custodian. You would not be incentivized to take crazy risks to chase yield. Your job would be incredibly boring and your bank only very mildly profitable.

But, sadly, the addiction is still doing the talking. So we’re here to say “no more.” It’s time to put down that fifth drink and walk away from the baccarat table, because no matter how many martinis you have and no matter how much money you lose, you’re still a glorified accountant, not a secret agent. And that’s fine. There’s nothing that JPMorgan Chase, and the world economy for that matter, needs more than a very good accountant.

Perhaps you will protest that you don’t need this intervention. In fact, over the past few days you have repeatedly acknowledged your sloppiness, stupidity, and bad judgment. And though that sounds compelling and humble, as we know you expect it to, you haven’t gone far enough to demonstrate that you understand just how deeply in trouble you are. And don’t claim stupidity – “stupid” isn’t a word associated with Jamie Dimon. You need to admit that you are powerless over your addiction and that your bank has become unmanageable.

Here is what we ask of you:

First, stop gambling with our money and our futures. Stop lobbying for deregulation — we are way past that now. Stop lying to us all by doing silly things like pushing proprietary trading into the treasury office and renaming it, or by pretending that there are no losses when there very clearly are, to the tune of $2,000,000,000 and growing. And, please, stop trying to convince us that nobody at JPMorgan Chase saw this coming. Ina Drew was offering to resign in April but you kept telling the world that nothing serious was amiss, a lie which could get you serious jail time.

Second, admit that your bank is too big to take risks that neither you nor anyone in your bank understands or is able to handle, and that the only thing that will stop you from misbehaving is strong, enforced, and uncompromised regulation.

Third, resign as Director of the Federal Reserve Bank of New York. It is inappropriate, and dangerous to us, for you to oversee the banking system or the economy when you have proven incompetent at overseeing your own bank — particularly since the Federal Reserve is investigating your bank and your behavior.

Because this in an intervention, you’re going to need to get used to a lot of new folks who will challenge the bad decisions that have become habit for you. The SEC should be facilitating the first step by getting you into a full in-patient rehab program, where the Fed, the FDIC, and every other regulator who has an interest in your bank’s good health can help you make a searching and fearless moral inventory of your bank and its choices. Although the “revolving door” connecting Wall Street to the Beltway has turned our regulatory agencies into the Keystone Kops of the 21st century, your crisis should serve as a wake-up call and put an end to their denial as well.

When you reach your twelfth step, you can help the regulators write tougher regulations based on the knowledge you acquired during your efforts to undermine them.

After all, if you can’t manage the risk, then nobody can. And you’ve taken the first step by admitting that you can’t. Now take the other eleven.

Best regards,

The Alternative Banking Working Group

Demeter

(85,373 posts)As reporters keep digging into the “London Whale” story, the picture that emerges about the caliber of risk controls and management supervision at JP Morgan only look worse and worse.

The latest revelations comes via the Wall Street Journal. First, that there was no treasurer during the period when the CIO entered into the loss-making trades. The idea that a bank of any size, let alone one as big as JP Morgan, would go for months (five in this case) without a treasurer in place is stunning. JP Morgan contends this is not germane, since (allegedly) the CIO did not report to the treasurer. Then pray tell, why was it housed in the treasury at all? And the bank’s efforts to make this all sound normal are undermined by this part of the story:

So the former treasurer was looking over the positions, even if he was not part of the reporting line (or was he?).

But worse, the risk manager tasked to the oversight of the unit appears underqualified for the job, and that might not be unrelated to the fact that he is the brother-in-law of a JP Morgan executive. The Key extracts:

In addition, the executive put in charge of risk management for the Chief Investment Office in February, Irvin Goldman, was a former trader, not a risk manager. He is also the brother-in-law of another top J.P. Morgan executive, Barry Zubrow. JP Morgan argued that many risk professionals come from trading (true) but his background does not look logical for oversight of a business dealing in complex “hedges”:

MORE

hamerfan

(1,404 posts)Chico and Harpo. Piano duet. Killer:

bread_and_roses

(6,335 posts)I'll be in and out - lots on the agenda this weekend - including the Preakness tomorrow

Demeter

(85,373 posts)And I was exceedingly desperate.

