Economy

Related: About this forumSTOCK MARKET WATCH, Wednesday, December 14, 2011

[font size=3]STOCK MARKET WATCH, Wednesday, December 14, 2011[/font]

[font color=red]

Dow 11,954.94 -66.45 (-0.56%)

Nasdaq 2,579.27 -32.99 (-1.28%)

S&P 500 1,225.73 -10.74 (-0.88%)

10-Yr Bond... 1.97 +0.0040 (+0.20%)

30-Year Bond 3.01 -.00 (-0.10%)

[/font]

[HR width=85%]

[center]

[font color=blue][font size=2]Euro, Yen, Loonie, Silver and Gold[/font[center]

[HR width=95%]

[div align="center"][font color=black]Bush Administration Officials Convicted = 2[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font][center]Economic Calendar [link:cbs.marketwatch.com/tools/marketsummary/default.asp?siteid=mktw|Marketwatch Data] Bloomberg Economic News [link:finance.yahoo.com/|Yahoo! Finance] [link:finance.google.com/finance|Google Finance] [link:banktracker.investigativereportingworkshop.org/banks/|Bank Tracker][/center]

[link:banktracker.investigativereportingworkshop.org/credit-unions/|Credit Union Tracker] Daily Job Cuts[font color=black][font size=2]Handy Links - Economic Blogs:[center][/font][/font]

The Big Picture Financial Sense:sp::sp::sp::sp:Calculated Risk Naked Capitalism Credit Writedowns

[link:delong.typepad.com/sdj|Brad DeLong] Bonddad [link:atrios.blogspot.com/|Atrios] goldmansachs666 The Stand-Up Economist[/center][font color=black][font size=2]Handy Links - Government Issues:[/font][/font][center]

[link:legitgov.org/action.html|LegitGov] Open Government Earmark Database [link:usaspending.gov/|USA spending.gov][/center]

" target="_blank">The Coming Collapse of the Middle Class Charlie Rose talks with Roubini Charlie Rose talks with Krugman

William Black: This Economic Disaster:sp::sp::sp::sp:Bill Moyers with Kevin Drum and David Corn

[/center]

Names: David Safavian, James Fondren

Dishonorable Mention: former House majority leader, Tom DeLay

Bush Administration Officials Charged = 1

Name(s): Richard Lopez Razo

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

[HR width=95%]

[center]

[/center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font]

Pale Blue Dot

(16,834 posts)Dec 14 07:00 MBA Mortgage Index 12/10 NA NA 12.8%

Dec 14 08:30 Export Prices ex-ag. Nov NA NA -1.5%

Dec 14 08:30 Import Prices ex-oil Nov NA NA -0.2%

Dec 14 10:30 Crude Inventories 12/10 NA NA 1.336M

Read more: http://www.briefing.com/investor/calendars/economic/2011/12/12-16/#ixzz1gViVhP4I

Pale Blue Dot

(16,834 posts)SINGAPORE – Oil prices inched down below $100 a barrel Wednesday in Asia amid expectations OPEC will likely keep its output quotas unchanged.

Benchmark crude for January delivery was down 29 cents to $99.85 a barrel in midday Singapore time in electronic trading on the New York Mercantile Exchange. The contract rose $2.37 to settle at $100.14 on Tuesday.

In London, Brent crude was down 16 cents at $109.34 on the ICE futures exchange.

The Organization of Petroleum Exporting Countries will meet later Wednesday in Vienna amid a slowing global economy threatened by rising energy costs. The 12-nation group will also seek to avoid a supply glut as Libya's oil exports gradually recover next year.

http://old.news.yahoo.com/s/ap/oil_prices

xchrom

(108,903 posts)SINGAPORE (AP) -- High oil prices threaten to worsen a global economic slowdown and crude producers should consider boosting output, the chief economist for the International Energy Agency said Wednesday.

"The current high oil prices have the potential to strangle the economic recovery in many countries," Fatih Birol said in a speech Wednesday in Singapore. "I hope that high oil prices don't slow down Chinese economic growth and the negative effect that would have on the global recovery."

Crude has jumped to $100 a barrel from $75 in October amid signs the U.S. economy will likely avoid a recession. Most economists expect global economic growth to slow next year as Europe's debt crisis threatens to drag the continent into recession.

Birol suggested crude producers should boost output amid growing demand in developing countries and falling inventories in wealthy nations.

Demeter

(85,373 posts)I've seen this part before...

Pale Blue Dot

(16,834 posts)U.S. stock futures were little changed as investors bet the world’s largest economy will continue its recovery, offsetting concern that euro-area policy makers are struggling to contain the region’s debt crisis.

Futures on the Standard & Poor’s 500 Index expiring in March dropped less than 0.1 percent to 1,219.9 at 6:31 a.m. in New York. The benchmark gauge retreated yesterday after Federal Reserve policy makers refrained from taking further action to bolster growth. Dow Jones Industrial Average futures slipped 16 points, or 0.1 percent, to 11,879.

“We do see an improvement in the economic data,” Mikio Kumada, a global strategist at LGT Capital Management in Singapore, said in a Bloomberg television interview. “U.S. corporations are earning good money. The U.S. is doing relatively well,” he said. The worst seems to have passed for the U.S. economy which is now sheltered from the euro-area debt crisis “at least to a certain degree,” he added.

The S&P 500 has fallen 2.5 percent this year as economic growth slowed and Europe’s debt crisis spread to Italy and Spain. Still, the gauge is the second-best performer, after New Zealand, of the largest 24 developed markets tracked by Bloomberg News.

http://www.bloomberg.com/news/2011-12-14/u-s-stock-index-futures-rise-s-p-500-may-snap-two-day-decline.html

Pale Blue Dot

(16,834 posts)The Stock market Watch thread will die on December 31st unless someone steps up to take my place! If you find this thread informative and important, don't let it go away. Send my a message and I'll set you up with everything you need to continue this thread in the year 2012 and beyond.

rfranklin

(13,200 posts)Demeter wins the first rec lottery!

Demeter

(85,373 posts)I can't do everything.

Hugin

(37,730 posts)I've got $0.67 and a $5.00 if you buy $20.00 coupon at a Dollar store.

Demeter

(85,373 posts)and what I need probably isn't for sale, anyway.

Fuddnik

(8,846 posts)We want to thank you for your dedication over the last year PBD.

We know it takes a lot of determination and work to get out of bed every morning, and make sure this is up and running for our morning coffee.

I'll get to use this Commercial Pilot's License I got in a box of Cracker Jacks. ![]()

Ghost Dog

(16,881 posts)I would be very unreliable, not being on a regular schedule, why I didn't offer.

dixiegrrrrl

(60,154 posts)kickysnana

(3,908 posts)Here's to Hugin...hip, hip hurray!

Hugin

(37,730 posts)One here in the SMW and one for LBN.

Not a complaint, only an observation. ![]()

DemReadingDU

(16,002 posts)Appreciate that you will continue the SMW

Loge23

(3,922 posts)A regular daily routine for myself and many others - thank you.

Tansy_Gold

(18,167 posts)far far far fewer than even a week ago.

rfranklin

(13,200 posts)Between the cost of the seats and a few hot dogs and a beer plus parking for three people, that's about what it costs to see one baseball game. And they weren't even good seats!

AnneD

(15,774 posts)Go to a little league game. Even I could afford those tickets. Daughter and I would have a baseball night. We would eat hot dogs, nachos and drink soda until we were stuffed (the teams or the club got money from the snack bar too).

It was just as exciting, if not more so. We cheered for both sides for all the teams. All totaled it was less than $20 and the parking was free. We would play in the park afterwards and she would fall asleep in the car during the 1/2 mile drive back to the house. She thought we were living large, but it was cheaper than a movie or anything else I could think of. And it supported the kids and community.

For what you paid for one pro game, you could get team jerseys for a little league team!

rfranklin

(13,200 posts)but I stopped because they could never spell my company name correctly.

I have also gone to the Atlantic League locally and they are a lot more reasonable.

