Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 29 May 2013

[font size=3]STOCK MARKET WATCH, Wednesday, 29 May 2013[font color=black][/font]

SMW for 28 May 2013

AT THE CLOSING BELL ON 28 May 2013

[center][font color=green]

Dow Jones 15,409.39 +106.29 (0.69%)

S&P 500 1,660.06 +10.46 (0.63%)

Nasdaq 3,488.89 +29.75 (0.86%)

[font color=red]10 Year 2.16% +0.12 (5.88%)

30 Year 3.32% +0.11 (3.43%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)It wasn't a very significant agenda, and the results were not great, IMO. But I get a 3 week reprieve...

Demeter

(85,373 posts)Jesse

Gold is flowing from weaker hands to stronger hands, from speculators to central banks and wealthy investors, the multitudes in China and India, and in general from West to East.

Nick Laird of Sharelynx.com does some incredible work tracking and charting almost every aspect of the gold and silver markets. His site is well worth visiting.

I have included some comments from Nick below that touch on some factors that had not yet occurred to me.

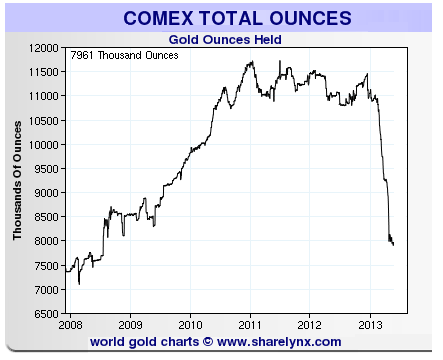

Total Ounces In Warehouse Including Both Registered and Eligible

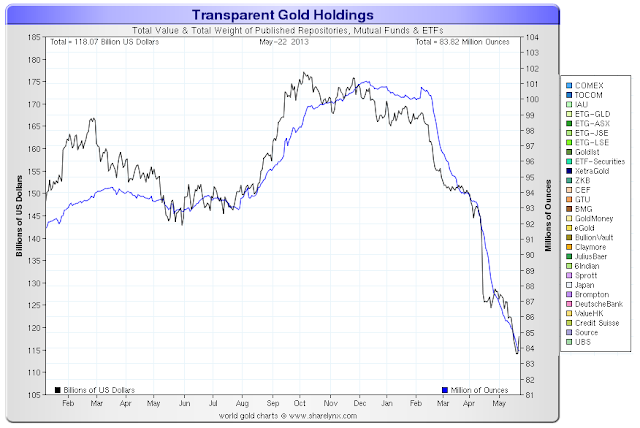

Here is the summation of quite a few repositories/Trusts/ETFs/Funds that list their inventory levels.

Here is a comment on this from Nick:

Gold holdings have fallen 17.5 %

Yet;

Silver holdings have risen 2.7%

Platinum holdings have risen 0.1%

Palladium holdings have risen 8.2%

I believe that there's a transfer of gold holdings from the publicly visible sector to the private sector where the numbers cannot be followed. Gold holders are taking possession of physical by removing physical from public places, eg. Comex, and selling them from visible accounts, eg. ETFs.

I do believe that there is a lot more to this than meets the eye and that we're seeing the initial transition stages that in a year or two's time we will look back & say 'Aha!' Gold is flowing not just from West to East but also from public to private places, and this I think is solely related to Cyprus and the future implications of a financial meltdown.

I think we're on the verge of the music stopping and a rush to safety.

All we need do is sit back and watch what happens to these public stocks when gold starts rising again. My bet would be that public stocks will continue to dwindle as more people feel unsafe about where their gold is held."

I tend to agree. I also think that a fear of the 'rehypothecation' of gold, especially in light of the seizure of assets held even with allocated receipts in the failure of MF Global, is driving people to take more care about where they keep their wealth.

As Nick points out, the biggest drawdowns are in gold itself. Ted Butler has recently speculated that some of the bullion banks may be taking inventory on the cheap as GLD disgorges inventory. So something is happening with gold that is not happening in the same way with the other precious metals.

And I am sure that by now you know that I am persuaded that big changes are coming to long standing global currency arrangements. My first take was that on the whole this remarkable inventory drawdown in public repositories in the West resembles the receding of the ocean after an earthquake. I don't think the bankers realize the signals that they sent to the markets with the manner in which they handled Cyprus. And MF Global and the entire financial crisis for that matter. These things take time to build, and then it seems that suddenly people begin to act. We will have to wait and see what comes next, and, as Nick points out, what the inventory levels do when the price of gold starts rising again.

Demeter

(85,373 posts)if you fool me twice...... ain't gonna get fooled again!

Demeter

(85,373 posts)The curse of hedging that blighted gold in the 1990s is making a comeback, and threatens to loom over the market like Banquo's ghost. London-listed gold producer Petropavlovsk has said it will pre-sell 55pc of its future output planned for the second quarter of 2014, at an average price of $1,408 an ounce. This is the first time that a big producer has hedged more than half its future sales.

“We have a huge investment programme and thought a little price protection in the short-term will let us sleep better at night,” said chairman Peter Hambro.

Tyler Broda from Nomura said this may signal the return of “structural hedging” across the industry, with other companies scrambling to lock in forward contracts. “This could increase the pressure on the spot gold price over the coming years,” he said. The risk is a vicious circle as hedging leads to lower prices, leading to more hedging. The process pushed gold down to $252 an ounce in 2009, though there were many other forces at work, including sales by the Bank of England and other Western central banks.

