Economy

Related: About this forumWeekend Economists View the Trojan Horse June 15-17, 2012

SOURCE FOR FRACTAL FLAG: http://shortgreenpigg.deviantart.com/art/US-Flag-86794316

Yep, it's Friday, the start of a momentous weekend. This weekend we have Flag Day (Thursday), Father's Day (Sunday) and the long-awaited, much dreaded Election in Greece, in which the fate of the euro, the eurozone, globalism, and the whole world will be determined.

Or not.

But probably, yes. Things have come to such a tangle that any further scheming is bound to start unravelling the Gordian Knot.

"Turn him to any cause of policy,

The Gordian Knot of it he will unloose,

Familiar as his garter" (Shakespeare, Henry V, Act 1 Scene 1. 45–47)

Alexander cuts the Gordian Knot, by Jean-Simon Berthélemy (1743–1811)

At one time the Phrygians were without a king. An oracle at Telmissus (the ancient capital of Phrygia) decreed that the next man to enter the city driving an ox-cart should become their king. A peasant farmer named Gordias drove into town on an ox-cart. His position had also been predicted earlier by an eagle landing on his cart, a sign to him from the gods, and on entering the city Gordias was declared king by the priests. Out of gratitude, his son Midas dedicated the ox-cart to the Phrygian god Sabazios (whom the Greeks identified with Zeus) and either tied it to a post or tied its shaft with an intricate knot of cornel (Cornus mas) bark. The ox-cart still stood in the palace of the former kings of Phrygia at Gordium in the fourth century BC when Alexander arrived, at which point Phrygia had been reduced to a satrapy, or province, of the Persian Empire.

Several themes of myth converged on the chariot, as Robin Lane Fox remarks: Midas was connected in legend with Alexander's native Macedonia, where the lowland "Gardens of Midas" still bore his name, and the Phrygian tribes were rightly remembered as having once dwelt in Macedonia. So, in 333 BC, while wintering at Gordium, Alexander the Great attempted to untie the knot. When he could not find the end to the knot to unbind it, he sliced it in half with a stroke of his sword, producing the required ends (the so-called "Alexandrian solution"

Status of the legend

Alexander is a figure of outstanding celebrity and the dramatic episode with the Gordian Knot remains widely known. Literary sources are Alexander's propagandist Arrian (Anabasis Alexandri 2.3) Quintus Curtius (3.1.14), Justin's epitome of Pompeius Trogus (11.7.3), and Aelian's De Natura Animalium 13.1

While sources from antiquity agree that Alexander was confronted with the challenge of the knot, the means by which he solved the problem are disputed. Both Plutarch and Arrian relate that according to Aristobulus, Alexander pulled the knot out of its pole pin, exposing the two ends of the cord and allowing him to untie the knot without having to cut through it. Some classical scholars regard this as more plausible than the popular account.

Alexander later went on to conquer Asia as far as the Indus and the Oxus thus, for Callisthenes, fulfilling the prophecy. http://en.wikipedia.org/wiki/Gordian_Knot

Well, in Greece this Sunday, a young man with the memorable name of Alexis Tsipras seeks to do Alexander the Great one better.

Isn't it interesting that I could not find an image of Alexis with a Greek flag? How on earth do they manage to get elected in Greece without demonstrable flag-worshipping? But I digress...

Tsipras (I wonder if it's pronounced Cyprus?) is going to try to disentangle Greece from the Euro-noose while keeping the Euro-knot intact, a feat worthy of a political Houdini. But Greeks are creative and resourceful people, capable of enduring great trials and prevailing. Consider that the Trojan Horse was a Greek trick that led to the fall of Troy....

We'll line up the news on this and other items of quasi-economic impact.

And to all the fathers out there...

Demeter

(85,373 posts)No Father's day Weekend for the FDIC. They probably have enslaved women only working this weekend...

Putnam State Bank, Palatka, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Harbor Community Bank, Indiantown, Florida, to assume all of the deposits of Putnam State Bank.

The three branches of Putnam State Bank will reopen during their normal business hours beginning Saturday as branches of Harbor Community Bank...As of March 31, 2012, Putnam State Bank had approximately $169.5 million in total assets and $160.0 million in total deposits. In addition to assuming all of the deposits of the failed bank, Harbor Community Bank agreed to purchase essentially all of the assets.

The FDIC and Harbor Community Bank entered into a loss-share transaction on $112.3 million of Putnam State Bank's assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.4 million. Compared to other alternatives, Harbor Community Bank's acquisition was the least costly resolution for the FDIC's DIF. Putnam State Bank is the 29th FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was Security Bank, National Association, North Lauderdale, on May 4, 2012.

Security Exchange Bank, Marietta, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Fidelity Bank, Atlanta, Georgia, to assume all of the deposits of Security Exchange Bank.

The two branches of Security Exchange Bank will reopen on Monday as branches of Fidelity Bank...As of March 31, 2012, Security Exchange Bank had approximately $151.0 million in total assets and $147.9 million in total deposits. In addition to assuming all of the deposits of the failed bank, Fidelity Bank agreed to purchase essentially all of the assets.

The FDIC and Fidelity Bank entered into a loss-share transaction on $102.8 million of Security Exchange Bank's assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $34.3 million. Compared to other alternatives, Fidelity Bank's acquisition was the least costly resolution for the FDIC's DIF. Security Exchange Bank is the 30th FDIC-insured institution to fail in the nation this year, and the fifth in Georgia. The last FDIC-insured institution closed in the state was Covenant Bank & Trust, Rock Spring, on March 23, 2012.

The Farmers Bank of Lynchburg, Lynchburg, Tennessee, was closed today by the Tennessee Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Clayton Bank and Trust, Knoxville, Tennessee, to assume all of the deposits of The Farmers Bank of Lynchburg.

The four branches of The Farmers Bank of Lynchburg will reopen during their normal business hours beginning Saturday as branches of Clayton Bank and Trust, including the one branch that operates as First State Bank, Chapel Hill, Tennessee, and the two branches that operate as Oakland Deposit Bank, Oakland, Tennessee...As of March 31, 2012, The Farmers Bank of Lynchburg had approximately $163.9 million in total assets and $156.4 million in total deposits. Clayton Bank and Trust will pay the FDIC a premium of 0.10 percent to assume all of the deposits of The Farmers Bank of Lynchburg. In addition to assuming all of the deposits of the failed bank, Clayton Bank and Trust agreed to purchase essentially all of the assets...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $28.3 million. Compared to other alternatives, Clayton Bank and Trust's acquisition was the least costly resolution for the FDIC's DIF. The Farmers Bank of Lynchburg is the 31st FDIC-insured institution to fail in the nation this year, and the third in Tennessee. The last FDIC-insured institution closed in the state was Tennessee Commerce Bank, Franklin, on January 27, 2012.

CHECK BACK LATER FOR UPDATES IF ANY

Demeter

(85,373 posts)It was a scenario many have imagined: Retiring to a lonely beach in Mexico after a few minutes of a heart-pounding crime — like Bonnie and Clyde riding into the sunset with a good stash of money attained through a handful of bank heists. A group of scientists armed with a "normally confidential data set" decided to test the financial realities of robbing banks (pdf) and they found that it simply doesn't pay. Well, that's speaking figuratively. In reality, the statisticians report it does pay — just "not very much."

Here is their conclusion:

"It is not going to keep him long in a life of any kind. Given that the average UK wage for those in full-time employment is around £26 000, it will give him a modest lifestyle for no more than 6 months. If he decides to make a career of it, and robs two banks a year to make a sub-average income, his chances of eventually getting caught will increase: at 0.8 probability per raid, after three raids or a year and a half his odds of remaining at large are 0.8×0.8×0.8=0.512; after four raids he is more likely than not to be inside. As a profitable occupation, bank robbery leaves a lot to be desired."

The Wall Street Journal reports the same is true in the United States, where 1,081 robberies occurred. The average "loot" in the U.S., according to the FBI? $5,531.

The authors of the study note that bank robbers already got the hint.

"Bank robberies and attempted bank robberies have been decreasing, in both the USA and the UK; in the UK, robberies from security vans are on the increase. Security vans offer more attractive pickings," the authors report.