Good luck! I assume you have a bet?

Demeter

(85,373 posts)and I'm at least half right.

bread_and_roses

(6,335 posts)have never had any interest in wagering. On the few occasions I make it to the track I'll put $2 on a name I like for the fun of it. But I really just love to watch the horses.

DemReadingDU

(16,002 posts)5/19/12 I'll Have Another Wins Preakness

http://abcnews.go.com/Sports/wireStory/wins-preakness-16386944#.T7hKKlI5v84

Demeter

(85,373 posts)THINK IT WILL HAPPEN? IT'S BETTER THAN $2000 FOR A FAULTY FORECLOSURE

http://www.latimes.com/news/nation/nationnow/la-na-nn-texas-court-inmate-20120518,0,5439511.story

The Texas Supreme Court has ordered the Lone Star State to pay more than $2 million to a former inmate who spent 26 years in prison for murder, a ruling that could set a precedent for compensating other prisoners whose convictions are overturned.

Billy Frederick Allen, now in his 60s, was convicted of two 1983 Dallas-area murders. Unlike other inmates freed after DNA evidence proved their innocence, Allen was freed in 2009 after a court found problems with witness testimony and his trial attorneys' representation. Allen sued the state for compensation for wrongful imprisonment. Allen's attorney said the Supreme Court ruling may prove key to developing standards for when the state must compensate former prisoners.

"There are many cases where people are struggling and they don't have DNA, but they now have hope," Allen's attorney, Kris Moore of McKinney, Texas, told The Times. "The implications of this for the Texas justice system are probably larger than people realize."

He said the ruling may make it easier for inmates such as Richard Miles of Dallas -- who served 14 years for crimes he didn't commit, then spent two years awaiting a court ruling that finally came in February -- to be compensated more quickly. But he said it's not clear what bearing Allen's case may have on other ongoing high-profile exoneration battles. In one such case, Kerry Max Cook has written a book and attracted celebrity supporters in his fight to prove his innocence and receive compensation for serving 22 years on Texas' death row for an East Texas murder he says he never committed.

Texas' compensation law is the most generous in the U.S., according to officials at the New York-based Innocence Project. Freed inmates declared innocent by a judge, prosecutor or a governor's pardon can collect $80,000 for every year of imprisonment, along with an annuity and medical and education benefits.

MORE

Demeter

(85,373 posts)MUST READ! OBAMA AND HOLDER ACTUALLY DO SOMETHING!

Demeter

(85,373 posts)Commerce Department announces the duties after a finding that Chinese solar panel makers 'dumped' their goods. If approved, the tariffs are expected to have a significant effect on the industry...In just a few years, China has grabbed about half the U.S. market for solar panels...The Obama administration ordered tariffs of 31% and higher on solar panels imported from China, escalating a simmering trade dispute with China over a case that has sharply divided American interests in the growing clean-energy industry.

The Commerce Department announced the stiff duties Thursday after making a preliminary finding that Chinese solar panel manufacturers "dumped" their goods — that is, sold them at below fair-market value. The widely anticipated ruling, if affirmed by U.S. trade officials this fall, is expected to have significant implications for both the global production of solar cells, now largely in China, and the growth of the solar energy industry in the U.S., which employs about 100,000 people in manufacturing, installation and services.

More than 60 Chinese firms, includingSuntech Power Holdings Co., the world's largest solar panel maker, and Trina Solar Ltd., face a 31% duty on their exports to the U.S., retroactive to shipments made in February. All other Chinese exporters of solar cells will be hit with a tariff of 250%. In just a few years, China has grabbed about half the U.S. market for solar panels. U.S. imports of Chinese solar cells — the primary component in solar panels — were valued at about $3.1 billion last year, up from $640 million in 2009, according to the Commerce Department.

The tariffs are more than what many industry executives and analysts were expecting. They are on top of the Commerce Department's duties of 2.9% to 4.7% imposed in March on Chinese solar panel imports for illegal subsidies. The anti-subsidy tariffs were seen as modest and unlikely to have much of an effect on the U.S. solar energy market. Chinese companies and government officials largely took that decision in stride.

