Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 8 May 2015

[font size=3]STOCK MARKET WATCH, Friday, 8 May 2015[font color=black][/font]

SMW for 7 May 2015

AT THE CLOSING BELL ON 7 May 2015

[center][font color=green]

Dow Jones 17,924.06 +82.08 (0.46%)

S&P 500 2,088.00 +7.85 (0.38%)

Nasdaq 4,945.54 +25.90 (0.53%)

[font color=green]10 Year 2.18% -0.06 (-2.68%)

30 Year 2.91% -0.06 (-2.02%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

DemReadingDU

(16,002 posts)What does this candle mean?

Fuddnik

(8,846 posts)DemReadingDU

(16,002 posts)Demeter

(85,373 posts)but it didn't rain today. It was pretty hot...83F. Supposed to go down to freezing on Wednesday, though...

Demeter

(85,373 posts)My late brother's birthday. I'm feeling like the last leaf of autumn, sorry for myself, etc. He would have been 59 today.

Fuddnik

(8,846 posts)Demeter

(85,373 posts)I don't have many safe places, at the moment, for something that renders one as vulnerable as grief does, nor many safe people whose company can be trusted. I'm grateful for the indulgence, and I'll not make it a habit. Or a topic, for that matter.

DemReadingDU

(16,002 posts)It is most difficult to lose a sibling

Demeter

(85,373 posts)and Americans in general are not trained to cope with loss.

DemReadingDU

(16,002 posts)We need to make the most of those people and things that gives us joy and happiness.

![]()

At present, my 15 year old refrigerator/freezer has a failing compressor. The repair job would be as expensive as buying a new one! Since I don't want an appliance that has spying capabilities, this is going to take some time searching around for a basic model.

Demeter

(85,373 posts)NO SOUP FOR YOU! NO WAIVER, EITHER!

http://www.reuters.com/article/2015/05/04/us-sec-se-waiver-idUSKBN0NP26820150504

Credit Suisse (CSGN.VX) has quietly withdrawn a request for a waiver to raise capital more easily, after U.S. Securities and Exchange Commission staffers told the bank in recent weeks it would not win approval, people familiar with the matter told Reuters. The bank had applied for the waiver following its agreement last year to pay $2.5 billion to resolve criminal charges that it helped wealthy Americans evade U.S taxes. The criminal charges automatically triggered a federal law that deprives the bank for three years of the privilege of being known in the market as a "well-known seasoned issuer," or WKSI. The designation lets public companies bypass SEC approval and raise capital "off the shelf" - a process that is speedier and more convenient. Failing to obtain the waiver will make it more costly and burdensome for Credit Suisse to sell shares and debt to the public.

A spokesman for the bank declined to comment.

This marks at least the fourth time in recent years that Credit Suisse has sought various waivers from the SEC. The bank was previously granted two waivers in connection with its May 2014 guilty plea that permit it to continue acting as an investment adviser and to raise capital privately. In 2012, it won approval for a WKSI waiver after it settled civil charges by the SEC that it misled investors in mortgage-backed securities.

Granting waivers to big banks that break the law has become a flash point at the SEC, where Commissioner Kara Stein, a Democrat, in particular has openly criticized the agency for rubber stamping banks' requests. She and Luis Aguilar, another Democratic commissioner, have said they fear that by granting waivers so often, the SEC will not deter banks from breaking the law again.

On Monday, Stein issued another dissent - this time on a WKSI waiver granted to Deutsche Bank DBKGn.De over its guilty plea to manipulating the Libor interest rate benchmark. The SEC does not keep formal records on when banks are denied waivers. Only waivers that are granted are made public.

In most cases, lawyers for the banks will confidentially request feedback from the SEC staff on whether an application stands a chance. If the staff tells them an application will not get approved, the banks typically withdraws it. In the past, many waivers were granted by the SEC's staff, but today most are voted on by the full five-member commission after Stein and Aguilar began requesting recorded votes.

SEC Chair Mary Jo White recently provided limited statistics on waiver approvals, saying in a March speech that at least four WKSI waivers had been denied since the agency started tracking it in January 2014. In that same time period, seven were granted, she said.

