Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 19 December 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 19 December 2012[font color=black][/font]

SMW for 18 December 2012

AT THE CLOSING BELL ON 18 December 2012

[center][font color=green]

Dow Jones 13,350.96 +115.57 (0.87%)

S&P 500 1,446.79 +16.43 (1.15%)

Nasdaq 3,054.53 +43.93 (1.46%)

[font color=red]10 Year 1.82% +0.05 (2.82%)

30 Year 3.00% +0.06 (2.04%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)This one was shortened, since we combined this week and next week's meetings (since next week is Xmas).

So it was like drinking from a fire hose. I'm soaking wet, figuratively speaking...

and have too much follow up work to do. Fortunately, I'm getting some time off in the next two weeks to do it. And maybe some Xmas, too?

Which idiot put a 31 day limit on a month, anyway?

Demeter

(85,373 posts)It comes to about 10% this year. I thought that was rather impressive.

Of course, some jobs are harder than others...but every little bit helps. And sometimes, you can ensnare someone with a "fun" job, and lure them into something a little more substantial....

and then there are the workaholics (or paranoid) who join everything (who, me?)

Demeter

(85,373 posts)SOLD TO RENTIERS, EVERYONE...AS INVESTMENT VEHICLES, SO THAT THE RENTS CAN BE BUNDLED AS SECURITIES....OH, WHEN WILL THEY EVER LEARN?

http://www.creditslips.org/creditslips/2012/11/where-are-the-foreclosures.html

Bloomberg has a story Foreclosure Wave Averted as Doomsayers Defied. http://www.bloomberg.com/news/2012-11-29/foreclosure-wave-averted-as-doomsayers-defied-mortgages.html

I think it's a great example of defining deviancy downward. There's no question that we haven't seen a foreclosure tsunami in the wake of the federal-state servicing fraud settlement. But there was little reason to expect one and let's not lose sight of the big picture--foreclosure levels are still incredibly high. Here's why it didn't make a lot of sense to expect a huge pick up in foreclosures: there simply isn't the system bandwidth to handle them. Servicers really can't move significantly more foreclosures through the courts/trustee systems if they wanted. States have adopted all kinds of approaches that have significantly slowed down the foreclosure process. If I started a foreclosure in New York state today, I probably wouldn't have title and possession until early 2015. To the extent they could, it would risk pushing down housing prices and triggering more defaults. Moreover, the banks' plan for several years has been to slowly recognize losses against earnings. If all defaults had been foreclosed at once, the banking system would look a lot less solvent. The game plan has always been to run the clock. Hence all the "kick the can down the road" mods. As a result, what we're likely to see is not a foreclosure tsunami, but rather an extended foreclosure high-tide.

Assuming no major hiccups (e.g., interest rates rising), it will still take a few years before foreclosure levels return to historic averages. Unfortunately, that's when a lot of 2009-2011 HAMP mods will start to have their interest rates rise. Probably not a crisis from that, but certainly not good.

The article also buys into the belief that there's a meaningful distinction between a foreclosure and a short sale. They are different, but in terms of the social displacement from foreclosures, they look pretty similar. Maybe there's a negotiated exit time frame with the short sale, etc., making it a softer landing, but let's not see short sales as Mission Accomplished. The chart below shows HOPE Now data on foreclosure starts, foreclosure sales, short sales, and foreclosure & short sales. While there's been a 48% increase in short sales since Q1-2010, the number is still small in absolute terms. Viewed as a whole, there hasn't been any real change in total foreclosure or short sale activity since the end of 2010. Foreclosure starts have been coming down, but they're still perhaps 4x what they usually are. So yes, we haven't had a an increase in foreclosures, but the situation already was a disaster. This is hardly success. So no storm surge, but extended high tide.

http://www.creditslips.org/.a/6a00d8341cf9b753ef017ee5c0185e970d-800wi

FROM THE COMMENTS:

You really want to stop a FORECLOSURE? I went to Financial Screen Shots – got the link from stopforeclosurefraud com. I ordered the Loan Search Within 2 days I got back the info showing my loan was securitized. I order the full package of all My documents and it contained everything! I have absolute evidence my mortgage note was sold in 2008. I stopped paying 2011 and I am being foreclosed by Bank of America. My lawyer says they have absolutely NO STANDING and he plans to sue the lawyers bringing the case into court. I finally have BOFA in a lie! More proof at http://deadlyclear.wordpress.com/2012/03/15/securitized-distrust/ Anyway, felt such a need to express myself. Good luck everyone.

Fighting fraudulent foreclosures (and fascism/corporatism, AND defending property rights, fact and law, and due process - 7 days a week - National WAMU Homeowners Support Group. http://www.huffingtonpost.com/social/Rob_Harrington/matt-taibbi-jamie-dimon-treasury-secretary_n_2210871_209951750.html

Demeter

(85,373 posts)Let me try to keep this short and still make the point I want to make. Lately, I've seen a huge amount of people talking about an economic recovery, certainly in the US, so much so that people who disagree with that assessment are labeled "doomer" or things like that. Again. It's an easy thing to do.

