Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 26 September 2014

[font size=3]STOCK MARKET WATCH, Friday, 26 September 2014[font color=black][/font]

SMW for 25 September 2014

AT THE CLOSING BELL ON 25 September 2014

[center][font color=red]

Dow Jones 16,945.80 -264.26 (-1.54%)

S&P 500 1,965.99 -32.31 (-1.62%)

Nasdaq 4,466.75 -88.47 (-1.94%)

[font color=green]10 Year 2.50% -0.03 (-1.19%)

30 Year 3.21% -0.03 (-0.93%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

http://news.msn.com/eric-holder-wants-his-legacy-to-be-punishing-bad-banks

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

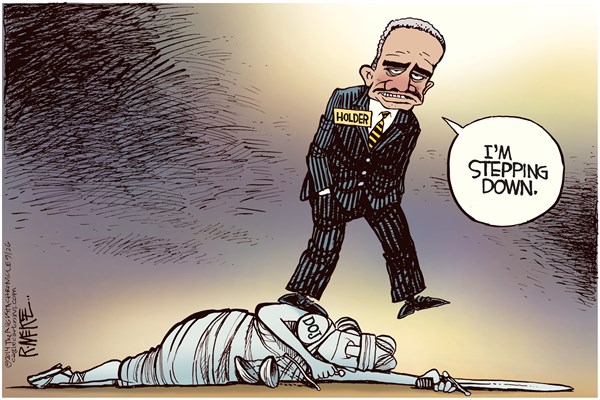

(18,167 posts)For the 'toon suggestion.

![]() indeed!

indeed!

DemReadingDU

(16,002 posts)the real truth...

9/25/14 The Blotch on Eric Holder’s Record: Wall Street Accountability

there is one area where Holder falls woefully short: prosecution of Wall Street firms and executives. He came into office just months after widespread fraud and malfeasance in the financial sector brought the American economy to its knees, and yet no executive has faced criminal prosecution. Beyond the crash, Holder established a disturbing pattern of allowing large financial institutions escape culpability.

“His record is really badly blemished by his nearly overwhelming failure to hold corporate criminals accountable,” said Robert Weissman, president of Public Citizen. “Five years later, we can say he did almost nothing to hold the perpetrators of the crisis accountable.”

Advocates for financial accountability often point to the Savings and Loan crisis as a counter-example: despite much smaller-scale fraud, 1,000 bankers were convicted in federal prosecutions and many went to prison.

Holder has tried to explain his lack of prosecutions relating to the 2008 collapse by claiming the cases were too hard to prove—but many experts disagree. The Sarbanes Oxley Act, for example, would provide a straightforward template: it makes it a crime for executives to sign inaccurate financial statements, and there is ample evidence that Wall Street CEOs were aware of the toxicity of the sub-prime mortgages sold by their firms.

Late last year, Judge Jed Rakoff of the Federal District Court of Manhattan wrote an essay in The New York Review of Books bluntly titled, “The Financial Crisis: Why Have No High-Level Executives Been Prosecuted?” He suggested a doctrine of “willful blindness” at Holder’s Justice Department and said “the department’s claim that proving intent in the financial crisis is particularly difficult may strike some as doubtful.” A federal judge will generally not proclaim people guilty outside the courtroom, but Rakoff came close with that statement. The fact he wrote the essay at all stunned many observers.

more...

http://www.thenation.com/blog/181763/blotch-eric-holders-record-wall-street-accountability?

Fuddnik

(8,846 posts)Those two incompetent corrupt maroons could bring the house down without even trying.

Demeter

(85,373 posts)InkAddict

(3,387 posts)Gonna tear out the tomatos this weekend - you're welcome to all the green ones - they don't squish, but are "major league" hard - Do you watch "The Strain." Love those vamps' tongues.

Warpy

(114,547 posts)It's covered in mold, squishy, and stinks out loud.

Tansy_Gold

(18,167 posts)InkAddict

(3,387 posts)three words.

Demeter

(85,373 posts)WHY AM I GETTING VISIONS OF JIMMY HOFFA?

http://www.bloomberg.com/news/2014-09-25/eric-holder-legacy-on-financial-crime-built-in-final-year.html

Attorney General Eric Holder spent the past year making up for lost time in an effort to hold banks accountable for their role in the 2008 financial crisis.

Under fire during his tenure for shying away from prosecuting the largest banks and their top executives, Holder since last fall has rolled out a series of multibillion-dollar penalties against financial institutions culminating with Bank of America (BAC) Corp.’s record $16.7 billion settlement last month.

“No attorney general has ever done anything of this magnitude in keeping the banks in check,” Maryland Attorney General Douglas Gansler, who worked on the Bank of America case, said in an interview.

MAYBE IT'S BS, NOT CEMENT....SEE TORTURED SUMMARIES OF HIS CAREER AT LINK

http://www.theguardian.com/money/us-money-blog/2014/sep/25/eric-holder-resign-mortgage-abuses-americans

US attorney general’s tenure has proven unhelpful to the five million victims of mortgage abuses in the US...The telling sentence in NPR’s report that US attorney general Eric Holder plans to step down once a successor is confirmed came near the end of the story.

“Friends and former colleagues say Holder has made no decisions about his next professional perch,” NPR writes, “but they say it would be no surprise if he returned to the law firm Covington & Burling, where he spent years representing corporate clients.”

A large chunk of Covington & Burling’s corporate clients are mega-banks like JP Morgan Chase, Wells Fargo, Citigroup and Bank of America. Lanny Breuer, who ran the criminal division for Holder’s Justice Department, already returned to work there....A MORE HONEST HISTORICAL ACCOUNT FOLLOWS

Eric Holder's Biggest Failure: Wall Street ruined the economy. Obama's AG let them off too easy.

http://www.newrepublic.com/article/119586/eric-holders-legacy-weak-record-prosecuting-wall-street

...Holder took over the Justice Department in 2009. It was at a time of national crisis, with the economy cratering and millions of Americans out of work. His job was not, of course, to rebuild the economy. It was to hold accountable those who caused the crisis. On that, he has fallen woefully short: Criminal prosecutions of financial crimes have been rare under Holder’s DOJ, and it will have consequences for years to come...

The DOJ’s prosecution of high-level executives has been even worse than its prosecution of banks. In fact, the department has prosecuted zero executives for those crimes. One way to convict Wall Street executives is to flip low-level bankers, as the DOJ is now doing for crimes manipulating foreign exchange markets. But that tactic has not been used to prosecute crimes after the financial crisis.

Prosecuting bankers would show the public that regulators are committed to finding and punishing financial fraud. More importantly, it would deter Wall Street from committing those same crimes again. The possibility of going to prison could deter bankers from doctoring loan forms or using fraudulent accounting practices. Instead, many top-level executives walked away with golden parachutes and are living nicely despite their crimes. What’s going to deter the newest Wall Street execs from making the same choices?

Prosecuting the banks with their well-funded legal teams for criminal crimes wouldn't have been easy. But the DOJ has a lot of legal firepower as well. Holder simply never tried to use it to hold Wall Street executives accountable. That is a major blemish on Holder’s record. Bankers sleep easier at night thanks to his decisions. And when the next financial crisis hits—and when we discover that financial fraud was a major cause of it—Holder will deserve blame as well.

InkAddict

(3,387 posts)Don't know about BS, bu the kitteh poo dries like concrete, though the Chinese foo doggie (new Shih Tzu pup) still thinks it tastes like Pecan Sandies. Go figure.

DemReadingDU

(16,002 posts)Bumpy!