The precise reasons of why the SEC took the somewhat unusual step of denying Credit Suisse's request were not immediately clear. One issue that came to light during the SEC's review of its application centered on an error the bank made in its March annual report. In that report, the bank erroneously stated its status as a well-known seasoned issuer, when in fact the SEC had not granted the bank a waiver. The bank had previously disclosed it was not a WKSI before it made the mistake, and it corrected the error in a filing the next day. Credit Suisse's mistake on its 20F form was discussed internally at the SEC, with some staffers raising questions about whether the bank had adequate controls in place over its financial disclosures, according to people familiar with the matter. In the end, though, several people familiar with the matter said it was not a factor considered by the SEC.

The bank is also separately still hoping to win approval for another exemption from the Department of Labor following its 2014 criminal plea. In January, the Labor Department held an unusual public hearing to decide whether the bank should be allowed to continue managing retirement plans. The department is still reviewing the application.

WHY IS THIS BANK STILL LICENSED IN THE UNITED STATES?

Demeter

(85,373 posts)I respectfully dissent from the Commission’s Order (“Order”), approved on May 1, 2015, by a majority of the Commission.[1] The Order grants Deutsche Bank AG a waiver from ineligible issuer status triggered by a criminal conviction of its subsidiary, DB Group Services (UK) Ltd. (collectively with Deutsche Bank AG, “Deutsche Bank”), for manipulating the London Interbank Offered Rate (“LIBOR”), a global financial benchmark.[2] This waiver will allow Deutsche Bank to maintain its well-known seasoned issuer (“WKSI”) status, which would have been automatically revoked as a result of its criminal misconduct absent a Commission waiver.

Created by the Commission as part of the Securities Offering Reforms of 2005, WKSI status is available “for the most widely followed issuers representing the most significant amount of capital raised and traded in the United States.”[3] This status confers on the largest companies certain advantages over smaller companies. WKSIs are granted nearly instant access to investors through the capital markets. WKSIs enjoy greater flexibility in their public communications and a streamlined registration process with less oversight than smaller businesses. For example, unlike smaller businesses, the WKSI issuer does not have to wait for the Division of Corporation Finance to review and declare a registration statement effective prior to selling financial products to investors.[4] WKSI companies also enjoy a number of other privileges related to the payment of fees.

With these WKSI advantages comes a modicum of responsibility. WKSIs must meet the very low hurdle of not being ineligible. This means that, among other things, they have not been convicted of certain felonies or misdemeanors within the past three years.[5] In granting this waiver, the Commission continues to erode even this lowest of hurdles for large companies, while small and mid-sized businesses appear to face different treatment.[6]

Deutsche Bank’s illegal conduct involved nearly a decade of lying, cheating, and stealing. This criminal conduct was pervasive and widespread, involving dozens of employees from Deutsche Bank offices including New York, Frankfurt, Tokyo, and London. Deutsche Bank’s traders engaged in a brazen scheme to defraud Deutsche Bank’s counterparties and the worldwide financial marketplace by secretly manipulating LIBOR.[7] The conduct is appalling. It was a complete criminal fraud upon the worldwide marketplace...MORE

GO GET 'EM, KARA!

Demeter

(85,373 posts)Even knowlege-based jobs will disappear as wealth gets more concentrated at the top in the next ten years..

http://www.alternet.org/economy/robert-reich-nightmarish-future-american-jobs-and-incomes-here?akid=13083.227380.2IU13q&rd=1&src=newsletter1036016&t=3

...In 1991, in my book The Work of Nations, I separated almost all work into three categories, and then predicted what would happen to each of them.

I was not far wrong.

Here again, my predictions were not far off. But I didn't foresee how quickly advanced technologies would begin to make inroads even on in-person services. Ten years from now I expect Amazon will have wiped out many of today's retail jobs, and Google's self-driving car will eliminate many bus drivers, truck drivers, sanitation workers, and even Uber drivers.