“It was hedging that killed gold prices the 1990s,” said Ross Norman from Sharps Pixley. “Every time there was rally, the producers seized on the chance to sell forward. It was most unhelpful.”

MORE

Demeter

(85,373 posts)German Finance Minister Wolfgang Schaeuble warned on Tuesday that failure to win the battle against youth unemployment could tear Europe apart, and dropping the continent's welfare model in favor of tougher U.S. standards would spark a revolution.

Germany, along with France, Spain and Italy, backed urgent action to rescue a generation of young Europeans who fear they will not find jobs, with youth unemployment in the EU standing at nearly one in four, more than twice the adult rate.

"We need to be more successful in our fight against youth unemployment, otherwise we will lose the battle for Europe's unity," Germany's Schaeuble said.

While Germany insists on the importance of budget consolidation, Schaeuble spoke of the need to preserve Europe's welfare model.

If U.S. welfare standards were introduced in Europe, "we would have revolution, not tomorrow, but on the very same day," Schaeuble told a conference in Paris.

WHAT DOES THAT MAKE US LOOK LIKE? CHUMPS!

Egalitarian Thug

(12,448 posts)Demeter

(85,373 posts)Egalitarian Thug

(12,448 posts)Believe it or not, for a short time we realized that we really do hold the power if we choose to exercise it.

Even Henry Ford, the bigoted, fascist bastard that he was understood this. One of my favorite quotes was uttered by him: "It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."

Demeter

(85,373 posts)I thought you meant currently. I agree, but there's no guarantee that those times won't come again.

Egalitarian Thug

(12,448 posts)so maybe we'll do better this time around.

Demeter

(85,373 posts)I’d like to connect a few dots for you. We had a couple of pieces of news come out on Friday that were strange. One piece did not even seem credible because of size and the other one seemed odd because of the lack of size. Here is what we learned and if this is true THE biggest financial news of the 21st century. Europe announced that they may crack down on the Shadow Banking System. Basically, assets of all sorts that are “deposited” within the system are routinely “re” lent out by the custodian. This “re lending” of assets is called rehypothecation. The scheme has gone on for years and has been abused to the tune of the same asset being lent out 10 times, 50 times or even 100 times over. Legal? Well no, but everyone does it and “it’s the way business gets done all the time”…plus the regulators turn a blind eye to …party on dudes!

Before I talk about the ramifications of the above, another, seemingly unimportant/unconnected piece of news hit the tape. 3 men were arrested in Hong Kong and in their possession were $500 million worth of “fraudulent” letters of credit, letters of guarantee and proof of funds; these were supposedly issued by HSBC and Standard Charter. A 4th man arrested was not named, only that he is 55 years old. Which coincidentally is the same age as Barry Cheung who sits (sat until his resignations this past week) on the boards of several government agencies, he was chairman of HKMEX and has very close ties to the CEO of Hong Kong, Mr. CY Leung. The investigation and arrests are tied to the HKMEX (metals exchange) that closed a week ago Friday and claimed that all open contracts would be settled in cash…not metal. OK, so these guys got arrested and had in their possession $500 million fraudulent “collateral.” Is this ALL of the fraudulent collateral? Did they have more? Do others possess or have pledged fraudulent collateral? How much? Where and to whom has it been pledged? How many times over has it been pledged? …And then out of nowhere, Europe decides to rein in the Shadow Banking System that is purported to be $80 TRILLION (with a capital “T”)! Do you see any connection here? I’ll make it easy for you, “collateral” is the common denominator.

I also want to mention that “collateral” is what makes the financial world turn. Everything runs on “credit,” if you have “collateral” then you can obtain credit. The problem now, that is being exposed, is that no one knows anymore if collateral is real or even “who’s” collateral it is anymore since it has been lent out so many times. Now, to add even more fuel to the fire, it turns out that some of the so called “collateral” is not and was not even real to begin with! Funds in the trillions of dollars have been lent and now it seems as if the collateral backing many loans may not be real. …And Europe is now considering pulling the plug on shadow banking? How many “assets” will banks and brokers have to sell to keep their capital ratios adequate? Do they even have enough real assets to sell to cover the collateral that turns out to be fake or has been lent out 10 times over (not to mention 100 times over). I might also ask the question, “What happens to the markets?” What will happen to the stock markets, bond markets, and real estate markets, ALL MARKETS if banks are forced into liquidation to cover for fraudulent or many times pledged collateral?

Back to the HKMEX, though quite small they did not even have the gold (collateral) to settle contracts with and this was a teeny tiny exchange. We have been watching GLD bleed, COMEX inventories decline and JP Morgan monkey with purported inventory between registered and eligible. Massive quantities of paper gold were sold last month that had the effect of depressing price; was it real gold? No, we already knew this…but there had to be some sort of “collateral” or letter of credit standing behind the seller right? I mean who could be allowed to sell “naked” contracts if they didn’t have the muscle of “collateral” behind them to ensure “settlement” even if only in paper terms, right?

My point is this, the tide is going out and it looks like EVERYONE is naked and no one has drawers on. Margin debt for stocks are at an all-time high, shorts by hedge funds in gold are at an all-time high, printing by central banks are at an all-time high, yields on sovereign bonds (even the deadbeats like Spain and Italy) were recently compressed to all-time lows and are now rising…and the real economies across the globe are beginning to contract again. The “inflection point” has apparently arrived and fraud everywhere you look is being uncovered. In a system that runs on debt, “collateral” is the foundation. What are the ramifications when “collateral” is questioned and turns out to be nothing more than a piece of paper with no value whatsoever? Everything that has derived value from this initial capital …is worth nothing.