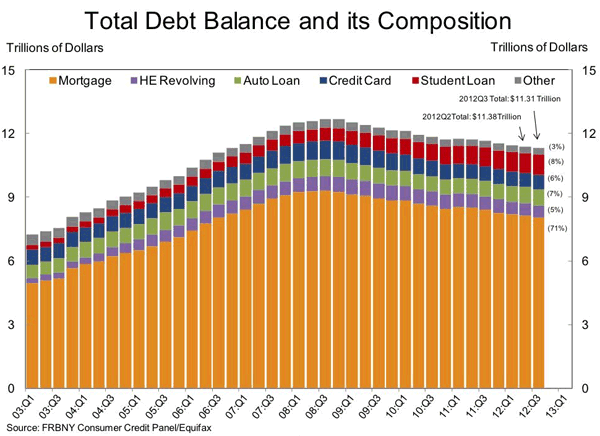

I'll start with a graph from this New York Fed report. It depicts the - almost - 10-year development of US household debt, which culminates in a total of $11.31 trillion at the end of Q3 2012.

The conclusion many people draw from the graph is that total debt is "still" falling. And that is supposed to mean that things are going well, or better if you will. But when I look at the graph, that's not the first thing I notice. What I see is mortgage debt at around $5 trillion in Q1 2003 and, after a peak just over $9 trillion in Q3 2008, slightly lower, at $8.03 trillion (the report provides the exact number), in Q3 2012.

Which means that mortgage debt may have come down by about 11% over the past 4 years (while home prices, mind you, fell 33%, as per Case-Shiller), but it's still 60% (!) higher than it was in 2003. And one thing is certain: it can't stay there, and it won't. We can discuss till we're blue in the face how much it still has to go on the way south, and we can argue about how long that will take, but I would think the main point is very clear. That is, an economic recovery in the US is not possible when households still have to deleverage to the tune of $2-3 trillion. And no, it's not different here, or this time, and no, Americans cannot carry a 40% mortgage debt increase in 10 years either, so another $2 trillion move south is really the minimum....Home prices are rising a little, says Case-Shiller now. If that were to last, mortgage debt would even rise again. Unless enormous amounts of the old existing debt were cancelled, forgiven, restructured. Well, it took more than four years to shave off 11%. So you tell me, where would that sudden drop come from? It's not going to happen, is it? So unless you would want to argue that $8.03 trillion is the new black, something's got to give. Rising home sales and rising home construction only serve to increase the debt. While the graph leaves no doubt that the debt must decrease. By about 25-30% from where it is now ($2-3 trillion of $8 trillion), and 40-60% of the $5 trillion it was in 2003....

MORE ANALYSIS AT LINK

Demeter

(85,373 posts)Banks have been told to lengthen directors’ incentive periods from three years to between five and eight years. It could also be made harder to qualify for a bonus, by penalising risk, while awards will increasingly be paid in bail-in debt.

In its Financial Stability Report (FSR), the Bank stressed “the importance of these concerns for UK banks’ current remuneration round”.

The latest crackdown follows a warning from the Financial Services Authority that deferred bonuses should be clawed back this year in the wake of the scandals involving the mis-selling of interest rate derivatives and the rigging of Libor rates.

City bonuses are already expected to be down to a total of £1.6bn, from £4.4bn in 2011 and a high of £11.6bn in 2007, according to the Centre for Economics and Business Research.

MORE

Demeter

(85,373 posts)YVES SMITH WRITES:

I’ve read the Department of Labor complaint of former Deutsche Bank employee Eric Ben-Artzi that, among other things, alleges that the German bank violated SEC, GAAP and IFRS (International Financial Reporting Standards) requirements and probably also Sarbanes Oxley, and have had follow up conversations with him and his counsel. The charges are specific and sufficiently well supported to merit serious investigation. In their efforts to dismiss his charges, defenders of the bank’s position overlook the public reporting requirements for complex financial transactions like the one in question, a leveraged super senior (LSS) trade. Nor does their Panglossian “everything worked out for the best” argument stand up to scrutiny....Deutsche’s CFO issued a statement on Thursday justifying the bank’s actions; we’ll address that after providing some context.

Overview of Allegations

Lost in the fulminating about these allegations, and the likely reason that the Financial Times gave this story such prominent play is that not one, but three whistleblowers came forward with overlapping concerns. All these individuals had to recognize that going this route would be at best a career-limiting move at Deutsche and would likely result in being fired.

Deals that did not have three (or any) whistle blowers:

AIG CDS

Timberwolf CDO

Hudson CDO

Magnetar CDOs

Dead President CDOs

Taylor Bean and Whitaker fraudulent conveyances

London Whale

LIBOR rigging

MF Global Euro trade scam

A former financial firm exec said via e-mail:

For 3 employees in a bank, 2 of whom were pretty senior, to speak up about the same deal, something unusual was happening.

In fairness, some of the pushback is due to the fact that the Financial Times’ lengthy and otherwise impressive discussion of the transactions and the whistleblower charges failed to discuss how Deutsche Bank’s alleged misbehavior fell afoul of accounting and regulatory requirements. We’ll start with Ben-Artzi’s allegations, not simply because we have the most detail on them, but also because they constitute the overwhelming majority of the alleged hidden losses, $10.4 billion of the $12 billion at issue.