We are now faced not just with labor-replacing technologies but with knowledge-replacing technologies. The combination of advanced sensors, voice recognition, artificial intelligence, big data, text-mining, and pattern-recognition algorithms, is generating smart robots capable of quickly learning human actions, and even learning from one another. A revolution in life sciences is also underway, allowing drugs to be tailored to a patient's particular condition and genome. If the current trend continues, many more symbolic analysts will be replaced in coming years. The two largest professionally intensive sectors of the United States -- health care and education -- will be particularly affected because of increasing pressures to hold down costs and, at the same time, the increasing accessibility of expert machines...

But the current trend is not preordained to last, and only the most rigid technological determinist would assume this to be our inevitable fate. We can -- indeed, I believe we must -- ignite a political movement to reorganize the economy for the benefit of the many, rather than for the lavish lifestyles of a precious few and their heirs. (I have more to say on this in my upcoming book, Saving Capitalism: For the Many, Not the Few, out at the end of September.)

HE FORGOT PLUMBERS, MECHANICS, AND OTHER SKILLED SERVICES...

Robert B. Reich has served in three national administrations, most recently as secretary of labor under President Bill Clinton. He also served on President Obama's transition advisory board. His latest book is "Aftershock: The Next Economy and America's Future." His homepage is www.robertreich.org.

mother earth

(6,002 posts)TY, Demeter, great reading today, as always.

Condolences to you on the loss of your brother.

Demeter

(85,373 posts)I don't know about great reading, but I thought it important information, unlikely to hit the local dailies or TV. (are there any dailies, anymore?)

Demeter

(85,373 posts)Hold onto your hats, Montana. President Barack Obama wants Congress to give him more power. Surprisingly, most Republicans are on board. Many Democrats, too.

He is asking for an undemocratic power, Fast Track authority, which would enable him to railroad trade deals through Congress with no changes and limited debate. The Constitution delegates authority over foreign treaties (which is what "trade" deals in fact are) to Congress for good reason, namely that treaties carry the force of law over domestic policy.

Why the willingness to hand over such great power to the president? Six hundred corporations have been negotiating, in secret, a new trade deal, the Trans-Pacific Partnership (TPP). They want to use Fast Track authority to slide this pact by the American public and through Congress. What is being shared with the public is nothing more than vague assurances about "free trade, exports and jobs."

I am a third-generation Montana rancher, and I have lived through the North American Free Trade Agreement with Canada and Mexico. I have watched the shrinking American cattle herd, young ranchers leaving this career, and families losing their ranches. Promoters of these trade deals tout increased exports, like a broken record, while ignoring increased imports. The U.S. International Trade Administration reports that U.S. exports only increased 0.5 percent since NAFTA was implemented 21 years ago. Imports from Mexico and Canada, however, have grown 115 percent. Our trade deficit to Mexico and Canada is a staggering $181 billion, and one million jobs have been lost since NAFTA went into effect.

The widely popular Country of Origin Labeling law, supported by ranchers and consumers alike, is now the victim of a NAFTA trade dispute before the World Trade Organization. The WTO may fine the U.S. for enforcing our labeling law that lets consumers know where the meat they buy is born, raised, and slaughtered, in an attempt to force us to overturn a legitimate domestic law. Simple efforts to market and brand our products will become victims of trade. TPP endangers our "Made in Montana" labels. Local food procurement efforts like "buy Montana beef" could be threatened, as could American farm support programs...The 2011 Korean Free Trade Agreement, was promised to increase beef exports substantially, but they have declined 9 percent to Korea. U.S. beef producers have lost over $62 million each year since the agreement was signed, according to the U.S. International Trade Commission.

I don't need "expert research," though, to see that the damage done by NAFTA and KFTA will only accumulate with the TPP. The bill of lies that was sold to us in NAFTA is being sold again, and Americans are about to buy the same lemon from a different salesman. Efforts to override Congress's authority to negotiate a complicated 11-country deal are a red herring; we should make trade agreements as intended in the Constitution....

BOTH BARRELS! GOOD SHOT!

Demeter

(85,373 posts)November 10, 2014

If the largest trade deals in U.S. history have any chance of becoming law, they will require an unusual alliance between the Obama administration and pro-trade Republicans. An emerging consensus is that this union could be tested soon, with the upcoming “lame duck” session of Congress considering a procedural bill called “Trade Promotion Authority” that would smooth both negotiation and congressional consideration of U.S. free trade agreements.