Demeter

(85,373 posts)I'll quote Hotler (where are you, by the way?)

I have no hope, I see no future.

Demeter

(85,373 posts)I THINK THEY ARE CALLED "ORIGINATION FEES"

Before dawn one hazy March day in L.A., Armando Granillo pulled his SUV into a Starbucks near MacArthur Park, where he planned to pick up an envelope full of cash from an Arizona real estate broker, federal investigators say.

Granillo, a foreclosure specialist at mortgage giant Fannie Mae, expected to drive off with $11,200 — an illegal kickback for steering foreclosure listings to brokers, authorities allege in court records.

Granillo would leave in handcuffs. And investigators are now looking into assertions by Granillo and another former Fannie Mae foreclosure specialist that such kickbacks were "a natural part of business" at the government-sponsored housing finance company, as Granillo allegedly told the broker in a wiretapped conversation.

Investigators are examining whether other workers in Fannie Mae's Irvine office solicited illegal payments, according to three people with knowledge of the probe, who asked for anonymity because they were not authorized to speak publicly. Granillo at first offered to cooperate with investigators but later declined to talk, two of the people said...Another former foreclosure specialist in Irvine, Cecelia Carter, contends in an Orange County Superior Court lawsuit that Fannie Mae fired her in 2011 for trying to expose the kickbacks.

MUCH MORE

Demeter

(85,373 posts)THE FEDERAL RESERVE CAN'T TOLERATE THE COMPETITION....

http://www.globalpost.com/dispatch/news/regions/americas/130524/peru-counterfeit-currency-king

...Criminals here have a new prohibited export to rival the Andean marching powder — fake dollars. This South American country is now thought to be the world’s top producer of counterfeit greenbacks. Some 17 percent of the false bills circulating in the United States come from Peru, one US law enforcement official told GlobalPost.

Peruvian crooks aren't just churning out vast numbers of phony $20, $50 and $100 bills: They are also making much higher quality fakes than the false dollars produced within the US.

One of the reasons is technology. The counterfeiting gangs here use offset printers rather than photocopiers. But Peru is also home to some of the world’s most skilled counterfeiters, who employ painstaking, traditional techniques to give their bills apparent authenticity.

“They are specialists in giving it the tonality, texture, the watermark. Each of these bills goes through a rigorous process,” says Col. Segundo Portocarrero, head of the Peruvian police’s anti-fraud unit.

As he talks, Portocarrero illustrates how the gangs use a needle to pierce the bills and pull through a fake metal security thread, an extremely delicate, time-consuming task that only the steadiest, most skilled hands can pull off...

MORE

Demeter

(85,373 posts)...Jared Diamond wrote about the collapse of earlier civilizations to great acclaim and brisk sales, in a nimbus of unimpeachable respectability. The stories he told about bygone cultures gone to seed were, above all, dramatic. No reviewers or other intellectual auditors dissed him for suggesting that empires inevitably run aground on the shoals of resource depletion, population overshoot, changes in the weather, and the diminishing returns of complexity.

Yet these are exactly the same problems that industrial-technocratic societies face today, and those of us who venture to discuss them are consigned to a tin-foil-hat brigade, along with the UFO abductees and Bigfoot trackers. This is unfortunate, but completely predictable, since the sunk costs in all the stuff of daily life (freeways, malls, tract houses) are so grotesquely huge that letting go of them is strictly unthinkable. We’re stuck with a very elaborate setup that has no future, but we refuse to consider the consequences. So messengers are generally unwelcome. Will the cost or availability of oil threaten America’s Happy Motoring utopia? There should be no question. But rather than prepare for a change in our daily doings, such as rebuilding the railroad system or promoting walkable neighborhoods over suburban sprawl, we tell ourselves fairy tales about how the Bakken shale oil play will make America “energy independent” to provide the illusion that we can keep driving to Wal-Mart forever.

This is an especially delusional season in the U.S., with salvos of disinformation being fired every day by happy-talkers seeking to reassure a nervous public that everything is okay. Just in the past few weeks, we’ve seen an Atlantic Magazine cover story titled “We Will Never Run Out of Oil” followed by a report from the International Energy Agency (IEA) stating that the U.S. would become the world’s number-one oil producer by the year 2020, and many other bulletins of comforting optimism from The New York Times, NPR, and Forbes. The Atlantic Magazine used to be a credible organ of the American thinking classes, and the Paris-based IEA is vested with authority, though its political agenda – to prop up the status quo – is hidden. In any case, these are the interlocutors of reality for the public (and its leaders), and the memes they sow travel far, wide, and deep, whether they are truthful or not. The infectious cornucopianism they gleefully retail has goosed the stock markets and made it even more difficult to put out the contrary view that we are in deep trouble, perhaps even on the verge of an epochal disruption.

Dmitry Orlov published a fascinating book on this subject in 2008 titled Reinventing Collapse: The Soviet Experience and American Prospects. Orlov, born in Leningrad (now St. Petersburg) in 1962, had the unusual experience of emigrating to the U.S. as a twelve-year-old in the mid 1970s, and then returning periodically to what is now called Russia before, during, and after the collapse of its Soviet system. He had a front-row seat for the spectacle and an avid intelligence rigorously trained in the hard sciences to evaluate what he saw. He also possessed a mordant, prankish sense of comedy that endowed his gloomy subject with a lot of charm, so that reading him was the rare pleasure of encountering true prose artistry on a par with his countryman and fellow émigré, the late Vladimir Nabokov. Nabokov was a scientist, too, by the way, working for years as a professor of entomology (insects, with a specialty in butterflies) to pay the light bill.