Demeter

(85,373 posts)SOUNDS LIKE THE WORST PLACE IN THE WORLD TO HAVE WORKED

...Niemela’s account of her struggles at Countrywide provides another perspective on the culture inside what was once the nation’s largest home lender. Many other ex-employees who claimed they were mistreated by the company were mid- and low-level workers who worked deep inside Countrywide’s mortgage-lending machine. Niemela, by contrast, was a high-level tactician who dealt with the big picture of how Countrywide treated its employees and what that said about the company’s culture. She was among a group of management experts brought in to help the company as it grew in a period of a few years from 11,000 employees to 55,000, with a goal of reaching 100,000 by 2010. What they encountered was like nothing they’d seen before in corporate America... a toxic culture ruled by fear and top-down intimidation...

“I always regarded myself as a CEO, not a dictator,” Mozilo testified earlier this year during a civil trial involving another Countrywide executive’s wrongful dismissal claim. “I think the jury will note that I'm a pretty frank person — straightforward, I say what I believe. But I'm also willing to listen...Countrywide was about people,” Mozilo testified. “Obviously, without quality people you can't have a quality company.” In the end, the jury in that case awarded Countrywide’s former chief leadership officer, Michael Winston, a $3.8 million verdict, upholding his claims that Mozilo and other senior officials had punished him for standing up against management misconduct...Winston charged that he’d been retaliated against for reporting an environmental hazard that had sickened workers inside a Countrywide office complex, and for refusing to falsify a report about the lender’s corporate governance practices. Winston says he and Niemela and other organizational change specialists clashed with a culture in which breaking the rules “was more than okay. It was incentivized.” Winston claims they were punished for speaking up about bad management practices, just as lower-level employees were harassed for reporting fraudulent lending practices....Bank of America has appealed the jury’s decision. A spokeswoman said the verdict was “not supported by any evidence.”

‘We all know’

Niemela has worked more than 20 years as an executive coach and management consultant. She was featured in a 2000 Fortune article about executive coaches and, in 2001, published a book, “Leading High Impact Teams: The Coach Approach to Peak Performance.” In 2005, Countrywide recruited Niemela away from Boeing, hiring her as a first vice president in the company’s human resources department. She’d never worked in a financial company before.

She got a first-hand lesson, she says, in how her new employer did business when she took out a Countrywide mortgage to purchase a new home and move her family from the San Francisco Bay area to Los Angeles. When she sat down at the closing table, she says, she got a nasty surprise: She discovered the loan, among other unappealing features, carried a “pre-payment penalty,” meaning that she’d have to pay thousands of dollars extra if she tried to refinance within seven years. Even the worst subprime loans generally carried an early payment penalty of no longer than three years, say fair-lending advocates. She had no choice but to sign the papers, she says, because her relocation package required that she use a Countrywide loan to buy her house. If she didn’t, she stood to lose some $50,000 in relocation money.

She did complain to an executive in the company’s risk-management unit. He listened to her story, she says, and then said nonchalantly, “Yes, we all know. We screw our employees.”

Tansy_Gold

(18,167 posts)Gee, does that sound familiar or anything???

And once again, no one should be surprised at the results.

TG

Demeter

(85,373 posts)with less murder. (That we know of)

AnneD

(15,774 posts)the food is worse too. At least with the Mafia, you ate good!

Ditch the gun, grab the canolli.

Demeter

(85,373 posts)....there is not a common U.S. interest against China. The interests of the 99 percent differ greatly from the interests of the 1 percent. Until this fact is recognized more generally, there is no possibility that our economic relations with China will change in a way that benefits the vast majority of working people in the United States...In short, there is a very clear class divide in U.S. negotiations with China. The 1 percent have their laundry list of special concerns that will make them even richer. The 99 percent care about a lower-valued currency to create millions of manufacturing jobs. We will see which side the Obama administration is on.

.............................................................................

The central issue with China is the fact that the dollar is over-valued against the Chinese currency. This over-valuation is the result of the explicit Chinese policy of pegging its currency against the dollar. The peg is often referred to as “manipulation,” but it doesn’t really fit the bill for two reasons. First, it is an official policy. China targets the value of its currency quite openly; it is not doing it in the middle of the night when no one is looking. The second reason is that China’s mechanism for targeting the value of its currency is something that on alternate days our Treasury actually requests. They buy up U.S. government debt. If this seems absurd, it should because it is. The way in which China keeps its currency down against the dollar (or keeps the dollar up against its currency) is by buying huge amounts of U.S. government bonds.

The media often tells us that we need China to buy our debt. This is not true. There are plenty of other potential investors, including the Federal Reserve Board. However we cannot both want China to buy U.S. government debt and then complain about China’s currency manipulation. This is how they “manipulate” their currency...But the currency issue is only one of many complaints that routinely appear in the list of grievances against China. The longer list includes complaints that China doesn’t respect the patents and copyrights of companies like Pfizer and Disney, they don’t grant full access to financial giants like Merrill Lynch and Goldman Sachs, and they put up barriers to retail chains like Wal-Mart who want to open up stores across China. These sorts of items are often lumped together with the undervaluation of the Chinese yuan to make a sort of economic indictment against the Chinese government.

One can argue the merits of each of these issues, but that doesn’t have anything to do with the real world. There is no court where we are going to prosecute China for its economic wrongdoing. China is a huge powerful country. Its GDP is nearly 80 percent of U.S. GDP. By comparison, at its peak the GDP of the Soviet Union may have been half as large as the GDP of the United States...We are not ever going to be in a situation to dictate to China what it can and cannot do. We are going to have to negotiate with them as the equal that they are. This means that in order to get some concessions from China’s government on issues that we care about we will have to give up on other issues.

Demeter

(85,373 posts)...according to a now-departed Justice Department official who used to be in charge of investigating such matters, the Justice Department has decided that holding top Wall Street executives criminally accountable is too difficult a task. David Cardona, who recently left the FBI for a job at the Securities and Exchange Commission, told the Wall Street Journal that bringing financial wrongdoing to account is “better left to regulators,” who can bring civil cases. Civil cases, of course, can produce penalties from the banks -- as well as promises to be on better behavior -- but don’t put any executives behind bars. Here’s the Journal:

Cardona told the Journal that the failed first attempt to charge financial players with crisis-related fraud -- the 2009 trial and eventual acquittal of two Bear Stearns Cos. hedge-fund managers -- triggered "a lot of rethinking on how we do things.” After that, he said, the federal government began to question its “ability to convince a jury that criminality has occurred” on complex and technical financial cases.

The lack of prosecutions was also raised in a ‘60 Minutes’ piece Sunday about large-scale mortgage fraud during the bubble. Assistant Attorney General Lanny Breuer told CBS that the Justice Department had not lost confidence and was “bringing every case that we believe can be made....I get it. I find the excessive risk taking to be offensive,” said Breuer. “I may personally share the same frustration that American people all over the country are feeling, that in and of itself doesn’t mean we bring a criminal case.”

However, one question raised by the 60 Minutes segment is why the Justice Department isn’t building criminal cases against companies for violating Sarbanes-Oxley -- a landmark corporate reform law enacted after Enron. From the transcript:

Frank Partnoy is a highly regarded securities lawyer, a professor at the University of San Diego Law School and an expert on Sarbanes Oxley.

Frank Partnoy: The idea was to have a criminal statute in place that would make CEOs and CFOs think twice, think three times before they signed their names attesting to the accuracy of financial statements or the viability of internal controls.

Kroft: And this law has not been used at all in the financial crisis.

Partnoy: It hasn't been used to go after Wall Street. It hasn't been used for these kinds of cases at all.

Kroft: Why not?

Partnoy: I don't know.

As Cardona -- the former Justice official -- sees it, financial regulators have been doing a “fine job” building civil cases against big firms. That might come as a surprise to U.S. District Judge Jed Rakoff, who’s repeatedly rebuked the SEC for striking relatively small agreements to settle civil charges against financial firms. As we noted last week, Rakoff tore into a recent $285 million settlement with Citigroup, calling the financial penalty “pocket change” for Citi and blasting the SEC’s longstanding practice of allowing firms to settle without admitting wrongdoing.

xchrom

(108,903 posts)fire them.

how many convictions did that -- what was his name? michael black? -- get out of the S&L thingy?

