Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 23 May 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 23 May 2012[font color=black][/font]

SMW for 22 May 2012

AT THE CLOSING BELL ON 22 May 2012

[center][font color=red]

Dow Jones 12,502.81 -1.67 (-0.01%)

[font color=green]S&P 500 1,316.63 +0.64 (0.05%)

[font color=red]Nasdaq 2,839.08 -8.13 (-0.29%)

[font color=green]10 Year 1.77% -0.01 (-0.56%)

[font color=red]30 Year 2.86% +0.01 (0.35%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

DemReadingDU

(16,002 posts)Po_d Mainiac

(4,183 posts)Any investor who can get shares of the Facebook IPO should purchase as many shares as possible, Jim Cramer said on CNBC’s “Mad Money", CNBC

But here's the real deal

Fuddnik

(8,846 posts)NO! NO! NO!

DO NOT SELL BEAR!!!!!!

Cramer is Wall Street's David Brooks.

Po_d Mainiac

(4,183 posts)they charge.

Advertisers ain't getting the traffic from the exposure, and as soon as FB tries to charge an account fee, it's 'game over

Those that take advice from CNBS will get Zucked again.

Fuddnik

(8,846 posts)Kind of like this place?

Po_d Mainiac

(4,183 posts)I might have. Or maybe not.

Warpy

(114,547 posts)Pay a fee and avoid the ads, or don't pay the fee and have your screen cluttered up with people trying to sell you stuff. Either way, it pays to keep the site up and running.

I think the membership fee is a bargain, but I have the money to pay it these days.

Fuddnik

(8,846 posts)^AORD All Ordinaries 4,130.30 11:51PM EDT Down 43.20 (1.04%) Components, Chart, More

^SSEC Shanghai Composite 2,360.97 May 22 Down 12.34 (0.52%) Chart, More

^HSI HANG SENG INDEX 18,728.48 12:09AM EDT Down 310.67 (1.63%) Components, Chart, More

^BSESN BSE 30 15,959.72 12:01AM EDT Down 66.69 (0.42%) Chart, More

^JKSE Jakarta Composite 3,966.49 12:11AM EDT Down 54.61 (1.36%) Components, Chart, More

^KLSE KLSE Composite 1,540.73 11:56PM EDT Down 6.11 (0.39%) Components, Chart, More

^N225 Nikkei 225 8,605.94 11:51PM EDT Down 123.35 (1.41%) Chart, More

^NZ50 NZSE 50 3,513.51 11:55PM EDT Down 16.35 (0.46%) Components, Chart, More

^STI STRAITS TIMES INDEX 2,787.65 11:51PM EDT Down 36.10 (1.28%) Components, Chart, More

^KS11 KOSPI Composite Index 1,804.87 12:11AM EDT Down 23.82 (1.30%) Components, Chart, More

^TWII Taiwan Weighted 7,162.14 11:51PM EDT Down 112.75 (1.55%)

Fuddnik

(8,846 posts)jtuck004

(15,882 posts)A little humor, (prophecy?) from Google Translate, courtesy of Zero Hedge.

Demeter

(85,373 posts)But they can establish protective tariffs on goods and capital flows. And they really ought to, and forget all this "free trade" lies and drugging.

girl gone mad

(20,634 posts)to manage the "Grexit". how well they can be enforced, I'm not sure.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)....Class privilege, and the power it confers, is often conveniently misunderstood by its beneficiaries as the product of their own genius rather than generations of advantage, stoutly defended and faithfully bequeathed. Evidence of such advantages is not freely available. It is not in the powerful's interest for the rest of us to know how their influence is attained or exercised. But every now and then a dam bursts and the facts come flooding forth....

Issues of alleged criminality will eventually be determined in the courts. But while illegality would be more damning, much of what we now know that is legal is no less corrosive. The evidence has laid bare the intimate, extensive and insidious web of social, familial and personal ties between the political, corporate and legal forces that govern a country: a patchwork of individual and institutional associations so tightly interwoven that to pick at one part is to watch the whole thing unravel. The "sit downs", pay-offs and class camaraderie on display owe more to a cross between Downton Abbey and the Sopranos than the functioning of a 21st-century democracy.

...Such is the incestuous nature of the British ruling class and the gene puddle from which it draws its stock. Such is their brazen venality, complicity, contempt and mendacity. Eton, Oxford, Bullingdon, Westminster – if you're looking for a tiny minority who are struggling to integrate, look no further than the cabinet.

Two things make this a matter of import as well as intrigue. The first is the lie it gives to the insistence on meritocracy at a time of acute economic crisis when benefits are slashed, the poor hammered. Cameron and his cabinet insist others pull themselves up by their bootstraps even as they themselves swan around in their parents' expensive pairs of loafers. Today almost 40% of MPs went to private school. In 1997 it was just 30%. In terms of social mobility, we are going backwards. The issue here is not class envy but class entrenchment. The fact that they were born rich is irrelevant. They had no choice in the matter. But the fact that they appear to want to give even more to those who already have a great deal while denying much to those who have little is unforgiveable...Rocked in the cradle of power from birth so that its rhythms become second nature, these people imbibe their sense of entitlement with their mother's milk. But the personal tutors, private schools, the most expensive universities do not, somehow, suffice. As though the benefits of wealth were not enough, they apparently feel the need to game the very system they already control.

Which brings us to the manner in which these interactions mock the very notion of democracy on which the nation's illusions are based. For the meetings, lunches and visits showcase a parallel, unaccountable universe where actual decisions are made and deals are done.

SPECIFICS AT LINK, UK AND US

Demeter

(85,373 posts)IT'S JUST NOT ALWAYS OBVIOUS WHY THEY DO SOMETHING

http://www.aljazeera.com/news/asia-pacific/2012/05/201257195136608563.html

Al Jazeera English has closed its bureau in Beijing after the Chinese authorities refused to renew its correspondent's press credentials and visa, or allow a replacement journalist. The channel expressed its disappointment at the situation and said it would continue to request a presence in China. It has been requesting additional visas for correspondents for some time through the normal procedures but these have not been issued.

Melissa Chan, who has been Al Jazeera English's China correspondent since 2007, has filed nearly 400 reports during her five years in the country. She has covered stories about the economy, domestic politics, foreign policy, the environment, social justice, labour rights and human rights.

Salah Negm, director of news at Al Jazeera English said:

"We've been doing a first class job at covering all stories in China.

"Our editorial DNA includes covering all stories from all sides. We constantly cover the voice of the voiceless and sometimes that calls for tough news coverage from anywhere in world.

"We hope China appreciates the integrity of our news coverage and our journalism. We value this journalist integrity in our coverage of all countries in the world.

"We are committed to our coverage of China. Just as China news services cover the world freely we would expect that same freedom in China for any Al Jazeera journalist.

"Al Jazeera Media Network will continue to work with the Chinese authorities in order to reopen our Beijing bureau."

Bob Dietz of the New York-based Committee to Protect Journalists said Chan's case, the first expulsion of a journalist since 1998, "marks a real deterioration in China's media environment and sends a message that international coverage is unwanted".

Demeter

(85,373 posts)THIS ARTICLE ADDS BETTING LOSSES AND STOCK LOSSES...

http://www.huffingtonpost.com/mark-gongloff/jamie-dimon-jpmorgan-chase_b_1533126.html

Champion American complainer Jamie Dimon complained on Monday about Wall Street regulation, while also insisting he not be described as a complainer. All the while, his bank's losses, partly resulting from lax regulation, continued to grow. An initial $2 billion trading loss has likely resulted in a total loss of more than $30 billion, when you include a 19 percent drop in the bank's stock price. By itself, the trading loss alone might balloon to more than $6 billion, according to one estimate.