To give a very brief and simplified overview (see this post by Lisa Pollack for more details), the so-called LSS trade involved the creation of a special purpose vehicle. The asset side of the SPV was a portfolio of corporate credit exposures, achieved through credit default swaps.* The SPV was leveraged because it was not fully funded...

Read more at http://www.nakedcapitalism.com/2012/12/deutsche-banks-12-billion-in-hidden-losses-why-whistleblower-charges-have-merit-and-why-they-matter.html#7dfeJLXVPSp56D4o.99

Demeter

(85,373 posts)Yves here. One of the things that has too often gone missing in the many discussions of why massive scale money launderer HSBC was not prosecuted is the basis of the “doing that would be destabilizing” excuse. When a company is indicted (mind you, indicted, not convicted), pretty much all Federal and many (most?) state agencies are required to stop doing business with it, immediately. The effect of the loss of so much business, particularly for a large financial firm, is seen as a death knell.

Of course, that’s the point. The threat of indictment of the company provides tremendous leverage to go after individuals. The Wall Street Journal’s editorial page went on a rampage against Eliot Spitzer when he used that cudgel to force the resignation of CEO Hank Greenberg. Now of course there is a different way to use this power. A prosecutor could just as well inform a board that it is ready to indict the company unless it secures the full cooperation of executives in order to secure prosecutions of all individuals involved in a meaningful fashion, top to bottom. That includes waving the company’s attorney-client privilege on this matter. Sending executives to prison has far more deterrent value that bringing a company down, since many will argue that employees who had nothing to do with the criminal activity would also be harmed.

..............................................................................................

By Ian Fraser, a financial journalist who blogs at his web site and at qfinance. His Twitter is @ian_fraser.

The ‘settlements’ that London-headquartered banks HSBC and Standard Chartered have reached with the US authorities over serious criminal offences — including sanctions-busting and aiding and abetting terrorism and the global drug trade — are a travesty of justice. Even The Economist, a publication of which I am not usually fan, had a go at the ‘settlements’ saying:

Andrew Bailey, chief executive-designate of the Prudential Regulatory Authority, seems to believe they have. Bailey told the Telegraph’s Harry Wilson that some banks had grown too large to prosecute.

So let’s get this straight. In Bailey’s universe protecting a bit of money is more important than the rule of law? Large banks and their senior executives must have an immunity from criminal prosecution — i.e. carte blanche to do whatever they want, including plundering the real economies, forming price-fixing cartels, rigging rates and markets, ransacking communities and funding terrorism, irrespective of the harm caused to others — for fear of upsetting financial stability? I am afraid this won’t wash...If Bailey really believes it, he is unfit for regulatory office and should be forced out of his job.

MORE

Demeter

(85,373 posts)Maria Katri sent her son to live at a charitable home for poor boys after Greece's economy crashed. Now, as Greece slides deeper into depression, the widowed mother is so poor that her teenage daughter, who stills lives at home, is "jealous that her brother is having a better time than her in the institution," Ms. Katri says. The spread of economic hardship is fraying Greece's social fabric and straining its political cohesion as the country enters the harshest winter of its three-year-old debt crisis. Even the tightknit Greek family—an institution that has helped the population to absorb a collapse in employment—is under pressure as household incomes dwindle.

Many families are sliding down the economic ladder that their parents and grandparents climbed, often making them reliant on those same retirees' shrinking pensions. Already-poor families are slipping off the ladder, into the arms of overburdened charities. In a country of 11 million, only 3.7 million people have jobs, down from 4.6 million four years ago. Economic activity has shrunk by over 20% in that time.

...The embattled government hopes this month's €34.4 billion bailout-loan installment, or about $45 billion, from Europe and the International Monetary Fund will lift the depressed national mood. But ordinary Greeks are bracing for the latest austerity package demanded by the country's creditors, which will hit them in January. Fresh pay and pension cuts and tax hikes, totaling about 5% of gross domestic product, will lead to another 4.5% decline in gross domestic product in 2013, the government says. Some economists say the drop could be much bigger.

Greek society's ability to take one more big economic hit this winter could make or break the coalition government's effort to enact the tough bailout program—and Europe's quest to tame its crisis. In the heart of Athens, the signs are everywhere that Greek society is living off its reserves. Families, businesses and nonprofits are running low on savings and stamina...

Demeter

(85,373 posts)FOR those who started out the year optimists on American growth (such as me), 2012 was sobering. It looks like America will end the year having grown about 2%, according to Deutsche Bank, marginally below the average pace since the recovery began in mid-2009.

Why was it disappointing? In great part part because the rest of the world had an even worse year. Take a look at the nearby table. Of the world's four major developed economies plus China, America was the only country to grow roughly as fast as the International Monetary Fund projected in the fall of 2011. Europe and the U.K. actually contracted, while China (and several other emerging economies) grew notably less briskly.

I draw four lessons from this.

First, America would have had a much better year had the rest of the world performed as expected. This isn't so much through trade, whose contribution to growth has been so far marginally positive, but through the impact on confidence. Complaints that American fiscal and monetary policy are too tight are more true in hindsight than they would have been at the time those policies were being formulated. By kicking the can repeatedly down the road, policy makers have so far managed to avoid tightening fiscal policy.