Tansy_Gold

(18,167 posts)I guess that's too hard, too.

Fuckers.

Demeter

(85,373 posts)and when that attempt failed, washed their hands of it, forever.

I think there ought to be an investigation of that fiasco, too. Seems the BFEE was in charge then....

dixiegrrrrl

(60,154 posts)I am glad to see he is speaking up a lot more about the rampant criminality.

xchrom

(108,903 posts)i can't remember anything any more.

Demeter

(85,373 posts)Michael Moore talks about the Occupy Movement: “How Great! People are finally saying to the banks and Wall Street: We are sick and tired of you running our congress, running our country; we want our country back. I think this is a great moment right now in our history. There is a structure to the Occupy Movement but instead of being vertical where there is some charismatic leader at the top that everybody is suppose to follow, this movement is a horizontal structure, which means we are all leaders. So in your neighborhood, you are a leader of this movement.”

http://teamcoco.com/video/michael-moore-wants-conan-for-president

Demeter

(85,373 posts)Last edited Wed Dec 14, 2011, 09:16 AM - Edit history (1)

http://www.npr.org/blogs/thetwo-way/2011/12/14/143699593/the-protester-is-time-magazines-person-of-the-year?ft=1&f=1001 ?t=1323867312&s=15

?t=1323867312&s=15

...That covers, most notably of course, those who went to the streets in the Arab Spring movement that swept across much of North Africa and the Middle East. But as Time writes, protesters have also had major impacts in Greece, Spain, the U.K. and — via the Occupy Wall Street movement — the United States.

"These are folks who are changing history already and will change the future," Time editor Richard Stengel said on Today....

AND IT DIDN'T TAKE A GENERATION TO RECOGNIZE THAT!

Demeter

(85,373 posts)THAT, ladies and gentlemen, is the art of PROPAGANDA. Furthermore, to feed Misogyny, religious bigotry, and male inadequacy fears, it's a woman, A MUSLIM WOMAN.

If they wanted to truly "honor" PROTEST, they would have shown one of the large crowds of heterogeneous participants, preferably under fire from uniformed, militarized police.

Tansy_Gold

(18,167 posts)

I thought the second one was especially interesting because 30+ years later, the collective memory does not as easily distinguish between the blindfolded "hostage" and the masked "terrorist". Symbols are powerful.

dixiegrrrrl

(60,154 posts)

Loge23

(3,922 posts)I immediately thought "Occupy" when the cover was announced - then I see the "terrorist" on the cover. Nice.

The real terrorists are in the offices as well as on the streets assaulting protesters with pepper spray.

dixiegrrrrl

(60,154 posts)Demeter

(85,373 posts)Subliminals strike again.

Demeter

(85,373 posts)...The public understands correctly that Wall Street’s financial elites dominate politics. How else can we account for the fact that the financial sector was rewarded for gambling our economy into debt and killing 8 million jobs in a matter of months? At the same time, wages are stagnant, benefits are being cut right and left, public sector workers are under attack, and unemployment remains above 8 percent. No wonder Americans believe that both parties are beholden to the 1 percent.

To be sure, the 99 percent framework, so magnificently popularized by Occupy Wall Street, will be deployed by just about everyone to energize the base. Yet, we’re hearing arguments that Occupy Wall Street should occupy the Democratic Party...If Occupy Wall Street has anything at all to do with the 2012 elections, I hope it will organize large demonstrations at both conventions to dramatize the well-documented fact that both parties care more about financial elites than they do about the 99 percent. Of course there are worthy Democrats who have shown the gumption to take on Wall Street. But their power is muted as the Democratic Party overall defers to Wall Street’s lobbyists and campaign funds...For over a generation, we’ve watched the Democratic Party move steadily to the right and increasingly accommodate the top 1 percent. (In case you have any lingering doubts, read Winner Take All Politics, by Jacob Hacker and Paul Pierson.) The Wall Street orgy of the last 30 years was built upon the deregulatory push initiated by Jimmy Carter and then accelerated by Bill Clinton. Wall Street–friendly policies continue today, actualized by Obama’s appointment of Tim Geithner as Treasury Secretary. Even after the enormous crash, born and bred on Wall Street, the needs of the financial elites still come first. The banks who caused the crash, we recently discovered, had access to $7.77 trillion in secret bailouts, while the real economy languished....Nevertheless, labor and progressive organizations see no other option save the Democrats. They believe it’s a fool’s errand even to consider a political alternative because, they argue, third parties always fail, sometimes miserably. (They feel particularly burned by Ralph Nader’s run, which they believe put G.W. Bush into office.)

So what’s to be done? For starters, we should investigate carefully the last massive movement that explicitly challenged the one percent and that demanded a democratization of high finance — the Populists of the late 1880s...This made-in-America movement grew out of the horrendous conditions faced by small farmers, especially in the South. In order to survive through the winter, farmers had to pledge their future crops to one dominant local merchant in exchange for food and supplies. The merchant (then called “The Man”) would charge outrageous interest rates, insuring that eventually farmers would have to sign over title to their land in order to settle their debts. As a result, thousands of independent farmers turned into impoverished sharecroppers. All the necessities of farming, from the grain elevators to farm implements to the railroads were run by monopolies that squeezed the farmers dry. To compound these problems, the U.S. money supply was limited to a fixed quantity of gold, as demanded by Wall Street. This insured that as the population grew, the money supply would remain fixed, leading to enormous downward pressures on farm prices. It was a continuous rural depression as black and white farmers drifted into peonage. (Will rising student loans do something similar to the next generation? Will all of us be indebted to a handful of Wall Street banks?)

...Out of these conditions grew the People’s Party, one of the most powerful third party alternatives in U.S. history. But it didn’t end well. In 1896 the People’s Party was hijacked by a group of ambitious politicians who rammed through a fusion ticket behind the Democratic presidential nominee, William Jennings Bryan. That retreat, combined with Bryan’s defeat, alienated the farmer base within the National Farmers Alliance. With the failure to achieve political power, the cooperative movement was starved to death due to lack of credit and faded away. More and more small farmers lost their land and slipped into abject poverty as the elites tightened their grip on political power and held it, with few exceptions, until the New Deal. (See Lawrence Goodwin’s The Populist Moment for a definitive account.)

VARIOUS TENTATIVE IDEAS FOLLOW....A MUST-READ FOR THE 99%

Fuddnik

(8,846 posts)"Lifting the Veil".

It's long, but well worth watching. A good reason not to occupy the Party. Hold them accountable instead.

An excellent speech by Chris Hedges at the end.

http://vimeo.com/20355767

Demeter

(85,373 posts)With encampments being closed across the country it is important to remember the end goal is not to occupy public space, it is to end corporate rule. We seek to replace the rule of money with the rule of people. Occupying is a tactic but the grand strategy of the Occupy Movement is to weaken the pillars that hold the corporate-government in place by educating, organizing and mobilizing people into an independent political force.

The occupations of public space have already done a great deal to lift the veil of lies. People are now more aware than ever that the wealth divide is caused by a rigged economic system of crony capitalism and that we can create a fair economy that works for all Americans. We are also aware that many of our fellow citizens are ready to take action – extreme action of sleeping outside in the cold in a public park. And, we also now know that we have the power to shift the debate and force the economic and political elites to listen to us. In just a few months we have made a difference...

Occupying public space involves a lot of resources and energy that could be spent educating, organizing and mobilizing people in much greater numbers. There is a lot to do to end corporate rule and the challenges of occupying public space can divert our attention and resources from other responsibilities we have as a movement...When we were organizing the Occupation of Washington, DC – before the occupation of Wall Street began – we were in conversation with movements around the world. The Spanish Indignados told us that an occupation should last no more than two weeks. After that it becomes a diversion from the political objectives. The occupation begins to spend its time dealing with poverty, homelessness, inadequately treated mental illness and addiction – this has been experienced by occupies across the country....Occupying for a short time accomplishes many of the objectives of holding public space – the political dialogue is affected, people are mobilized and all see that fellow citizens can effectively challenge the corporate-state. Staying for a lengthy period continues to deepen these goals but the impacts are more limited and the costs get higher.