For TPA to pass (now or next year), President Obama and Republicans will need to work together to overcome opposition from Democrats allied with traditional anti-trade groups, like environmentalists and labor unions. But if you ask the media and some on Capitol Hill, these strange pro-trade bedfellows face a new threat: a “Tea Party” caucus that could rebel against the Republican agenda to spite the president or scuttle FTAs. Though it makes for titillating political journalism (and a great scapegoat for a divided Democratic Party), the “Tea Party opposes trade” narrative is a myth that grows from fundamental misunderstandings of who the Tea Party is, how U.S. trade agreements work, and what “free trade” actually means.

Despite years of ineptitude, the United States might (maybe!) soon conclude the Trans-Pacific Partnership. The TPP is a free-trade agreement with 11 other countries that, for all its imperfections, would undoubtedly open new markets abroad and improve living standards here at home. The Obama administration is also working to secure a deal with the European Union—the Transatlantic Trade and Investment Partnership(TTIP) —that would remove tariff and regulatory barriers to trade between two of the world’s largest economies. However, President Obama’s chief negotiator, U.S. Trade Representative Michael Froman, has recently made clear that these benefits can only materialize when Congress approves not only the FTAs (which require congressional approval), but also the TPA bill that governs the approval process.

Piggybacking Onto the Tea Party

The possibility that TPA could be passed during the lame-duck session or early next year has mobilized trade critics, and a coalition of unions and other left-wing groups will descend on Capitol Hill this week to protest any near-term consideration of the bill. Most of these protests will target trade-skeptical Democrats, but a new group of activists will seek to sway Republicans by claiming, among other things, that TPA is an unconstitutional power grab by the Obama administration that would erode U.S. sovereignty and, by easing passage of the TPP and TTIP, destroy American jobs. By nicknaming TPA “Obamatrade” and attaching the familiar slogan “if you like your job, you can keep your job,” this “conservative” group’s attempt to pander to partisan animosity is clear. Nevertheless, the crux of their message and their goal of scuttling TPA, TPP, and the TTIP aligns not with the pro-market Right but with the AFL-CIO and other left-wing groups who routinely push outlandish claims to fight globalization and economic freedom. Perhaps taking a cue from previous Obama administration attempts to deflect blame for its trade policy foibles onto the Tea Party, the media have run with the exciting new narrative that unpredictable, nativist right-wingers, not just those well-meaning-but-ill-informed lefties, pose a threat to the U.S. trade agenda. The problem with this narrative is that it’s completely false. In reality, the Obamatrade campaign is the dying gasp of protectionist dinosaurs still haunting the Republican Party, and any member of Congress or the media who falls for this anti-trade message, or the notion that Obamatrade represents the modern conservative grassroots, deserves to be laughed out of his job....

WELL, CATO INSTITUTE IS NOT KNOWN FOR THE QUALITY OF ITS THINKING....

Demeter

(85,373 posts)USA Today got its numbers seriously wrong in pushing the case for the Trans-Pacific Partnership (TPP). Its editorial told readers:

"Theirs is a simplistic view that ignores the fact that manufacturing output has nearly doubled since the late 1990s, showing that technology is the real job killer."

It's USA Today, not the unions, who are being simplistic here. The data they are relying on refers to gross output. This would include the full value of a car assembled in the United States even if the engine, transmission, and the other major components are imported. It also doesn't adjust for inflation. If USA used the correct table it would find that real value added in manufacturing has risen by a bit less than 41.0 percent since 1997, compared to growth of 45.8 percent for the economy as a whole.

The story here is a one of very basic marcoeconomics. The $500 billion annual trade deficit ($600 billion at an annual rate in March), implies a loss of demand of almost 3.0 percent of GDP. In the context of an economy that is below full employment, this has the same impact on the economy as if consumers took $500 billion every year and stuffed it under their mattress instead of spending it. USA Today might try working on its numbers and economics a bit before calling people names.

Demeter

(85,373 posts)MORE SNAKE OIL

http://www.nakedcapitalism.com/2013/09/45883.html

By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and Daily Kos as letsgetitdone, and Lambert Strether, who blogs at Corrente. Joe did the heavy lifting on this!