...From his special perch between the two nations, Orlov saw the whole show differently: as a warning that the U.S. would probably meet a similar fate, but that the outcome for us would probably be much worse due to our massive stranded assets (the whole kit of suburban sprawl), our degraded sense of public goods, our lost traditional craft skills, and our pathetic lack of mental fortitude. The arguments he presented were clear, sensible, and absent in virtually every other venue where people discussed the repercussions of the Soviet collapse.

MORE

THIS IS A MUST READ

Demeter

(85,373 posts)Forbes Magazine likes to call itself a “capitalist tool,” and routinely offers tool-like justifications for whatever it is that profit-seeking corporations want to do. Recently it has deployed its small army of corporate defenders and apologists in the multi-billion dollar fight to keep the effective tax rates of global corporations low. One of its contributors, Tim Worstall, recently took me to task for suggesting that a way for citizens to gain some countervailing power over large global corporations is for governments to threaten denial of market access unless corporations act responsibly. He argues that the benefits to consumers of global corporations are so large that denial of market access would hurt citizens more than it would help them. The “value to U.S. consumers of Apple is they can buy Apple products,” Worstall writes. “Why would you want to punish U.S. consumers, by banning them from buying Apple products, just because Apple obeys the current tax laws?”

Wortstall thereby begs the central question. If global corporations obeyed all national laws — the spirit of the laws as well as the letter of them – and didn’t use their inordinate power to dictate the laws in the first place by otherwise threatening to take their jobs and investments elsewhere, there’d be no issue. It’s the fact of their power to manipulate laws by playing nations off against one another – determining how much they pay in taxes, as well as how much they get in corporate welfare subsidies, how much regulation they’re subject to, and so on – that raises the question of how citizens can countermand this power. Consumer benefits may sometimes exceed such costs. But, as we’ve painfully learned over the years (the Wall Street meltdown, the BP oil spill in the Gulf, consumer injuries and deaths from unsafe products, worker injuries and deaths from unsafe working conditions, climate change brought on by carbon dioxide emissions, and, yes, manipulation of the tax laws – need I go on?), the social costs may also exceed consumer benefits.

Why would an economics writer for a seemingly sophisticated national publication such as Forbes deny the existence of corporate power to circumvent or create favorable laws, or dismiss the social costs that corporations bent solely on maximizing profits routinely disregard? ...(BIG CUT)...Economics writers like those affiliated with Forbes Magazine surely are sophisticated enough to know this as well. So why are they so eager to trot out such economic nonsense? Perhaps because so much profit is at stake that those who pay their salaries – and who have also put many academic economists on retainers – prefer that they mislead the public with simplistic economic theory that appears to justify these profits rather than to tell the truth.

My modest suggestion that governments become the agents of their citizens in bargaining with global capital should hardly raise an eyebrow. But the capitalist tools at Forbes, and elsewhere, must be worried that average citizens may be starting to see what’s really going on, and might therefore take such a suggestion seriously.

Demeter

(85,373 posts)AS YVES POINTS OUT....2016=NEVER

http://bangordailynews.com/2013/05/23/business/colgan-jobs-recovery-expected-in-2016/

The year 2013 is off to a promising start — but don’t get used to it.

Charlie Coglan said he’s hoping for nine months in a row with modest job growth, a streak Maine hasn’t seen since 2007.

Ahead of his state forecast for the New England Economic Partnership conference in Boston on Thursday, Colgan said he had revised an earlier outlook for Maine coming out of the recent recession.

One year ago, he forecast full job recovery by 2015.

Now it’s late 2016...

Demeter

(85,373 posts)In April 2010, the International Monetary Fund’s World Economic Outlook offered an optimistic assessment of the global economy, describing a multi-speed recovery strong enough to support roughly 4.5% annual GDP growth for the foreseeable future – a higher pace than during the bubble years of 2000-2007. But, since then, the IMF has steadily pared its economic projections. Indeed, this year’s expected GDP growth rate of 3.3% – which was revised downward in the most recent WEO – will probably not be met. Persistent optimism reflects a serious misdiagnosis of the global economy’s troubles. Most notably, economic projections have vastly underestimated the severity of the eurozone crisis, as well as its impact on the rest of the world. And recovery prospects continue to depend on the emerging economies, even as they experience a sharp slowdown. The WEO’s prediction of a strengthening recovery this year continues the misdiagnosis.

European Central Bank President Mario Draghi’s announcement last summer that the ECB would do “whatever it takes” to preserve the euro reassured financial markets. But, as pressure from financial markets has eased, so has European leaders’ incentive to address problems with the eurozone’s underlying economic and political dynamics. Easy ECB liquidity is now sustaining a vast swath of Europe’s banking system. The eurozone is operating under the pretense that public and private debts will, at some point, be repaid, although, in many countries, the distress now is greater than it was at the start of the crisis almost five years ago. As a result, banks, borrowers, and governments are dragging each other into a vicious downward spiral. Politicians have exacerbated the situation by doubling down on fiscal austerity, which has undermined GDP growth while failing to shrink government debt/GDP ratios. And no decisive policy action aimed at healing private balance sheets appears imminent.