What to do next? The Occupy Movement needs to bring participatory democracy to communities. Occupiers should develop an aggressive organizing plan for their city. Divide the city and appoint people to be responsible for different areas of the city. Depending on how many people you have make these areas as small as possible.

- Develop plans for house-to-house campaigns where you knock on doors, provide literature, ask what you can do to make their lives better. Do they need snow removed? Clothes? If so, get the occupy team to fulfill their needs, find used clothes, clean their yard – whatever you can do to help. This shows community and builds relationships.

- Plan a march through the different communities in the city. Make it a spectacle. Have a marching band. Don’t have one – reach out to local school bands. Organize them. Create floats, images and signs. Display yourselves and your message. Hand out literature as you march. Let people know what the occupy stands for they should join us in building a better world for them and their families.

- Plan public General Assemblies in communities across the city. Teach people the General Assembly process, the hand signals, how to stack speakers, how to listen and reach consensus. Learn the local issues. Solve local problems. Again, build a community that works together to solve problems.

- Let people know about the National Occupation of Washington DC (NOW DC), the American Spring beginning on March 30th. Organize people to come, share rides, hire buses, walk, ride a bike – get people to the nation’s capital to show the united force of the people against the rule of money. This will be an opportunity to display our solidarity and demand that the people, not money, rule.

How rapidly a movement makes progress is hard to predict. It is never a constant upswing of growth and progress. We may be in for a sprint, or more likely, a marathon with hurdles. If you are hoping for a sprint, note that the deep corruption of the government and the economy has left both weaker than is publicly acknowledged. It may be a hollowed out shell ready to fall....But, this may also take years to accomplish. Take the timeline of the Civil Rights movement: 1955 Rosa Parks sits in the front of the bus, not until five years later in 1960, do the lunch counter sit-ins begin. Not until three years later in 1963 does Dr. Martin Luther King, Jr. lead a march on Washington for the “I have a Dream” speech. No doubt the time between Rosa Parks and the lunch counter sit-ins and Civil Rights Act passing in 1964 seemed slow to those involved. Looking back it was rapid, transformational change. In fact, the movement grew in fits and starts and had roots decades of activity before the 1950s. In those times of seeming lull, work was being done, to educate and organize people that led to the big spurts of progress....With mass media, and especially the new democratized media of social networks, the Internet, anonymous leaks and independent media, it is very likely the end of the rule of money will come more quickly. If we focus on our goal, act with intention and use our energy and resources wisely victory will come sooner...

***********************************************************

Kevin Zeese is an organizer of Occupy Washington, DC and co-director of It’s Our Economy.

xchrom

(108,903 posts)Demeter

(85,373 posts)It looks as though the eurozone may be in a decisive meltdown, which is just fine in my book. The sooner we get back to francs, lire, punts, drachmas and the rest of the old sovereign currencies, the better...The argument against the eurozone is that hard-faced Euro-bankers — their killer instincts honed at Goldman Sachs, Wall Street's School of the Americas — have the power to act as the bully-boys of international capital and impose austerity regimes from Dublin to Athens, scalping the poor to bail out the rich.

Now the end of the eurozone does not mean the end of the European Union. They're different. There are 17 nations in the former, 27 in the latter...At the moment, the European Union has virtually no tax collecting powers. Its annual haul is about 1 percent of the EUs gross domestic product. By comparison, the U.S. government collects about 20 to 24 percent of GDP.

Throughout the entire Eurocrisis, there has been a basso profundo chorus from the Eurocrats that what's needed is a lot more centralizing. In the words of Wolfgang Munchau at the Financial Times on Nov. 28, the EU needs "a fiscal union": "This would involve a partial loss of national sovereignty, and the creation of a credible institutional framework to deal with fiscal policy, and hopefully wider economic policy issues as well."...I've read many editorial paragraphs with this same bullying timbre — that what the whole European enterprise needs is an impregnable fortress of Eurocrats dispatching its disciplinary legions — first technocrats and then, if necessary, NATOs shock troops to crush all resistance...As Serge Halimi, the director of Le Monde diplomatique, put it recently, "There is no reason to believe that Francois Hollande in France, Sigmar Gabriel in Germany or Ed Miliband in the U.K. will succeed where Obama, Jos Luis Zapatero and Papandreou have failed.... In the current political and social situation, a federal Europe would strengthen the already stifling neo-liberal mechanisms and reduce the sovereign power of the people by handing it over to shadowy technocratic bodies."

The EU "project," a very irritating word that should be tossed in the dumpster along with "iconic," "meme," "parse" and "narrative," is a potential outline of a totalitarian nightmare. Down with federalism! Remember Simone Weil's hatred of the Roman Empire and what it did to Europe's cultural richness and diversity: "If we consider the long centuries and the vast area of the Roman Empire and compare these centuries with the ones that preceded it and the ones that followed the barbarian invasions, we perceive to what extent the Mediterranean basin was reduced to spiritual sterility by the totalitarian State." As Weil's biographer, Simone Petrement, comments, "The Roman peace was soon the peace of the desert, a world from which had vanished, together with political liberty and diversity, the creative inspiration that produces great art, great literary works, science, and philosophy. Many centuries had to pass before the superior forms of human life were reborn." But as Halimi concludes, "But when the people cease to believe in a political game in which the dice are loaded, when they see that governments are stripped of their sovereignty, when they demand that banks be brought into line, when they mobilize without knowing where their anger will lead, then the left is still very much alive."

Demeter

(85,373 posts)A short-lived rumor recently suggested that the International Monetary Fund was putting together a €600 billion ($803 billion) package for Italy to buy its new government about 18 months to implement the necessary adjustment program. Except for the magnitude of the package, this sounds no different from a standard IMF adjustment program – the kind that we are accustomed to seeing (and criticizing) in the developing world. But there is one crucial difference: Italy is part of a select club that does not need outside rescue funds...So far, programs for the eurozone periphery have been spearheaded and largely financed by European governments, with the IMF contributing financially, but mainly acting as an external consultant – the third party that tells the client the nasty bits while everyone else in the room stares at their shoes.

By contrast, the attempt to crowd multilateral resources into Europe was made explicit by eurozone finance ministers’ call in November for IMF resources to be boosted – preferably through debt-generating bilateral loans,– so that it could “cooperate more closely” with the European Financial Stability Facility. That means that the short-lived story of Italy’s jumbo IMF package, which was to be funded largely by non-European money, can be regarded as a game changer: while Italy may never receive such a package, Europe, it seems, is determined to resolve its problems using other people’s money.

There are at least three reasons why the IMF should resist this pressure, and abstain from increasing its (already extremely high) exposure to Europe. First, and most obviously, Europe already has its own in-house lender of last resort. The European Central Bank can make available all the euros needed to backstop Italy’s debt. And printing them would only offset, through mild inflation, the effects of the otherwise Draconian relative price adjustment that is taking place under the corset of the common currency...So it is puzzling that some observers have saluted the IMF’s involvement as a virtuous effort by the international community to bring the listing European ship to port. Why should the IMF (or, for that matter, the international community) do for Europe what Europe can but does not want to do for Italy? Why should international money be mobilized to pay for European governance failures? And if, as appears to be the case, Germany is playing a dangerous game of chicken with some of its eurozone partners, why should the cost be shifted to the IMF for the benefit of Europe’s largest and most successful economy? Letting the ECB off the hook in this manner would simply validate for Europe as a whole the same moral hazard feared by German and other leaders who oppose ECB intervention.