Po_d Mainiac

(4,183 posts)The book is titled:

The Best Way to Rob a Bank is to Own One: How Corporate Executives and Politicians Looted the S&L Industry, 2005

Unlike the looting taking place today, a decade ago the crime didn't always pay.

Demeter

(85,373 posts)Alexis Tsipras (Greek: Αλέξης Τσίπρας, pronounced [aˈleksis ˈtsipras]) (born 28 July 1974) is a Greek left-wing politician, member of the Hellenic Parliament, president of the Synaspismós political party and head of the Coalition of the Radical Left (SYRIZA) parliamentary group.

On 8 May 2012, Karolos Papoulias, the President of Greece, mandated him to form a coalition government. One day before, Antonis Samaras (ND) had given up his attempt to form a coalition. Each politician mandated in this way in Greece are allowed 72 hours for such an attempt. In the evening of 9 May 2012, Tsipras announced he had failed to form a coalition government.

HENCE THIS SUNDAY'S RUNOFF ELECTION

Early life and career

Tsipras was born on 28 July 1974, in Athens. He studied civil engineering at the National Technical University of Athens (NTUA). After graduating in 2000, he pursued graduate training in land surveying and planning at an inter-departmental programme of NTUA, and he worked as a civil engineer in the construction industry. He undertook several projects and wrote several studies related to the city of Athens.

Political activity

Tsipras joined the Communist Youth of Greece in the late 1980s. In the early 1990s, as a student of Ampelokipoi Branch High School, he was active in the student uprising against the controversial law of then minister Vasilis Kontogiannopoulos. Tsipras rose to prominence as a representative of the student movement when he was featured as a guest at a show hosted by journalist Anna Panagiotarea. During an interview, the journalist implied that Tsipras was being disingenuous in defending middle and high school students' right to absenteeism without parental notification.

As a university student he joined the ranks of the renovative left student movement and was member of the executive board of the Students' union of the Civil Engineering School of NTUA and also served as student representative at the University Senate. From 1995 to 1997, he served as an elected representative on the Central Council of the National Students Union of Greece (EFEE).

Political career

After the departure of the Communist Party of Greece from Synaspismós coalition of radical parties, Tsipras left the party to remain in the coalition. He was the first person ever to hold the leading position (political secretary) of the youth wing of Synaspismós Neolaia Syn, from May 1999 to November 2003, and was succeeded by Tasos Koronakis. He managed quite efficiently to maintain a strong adherence to the policy of the party, effectively outvoicing political rivals to the left and the right. As secretary of the Synaspismós Youth he took active part in the process of creating the Greek Social Forum and attended all the international protests and marches against neoliberal globalization. In December 2004, at the fourth Congress of Synaspismós, he was elected a member of the party's Central Political Committee and consequently to the Political Secretariat, where he was responsible for educational and youth issues.

Tsipras first entered the limelight of the Greek political system during the 2006 local elections when he ran for the municipality of Athens on the "Anoihti Poli" (Greek: Ανοιχτή Πόλη, "Open Town"![]() Coalition of the Radical Left (SYRIZA) ticket that gained 11% of the Athenian vote. He did not run for membership of the Hellenic Parliament (Vouli) in the 2007 legislative election, choosing instead to continue to serve his term as a member of the municipal council of Athens.

Coalition of the Radical Left (SYRIZA) ticket that gained 11% of the Athenian vote. He did not run for membership of the Hellenic Parliament (Vouli) in the 2007 legislative election, choosing instead to continue to serve his term as a member of the municipal council of Athens.

On 10 February 2008, Tsipras was elected chairman of Synaspismós during the fifth party congress after the previous chairman, Alekos Alavanos, decided not to apply for a renewal of his chairmanship citing personal reasons. Tsipras was 33 when he was elected president of Synaspismós, thus becoming the youngest ever head of a Greek parliamentary political party.

In the 2009 Greek legislative election, he was elected a member of the Hellenic Parliament for the Athens A' constituency. He was elected unanimously by the secretariat of the SYRIZA as the head of its parliamentary group.

In the May 2012 Greek legislative election, SYRIZA came second and Tsipras was elected a member of the Hellenic Parliament for the Athens A' constituency being the head of the coalition. As a result, on 8 May 2012, Karolos Papoulias, the President of Greece, mandated him to form a coalition government. One day before, Antonis Samaras (ND) had given up his attempt to form a coalition government.

Personal life

His partner is Peristera Baziana, an electrical and computer engineer. They met in 1987 as schoolmates at the Ampelokipoi Branch High School and both became members of the Communist Youth of Greece. Today, they live together and have one son.

Demeter

(85,373 posts)The following are the main pledges and economic policy of Syriza leader Alexis Tsipras for the Greek national election on June 17.

-- Cancel Greece’s bailout and implementation laws and replace them with a national recovery plan

-- Reduce the number of ministers and government advisers

-- Renegotiate the country’s loan agreement and seek a European solution to the Greek debt crisis

-- Restore Feb. 28 wage reductions, special bonus cuts and labor collective agreements; minimum wage of 751 euros

-- Restore unemployment benefit of 461.5 euros and extend payment to two years from one

-- No special taxes for the unemployed, people on low incomes and pensioners

-- Set a primary spending plan of as much as 43 percent of Greek GDP instead of 36 percent

-- Increase the country’s revenue by taxing higher incomes to reach a European level of 4 percent of GDP

-- Halt implementation of cuts in wages, social spending and pensions

-- Implement and extend public spending control using technology

-- Implement a Greek citizens’ property registration system

-- Gradually reduce sales taxes, minimize them for basic food products

-- Modernize and staff tax offices, enhance information technology

-- Sign a special national agreement with shipowners, cancel 58 tax reductions

-- Help return bank deposits to Greece, stabilize the Greek banking system

-- Nationalize, socialize banks

-- Redesign management of European funds

-- Write down loans for heavily indebted businesses and households

-- Freeze program of privatizing state-run companies and gradually bring strategically significant companies back to state control (OTE, PPC, Hellenic Postbank, Athens Water)

-- Restructure the public sector and administration

-- Amend constitutional law on ministers’ responsibilies

-- Declare a Greek exclusive economic zone

-- Find a mutually acceptable solution of the dispute over the name “Macedonia” in the United Nations. Greece, the northern third of which consists of the region of Macedonia, objects to use of the name by the former Yugoslav Republic of Macedonia.

Demeter

(85,373 posts)ATHENS: Greek leftist Alexis Tsipras, "enfant terrible" of Europe's debt crisis, cut his political teeth as a student protest leader in the 1990s and is now championing a rebellion that could end up sinking the single currency. His vow to tear up the terms of an international bailout deal keeping debt-ridden Greece afloat has put him and his SYRIZA party within a few votes of government in a knife-edge election on Sunday in which the stakes could not be higher. The strategy amounts to a game of chicken. Tsipras says Europe's lenders will not pull the plug on Greece for fear of the ripple effect of a Greek exit from the euro, so they will be forced to scrap the bitterly unpopular austerity measures demanded of Athens and which have driven the country into a spiral of recession.

"The memorandum of bankruptcy will belong to the past on Monday," Tsipras told thousands of flag-waving supporters on Thursday in the capital's Omonoia square, once one of the ornaments of central Athens but now grimy and scarred by crime and poverty.

"Today you made Omonoia the most beautiful square in Athens and you sent a message of victory inside and outside the country: Brussels expect us, we are coming on Monday to negotiate over people's rights, to cancel the bailout," he said. It is a high-risk strategy that detractors say smacks of political inexperience and a short, comfortable life spent mainly on Greece's anti-establishment fringe.

Born into a middle-class family with a small building business, Tsipras has a post-graduate degree in engineering but worked only briefly in construction before turning to full-time politics. He dabbled while at university as a member of the Communist party's youth wing and as a student protest leader in the 1990s, before joining the SYRIZA coalition of 12 radical leftist groups, including environmentalists and human rights activists.

REFRESHING CHANGE OR UNTESTED IDEOLOGUE?