To strengthen the Cognitive Dissonance Vortex he had created, the JPMorgan Chase CEO's comments came as the ink was still drying on news reports that reminded everybody of why the Wall Street regulation he complains about constantly is necessary in the first place. Namely, the Wall Street Journal reported that a top risk-management officer at JPMorgan apparently had a spotty track record of risk-management. And CNNMoney said estimates of the bank's initial $2 billion loss due to poor risk-management have tripled to at least $6 billion...But first, to the Dimon Complain-Bot 9000: Speaking at the Deutsche Bank Securities Global Financial Services Investor Conference in New York, Dimon rolled out several of his standard complaints about post-crisis efforts to regulate the financial sector, according to the Wall Street Journal's Deal Journal blog, which live-blogged his comments. On the Volcker Rule, which -- if it is ever actually put in place in any real way -- would prohibit banks with federally insured customer deposits from being able to blow billions of dollars on stupid market gambles, Dimon warned that regulators should be very careful not to "throw the baby out with the bathwater." Typically in this analogy, which he has used more than once before, Dimon implies that JPMorgan is the squeaky-clean baby and other banks are the nasty bathwater. But now that JPMorgan Chase has done exactly the sort of thing the Volcker Rule was designed to stop, the analogy is less effective -- the baby a bit scummier, if you will. Dimon also issued his usual dire warnings about how regulation would harm American banks and drive business overseas to places where regulations aren't so horribly constraining. But, amazingly, Dimon also said of regulation: "Please don't anyone write I am complaining about it." This is the man who has honed complaining about regulation to a fine art. He is the Mozart of Complaining. If you haven't seen it, you should really take a few minutes and watch Hunter Stuart's Huffington Post video mashup of all of the times Jamie Dimon has complained about regulation.

http://www.huffingtonpost.com/2012/05/15/jamie-dimon-financial-regulation-jpmorgan_n_1518742.html

Ironically, the regulations he hates most might have saved his bank at least $2 billion, and possibly $5 billion or even $7 billion. Bad bets on unregulated credit derivatives cost the bank an initial $2 billion, and now Morgan Stanley estimates the losses will rise to $5 billion by the end of the year, the Financial Times's FT Alphaville blog writes. That is $2 billion more than Dimon has publicly estimated, but increasingly nobody believes Dimon on this. In fact, CNNMoney suggests the losses may have already hit $6 billion or $7 billion, citing traders in the derivatives market, where JPMorgan and its enormous bets are still trapped, being eaten alive by hedge funds.

Dimon, in his comments on Monday, said the bank wasn't going to keep updating everybody on its losses. An easier amount of money to track is the amount of market value that has been vaporized since this episode began. JPMorgan stock has tumbled nearly 19 percent since May 10, erasing nearly $30 billion in shareholder value. Adding insult to injury, Dimon said that the bank was going to cancel its plans to buy back its stock -- despite the shares now being available at a steep discount -- in order to make sure the bank's capital will be ready to meet new global regulatory requirements. These developments may not undermine Dimon's arguments that the bank has a "fortress balance sheet," but they won't make shareholders happy. And clearly the bank's reputation for risk management is getting worse by the day...

Demeter

(85,373 posts)JPMorgan Chase & Co officials met with the U.S. futures regulator one day after revealing a $2 billion loss on trades booked in London, according to information from the Commodity Futures Trading Commission. Five JPMorgan officials met with Democratic Commissioner Mark Wetjen to discuss the overseas reach of U.S. swaps reforms, which the banking industry has argued will put U.S. banks at a disadvantage and increase the cost of hedging. But JPMorgan's now infamous trades -- which could generate up to $5 billion in losses and are now under investigation by the CFTC and other agencies -- have appeared to harden the CFTC's resolve to create a robust overseas regulatory regime. The CFTC is in the process of finalizing some of the most critical swaps rules required by the 2010 Dodd-Frank financial oversight law.

"Some commenters have expressed the view that if a transaction is done offshore, it should not come under Dodd-Frank," CFTC Chairman Gary Gensler said on Tuesday at a Senate Banking Committee hearing about JPMorgan's trading losses.

"The law, the nature of modern finance and the experiences leading up to the 2008 crisis, as well as the reminder of the last two weeks, strongly suggest this would be a retreat from much-needed reform," Gensler said, referring to JPMorgan's losses.

The faulty portfolio was built on layers of supposedly offsetting bets with credit derivatives tied to corporate bonds. The failed hedging strategy was executed by JPMorgan's Chief Investment Office in London. Those trades, which are also under investigation by the Securities and Exchange Commission and the FBI, have prompted Chief Executive Jamie Dimon to suspend a $15 billion share repurchase plan and shaved roughly $30 billion off the market value....

REFORM PUSHBACK WEAKENS

The CFTC was tasked by Dodd-Frank with boosting transparency and limiting risk in the $708 trillion over-the-counter global swaps market. Risky derivatives trading at overseas subsidiaries of firms like insurer American International Group severely damaged the U.S. financial system during the 2007-2009 credit crisis. The global profile of risk prompted Congress to give the CFTC broad authority to regulate overseas swaps activity that has a "direct and significant" impact on U.S. commerce. U.S. banks, including JPMorgan, had mounted a full court press to convince the agency to spell out a more limited view of its authority, while pushing bills through Congress to reduce it by law. But the momentum behind the push has faded as financial reform advocates have pointed to JPMorgan's trading losses to highlight the need for tough overseas rules.

Last week, a House Agriculture panel suspended consideration of a bill that would have exempted the vast majority of foreign trades from some Dodd-Frank rules. Republican Committee Chairman Frank Lucas cited the JPMorgan trading losses as a reason for the panel to slow down. CFTC Commissioner Bart Chilton said the agency must be careful not to "overshoot" with rules that cut too deeply into the authority of foreign regulators, but agreed that the trading losses made a case for tough overseas application.

"The JPMorgan circumstance exemplifies that these are global markets and just because something is done in a jurisdiction outside of the U.S. doesn't mean that it doesn't impact U.S. customers, markets or potentially our economy," he said in an interview.

Demeter

(85,373 posts)The retention of William McLucas comes as the bank is facing an investigation by the markets watchdog and by the CFTC into $2bn in trading losses

Read more >>

http://link.ft.com/r/XYEWFF/VLI8PL/9MEOW/NJ81I6/ZGJFXP/7V/t?a1=2012&a2=5&a3=2

Po_d Mainiac

(4,183 posts)The story should probably read something more like:

JPMorgan Chase & Co officials met with the regulators and wined and dined them till the wee hours of the following morning. Jamie assured all present that the Columbian escort service had been pre-paid, and all maids were actually JPM staff.

There may have actually been some discussion of recent losses at JPM's CIO London office , but the minutes of the meeting have yet to written. CFTC staff are said to thinking about what to set to type, at the time of this article

AnneD

(15,774 posts)smell blood in the water and are starting a feeding frenzy on one of their own. I guess you call this the Bear Stearn Business Model. I look for JP to bleed to death, the result of a thousand small cuts. Even Warren will lose on this one.

girl gone mad

(20,634 posts)I have it on good authority.

Demeter

(85,373 posts)VIDEO AT LINK

"If somebody told me this happened to them, I absolutely would not believe this could happen in America."

That was the reaction of a New Jersey man who found out just how risky it can be to carry cash through Tennessee. For more than a year, NewsChannel 5 Investigates has been shining a light on a practice that some call "policing for profit." In this latest case, a Monterey police officer took $22,000 off the driver -- even though he had committed no crime.

"You live in the United States, you think you have rights -- and apparently you don't," said George Reby.

As a professional insurance adjuster, Reby spends a lot of time traveling from state to state. But it was on a trip to a conference in Nashville last January that he got a real education in Tennessee justice.

"I never had any clue that they thought they could take my money legally," Reby added. "I didn't do anything wrong."

Reby was driving down Interstate 40, heading west through Putnam County, when he was stopped for speeding. A Monterey police officer wanted to know if he was carrying any large amounts of cash.

"I said, 'Around $20,000,'" he recalled. "Then, at the point, he said, 'Do you mind if I search your vehicle?' I said, 'No, I don't mind.' I certainly didn't feel I was doing anything wrong. It was my money."

That's when Officer Larry Bates confiscated the cash based on his suspicion that it was drug money.

"Why didn't you arrest him?" we asked Bates.

"Because he hadn't committed a criminal law," the officer answered.

Bates said the amount of money and the way it was packed gave him reason to be suspicious.

"The safest place to put your money if it's legitimate is in a bank account," he explained. "He stated he had two. I would put it in a bank account. It draws interest and it's safer."

"But it's not illegal to carry cash," we noted.

"No, it's not illegal to carry cash," Bates said. "Again, it's what the cash is being used for to facilitate or what it is being utilized for."

NewsChannel 5 Investigates noted, "But you had no proof that money was being used for drug trafficking, correct? No proof?"

"And he couldn't prove it was legitimate," Bates insisted.

Bates is part of a system that, NewsChannel 5 Investigates has discovered, gives Tennessee police agencies the incentive to take cash off of out-of-state drivers. If they don't come back to fight for their money, the agency gets to keep it all.

"This is a taking without due process," said Union City attorney John Miles.