The second reason to avoid IMF intervention in Europe is that lending to a potentially insolvent country has serious implications for the Fund. For starters, taking the IMF’s preferred-creditor status at face value, an IMF loan would entail substituting its “non-defaultable” debt for “defaultable” debt with private bondholders, because the Fund’s money is used primarily to service outstanding bonds. As a result, a group of lucky bondholders would be bailed out at the expense of those that became junior to IMF debt and remained highly exposed to a likely restructuring. Since a “haircut” can be imposed only on whatever is left of the defaultable private debt, the larger the IMF share, the deeper the haircut needed to restore sustainability....For the same reason, IMF loans can be a burdensome legacy from a market perspective. Because they represent a massive senior claim, they may discourage new private lending for many years to come. This brings us to the third reason why the IMF should stay out of Europe’s crisis: what if Fund seniority fails? The implicit preferred-creditor status is based on central-bank practices that establish that the lender of last resort is the “last in and first out.” It is this seniority that enables the IMF to limit the risk of default so that it can lend to countries at reasonable interest rates when nobody else will. This works when the IMF’s share of a country’s debt is small, and the country has sufficient resources to service it....But seniority is not written in stone: poor economies that are unable to repay even the IMF are eligible for debt reduction under the Heavily Indebted Poor Countries program, and 35 have received it since the program was established in 1996. What would happen if, in five years, Italy were heavily indebted to the IMF? What if private debt represented a share so small that no haircut would restore sustainability, forcing multilateral lenders to pitch in with some debt relief?

...The solution for Europe is not IMF money, but its own.

Ghost Dog

(16,881 posts)Russia is open to any requests from the European Union for assistance in fighting Europe’s sovereign debt crisis and is ready to help finance regional anti-crisis measures via the International Monetary Fund, Kremlin aide Sergei Prikhodko said on Wednesday.

“We are exclusively interested in joint and solidarity efforts by the EU countries that could help them overcome those complex and ambiguous processes that are threatening the stability of the euro area, at least its financial stability, and could affect the scope and nature of cooperation with Russia,” Prikhodko said...

... “We are interested in the stability of the euro, at least in the preservation of the role played by the euro in serving the commodity trade turnover, investment, scientific and technical and other cooperation between Russia and the European Union,” Prikhodko said.

The EU accounts for about 50 percent of Russia’s foreign trade while Russia is the EU’s third largest trading partner after the United States and China. Also, the euro holds a 41 percent share in Russia’s international reserves, Prikhodko said...

/... http://en.rian.ru/business/20111214/170244459.html

Ghost Dog

(16,881 posts)NEW YORK (Reuters) - The International Monetary Fund's chief economist cautioned on Wednesday against exacting tough austerity measures too quickly and instead favors a longer process as countries around the world grapple with high debt levels.

The IMF's Olivier Blanchard said he was surprised over the debate over whether the best way forward was more stimulus to boost economic growth or tighter measures to deal with deficits, saying in most circumstances austerity would lead to contraction.

"The hope that fiscal consolidation will make people optimistic about the future and lead to a boom in the economy next year I think is something we should give up," said Blanchard, speaking on a panel at the Council on Foreign Relations in New York...

... "It seems to me everybody should agree that the fiscal adjustment should be a long, drawn out, credible, medium-term process," said Blanchard, who also said austerity was clearly needed.

/... http://www.courant.com/business/sns-rt-us-usa-economy-blanchardtre7bd199-20111214,0,5000168.story

Demeter

(85,373 posts)He said what?

xchrom

(108,903 posts)In a year of record agricultural earnings in the U.S., Steve Ruh spent a chunk of his income to build what’s become an increasingly common sight at farms across the Midwest -- grain storage bins.

The Illinois corn grower started with 250,000 bushels (2 million gallons) of storage capacity in 2009 and added 100,000 this year to avoid wasting precious harvest time in line at grain elevators. He can now hold crops in gluts, hoping to sell at higher prices when grain is scarcer, and is storing half the 400,000-bushel corn crop this season at his farm in Sugar Grove.

“I like the control,” said the 42-year-old, who works 3,000 acres (1,214 hectares) of corn, soybeans, wheat and alfalfa. “This allows me to market 12 months out of the year instead of half that time.”

Corn-belt farmers like Ruh have pushed up U.S. oilseed and grain storage capacity to the highest in two decades, enriching bin makers from GSI Holdings Corp. to Brock Grain Systems, which is controlled by Warren Buffett’s Berkshire Hathaway Inc., while raising costs for Cargill Inc. and other grain traders.

xchrom

(108,903 posts)Gold may rebound from a seven-week low in London as concern about Europe’s debt crisis spurs investors to buy the metal as a protection of wealth.

Gold slid 2.1 percent yesterday after the Federal Reserve said the U.S. economy is maintaining its expansion and refrained from taking new action to bolster the economy. The dollar was near an 11-month high versus the euro amid speculation the region’s sovereign-debt crisis is far from resolved. Gold holdings in exchange-traded products are at an all-time high.

“With the dollar pushing higher, that suggests the market remains nervous about Europe and the contagion it is causing,” William Adams, head of research at Basemetals.com in London, wrote in a report today. “Given the dire situation in Europe and stresses in the monetary system, we feel the big picture outlook for bullion remains bullish.”

Bullion for immediate delivery rose 23 cents to $1,631.80 an ounce by 11:10 a.m. in London. The metal touched $1,622.65 yesterday, the lowest price since Oct. 21. Gold for February delivery slipped 1.7 percent to $1,634.30 on the Comex in New York.

Ghost Dog

(16,881 posts)While meanwhile...

See also "The gold bugs are throwing in the towel" - http://www.democraticunderground.com/1116538#post2

Zerohedge comments:

How much further might gold fall? Market momentum is a powerful force and therefore further weakness is quite possible. Support is at the 200 day moving average at $1,619/oz. Below that is the psychological level of $1,600 per ounce and the 250 day moving average of $1,571/oz. Price resistance was seen at the $1,570/oz level between late April and July 2011 (see chart) and this level could become support as is often the case in bull markets. It is important to note that gold’s falls have been primarily dollar related and gold has fallen by a lot less in pound and in euro terms. Most analysts of the gold market remain of the view that this is another correction and that the medium and long term uptrend will continue due to significant investment, store of wealth and central bank demand due to geopolitical, macroeconomic, systemic and monetary risk.

/... http://www.zerohedge.com/news/roubini-asks-%E2%80%98goldbugs%E2%80%99-twitter-%E2%80%9Cwhere-2000%E2%80%9D

xchrom

(108,903 posts)i was raised that investments like that are a little strange -- i mean SOME silver but really not much.

we always picked stuff like caterpillar, or steel, sort of old slow grow stuff.

never very expensive to buy -- relatively -- and not sexy.

it's all i know from.

Ghost Dog

(16,881 posts)And volatility.

Caterpillar down 5% today I see... but generally a strong traditional manufacturer.

xchrom

(108,903 posts)never a lot -- except it was dicey in the 70s.

i hate their anti-union stand -- since the union helped make them what they are.

and i hate that they kind of dominate labor markets in places like peoria -- i.e. they make it kinda hard for other industries locate there since they soak up all the labor.

used to be the same with stuff like steel -- but that's changed these days of course.

AnneD

(15,774 posts)at the moment that means all currency with the exception of a few countries. I think the market is chosing a gold standard, no matter what the IMF or world bankers say.

IMHO, I think that it is mathamatical certainty that this ponzi scheme will be blowing up soon. I further think that, while a gold standard may not be perfect, it had worked for thousands of years. I think gold in some way will be a part, if not the basis of any new currency. I am bullish and very long. I think we will look back on this as a buying opportunity and those that don't buy at least some silver will wish they had.

I did not come to this conclusion overnight and I have read more than I care to on the subject. I see gold as a safety net (profit neutral). I may not get the profit (profit positive) that I would like, but I will not lose (profit negative), which is more than I can say for the MF global investors.

Right now, the AnneD household is beefing up cash, PM, and pantry commodities. I still have stock, but I am extremely picky with those I choose. I have no say over my state run Teacher's Retirement System. I am very comfortable with my choices and will gladly change my position should I need too. The peace of mind is priceless.

xchrom

(108,903 posts)AnneD

(15,774 posts)doesn't mean it won't. America is not that special. This idea of American exceptionalism will do us in yet.

DemReadingDU

(16,002 posts)Demeter

(85,373 posts)An auditor with the CME Group Inc. was informed that former MF Global Chief Executive Jon Corzine may have known about a loan made using customer funds to one of the firm’s European affiliates, CME Executive Chairman Terrence Duffy said Tuesday.

Duffy told senators on the Senate Agriculture Committee that he learned about the disclosure over the weekend and that the loan was for roughly $175 million. The CME Group has provided this information to the Justice Department, according to Duffy, who declined to name the MF Global executive who said Corzine was aware of the breach.