Tsipras lost an election for mayor of Athens in 2006, but the race lifted him into the party's top ranks and in 2008, his mentor and then SYRIZA leader Alekos Alavanos virtually handed him the leadership at the age of 33. Now 37, spurning suit ties and stuffy formality, Tsipras represents a refreshing change for many Greeks fed up with a close-knit political establishment that has run the country into the ground...To Greece's euro zone partners, he is an untested ideologue who lacks the acumen to run a country, let alone steer it through a crisis that threatens financial calamity. "So what if he doesn't have the experience?" said SYRIZA deputy Panagiotis Kouroublis. "If he can run a party, he can run a country. Greece has suffered from people who promised one thing and did another."

Tsipras has promised to nationalise banks, stop privatisations and freeze the austerity measures that his establishment rivals - the conservative New Democracy and socialist PASOK - agreed to in February as the price of a 130 billion euro EU/IMF bailout package. Greeks rebelled in the streets the night the measures were adopted, burning banks and shops. Then the country held an election on May 6, and New Democracy and PASOK were roundly punished. SYRIZA polled 16.8 percent in a highly fragmented field, putting it second. Opinion polls suggest it is neck-and-neck with New Democracy ahead of Sunday's repeat vote, forced after bitterly divided political factions failed to form a government.

Tsipras is a father of one child and is expecting another with his partner Betty after the election. In trademark defiance of traditional Greek society, the two have not married.

Warpy

(114,547 posts)instead of being assassinated before he does much at all, then Greece has a chance of coming out of this thing well. All he has to do is look to Iceland for the road map: nationalize the banks, jail the fraudsters, tax the wealthy, and keep the social safety net intact. People on the bottom will slowly spend their way out of trouble and the rich will start to pay down all the debt their greed caused. Banks can go back to the private sector once they've learned their lessons, changed the corrupt culture, and have enough safeguards written into law to prevent thieves from setting up shop again for a very long time.

It doesn't have to be a communist coup to work, although those have been able to get rid of entrenched moneyed aristocracy and allow the country to move toward a reasonably equitable and profitable mixed system.

Then again, they might vote for the right wing guy and more of them will be giving up their children to the state because they can no longer feed them.

Demeter

(85,373 posts)For the past eight years, Greece’s leaders have had impressive degrees from top world universities, Amherst, Harvard and the London School of Economics among them. They have left the country in quite a pickle, and the question now is whether a 37-year-old, Greek-educated civil engineer can do any better...Alexis Tsipras comes from a grand tradition in Greece’s boisterous democracy, a strident left-winger who cut his teeth in student politics and, like his predecessors in the 1970s who helped overthrow a military junta, is rattling the establishment. His student movement was called “The Earthquake,” and that’s what many worry will be felt if he becomes prime minister in a Sunday election that could determine whether Greece remains in the euro zone – or one of Europe’s central projects begins to unravel.... He insists that the leverage is on Greece’s side — that in the end the likes of German Chancellor Angela Merkel and International Monetary Fund Managing Director Christine Lagarde will cave and give the recession-plagued country more time and more money rather than risk a euro exit.

If there’s any doubt about the stakes, the world’s central banks are girding for the worst.

“On Sunday, the old world will die,” Tsipras said at an Athens rally Thursday, his brow knitted and sweaty on a sultry Greek night. Invoking what has become Greece’s modern version of a mythic beast — the “memorandum” that lays out the strict conditions for the country’s bailout loans — he made clear what will happen if Syriza wins enough parliamentary seats to form a government.

“This will be a historic change for Greece and Europe. . . . The memorandum is coming to an end.”

That sort of epochal language is driving Syriza’s popularity in a country weary of a five-year recession that only seems to deepen, and of a pile of debt that has grown larger in the hands of bailout lenders such as the IMF, the European Central Bank and other European nations. Right now Greece is obliged to pay about $15 billion a year in interest alone, money those institutions sequester from each chunk of Greece’s emergency loans — kind of like a credit-card company adding monthly payments to the balance of a bill. Tsipras has captured a sense of indignity over the situation and reflected it in a youthful package. Square-shouldered while standing on a stage at Athens’ Omonoia Square in a white shirt with sleeves rolled up, tie discarded and collar unbuttoned, he called out by name the politicians he hopes the country will reject — all of them a generation older, professorial in demeanor, sometimes more comfortable speaking in English than Greek...At the National Technical University of Athens, where Tsipras studied how to build roads and fire up a crowd, former teachers remember a strong-willed student. The campus outside the city center is speckled with revolutionary graffiti, while student opinion covers the spectrum from hard-left anti-capitalist to hard-right anti-immigrant. “He has been in protests and occupations since he was a teenager,” said Konstantinos Moutzouris, chairman of the civil engineering department when Tsipras was a student and now a conservative candidate for parliament on the Greek island of Lesbos.

“He is soft-spoken, but if you dig inside him, he is iron. You don’t change his position,” Moutzouris said.

Personal Post

The perception that Tsipras will prove too strident for the intricacies of an international financial negotiation is one reason the election is an apparent dead heat between Syriza and the center-right New Democracy party led by Antonis Samaras. Samaras, a Harvard MBA, was as a key opposition figure under earlier governments and signed letters agreeing to the terms of the international bailout. In New Democracy circles, there is talk that a Tsipras victory would prompt Merkel and others to make an example of Greece and push it from the euro to prove the region will enforce its budget and economic standards — courting short-run calamity in return for longer-term confidence. Tsipras’s rise “is a mistake that’s about to become a tragedy,” said Chrisanthos Lazaridis, a New Democracy candidate. New Democracy television ads set that tone, with disappointed school children wondering why they don’t get to use the euro like other kids around Europe — even in Cyprus! — and a Greek flag sadly descending from among the others in the European Union...Syriza’s ads note how Samaras is suddenly ready to demand easier terms for the deal he endorsed just a few weeks ago, when Greece signed a second bailout package that was already a renegotiation from its original 2010 rescue.

Assuming a government emerges from Sunday’s voting — an election last month left New Democracy in the lead and Syriza second, but neither able to form a coalition with Greece’s myriad other parties — the real battle will be joined. Whoever takes power will have to open immediate talks with the IMF, the ECB and the European Commission over an urgently needed tranche of bailout money — negotiations that will set the fate of the bailout program and perhaps the euro itself....IMF and European officials have left room for modest amendments to the program. But the sort of changes envisioned by Tsipras — such as repealing a cut in the minimum wage that IMF economists say is important to encourage hiring — may go too far. Syriza’s plan for state control of the banks, meanwhile, would likely endanger some $38 billion set aside by Europe and the IMF to restart Greece’s banking system. The constraints, in other words, are real and binding: Greece’s government does not collect enough money month to month to pay its bills, and the economy as a whole needs hard currency from outside to import oil and other necessities. If the cash squeeze leaves Greece unable to pay bondholders, this default could trigger Greece’s exit from the euro, either by its own choice or at the insistence of other euro-zone members.

With Tsipras, the essential puzzle is whether to fully trust a man whose gravity-defying platform would have Greece tear up the IMF’s advice, put government officials in charge of bank lending, quickly collect the taxes no one else has been able to collect and all the while remain within the euro and restore the faith of global investors.

MORE

girl gone mad

(20,634 posts)Demeter

(85,373 posts)Greece’s radical leftist leader Alexis Tsipras told a final campaign rally on Thursday night that his party represented the new Europe and German Chancellor Angela Merkel the old...

He said his main rival, New Democracy leader Antonis Samaras, "has guaranteed Merkel's Europe of the past”.

“We guarantee the Europe of the future," he told about 8,000 supporters in central Athens.

"On Monday we will form a government for all Greeks... with Europe and the euro," said the 37 year-old.

MORE

Demeter

(85,373 posts)Harvard professor Niall Ferguson told Bloomberg TV this morning that a Lehman moment could be nearing for the euro crisis as elections in Greece threaten to undermine European stability.

"If there's going to be a Lehman moment in the crisis it's going to be next week," he explained, saying that the back-and-forth between Athens and Berlin is "a game of chicken" that will not be resolved until the power structure in Greece has been decided.