.

.

But 2008 Wall Street crisis was the big one that got away for Holder, whose Justice Department never engineered a reckoning for any individuals responsible for the financial collapse. That's still a source of anger for many — including former congressional aide Jeff Connaughton. "Did the department ever organize a timely, purposeful, concerted investigation of Wall Street executives?" Connaughton asks. "The answer is no."

Charles Ferguson, whose documentary on the mortgage meltdown won an Academy Award in 2011, used his turn at the awards ceremony to make this point. "I must start by pointing out that three years after a horrific financial crisis caused by massive fraud, not a single financial executive has gone to jail," Ferguson said. "And that's wrong."

Eventually Holder started paying more attention — asking more questions — and demanding the mortgage team meet every two weeks for updates. And the Department of Justice did rack up huge monetary settlements from major firms — including Bank of America, JP Morgan and Citigroup. But no individual executive got prison time.

more...

http://www.npr.org/2014/09/26/351559552/despite-a-bumpy-tenure-holder-had-a-broad-impact

InkAddict

(3,387 posts)Like a bridge over tiny Sinkholes, I will lay me down. Pleasant dreams, Holder, NOT!

Demeter

(85,373 posts)Goldman Sachs responds to accusations that Libya's sovereign wealth fund was cheated out of more than $1bn during the Gaddafi era.

The Telegraph reports that Goldman Sachs has hit back at allegations that the Wall Street giant duped Libya’s $60bn sovereign wealth fund into trades that lost the country vast sums of money while making the bank hundreds of millions in profits.

In court documents, Goldman denied that the Libyan Investment Authority (LIA) had been 'financially illiterate' when entering into trades that proved worthless, and rejected claims that its bankers had cosied up to LIA officials. It is also claiming unspecified damages against the LIA.

The LIA is gearing up for separate London court battles against Goldman and the French bank Societe Generale, claiming they raked in huge fees and abused the fund’s trust during the Muammar Gaddafi era.

MORE:

Goldman Sachs hits back against Libyan claims

Goldman Sachs has hit back at allegations that the Wall Street giant duped Libya’s $60bn sovereign wealth fund into trades that lost the country vast sums of money while making the bank hundreds of millions in profits.

In court documents filed this week, Goldman denied that the Libyan Investment Authority (LIA) had been “financially illiterate” when entering into trades that proved worthless, and rejected claims that its bankers had cosied up to LIA officials. It is also claiming unspecified damages against the LIA.

The LIA is gearing up for separate London court battles against Goldman and the French bank Societe Generale, claiming they raked in huge fees and abused the fund’s trust during the Muammar Gaddafi era.

The LIA, created in the mid-2000s as the West gradually lifted sanctions on Gaddafi’s Libya, planned to grow to a $100bn wealth fund, but lost billions in trades executed by the banks when the financial crisis struck...A $1.2bn investment in derivatives linked to the share prices of major banks and energy firms made by Goldman on the LIA’s behalf became almost worthless in 2008 as stock markets crashed around the world. The bank is said to have made a $350m profit on the deal...

Demeter

(85,373 posts)The Federal Reserve and its bullion bank agents (JP Morgan, Scotia, and HSBC) have been using naked short-selling to drive down the price of gold since September 2011. The latest containment effort began in mid-July of this year, after gold had moved higher in price from the beginning of June and was threatening to take out key technical levels, which would have triggered a flood of buying from hedge funds.

The Fed and its agents rig the gold price in the New York Comex futures (paper gold) market. The bullion banks have the ability to print an unlimited supply of gold contracts which are sold in large volumes at times when Comex activity is light.

Generally, on the other side of the trade the buyers of contracts are large hedge funds and other speculators, who use the contracts to speculate on the direction of the gold price. The hedge funds and speculators have no interest in acquiring physical gold and settle their bets in cash, which makes it possible for the bullion banks to sell claims to gold that they cannot back with physical metal. Contracts sold without underlying gold to back them are called “uncovered contracts” or “naked shorts.” It is illegal to engage in naked shorting in the stock and bond markets, but it is permitted in the gold futures market.

The fact that the price of gold is determined in a futures market in which paper claims to gold are traded merely to speculate on price means that the Fed and its bank agents can suppress the price of gold even though demand for physical gold is rising. If there were strict requirements that gold shorts could not be naked and had to be backed by the seller’s possession of physical gold represented by the futures contract, the Federal Reserve and its agents would be unable to control the price of gold, and the gold price would be much higher than it is now...The bullion banks do not have nearly enough gold in their possession to make deliveries to the buyers if the buyers decide to stand for delivery per the terms of the paper gold contract. The reason this scheme works is because the majority of the buyers of the contracts are speculators, not gold purchasers, and never demand delivery of the gold. Instead, they settle the contracts in cash. They are looking for short-term trading profits, not for a gold hedge against currency inflation. If a majority of the longs (the purchasers of the contracts) required delivery of the gold, the regulators would not tolerate the extent to which gold is shorted with uncovered contracts.

In our opinion, the manipulation is illegal, because it is insider trading...

MORE

Crewleader

(17,005 posts)Last edited Thu Sep 25, 2014, 08:39 PM - Edit history (1)

Eric Holder Wants His Legacy to Be Punishing Bad BanksHolder Steps Down

Holder Resigns

DemReadingDU

(16,002 posts)Anyone see a toon like this?

Eric holder stepping down, and banksters with big smiles holding their loot

Crewleader

(17,005 posts)

Demeter

(85,373 posts)YVES: I’m a day late to get to a revealing Financial Times comment by Edward Luce, who has among other things served as Larry Summers’ speechwriter. Luce has written important articles on politics (for instance, being one of the first prominent writers to finger how Obama was served poorly by his undue reliance on a handful of long-established retainers like Valerie Jarret and David Axelrod). However, his close connections to Washington insiders means his economics pieces are too often reflections of thinking inside America’s Versailles, as opposed to real world conditions.

Luce’s latest article is a bizarre combination of a solid description of the symptoms of economic pathology and an executive-exclupating, demonstrably erroneous diagnosis.

The Financial Times columnist describes how much firepower major corporations are devoting to propping up their stock prices. Mind you, this is hardly news to anyone who has been paying attention, but it is still useful to have a current reading. From his article:

But the impact is much broader than that. According to William Lazonick, a scholar at the University of Massachusetts Lowell, seven of the top 10 largest share repurchasers spent more on buybacks and dividends than their entire net income between 2003 and 2012. In the case of Hewlett-Packard, which spent $73bn, it was almost double its profits. For ExxonMobil, which came top with $287bn in buybacks and dividends, it amounted to 83 per cent of net income. Others, such as Microsoft (125 per cent), Cisco (121 per cent) and Intel (109 per cent) were even more extravagant. In total, the top 449 companies in the S&P 500 spent $2.4tn – or more than half their profits – on buybacks in those years. They spent almost the same again in dividend payouts. Taken together, they came to 91 per cent of net income.

Yves here. This section is solid, well argued, and suitably urgent.

But then having fingered the real driver of this trend in passing, lousy incentives created by equity linked pay, Luce succeeds in walking that back by spending the bulk of his piece justifying looting lite by US executives. At the very top of the article, he stresses the need to keep share prices up to fend off hostile takeovers. Huh? CEO profit handsomely from losing to an acquisition bid, whether the seriously endangered hostile species or the prevalent faux-friendly type, thanks to golden parachutes. And most deposed CEOs can at a minimum look forward to a lucrative afterlife on big corporate boards, with even the lousy ones having a decent shot landing a new CEO assignment (witness how one of America’s famously bad corporate chieftans, Robert Nardelli, was picked up by Cerberus).