Regulators are investigating whether the brokerage tapped into customer-segregated futures accounts for its own proprietary trading. No one at the firm has been charged, so far but a trustee overseeing the bankruptcy reported that roughly $1.2 billion in customer funds are missing...Testifying before the committee immediately before Duffy, Corzine said he never authorized the misuse of customer funds, and that he doesn’t believe it would be possible to construe anything he’d done as an authorization for that kind of activity...

DemReadingDU

(16,002 posts)He, and others, need to be in jail

xchrom

(108,903 posts)When it comes to fighting the European crisis, the Netherlands may as well be a part of Germany.

“The Dutch are often a mainstay for the Germans, and as such, play a bigger role than justified by their economy,” said Sylvester Eijffinger, a professor of financial economics at Tilburg University, 69 miles south of Amsterdam. It’s good for Germany because “it never wants to be accused of going it alone,” he said.

As European leaders have struggled for more than two years to tame their financial crisis, the Dutch government has sided with neighboring Germany in pushing austerity and central bank independence, underscoring differences between northern and southern Europe in seeking solutions.

In February 2010, then acting Dutch Prime Minister Jan Peter Balkenende called German Chancellor Angela Merkel to say the International Monetary Fund should help Greece solve its funding needs. The plan was opposed by French President Nicolas Sarkozy, who said it would show the European Union couldn’t solve its own crises. A month later, EU leaders went to the Washington-based IMF for aid.

xchrom

(108,903 posts)Commerzbank AG’s 8.26 billion euros ($10.8 billion) of share sales this year propelled equity capital-market deals by German companies to the highest level since 2000, defying a worldwide decline. A backlog of initial public offerings means the trend may extend into 2012.

While the volume of stock, equity-linked and rights offerings dropped in the U.S., Japan, China, France and the U.K., German companies raised 24.3 billion euros this year, up 14 percent from 2010 and the most in more than a decade, data compiled by Bloomberg show. Globally, issuance fell 32 percent.

Europe’s biggest economy is forestalling the worsening debt crisis as business confidence unexpectedly rose for the first time in 10 months in December, and industrial production and retail sales climbed in October. Siemens AG (SIE)’s lighting unit Osram AG and chemical company Evonik Industries AG are clinging to IPO plans after market turmoil postponed proposed share sales in the second half of 2011. The DAX Index has dropped 22 percent since the end of June.

xchrom

(108,903 posts)ROME (AP) -- Italy's last bond auction of the year saw the country having to pay higher borrowing rates to get investors to lend it the money it needs to rollover its big debts.

Wednesday's auction showed that the debt-riddled country paid an average yield of 6.47 percent for investors to lend it euro3 billion ($3.95 billion) over five years.

The yield was up 0.17 percentage point from last time Italy looked to raise money over five years and was the highest rate since 1997. The euro came into existence in 1999.

Italy has seen its borrowing costs, both in the markets and in bond auctions, rise markedly over the past few months as investors have grown increasingly worried over the country's ability to deal with its debts, which total around euro1.9 trillion ($2.5 trillion), or around 120 percent of its GDP. It is considered too big to bail out by its partners in the 17-country eurozone.

xchrom

(108,903 posts)BERLIN (AP) -- Germany is reactivating its financial sector rescue fund as the eurozone debt crisis raises increasing questions about how banks can cover their capital needs.

Chancellor Angela Merkel's spokesman, Steffen Seibert, said the Cabinet decided Wednesday to reopen the euro360 billion ($474 billion) fund, first established at the height of the 2008 financial crisis.

The fund closed to new applications at the end of 2010. But much of the money - which totaled euro60 billion for potential capital injections and euro300 billion for loan guarantees - remains untapped.

European authorities have determined that German banks require a total of euro13.1 billion in new capital to comply with tougher new requirements. The country's second-biggest bank, Commerzbank AG, has been told it needs euro5.3 billion.

Demeter

(85,373 posts)As long-term readers recall, the observation of Goldman's dominant presence in the NYSE's weekly program trading reports by Zero Hedge back in early 2009 was one of the key drivers that set in motion the backlash against algorithmic trading and HFT which back in 2009 was the pinnacle of fringe topics and has since become a daily talking point and market scapegoat du jour on days when stocks are down (but never up). It also drew attention to Goldman's prop trading division which Zero Hedge was the first and only vocal opponent of, and has since been demolished courtesy of the Volcker Rule, an event which both Moody's and Alliance Bernstein now say could cost the bank dearly in top and bottom line, yet which Goldman told us on the record "represents approximately 10% of this year’s reported net revenue." Guess it was more, huh... Yet the same NYSE weekly program trading update indicates that Goldman, up until now a monolith in NYSE program trading, has just lost its crown in that field as well. The new king. A firm called Latour Trading, which in the last week traded 484.6 million shares in principal strategies. Which begs the question: just who is this Latour Trading which dares to upstage the firm that does god's work on earth. Alas, their website has been less than forthright. Inquiring minds certainly want to know.

SEE ALSO http://dismagazine.com/discussion/26423/htmlhtml/ FOR MORE SLIMINESS

Demeter

(85,373 posts)...Free Speech for People, Appalachian Voices and the Rainforest Action Network... have renewed their call for Delaware Attorney General Beau Biden to revoke Massey’s corporate charter.

In a joint statement the groups said, “A financial settlement, even for hundreds of millions of dollars, is just not enough to prevent corporations like Massey from abusing their enormous power over our lives. Alpha earned $2.3 billion in the last quarter alone. It is simply not acceptable for corporations to buy their way out after criminally killing people.”

Demeter

(85,373 posts)The following is the foreword to Corporations Are Not People: Why They Have More Rights Than You Do and What You Can Do About It, by Jeffrey Clements, a new book from Berrett-Koehler Publishers.)

Rarely have so few imposed such damage on so many. When five conservative members of the Supreme Court handed for-profit corporations the right to secretly flood political campaigns with tidal waves of cash on the eve of an election, they moved America closer to outright plutocracy, where political power derived from wealth is devoted to the protection of wealth. It is now official: Just as they have adorned our athletic stadiums and multiple places of public assembly with their logos, corporations can officially put their brand on the government of the United States as well as the executive, legislative, and judicial branches of the fifty states...The decision in Citizens United v. Federal Election Commission giving “artificial entities” the same rights of “free speech” as living, breathing human beings will likely prove as infamous as the Dred Scott ruling of 1857 that opened the unsettled territories of the United States to slavery whether future inhabitants wanted it or not. It took a civil war and another hundred years of enforced segregation and deprivation before the effects of that ruling were finally exorcised from our laws. God spare us civil strife over the pernicious consequences of Citizens United, but unless citizens stand their ground, America will divide even more swiftly into winners and losers with little pity for the latter. Citizens United is but the latest battle in the class war waged for thirty years from the top down by the corporate and political right. Instead of creating a fair and level playing field for all, government would become the agent of the powerful and privileged. Public institutions, laws, and regulations, as well as the ideas, norms, and beliefs that aimed to protect the common good and helped create America’s iconic middle class, would become increasingly vulnerable. The Nobel Laureate economist Robert Solow succinctly summed up the results: “The redistribution of wealth in favor of the wealthy and of power in favor of the powerful.” In the wake of Citizens United, popular resistance is all that can prevent the richest economic interests in the country from buying the democratic process lock, stock, and barrel.

America has a long record of conflict with corporations. Wealth acquired under capitalism is in and of itself no enemy to democracy, but wealth armed with political power — power to choke off opportunities for others to rise, power to subvert public purposes and deny public needs — is a proven danger to the “general welfare” proclaimed in the Preamble to the Constitution as one of the justifications for America’s existence...It’s been done before. As my friend and longtime colleague, the historian Bernard Weisberger, wrote recently, the Supreme Court remained a procorporate conservative fortress for the next fifty years after the Southern Pacific decision. Decade after decade it struck down laws aimed to share power with the citizenry and to promote “the general welfare.” In 1895, it declared unconstitutional a measure providing for an income tax and gutted the Sherman Antitrust Act by finding a loophole for a sugar trust. In 1905, it killed a New York state law limiting working hours. In 1917, it did likewise to a prohibition against child labor. In 1923, it wiped out another law that set minimum wages for women. In 1935 and 1936, it struck down early New Deal recovery acts.