He explained what will happen with another frightening analogy:

"It's not clear who's going to blink at this point. My guess is that, in the end, there will be a bit of blinking on both sides. This is the financial equivalent of the Cuban Missile Crisis. And the missile is really a bank run, which ultimately even the Germans can't be completely immune to. Not that there will ever be a run on German banks, but the effects of a bank run right across Southern Europe are going to be felt by the economy. German policymakers know that; they're just having to say one thing to their own voters and another thing privately to other European leaders."

While Ferguson waxed optimistic about the likelihood that Greece will stay in the euro and that EU leaders will find common ground after the Greek elections, he warned against putting too much faith in central banks.

Referring to the huge rally yesterday following rumors of coordinated central bank action, he said:

"In the end, the central banks can't do this on their own. And I think for the markets to assume that this can be fixed by yet another round of quantitative easing or whatever you want to call it—LTRO—I think that's not realistic, because this is no longer just about liquidity. It's about the solvency of governments, the solvency of banks."

Demeter

(85,373 posts)...The head of the European Central Bank, Mario Draghi, hinted that he would be ready to pump cash into banks there to head off turmoil. His counterpart in Tokyo, Masaaki Shirakawa, promised that the Bank of Japan was ready to “to take all possible measures to ensure the financial system does not come under threat.”

The statements underscored just how anxious policy makers are ahead of the vote, which they fear could result in a victory by left-wing parties that oppose the deep austerity Greece agreed to in exchange for financial help. If the anti-austerity Syriza party wins, it could eventually force an exit by Greece from the euro zone and feed fears of a broader financial crisis.

Authorities hope that a large infusion of cash into the financial system, if needed next week, could act as a financial firewall to help protect shakier banks in Southern Europe. Depositors have been fleeing not only Greek banks, but Spanish banks as well, raising concerns that these institutions could run short of the funds necessary to conduct normal business. As worries have spread, banks on the Continent have sharply curtailed short-term loans to each other out of concern that they may not be repaid if things start spinning out of control. That fear has further dried up the flow of money in many European economies.

It is unclear whether authorities can pump enough money into the system to stave off troubles if the Greek election results scare investors. But investors welcomed Mr. Draghi’s pledge as a sign that after years of half-steps that repeatedly failed to halt the momentum of the crisis in Europe, leaders were finally facing up to the severity of Europe’s distress and acting before investors forced their hand...

LIKE TRAINING A DOG, ISN'T IT?

Demeter

(85,373 posts)At the end of a summit meeting at Camp David last month, as the other world leaders were heading for their helicopters, President Obama did what has become a habit during his years in the White House: he made time for an informal but deadly serious talk with Chancellor Angela Merkel of Germany...

...A collapse of the euro could derail America’s fragile recovery and doom Mr. Obama’s re-election hopes. So the president finds himself in the strange position of having forged a relationship with Ms. Merkel that is perhaps the best he has with any foreign leader, but that has not yet resulted in the chancellor’s agreeing to what Mr. Obama thinks must be done in Europe: an American-style bailout and fiscal stimulus.

Mr. Obama and Ms. Merkel will meet again Monday at a Group of 20 summit meeting in Mexico, with the stakes for Europe even higher than they were last month. With Greece holding elections on Sunday that could precipitate its exit from the European currency union — the nightmare feared by the financial markets — Mr. Obama may be running out of time to make his case.

And there is no indication Ms. Merkel is any more inclined to heed his advice. In a speech to the German Parliament on Thursday, she said the world should not expect Berlin to be Europe’s savior, rejecting calls to create euro bonds to share the debt burden of the Mediterranean countries...

MUCH MORE, MOST OF IT FLUFF

Demeter

(85,373 posts)Bank of America's top strategists and economists put together forecasts on the prices for stocks, bonds, commodities, and currencies depending on how the Greek elections shape up on Sunday night.

The three scenarios they examine for each asset class include:

- A base case (the highest probability scenario) in which Greek voters elect parties that can form a "pro-EU" government and there are no surprise policy responses from the European Union or the European Central Bank.

- A bull case (the lowest probability scenario) in which a "pro-EU" government is not forthcoming and, as a result, the EU and ECB are forced to step in with bold policies that trigger a risk rally.

- A bear case (which BofA assigns a "low to medium probability"

in which a "pro-EU" government is not formed and the ECB and EU don't step in to limit the fallout.

in which a "pro-EU" government is not formed and the ECB and EU don't step in to limit the fallout.

BofA breaks down what each asset class will look like in each of these three scenarios...

Base Case: 1.75 percent

Bull Case: 2.10 percent

Bear Case: 1.3 percent

Commentary: BofA notes that in the base and bull cases, we still have the fiscal cliff to deal with in the United States, which will be an important factor for Treasury yields. However, the bear case assumes the safe haven flows we've grown accustomed to lately and more QE from the Fed, which will floor rates.

Source: Bank of America Merrill Lynch

Read more: http://www.businessinsider.com/bofa-stocks-bonds-euro-gold-rates-greek-elections-2012-6?op=1#ixzz1xuRw8yIU

Demeter

(85,373 posts)Investors are anxiously waiting this weekend's parliamentary elections in Greece, a repeat of elections on May 6 that failed to produce a government.

As the leading opposition party repudiates the terms of the aid package Greece has received from the European Union and the IMF, European leaders led by Germany insist that this vote is a referendum on Greece's euro membership, and that there will be no wiggle room to negotiate the bailout deal.

Brinksmanship at its best.

Here's a look at the Greek players:

Antonis Samaras and New Democracy: Samaras and New Democracy once frightened European leaders when they took a tougher stance against austerity, but remarkably their party has come full circle to represent the pro-bailout incumbency. While Samaras has now called for some changes to the terms of the deal which would ease downward pressure on the Greek economy, ND's commitment to the bailout and euro membership dictate its policies. New Democracy won 18.9 percent of the vote on May 6.

Alexis Tsipras and SYRIZA: Tsipras and his party argue that Greek's bailout agreement is untenable because harsh austerity policies have forced the country into a Great Depression from which recovery in the medium-term is unlikely. They argue that Europe has much to lose from a Greek exit, and therefore EU leaders are bluffing when they frame the elections as a referendum on the euro and refuse to consider any amendments to Greece's bailout agreement. SYRIZA won 16.8 percent of the vote on May 6, and appeared to win support directly after those elections.

Evangelos Venizelos and PASOK: PASOK led the Greek government from June 2009-November 2011, and support for the party declined dramatically as the crisis worsened. Analysts expect little dissension between PASOK and New Democracy on the bailout. PASOK won 13.2 percent of the vote on May 6.

While four other parties also won seats in the May election, analysts are focusing on the success of these three parties primarily because both SYRIZA and ND-PASOK governments will face difficulty winning support from other parties.

Read more: http://www.businessinsider.com/guide-greek-elections-this-sunday-2012-6#ixzz1xuSvsyFZ

Demeter

(85,373 posts)Unemployment rose to 22.6 percent in the first quarter of the year, according to data released on Thursday by the Hellenic Statistical Authority (ELSTAT), but even more worrying is the soaring number of long-term jobless.

ELSTAT’s survey showed that in the first three months of 2012 the total number of unemployed people climbed to 1,120,097, with 56.5 percent of these seeking work for over a year.

Among young people aged up to 24 the jobless rate stood at 52.7 percent, while for women in that age group the rate came to a staggering 60.4 percent.

The biggest drop in employment was in the manufacturing sector, where it fell 15.1 percent compared to the first quarter of 2011. In the primary sector it contracted by 5.8 percent while in the service sector employment shrank by 7.2 percent. Foreigners had a jobless rate of 30.5 percent, far above that of Greeks (21.8 percent).

Demeter

(85,373 posts)Yes, you read that correctly! Greece killed its own banks. You see, many knew as far back as January (if not last year) that Greece would have a singificant problem floating its debt. As a safeguard, they had their banks purchase a large amount of their debt offerings which gave the perception of much stronger demand than what I believe was actually in the market. So, what happens when these relatively small banks gobble up all of this debt that is summarily downgraded 15 ways from Idaho.

Reference (Bloomberg) Stocks Plunge as Dollar, Treasuries Gain After Greece, Portugal Rate Cuts and (the Wall Street Journal) S&P Downgrades Greece to Junk Status:

“S&P cut Greece's ratings to junk status, saying the country's policy options are narrowing as it tries to cut its large budget deficit. The news, combined with an S&P downgrade of Portugal, pushed down the euro to $1.3269, hit U.S. stocks and sent Treasury prices higher”.