Moreover, Europe’s problems are no longer its own. Europe’s extensive regional and global trade networks mean that its internal problems are impeding world trade and, in turn, global economic growth. In 2012, world trade expanded by only 2.5%, while global GDP grew at a disappointing 3.2% rate. Periods in which trade grows at a slower pace than output are rare, and reflect severe strain on the global economy’s health. While the trauma is no longer acute, as it was in 2009, wounds remain – and they are breeding new pathologies. Unfortunately, the damage is occurring quietly, enabling political interests to overshadow any sense of urgency about the need to redress the global economy’s intensifying problems.

Against this bleak background, it is easy to celebrate the success of emerging markets. After all, emerging and developing economies are growing much faster than the advanced countries. But even the world’s most dynamic emerging markets – including China, Brazil, and India – are experiencing a sharp deceleration that cannot be ignored...

MORE

Demeter

(85,373 posts)EAT DRINK AND BE MERRY....

http://www.marketwatch.com/story/punch-bowl-is-still-here-so-party-on-2013-05-28?siteid=YAHOOB

Regardless of whether the Federal Reserve maintains its current rate of bond purchases or cuts back a bit, the central bank will still be running a very easy monetary policy.

Before the Fed can even begin to think about changing its posture, two important statistics have to change: The unemployment rate, which at 7.5% remains well above its pre-recession low, must fall by at least another percentage point. Meanwhile, the inflation rate, which is currently hovering close to zero, needs to pick up a bit.

Until either or both of these stats move, the Fed will keep the pedal to the metal, meaning that short-term rates will remain at or just above zero.

MORE

Demeter

(85,373 posts)When it comes to raising the U.S. debt ceiling, 2013 is not 2011. At least not yet.

Around this time two years ago, then-Treasury Secretary Timothy Geithner sent Congress a letter saying that the U.S. would be able to take “extraordinary measures” until Aug. 2 to keep paying the country’s bills after it reached the debt limit. President Barack Obama signed legislation lifting the borrowing limit into law on Aug. 2 — but only after a standoff that took the country to the brink of default and later led to the first downgrade of the nation’s credit.

Fast forward two years, and the atmosphere is much calmer as Washington prepares for another of its famously muggy summers. The U.S. bumped up against its $16.4 trillion borrowing limit on May 19, but because of hefty payments to the Treasury by Fannie Mae and Freddie Mac and those extraordinary measures (things like suspending sales of state and local securities), current Treasury chief Jacob Lew says default can be avoided “until after Labor Day.”

A further reason there’s now a relative lack of heat over the debt ceiling: Others are putting the drop-dead date for raising it more than five months away. On May 23, the Bipartisan Policy Center said that what it calls the “X Date” — the day the federal government can’t pay all its bills in full and on time — will be sometime in October or the beginning of November. The Congressional Budget Office similarly says October or November.

So this summer is looking debt-crisis free, in sharp contrast to two years ago. But does that mean that there won’t be another showdown in the fall? Make no mistake, the seeds are being sown for a fight, as the Obama administration demands a no-strings-attached increase in the borrowing limit and Republicans mull their price for agreeing.

“We will not negotiate over the debt limit,” Lew wrote to congressional leaders on May 17.

FAMOUS LAST WORDS (PLEASE, LET THEM BE HIS LAST....)

Demeter

(85,373 posts)The operators of a global currency exchange ran a $6 billion money-laundering operation online, a central hub for criminals trafficking in everything from stolen identities to child pornography, federal prosecutors in New York said on Tuesday.

The currency exchange, Liberty Reserve, operated beyond the traditional confines of United States and international banking regulations in what prosecutors called a shadowy netherworld of cyberfinance. It traded in virtual currency and provided the kind of anonymous and easily accessible banking infrastructure increasingly sought by criminal networks, law enforcement officials said.

The charges announced at a news conference by Preet Bharara, the United States attorney in Manhattan, and other law enforcement officials, mark what officials said was believed to be the largest online money-laundering case in history. Over seven years, Liberty Reserve was responsible for laundering billions of dollars, conducting 55 million transactions that involved millions of customers around the world, including about 200,000 in the United States, according to prosecutors.

Richard Weber, who heads the Internal Revenue Service’s criminal investigation division in Washington, said at the news conference that the case heralds the arrival of “the cyber age of money laundering,” in which criminals “are gravitating toward digital currency alternatives as a means to move, conceal and enjoy their ill-gotten gains.”

“If Al Capone were alive today, this is how he would be hiding his money,” Mr. Weber said. “Our efforts today shatter the belief among high-tech money launderers that what happens in cyberspace stays in cyberspace.”

MORE

DemReadingDU

(16,002 posts)5/28/13 Rachel Maddow: Technology creates new challenges for policing money laundering

video about Liberty Reserve, appx 5.5 minutes

http://www.nbcnews.com/id/26315908/#52027975

Demeter

(85,373 posts)FROM EMAIL NEWLETTER BY: The Balance Sheet (newsletters@prospect.org)

Federal prosecutors indicted the owners of the online currency-exchange company Liberty Reserve yesterday on charges of running a $6 billion money laundering operation for drug dealers, credit card thieves, Ponzi scheme operators, computer hackers, and other criminals. Access to the now-closed exchange required little more than an email address, giving the holder a means to execute currency moves of any size quickly and nearly anonymously to most anywhere in the world. Lawbreakers readily took advantage. “If Al Capone were alive today, this is how he would be hiding his money,” said Richard Weber, head of the IRS's criminal investigation unit in Washington, D.C.