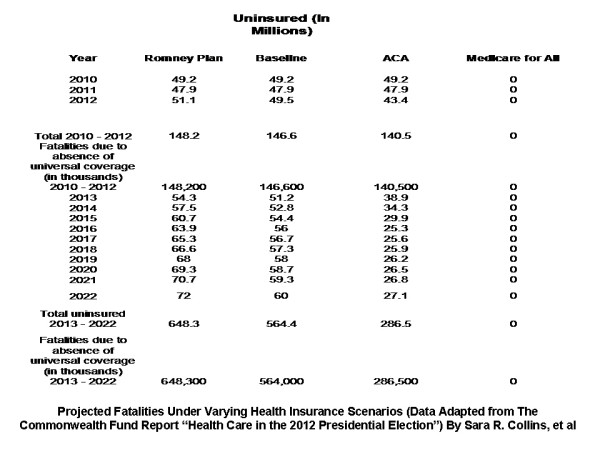

Many people, and especially Obama supporters, characterize the ACA (ObamaCare) as “just starting” or a “work in progress” and then go on to urge that the program will have “glitches,” needs to be “tweaked,” isn’t yet “fully implemented,” and so forth. We think it’s a mistake to see the ACA as just starting. We also think it’s a mistake not to weigh the costs of ObamaCare’s stately three-year progress toward partial coverage for the the American people, and just as important to weigh the opportunity costs. The ACA was passed in March 2010, incorporating many features designed to meet Republican objections to the Bill. Yet, in the end, Democrats never put Medicare for All on the table, abandoned the public option and many other features, and did not get a single Republican vote in either chamber.

The Democrats even saw to it that the bill was fiscally neutral over a 10 year projection at a time when the tanked economy needed more deficit spending and the jobs that would have brought. And to do that, they postponed implementation of most of the bill for more than three years, until now, allowing people to go without care, to die, to divorce, and to lose their homes or go bankrupt due to medical bills, just so they could argue that the bill was fiscally neutral. In gauging the record of the bill, these 3 to 3.5 years of waiting for its implementation and their real costs to the people of the United States must be taken into account. It also must be taken into account that in the year before the ACA was passed there were some 45 million Americans uninsured, and they were dying at the rate of 1,000 more for every million than in the general population. That is, lack of insurance was causing more than 45,000 fatalities per year. (The cost of those deaths in money terms: $1.38 trillion).

When the ACA was passed it was estimated by its proponents that it would cover 35 million more people than before. Now these same proponents are using the figure 31 million new people covered instead. Meanwhile the population of the United States has grown by 9 million people, and due to the effect of the crash of 2008, millions of people who were insured before the crash are now uninsured. So, though there are no hard figures on this it is likely that estimates of 30 million still uninsured are on the low side. And when we consider that HHS, today, for actuarial reasons, is marketing to the young and healthy, and not the vulnerable and disengaged, it seems quite possible that the 45,000 fatalities per year will not decrease significantly, if at all.

Even if the projection of 31 million new people covered is accurate by say 2017, we will still have as many (assuming further population growth) as 28 million uncovered people then, because the Democrats chose to pass the ACA rather than the Conyers/Kucinich enhanced Medicare for All bill, HR 676. So, 9 years after the effort to pass universal health care started in 2017, we would still have 28,000 fatalities per year to cope with and 28 million going to emergency rooms for care that is too little and often too late (assuming that regulations and laws are not changed to tighten up or eliminate ER access, using the ACA as a pretext). Furthermore, it’s perfectly possible that the current 31 million new coverage projection is still too optimistic about the future. Many states are still fighting the ACA and will not implement its Medicaid provisions. Some 17 million out of the 31 million new people covered were going to go into the expanded Medicaid program. But with State Governors in Southern and some Western Red States refusing to allow that Medicaid expansion to occur, we may end up with only 9 million new Medicaid enrollees nationwide. Many others will try to game the system because they are willing to accept the risk of mandate violations and fines rather than pay the cost of the lousy insurance offered for basic plans in the ACA.