A former Texas prosecutor and chairman of the Obion County Tea Party, Miles has seen similar cases in his area. He said that, while police are required to get a judge to sign off on a seizure within five days, state law says that hearing "shall be ex parte" -- meaning only the officer's side can be heard. That's why George Reby was never told that there was a hearing on his case.

"It wouldn't have mattered because the judge would have said, 'This says it shall be ex parte. Sit down and shut up. I'm not to hear from you -- by statute," Miles added.

George Reby said that he told Monterey officers that "I had active bids on EBay, that I was trying to buy a vehicle. They just didn't want to hear it."

In fact, Reby had proof on his computer.

But the Monterey officer drew up a damning affidavit, citing his own training that "common people do not carry this much U.S. currency."

AND THERE'S SO MUCH MORE! SEE ALSO: http://www.informationclearinghouse.info/article31404.htm

Demeter

(85,373 posts)

DemReadingDU

(16,002 posts)The cops here stop anybody and everyone for anything.

A man, Mr.X, was driving on main street and the person Mr.Y in front of him made a right turn. MR.X drove slowly past Mr.Y on the left.

No can do in my town. Because, the main street has 2 lanes, and a center section outlined with yellow lines, for only making turns. A person cannot use that middle section for driving around the person in front of you. Seriously! Actually, this has happened twice that I am aware of.

Anyway, Mr.X was stopped, and somehow it was determined that Mr.X was carrying several thousand dollars on his person, and a several boxes in his back seat which Mr.X said were tools for fixing his rental houses. The cop didn't believe MR.X and asked to search his vehicle. Mr.X said 'NO", that the cop had to get a search warrant first.

Mr.X was then ordered into the village court which developed into a small trial (called a 'hearing' in the village) with Mr.X, the cop, and a magistrate to determine who could best prove their side.

And the magistrate found Mr.X guilty of crossing the yellow line to drive around Mr.Y.

edit to add that the man was able to keep his money.

Basically, the same scenario happened with a Ms.Z, and she too was found guilty of crossing the yellow line to drive around the person in front of her.

P.S. We have learned a lot about how our cops give citations by attending the village court every other week. Tonight is court again. Much more entertaining that watching TV!

Demeter

(85,373 posts)The ruling UK coalition is preparing a “massive” increase in state-backed investment in housing and infrastructure, as Nick Clegg signalled a shift from lurid warnings by ministers about the debt crisis to a fresh emphasis on growth

Read more >>

http://link.ft.com/r/LVA6WW/AMHXCC/204L2/4CYAEZ/4CP17S/B7/t?a1=2012&a2=5&a3=22

EVERYBODY'S "ON MESSAGE" FOR THE NEW CONFIDENCE CAMPAIGN....THAT'S AS IN "CON"

Demeter

(85,373 posts)Singapore has enticed Trafigura, one of the world’s biggest commodities trading houses, to move its legal headquarters from Switzerland to the Asian city state, highlighting the attractions of its low-tax regime and proximity to China

Read more >>

http://link.ft.com/r/0QSDPP/MS73JV/XBAN6/7AQXOW/II2Z94/QR/t?a1=2012&a2=5&a3=22

RUNNING FROM REGULATION, TOO, I'LL WAGER

Demeter

(85,373 posts)Last edited Wed May 23, 2012, 01:35 AM - Edit history (1)

DOES THIS MEAN ISRAELI CARPET-BOMBING IS OFF, TOO?

Western powers are prepared to offer Iran an “oil carrot” that would allow it to continue supplying crude to Asian customers in exchange for guarantees it is not building an atomic bomb

Read more >>

http://link.ft.com/r/WDI4RR/FKOQWR/3CWTA/OR6LEU/TUYELZ/SN/t?a1=2012&a2=5&a3=22

Roland99

(53,345 posts)and no take backs!

Fuddnik

(8,846 posts)If you give BP, and Exxon-Mobil a cut of the oil contracts, we're good to go.

Which is what the whole thing was about in the first place.

Demeter

(85,373 posts)I really do. Stop laughing.

Demeter

(85,373 posts)Perhaps it's a coincidence that the decline of the American empire is occurring as there has been an increasing advocacy for profit-driven charter schools and vouchers for corporate-run private schools. But maybe it's really a symptom of a nation that once drew its ingenuity and creativity from the collective knowledge imbued through public education. As BuzzFlash at Truthout has noted before, there is no public education crisis in upper middle class and wealthy suburban public schools. NOT EXACTLY TRUE...SEE MY NOTES BELOW

Saying there is a crisis in public education is like saying we have an immigration problem. We don't have a general "immigration" problem; we have a society that wants to make sure that more brown-skinned people don't enter the US and quicken the timetable for whites becoming a minority in America. Similarly, we don't have a public education problem; we have a problem of education in poor areas where there are no jobs and in areas that have endured social neglect, but is this anything new? No, this nation just ignored its economically depressed urban areas for decades. Now, the for-profit school industry has given enough money to people in power to suddenly say: "Oh, it's not the poverty and multi-generational gridlock due to the lack of economic opportunity; it's the teacher's unions."

Maybe the teacher's unions aren't perfect; maybe some teachers get burned out from being punching bags for the result of society's neglect of the poor without economic opportunity. But putting in for-profit schools whose goal is to make big bucks off of public funds by hiring inexperienced teachers at rock-bottom salaries isn't going to change the cultural/economic context in which such public education takes place.

Charter schools and vouchers are just another way for the one percent to make a profit off of the poor. It's no coincidence that wealthy and well-off suburbs and neighborhoods don't have the "shock doctrine need" for charter schools and vouchers...Like the privatization of prisons, charter schools and vouchers are meant to enrich the wealthy not to improve anything -- in this case the education of children who live in economically distressed communities -- but rather to improve the profits of "education" corporations who have bought off politicians.

YESTERDAY I SPOKE WITH THE KID'S TUTOR, A LADY WITH DECADES OF EXPERIENCE IN TEACHING CHILDREN, INSIDE AND OUTSIDE THE PUBLIC SCHOOL SYSTEM

HER PUPILS ARE BRINGING IN TO THEIR TUTORS HOMEWORK SUITABLE FOR COLLEGE GRADUATE LEVELS...BUT THE KIDS ARE IN GRADE SCHOOL OR AT BEST HIGH SCHOOL

THIS CRAMMING DOWN, PUSHING KIDS INTO LEVELS OF RARIFIED, TRULY POINTLESS "ANALYSIS" AND NEGLECTING THE BASIC BUILDING BLOCKS THAT THEY SHOULD BE GETTING, ARE DESTROYING KIDS BEFORE THEY EVEN GET STARTED.

TAKING 9 WEEKS OUT OF EACH SCHOOL YEAR FOR "TESTING" IS MAKING SURE THAT NOTHING GETS TAUGHT.

OH, YES, THE PROBLEM EXISTS IN WEALTHY NEIGHBORHOODS, TOO. IT'S JUST THAT THOSE FAMILIES HAVE MORE RESOURCES TO COPE...AND MORE WILL TO HAVE THE KIDS SUCCEED. BUT THEY ARE BEING PUSHED BEYOND THEIR LIMITS, TOO.

kickysnana

(3,908 posts)Willow Lane's designation changed Tuesday, May 22, when the state Department of Education unveiled Multiple Measurement Ratings, the state's new way of grading schools. Under the new measures, Willow Lane is a school state education officials say should be emulated.

===========

One down 49 more left to go.

Tansy_Gold

(18,167 posts)not necessarily each and every individual charter, but the whole concept of them, like some kind of separate but equal bullshit. May they all die.

Ironically, iirc, Minnesota was one of the first states to charter charter schools.

proud2BlibKansan

(96,793 posts)AnneD

(15,774 posts)Last edited Wed May 23, 2012, 11:23 AM - Edit history (1)

To hid the fact that funding has been taken from the education system, a series of crucial, all important 'test' over the been sanctified as the true marker of a child's education. Teachers have been instructed not to teach to the test but their jobs and pay depends on the outcome.

Educrates that have never spent a day in a class teaching a child are telling teacher how to be a more effective teacher. They all have products and tests that if bought, will preform miracles that will make the most impoverished, malnourished, attention starved child a Rhodes Scholar.

Children are treated like widgets or worse yet, trained preforming animals that need only to regurgitate facts on command. And when teachers stand up and call this nonsense out for what it is-they are overpaid, union loving, lazy good for nothing bums. They are responsible for a host of problems, the least of which is the economic collapse of their respective states and the nation.

