Economy

Related: About this forumWhat percent of mandatory budget do top 1% pay?

Last edited Fri May 3, 2013, 01:12 AM - Edit history (2)

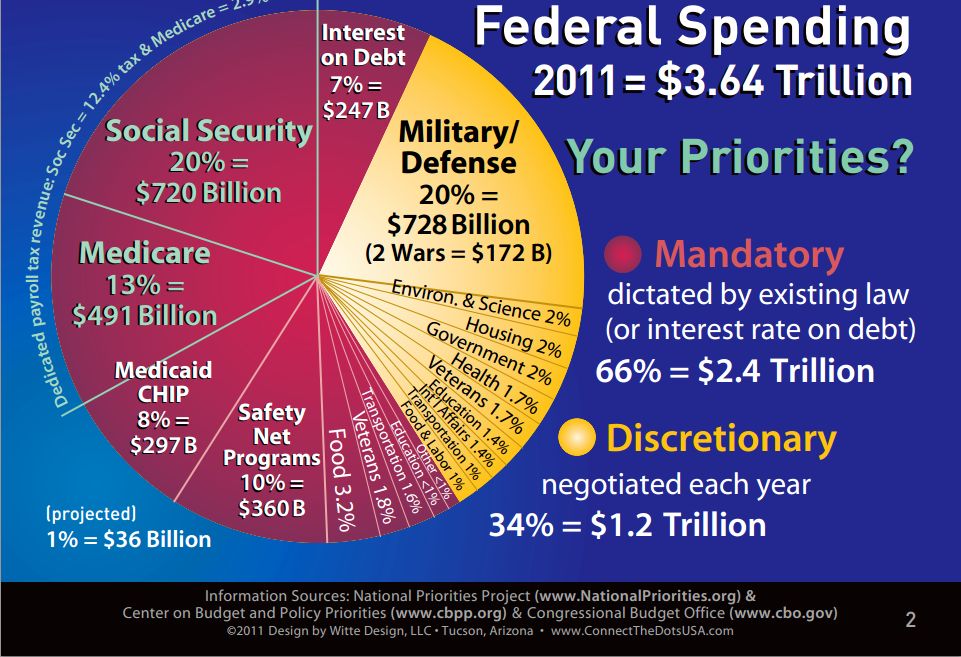

THe GOP often likes to say that the top 1% pay most of the taxes but I believe that is the Federal Income taxes which goes to Discretionatry spending only. Discretionary spending is only 34% of the total federal budget.

Mandatory spending which makes up Medicare, Medicaid and SS and a other safety net programs makes up 66% of the total Fed budget. So the Fed DISCRETIONARY budget paid with Fed Income taxes is only HALF the MANDATORY budget paid by Payroll taxes.

And its interesting to note that Reagan dropped the top Fed Income tax from 70% to 28%..... while DOUBLING the Payroll tax. The SS Trust Fund's surplus then started growing rapidly and the Fed Income tax took a dive which is why Reagan started borrowing from the SS surplus to compensate for the low top tax income tax rate on the rich.

So I was trying to find out what percent of the Mandatory budget the top 1% pay but cant find anything. I would think that since the SS tax is capped at $110,000, they would probably pay a little more than 1% of the Mandatory budget. This would make their total share of taxes paid much less.

Total Fed Budget including Discretionary and Mandatory spending

Total Fed Budget including Discretionary and Mandatory spending

Many more interesting graphs. http://www.connectthedotsusa.com/pdf/BudgetsOhMySlides.pdf

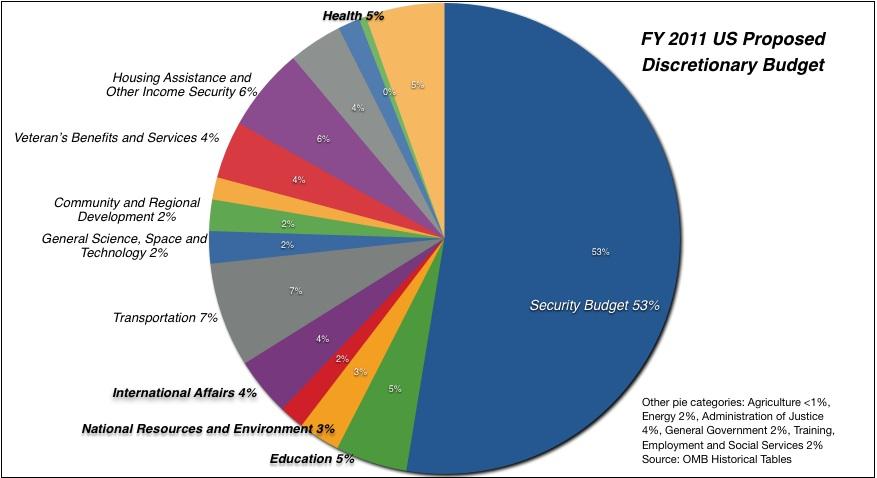

Discretionary Budget by itself.

Discretionary Budget by itself.

Demeter

(85,373 posts)What was it Reagan said? Oh, here it is:

"Facts are stupid things." -at the 1988 Republican National Convention, attempting to quote John Adams, who said, "Facts are stubborn things"

http://politicalhumor.about.com/cs/quotethis/a/reaganquotes.htm

See my signature line...

Fuddnik

(8,846 posts)No payroll taxes, and they have a much lower effective tax rate than a poor person.

Mitt Romney's 14% effective rate was lower than a burger flippers SS including both the employee and employer contribution. You can't separate the two, because they're both part of the same wage package.

ErikJ

(6,335 posts)I debate lots of the RW clowns and they always leave "income " out of it, so I think they are brainwashed that the rich are paying the majority of the taxes when in actuality they are paying a much smaller % of the TOTAL Federal tax revenue since their mandatory potion is very small in relation to their income. Lots of these millionaires reach their $110,000 SS cap in the first few days of Jan. of the year meaning the SS tax its a tiny portion of the income.

And Romney belongs to the investor class rich who only pay dividend and cap gains taxes which now tops out at 20%, up from 15% last year.

Talking about misleading RW propaganda, read this CNN Money article. I like how they started the graph in 1986 when Reagan dropped the top rate down to 28%,...... while 6 years before that the top rate was 70%!

http://money.cnn.com/2013/03/12/news/economy/rich-taxes/index.html