But in the face of such discouragement, embattled citizens refused to give up. Into their hearts, wrote the progressive Kansas journalist William Allen White, “had come a sense that their civilization needed recasting, that the government had fallen into the hands of self-seekers, that a new relationship should be established between the haves and the have-nots.” Not content merely to wring their hands and cry “Woe is us,” everyday citizens researched the issues, organized public events to educate their neighbors, held rallies, made speeches, petitioned and canvassed, marched and exhorted. They would elect the twentieth-century governments that restored “the general welfare” as a pillar of American democracy, setting in place legally ordained minimum wages, maximum working hours, child labor laws, workmen’s safety and compensation laws, pure foods and safe drugs, Social Security and Medicare, and rules to promote competitive rather than monopolistic financial and business markets....

How to fight back is the message of this book.... Try it yourself: “Corporations are not people.” Again: “Corporations are not people.” You are now ready to join what Clements believes is the most promising way to counter Citizens United: a campaign for a constitutional amendment affirming that free speech and democracy are for people and that corporations are not people...It is not a partisan issue; it is more than a political issue; it is a great moral issue. If we condone political theft, if we do not resent the kinds of wrong and injustice that injuriously affect the whole nation, not merely our democratic form of government but our civilization itself cannot endure.

Demeter

(85,373 posts)The presidential campaign season keeps getting longer, and more expensive, allowing the uber-rich to effectively control our democracy...Think about that. You vote for the president to spend some part of 20% of his days raising money for his own future from the incredibly wealthy. Or put another way, the Washington Post now estimates that if you add in the non-fundraising, election-oriented events that involve him -- 63 so far in 2011 -- perhaps 12% of his time is taken up with campaign efforts of one sort or another; and this is what he’s been doing 12 to 24 months before the election is scheduled to happen.

...In this age, our rulers, the 1% whose money has flooded the electoral cycle, are turning the election itself into our extended circus....The only problem: however strange all this may be, it’s not, at least in the old-fashioned sense, an election nor does it seem to have much to do with democracy. The fact is that we have no word for what’s going on. Semi-democracy? Unrepresentative democracy? 1% democracy? Demospectacracy?

...It's an ever-expanding system, engorging itself on money and sucking in ever larger audiences. It’s the Blob of this era. In fact, the next campaign now kicks off in the media the day after (if not the day before) the previous election ends with speculation (polls soon to follow) handicapping the odds of future candidates, none yet announced...

On money, the sky’s the limit. In 2000, the total federal election season cost $3 billion; in 2008, more than $5 billion, of which an estimated $2.4 billion went into the presidential campaign. With the Supreme Court having made it easier for outside money to pour in, thanks to its Citizens United decision, funding for campaign 2012 is expected to pass $6 billion and could even top $7 billion. The Obama campaign, which raised $760 million in 2008, is expected to pass the billion-dollar mark this time around (with money already pouring in from the financial and banking sector on which candidate Mitt Romney is also heavily reliant). TV advertising alone, which topped $2.1 billion in 2008, is expected to reach or exceed $3 billion this time around...For comparison’s sake, back in 1976, in the era when pundits were first beginning to write about presidential elections as perpetual campaigns, the total spending of presidential candidates Gerald Ford and Jimmy Carter was $66.9 million.

Demeter

(85,373 posts)They won't tell us who they are, but they are spending tens of millions as part of 'Americans Elect' to nominate and to field an 'Independent' presidential candidate in 2012...There’s an increasing amount of buzz around Americans Elect, a peculiar Internet-based effort to shake up presidential politics. But dig a bit beneath the surface and there’s reason to be deeply skeptical of the endeavor. The basic pitch of Americans Elect goes like this: We’ll go through the expensive and time-consuming process of getting ballot access in all 50 states. Then we’ll hold an online convention in June in which any registered voter can participate. Participants will nominate a presidential ticket including one Democrat and one Republican who will then enter the general election fray...Here’s what the group is not so upfront about: It’s fueled by millions of dollars of secret money, there is a group of wealthy, well-connected board members who have control over Americans Elect’s nominating process, and the group has myriad links to Wall Street...So here are some facts about the group to keep in mind.

SECRET MONEY

The group is hoping to raise $30 million for its effort. It has already raised an impressive $22 million as of last month. So where is all that money coming from? Americans Elect won’t say. In fact, the group changed how it is organized under the tax code last year in order to shield the identity of donors. It is now a 501(c)(4) “social welfare” group whose contributors are not reported publicly. What we do know about the donors, largely through news reports citing anonymous sources, suggests they are a handful of super-rich Americans who made fortunes in the finance industry. (More on this below.) But it’s impossible to fully assess the donors’ motives and examine their backgrounds and entanglements – important parts of the democratic process – while their identities and the size of their donations remain secret. In response to critics, Americans Elect official Darry Sragow argues that the donors fear there will be a backlash if their names are public. “Cross those who hold power and you are banished to political Siberia, or targeted not by the Molotov cocktails conjured up by the professor, but by unresponsive or hostile government actions,” he wrote in a recent column. HUH?

ANTI-DEMOCRATIC RULES

Americans Elect officials often tout their “revolutionary” online nominating convention, which will be open to any registered voter. But there’s a big catch. Any ticket picked by participants will have to be approved by a Candidate Certification Committee, according to the group’s bylaws...Among other things this committee will need to certify a “balanced ticket obligation” – that the ticket consists of persons who are “responsive to the vast majority of citizens while remaining independent of special interests and the partisan interests of either major political party,” according to the current draft of Americans Elect rules. Making these sorts of assessments is, of course, purely subjective. And who appoints the members of the Candidate Certification Committee? The board members of Americans Elect....In response, Americans Elect’s Sragow has written that some of these rules are still subject to change. And he has defended the board, comparing them to the Founding Fathers. “While we don’t mean to put the board in the company of the Founding Fathers, we’d point out that nobody picked the Founding Fathers, either,” Sragow argues. “They took it upon themselves to turn a popular dream into a shared reality. And they, too, had debates over how much control should be centralized. They knew that too much power in the hands of too few isn’t real democracy, but that power too diffuse is anarchy.”

WALL STREET CONNECTIONS

So who is on the Americans Elect board, and where is the money coming from? Thomas Friedman reported over the summer that the group is “financed with some serious hedge-fund money,” which has paid for, among other things, prime office space in New York and Washington. A spokeswoman for the group did not respond to a request for comment about Friedman’s report. At one point over the summer, the group was claiming that none of its funding comes from “special interests” – a difficult-to-define term that, if it has any meaning at all, would have to include the hedge fund industry...We do know that Peter Ackerman, chairman of the board of Americans Elect, has given over a million dollars to the group. A wealthy investment banker, he has been a donor to both President Obama and Republicans over the years. He was also on the board of the CATO Institute’s Social Security Choice project, which advocated for a Bush-style scheme to dismantle and privatize social security...According to the Guardian, other funders include Melvin Andrews of Lakeside Capital Partners and Kirk Rostron of an investment firm called the Mt. Vernon Group. Rostron formerly worked as a director at Merrill Lynch’s hedge fund group. Another reported funder is Jim Holbrook, chairman of the Promotion Marketing Association, the trade association for the marketing industry. And the list of political operatives who have signed on to the effort – including former McCain aide Mark McKinnon, Will Marshall of the Progressive Policy Institute, former New Jersey governor Christine Todd Whitman, and Bloomberg pollster Douglas Schoen – suggest the group will promote a kind of pro-establishment, “why can’t we just all get along by agreeing to dismantle Social Security”-style centrism.

The blog Irregular Times has been providing very close coverage of Americans Elect, so keep an eye over there as the group continues its rise to prominence.

dixiegrrrrl

(60,154 posts)Not widely discussed much, and it should be.

xchrom

(108,903 posts)Four years and $1.8 trillion after the worst financial collapse since the 1930s, there appears to be little more the Federal Reserve can do to get the U.S. economy back on track. Rarely in the central bank’s 99-year history has so much been so far beyond its control.