Mom always told me that you really shouldn't judge a person, that only God knows your heart. But she did say that your actions could be judged by their fruits. I only know what I see and these are the fruits I now observe. The joy of learning is wiped out at an earlier age than ever. Kids come in to kindergarten with a desire to learn. Their little eyes sparkle so. More and more it is gone by the first grade, killed by hundreds of benchmark tests that away time from hands on learning. Recess, a very important tool for learning, socializing, and burning off excess energy, is increasing viewed as a distraction from teaching and has become as rare in schools as PE, Art, and Music.

Children are not the only ones adversely affected by these 'reforms'. Experienced teachers that can retire are leaving. Those that are not invested by time in the system are getting out into another line of work, not because they want to, but because it is a dead end, capricious career. The only ones left lack the experience and skill to teach in extremely difficult situation. They generally work just long enough to have their loans forgiven, then leave for better paying jobs.

I am so glad my daughter went through public school when one could still get an education. If I were a parent, I would certainly home school my child, not for religious reasons, but for academic ones. My mother was my first and best teacher and I hope to teach my grandchildren one day.

I love education but I am sad as to what is being destroyed before my eyes. I have fought tooth and nail for education but it has taken a toll. I am thankful I am soon to retire. Those still in the field will have my sincere sympathies.

Happy hunting and watch out for the bears.

proud2BlibKansan

(96,793 posts)Demeter

(85,373 posts)...Simon Wren-Lewis, an economics professor at Oxford, has looked on in horror as the Dutch have agreed on completely unnecessary austerity measures, as a way of showing their commitment to Europe's totally misguided fiscal pact. "Towards the end of April the Dutch conservative coalition government collapsed when the far-right party refused to discuss further budget cuts," Mr. Wren-Lewis wrote on his blog on May 7. "The prime minister resigned. And yet a few days later other parties rallied round to give their support to a similar package of austerity measures, which now have majority support in parliament."

British Prime Minister David Cameron vowed "no going back" on his failed austerity strategy in a speech after the elections.

And Jens Weidmann, president of the German central bank, vowed to destroy the euro. O.K., that's not what he said in so many words, but that's the implication of his op-ed in the Financial Times on May 7. The meat is at the end: "Monetary policy in the euro zone is geared towards monetary union as a whole; a very expansionary stance for Germany therefore has to be dealt with by other, national instruments," Mr. Weidmann wrote. "However, this also implies that concerns about the impact of a less expansionary monetary policy on the periphery must not prevent monetary policy makers' taking the necessary action once upside risks for euro zone inflation increase. Delivering on its primary goal to maintain price stability is the prerequisite for safeguarding the most precious resource a central bank can command: credibility."

Let's parse this. "A very expansionary stance for Germany therefore has to be dealt with ..." I'm pretty sure is code for saying that Germany will try to prevent any inflationary impact of low European Central Bank rates with fiscal contraction. Austerity for all! (And no help for peripheral economies in the form of above-normal German inflation.) And then, a declaration that the E.C.B. will tighten to prevent any "upside risks for eurozone inflation" — even if the southern economies are facing deflation. Put it together, and it's a declaration that all of the burden of "internal devaluation" — the need to bring costs and prices in Spain and others down relative to the core — will be borne by deflation in the south.

This won't work, of course; it's a prescription for catastrophic failure of the euro. What is Mr. Weidmann thinking? My guess is that he isn't — or at least that there's no model there, just a series of central bankerish catch-phrases strung together, in a way that fails to reveal the underlying impossibility of the strategy...

Demeter

(85,373 posts)There is probably no greater waste of our taxpayer money than the increased incarceration of our population.

The state of Illinois had a prison population of 7,326 inmates in 1970; in 2012, the number has risen to over 48,000. Over that period of time, the state's population has grown only by 12 percent. The average cost of incarceration is approximately $30,000 a year, and our Department of Corrections (DOC) has a budget of over $1.5 billion.

We would be foolish to think that the cost of incarcerating someone ends when they leave the system. The recidivism rate is as high as 50 percent, so many will go through the system multiple times.

The biggest cost to society, though, comes from incarcerating a young person for a nonviolent offense. He or she will lose earning potential over a lifetime, and we will lose a potentially productive and contributing member of society. With the difficulties of becoming employed after an incarceration and the loss of time in the job market, there is a loss to society of potential tax revenue over time. In addition, there is a higher probability that the offender and his or her family will rely on programs such as Medicaid and food stamps. It creates the cycle of poverty that succeeding generations will struggle to break...There are strong forces behind keeping the status quo in our penal systems. There is money to be made in the prison industry; feeding, clothing and housing a large number of people produces a profit for many companies. For the downstate legislators, this is a jobs program. In some of the rural areas of Illinois, the prisons located there are the largest employers in the area. Closing prisons means a tremendous loss of decent-paying jobs with benefits. No state legislator wants to lose good-paying jobs from his or her district...

*******************************************************************

Christine Cegelis is a national board member for Americans for Democratic Action and a previous assistant director of the Illinois Department of Central Management Services, as well as a Democratic Congressional candidate in 2004 and 2006.

AnneD

(15,774 posts)we get our slave labor, and fill the government coffers with out taxing our 1% friends.

Demeter

(85,373 posts)Many of the G8 countries - comprised of France, Germany, Italy, Japan, the United Kingdom, Canada, the United States and Russia - are former colonial powers that have thrived by capturing at gunpoint basic mineral, petroleum and agriculture resources around the world, paying relatively little and thus subsidizing their corporations and their national economies.

Right now, the G8 interest in Afghanistan is undoubtedly related to investment potential in minerals, as well as overland routes for oil, gas and electric lines....Although there will be absolute official denial of this view, the goal of the war in Afghanistan is largely to subdue local people in order to create a hospitable environment for investment by G8 businesses. This is true in other US war zones - Pakistan, Yemen, Somalia - which are also important to G8 corporations because of material resources - primarily oil, gas and minerals - or their location near these resources and/or resource shipment routes. There are Yemeni factions, for example, who threaten the Saudi princes; Somalia, in addition to having apparent great potential for oil production, is located on a main oil shipping route. The urgency to subdue local people has increased for G8 politicians as their national debt loads increase to a significant degree because of the increase in the prices of resources, particularly oil. The prices of basic resources have increased as local people become more educated and determined to control their God-given natural wealth. G8 corporations suffer less than governments because they pass their increased resource costs through to governments and the public, in some cases making huge profits. Corporate leaders know, however, that they will come more under public scrutiny and face threats of government takeover if their prices become unbearable to the public. Hence, for their survival as well as their profit, corporations want relatively cheap resource prices as well.

Although the G8 need to subdue factions and nations is increasing, their military ability to do this, particularly the United States' military ability, is diminishing. Members of the general public of the G8 countries are weary of the wars, and, in the case of the United States, its military is also exhausted and demoralized by relentless, multiple troop deployments. Drones enter the picture now, coupled with special forces units, as a new way of exerting control on the aforementioned local people on behalf of major corporations and G8 politicians. Drones reduce the dollar cost of war, and public support is not as essential as it would be if there were "boots on the ground." Drone warfare is evidence of desperation on the part of the G8, a desperation that has led to a declaration of lawlessness by the United States, whose top officials have said that international and domestic constitutional law will not apply to the use of drones. The United States, to the silence of the other G8 members, has adopted an explicit war-by-assassination strategy.

The drone experiment is not working... IN FACT, IT IS BACKFIRING

AND WHEN THE EMPIRE OF AMERICA COMES TO AN END, MAY OUR CONQUERORS BE MORE MERCIFUL TO THE PEOPLE, AND UTTERLY RUTHLESS TO THE MULTINATIONAL CORPORATIONS THAT ENSLAVE US AT HOME, AND THOSE ABROAD...

Demeter

(85,373 posts)Corporate Lobbying Group Asks Supreme Court Not to Use “Empirical Evidence” When Reconsidering Citizens United

LOBBYING THE DANCING SUPREMES? THE COURT IS COMING OUT OF THE CLOSET. I'M SURE IT HAPPENED BEFORE, BUT WE COULDN'T KNOW OR TALK ABOUT IT...BEFORE THE INTERNET

http://truth-out.org/news/item/9311-corporate-lobbying-group-asks-supreme-court-not-to-use-empirical-evidence-when-reconsidering-citizens-united

Late last year, the Montana high court, citing the state’s long history of corporate money corrupting politics, defied the U.S. Supreme Court’s Citizens United decision and continued enforcing the state’s 100-year old law banning corporate involvement in state elections. The Supreme Court has blocked the Montana court’s decision pending on its own determination as to whether to formally hear the case this fall. Allowing a full argument in matter could allow the Court to reconsider the merits of the Citizens United decision, which opened the doors to unlimited corporate and union involvement in American elections.