But the big canard that dominates the piece is that US companies don’t have decent investment opportunities. The evidence for that claim? Larry Summers’ “secular stagnation” talk, which was long on intuition and short on evidence. In fact, it is well documented that corporations have become so short term in their orientation that they have been underinvesting for nearly a decade. Yours truly wrote about that syndrome in 2005 in the Conference Board Review and updated the argument in a 2010 New York Times op-ed with Robert Parenteau. That is not to suggest that Luce could have or should have known of our work, merely that the drivers of the corporate profits have been cost-savings because they are easy to achieve, easy to explain to investors, and thus low risk. But they result in systematic, slow liquidation as companies chronically underinvest. Had Luce done his homework, he could have readily found ample, rigorous proof that companies are choosing to underinvest, and not that they are plagued with dearth of good options. For instance, the widely respected Andrew Haldane of the Bank of England determined that companies are using overly high discount rates when assessing possible investments.

To translate that out of economics-speak, that means they are seeking unreasonably high returns. Overly high return targets = underinvestment. QED. His conclusion: “Capital markets myopia is real.” Haldane further demonstrated that these excessively high return targets penalized long-term projects, which are often the ones that produce the greatest payoffs and spillover benefits

MORE

*******************************************************************

By Roy Poses, MD, Clinical Associate Professor of Medicine at Brown University, and the President of FIRM – the Foundation for Integrity and Responsibility in Medicine. Cross posted from the Health Care Renewal website

Appearing during the last few weeks were a series of articles that tied the decline of the US economy to huge systemic problems with leadership and governance of large organizations. While the articles were not focused on health care, they included some health care relevant examples, and were clearly applicable to health care as part of the larger political, social, and economic system. The articles reiterated concerns we have expressed, about leadership of health care by generic managers, perverse executive compensation, the financialization of health care, in part enabled by regulatory capture, and the abandonment by effective stewardship by boards of directors, but with new takes on them.

The articles included “Profits Without Prosperity,” by William Lazonick in the the Harvard Business Review, “Why Have US Companies Become Such Skinflints,” by Paul Roberts in the Los Angeles Times, and “How Business Leaders Turned Into Vampires,” by Steve Denning in Forbes, which in turn was partially based on “The Rise (and Likely Fall) of the Talent Economy,” in the Harvard Business Review.

Let me summarize the main points, and discuss some health care examples.

Steve Denning’s article contrasted people who add value to the economy versus those who extract value. The first species of value extractor he listed was:

‘Super-managers’ are people who hold administrative positions in the C-suite of private-sector bureaucracies but are masquerading as entrepreneurs. They are, to use Thomas Piketty’s slyly ironic term, “super-managers.” As such, they have been able to extract extraordinary levels of compensation. They have been lavished with stock and stock options and have been able to ‘manage’ the share price of their firms with massive share buybacks and other financial engineering so that they receive massive bonuses. As Bill Lazonick documented in the September 2014 issue of HBR, the net effect of their activities is to extract value, rather than create value [see below].

Presumably, “super-managers” as health care executives are also likely to be generic managers, unlikely to have much actual knowledge of caring for patients, unsympathetic to the values of health care professionals, and hence unlikely to uphold the health care mission.

He noted that

there is a tendency to dismiss the activities of ‘vampire talent’ as de minimis. ‘That’s capitalism, right? Every man for himself. It’s no big deal if there’s an occasional bad apple in the barrel. The ‘invisible hand’ of capitalism will make everything come out right for society in the end.’

However,

The problem today is that the super-sized executive compensation, the gambling and the toll-keeping of the financial sector aren’t tiny sideshows. They have grown exponentially and are now macro-economic in scale. They have become almost the main game of the financial sector and the main driver of executive behavior in big business. When money becomes the end, not the means, then the result is what analyst Gautam Mukunda calls ‘excessive financialization‘ of the economy, in his article, ‘The Price of Wall Street Power,’ in the June 2014 issue of Harvard Business Review.

Mr Denning further asserted that the value extraction of super-managers is augmented by the value extraction of two different groups of players, hedge funds that speculate with other peoples’ money, and “tollkeepers” who extract rents through the financial system.

Furthermore, Mr Denning stated that

The growth of super-sized executive compensation is inversely related to performance. The super-managers are in effect being rewarded for doing the wrong thing.

Of course, if executives in health care, like those in other sectors, are mainly concerned with enriching themselves in the short-term, than they are not mainly concerned with patients’ and the public’s health, or the values of health care professionals, and hence the performance of their organizations in terms of health care processes and outcomes will suffer.

Furthermore, the ability of commercial health care firms to actually make a positive impact on health care will be decreased as they are whipsawed by other value extractors like hedge funds and tollkeepers.

Example – Renaissance Technologies

Mr Denning’s first example of tollkeepers’ value extraction was:

James Simons, the founder of Renaissance Technologies, ranks fourth on Institutional Investor’s Alpha list of top hedge fund earners for 2013, with $2.2 billion in compensation. He consistently earns at that level by using sophisticated algorithms and servers hardwired to the NYSE servers to take advantage of tiny arbitrage opportunities faster than anybody else. For Renaissance, five minutes is a long holding period for a share.

In fact, as we noted here, Renaissance Technologies does not hesitate in trading health care firms. Furthermore, that company has a noteworthy direct tie to health care. Its current co-CEO, Peter F Brown, is married to the current Commissioner of the US Food and Drug Administration (FDA).

William Lazonick’s article also emphasized how corporate leadership is now focused on extracting value from their companies for their own personal benefit, rather than promoting growth, innovation, better products and services, etc. In particular, large public for-profit companies now tend to use their surplus capital to buy back shares of their own stock, rather than invest in new facilities, equipment, employees, etc. Perhaps we should not be surprised that this was facilitated by changes in US government regulation, that is deregulation, in this case instituted during the Reagan administration:

Companies have been allowed to repurchase their shares on the open market with virtually no regulatory limits since 1982, when the SEC instituted Rule 10b – 18 of the Securities Exchange Act.

Note that

The rule was a major departure from the agency’s original mandate, laid out in the Securities Exchange Act of 1934. The act was a reaction to a host of unscrupulous activities that had fueled speculation in the Roaring ’20′s, leading to the stock market crash of 1929 and the Great Depression.

Given the context, and that the deregulation was implemented by an SEC chair who was “the first Wall Street insider to lead the commission,” this seems to be an example of regulatory capture in service of corporate insiders.

The issue here is that while it might make some financial sense for companies to buy back their own shares if they are priced at bargain rates, after this change they could buy shares at any price without supervision. On one hand, such purchases could lead to short-term bumps in stock prices. On the other hand, a major reason for these buybacks appears to be that they enrich corporate insiders, particularly top hired executives, who now receive much of their pay in the form of stock and stock options, and often can get bonuses based on short-term increases in stock prices. Lazonick wrote,

Combined with pressure from Wall Street, stock-based incentives make senior executives extremely motivated to do buybacks on a colossal and systemic scale.

Consider the 10 largest repurchasers, which spent a combined $859 billion on buybacks, an amount equal to 68% of their combined net income, from 2003 through 2012. (See the exhibit “The Top 10 Stock Repurchasers.”) During the same decade, their CEOs received, on average, a total of $168 million each in compensation. On average, 34% of their compensation was in the form of stock options and 24% in stock awards. At these companies the next four highest-paid senior executives each received, on average, $77 million in compensation during the 10 years—27% of it in stock options and 29% in stock awards. Yet since 2003 only three of the 10 largest repurchasers—Exxon Mobil, IBM, and Procter & Gamble—have outperformed the S&P 500 Index.