Second, America's performance next year rides heavily on whether the rest of the world gets its act together. China has emerged from its soft landing but its new leadership seems determined to keep stimulus to a minimum and allow growth to maintain its leislurely (for China) pace of 7.5% to facilitate transition to a more consumer-led economy. Europe's leaders are slowly remaking the region's institutions while Mario Draghi has their back. The threat of a disorderly euro breakup and sovereign default have receded. Whether that is enough to bring the region out of recession remains to be seen.

Third, perhaps the biggest risk in 2013 is that America follows the formula of the U.K. and Europe in 2012. Even if the bulk of its fiscal cliff is avoided, America should count on fiscal tightening in the area of 1.5% to 2% of GDP (and perhaps even 3% if only a partial deal is struck). The mere prospect that policy might tighten that much has been a major dampener on business investment and thus GDP lately. In the face of that austerity it will rely, as Japan, Europe and Britain have, on its central bank pushing quantitative easing even further towards the frontier. Even if you believe the Fed still has some juice left, it's hard to be optimistic about a global policy mix that emphasizes tight fiscal and ever more expansive monetary policy which, as Tom Gallagher of Scowcroft group notes, is not the preferred choice in a deleveraging world with short-term interest rates at zero.

Fourth, beware of forecasts.

Demeter

(85,373 posts)The deal between the White House and congressional Republicans includes changes to the cost-of-living formula that amount to needless cuts for seniors. NOT TO MENTION PUNITIVE AND CRUEL

Once again, President Obama seems to be on the verge of folding a winning hand...Widely leaked reports indicate that the president and House Speaker John Boehner are making a fiscal deal that includes hiking tax rates back to the pre-Bush levels with a threshold of $400,000 rather than the original $250,000, and cutting present Social Security benefits. Obama, the reports say, will now settle for as little as $1.2 trillion in tax increases on the rich rather than the $1.6 trillion that he had originally sought. The difference, in effect, will come out of the pockets of workers, retirees, the young, and the poor.

Especially foolish is the cut in Social Security benefits, disguised as a change in the cost-of-living adjustment formula. Before getting to the arcane details of the formula, here’s the bottom line. The proposed change will save only $122 billion over ten years, but it will significantly cut benefits for the elderly. Because the cut is in the form of a change in the Consumer Price Index (CPI), the longer you live, the more is the total cut. On average, the cut is about 3 percent a year, but if you live twenty years after you start drawing benefits (the average), that adds up to over ten thousand dollars.

Put this in the context of the reliance of the elderly on Social Security. More than 70 percent of all recipients depend on Social Security for more than half their income. The average Social Security benefit is less than $15,000 a year, and in recent years all of the cost-of-living adjustments and more have gone to defray the annual increases in Medicare premiums and other health costs. One interesting detail in Obama’s apparent cave-in on Social Security is the role played by some prominent liberals, notably Robert Greenstein of the Center on Budget and Policy Priorities (CBPP).

The proposed change involves a shift to something called the Chained CPI. Supposedly, when the price of something goes up, people substitute cheaper products. The application of the Chained CPI to the elderly (who are already scrimping) is problematic—more on that in a moment—but Greenstein has had kind words for disguised cuts in Social Security via the Chained CPI...In a piece last February, Greenstein and colleagues wrote that a shift to the Chained CPI would be acceptable if it protected longtime Social Security recipients and those receiving disability benefits via Supplemental Security Assistance. The respected Greenstein’s support provides crucially important political cover for Obama’s cave-in. Why does the CBPP, which exists to defend social programs, accept this disguised cut? There seem to be four major reasons. First, Greenstein’s operating principle is that programs for the poor, above all, need to be protected. Second, Greenstein has long been of the belief that making progress on deficit reduction helps safeguard programs for the poor. Third, Greenstein is always eager to remain a player—and providing this support to a beleaguered White House makes him a player par excellence. Finally, Greenstein also likes to stay on good terms with both the budget-balance crowd and the liberals. But this is one of those times when you need to decide which side you are on. I have a lot of admiration for the role Greenstein has played over the years. But on this crucial issue, I think his calculation is just plain wrong. Look at budget politics over the past decade. Joining the call for deficit reduction has hardly saved programs for the poor. Discretionary domestic spending, from which programs for the poor come, is at its lowest share of GDP since the Eisenhower years. The siren call of the austerity lobby is that Social Security spending is “crowding out” other social spending. But that doesn’t hold up either. Even in today’s weak economy, Social Security is in surplus. If we got back to full employment with decent wage growth, increased payroll tax receipts would keep Social Security in surplus indefinitely.

MUCH MORE

This promises to be an epic showdown. We will soon learn what Obama, the progressive community, and congressional Democrats are made of.

Demeter

(85,373 posts)This morning brings news of a possible deal on the horizon, concerning the “fiscal cliff.” Obama would get the an extension of the Bush tax cuts for households with incomes under $400,000 (not $250,000, which was his goal), a two-year debt limit reprieve, the elimination of the sequester, and additional revenue and the extension of emergency unemployment benefits. What he is willing to give up for this? Quite a lot, actually. It amounts to about half a trillion dollars in future cuts to social programs (the nature of these cuts have yet to be determined), and also significant cuts to Social Security benefits, in the form known as “chained CPI.” “Chained CPI” is an alternative way of calculating the cost of living which will lower benefit amounts.