•Greece's Junk Contagion Pressures EU to Broaden Bailout After Market Rout

•Trichet Travels to Berlin on Diplomatic Mission as Merkel Nears Greek Vote

•Greece Bondholders May Lose $265 Billion in Default as S&P Sees 70% Loss

The ratings firm cut Greece three steps yesterday to BB+, or below investment grade, and said bondholders may recover only 30 percent and 50 percent for their investments if the nation fails to make debt payments. Europe’s most-indebted country relative to the size of its economy has about 296 billion euros of bonds outstanding, data compiled by Bloomberg show.

The downgrade to junk status led investors to dump Greece’s bonds, driving yields on two-year notes to as high as 19 percent from 4.6 percent a month ago as concern deepened the nation may delay or reduce debt payments. Prime Minister George Papandreou is grappling with a budget deficit of almost 14 percent of gross domestic product.

“It’s now not just market sentiment, but a top rating agency sees Greek paper as junk,” said Padhraic Garvey, head of investment-grade strategy at ING Groep NV in Amsterdam.

Before yesterday, Greece’s bonds had lost about 17 percent this year, according to Bloomberg/EFFAS indexes. The 4.3 percent security due March 2012 fell 6.54, or 65.4 euros per 1,000-euro face amount, to 78.32.

...

S&P indicated the cuts, which may force investors who are prevented from owning anything but investment-grade rated bonds to sell, may not be over, assigning Greece a “negative” outlook.

“The downgrade results from our updated assessment of the political, economic, and budgetary challenges that the Greek government faces in its efforts to put the public debt burden onto a sustained downward trajectory,” S&P credit analyst Marko Mrsnik said in a statement.

Traders of derivatives are betting on a greater chance that Greece fails to meet its debt payments.

Credit-default swaps on Greek government bonds climbed 111 basis points to 821 basis points yesterday, according to CMA DataVision. Only contracts tied to Venezuela and Argentina debt trade at higher levels, according to Bloomberg data. Venezuela is at about 846 basis points and Argentina is at about 844, Bloomberg data show.

Just minutes before lowering Greece’s ratings, S&P cut Portugal to A- from A+. Yields on Portugal’s two-year note yields jumped 112 basis points to 5.31 percent, while credit- default swaps on the nation’s debt rose 54 basis points to 365. The downgrades may force banks to boost the amount of capital they are required to hold against bets on sovereign debt, said Brian Yelvington, head of fixed-income strategy at broker-dealer Knight Libertas LLC in Greenwich, Connecticut.

While bank capital rules give a risk weighting of zero percent for government debt rated AA- or higher, it jumps to 50 percent for debt graded BBB+ to BBB- on the S&P scale and 100 percent for BB+ to B-.

“These downgrades are going to cause people to increase their risk weightings,” Yelvington said.

Well, the answer is.... Insolvency! The gorging on quickly to be devalued debt was the absolutely last thing the Greek banks needed as they were suffering from a classic run on the bank due to deposits being pulled out at a record pace. So assuming the aforementioned drain on liquidity from a bank run (mitigated in part or in full by support from the ECB), imagine what happens when a very significant portion of your bond portfolio performs as follows (please note that these numbers were drawn before the bond market rout of the 27th)...

The same hypothetical leveraged positions expressed as a percentage gain or loss...

SEE ALSO: http://boombustblog.com/blog/item/6089-dead-bank-deja-vu?-how-the-sovereigns-killed-their-banks-why-nobody-realizes-theyre-dead

Demeter

(85,373 posts)Demeter

(85,373 posts)Spain's borrowing costs have surged to record highs and are perilously close to the point of no return, threatening a full-blown sovereign crisis unless the European Central Bank comes to the rescue..."We're facing maximum tension. The situation is unsustainable over time," said the country's finance minister Luis de Guindos. Yields on 10-year Spanish bonds yields punched to almost 7pc, above levels that triggered ECB intervention to back stop Spain last November.

"The ECB needs to intervene very quickly or it is game over," said Nicholas Spiro from Spiro Sovereign Strategy. "There is a whiff of capitulation in the air."

The dramatic escalation comes just days after the eurozone agreed a €100bn rescue package for the Spanish state to recapitalise its crippled banks. "It is very worrying. Markets are behaving as if the eurozone is heading for break-up," said Jens Sondergaard from the Japanese bank Nomura.

France's industry minister Arnaud Montebourg said the markets were flying out of control because the ECB was failing to take charge. "We need an ECB that does its job," he said.

In an astonishing outburst for a French minister, he lashed out at German Chancellor Angela Merkel and the "German right" for driving much of Europe into slump. "Certain European leaders, led by Mrs Merkel, are fixated by blind ideology."

Demeter

(85,373 posts)As we head towards Greece’s weekend election, rumoured to be celebrated by the locals by moving ever larger sums of money elsewhere, the Eurozone appears to be seriously straining under the constant pressure of its ongoing crisis. I have long felt that Italy would be the limit for the monetary union, most notable for its sheer size, and due to this I expected much more decisive action, one way or the other, once the crisis returned to Italian shores.

Last week I noted a warning from the head of the IMF suggesting Europe only has a short period of time left and did wonder whether it was triggered by growing concerns that Italy was next after Spain:

As the clock ticks down to Greece’s crunch election on June 17, which is being seen as a referendum on the country’s membership of the euro zone, the warnings that European leaders need to act to prevent a collapse of the currency union are getting stronger by the day.

Now, Christine Lagarde, head of the International Monetary Fund (IMF), has warned that the euro zone has less than three months to get its act together. In an interview broadcast on Monday evening, Lagarde told the television station CNN that action to save the euro is needed in “more shortly (sic) than three months.” She was referring to a recent prediction by billionaire investor George Soros that Europe has three months to save the euro.

Not to be outdone, the UK finance minster has also suggested that it could be time to let Greece go in order to shift Germany into action:

…

“I ultimately don’t know whether Greece needs to leave the euro in order for the euro zone to do the things necessary to make their currency survive,” Osborne said in remarks published on Wednesday in The Times newspaper.

“I just don’t know whether the German government requires a Greek exit to explain to their public why they need to do certain things like a banking union, euro bonds and things in common with that.

Such stability.

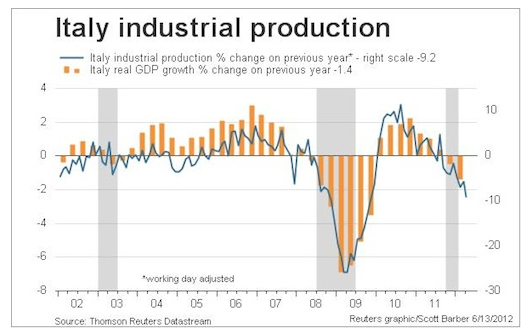

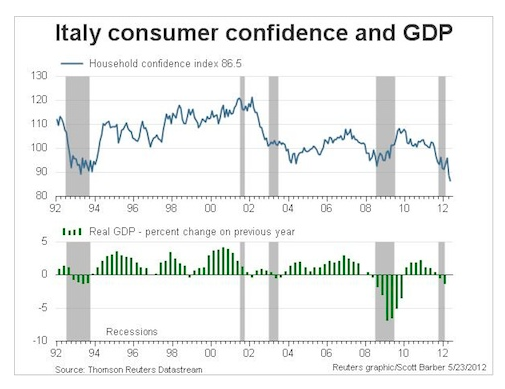

As you can also see from the chart, GDP growth is now negative with the 2012 Q1 figure coming in at -0.8% taking Italy deeper into recession. The Bank of Italy suggested the yearly figure will come in around -1.5% but with a solid trend in place that figure could now be optimistic. Unemployment has also increased by 2% this year to stand at Eurozone record high of 9.8% with youth unemployment hovering in the mid 30s. To add to the woe, business confidence is the lowest it has been since the GFC and consumer confidence is now at record lows:

MORE

Demeter

(85,373 posts)In Greece’s chaotic wake bobs the listing Republic of Cyprus, soon to be the fifth Eurozone country, out of seventeen, to get a bailout. By June 30. And on July 1, in the ironic European manner, the tiny country on a Mediterranean island that is geographically closer to Turkey, Syria, and Israel than any European country, will automatically rotate into the Presidency of the Council of the European Union for a six-month term—mechanized democracy at the EU level.