Example – Pfizer

Mr Lazonick’s noted some potential outcomes of the frenzy of stock buybacks affecting the US pharmaceutical industry and hence the US health care system.

In response to complaints that U.S. drug prices are at least twice those in any other country, Pfizer and other U.S. pharmaceutical companies have argued that the profits from these high prices—enabled by a generous intellectual-property regime and lax price regulation— permit more R&D to be done in the United States than elsewhere. Yet from 2003 through 2012, Pfizer funneled an amount equal to 71% of its profits into buybacks, and an amount equal to 75% of its profits into dividends. In other words, it spent more on buybacks and dividends than it earned and tapped its capital reserves to help fund them. The reality is, Americans pay high drug prices so that major pharmaceutical companies can boost their stock prices and pad executive pay.

Moreover, during approximately the same period Pfizer compiled an amazing record of legal misadventures including settlements of allegations of unethical behavior, and some convictions, including one for being a racketeering influenced corrupt organization (RICO), as most recently reviewed here, and then updated here. So while it was putting huge amounts into buybacks, it also put billions into legal fines and costs. This suggests that note only does executive compensation not correlate with “performance,” it may also correlate with corporate bad behavior.

The “Shareholder Value” Dogma

In explaining how US corporate executives turned to stock buybacks to boost their own pay, at the expense of essentially everyone else, Mr Lazonick sounded some familiar themes. One was focus on short-term revenues and short-term stock performance drive by the “share-holder value” dogma out of business schools,

the notion that the CEO’s main obligation is to shareholders. It’s based on a misconception of the shareholders’ role in the modem corporation. The philosophical justification for giving them all excess corporate profits is that they are best positioned to allocate resources because they have the most interest in ensuring that capital generates the highest returns. This proposition is central to the ‘maximizing shareholder value” (MSV) arguments espoused over the years, most notably by Michael C. Jensen. The MSV school also posits that companies’ so-called free cash flow should be distributed to shareholders because only they make investments without a guaranteed return — and hence bear risk.

But the MSV school ignores other participants in the economy who bear risk by investing without a guaranteed return. Taxpayers take on such risk through government agencies that invest in infrastructure and knowledge creation. And workers take it on by investing in the development of their capabilities at the firms that employ them. As risk bearers, taxpayers, whose dollars support business enterprises, and workers, whose efforts generate productivity improvements, have claims on profits that are at least as strong as the shareholders’.

Mr Denning similarly noted

Nor will change happen merely by pointing out that shareholder primacy is a very bad idea. Bad ideas don’t die just because they are bad. They hang around until a consensus forms around another idea that is better.

Mr Roberts’ article “Why Have US Companies Become Such Skinflints,” went at this issue from a slightly different angle, noting first

He attributed this to the notion promulgated by

conservative economists, [that] the best way for companies to help society was to ditch the idea of corporate social obligation and let business do what business does best: maximize profits.

He noted that this focus on short-term revenues has led to the decline in long-term results,

But because management is so focused on share price and because share price depends heavily on current company earnings, strategic focus has grown ever more short term: do whatever is needed to hit next quarter’s earnings target. And since cost-cutting is a quick way to boost near-term earnings, layoffs and other downsizing once regarded as emergency measures are now routine.

And here is the paradox. Companies are so obsessed with short-term performance that they are undermining their long-term self-interest. Employees have been demoralized by constant cutbacks. Investment in equipment upgrades, worker training and research — all essential to long-term profitability and competitiveness — is falling.

Of course, this is antithetical to the “innovation” that current corporate boosters proclaim as the goal of drug, biotechnology, medical device companies and other players in the brave new world of corporate health care.

The Incestuous Mechanisms Used to Set Executive Compensation

Another explanation for the rise in value extraction, and specifically the use of share buybacks to reward top corporate hired executives, was the incestuous way in which corporations set pay for top hired executives. Mr Lazonick wrote,

This is enabled by boards of directors who seem to represent the ‘CEO union,’ not stockholders, and certainly not other less favored employees, customers, clients or patients, or society at large,

Boards are currently dominated by other CEOs, who have a strong bias toward ratifying higher pay packages for their peers. When approving enormous distributions to shareholders and stock-based pay for top executives, these directors believe they’re acting in the interests of shareholders.

Once again, this was also enabled by the dergulation that started with during the Reagan administration, and continues this day (although the specific relevant deregulatory change occurred during the Clinton administration),

In 1991 the SEC began allowing top executives to keep the gains from immediately selling stock acquired from options. Previously, they had to hold the stock for six months or give up any ‘short-swing’ gains. That decision has only served to reinforce top executives’ overriding personal interest in boosting stock prices. And because corporations aren’t required to disclose daily buyback activity, it gives executives the opportunity to trade, undetected, on inside information about when buybacks are being done.

Summary

Note that while all the discussion above has been about for-profit corporations, we have seen that in health care, various non-profit organizations, particularly hospitals, hospital systems, academic medical institutions, and health insurers, which all now operate in the current market fundamentalist environment, are acting more and more like for-profits. So while non-profit corporate executives cannot do stock buybacks, they are also all too often generic managers, given huge compensation, but not often for upholding the mission, putting patients’ and the public’s health first, or upholding health care professionals’ values.

It is striking that we are beginning to see protests like those above not in radical publications, but in the Harvard Business Review and Forbes. It is more striking that these protestors are beginning to fear the worst. Mr Roberts wrote,

Sooner or later, markets punish such myopic behavior. Companies that neglect innovation run out of things to sell. Companies that demoralize workers see performance lag.

Although Mr Denning hopefully wrote,

He then warned,

As usual with anagnorisis and the shock of recognition at a disturbing, previously-hidden truth, there is a disquieting sense that the accepted coordinates of knowledge have somehow gone awry and the universe has come out of whack. This can lead to denial and a delay in action, even though the facts are staring us in the face.

If the recognition of our error comes too late, as in Shakespeare’s Lear, the result will be terrible tragedy. If the recognition comes soon enough, the drama can still have a happy ending. We are about to find out in our case which it is to be.

Let us hope that anagnorisis is really beginning, the anechoic effect is fading, and the drama may yet have a happy ending.

Hugin

(37,750 posts)Thanks for posting.

Demeter

(85,373 posts)DemReadingDU

(16,002 posts)"If the recognition of our error comes too late, as in Shakespeare’s Lear, the result will be terrible tragedy. If the recognition comes soon enough, the drama can still have a happy ending. We are about to find out in our case which it is to be."

Demeter

(85,373 posts)Bank lending to private euro zone businesses needs to grow at a 3 percent annual rate on a sustained basis in order to stir inflation, according a Reuters poll of economists who say that is not likely to happen.

In the latest monthly survey on European Central Bank policy taken Sept. 22-24, forecasters were also skeptical over whether the bank's latest offer of hundreds of billions of cheap cash in exchange for lending will even work.

The consensus forecast is that banks will take up 175 billion euros at the next tender in December, which would take the total from two tenders to about 140 billion euros short of the 400 billion the ECB has put on offer.

That echoes views from money market traders polled earlier this week and suggests that bank lending, which has been contracting for years and at last measure fell by 1.6 percent on an annual basis, is weak because of insufficient demand, not supply...