I realize that compromises are going to be made on this deal which I, along with most Democrats, are not going to like, but I am not a fan of this deal. At all. Where do I begin? First of all, the idea of all those large unspecified cuts in social programs makes me very uneasy. Secondly, the two-year debt reprieve, while it sounds like a good idea, is actually quite risky for the Democrats, as Brian Beutler explains . And then there are those Social Security cuts.

In last night’s lukewarm blog post about the deal, Paul Krugman pointed out that at least the Social Security cuts “are not nearly as bad as raising the Medicare age.” That is true, but it is also faint praise. Basically, I’m with Delong, who says,“‘Chained-CPI’ is code for ‘let’s really impoverish some women in their 90s!’ It’s a bad policy.” Indeed. Chained CPI would have a disproportionately negative effect on women, who receive less Social Security than men to begin with, and who also rely more heavily on Social Security as a source of retirement income than men do (because they are less likely to have savings or private pensions). We actually should be talking about raising Social Security benefits, not lowering them. Very few employers are providing defined benefit pensions these days, and declining wages and increasing economic instability make it difficult for many Americans to save for their retirement. Dramatic fluctuations in the stock market mean the values of workers’ retirement portfolios can suddenly plunge in value. As Joe Nocera pointed out in this excellent column from earlier this year, our pension system has utterly failed to meet the challenges of our brave new economy. Already, the U.S. social security system is far less generous than those of other industrialized nations. According to the OECD, the social security benefits the median U.S. worker earns are among the lowest of any OECD country — about 42% of earnings, as compared to an average among OECD countries of 61% of earnings (see p. 119 of the report).

Cutting Social Security benefits should be off the table. As Delong says, “This deal would still be on the table in January. And odds are Obama could get a much better deal than this come January.” I agree. I worry, though, that cutting Social Security may be the kind of “Grand Bargain” Obama has always seemed amenable to. I don’t think it’s too cynical to believe that the White House floated the story that they were considering raising the Medicare age, so that Democrats would find the bitter pill of cutting Social Security more acceptable. Let’s hope progressives put up a real fight on this one and force the White House to hold out for something better.

Fuddnik

(8,846 posts)Ahhhhh The Wisdom of the Ages........

A female CNN journalist heard about a very old Jewish man who had been going to the Western Wall to pray, twice a day, every day, for a long, long time.

So she went to check it out. She went to the Western Wall and there he was, walking slowly up to the holy site.

She watched him pray and after about 45 minutes, when he turned to leave, using a cane and moving very slowly, she approached him for an interview.

"Pardon me, sir, I'm Rebecca Smith from CNN. What's your name?

"Morris Feinberg," he replied.

"Sir, how long have you been coming to the Western Wall and praying?"

"For about 60 years."

"60 years! That's amazing! What do you pray for?"

"I pray for peace between the Christians, Jews and the Muslims."

"I pray for all the wars and all the hatred to stop."

"I pray for all our children to grow up safely as responsible adults and to love their fellow man."

"I pray that politicians tell us the truth and put the interests of the people ahead of their own interests."

"How do you feel after doing this for 60 years?"

"Like I'm talking to a fucking wall."

tclambert

(11,187 posts)Maybe the problem all along was that people weren't specific enough about which world they wanted to have peace.

Demeter

(85,373 posts)They say in the grave there is peace, and peace and the grave are one and the same.

(Quote by - Georg Buchner)

Roland99

(53,345 posts)DOW +0.2%

NASDAQ 0.0%

Europe up pretty well (esp the IBEX)

US 10 Year yields popped over 1.8...rocketing up the last few days...glad I finally closed on my refi last week!!

Demeter

(85,373 posts)Everything is hunky-dorey now...Greece's credit rating has been raised 6 notches, because the ECB finally released some loans to it.

That's still junk bond level: B-, but they wanted to celebrate the total annihilation of the Greek people.

Demeter

(85,373 posts)...America engaged in one of its perennial paroxysms of constitutional cogitation – this time over the Obama health care bill – with (mostly) predictable results....Four of the great legal priests on our High Temple’s Council of Scriptural Interpretation said that, yes, the Affordable Care Act was within the boundaries of what a small collection of men riding horseback to a meeting in Philadelphia one summer two-and-a-quarter centuries ago allow us to do today as a continent-wide superpower society of 300 million people in the age of atom bombs, space travel, heart transplants and genetic engineering. George and John and Thomas say it’s okay, we can have health care. Whew. That’s a relief....But then four other priests insisted, “Oh, no, this is fundamentally not allowed. Not at all.” And one apparently went both ways, voting against it before he was for it.

.........................................

Today’s rant is on the destructive dogmas and horrid habits of our national addiction to the practice of constitutionalism itself. By that, I don’t mean the fact that law in America is ultimately decided by five unelected, politically insulated and almost entirely unremovable individuals, meeting in secret and doing who knows what underneath their black robes. I have addressed the wisdom of that profoundly undemocratic process, known as judicial review, previously.