Only last year’s €2.5 billion loan from Russia has kept it afloat. Its economy is shrinking, unemployment is at a record, and real estate is collapsing after a phenomenal bubble and after an even more phenomenal nationwide title-deed scandal that bankers, lawyers, and developers were colluding in to their immense benefit. And it has taken down the banks. [For more on that fiasco, read my post from last October.... Another Eurozone Country Bites the Dust].

So the banks need to be “recapitalized.” As is the case in Eurozone bailouts, the losses will be socialized to taxpayers in distant countries. €1.8 billion, or 10% of GDP, is needed just to recapitalize its second-largest bank, Cyprus Popular Bank. Many more billions will be needed for the other banks. And as the first bailout is never enough, more money will be needed for the second wave. The government itself needs to be bailed out too; it has been cut off from the markets and can’t get its deficits under control—amazing how a country with 803,000 people can concoct problems of such magnitude.

“The issue is urgent,” said Finance Minister Vassos Shiarly on Monday because “recapitalization of the banks must be completed by June 30.” And on Tuesday, a government spokesman confirmed that a bailout would be “one of the options.” It would be large—”a comprehensive request covering not only present circumstances and the recapitalization of the banks but also future needs,” Shiarly said. But there is one thing Cyprus has that the other four bailed-out debt sinners don’t have...Vast deposits of natural gas. Noble Drilling announced the discovery last December. Based on its Cyprus A-1 well, it estimated that the field off the southern coast held up to 8 trillion cubic feet of gas. There is a good probability of other gas fields around Cyprus. And a mad scramble has ensued. 15 major oil and gas companies and consortiums, among them Russia’s Novatec, Italy’s ENI, France’s Total, and Malaysia’s Petronas, are bidding to start exploratory drilling activities. Novatek may also invest in transport, processing, and liquefaction facilities (to produce LNG for export). Chinese firms have submitted proposals. Israel is working with Cyprus on a “unitization agreement” for reserves that overlap the border between their “exclusive economic zones.” And they’re bent over plans for a pipeline between their gas fields...MORE

Demeter

(85,373 posts)<iframe width="560" height="315" src="

" frameborder="0" allowfullscreen></iframe>Demeter

(85,373 posts)Yves here. Das’ post has a lot of useful information, but like a lot of finance people, he is hostage to a conventional markets-driven reading of the issues. Governments are not households or businesses. When the private sector delevers, unless a country is running a big surplus (as Germany is) you can’t have government delever at the same time. So Germany’s notion of virtue (that governments and private citizens should wear an austerity hair shirt) works only for Germany.

There are also ways to prevent an Euro train wreck that don’t involve using German’s balance sheet, such as having the ECB issue bonds, or do revenue sharing (say on a per capita basis, as Marshall Auerback suggested in a NC post). Or the ESM could be given a banking licence via the ECB so that it has the ability to deploy unlimited capital to sort out the solvency issue (as France has suggested). Yanis Varoufakis’ “Modest Proposal” is another approach. But if Germany continues to oppose having the ECB take a much more aggressive stance, Das’ concerns are germane...

MULTIPLE LINKS TO REFERENCED ARTICLES / SATAYAJIT STARTS BELOW:

...Germany is financially vulnerable. Irrespective of the course of events, it faces crippling costs...Germany may be in great danger, having left it to late to excise the gangrenous body parts of the Euro-Zone...To date, Germany has had a very good European debt crisis. The German economy is one of the few economies to have grown since 2008. Unemployment is low and workers have received pay rises. Interest rates on its government bonds, Bunds, are at a record low. On 23 May 2012, the two year note was issued with a zero coupon and gave investors a return of 0.07% per annum, prompting the Financial Times to post the headline: Oh Schatz: No Coupon (the German two year bond is known as the Schatz). A few days later the bonds were yielding zero percent. Shortly thereafter, the yield on the 2-year bonds was negative. The low rates reflect safe haven buying as investors flee other European markets.

Politically, Germany’s importance has never been greater. Chancellor Angela Merkel bestrides Europe as a female Bismarck (the German view) or a Gorgon (the Greek view).

...Germany’s success is based on an economy heavily rooted in manufacturing. It is also the result of Chancellor Gerhard Schröder’s structural reforms, especially of the labour market. The recent 4.3% pay increase won by the influential IG Metal union is the largest since 1992. Interestingly, the union made little headway in the recent negotiations on the area of greater controls on contract labour, which companies use for flexibility and managing costs.

But a significant part of Germany’s growth has been driven by the Euro-Zone...German exporters were major beneficiaries of this growth. German banks and financial institutions helped finance the growth. It was the European version of Chimerica, where China financed American buyers of its products by lending back its trade surpluses. German exporters also benefitted from a cheap Euro, receiving a significant subsidy because of the inclusion of weaker economies such Italy, Spain, Portugal and Greece in the common currency. This cost advantage assisted German export performance, especially in emerging markets in Eastern Europe and Asia.

But the good times are ending. The question is whether the Wirtschaftswunder (post-second world war economic miracle) ends in Götterdämmerung (the twilight of the Gods) or Weltuntergang (the end of the world). MUCH MORE AT LINK

Demeter

(85,373 posts)...Wallenda is trying to become the first person to walk across Niagra Falls on a tightrope. Here's ABC with a the details:

"Others have crossed the Niagara River itself, but never over the falls. Wallenda said that tonight's feat will be the fulfillment of a lifelong dream as well as a chance to honor his great-grandfather, legendary funambilist Karl Wallenda, who died after falling from a tightrope in Puerto Rico in 1978.

"Wallenda, 33, has called his great-grandfather his "biggest inspiration" and said he will be thinking of him during the stunt. The 1,500-foot walk between Goat Island in the U.S. side to Table Rock in Canada will be fraught with unforgiving natural conditions: blinding mist and drafts created by the force of the waterfalls crashing down on the Niagara River.

"Those obstacles notwithstanding, Wallenda told reporters Thursday that he hopes the walk will be "peaceful and relaxing."

Wallenda is scheduled to begin his walk at 10:15 p.m. ET. ABC is airing it live and it will stream beginning at 8 p.m. here: http://www.where.ca/nik-wallenda-tightrope-walk-live/

Demeter

(85,373 posts)Stocks rallied on Friday to close a second straight week of gains on hopes of collective action from global central banks if Sunday's election in Greece triggers market turmoil.

The news helped offset the latest round of weak U.S. economic data, which pointed to sluggish domestic growth. But traders were cautious and safe-haven U.S. bond prices also rose on Friday...

...Officials of the Group of 20 leading nations told Reuters on Thursday that central banks of major economies would take steps to stabilize markets and prevent a credit squeeze, if necessary. The news spurred sharp gains late in Thursday's session. Later reports of the European Central Bank hinting at an interest-rate cut and Britain's pledge to flood banks with cash sparked further bullishness.

"It pokes a hole in the balloon of bad news after more bad news," said Richard Sichel, chief investment officer of Philadelphia Trust Co.

"None of the (U.S.) economic data we saw today were impressive. The gains seem to be based more on hope and less on the economic reports."

HOPIUM...CAN'T KEEP A BAD MARKET DOWN!

Demeter

(85,373 posts)While we’re sitting on the edge of our chairs, waiting breathlessly for the Greek election, or for Fate to swallow Greece and send financial Armageddon over the Eurozone, stock markets rallied. Not because of a sudden plethora of good economic news, but in anticipation of how central banks might react to the Greek vote—that’s how far this farce has come! As if sheer artificial liquidity could wash away the putrid odor of decomposing debt.

They lined up on Friday to give their spiel. ECB President Mario Draghi would “continue to supply liquidity to solvent banks where needed.” Bank of Japan governor Masaaki Shirakawa was “prepared to take all possible measures” but denied rumors that central banks around the globe would take coordinated action. The Bank of England spoke up. The Swiss National Bank confirmed its iron determination to keep the flood of euros at bay, with capital controls, if it had to; its currency peg would hold, come hell or high water.