NO KIDDING! MORE IRONY AT LINK

DemReadingDU

(16,002 posts)9/26/14 Former Fed Bank Examiner Says Secret Tapes Show Fed Leniency

The Federal Reserve is among the most powerful institutions in the nation and also among the more private. But new audio tapes secretly recorded by a former employee provide a rare look into meetings involving officials from the Federal Reserve Bank of New York.

In them, you hear officials considering how to oversee Goldman Sachs, and specifically, they discuss a financial transaction that one official describes as "legal but shady."

The recordings were made in 2012 by Carmen Segarra, who at the time was a New York Fed bank examiner, charged with making sure banks followed the rules. She felt the Fed was going too easy on a powerful and very well-connected investment bank. She was later fired. She sued the Fed, which made some news.

Segarra recorded 46 hours of meetings using a small audio recorder on a key chain. She gave those recordings to Jake Bernstein, an investigative reporter from ProPublica, and to the public radio program, This American Life.

The concern being raised by the recordings, Bernstein tells NPR's Steve Inskeep, is that regulators may be too cozy with the banks they oversee.

"These are people who work inside the banks. They see these people every day, and they need to obtain the information from these banks, and it's easier to obtain the information if you're friendly and if you have a good relationship, but sometimes that can slide to deference," Bernstein says.

Goldman Sachs says that the concerns raised in Segarra's examination were off base.

audio at link, appx 9 minutes

http://www.npr.org/2014/09/26/351520037/former-fed-bank-examiner-says-secret-tapes-show-fed-leniency

This American Life - Listen now or download the podcast...

The Secret Recordings of Carmen Segarra

This week, an unprecedented look inside one of the most powerful, secretive institutions in the country. The NY Federal Reserve is supposed to monitor big banks and prevent another financial crisis. But when Carmen Segarra was hired, what she witnessed inside the Fed was so alarming that she bought a tiny recorder, and started secretly taping. ProPublica reports.

appx 1 hour

http://www.thisamericanlife.org/radio-archives/episode/536/the-secret-recordings-of-carmen-segarra

Demeter

(85,373 posts)Just the fact that she thought to record it indicates how bad it truly must be...

Demeter

(85,373 posts)In a mere four months, the SEC has gone from calling out widespread abuses in the private equity industry to not just walking back its detailed criticisms, but actually enabling a coverup.

Readers may recall that in May, SEC inspection chief Andrew Bowden gave what was by regulatory standards a blistering speech describing widespread misconduct in the private equity industry. His detailed account followed SEC Chairman Mary Jo White setting forth uncharacteristically clear-cut details of private equity abuses in testimony to Congress.

Bowden was specific about the extent of the abuses by general partners, which included what amounts to theft, as in taking funds they weren’t entitled to. Bowden categorically stated that the bad acts implicated over half the firms they’d examined. Moreover, he described in considerable detail the types of grifting they’d found so far. Privately, the SEC has made clear that the abuses weren’t concentrated at small fry but were across the spectrum of firms, including the very top players... a careful reading of Bowden’s recent remarks indicate that the SEC isn’t merely retreating from its earlier bold talk. It appears to be actively enabling a massive coverup of these abuses. Mind you, this is even worse than the SEC’s limp-wristed enforcement of financial-crisis-related misconduct against the too-big-to-fail banks.

The real message is that private equity is too powerful to discipline.

DETAILS AT LINK

IT REALLY SOUNDS LIKE THE TITANIC IS GOING DOWN

Demeter

(85,373 posts)The present global financial ‘crisis’ began in 2007-8. It is not nearly over. And that simple fact is a problem. Not because of the life-choking misery it inflicts on the lives of millions who had no part in its creation, but because the chances of another crisis beginning before this one ends, is increasing. What ‘tools’ - those famous tools the central bankers are always telling us they have – will our dear leaders use to tackle a new crisis when all those tools are already being used to little or no positive effect on this one?

I think it is worth remembering how many financial crises we have had since the economy became globally interconnected and since we began the deregulation of finance and the roll back of all Great Depression safeguards under Reagan and Clinton. It’s also worth noticing that the causes and pattern of the various crises have an unpleasant ring of familiarity about them – as in – the bank lobbyists making sure nothing gets learned and nothing gets changed.

In the 80′s there were four financial crises: The Latin American crisis caused by those countries borrowing and the global banks agreeing to lend them far too much (too much lending to people who couldn’t afford it – check), the American Savings and Loan (S&L) crisis when American S&L’s made too many bad, long-term and leveraged loans relying on rolling over and over short-term loans to fund it all (reliance on short-term liquidity to cover massive loan books of dodgy loans – check) , and the 1987 Stock market crash when the system of global debt had its first major modern global paroxysm (systemic contagion – check) . And before the dust had even settled from that we had the Junk Bond collapse ( Too much junk – check. $400 billion in junk bonds were issued in 2013 alone). In the 90s there were two more crises (if one ignores the Mexican currency devaluation): The Asia currency crisis (a replay of the Latin Crisis with the same global banks doing the same lending to different corrupt or stupid leaders who agreed to loans on behalf of people who couldn’t afford to pay back – ie nothing learned at all - check) and the Dot Com bubble (valuations way above reality fueled by cheap money and lax lending – check). I think that’s most of the kinds of greed fueled idiocy accounted for.

If you line up the S&L, the Junk Bond and the Dot Com bubble, America has had a major home-brewed financial crisis every ten years. If you consider that none of these events happened in isolation nor limited their effects to the country of origin then we have to conclude that the global financial system is prone to crises. You can, if you see the world through resolutely libertarian glasses, blame everything on interfering governments – it matters little. The fact remains that the system as is, is unstable and run by the myopic, the greedy and the corrupt. Where they draw their salary, which side of the revolving door they happen to be on, on any day seems to me irrelevant. The worst of them don’t understand and are easily bought. The best have no concern for anyone or anything beyond their next bonus.

And here we are being led by them.

***********************************

The first thing we should bear in mind is that however it starts, the next crisis will be another debt-crisis like the current one. This is because debt is now the global currency and global financing mechanism. Once it starts, however, one thing will be very different from the last time – this time nearly all nations are already heavily indebted. Last time they were not. And this is what changes everything for the over-class.

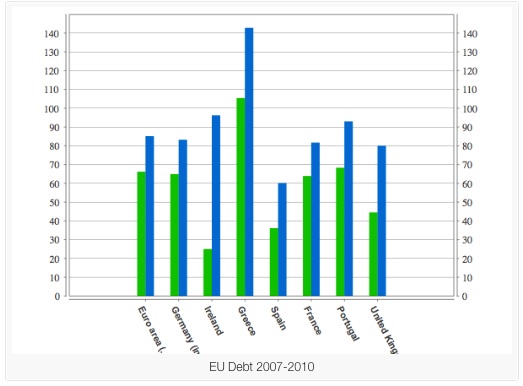

Contrary to the endless misinformation repeated at every juncture by austerity politicians and bankers alike, the debt load of most nations at the beginning of the present crisis was not already out of control before the banks blew up.

The green bars are debt as percentage of GDP before the bank bail outs and the blue bars are after. These are official Eurostat figures. Notice Ireland. Its debt to GDP was down at 27%. The ONLY thing that altered between 2007 and 2010 was the bank bails outs. Ireland’s ENTIRE debt problem is due to bailing out private banks and their bond holders. Britain’s debt almost doubled and again the ONLY thing that happened was bailing out the banks. The government claims that UK public debt was out of control due to spending on public services is just WRONG. UK government debt against GDP had not gone up in 7 years. Then when we bailed out the banks it nearly doubled. That is the fact as opposed to the propaganda of what happened and why.

