Economy

Related: About this forumDr. Housing Bubble 09/22/2014

Turning the nation into permanent renters: Stagnant household incomes and growing renter class strikes at core of home ownership.The summer selling season has now come to an official close. Not that it had much substance behind it. The sales volume has been wickedly low for all the hoopla being bandied about how great the housing market is doing. Much of the momentum from investor demand has started to wane significantly. At a certain point, the well does run dry and many investors were buying to turn units into rentals so local area incomes absolutely matter especially when prices increase so quickly that they put a damper on cap rates. Many flippers are looking for the next lemming to purchase their pig with lipstick. Crap shacks are selling for $700,000 and we are starting to see that some sellers are hitting a brick wall. Stepping back and looking at the bigger picture however, we find that we have slowly become a nation of renters since the housing bubble first popped back in 2007. Wild financing glossed over the fact that the middle class in the US has been steadily declining. Now that you have to actually show some real income, the numbers don’t look so great especially when you look at mortgage application volume. Census figures also show that we are definitely in a trend of adding more rental households versus people owning their homes. Until the trend reverses, we are seeing many areas become renter hubs.

Middle class shrinking

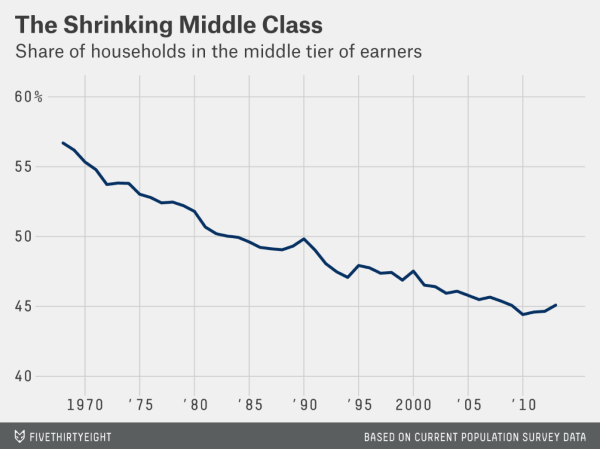

Probably the most obvious reason for the lack of demand on the home buying front from regular families stems from the shrinking of the middle class. This trend isn’t new. What is new however is that the easy financing years are long gone and this has taken a direct hit to regular family demand when it comes to buying homes, even with ultra-low interest rates.

Take a look at the trend here:

http://www.doctorhousingbubble.com/renter-households-rentals-home-ownership-rate-household-incomes/

DCBob

(24,689 posts)Maybe some hope things might get better.

jtuck004

(15,882 posts)the average went up. And since income has steadily dropped since then, and the number of people in poverty increased, there is no evidence of it getting better. The only real bright spot is builders making apartments for people in servitude. Bright for the builders, anyway.

Because of the plan today (and how it was shoved through is detailed, happily and proudly, in Timothy Geithner's book - and ridiculed to his face by voters on Jon Stewart's show in May of this year <lol>![]() there are 9 million loans underwater. A lot of the loans in the HARP program became ARMs, and when interest rates adjust we may well see millions more added to those numbers. And that doesn't count the hundreds of thousands of people who have spent down their 401Ks trying to make it until "hope" brought them relief, and they are almost finished as well, now surveying the cat food aisle.

there are 9 million loans underwater. A lot of the loans in the HARP program became ARMs, and when interest rates adjust we may well see millions more added to those numbers. And that doesn't count the hundreds of thousands of people who have spent down their 401Ks trying to make it until "hope" brought them relief, and they are almost finished as well, now surveying the cat food aisle.

Perhaps we should shelve "hope" and find people who actually make things happen. For the worker, not the thieving bankers.