Law officials allege Liberty Reserve deliberately designed its website to enable criminals to complete transactions, over 55 million of which were made in site's seven year lifespan, involving millions of clients, including 200,000 in the United States. Arthur Budovsky incorporated the company in Costa Rica in 2006; he is now under arrest along with four others, facing a maximum sentence of 20 years for money laundering. The case is an important one, prosecutors say, since targeting illicit online exchanges undermines cybercriminals in the same way targeting hard-money laundering undoes drug dealers. It also sends a message to other online currencies, notably bitcoin, to obey anti-laundering regulations at the risk of major legal penalties.

Demeter

(85,373 posts)Capitalism is now a cult, and Jamie Dimon is the self-appointed leader of the “cult of capitalism.”

That message is gleaned from a Huffington Post column by Mark Gongloff, whose headline stated that not only is the J.P. Morgan CEO and chairman a cult leader but a “very dangerous” one. Why? Because apparently shareholders have signed “a billion-year contract” to join the cult, notwithstanding portrayals of Dimon as a greedy egomaniac and poster boy for everything wrong with capitalism.

His is a monster of a cult: Warren Buffett is a member. So is CNBC’s Jim Cramer. Says Gongloff, who labels Cramer a “shouty man”: “Cramer joined Warren Buffett and many more VIPs in singing Dimon’s praises and warning of the woe that would befall shareholders” if they split his roles. Still, “the media played along, helping ... Dimon keep both of his jobs” as J.P. Morgan Chase & Co.’s chief executive and chairman.

Dimon, meanwhile, was doing what any self-respecting egomaniac under such a threat would do: acting like a petulant teenager and threatening to quit.

Today, reconfirmed as leader of the cult of capitalism, Dimon could serve as the perfect example of what psychologist Ernest Becker wrote about in his Pulitzer Prize–winning classic, “The Denial of Death,” a favorite from my years at Morgan Stanley. Dimon fits the cult-leader profile: charismatic narcissist, uncompromising, manipulating and threatening to his co-conspirators in the “cult of capitalism” and to the masses marching to the drumbeat of his destiny, off another economic cliff, bigger than 2008’s.

MORE BLOOD IN THE MORNING

siligut

(12,272 posts)No product or contribution, just making lots of money. The best and the brightest now go into finance. Medical doctors sell-out their patients for profit. Caveat Emptor applies to everything from an oil change to buying apples. Propaganda is now legal in the US.

Demeter

(85,373 posts)but now it is policy...it is in fact the ONLY policy. It has replaced the Bill of Rights, the Constitution, the New Testament and common sense.

Demeter

(85,373 posts)JPMorgan Chase shareholders have signed a billion-year contract to join the Cult Of Jamie Dimon. For better or worse. With their overwhelming vote on Tuesday to let Dimon keep both his chairman and CEO titles at the biggest U.S. bank, shareholders proved themselves vulnerable to incessant warnings from the bank, Dimon's fellow CEOs and board members, and the financial media that Dimon is indispensable, that no other human being on the planet could possibly lead JPMorgan. This is a dangerous message to send, to Dimon and the rest of Wall Street.

"JPMorgan should be a machine, not the expression of one man's individual genius," said Bart Naylor, financial policy advocate at the nonprofit group Public Citizen.

The shareholders trying to take away Dimon's chairmanship weren't trying to take the job of running JPMorgan away from him. They just wanted to give the board's oversight function to somebody else -- they didn't want Dimon being his own boss, in other words. But even this minor tweak to Dimon's job function would have been such an outrageous affront to Dimon's royal personage that he might have taken his indispensable skills away from the bank forever, causing the stock price to collapse, or so the bank reportedly warned shareholders in private.

"If you voted for Dimon to lose chairmanship, you voted for a lower stock," CNBC shouty man Jim Cramer tweeted on Tuesday morning before the final tally. "Who in heck would every [sic] do that."

Cramer joined Warren Buffett and many more VIPs in singing Dimon's praises and warning of the woe that would befall shareholders if they chased him back to Mount Olympus. The media played along, helping the bank successfully carry out what New York's Kevin Roose described as something "more like a presidential campaign than a normal lobbying effort" to help Dimon keep both of his jobs...Virtually ignored in the debate about Dimon's indispensable leadership was the fact that Dimon and his compliant board have left JPMorgan -- again, the biggest bank in the United States, with more than $2 trillion in assets -- without a potential successor should Dimon ever get hit by a bus, God forbid, or take his talents to the Federal Reserve. As Slate's Matthew Yglesias points out, picking a successor is a key responsibility of a chairman of the board -- Dimon's job.

"It highlights the failure of this board to act as a check on Mr. Dimon and to fulfill their most fundamental duty to the bank: ensuring that there is someone capable to run the bank if the current CEO isn’t there for whatever reason,” Dennis Kelleher, president of Better Markets, a nonprofit group advocating for financial reform, said in an emailed statement.

...Dimon's many defenders note that he steered the bank safely through the financial crisis, opened up to shareholders about the bank's $6 billion "London Whale" trading loss, and guided the bank to record profits despite that loss. But then, he also let the bank get itself into those London Whale trades in the first place, taking unnecessary risks to keep boosting profits. He has been at the helm as the bank has wandered into one regulatory rat's nest after another and as the Office of the Comptroller of the Currency cut its rating of the bank's management to "needs improvement." Splitting the CEO and chairman roles shouldn't necessarily have been some kind of punishment for these failings. It's just good governance. And it is certainly not the end of the world that Dimon has held onto both of his jobs. But the manner in which Dimon won, terrorizing shareholders into believing that catastrophe will follow his departure, is a dangerous precedent. The hubris of JPMorgan's management was already on full display in the recent Senate report on the bank's London Whale losses. Dimon & Co. ignored warnings about the risks they were taking and defied regulators and media prying into their business.