Now, attorneys for the U.S. Chamber of Commerce, a 100%-corporate funded lobbying group that has used the Citizens United decision to pump tens of millions of undisclosed dollars into federal elections over the last two years, is fighting to maintain the status quo. And they don’t want the justices to consider the evidence that the Citizens United decision, along with prior examples of corporate involvement in campaigns, causes corruption.

At the heart of the issue is whether the Citizens United decision has increased corruption. Justices Stephen Breyer and Ruth Bader Ginsburg, in a statement about the Montana decision, said the court must make clear if “Montana’s experience, and experience elsewhere since this Court’s decision in Citizens United v. Federal Election Commission, make it exceedingly difficult to maintain that independent expenditures by corporations ‘do not give rise to corruption or the appearance of corruption.’”

Interest groups and politicians are lining up to offer briefs to the Supreme Court. Some, like Senators Sheldon Whitehouse (D-RI) and John McCain (R-AZ), have submitted a brief urging the court to overturn Citizens United...But on the other side of the issue, the U.S. Chamber of Commerce has submitted a brief arguing that unlimited corporate spending in elections should be maintained. The argument? The Chamber says there is “no evidence” that corporate electioneering has given rise to corruption anywhere. Moreover, the Chamber says that if there is “empirical evidence” that states have been corrupted by corporate involvement in campaigns, the court “should not” consider it....

Demeter

(85,373 posts)Late last week, Senators John McCain (R-Ariz.) and Sheldon Whitehouse (D-R.I.) submitted a brief asking the U.S. Supreme Court to let Montana’s century-old ban on corporate money in political campaigns stand. Montana’s law contradicts the Court’s 2010 decision onCitizens United which declared a similar federal law, McCain-Feingold, unconstitutional.

A lawsuit led by the American Tradition Partnership has asked the U.S. Supreme Court to block Montana’s decision. The Court temporarily blocked Montana’s decision in February to allow for more airing and discussion.

McCain and Whitehouse said they strongly disagree with American Tradition Partnership’s brief and the Citizens United decision:

“We are deeply concerned about the rise of unlimited, anonymous money now flooding our elections…This unregulated and unaccountable spending invites corruption into our political process, and undermines our democracy. We urge the Supreme Court to make clear that legislatures can take appropriate actions against corrupting influences in campaigns.

Thousands of United Republic members have taken a stand and signed their names to the senators’ letter asking the Supreme Court to reverse its atrocious Citizens United ruling. You can add your name here:

http://unitedrepublic.org/mccain-whitehouse/

Demeter

(85,373 posts)An investigation is being launched into whether Morgan Stanley analysts communicated revisions of Facebook’s revenue forecasts to all clients before the initial public offering.

Read more >>

http://link.ft.com/r/XYEWFF/VLI8PL/9MEOW/NJ81I6/621T9B/7V/t?a1=2012&a2=5&a3=23

just1voice

(1,362 posts)We'll read how somebody got "grilled by Congress" and maybe even a fine amounting to 1/1000th of what was made will be levied. The entire financial system is criminally occupied, it's no longer capitalism it's "corruptionism".

Demeter

(85,373 posts)Mobile devices and tablets cut further into the desktop market, causing Dell to miss expectations

Read more >>

http://link.ft.com/r/XYEWFF/VLI8PL/9MEOW/NJ81I6/YBSRWL/7V/t?a1=2012&a2=5&a3=23

THIS REPORT MUST HAVE TRIGGERED THE PANIC

Demeter

(85,373 posts)Calstrs will vote against the re-election of the retailer’s directors at the shareholder meeting next week as allegations of bribery in Mexico hang over it

Read more >>

http://link.ft.com/r/XYEWFF/VLI8PL/9MEOW/NJ81I6/B5G635/7V/t?a1=2012&a2=5&a3=23

Demeter

(85,373 posts)European hotels group sells its underperforming Motel 6 chain in a $1.9bn deal with the intention of using some of the cash to expand in eastern Europe

Read more >>

http://link.ft.com/r/XYEWFF/VLI8PL/9MEOW/NJ81I6/II2ZHW/7V/t?a1=2012&a2=5&a3=23

Demeter

(85,373 posts)Jitters over how Europe’s banks would be affected by a Greek exit from eurozone have lent urgency to latest discussions on sovereign debt crisis

Read more >>

http://link.ft.com/r/FG6LAA/2OFZCN/4VXHZ/TU2TZV/C48OTO/OS/t?a1=2012&a2=5&a3=23

I'VE GOT TO THINK GERMANY JUST KILLED THE EURO ALL BY ITSELF.

Demeter

(85,373 posts)Top figures at the International Monetary Fund and the European Central Bank argue the long term solution lies in a full banking union

Read more >>

http://link.ft.com/r/FG6LAA/2OFZCN/4VXHZ/TU2TZV/8ZTBP6/OS/t?a1=2012&a2=5&a3=23

"FULL BANKING UNION"....SOUNDS OMINOUS...SOUNDS DANGEROUS...SOUNDS UNLIKELY

IF BANKS CAN HAVE UNIONS, SO CAN THE PEOPLE!

AnneD

(15,774 posts)same rights as people; free speech, unionizing, legal protections, etc... When can we start taking them to trial and issuing a corporate death sentence for killing our economy, starting wars, etc. I recommend Texas as a trial venue

Demeter

(85,373 posts)Paris-based organisation warns crisis management must go hand in hand with construction of institutions to make monetary union ‘work properly’

Read more >>

http://link.ft.com/r/FG6LAA/2OFZCN/4VXHZ/TU2TZV/L975V7/OS/t?a1=2012&a2=5&a3=23

LUCY, CHARLIE BROWN, FOOTBALL

Demeter

(85,373 posts)Country downgraded over concerns about rapid deterioration of public finances, a move that may galvanise support for consumption tax increase

Read more >>

http://link.ft.com/r/FG6LAA/2OFZCN/4VXHZ/TU2TZV/HYVA6Z/OS/t?a1=2012&a2=5&a3=23

LAND OF THE SETTING SUN?

Demeter

(85,373 posts)Asia markets slumped Wednesday, with European concerns bruising sentiment, and with stocks in Tokyo deepening losses after the Bank of Japan failed to announce any new easing measures...NO QE FOR YOU!

...Former Greek Prime Minister Lucas Papademos reportedly warned that a preparations for a Greek exit were being considered, with the remarks coming one day ahead of a informal summit of European Union leaders expected to target options to avoid that outcome...

Demeter

(85,373 posts)IF proof were needed of the maxim that the road to hell is paved with good intentions, the economic crisis in Europe provides it. The worthy but narrow intentions of the European Union’s policy makers have been inadequate for a sound European economy and have produced instead a world of misery, chaos and confusion.

There are two reasons for this.

First, intentions can be respectable without being clearheaded, and the foundations of the current austerity policy, combined with the rigidities of Europe’s monetary union (in the absence of fiscal union), have hardly been a model of cogency and sagacity. Second, an intention that is fine on its own can conflict with a more urgent priority — in this case, the preservation of a democratic Europe that is concerned about societal well-being. These are values for which Europe has fought, over many decades...

...Perhaps the most troubling aspect of Europe’s current malaise is the replacement of democratic commitments by financial dictates — from leaders of the European Union and the European Central Bank, and indirectly from credit-rating agencies, whose judgments have been notoriously unsound...

MORE AT LINK...WORTH READING...NOT THAT ANYONE WILL LISTEN TO A NOBEL LAUREATE THESE DAYS...

***************************************************************

Amartya Sen, a Nobel laureate and a professor of economics and philosophy at Harvard, is the author, most recently, of “The Idea of Justice.”

Demeter

(85,373 posts)...It is precisely at this critical moment that it is essential to re-inject hope and, above all, common sense into the equation. So here are ten good reasons to believe in Europe – ten rational arguments to convince pessimistic analysts, and worried investors alike, that it is highly premature to bury the euro and the EU altogether.

The first reason for hope is that statesmanship is returning to Europe, even if in homeopathic doses. It is too early to predict the impact of François Hollande’s election as President of France. But, in Italy, one man, Mario Monti, is already making a difference...