All in all that 31 million may well turn into 17 million or so before all this is done. And then we would have taken 9 years of passage, waiting, and implementation and would still have as many as 40 million people uncovered in 2017, and 40,000 annual fatalities.

That is the measure of the possible failure of the ACA.

Demeter

(85,373 posts)It’s been well-documented that America’s banks and financial institutions are no longer the loose-and-easy lenders they were several years ago. But newly released data from the Federal Reserve Bank of New York reveals a less explored implication of that credit tightening: A new geographic divide in how easily Americans can borrow money.

Those who live in the upper Midwest, particularly Minnesota and the Dakotas, still have the healthy borrowing profiles they did before the Great Recession. Those in many other states have seen only modest declines in the ability to borrow. But those in the Deep South — especially in states hugging the Gulf Coast — have seen their access to credit drop off significantly, even though it was already weak to begin with.

The consequences of a credit freeze in the Deep South are daunting. The region is already economically distressed, with disproportionately high poverty levels, and restrictions on credit access limit the ability of those living there to start businesses, make investments, or manage unforeseen expenses. If enough people in an area cannot borrow, the community itself becomes less resilient, said Kausar Hamdani, a senior vice president at the New York Fed.

“It’s the ability to access resources,” Hamdani said. “Not just for emergencies, but to grow a dream, to start a business.”

The map below provides a snapshot of America’s credit picture in 2007 — the tale end of the credit bubble. At that time, 74.0 percent of Americans with a credit file borrowed on standard, revolving terms, using either a credit card or (for more significant needs) home equity line of credit.

https://img.washingtonpost.com/wp-apps/imrs.php?src=

&w=1484

&w=1484

By 2014, 67.9 percent of Americans were borrowing in that manner. But at the state level, the differences have become more stark, as seen in the next map. In Utah, 75.2 percent now use revolving credit (compared with 77.1 percent in 2007). In New York, the number is 74.9 (compared with 78.7 in 2007). And in Mississippi? Less than half — 49.3 percent — use revolving credit, compared with 62.5 percent in 2007. No other state saw a sharper decline during that span.

https://img.washingtonpost.com/wp-apps/imrs.php?src=

&w=1484

&w=1484

“Revolving credit,” as the New York Fed calls it, is just one barometer for credit access. But other data reveals similar geographic divides. The Deep South has a fewer percentage of prime borrowers and on-time bill payers than the rest of America. Mississippi ranks last in both categories.

It should be mentioned, of course, that not all borrowing is healthy. In the run-up to the financial crisis, there was a disastrous increase in the supply of mortgage credit, and individuals across America were stuck with loans they couldn’t pay back. Since then, lenders have become much more conservative. Though the pendulum swing was necessary, by some measures lenders have become even more cautious than they were in the years well before the financial crisis. Those who can’t borrow money through banks and other conventional channels are likelier to seek help from riskier sources, like payday lenders.

According to separate research from the Urban Institute, African Americans and Hispanics have been particularly affected by the tight credit conditions. Borrowing has dropped for African American and Hispanic households more sharply than for white households.

Demeter

(85,373 posts)Award-winning journalist tells Salon why the erosion of civil liberties at home and abroad is interconnected

It got lost in all the hubbub of the uprising in Baltimore, as well as the addition of a few more candidates to the 2016 presidential election, but according to reports from multiple sources last week, it’s looking more probable than ever that the so-called Patriot Act will not be reauthorized until after it’s undergone some privacy-protecting revisions. The distance between vague promises in a report and an actual change to the bill’s infamously broad language is considerable, of course. But absent the waves of outrage inspired by leaks from former CIA contractor Edward Snowden — whose collaboration with Salon alum and Intercept founding editor Glenn Greenwald recently led to an Academy Award — it’s hard to imagine reformers ever getting even this close.

Recently, Salon spoke over the phone with Greenwald, whose book on his experience with Snowden, “No Place to Hide: Edward Snowden, the NSA, and the U.S. Surveillance State,” was recently released in paperback. We touched on the reception to the book, the events in Baltimore, Hillary Clinton’s sincerity and the importance of the controversy involving this year’s PEN Awards and Charlie Hebdo. Our conversation is below and has been edited for clarity and length....