At their regularly scheduled meeting Tuesday, Federal Reserve policymakers made no changes in interest rates and held fire on buying more bonds to pump cash into the financial system. Beyond that, they were expected to devote much time at the meeting to an extensive discussion about changing the way the committee communicates its decision-making with the public.

Fed policymakers have gotten a bit of breathing room lately from data showing a gradual pickup in the U.S. economy. But that growth remains threatened by the financial crisis in Europe, the ongoing budget gridlock in Washington and a housing market that shows no sign of emerging from a deep recession.

After spending close to $2 trillion to put out the financial fires that swept through the U.S. banking system in 2008, Fed officials have watched their European counterparts fail to move decisively as fearful investors flee eurozone countries teetering on the brink of default. Despite calls to backstop Greece, Italy and Spain, the European Central Bank has responded tepidly to the crisis, arguing that those countries need to work harder to balance bloated budgets.

Demeter

(85,373 posts)The Fed has been the prime mover in this catastrophe since Greenspan. Which is why people call for its dismantlement.

Ghost Dog

(16,881 posts)... Given the magnitude of the decline in farm income, it’s no wonder that the New Deal itself could not bring the country out of crisis. The programs were too small, and many were soon abandoned. By 1937, F.D.R., giving way to the deficit hawks, had cut back on stimulus efforts—a disastrous error. Meanwhile, hard-pressed states and localities were being forced to let employees go, just as they are now. The banking crisis undoubtedly compounded all these problems, and extended and deepened the downturn. But any analysis of financial disruption has to begin with what started off the chain reaction.

The Agriculture Adjustment Act, F.D.R.’s farm program, which was designed to raise prices by cutting back on production, may have eased the situation somewhat, at the margins. But it was not until government spending soared in preparation for global war that America started to emerge from the Depression. It is important to grasp this simple truth: it was government spending—a Keynesian stimulus, not any correction of monetary policy or any revival of the banking system—that brought about recovery. The long-run prospects for the economy would, of course, have been even better if more of the money had been spent on investments in education, technology, and infrastructure rather than munitions, but even so, the strong public spending more than offset the weaknesses in private spending.

Government spending unintentionally solved the economy’s underlying problem: it completed a necessary structural transformation, moving America, and especially the South, decisively from agriculture to manufacturing. Americans tend to be allergic to terms like “industrial policy,” but that’s what war spending was—a policy that permanently changed the nature of the economy. Massive job creation in the urban sector—in manufacturing—succeeded in moving people out of farming. The supply of food and the demand for it came into balance again: farm prices started to rise. The new migrants to the cities got training in urban life and factory skills, and after the war the G.I. Bill ensured that returning veterans would be equipped to thrive in a modern industrial society. Meanwhile, the vast pool of labor trapped on farms had all but disappeared. The process had been long and very painful, but the source of economic distress was gone.

The parallels between the story of the origin of the Great Depression and that of our Long Slump are strong. Back then we were moving from agriculture to manufacturing. Today we are moving from manufacturing to a service economy. The decline in manufacturing jobs has been dramatic—from about a third of the workforce 60 years ago to less than a tenth of it today. The pace has quickened markedly during the past decade. There are two reasons for the decline. One is greater productivity—the same dynamic that revolutionized agriculture and forced a majority of American farmers to look for work elsewhere. The other is globalization, which has sent millions of jobs overseas, to low-wage countries or those that have been investing more in infrastructure or technology. (As Greenwald has pointed out, most of the job loss in the 1990s was related to productivity increases, not to globalization.) Whatever the specific cause, the inevitable result is precisely the same as it was 80 years ago: a decline in income and jobs. The millions of jobless former factory workers once employed in cities such as Youngstown and Birmingham and Gary and Detroit are the modern-day equivalent of the Depression’s doomed farmers...

... Of four major service sectors—finance, real estate, health, and education—the first two were bloated before the current crisis set in. The other two, health and education, have traditionally received heavy government support. But government austerity at every level—that is, the slashing of budgets in the face of recession—has hit education especially hard, just as it has decimated the government sector as a whole. Nearly 700,000 state- and local-government jobs have disappeared during the past four years, mirroring what happened in the Depression. As in 1937, deficit hawks today call for balanced budgets and more and more cutbacks. Instead of pushing forward a structural transition that is inevitable—instead of investing in the right kinds of human capital, technology, and infrastructure, which will eventually pull us where we need to be—the government is holding back. Current strategies can have only one outcome: they will ensure that the Long Slump will be longer and deeper than it ever needed to be.

/... http://www.vanityfair.com/politics/2012/01/stiglitz-depression-201201?wpisrc=nl_wonk

xchrom

(108,903 posts)The Bank of Japan said Tuesday it will provide an additional $4.77 billion to money markets as part of measures to ease tensions over funding conditions for commercial lenders affected by the sovereign debt crisis in Europe.

It will be the biggest move since the BOJ reintroduced such operations in May 2010. The move follows an agreement last month between six central banks, in the U.S., Japan, Canada and Europe, to boost dollar-fund injections into domestic markets.

In an auction held Tuesday, bids for the short-term funds totaled $4.77 billion and the BOJ accepted all of them.

xchrom

(108,903 posts)China's economic policymakers have pledged to guarantee growth in 2012, despite an "extremely grim" global outlook for the year ahead.

After their annual closed-door economic meeting in Beijing, the country's leaders declared that monetary policy would remain "prudent".

They said the currency, the yuan, would remain "basically stable".

The meeting avoided big policy changes before China's top two leaders retire next year, analysts said.

xchrom

(108,903 posts)European officials may have flown to Beijing with their begging bowl underarm, but for developing countries, China's cheque book comes to you.

Over the past few years, delegations from China's big banks have been criss-crossing the globe signing a plethora of billion dollar deals with some of the world's poorest nations.

"Last year China provided more loans to the developing world than even the World Bank," says Jamie Metzl from the US-based Asia Society. "The role of China is large, it's growing and it's critically important."

As the lender to go to for credit-poor governments, China's yuan is replacing World Bank dollars as the cash behind new roads, power stations, hospitals and other infrastructure.

Demeter

(85,373 posts)You don't have to make a million to rate as an all-star greedster. You do have to be ruthless, self-absorbed and grossly insensitive. The greediest among us in 2011 probably haven’t been any greedier, as a gang, than any greedy of the recent past. They just seem that way.

Why so? We have a whole new frame of reference. This fall’s sudden — and exhilarating — rise of the Occupy movement has helped us remember what we, as a society, had sadly forgotten: that decent, smart societies never let the few grab away rewards that ought to be shared among the many.

LIST FOLLOWS

xchrom

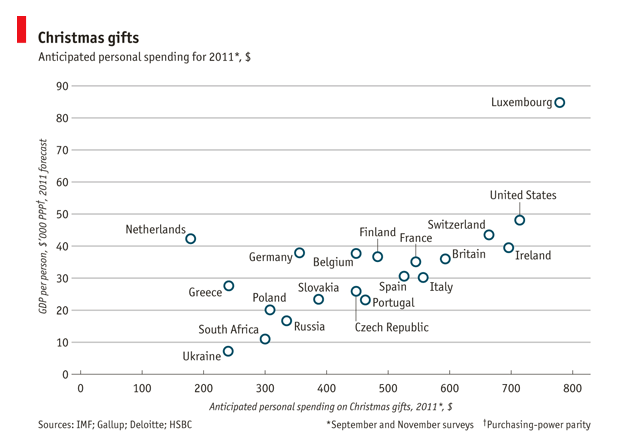

(108,903 posts)The world's most generous gift-givers? You won't be surprised to learn they live in Europe's richest country. With nearly $800 in Christmas spending per year, the folks from Luxembourg lead the world in yuletide shopping, followed by the United States, Ireland, Switzerland, and Britain, to round out the top five.

The relationship between GDP per person (graphed along the Y-axis) and Christmas spending is strong indeed, according to this graph prepared by the Economist.

As the guys from Freakonomics put it, the Netherlands holds up to its "austerity chic" stereotype. Four times richer than countries like South Africa and Ukraine, it somehow spends less per person on Christmas.