Rather than humbling Dimon, JPMorgan shareholders have declared, loudly, that Dimon alone should hold their fate in his hands. They had better hope it doesn't go to his head.

Demeter

(85,373 posts)

Roland99

(53,345 posts)DOW -0.5%

NASDAQ -0.5%[/font]

Demeter

(85,373 posts)Band-aids falling off?

Or maybe it's yet another spin on the Wheel of Fortune! Of course, the wheel is rigged to a fare-thee-well.

I really ought to take time off the thread after a board meeting, or when the Kid is sick. but then, I'd never post at all! Sorry for the crankiness.

siligut

(12,272 posts)Today's Stock Market Watch thread is filled with reality and I appreciate fair warning, it saved me in 2008. As far as the futures go, traditional wisdom is tough to break.

It's the humidity, the Kid home sick for a week nearly, the board meeting, and the humidity. Also, the renovations, meaning chaos all around me.

Unfortunately, chocolate doesn't work like it used to, and I can't take the time to get drunk. I should go to the pool, now that it's open...

Roland99

(53,345 posts)In relation to the U.S., the OECD said it expects the economy to grow 1.9% in 2013, down from an earlier estimate of 2.0%, and to grow 2.8% in 2014. Global gross domestic product is projected to rise 3.1% this year and 4% in 2014, down from 3.4% growth and 4.2% respectively. For the euro zone, the organization expects the economy to shrink 0.6% in 2013, a deeper contraction than the 0.1% expected previously. "The global economy is moving forward, but divergence between countries and regions reflects the uneven progress made toward recovery from the economic crisis," the release said. The OECD further said historically high unemployment remains the most serious challenge facing governments, but that the global economy generally is moving forward

Demeter

(85,373 posts)"A record 40 percent of all households with children under the age of 18 include mothers who are either the sole or primary source of income for the family," the Pew Research Center reported as it released data that certainly won't surprise many Americans but will underscore some dramatic shifts over recent decades.

Citing data from the Census Bureau as its source, Pew notes how much has changed in just a few generations: In 1960, so-called breadwinner moms were the sole or primary sources of income in just 11 percent of U.S. families with children.

According to Pew:

Demeter

(85,373 posts)gonna find my whip and chains...and a large cage. Whether I shall be on the inside or the outside is a toss-up, right now.

bread_and_roses

(6,335 posts)... most days, actually, but some days more so than others ... probably different for each of us, but for me, the above makes this one of those days.

Demeter

(85,373 posts)fueled by my state of mind....which is really acidic today....

DemReadingDU

(16,002 posts)Demeter - more acid for you...

5/29/13 Gov. Snyder says EM has to consider the value of all Detroit's jewels to help pull it out of crisis

MACKINAC ISLAND — While the art pieces at the Detroit Institute of Arts and Belle Isle are essential elements of life in Detroit, Gov. Rick Snyder said Wednesday that emergency manager Kevyn Orr has to consider the value of all the city’s jewels when determining how to pull the city out of financial crisis.

Orr stirred outrage last week after the Free Press reported that Orr was evaluating the DIA’s art collection and preparing in case creditors seek repayment of the their debts through asset sales.

“From a fidicuary point of view, he has to let people know that these are the assets of the city,” Snyder said Wednesday during an interview with the Free Press on Mackinac Island. “Things that are good for the people of Detroit, like Belle Isle and the DIA, are important to the livelihood of the city. “I’m letting Kevyn do his job as a practical matter.”

more...

http://www.freep.com/article/20130529/NEWS06/305290101

Reminds me of Greece likely selling the islands to pay creditors

![]()

Demeter

(85,373 posts)No chance of ever getting them back.

Demeter

(85,373 posts)Legend has it that Marie Antoinette, told of Parisians protesting the shortage of bread, impatiently exclaimed, “Let them eat cake.”

American Express’s chief executive, Kenneth I. Chenault, adopted a kinder tone in his commencement speech this year at the University of Massachusetts, Amherst, but offered a similar message. Acknowledging that jobs are hard to find, he emphasized that new technology makes it easier to invent them...Yes, and the price of cake may have fallen relative to bread, but that is slim consolation to college graduates who face weak demand for their hard-won skills either as workers or entrepreneurs. Their new diplomas may send them to the front of the employment line, but the jobs they find there don’t offer as much money or career potential as before. A recent report from the Economic Policy Institute estimates that the inflation-adjusted wages of young college graduates declined 8.5 percent from 2000 to 2012. Graduating in a poor job market has long-lasting negative consequences. AS ANYONE IN MY CLASS OF 1976 KNOWS!

Such lemony facts can be turned into lemonade and sold by the side of the road. The business news media brims with celebration of millennial entrepreneurship and the rise of freedom-seeking freelancers. But entrepreneurship goes up with joblessness partly because it just sounds so much more hopeful. It also looks better on a résumé, since reported spells of unemployment reduce job chances. Largely as a result of “jobless” or “unintended” entrepreneurship, the number of individuals starting businesses increased in recent years. But the number bailing out grew even faster. The Great Recession reduced self-employment over all because sole proprietorships and small businesses were so hard hit by the downturn. Scott Shane, professor of management at Case Western Reserve University, points out that the median family incomes of the self-employed declined sharply relative to others from 2007 to 2009. He also emphasizes that start-ups are not revitalizing the United States labor market. The number of people employed in one-year-old businesses declined by half from 1990 to 2010.