A LONG INTERVIEW...GO AND READ!

Demeter

(85,373 posts)DO TELL! IT'S BEEN BRUITED ABOUT FOR YEARS! DOES THIS MAKE IT AN OFFICIAL OFFENSE? WILL DIFI FOLD?

https://firstlook.org/theintercept/2015/05/05/watchdog-slams-company-part-owned-feinsteins-husband-abusing-huge-post-office-contract/

CBRE, a giant real estate company partially owned by Sen. Dianne Feinstein’s husband, Richard Blum, is costing the U.S. Postal Service millions of dollars a year in lease overpayments, and its exclusive contract should be immediately canceled, the service’s inspector general has found.

Eyebrows rose when the USPS made the contract with CBRE in June 2011 for all real estate transactions. Blum chaired CBRE at the time; he stepped down last year, but remains a director and a major shareholder. Feinstein, D-Calif., has always denied involvement in the deal, which proved lucrative as the cash-strapped Postal Service looked to its excess real estate to finance operations.

The contract enables CBRE to market and sell properties, and conduct negotiations for leases of postal buildings. Prior to the contract, USPS negotiated leases directly with landlords. Now, CBRE often represents both the Postal Service and the landlord in negotiations, known as “dual agency transactions.”

The inspector general’s report described something akin to a shakedown, with a kickback thrown in....

MORE SCANDAL AT LINK...GO TEAM!

Demeter

(85,373 posts)I’m super excited to announce that the Alt Banking group is creating a summer school program, which we’re calling Occupy Summer School. The project has a webpage with more details, but briefly:

- It will last three weeks, taking place in a downtown Brooklyn high school.

- The first week we will bring in cool and inspiring organizers and activists who will hopefully connect with the kids

- The second week we will delve into topics and the kids will decide what they care about and, by the end of the week, what they will protest and how,

- The third week the students will plan the protest, including training on safe protesting techniques, they will stage it and write it up, and hopefully help the issue get media attention.

- So far we have ideas for the first week, including a few of our really interesting and thoughtful members going to facilitate conversations around what’s going on in Baltimore, and how to stage a creative protest, involving our very own Marni Halasa:

?w=595

?w=595

- We are starting to line up speakers for the second week, but we are waiting on a focus group to come back to us from the students to see what topics they get really excited about. We want them to more or less lead the way.

What an exciting project! I can’t wait for it to start.

http://mathbabe.org/2015/05/05/occupy-summer-school-ows/

Demeter

(85,373 posts)THEY ARE MILKING THE PRESENT CHAOS FOR ALL IT'S WORTH!

http://failedevolution.blogspot.gr/2015/05/why-greek-elite-doesnt-want-grexit.html

It has happened again and again. However, IMF insists on the same recipe. What Greece faces can be seen in the Russian crisis back in the late 90s. The only difference this time is that the IMF has a united currency (euro) to use as alibi and a partner (Commission, ECB) to blame for one more failure.

As Joseph Stiglitz points in his book "Globalization and Its Discontents" :

and

“For the oligarchs trying to get their money out of the country, too, the overvalued exchange rate was a boon-it meant that they could get more dollars for their rubles, as they squirreled away their profits in foreign bank accounts.”

http://digamo.free.fr/stig2002.pdf

This explains to a great extent the propaganda of fear launched by the mainstream media long before Tsipras come to power, about the disaster that Greece would face in case of Grexit. Public opinion has been brainwashed to be terrified in such a possibility (although this starts to change), because the return to national currency would be the final crucial defeat for the Greek and the European elites, as it could mark the fall of their financial empire.

In the case of euro, the Greek oligarchs straightly profiting from the hard currency. It is not accidental that the economically devastated Greece is the country with the second growing number of multimillionaires in Europe! (http://failedevolution.blogspot.gr/2014/12/greece-country-with-second-growing.html)

MPs from the River (Potami) party, repeat all the time that Greece must stay in euro at any cost. Recently, River's leader Stavros Theodorakis, stated in an interview to the journalist Nikos Chatzinikolaou, that Greece should stay in euro at any cost because the other choice would be a hell.