Though that’s not our concern here, the absurdity of the process as demonstrated so emphatically once again last week nevertheless cannot go without being briefly noted. How anyone can argue with a straight face that judicial review of legislation in America – especially in our hyper-polarized era, where presidential elections are as much about loading up the courts as they are about executive branch policies – is not entirely political, but purely about ‘finding’ the constitutionality of issues, is quite beyond me. I guess it’s just a massive coincidence that the votes of Supreme Court are almost always entirely predictable based on ideology, eh? I guess it’s also just a quirk of legal quantum mechanics that conservative justices always find their way to the conservative ruling, no matter what principles they need to invoke to get there. If, for example, the question is whether the federal government has the power under the commerce clause to smash state law on medical marijuana, Scary Scalia explicitly says, “Hell, yes, the feds can do just about anything they want!” Anything except, as it turns out, providing people with health care. Then, it’s abundantly clear to the very same good judge, that the national government has no such power according to the very same provision of the Constitution.

Anyone who would still today deny that the Supreme Court is little short of a profoundly non-democratic mini-legislature is simply lying to you, and probably lying to themselves as well. The very ideological predictability of the justices’ votes, and the way they obliterate any principle in their way makes that emphatically clear, as does the swaggering aggressive activism of the regressive majority of the Court in cases like Bush v. Gore or Citizens United. As, for that matter, does the rage this week in the regressive community focused on John Roberts for his defection from Tory orthodoxy. Does anyone seriously think that these people have a problem with his ‘legal reasoning’, as opposed to his ultimate vote? Let’s not be ridiculous. They’re angry because a guy on the conservative team defected to the enemy, and legal principles have nothing whatsoever to do with it. It’s like the friends and family of a Red Sox fan who suddenly starts rooting for the Yankees.

By the way, the vote itself also demonstrates the pure politicization of the judicial process. By the available evidence, the good tool Roberts appears to have been all set to have voted his ideology in this case, just as he has in the past, and just as we’d expect him to have done on this issue. But then something happened, and he switched votes. I can tell you what that something was, and why it effected John Roberts and not, say, Anthony Kennedy, who is normally considered the ideological swing vote (though never, it should be noted, when there is real money on the table). What happened was that the rising crescendo of criticism of the Court for its ideological bias, its massive overreach, and the horrific decisions it has been rendering, such as those creating the Bush presidency and the monstrosity of corporate-owned government, got to him. If there was a single development that switched Roberts’ vote, it was the New York Times front page article published in recent weeks detailing poll data which demonstrate that America’s admiration for the Court is way down, at historic lows. This is why it was Roberts who switched, and not one of the associate justices. His name will forever be attached to this court, and he didn’t want history to record that it was the Roberts Court that ruined the historically well-regarded institution. He didn’t want ‘Roberts Court’ to show up on the same list as Dred Scott and Plessy v. Ferguson. By taking a hit on this big issue once, he can now go back to stuffing plutocracy down our throats, as he assuredly will, but henceforth with an historic alibi in his pocket. In other words for the next thirty years we’ll be hearing: “Hey, you can’t say my vote is always just a shill for the corporatist oligarchy – look how I voted on Obamacare!”

AND HE GOES ON FROM THERE....AN INTELLECTUAL TOUR DE FORCE

MUST READ

xchrom

(108,903 posts)

Fuddnik

(8,846 posts)AnneD

(15,774 posts)LOL you are just full of it today. Love the joke BTW.

Fuddnik

(8,846 posts)I've got to pick him up at the airport at 5:00. Looking forward to a whole week of sheer pleasure. I'll be making a stop at the liquor store first.

AnneD

(15,774 posts)Of course, we can't bring liquor to school, but as a Christmas gift, I gave my principal a gift card to a local liquor store and a decorative wine bottle stopper. She has both sides of the family visiting now (she is Chinese/Puerto Rican) and hubby is Anglo. She came over and told me 'God Bless You'. I think she really will use the gift before the month is out.

Demeter

(85,373 posts)There's always Phyllis Diller's shoes to fill....

rusty fender

(3,428 posts)xchrom

(108,903 posts)The U.S. gun industry faced a new set of challenges to its financial and political power Tuesday as more of its Washington allies called for gun control and a major investor sought to get out of the firearms business entirely.

In Washington, a trio of new senators — all elected with National Rifle Association backing — said they were willing to discuss tightening gun laws. The White House gave a stronger signal of President Obama’s support for reinstating a ban on assault weapons.

A new law, if it should come, is still far off. In the business world, however, there was action Tuesday. Cerberus Capital Management, a huge investor in the gun industry, said it would sell its marquee gun company. Also, Dick’s Sporting Goods promised to stop selling “modern sporting rifles,” at least temporarily.

All of that would have seemed impossible a week ago, before a man with a semiautomatic rifle killed 20 students and six adults Friday at an elementary school in Newtown, Conn.

Demeter

(85,373 posts)and it's about time, too.

Did you hear?

Gov. Rick Snyder of Michigan did not sign the bill permitting concealed carry into daycares, schools, churches, etc.

His email must have spontaneously combusted.

xchrom

(108,903 posts)PARIS — France’s government is proposing to split banks’ risky trading activities from their more traditional lending operations as part of a Europe-wide effort to shore up a fragile industry that contributed to the continent’s financial crisis.

A bill presented Wednesday by President Francois Hollande’s Socialist administration would force banks to house any trading done for their own profit in a separate subsidiary.