THIS ARTICLE READS LIKE STRAINING AT GNATS...POLLYANNA TO THE MAX

Demeter

(85,373 posts)...Corzine resigned from the firm and turned down an $11 million severance package after MF Global filed for bankruptcy October, and he is not likely to realize the more than $5 million of his pay package that is tied to the firm’s now worthless stock. But he didn’t walk away empty-handed, the Wall Street Journal reports:

Demeter

(85,373 posts)...The common-sense SAFE Act introduced by Sen. Sherrod Brown and Rep. Keith Ellison would end the era of too big to fail. It's a smart first step toward ridding the world of these menaces to society.

Legislation should also be introduced to strengthen and expand antitrust laws so that they can rein in out-of-control banks like JPM.

True, the SAFE Act and antitrust banking bills are unlikely to pass under our corrupt political system. But every politician in Washington should be forced to vote "yes" or "no" on this bill before the elections and let the public know where they stand on this vital issue. That's the only way Americans can make an informed decision in November.

During the drafting of Dodd/Frank financial legislation we saw something important happen a number of times: If politicians were allowed to craft deals in private, those deals always benefited the big banks. But if they were forced to debate these issues publicly, we saw a much greater consensus against Wall Street.

Public debate: It's how democracy is supposed to work. It will help us break up the big banks...

NOT MUCH MORE USEFUL INFO IN THAT ARTICLE...BUT IT GOES ON FOR PAGES

Demeter

(85,373 posts)... observation by development economist Dani Rodrik:

Here is what the theorem looks like in a picture:

To see why this makes sense, note that deep economic integration requires that we eliminate all transaction costs traders and financiers face in their cross-border dealings. Nation-states are a fundamental source of such transaction costs. They generate sovereign risk, create regulatory discontinuities at the border, prevent global regulation and supervision of financial intermediaries, and render a global lender of last resort a hopeless dream….If we want more globalization, we must either give up some democracy or some national sovereignty. Pretending that we can have all three simultaneously leaves us in an unstable no-man’s land.

So what looks like a backlash may simple be these governments recognizing intuitively what Rodrik was able to make explicit: going further on economic integration would lead to tradeoffs they regarded as undesirable. And a big one is basic security needs of its citizens...

Demeter

(85,373 posts)The Tennessee Court of Appeals has issued a decision that highlights the problems facing credit card debt collectors in a post-robosigning world... The decision reaffirms what should be a simple principle in a debt-collection lawsuit. The burden is on the debt collector to show it owns the debt and to show the consumer is liable for the amount the debt collector asserts. The debt collector's say-so is not enough.

In LVNV Funding, the consumer had opened a Sears Gold Mastercard account in 1985 and was being sued for a balance that was a little more than $15,000. He had not used the account since 2001 and thought it had been settled in 2005...One might first think Sears was the plaintiff. It was not. Sears had sold the account to Citibank, but Citibank was not the plaintiff either as it had sold the account to Sherman Financial Group. The plaintiff was LVNV Funding, a subsidiary of Sherman Financial to which the account had been assigned.

What should have happened is that the account history should have been transferred along with each sale of the account. It is not exactly clear what did happen but nothing more than a bare list of account names and balances was apparently transferred. The custodian of records for LVNV Funding testified that she was familiar with LVNV's business records, and that $15,000 was the amount due based on what was told to LVNV. Of course, testimony about what someone else said is hearsay. LVNV sought to admit its custodian testimony under the business records exception to the hearsay rule. Judge Kirby, writing for the Tennessee Court of Appeals, correctly pointed out one major flaw with LVNV's positon. Its custodian may be familiar with its business records, but she was not familiar with the business records of Sears or Citibank. The business records exception does not create a documentary record where one does not exist. The result was that LVNV's suit failed for lack of evidence.

The case is interesting not because it is extraordinary but because it is typical. The documentation problems identified in LVNV Funding are pervasive throughout the debt collection industry. Because not every court is careful and because not every consumer has good representation, credit card debts undoubtedly are being collected without adequate evidence the debt is due and owing. (Having had to personally deal with a $50 credit card bill from Sears back in 1990, it would take a lot more than their say-so to persuade me that a debt was actually owed.) And, if courts correctly apply the law, there are millions of dollars in credit card debts that are practicably uncollectible due to lack of documentation. Attorneys who work in the area always tell me these problems are well known within the industry, but I wonder how well known they are outside the industry.

Demeter

(85,373 posts)Wednesday is paper day. See you tomorrow.

xchrom

(108,903 posts)

DemReadingDU

(16,002 posts)All the markets are down

xchrom

(108,903 posts)xchrom

(108,903 posts)ORIGINAL POST, SEE UPDATE BELOW: Markets are selling. Rinse, repeat.

It was a particularly rough night in Asia, as fresh concerns about Chinese growth were raised in multiple quarters.

Hong Kong's Hang Seng fell by over 1%. Japan fell by nearly 2%.

And the scene is not pretty in Europe this morning.

Spain is down over 1%.

Italy is down 1.8%.

Germany is down 1.2%.

Basically yesterday there was a big rally ahead of the Eurogroup meeting. Today that's melting away. This is how it goes.

US futures are down about 0.3%.

UPDATE: It's not taking long for things to get much hairer. Italy is now down 2.3%. The euro is cliffdiving, hitting levels not seen since August 2010.

Read more: http://www.businessinsider.com/morning-markets-may-23-2012-5#ixzz1vgMucngq

Tansy_Gold

(18,167 posts)Sunny and hot, until it's not, sometime around late October. Should hit 102 today.

Warpy

(114,547 posts)The whole system is unsustainable. They tried putting austerity bandaids on it to keep the game going, but austerity hawks are getting booted out of office by the people who quite rightly think that since they had nothing to do with creating this mess, it shouldn't be resolved on their backs. Markets are now spooked because they know the house of cards is close to collapse, yet the plutocracy is unwilling to allow the systemic changes that will prevent disaster.

xchrom

(108,903 posts)Really bad UK retail sales numbers

These numbers are straight from the report.

---------

Headline: All retail sales values in April 2012 increased by 0.4 per cent when compared with April 2011. This is the slowest rate of growth since January 2010 when sales values were also 0.4 per cent higher compared with a year ago.

Headline: Sales volumes in April 2012 decreased by 1.1 per cent when compared with April 2011. This is the largest fall in sales volume year-on-year growth since August 2011 when sales volumes fell by 1.2 per cent.

The slow down in sales values and the contraction in sales volumes growth were driven by predominantly food stores, predominantly automotive fuel stores and textile, clothing and footwear stores.

In April 2012 sales values in predominantly food stores increased by 0.1 per cent compared with April 2011, the slowest year-on-year growth in this series which started in January 1989.

In April 2012 sales volumes in predominantly automotive fuel stores fell by 13.2 per cent month-on-month, the largest fall in this series which started in February 1996. This follows an increase in month-on-month sales growth in this sector in March 2012 of 5.3 per cent.

The year-on-year implied price deflator, which can be interpreted as store price inflation, slowed in April 2012 to 1.7 per cent from 2.6 per cent in March 2012.

Read more: http://www.businessinsider.com/april-uk-retail-sales-2012-5#ixzz1vgPGe7tu

xchrom

(108,903 posts)From Markit Economics, a chart of Italian Consumer Confidence, which has dived 10% just since March.

Really, it's a chart of depression, more than confidence.

xchrom

(108,903 posts)The Greek euro tragedy is reaching its final act: it is clear that either this year or next, Greece is highly likely to default on its debt and leave the eurozone.

Postponing the exit after the June election, with a new government committed to a variant of the same failed policies (recessionary austerity and structural reforms), will not restore growth and competitiveness.

Greece is stuck in a vicious cycle of insolvency, lost competitiveness, external deficits, and ever-deepening depression. The only way to stop it is to begin an orderly default and departure, co-ordinated and financed by the European Central Bank, the European Union, and the International Monetary Fund (the troika), that minimises collateral damage to Greece and the rest of the eurozone.

Greece's recent financing package, overseen by the troika, gave the country much less debt relief than it needed. But, even with significantly more public-debt relief, Greece could not return to growth without rapidly restoring competitiveness. And, without a return to growth, its debt burden will remain unsustainable. But all of the options that might restore competitiveness require real currency depreciation.

xchrom

(108,903 posts)Britain needs a plan B. That was the stark message from the International Monetary Fund on Tuesday as it announced the findings of its checkup on the UK economy.