If you look a little more closely into the figures for government debt levels in Europe between 2000 and 2010 the fact is that all European nations apart from Portugal were either reducing their debt-to-GDP level or at least not allowing it to grow. Most of Europe was reducing government debt to quite manageable and historically low levels. Ireland’s debt was very low (27%). Take a good long look at those two bars for Ireland. Even Spain was bringing in more in tax than it was spending. Don’t take my word for it look at the figures yourself. Almost every European country was keeping debt to GDP even or going down – before the banks were bailed out that is. The exceptions, of course, were Greece and Italy whose debt was already very high even before they bailed out their banks.

The sudden explosion of European sovereign debt is the direct and indisputable result of all our political parties deciding they would safeguard their mates’ and their own personal wealth (it is the top 10% who hold the bulk of their wealth in the financial products which would be destroyed in a bank collapse. NOT the rest of us!) by bailing out the private banks and piling their unpaid debts on to the public purse... this crisis is no longer primarily financial; it is now political...

Demeter

(85,373 posts)...In Part One I suggested that not only are the 1% well aware of this but that while they have been telling us how we must ‘save’ the present system and assuring us that any radical break with the policies of the past will result in catastrophe, they have in fact been working hard to engineer very radical changes. We have all seen the decline in living standards and are all acutely aware of the changes which directly effect us. But I wonder if the true significance of the changes, when taken together, has largely gone unnoticed? Certainly the Over Class has not made clear their real intentions. Why would they? I believe the 1% know that to protect their wealth and power next time will require radical political dismantling of what is left of our democracy. Necessarily much of what follows is speculative. But the speculation is, I think, rooted in and extrapolated from what we can already see happening today...

As I have been writing this article it has grown, each section getting longer. I’m afraid I sometimes find it difficult to know where the sweet point is between, on the one hand – being too dense, and on the other – over explaining. So here is a outline of the sections so that you can see where I’m going and skip the sections that seem obvious.

Outline.

1) The Over Class must retain and consolidate their control over the global system of debt.

2) The power to regulate must be taken from nations and effectively controlled by corporations.

3) Professionalize governance. Democracy can be and must be neutered, and an effective way of doing this is to insist that amateur, elected officials MUST take the advice of professional (read corporate) advisors. Expand current law to enforce this.

4) The financial system badly needs un-encumbered ‘assets’ to feed the debt issuing system. A new way must be found to prise sovereign assets from public ownership. Such a new way is suggested.

5) In order to facilitate the political changes necessary, the public mind-set must be changed. National Treasures such as the NHS in Britain must be re-branded as evil State Monopolies.

6) Effective ways must be found to convince people that democratic rule is no longer sufficient to protect them.

7) An alternative to Democracy must be introduced and praised. That alternative must be the Rule of International Law as written and controlled by the lawyers of the 1%. People must be told that this is all that stands between them and an increasingly hostile and anarchic world. But that it can only keep them safe if it has absolute authority over democracy. People must voluntarily bow to it out of fear and its decisions must be as absolute and unquestionable.

In conclusion, I suggest that this amounts to a dystopian version of the old environmentalist idea of Spaceship Earth. A corporate version where we are just passengers who must pay our passage in a ship someone else owns. No longer inhabitants or citizens with the same inalienable right to be there and be heard as anyone else.

And yet, dark as all this may seem, victory for the 1% depends on no one understanding what is happening. If we are already beginning to see the outlines of what the Over Class wants, then their victory is not assured. If our ignorance is their bliss, then our understanding is like sunlight on a vampire’s skin.

All is not lost, not by a bloody long way...

SEE LINK FOR DETAILS

DemReadingDU

(16,002 posts)Part 3 coming soon

Demeter

(85,373 posts)specifically, the struggle of Labor to constrain Predatory Capitalists. This is a sort of Labor Day from the backside of the cloth...showing how the patterns emerged from the different colored strands of yarn.

Union songs, protest songs, etc will be our theme. Be there or be square!

DemReadingDU

(16,002 posts)xchrom

(108,903 posts)As the West grapples with the increasing reach of ISIS on home soil and as random and planned acts of terrorism continue to develop, the Islamic world is not siting idly by.

Earlier this week in his speech before the United Nations, President Obama signaled out the leadership being offered by a group of Muslim Clerics lead by Shaykh Abdallah bin Bayyah. This group, known as the Forum for Promoting Peace in Muslim Societies, issued a very powerful Fatwā* in opposition to the actions of ISIS and as a warning to young Muslims who may be attracted to it’s cause.

Entitled “This is Not the Path to Paradise, Response to ISIS”, the fatwā highlights that ISIS actions are against the tenets of Islam.

This is addressed to the young men who bear arms against their own nations and destroy both country and countrymen. You have abandoned all values and made enemies of the world. We call on you to pause, reflect, and heed this counsel for the sake of all who want good for our community.

It then offers 4 quotes from Islamic teachings before continuing with “A Statement to the Muslim World and its Leaders” reminding them to “Remember and Consider the Question Why?”

Read more: http://www.businessinsider.com.au/one-of-the-worlds-most-influential-sheiks-has-issued-a-fatwa-against-isis-2014-9#ixzz3EQ5tAqMF

Demeter

(85,373 posts)The people in the Middle East have nothing left to lose.

That's the definition of freedom, according to Clint Eastwood who got it from Kris Kristofferson...

That's the definition of revolution:

“The most important kind of freedom is to be what you really are. You trade in your reality for a role. You trade in your sense for an act. You give up your ability to feel, and in exchange, put on a mask. There can't be any large-scale revolution until there's a personal revolution, on an individual level. It's got to happen inside first.”

― Jim Morrison

“Better to die fighting for freedom then be a prisoner all the days of your life.”

― Bob Marley

“The first duty of a man is to think for himself”

― José Martí

“Remember, remember always, that all of us, and you and I especially, are descended from immigrants and revolutionists.”

― Franklin D. Roosevelt

“The people cannot be all, and always, well informed. The part which is wrong will be discontented, in proportion to the importance of the facts they misconceive. If they remain quiet under such misconceptions, it is lethargy, the forerunner of death to the public liberty. ... What country before ever existed a century and half without a rebellion? And what country can preserve its liberties if their rulers are not warned from time to time that their people preserve the spirit of resistance? Let them take arms. The remedy is to set them right as to facts, pardon and pacify them. What signify a few lives lost in a century or two? The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants. It is its natural manure.”

― Thomas Jefferson, Letters of Thomas Jefferson

“Freedom in capitalist society always remains about the same as it was in ancient Greek republics: Freedom for slave owners.”

― Vladimir Ilich Lenin

“Those who make peaceful revolution impossible will make violent revolution inevitable."

[Remarks on the first anniversary of the Alliance for Progress, 13 March 1962]”

― John F. Kennedy

“A revolution is not a bed of roses. A revolution is a struggle between the future and the past.”

― Fidel Castro

xchrom

(108,903 posts)1. Markets got crushed on Thursday during the biggest stock sell-off on Wall Street in two months.

2. The FBI says it knows the jihadist who murdered three hostages.

3. UK Parliament will debate on Friday whether to join the US-led coalition against Islamic State militants in Iraq. If the action receives its expected approval, British jets will be ready to attack within 24 hours of the vote, the Guardian said.

4. US Attorney General Eric Holder announced his resignation on Thursday. Holder will remain in his post until President Obama names a successor, however, White House officials told the New York Times that the president was "a long way" from that decision.