The goal is to prevent deposits from being used in speculative activities; banks would still be allowed to leverage deposits for activities considered to the benefit of the economy, like lending to companies.

The bill also calls for the shareholders to be the first in line to rescue troubled banks, and it would create a bailout fund financed by the banks themselves.

AnneD

(15,774 posts)the Glass Stegall Amendment here in the US?

Demeter

(85,373 posts)except us. Because, after all, IT WASN'T INVENTED HERE!

Oh, wait...

AnneD

(15,774 posts)a guaranteed kiss of death in this backwater country.

xchrom

(108,903 posts)In the town that launched the War on Poverty 48 years ago, the poor are getting poorer despite the government's help. And the rich are getting richer because of it.

The top 5 percent of households in Washington, D.C., made more than $500,000 on average last year, while the bottom 20 percent earned less than $9,500 - a ratio of 54 to 1.

That gap is up from 39 to 1 two decades ago. It's wider than in any of the 50 states and all but two major cities. This at a time when income inequality in the United States as a whole has risen to levels last seen in the years before the Great Depression.

Americans have just emerged from a close presidential election in which the government's role as a leveling force was fiercely debated. The right argued the state does too much; the left, too little. The issue is now at the center of tense negotiations over whose taxes to raise and what social programs to cut before a Jan. 1 deadline. And the government's role will be paramount again next year if Congress takes up tax reform.

xchrom

(108,903 posts)Ever hear the joke about the lying economist?

No? Well, neither have I. But we might need to come up with one.

Such is the takeaway from a working paper released in January, which I stumbled on while browsing Professor Andres Marroquin's top papers of 2012. Written by a pair of researchers from universities in Montreal and Madrid, it examined whether the study of economics made students more apt to lie for financial gain. The answer: a resounding yes.

Several past experiments have tried to test how people's personal beliefs and background influence their willingness to lie, and one, published in 2009, had yielded results suggesting that economics students were more likely to fib than those in other disciplines. Raul Lopez-Perez and Eli Spiegelman -- both economists themselves -- wanted to find out if those findings would hold up in another lab setting ... and if they did, exactly why that might be the case. Were econ students over-internalizing the lessons of the dismal science, which teaches that human being are supposed to act in their rational self interest? Or were dishonest young folks just more likely to sign up for econ classes in the first place?

To find out, Lopez-Perez and Spiegelman designed an experiment that gave its subjects every conceivable incentive to lie, and none to tell the truth -- unless, of course, they simply felt that was the moral thing to do. The test involved two participants, one we'll just call the "decision maker" and one we'll call "the other guy." Each decision maker sat in front of a computer screen that would flash either a blue or a green circle. They then had to send a message to the other guy informing them what color had appeared. If the decision maker reported that the circle was blue, he or she received 14 euros. If they reported that it was green, they received 15 euros. In other words, whenever a blue circle popped up, they were forced to choose between being honest or making an extra euro by claiming it was green. The researchers, however, did the best to make that choice simple. No matter what the decision maker reported, the other guy always received 10 euros, and never got to learn what color actually showed up on screen. All of these rules were clearly laid out for both people in the experiment.

xchrom

(108,903 posts)Six in seven households have received some sort of government benefit, according to a new survey from Pew Research Center. Here are some highlights from the report, plus some extra bits of context. These graphs focus on government spending, as opposed to tax benefits -- such as the Earned Income Tax Credit and the lower rate on investment income -- which can also be considered forms of "government assistance," since a dollar not taxed can perform a similar role to a dollar spent.

1. The big picture is bigger than 'the 47%.' Fully 55% of all Americans -- including a majority of those self-identifying as Democrats, Republicans, liberals, moderates, and conservatives -- have received benefits from one of these six federal programs: Social Security, Medicare, Medicaid, welfare (TANF), unemployment benefits, and food stamps (SNAP).

2. ... Actually, it's more than the 70%. If you broaden to households rather than individuals: "71% of adults are part of a household that has benefited" from at least one of those six programs.

3. In fact, it's the 86%. After you add veteran benefits and college assistance, 70% of individuals -- and 86% of households -- receive a government benefit of some kind. Put differently, one in seven households doesn't receive assistance from the federal government.

4. The demographic breakdown. Federal assistance is more likely to go to women than men (61% vs. 49%); to blacks than whites or Hispanics (64% vs. 56% vs. 50%); and to rural residents than urban or suburban (62% vs. 54% vs. 53%).

xchrom

(108,903 posts)In the Greek mountain town of Kastoria, less than an hour from the Albanian border, Kostas Tsitskos, 88, can’t afford fuel to heat his home against the winter’s cold. So he and his son live in a single bedroom, warmed by a small electric heater.

“One room is enough,” said Tsitskos, who lives on a 734 euro-a-month ($971) pension and doesn’t have the 1,000 euros a month he needs to buy heating oil.

Greece is facing a heating-oil crisis. With an economy that has contracted for five years and an unemployment rate at a record 25 percent, residents in northern Greece can’t heat their homes. Kastoria hasn’t received funds from the central government to warm schools and the mayor said he will close all 53 of them rather than let children freeze, a step already taken in a nearby town. Truckloads of wood are arriving from Bulgaria as families search for alternative fuels.