The Washington-based Fund says growth is weak, unemployment too high and the risks are clearly weighted to the downside. Extra stimulus, it says, is needed and needed now.

So, game and set and match to the shadow chancellor, Ed Balls, who has been warning George Osborne for the past 18 months that the government's austerity package is too much, too soon for an economy as enfeebled as Britain's at a time when its major trading partner, Europe, is involved in a life-or-death struggle to save the single currency?

Well, not quite. The IMF says plan B should involve the Bank of England cutting interest rates from their already record-low level of 0.5% and chucking some more newly minted money at the economy through the process known as quantitative easing. Only if that fails to do the trick does the Fund think the chancellor should resort to fiscal policy – decisions affecting tax and spending – to boost demand. As far as the Fund is concerned, deliberately increasing borrowing in an attempt to stimulate demand is plan C not plan B. It would, however, support further curbs on public sector pay so that spending could be increased on infrastructure projects. This would keep borrowing unchanged, while shifting spending to sectors of the economy deemed to have higher growth potential.

xchrom

(108,903 posts)

Customers using an ATM at a branch of the ATEbank in Athens. Photograph: Orestis Panagiotou/EPA

Almost 25% of deposits have been withdrawn from Greek banks in the last two years but outflows have been small from other banking systems inside the so-called periphery, according to Barclays analysts.

While Greek deposits are falling, those at Portuguese lenders have risen to record highs, and Spanish and Italian deposits have fallen 3% and 2% respectively.

"Talk of a possible exit of Greece from the European monetary union has sparked fears about deposit outflows from other peripheral countries, but these concerns are not new and evidence does not indicate material outflows from Spain, Italy, Ireland, and Portugal," the analysts said.

Even so, fears of a Greek exit from the eurozone have sparked debate about whether there should be an EU-wide guarantee for the single currency area. At the moment, the €100,000 deposit guarantees are paid for by national banking systems – which should prevent the need for any deposits to be withdrawn – but there are suggestions that the cost should be spread across the eurozone.

xchrom

(108,903 posts)What exactly does François Hollande want? It is a question that many in capitals across Europe have been asking since the Socialist was elected to replace Nicolas Sarkozy as French president earlier this month.

Hollande has spoken often of the need to adjust Europe's current focus away from austerity and toward economic growth, a sentiment shared by many, including US President Barack Obama, British Prime Minister David Cameron and even the Social Democrats in Germany.

But he has yet to provide details as to how exactly he envisions stimulating growth, most recently declining to do so at the G-8 summit in the US. On Wednesday evening, though, he will have his best chance yet to elaborate on his ideas. European Council President Herman Van Rompuy has invited the 27 European Union heads of state and government to an "informal dinner" in Brussels to discuss the elements of the so-called "growth pact," which is to be the focus of the next regular EU summit scheduled for June.

It will be Hollande's moment of truth. What exactly does his recipe for overcoming the euro crisis look like? How many billions of euros does he want to spend in order to stimulate the economies in those euro-zone countries currently struggling through deep crises? And will he, as he has hinted, challenge German Chancellor Angela Merkel on her ongoing opposition to bundling European debt in the form of euro bonds?

xchrom

(108,903 posts)U.S. stock futures fell as the Congressional Budget Office said America’s economy would slip into recession if necessary budget measures aren’t taken and concern mounted that Greece will leave the euro area.

Dell Inc. (DELL) plunged 13 percent in German trading after the company forecast fiscal second-quarter revenue that missed analysts’ estimates. Morgan Stanley (MS) dropped after a Massachusetts regulator subpoenaed the investment bank over its handling of Facebook Inc. (FB)’s initial public offering.

Standard & Poor’s 500 Index futures expiring in June declined 0.8 percent to 1,304.5 at 6:43 a.m. in New York. Dow Jones Industrial Average futures expiring the same month lost 90 points, or 0.7 percent, to 12,387.

“Uncertainty surrounding Greece’s membership in the euro and possible contagion into other countries plagued by high deficits just isn’t going away, at least not until Greek elections have taken place on June 17th,” said Markus Huber, head of German sales trading at ETX Capital in London.

Roland99

(53,345 posts)DOW 12,385 -92.00 -0.74%

NASDAQ 2,514 -21.00 -0.83% [/font]

Europe

[font color="red"]FTSE 100 5,295 -109 -2.01%

CAC 40 3,017 -68 -2.19%

DAX 6,321 -114 -1.77%

FTSE MIB 13,072 -384 -2.85%

IBEX 35 IDX 6,509 -152 -2.29%[/font]

TalkingDog

(9,001 posts)

Roland99

(53,345 posts)Another

Bungee

Market

Day

dead cat bounce!

Po_d Mainiac

(4,183 posts)Must be the new ad for Facebook!

TalkingDog

(9,001 posts)On the other hand.... it is a more-than-adequate depiction of their stock offering.

xchrom

(108,903 posts)The OECD on Tuesday predicted more pain for Spain over the next two years when the economy will remain mired in recession with a quarter of the population out of work.

The Paris-based organization also forecast the government would miss its deficit-reduction targets, with the shortfall coming in at 5.4 percent of GDP this year instead of 5.3 percent and at 3.3 percent the following year when the administration of Prime Minister Mariano Rajoy was hoping to bring it back within the European Union ceiling of 3 percent of GDP.

In its latest Economic Outlook, the OECD estimates GDP will shrink 1.6 percent this year and 0.8 percent the next with the jobless rate rising from 24.5 percent to 25.3 percent in 2013. The agency, however, predicted that the drastic overhaul of the laws governing the labor market making it easier and cheaper to sack workers should help boost employment in the medium term.

In the meantime, high unemployment is expected to depress private consumption, with spending estimated to contract 2.9 percent this year and 0.8 percent the following year.

westerebus

(2,978 posts)That is an option for the Greek people to decide. The same holds true for the rest of European Economic Community as people see the reality that removing the social safety nets that hold their societies together leaves them much worse off for generations to come.

If the private sector can't grow then the public sector has to expand to fill the gap or the deflationary depression accompanied with 50% youth unemployment will erupt into the anarchy of the late 60's early 70's.

In the mean time the push back by the right wing will continue. Austerity is very simple to define: STFU and eat your peas will you still can.

We should take a lesson from our own history. " When in the course of Human events, it becomes necessary.."

Demeter

(85,373 posts)China’s economy seems to be going gradually downhill but with the dips particularly steep at times. When Premier Wen Jiabao announced in March that the growth target would be 7.5 per cent this year, no one took him too seriously since outcomes have always been significantly higher.

Beijing was comfortable with growth moderating to around 8.5 per cent for this year compared with last year’s 9.2 per cent but prolonged uncertainties in the eurozone combined with the continuing lid on housing purchases now suggest that a soft landing may be more difficult to realise, writes Yukon Huang.

Read more >>

http://link.ft.com/r/BLH300/YB926W/87I64/16XCDF/B5G2OL/YT/t?a1=2012&a2=5&a3=23

Demeter

(85,373 posts)....on May 15 at midnight, when he will cease being President of France, Sarkozy will also emerge from under the umbrella of presidential immunity that so far has protected him against a ton of increasingly malodorous allegations.

“Yes, as Prime Minister, I myself supervised the issue of financing Sarkozy’s campaign from Tripoli,” Baghdadi Ali Mahmudi, Secretary of the General People’s Committee of Libya from March 2006 to September 2011, told the Court of Appeals in Tunesia, when it examined the extradition request filed against him by Libya. And he detailed how the Gaddafi regime financed the campaign of Nicolas Sarkozy in 2006 and 2007 through a secret funding system via Switzerland—to the tune of €50 million. That was on October 25, 2011, but now two lawyers who were present during the hearing have passed on this information and much more to Médiapart, a subscription-only French investigative journal whose series on Sarkozy’s alleged violations of campaign financing laws has become a blow-by-blow documentation of a political culture of corruption.

Scandalous accusations have bedeviled every presidential campaign in France since 1988 when the first campaign finance laws went into effect. Before, it was a free for all—corporations, foreign governments, and individuals with enough moolah to be taken seriously were legitimate sources of funding. Now, contributions are limited and funding from foreign countries is prohibited. But just because the laws changed didn’t mean that the political culture would change. And enforcement bodies purposefully lacked teeth.