5. The St. Louis suburb of Ferguson, Missouri, has descended into mayhem again after officers arrested protestors in front of the police station Thursday night. A scuffle broke out behind Police Chief Thomas Jackson after he decided to walk with the demonstrators, according to CNN.

Read more: http://www.businessinsider.com/10-most-important-things-in-the-world-right-now-september-26-2014-2014-9#ixzz3EQ6PKSb6

Demeter

(85,373 posts)

Demeter

(85,373 posts)Demeter

(85,373 posts)Wall Street must be relieved by the resignation of Attorney General Eric Holder, its fierce and unstoppable nemesis.

From their prison cells, Kerry Killinger of Washington Mutual, Lloyd Blankfein of Goldman Sachs, Sandy Weill of Citigroup, Stan O’Neal of Merrill Lynch, Hank Greenberg of AIG, Angelo Mozilo of Countrywide, Dick Fuld of Lehman Brothers, credit default swap-meister Joe Cassano, Ian McCarthy whose Beazer Homes violated mortgage regulations with its aggressive tactics, Frank Raines of Fannie Mae, Kathleen Corbet of Standard & Poor’s…and many more.

As they swab floors, serve slop in the penitentiary cafeteria and learn skills for the minimum-wage jobs that await them on the outside, they must be cursing Holder still. Even more so because the “clawbacks” he insisted upon ensured that these executives had to repay the hundreds of millions in compensation they received while setting the table for disaster. Mansions, yachts and expensive cars and jewelry — all sold at auctions.

“If a poor kid had robbed a liquor store of $10, he’d be serving time,” Holder said. “These people robbed the American people and economy of billions. They robbed the American people of hope.”

Holder insisted on applying the rule of law to the financial elite that brought down the economy, impoverishing millions of Americans and costing a trillion or more in lost output. This despite the “banksters,” as he called them, reviving a phrase from the Great Depression, owning the U.S. Congress and putting relentless pressure on President Obama to stop this new Untouchable.

Importantly, Holder and his U.S. Attorneys not only brought successful criminal prosecutions, he also explained to the American people how the hustles had been carried out and how the time bomb had been set that would bring the world economy to the brink of a second great depression. As a result, figures such as Alan Greenspan, Bill Clinton, Phil Gramm, Robert Rubin and former SEC Chairman Chris Cox are disgraced. Congress passed a new Glass-Steagall Act to prevent the criminal rackets that grew out of deregulation.

“Never again will profits be privatized while losses are socialized,” the Attorney General said. “Never again will the public good be held hostage by a gang of oligarchs.”

When Holder brought suit against JPMorgan Chase and Bank of America under the Sherman Antitrust Act, all the Too Big To Fail Banks entered consent decrees to voluntarily break themselves up. TBTF was over, as was the financialization that cost so many American jobs. After Holder, banking became a boring business again, lending money to help create and expand job-creating enterprises, and serving individual customers with integrity.

…Oh, wait.

None of that happened.

They got away with it. Holder’s Justice Department at best extracted wrist-slap fines that are the corporate equivalent of a rich person flashing a wad of cash when being stopped for speeding…and the officer takes the money and lets the perp go.

Next up: Revolving Door Watch. Where will General Holder end up on Wall Street, in a highly paid sinecure? Eric Cantor and a host of others will be waiting for him. Or maybe it will be K Street.

The saddest lesson of Holder’s tenure was that there is indeed a different set of laws for the wealthy and well-connected. The buck stops with President Obama. A “liberal leftist socialist”? No, another neo-liberal status quo leader, enabler of the “quiet coup,” with an even worse record than his predecessor, who oversaw criminal prosecutions of the heads of Enron, HealthSouth, Tyco, etc.

xchrom

(108,903 posts)NEW DELHI (Reuters) - India and China have agreed to pull back troops ranged against each other on a remote Himalayan plateau, the Indian government said on Friday, ending their biggest face-off on the disputed border in a year.

The two armies mobilized about 1,000 soldiers each in Ladakh this month, accusing the other of building military infrastructure in violation of an agreement to maintain peace until a resolution of the 52-year territorial row.

Indian Foreign Minister Sushma Swaraj said she met her Chinese counterpart, Wang Yi, in New York on Thursday and the two agreed to withdraw their soldiers to their original positions by the end of the month.

"The bad phase is over," state-run All India Radio quoted her as telling reporters in New York.

China defeated India in a brief war in 1962 and since then the border has remained unresolved despite 17 rounds of talks. The two armies cannot even agree on where the Line of Actual Control, or the ceasefire line following the fighting in 1962, lies, leading to face-offs between border patrols.

Read more: http://www.businessinsider.com/r-india-china-agree-to-end-himalayan-border-face-off-2014-9#ixzz3EQAO2Yth

xchrom

(108,903 posts)PRAGUE (Reuters) - Sanctions put in place amid the crisis in Ukraine have caused more problems for Europe than Russia, the chief executive of Italian bank UniCredit was quoted as saying in an interview with a Czech newspaper.

"The sanctions have caused Russia problems and my impression is that (they are) even bigger for Europe," Federico Ghizzoni told daily Hospodarske Noviny in an interview published on Friday, without giving more detail.

Ghizzoni also reiterated the bank's target of a full-year net profit of 2 billion euros.

He said UniCredit, Italy's biggest bank by assets, was doing well in Russia despite the current situation but added an economic slowdown would impact the bank in that market. "But not immediately. In a year or two at the earliest," he said.

Read more: http://www.businessinsider.com/r-unicredit-says-sanctions-hurting-europe-more-than-russia-czech-media-2014-9#ixzz3EQAsGttq

Demeter

(85,373 posts)It's all good.

xchrom

(108,903 posts)NEW YORK (Reuters) - Six world power have never been so close to a deal with Iran that would resolve the decade-long nuclear standoff once and for all, but the final phase of the negotiations will be the hardest, Germany's foreign minister said on Thursday.

"We have never been so close to a deal as now. But the truth is that the final phase of the talks that lay before us is probably the most difficult," Foreign Minister Frank-Walter Steinmeier told reporters after meeting Iran's President Hassan Rouhani on the sidelines of the U.N. General Assembly.

"Now is the time to end this conflict. I hope that Iran ... in view of the situation in the world and the situation in the Middle East, knows and senses that a collapse of the talks now is not permissible."

Read more: http://www.businessinsider.com/r-germany-weve-never-been-so-close-to-nuclear-deal-with-iran-2014-9#ixzz3EQC2o81a

Nuclear war with people who are barely Third World?

I need to get my eyes checked...I must have read that wrong.

xchrom

(108,903 posts)Mario Draghi’s plan to channel as much as 1 trillion euros ($1.3 trillion) into the euro region’s economy is running into a blockage: some companies in the countries hardest hit by the debt crisis don’t want the money.

“We’re getting calls from lenders every day,” said Miquel Fabre, 34, whose family-run beauty products firm Fama Fabre employs 43 people in Barcelona. “They can see that they’ll benefit from a loan because we’re doing good business and will return the money. Whether it’s in our interest as well is a different question.”

Many small and medium-sized businesses are wary of the offers from banks as European Central Bank President Draghi prepares to pump more cash into the financial system to boost prices and spur growth. The reticence in Spain suggests demand for credit may be as much of a problem as the supply.

xchrom

(108,903 posts)Japan’s inflation slowed more than expected in August, highlighting the risks facing Bank of Japan Governor Haruhiko Kuroda in his push for prices to rise 2 percent.