“This is the coldest place in Greece,” said Emmanouil Hatzisimeonidis, Kastoria’s mayor, in an interview in his office. “It’s winter from October to April. This year we are very lucky. Last year, it was snowing for four months.”

xchrom

(108,903 posts)For employees at the biggest Wall Street banks, 2012 brought a humbling post-crisis reality of job cuts, lower pay and tarnished reputations. For investors, it was a happier story.

The 81-company Standard & Poor’s 500 Financial Index (S5FINL) is up 27 percent this year, its largest annual increase since 2003, led by a 104 percent gain in Bank of America Corp. The index beat the broader S&P 500 Index for the first time since 2006.

Shareholders, impatient for the industry to boost profit, were rewarded as Wall Street firms cut jobs and pay, and exited businesses. The shrinking unnerved employees, who watched the chiefs of two big banks lose their jobs and others contend with a drop in deal making and stock trading, stiffer regulations, trading losses, rating downgrades and scandals involving interest-rate manipulation and money laundering.

“There’s always grumbling on Wall Street, which is pathetic given how overpaid we all are, but there is a level of angst this year that is just unprecedented,” Gordon Dean, who left a 26-year career at Morgan Stanley (MS) to co-found a San Francisco boutique advisory firm this year, said in a telephone interview. “It’s just a profound sadness and dissatisfaction.”

xchrom

(108,903 posts)Builders in November capped the strongest three months for residential construction in four years and permits climbed as record-low borrowing costs buoyed the U.S. housing market.

Starts fell 3 percent to a 861,000 annual rate from a revised 888,000 annual pace in October, the Commerce Department reported today in Washington. The median estimate of 85 economists surveyed by Bloomberg called for a drop to 872,000. Building permits, a proxy for future construction, advanced to a four-year high.

Low mortgage rates and an improving job market are boosting builders such as Toll Brothers Inc. (TOL), which are now able to raise prices as sales climb and inventory shrinks. Gains in housing will help shore up economic growth this quarter as businesses curb spending on concern lawmakers will fail to avert the tax increases and spending cuts slated to take effect in 2013.

“Housing is no longer a net negative dragging down the economy,” Lindsey Piegza, an economist with FTN Financial in New York, said before the report. “It’s taking clear steps in the right direction. We’re starting to see very clear signs of modest, slow recovery.”

xchrom

(108,903 posts)

Inflation is now an intergenerational issue. Photograph: Graham Hughes / Alamy/Alamy

Do central banks care about unemployment more than inflation? To some extent it is an intergenerational issue.

The question arises after the winner in the Japanese general election on Sunday, the Liberal Democratic party's Shinzo Abe, demanded the Bank of Japan accept higher inflation as a fair trade off for policies that could kickstart the moribund economy. The demand follows a speech by US central bank chief Ben Bernanke, who has taken the hint that unemployment remains too high and said, in central banker code, that cutting unemployment will be his chief target. If he starts to see prices rises get out of control, then he will pay attention to the old inflation target, but making sure the US avoids millions of long term unemployed is priority number one.

In the UK, the Bank of England can already point to three years of measures unemployment targeting at the expense of inflation. Its policy of printing money under its quantitative easing plan has infuriated inflation hawks and savers groups, who want to maintain the pre-crisis focus on fighting high inflation.

And here we have the intergenerational issue in a nutshell. Older people with pots of cash in savings and investment accounts want low inflation to protect their assets. Young people, who have only small savings, if any at all, and big debts, are keener on having a job to pay the bills.

xchrom

(108,903 posts)Swiss bank UBS AG agreed Wednesday to pay some $1.5 billion in fines to international regulators following a probe into the rigging of a key global interest rate.

The financial industry's image was already badly tarnished by banks' role in the U.S. mortgage meltdown that sparked the global financial crisis and recession. Some have been in the headlines for trading scandals and alleged money-laundering.

Here's a look at some of the low points for banking and bankers since the start of the financial crisis.

- Swiss bank UBS blames a rogue trader at its London office for a $2.3 billion loss that is Britain's biggest-ever fraud at a bank. Kweku Adoboli, the 32 year old trader, is sentenced to seven years in prison. Britain's financial regulator fines UBS after finding its internal controls were inadequate and allowed Adoboli, a relatively inexperienced trader, to make vast and risky bets.

xchrom

(108,903 posts)BERLIN (AP) -- German prosecutors have charged two former Porsche executives with market manipulation in connection with the sports car company's failed takeover of Volkswagen AG, officials said Wednesday.

Prosecutors in Porsche's home city of Stuttgart accuse former chief executive Wendelin Wiedeking and ex-chief financial officer Holger Haerter of making misleading statements about the company's intentions in 2008.

Porsche made at least five public statements denying they intended to increase their stake in Volkswagen AG to 75 percent, despite having decided to do so at least six months earlier, prosecutors said in a statement.

The denials caused VW's share price to drop at a time when Porsche was secretly preparing to buy stock in Europe's largest automobile maker, the prosecutors said.

Demeter

(85,373 posts)CLEAR!

Demeter

(85,373 posts)thunderstorms and/or snow showers. Or both, simultaneously.

It's a good thing I got my tires. Be seeing you (I hope) on the other side of tonight...