Demeter

(85,373 posts)The last 60 years have been the hottest in Australasia for a millennium and cannot be explained by natural causes, according to a new report by scientists that supports the case for a reduction in manmade carbon emissions.

In the first major study of its kind in the region, scientists at the University of Melbourne used natural data from 27 climate indicators, including tree rings, corals and ice cores to map temperature trends over the past 1,000 years.

"Our study revealed that recent warming in a 1,000-year context is highly unusual and cannot be explained by natural factors alone, suggesting a strong influence of human-caused climate change in the Australasian region," said the study's lead researcher, Dr Joelle Gergis.

The climate reconstruction was done in 3,000 different ways and concluded with 95% accuracy that no other period in the past 1,000 years match or exceeded post-1950 warming in Australia...

Demeter

(85,373 posts)than post another word about JPMorgan....goodnight, and sweet dreams, all!

xchrom

(108,903 posts)

westerebus

(2,978 posts)Saw them at Wolf Trap in 2000. Thanks X.

xchrom

(108,903 posts)i hope they were really good?

westerebus

(2,978 posts)If not, put it on your bucket list. We were eye level three rows back from the stage. They were excellent!

xchrom

(108,903 posts)i'm so glad they were good -- i love their recordings -- and imagined the live experience would be excellent.

westerebus

(2,978 posts)Karimba is a great cd, you will rumba through the kitchen. A different sound, but you'd like it.

westerebus

(2,978 posts)Roland99

(53,345 posts)I'm a little jealous, too!

xchrom

(108,903 posts)The final wake-up call came from Moody's. On Thursday evening, the US rating agency downgraded 16 Spanish banks in one fell swoop, some of them by three notches. On Monday, the agency had already downgraded 26 Italian banks -- including major institutions such as UniCredit and Intesa Sanpaolo. The outlook for all the institutions involved is negative, Moody's said.

These are drastic steps, but they are hardly excessive. The European sovereign debt crisis long ago also became a banking crisis. The fate of the affected countries can not be separated from that of their financial institutions: If a state goes bankrupt, its banks too will struggle to survive. On the other hand, the examples of Ireland and Spain show that a shaky banking system can quickly overwhelm national budgets.

Moody's justified its downgrades of Spanish banks with the argument that the ability of the government to support individual banks has worsened. On Friday, the Spanish central bank was also forced to admit that the proportion of bad loans on the books of Spanish banks has risen to an 18-year high. According to the central bank, the share of bad loans rose in March to 8.36 percent, compared to 8.15 percent in the previous month.

Clearing Out Accounts

Reports began trickling in earlier this week that savers in Greece were withdrawing hundreds of millions of euros from their bank accounts -- the German news agency DPA reported that almost €900 million was withdrawn just on Monday alone. Since then Europe has been seized by the fear of a worst-case scenario in Greek's banking system: a so-called bank run, as customers who have lost confidence in their banks rush to take out their savings.

xchrom

(108,903 posts)With much of Western Europe distracted by the euro crisis, China has begun in recent months to intensify its role as an investor in Central and Eastern Europe -- both through loans and the acquisitions of firms. Beijing has estimated foreign currency reserves of $3.2 trillion (€2.52 trillion), and some say the investment spree could be the start of something bigger.

Last month, at the April 26 China-Central Europe-Poland Economic Forum in Warsaw, Chinese Prime Minister Wen Jiabao announced the creation of a $10 billion credit line to support Chinese investments in Central European infrastructure, new technology, and renewable energy. Wen's goal is to reach a volume of $100 billion in trade with Central Europe by 2015, an astounding turnaround for a country that was regarded with deep suspicion by the post-communist countries of Central Europe only a decade ago. And for China, the political benefits of offering such a credit line may be just as important as the economic ones. Indeed, the leaders of 16 countries in the region all traveled to the Polish capital to meet with Wen.