To calm the credit markets, it was leaked earlier that Draghi, European Council President Herman van Rompuy, European Commission President José Manuel Barroso, and Euro Group President Jean-Claude Juncker were feverishly bent over a grand plan to convert the beleaguered monetary union into some sort of federal state governed by unelected EU bureaucrats....So, while waiting for the vision to appear, I skyped with a friend in Germany who owns two restaurants. They’re doing well, he said. 2011 was a record year, and this year looks good too. He’d redecorated, his new menu was a hit, and he was excited, though it was a day-to-day struggle, in a jungle of regulations, with taxes out the wazoo. And what about the debt crisis? He didn’t pay much attention to it, he said.

Indeed. The debt crisis has been good to Germany, formerly the “sick man of Europe.” After Reunification, Germany was marked by high unemployment, stagnation, and lacking innovation. The dotcom euphoria bypassed it. Inflation surged and real wages declined. Industry restructured, ditched unprofitable operations, axed workers. But countries around it boomed. Spain and Greece were riding high. The Celtic Tiger was cleaning everyone’s clock. And Germans became morose. Eventually, the internal devaluation, insidious as it was on the middle class, paid off for industry. Exports took off, and Germany was showing signs of growth. Then the financial crisis hit. Export orders fell off a cliff, causing GDP to plunge 2.1% in the fourth quarter of 2008 and a horrid 3.8% in the first quarter of 2009. Annualized, those two quarters printed a double-digit decline in GDP. The worst two quarters in the history of the Federal Republic. The German economy lives and dies by its exports.But... as the financial crisis morphed into the Eurozone debt crisis and began infecting the periphery, Germany recovered. Exports to Asia skyrocketed, exports to European countries did well, and a good part of the US stimulus money made its way to German enterprises, such as Siemens and its suppliers. They produced and hired. Exports last year exceeded €1 trillion for the first time ever. Unemployment dropped to a two-decade low. Its budget is nearly balanced, and yields on its debt probed zero. Euphoria set in. Short lived, it seems. According to a slew of recent data, Germany is backsliding. Its banks are highly leveraged and packed with who knows what kinds of decomposing assets. Its debt, at 81% of GDP, is high for a country that can’t print its own money, and is higher than that of Spain. If China implodes and the US enters a recession, while the Eurozone continues to teeter, German exports will once again collapse. The savior of Europe will find itself in a deep recession, with large deficits, rising unemployment, spiking yields....

“If Greece doesn’t get its next loan installment, the Eurozone will collapse the following day,” scowled Alexis Tsipras, leader of the left-wing SYRIZA. By threatening the entire Eurozone with its demise, if he won the election, he ratcheted up the bailout extortion racket a few more notches. The run on Greek banks turned into panic. Eurozone heads of state, already on edge, threatened Greece in return. Everything is coming to a head. Read.... Greece in Panic ... um, Wait!

mbperrin

(7,672 posts)to solve their problems.

Yet, their huge bonuses and salaries are "required" to hold onto their "talent."

I taught sophomores in high school for years, and they had better excuse-making skills than these dumbasses.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)Gotta go soak my sore little fingers... But please, post anything you found exceptionally egregious or funny or whatever...

And put some music or something in for variety:

&feature=related

Po_d Mainiac

(4,183 posts)From Wiki;

The most detailed and most familiar version is in Virgil's Aeneid, Book II [1] (trans. A. S. Kline).

After many years have slipped by, the leaders of the Greeks,

opposed by the Fates, and damaged by the war,

build a horse of mountainous size, through Pallas’s divine art,

and weave planks of fir over its ribs:

they pretend it’s a votive offering: this rumour spreads.

They secretly hide a picked body of men, chosen by lot,

there, in the dark body, filling the belly and the huge

cavernous insides with armed warriors.

[...]

Then Laocoön rushes down eagerly from the heights

of the citadel, to confront them all, a large crowd with him,

and shouts from far off: ‘O unhappy citizens, what madness?

Do you think the enemy’s sailed away? Or do you think

any Greek gift’s free of treachery? Is that Ulysses’s reputation?

Either there are Greeks in hiding, concealed by the wood,

or it’s been built as a machine to use against our walls,

or spy on our homes, or fall on the city from above,

or it hides some other trick: Trojans, don’t trust this horse.

Whatever it is, I’m afraid of Greeks even those bearing gifts.’

Tansy_Gold

(18,167 posts)Demeter

(85,373 posts)After this crisis is over, I can see the Greek Dictator proclaiming elections are not going to be held, because they are on Sundays...

DemReadingDU

(16,002 posts)Does anyone remember dancing around by oneself to the music?

I don't recall that I did, I mostly had my face in a book or taking pictures.

Which is another funny story...

The 10 year old grandkid was at a garage sale near his house, and bought a 35mm camera. So we went to the drugstore and bought some film and a new battery and he took a few pictures that the 4 & 5 year old grandkids immediately wanted to see in the review mode. Except there isn't any review on a 35mm camera!

So I had to explain we needed to take all 24 pictures on the roll, and not to open the camera until we finished all the pictures because light would get in and ruin the pictures. After all the 24 pictures are taken, then we take the film back to the drugstore where the pictures are made. Then we pick up the pictures and then get to look at them. The 10 year old explains this is the antique way of taking pictures.

Then I thought I would mention that people at the drugstore would see the film and pictures being made so to be careful what we take pictures of. Five year old tells the 10 year old not to take any pictures of his butt! So we all had a laugh that butt pictures are not really cool.

Tansy_Gold

(18,167 posts)Oh, honey, I still do!

And I may even have my old vinyl 45 of Don Costa's 1960 instrumental version of "Never On Sunday."

Demeter

(85,373 posts)

Demeter

(85,373 posts)It had to come, you know. We can't spend the entire weekend dreaming of Greek heroes reincarnated...

Demeter

(85,373 posts)Having sold out the possibility of getting a decent settlement for homeowners for a seat in Michelle Obama’s box at the State of the Union address and a star turn on a Potemkin mortgage fraud task force, Schneiderman appears to be an adept student of the Obama strategy of preferring empty gestures to substance, since they generate good PR and take a lot less effort.

The latest headfake is that Schneiderman has presented a bill to the New York State legislate opposing foreclosure fraud. What’s not to like? Well, for a former state Senator who got some heavily contested legislation through, Schneiderman appears not to even be doing the basics. From the Politics on the Hudson blog:

No Senate sponsor for a late-in-session bill? And it’s even later than that. Nevada’s attorney general, Catherine Cortez Masto pushed for legislation to criminalize foreclosure abuses and it became law last October. Schneiderman and Masto were almost certainly communicating last year; he was probably aware of the legislation before it was passed. Why did he take so long to launch (feebly) a similar measure here?

By contrast, the New York courts were swift to act when the robosigning scandal broke. A mere month later, it imposed a certification requirement which had the effect of lowering the bar for sanctioning attorneys for failing to take “reasonable” steps to verify the accuracy of documents submitted to the court. This has a chilling effect. Foreclosure filings plummeted. This was a de facto admission that the banks were not able, by legal means, to establish in court that they had the right to foreclose.

Now one might argue that this bill (were it ever to pass) still has merit because it, like the Nevada bill, criminalizes foreclosure abuses and preparing other types of false mortgage documents (like HUD or FHA documentation), and not just for attorneys, but for other document preparers and their managers. Even so, Schneiderman’s bill is less bloody minded than Masto’s. Hers had up to 10 years in prison and a $10,000 fine per violation. By contrast, it takes five or more incidents of bad conduct in one year to get a class E felony conviction, which would lead to up to four years in prison...

MORE

Demeter

(85,373 posts)Long-overdue rules to prevent a repeat of the 2008 run on money-market mutual funds may not be passed this year, thanks to a provision just inserted in a funding bill before Congress by Representative Jo Ann Emerson, Republican of Missouri. This is unfortunate but unsurprising. Because real reforms jeopardize the very existence of money-market funds, opposition from the industry has been fierce. There is a way out, however: Pairing such reforms with a creative alternative to the current model could make the demise of money funds palatable even to their sponsors.