“Despite the claim that recessions are a time of opportunity for entrepreneurs,” he explains, “the Great Recession had a negative impact on U.S. entrepreneurship.” The same can be said of the Not-So-Great Recovery.

In 2012, the number of venture capital deals was substantially lower than in 2007. The total amount of venture capital investment declined as well, to about 75 percent (in inflation-adjusted terms) of that in the earlier year. A recent Congressional Budget Office report shows that small and medium-size companies had disproportionately greater job losses than large companies in recent years. The latest Intuit Small Business Employment Index registers levels far below that of 2007. These trends show that employment and entrepreneurship aren’t substitutes but complements. The same factors that are hurting the job market are making it hard for start-ups and small businesses to succeed: consumers aren’t spending enough money to create an expansion on their own, and austerity-driven cuts in government spending are weakening economic growth. As Heidi Shierholz of the Economic Policy Institute puts it, the declining prospects of young college graduates are clearly the result of “a demand problem, not a skills problem.” Individual effort and ingenuity can’t guarantee success in either finding or inventing jobs.

Our national problem may be that we assume entrepreneurs are superheroes who can leap over macroeconomic constraints in a single bound, especially if liberated from the villainous clutches of government. But entrepreneurs can be crippled by a shortfall of demand for the goods and services they offer. And like the rest of us, they need bread, or at least cake, to survive.

Demeter

(85,373 posts)Underneath the huge drop in demand that drove unemployment up to 9 percent during the recession, there’s been an important shift in the education-to-work model in America. Anyone who’s been looking for a job knows what I mean. It is best summed up by the mantra from the Harvard education expert Tony Wagner that the world doesn’t care anymore what you know; all it cares “is what you can do with what you know.” And since jobs are evolving so quickly, with so many new tools, a bachelor’s degree is no longer considered an adequate proxy by employers for your ability to do a particular job — and, therefore, be hired. So, more employers are designing their own tests to measure applicants’ skills. And they increasingly don’t care how those skills were acquired: home schooling, an online university, a massive open online course, or Yale. They just want to know one thing: Can you add value?

One of the best ways to understand the changing labor market is to talk to the co-founders of HireArt (www.hireart.com): Eleonora Sharef, 27, a veteran of McKinsey; and Nick Sedlet, 28, a math whiz who left Goldman Sachs. Their start-up was designed to bridge the divide between job-seekers and job-creators.

“The market is broken on both sides,” explained Sharef. “Many applicants don’t have the skills that employers are seeking, and don’t know how to get them. But employers also ... have unrealistic expectations.” They’re all “looking for purple unicorns: the perfect match. They don’t want to train you, and they expect you to be overqualified.” In the new economy, “you have to prove yourself, and we’re an avenue for candidates to do that,” said Sharef. “A degree document is no longer a proxy for the competency employers need.” Too many of the “skills you need in the workplace today are not being taught by colleges.”

The way HireArt works, explained Sharef (who was my daughter’s college roommate), is that clients — from big companies, like Cisco, Safeway and Airbnb, to small family firms — come with a job description and then HireArt designs online written and video tests relevant for that job. Then HireArt culls through the results and offers up the most promising applicants to the company, which chooses among them.

With 50,000 registered job-seekers on HireArt’s platform, the company receives about 500 applicants per job opening, said Sharef, adding: “While it’s great that the Internet allows people to apply to lots of jobs, it has led to some very unhealthy behavior. Job-seekers tell me that they apply to as many as 500 jobs in four to five months without doing almost any research. One candidate told me he had written a computer program that allowed him to auto-apply to every single job on Craigslist in a certain city. Given that candidates don’t self-select, recruiters think of résumés as ‘mostly spam,’ and their approach is to ‘wade through the mess’ to find the treasures. Of these, only one person gets hired — one out of 500 — so the ‘success rate’ is very low for us and for our candidates.”

MISSING THE POINT, AS USUAL, FRIEDMAN IS CONSISTENTLY EMPLOYED....

DemReadingDU

(16,002 posts)5/28/13

Larry Summers top pick to replace Ben Bernanke as Federal Reserve chief: report

The former Treasury secretary is apparently edging out Tim Geithner and Janet Yellen.

http://www.nydailynews.com/news/politics/larry-summers-top-pick-replace-ben-bernanke-fed-chief-report-article-1.1356371?localLinksEnabled=false

Fuddnik

(8,846 posts)But, if you look at it in the context and results they are working for, he's a rousing success.

DemReadingDU

(16,002 posts)There aren't many people who could ensure the rest of our money would be transferred to the banksters!

I do wonder the timing...if Bernanke will be able to exit prior to the next crash to preserve his legacy and then Summers appointment for the 'recovery'.

Fuddnik

(8,846 posts)Would ensure that the banksters got the rest of our money. And their employees in Congress and the Cabinet, and elsewhere (ahem).

Demeter

(85,373 posts)The fairies are working to rule....

Fuddnik

(8,846 posts)I'm starting to see a pattern here.

Didn't 2008 start out kinda like that? Around this time of year?

DemReadingDU

(16,002 posts)I remember some days it was up a few hundred then down a few hundred the next day. It was chaotic for several months.

List of largest daily changes in the Dow Jones Industrial Average

Several occurred in 2008

http://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

Roland99

(53,345 posts)Didn't see that one coming.