Consumer prices excluding fresh food rose 3.1 percent from a year earlier, the statistics bureau said today in Tokyo, undershooting the median projection for a 3.2 percent increase in a Bloomberg News survey of 31 economists. Stripped of the effect of April’s sales tax increase, inflation was 1.1 percent, according to the BOJ’s estimates.

Weak consumption after the tax rise is weighing on inflation, adding weight to most economists’ views that the nation won’t achieve the 2 percent price target. Kuroda has said that prices are on track to reach it around the year starting April 2015.

“Prices are under pressure to fall” as there is no prospect for a solid pickup in consumer spending, said Hiromichi Shirakawa, chief Japan economist at Credit Suisse Group AG in Tokyo and a former BOJ official. “It’s likely the BOJ’s scenario will fall apart and they will be forced to add stimulus in December or January.”

xchrom

(108,903 posts)SPIEGEL: Mr. Weidmann, you are notorious for being a tough critic of European Central Bank President Mario Draghi. But the euro crisis seems to be over, largely thanks to ECB intervention. Has he not been proven right?

Weidmann: It's not about being right or a personal confrontation. When it comes to extremely important monetary policy decisions, the ECB Governing Council does its utmost to find the correct path. And the decisions are so difficult because the crisis is not yet behind us, even if the current calm on the financial markets might suggest as much.

SPIEGEL: Yet Spain, once wracked by the euro-zone crisis, can today borrow money more cheaply than ever before in the history of the monetary union. Do you not think that is a consequence of Mario Draghi's 2012 pledge to save the euro "whatever it takes"?

Weidmann: You shouldn't mistake the thermometer for the illness. I have never disputed that the ECB could impress and move the markets with the announcement that it would make massive purchases of sovereign bonds if necessary. But such measures focus on the symptoms and don't cure the causes of the crisis. As such, the current calm is misleading and even dangerous, because it takes pressure off of the governments to implement badly needed reforms. If they are not undertaken, investors could quickly change their risk evaluations.

Demeter

(85,373 posts)It ain't over.

Reminds me of that climax in Marathon Man, when he starts to fight back: "It's not safe."

Babe: You're talking to me?

Christian Szell: Is it safe?

Babe: Is what safe?

Christian Szell: Is it safe?

Babe: I don't know what you mean. I can't tell you something's safe or not, unless I know specifically what you're talking about.

Christian Szell: Is it safe?

Babe: Tell me what the "it" refers to.

Christian Szell: Is it safe?

Babe: Yes, it's safe, it's very safe, it's so safe you wouldn't believe it.

Christian Szell: Is it safe?

Babe: No. It's not safe, it's... very dangerous, be careful.

[Christian begins to torture Babe by using a dental probe and a mouth mirror to check for cavities]

Babe: [the probe hits a cavity] Ow.

Christian Szell: That hurt?

Babe: Uh-huh.

Christian Szell: I know. I should think it would. You should take better care of your teeth. You have a...

[hits the cavity again]

Christian Szell: quite a cavity here. Is it safe?

Babe: Look, I told you I can't...

[Christian stabs the probe into the nerve; screaming in pain]

Babe: AAH-HA! AAH! Aah!

[Babe's painful screams and moans continues]

Karl: You thinks he knows?

Erhard: Of course he knows! He's being very stubborn.

Babe: [Moaning in pain] Ohh, wait. Please. Please, don't. No. No.

Christian Szell: It's ok.

Babe: Huh?

[Christian then opens a small bottle of oil of cloves, in which he applies it in Babe's badly aggravated cavity to kill the pain]

Christian Szell: Is it not remarkable? Simple oil of cloves, and how amazing the results. Life can be that simple:

[holds up the oil]

Christian Szell: Relief...

[and the probe tool]

Christian Szell: Discomfort. Now which of these I next apply? That decision is in your hands. So... take your time... and tell me... is it safe?

Babe: Please, stop. Please, stop. Please.

[Szell prepares to torture Babe a second time]

Christian Szell: Oh, don't worry. I'm not going into that cavity. That nerve's already dying. A live, freshly-cut nerve is infinitely more sensitive. So I'll just drill into a healthy tooth until I reach the pulp. That is unless, of course, you can tell me that it's safe.

Babe: It isn't safe.

Only movie I ever walked out of...it's amazing I can go to the dentist.

Demeter

(85,373 posts)A Texas businessman and the estate of his brother must give up as much as $400 million after a civil jury found that they engaged in a massive fraud to evade taxes, a judge said in a ruling released Thursday.

"By any reasonable measure, the disgorgement and prejudgment interest awarded in this proceeding will be staggering and among the largest awards ever imposed against individual defendants," U.S. District Judge Shira Scheindlin wrote of her order against Sam Wyly and the estate of his brother, Charles. The case was brought by the Securities and Exchange Commission.

In a ruling dated Wednesday, Scheindlin said the brothers engaged in a 13-year fraud, created 17 trusts and 40 subsidiary companies, amassed an army of lawyers and hired an offshore accountant to hold records outside the United States.

"Reasonable and savvy businessmen do not engage in such activity unless it is profitable," the judge wrote of the onetime owners of the arts and crafts retail chain Michael Stores Inc. "Of course it was profitable ... the Wylys were able to accumulate tremendous tax-free wealth."

She ordered Sam Wyly and the estate of his brother, Charles, to surrender more than $187 million. Charles Wyly was 77 when he died in a 2011 car accident in Aspen, Colo. Defense attorney Stephen D. Susman has said Charles Wyly's estate has about $30 million in the United States while Sam Wyly has about $70 million plus a $12 million annuity. He said more than $380 million remained offshore...The judge said Sam Wyly must disgorge $123 million while Charles Wyly's estate must give up $63 million. Scheindlin said prejudgment interest would likely bring total disgorgement to between $300 million and $400 million, equivalent to about 10 percent of total penalties and disgorgement ordered in SEC enforcement cases nationwide last year.

She also barred Sam Wyly from future securities violations, though she noted he was subject to a similar 1979 order before he "engaged in a large securities fraud spanning 13 years, involving multiple trusts and entities and hundreds, if not thousands, of misstatements."

"The extensiveness of this scheme, the brazenness of Wyly's conduct, and his position of wealth and importance in the community warrants the imposition of a permanent injunction," Scheindlin wrote.

AT HIS AGE, THAT'S HARDLY AN ISSUE...

DemReadingDU

(16,002 posts)Take your pick

9/26/14

Bill Gross, the founder of PIMCO and the kind of the bond trading world is leaving the company he founded and is headed to Janus Capital (JNS). It's stock is up 40% on the news.

Gross has been on the hot seat at PIMCO lately. Earlier this week reports surfaced that the SEC was investigating the ETF tied to the company's flagship "Total Return Fund" (BOND). It's the latest hurdle surrounding that fund which has experienced 16 consecutive months of net outflows.

Earlier this year Bill Gross lost his right hand man in Mohammed El-Erian after the then CEO of PIMCO walked away citing in more than one news article, a caustic work environment perpetuated by Gross.

Yahoo Finance spent the day at PIMCO this past summer speaking with Gross and others about those accusations. The now-former PIMCO chief shrugged them off saying, “Since January, obviously with some of the headlines, investors are probably concerned about the new PIMCO,” Gross told Yahoo Finance. “How do we work without Mohamed? What is Gross gonna do? Is he happy? Is he sad?”

more...

http://finance.yahoo.com/news/pimco-founder-bill-gross-leaves-for-janus-131949159.html

Demeter

(85,373 posts)That was a short trip.