We propose extending a government program called TreasuryDirect, which allows investors to buy Treasury securities directly from the government in accounts held with the Treasury Department. Banks and brokerages should embed a more user-friendly version of TreasuryDirect in their accounts - - call it a (new) U.S. Money Fund.

To appreciate the merits of this alternative, it’s useful to review some history.

Checkered Past

Money-market funds were created in the early 1970s when inflation soared but banks weren’t allowed to pay interest on checking accounts. Initially, money-market funds bought only Treasury bills. Later, as funds competed for customers by promising higher yields, they loaded up on riskier commercial paper, the unsecured short-term securities that businesses often issue to meet day-to-day needs. Money funds had the same look and feel as traditional checking accounts -- customers could write checks against their balances -- but offered higher yields because they enjoyed several cost advantages. They didn’t have to pay for deposit insurance or hold capital in reserve, they weren’t subject to regular examination by multiple regulators, and they didn’t have to comply with most consumer-protection rules or demonstrate their contribution to the local community. Relying on ratings companies to identify investment-grade assets eliminated the costs of loan officers and credit committees.

True, the accounts weren’t insured. But they did carry the regulatory imprimatur of the Securities and Exchange Commission. As more and more people moved into money markets, banks lobbied for and eventually secured the right to offer their own funds. By 1985, balances in money-market funds dwarfed those in traditional bank accounts. Money-market funds were thought to be “unrunnable,” because all withdrawals could be met by selling the assets of the fund. That illusion was shattered in September 2008. The pioneering Reserve Fund had large holdings of commercial paper issued by Lehman Brothers Holdings Inc. The failure of Lehman triggered redemption requests for more than $20 billion, but less than half that amount could be honored by selling assets since the markets were frozen. Redemption requests then surged at all money-market funds, but they could only sell their safest and shortest-term securities. The commercial-paper market froze. Fears of an economic collapse prompted the government to guarantee the previously uninsured funds.

Today, risky investments by money-market funds remain a public menace. The Federal Reserve’s policy of maintaining short-term interest rates of almost zero has impelled a desperate search for yield. Until quite recently, dodgy European bank paper constituted about 45 percent of the assets of the large money-market funds in the U.S. Although most funds have since reduced this exposure, the experience of 2008 demonstrates that they won’t always have such clear warnings or the time to divest in the future...

LENGTHY, BUT EDUCATIONAL. WORTH THE READING

westerebus

(2,978 posts)How else are we going to know when the run on the banks are in full swing?

If the shares were not priced at a dollar per, the FED would have let it go in 2008, once it broke the buck, the FED had no choice.

"the regulatory imprimatur of the SEC". Now that's funny.

Demeter

(85,373 posts)A commentator on my recent post about the DEA installing license plate scanners on the nation’s interstate highways asks, “If you aren't doing anything illegal why would you care if someone captures your license plate number?” Another commentator countered: “If I'm not doing anything illegal, why do the police need to record my license plate number?” It’s a great response. In essence, it points to our civilization’s core principle that the government is not supposed to look over our shoulder unless it has particularized suspicion that we are involved in wrongdoing. But the original poster’s point is a frequent refrain: “Why should I care about surveillance if I have nothing to hide?” As a privacy advocate I have heard this question for many years, and over time developed my own list of answers, aided by the sharp thinking of others who have grappled with this question, such as Dan Solove and Bruce Schneier.

Here are the answers to this question that I have settled upon over time:

- Some people do have something to hide, but not something that the government ought to gain the power to reveal. People hide many things from even their closest friends and family: the fact that they are gay, the fact that they are sick, the fact that they are pregnant, the fact that they are in love with someone else. Though your private life may be especially straightforward, that should not lead you to support policies that would intrude on the more complicated lives of others. There’s a reason we call it private life.

- You may not have anything to hide, but the government may think you do. One word: errors. If we allow the government to start looking over our shoulders just in case we might be involved in wrongdoing—mistakes will be made. You may not think you have anything to hide, but still might end up in the crosshairs of a government investigation, or entered into some government database, or worse. The experience with terrorist watch lists over the past 10 years has shown that the government is highly prone to errors, and tends to be sloppily overinclusive in those it decides to flag as possibly dangerous.

- Are you sure you have nothing to hide? As I said in this 2006 piece, there are a lot of laws on the books—a lot of very complicated laws on the books—and prosecutors and the police have a lot of discretion to interpret those laws. And if they decide to declare you public enemy #1, and they have the ability to go through your life with a fine-tooth comb because your privacy has been destroyed, they will find something you’ll wish you could hide. Why might the government go after you? The answers can involve muddy combinations of things such as abuse of power, mindless bureaucratic prosecutorial careerism, and political retaliation. On this point a quotation attributed to Cardinal Richelieu is often invoked: “Give me six lines written by the hand of the most honest man, and I’ll find something in them to hang him by.”

- Everybody hides many things even though they’re not wrong. The ultimate example is the fact that most people don’t want to be seen naked in public. Nudity also makes a good metaphor for a whole category of privacy concerns: just because we want to keep things private doesn’t mean we’ve done anything wrong. And, it can be hard to give rational reasons why we feel that way—even those of us who feel most comfortable with our bodies. True, some people may be perfectly happy posting nude pictures of themselves online, but other people do not like to show even a bare ankle—and they should have that right. In the same way, there may not be anything particularly embarrassing about other details of our lives—but they are our details. The list of all the groceries you have purchased in the past year may contain nothing damaging, but you might not want a stranger looking over that either, because of that same difficult-to-articulate feeling that it would just be, somehow, invasive, and none of their damned business. As Bruce Schneier aptly sums it up, “we do nothing wrong when we sing in the shower.”

- You may not care about hiding it, but you may still be discriminated against because of it. As I discussed recently in this post about data mining, people are often denied benefits or given worse deals because some company decides that some behavior—entirely innocent and legal—might suggest you are a poor risk. For example, credit card companies sometimes lower a customer’s credit limit based on the repayment history of the other customers of stores where a person shops.

Privacy is about much broader values than just “hiding things.” Although many people will want more specific answers to the question such as the above, ultimately the fullest retort to the “nothing to hide” impulse is a richer philosophical defense of privacy that articulates its importance to human life—the human need for a refuge from the eye of the community, and from the self-monitoring that living with others entails; the need for space in which to play and to try out new ideas, identities, and behaviors, without lasting consequences; and the importance of maintaining the balance of power between individuals and the state.

One of my favorite stories re- this issue is that the US government blackmailed Lennon into abandoning his anti-war activities by threatening him with deportation based on his past marijuana use.

As Daniel Ellsberg has pointed out, they can even use your hopes and dreams against you.

Demeter

(85,373 posts)SCOTUS has just declined to take all seven of the pending Gitmo habeas corpus petitions, including Latif and Uthman.

This effectively kills habeas corpus.

Consider what SCOTUS just blessed:

Demeter

(85,373 posts)Now what?

That's the question attorneys who represent Guantanamo detainees are asking after the Supreme Court on Monday refused to consider the appeals of seven prisoners, who petitioned the justices to review decisions in their habeas cases made by a conservative appeals court. The decision flies in the face of the court's 2008 landmark ruling in Boumediene v. Bush, which granted detainees a "meaningful opportunity" to challenge their detentions.

SCOTUSblog reported that the "practical effect" of the Supreme Court's decision, "is that the D.C. Circuit Court now functions as the court of last resort for the 169 foreign nationals remaining at the U.S.-run military prison in Cuba, and that court has a well-established practice of overturning or delaying any release order issued by a federal judge, when the government objects."

None of the justices dissented and the Supreme Court did not issue a statement explaining its decision.

Brent Mickum, an attorney who has spent nearly a decade working on the habeas cases of several Guantanamo detainees and currently represents the high-value prisoner, Abu Zubaydah, said, "For those of us who have been working in the trenches for years and years this is a really sad and disappointing day."

"All of our work has essentially been for naught," Mickum said. "This leaves open a glaring question, what is the next step? All of the habeas attorneys will be getting together for a major meeting to discuss that."

MORE. READ IT AND WEEP

Demeter