"There is a big economic benefit to China for making a deal like this, because it wants to move out of lower-cost manufacturing eventually, and this is a way of getting a foothold in European markets," said Jonas Parello-Plesner, a senior policy fellow at the European Council on Foreign Relations.

The credit line is only one of a number of major China-related developments in Central and Eastern Europe in recent months. Shortly after Wen's trip, Chinese Deputy Prime Minister Li Kequiang also traveled to the region, announcing a string of deals, including a $1 billion credit line to Hungary for the construction of a Chinese-built rail line to the Budapest airport. Chinese shipping giant Cosco has also said it is considering investing $1 billion to develop the port of Rijeka, Croatia.

xchrom

(108,903 posts)SPANISH BANKS’ bad loans rose in March to their highest in 18 years, underscoring the problems facing the government as it drafts in independent auditors in an attempt to reassure investors it can clean up the sector.

The Bank of Spain said bad loans rose to 8.37 per cent of banks’ outstanding loans, the highest since August 1994 and up from 8.3 per cent in February, which was also revised higher.

The data was released before Spain names auditors on Monday to assess how bad the losses are likely to get, and how much cash banks will need to rebuild their balance sheets.

The audit will start with a one-month stress test followed by a deeper analysis of assets in the financial sector, deputy prime minister Soraya Saenz de Santamaria said.

Fuddnik

(8,846 posts)Five days without a cigarette, and bloody mary's for breakfast, I'm in this state of mind. SICK!!!!!!

Demeter

(85,373 posts)We are all rooting for you to kick the evil weed.

westerebus

(2,978 posts)Once you get past the first three days, provided there are no body parts located nearby, assuming the psychotic episodes have passed, you're good.

You can tell when your taste buds kick back in, then your sense of smell returns and your blood pressure levels out.

Tansy_Gold

(18,167 posts)And you got us backin' you up.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Greece installed a government to act as caretaker until an election in mid-June. The Cabinet consists of technocrats, including George Zannias, who has been the Finance Ministry's chief economist throughout the crisis and is now finance minister. Concerns about Greece exiting the eurozone persist. If election results signal a rejection of austerity, the country could be headed for an exit. Citizens also could launch a bank run. Officials have already noted a significant withdrawal of funds from Greek banks.

http://www.bloomberg.com/news/2012-05-17/greece-s-rating-downgraded-one-level-to-ccc-from-b-by-fitch.html

Fitch Ratings further cut credit ratings for Greece, citing an increased risk that the nation will exit the eurozone. "In the event that the new general elections scheduled for 17 June fail to produce a government with a mandate to continue with the EU-[International Monetary Fund] programme of fiscal austerity and structural reform, an exit of Greece from [the Economic and Monetary Union] would be probable," according to Fitch.

Demeter

(85,373 posts)The world's top 29 banks may need a total $556 billion (351 billion pounds) to meet tougher new capital rules, cutting returns by a fifth and forcing them to curb investor payouts and raise customer charges, Fitch Ratings said on Thursday.

The credit rating agency studied 29 banks named by world leaders (G20) as being globally systemically important financial institutions (G-SIFI) and required to hold core capital buffers of up to 9.5 percent by the start of 2019.

The list includes Barclays (BARC.L), Deutsche Bank (DBKGn.DE), Goldman Sachs (GS.N), HSBC (HSBA.L), JPMorgan Chase (JPM.N), and UBS (UBSN.VX).

Fitch said the banks represented $47 trillion in assets and may need to raise $566 billion common equity to hit core ratios of around 10 percent to satisfy new global Basel III requirements being phased in over several years from January....

Demeter

(85,373 posts)The Senate on Thursday confirmed two nominees to the Federal Reserve, bringing its short-handed board up to full strength for the first time in six years as it wrestles with a tepid economic recovery and a revamp of financial rules.

The Senate voted 70-24 to confirm Harvard economist Jeremy Stein and 74-21 to confirm investment banker Jerome Powell... Stein, who holds a doctorate in economics from the Massachusetts Institute of Technology, is a Harvard economist who served briefly as a senior adviser to Treasury Secretary Timothy Geithner. He also was a staff member for President Barack Obama's National Economic Council. Stein specializes in stock price behavior, corporate investment and financing decisions. Powell is a visiting scholar at the Bipartisan Policy Center in Washington. He is a lawyer who also brings Wall Street experience to the board. He worked at Bankers Trust, the Carlyle Group and Dillon Read after serving as a Treasury undersecretary in the administration of former U.S. President George H. W. Bush...