Médiapart is relentless in its revelations. On April 28, it published an official Libyan document from the archives of the Libyan secret service that it had obtained from former high-ranking Libyan officials who are now in hiding. Issued by the Department of External Security, dated October 12, 2006, and signed by Musa Kusa Imuhamad, head of external security, the document (in Arabic) “proved,” according to Médiapart, that Sarkozy accepted €50 million from the Gaddafi regime. From Médiapart’s translation into French:

We confirm to you the agreement in principle on the subject cited above, and having reviewed the minutes of the meeting held October 6, 2006, attended on our side by the Director of the Libyan intelligence service and by the president of the Libyan African Investment Fund, and on the French side, by Mr. Hortefeux and Mr. Ziad Takieddine, and during which an agreement was concluded to determine the amount and method of payment.

Brice Hortefeux, godfather of Jean Sarkozy, was Minister of Territorial Collectivities at the time—“Sarkozy’s gun carrier,” the French press called him. It was his first of a variety of ministerial jobs from 2005 until his departure in February 2011.

And Ziad Takieddine, a Franco-Lebanese arms dealer deeply entangled with the French right, was allegedly involved in scandals of kickbacks on French arms deals. He was fingered in French campaign finance violations. And French oil company Total allegedly paid him a commission to obtain gas contracts in Libya, the very country that Sarkozy would later move heaven and earth to attack. His “career” spans what Libération called “15 years of relations of trouble between the Sarkozy clan and countries like Libya or Pakistan.”...Médiapart had obtained that document as it was investigating the so-called Karachi case in which bribes, and kickbacks on those bribes, were allegedly paid as part of the sale in 1994 of three French submarines to Pakistan, a $1 billion deal. Bribery was legal in France until 2000, but kickbacks from bribes back to France were patently illegal even then. These kickbacks allegedly funded the 1995 presidential campaign of Edouard Balladur, Prime Minister at the time, and mentor of Sarkozy—his Budget Minister. The deal took a tragic turn in 2002, when a bomb in Karachi killed 11 French submarine engineers and three other people. After suspecting Islamic terrorists for seven years, French prosecutors changed their minds in 2009 and pointed at new culprits: pissed-off Pakistani officials who hadn’t been paid their promised bribes. Apparently, Balladur, after losing the election, had stiffed them.

AND THERE'S MORE...INCLUDING A GLIMPSE INTO THE POSSIBLE FUTURE

Eugene

(67,024 posts)Source: Reuters

Exclusive: Eurozone tells members to make contingencies for "Grexit"

By Jan Strupczewski and Claire Davenport

BRUSSELS | Wed May 23, 2012 9:30am EDT

(Reuters) - Euro zone officials have told members of the currency area to prepare contingency plans in case Greece decides to quit the bloc, an eventuality which Germany's central bank said would be "manageable".

Three officials told Reuters that the instruction was agreed on Monday by a teleconference of the Eurogroup Working Group (EWG) - experts who work on behalf of the bloc's finance ministers.

"The EWG agreed that each euro zone country should prepare a contingency plan, individually, for the potential consequences of a Greek exit from the euro," said one euro zone official familiar with what was discussed.

The news comes at a highly sensitive time, just hours before EU leaders gather to try to breathe life into their struggling economies at a summit over dinner on Wednesday.

[font size=1]-snip-[/font]

Read more: http://www.reuters.com/article/2012/05/23/us-eurozone-greece-idUSBRE84M0P420120523

Roland99

(53,345 posts)Nasdaq 2,811 -28 -0.99%

S&P 500 1,304 -13 -0.98%

GlobalDow 1,748 -34 -1.89%

Gold 1,546 -31 -1.93%

Oil 90.94 -0.91 -0.99%

$1US/YEN 79.4100 -0.5460[/font]

Euro/$1US 1.2587 -0.0097

Pound / $1US 1.5700 -0.0060

Dollar Index 81.84 0.17

10yr T-note 1.73 -0.04

Roland99

(53,345 posts)Roland99

(53,345 posts)* Crude oil supplies up 900,000 bbls last week: EIA

* Gasoline stocks down 3.3 mln bbls: EIA

* Distillate stocks down 300,000 bbls: EIA

Roland99

(53,345 posts)* New-home sales in U.S. rise 3.3% in April

* New U.S. home sales rise to 343,000 rate in April

* March sales of new homes revised up to 332,000

* Median price of homes climbs 0.7% to $235,700

Hopes for a new QE dashed. Markets drop more.

Po_d Mainiac

(4,183 posts)This may be the bottom, but it appears to be sticky.

YMMV

Roland99

(53,345 posts)One is over 4,000 sq ft. Nice home. 2-story. Listed at $349,000.

Other one is 2,900 sq. ft. Nice home. 1-story. Listed at $345,000 (paid about $290,000 for it about 2 years ago).

And this smaller home doesn't have a pool, no major upgrades inside, nothing that sets it apart.

Either someone isn't really interested in selling or someone has a VERY skewed view of what to expect from selling a newer home.

Roland99

(53,345 posts)still plumbing new daily lows.

Demeter

(85,373 posts)

Tansy_Gold

(18,167 posts)(And Bones was right. . . . . . )

Roland99

(53,345 posts)Po_d Mainiac

(4,183 posts)The only things that will be trading Friday, afternoon will be bots. Smart money ain't gonna be parking wondering how bad Europe is going to trade while the bell is silent Monday morning.

13K may well fall by noon Friday, with a bit of a melt up going into the close.... Unless the bernank makes some kind of slip and pre-announces another case of QE.

Roland99

(53,345 posts)Fuddnik

(8,846 posts)Or some such nonsense.

Almost even again.

Tansy_Gold

(18,167 posts)Faeries flying farcically?

Fuddnik

(8,846 posts)westerebus

(2,978 posts)Roland99

(53,345 posts)Fuddnik

(8,846 posts)S&P and NASDAQ positive.

This is starting to look like a sequel to 2008.

Demeter

(85,373 posts)or some such nonsense. I think they are just taunting us.

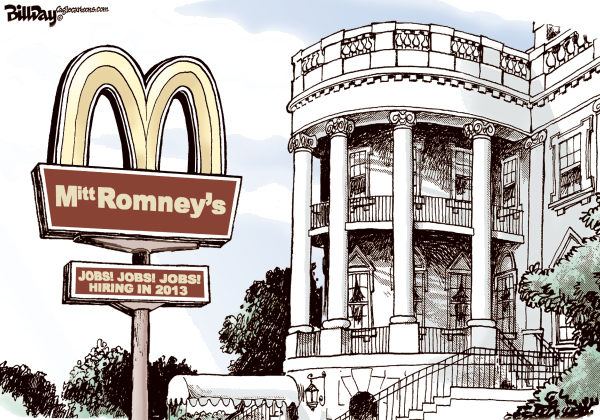

jtuck004

(15,882 posts)deals being done out there.Written by Josh Kosman in 2009, it has become very relevant because of the loose talk right now about how the bad deals were a minority, almost a fluke, private equity shouldn't be condemned, yada, yada, yada.. And that's from people on our side.

This book will give you an entirely different perspective about firms like KKR (a bigger employer than the Post Office), Bain, Carlyle, Blackstone. Not only the tragedy they have wreaked in the lives of our neighbors, but the danger to come.

It was mentioned in a post by MarmAr on the old DU - you can find it in a search for the title.

If you have a library or just want to buy it, now might be a good time.

People going on the tube and referencing Bain/Mi$$ Rmoney and his little campaign are trivializing the damage done by this company, and several others.. More than once I have heard people say "just a few of the deals", and some of the people say they are on his opponents side.

NO! Those deals involved the purchase of hundreds of companies, tens of thousands of good paying jobs which gave people money to buy their homes, their kid's education, their retirement - in other words the "demand" our economy needs to grow - replaced by jobs at Staples that are so bad they are only now down to a 45% turnover (on their web site). It was 65% back when people could find another job.

I wonder how many Staples clerks it takes to pay for a college education now? Or even bring food home every day. (Interesting - he owned Ampad, left, and then sat on the board of Staples when they bankrupted Ampad (he leaves that little tidbit out a lot when he says he was gone from Ampad as they went under. (Maybe, but with Ampad's financials in hand as his new investment pressured those people into poverty.)

The book lists hundreds of billions of dollars in debt these companies were saddled with, debt they could not have paid when their times were better, much less now. They were sold with the idea that they could perpetually refinance, but although the price of borrowing is down, credit is tighter. Will they be able to make loans that it is clear may never be paid off from their revenue and/or assets?