The two nominees were approved over the opposition of some conservative Republicans who worried the pair would rubber stamp Chairman Ben Bernanke's policies at the central bank...Vitter, who led the opposition to the nominees, argued that the two could strengthen Bernanke's hand in issuing new regulations under the Dodd-Frank financial reform law that many Republicans oppose. "These two new members change the map," he said. "I think that will significantly push these regulations to the left."

WOULD THAT IT WERE SO...

Demeter

(85,373 posts)Hefty state spending helped Venezuela's economy grow a brisker-than-expected 5.6 percent during the first quarter, boosting President Hugo Chavez's campaign for re-election in October.

Economists had expected robust growth in the first quarter as the socialist government pumped money into infrastructure and welfare programs in the hopes of bolstering voter support in the South American OPEC member.

The quarterly result - the highest in nearly four years - was better than most analysts expected and topped the fourth-quarter's 4.9 percent expansion, partly reflecting robust construction activity, Finance Minister Jorge Giordani said.

But strong domestic demand and growing public spending risks fueling stubborn double-digit inflation, which hit 27.6 percent last year. Giordani, however, said prices were showing signs of cooling...

Demeter

(85,373 posts)The U.S. Commodity Futures Trading Commission may propose easing Dodd-Frank Act regulations limiting speculation in oil, natural gas, wheat and other commodities, according to four people briefed on the matter.

The CFTC’s five commissioners are considering a private vote to change how companies aggregate their trading positions when they have ownership stakes in other firms, according to the people, who spoke on condition of anonymity. The agency may propose raising to 50 percent from 10 percent the threshold for when a company is considered to have an ownership stake and must add the trading positions, the people said.

Steven Adamske, a CFTC spokesman, declined to comment.

The change would affect rules on so-called position limits that were completed by the CFTC in October. The limits, which cap the number of contracts a trader can have, prompted a lawsuit by the International Swaps and Derivatives Association Inc. and the Securities Industry and Financial Markets Association seeking to overturn the regulation.

The agency is considering revising its rules in response to requests from lobbying groups representing agriculture and energy firms including Cargill Inc., ConocoPhillips (COP) and Archers- Daniels-Midland Co. The proposal may still change and the meeting could also be held in public.

Demeter

(85,373 posts)G8 leaders on Saturday vowed to “strengthen and reinvigorate” their economies while pointedly “recognising” that each country might pursue different policy paths in a statement that reflected the enduring split between proponents of greater stimulus or austerity.

Read more >>

http://link.ft.com/r/3JFELL/62P0DP/4VXHZ/5VIADC/5VUQTK/OS/t?a1=2012&a2=5&a3=19

Demeter

(85,373 posts)So Jamie Dimon is human after all. His firm has finally missed the fairway and found itself in the rough. His shareholders, employees and probably the White House are desperately hoping he can reach into his bag, grab his favorite club and pull off a Bubba Watson or a Phil Mickelson. Meanwhile, some rivals on Wall Street and antagonists in Washington are likely hoping he pulls a Jean van de Velde.

With Dimon facing some serious challenges in the coming days and weeks, a wise caddy would tell him to focus on these five key things.

- Keep your focus today.

- $3 billion is still a lot of money to some people.

- Optics matter.

- Don’t worry about the SEC. (NOBODY ELSE DOES, WHY SHOULD YOU?)

- They still love you in the clubhouse. (AFTER ALL, OBAMA IS NOT LIKELY TO MOVE HIS MONEY...)

ELABORATIONS ON POINTS AT LINK

Demeter

(85,373 posts)The FBI has opened an inquiry into the multibillion-dollar trading losses at JPMorgan Chase, stepping up pressure on the bank after key U.S. agencies said they were looking into high-risk trades that first drew regulators' attention last month.