The River party is an artificial creation by the banking-media establishment to attract voters from the Left and be used to control or even throw current government from power, if necessary: http://failedevolution.blogspot.gr/2015/04/the-global-financial-mafia-promotes.html

Demeter

(85,373 posts)Toyota Motor Corp (7203.T) said it will crank net profit up to a third straight record this year as cost cuts and rising U.S. sales offset weaker business elsewhere, building on bumper earnings last year powered largely by foreign-exchange gains.

Reporting net income jumped 50 percent in the quarter ended March, the world's top-selling automaker said on Friday it expects net profit to rise 3.5 percent to 2.25 trillion yen ($18.75 billion) in the year that began in April.

The forecast assumes the dollar will be worth 115 yen on average this year. That's conservative compared with 120 yen currently, implying Toyota's net profit for the year may yet come closer to the 2.44 trillion yen average estimate of 27 analysts polled by Thomson Reuters.

For the past few years, President Akio Toyoda has called an "intentional pause" for the company founded by his grandfather. The strategy seeks to ensure sales growth stays at a sustainable pace, free of the overcapacity and quality problems that plagued the company in previous years...MORE

Demeter

(85,373 posts)AND WE SHOULD BELIEVE THIS--WHY? OBAMA WILL BE GONE, NIKE WILL BE GONE...AND THE US WILL BE ENSLAVED AND FORCED INTO BLOODY REVOLUTION...ONE THING WILL BE CERTAIN, THOUGH. WE WON'T WEAR NIKES!

http://www.reuters.com/article/2015/05/08/us-trade-obama-nike-idUSKBN0NT0ZO20150508?feedType=RSS&feedName=businessNews

Sports shoe maker Nike Inc put its weight behind President Barack Obama's push for a trade deal with Asian countries on Friday with a promise to create up to 10,000 U.S.-based manufacturing jobs if the pact is approved. In an announcement that coincided with a visit by Obama to Nike's Oregon headquarters, the company said footwear tariff relief within the proposed 12-nation Trans Pacific Partnership trade agreement would allow it to speed up investment in "advanced footwear manufacturing" in the United States.

Obama is pressing the U.S. Congress to pass Trade Promotion Authority, which would enable him to negotiate international trade deals without the threat of changes by lawmakers. If TPA is passed and the TPP deal is sealed, Nike said, it would accelerate its U.S. investments and spur as many as 10,000 domestic manufacturing and engineering jobs, thousands of construction jobs, and up to 40,000 jobs elsewhere in its supply chain over 10 years. Nike has 26,000 employees in the United States and more than 1 million workers in 700 contract factories worldwide that manufacture its shoes. Its top-end soccer and baseball shoes retail for more than $300.

"We believe agreements that encourage free and fair trade allow Nike to do what we do best: innovate, expand our businesses and drive economic growth," said Nike Chief Executive Officer Mark Parker in a media release distributed by the White House.

The company did not say in the media release what it would pay those workers or where the U.S. jobs would be located.

Obama is scheduled to visit Nike's headquarters later on Friday. The trip was designed to help sell the free-trade agreement to skeptical Democrats, who say it will put more American workers out of jobs and cut their wages while enriching companies.

An administration official said Nike approached the White House about the issue, which led to the trip. White House aides have been coy all week about why they chose Nike, which suffered for years from a tarnished image for using Asian sweatshops to make its products.

Imports accounted for as much as 98 percent of the U.S. market for apparel, although that number has fallen slightly, according to the American Apparel & Footwear Association.

DEAR GODDESS, THIS REEKS! THE MAN IS SHAMELESS. IF HE WERE OLDER, I'D CALL HIM SENILE...SO IT MUST BE CYNICISM, AT BEST.

Demeter

(85,373 posts)Two of the nation’s biggest banks will finally put to rest the zombies of consumer debt — bills that are still alive on credit reports although legally eliminated in bankruptcy — potentially providing relief to more than a million Americans.

Bank of America and JPMorgan Chase have agreed to update borrowers’ credit reports within the next three months to reflect that the debts were extinguished.

THAT'S MIGHTY WHITE OF THEM...FOLLOWING THE LAW WHEN THE GUN IS PUT TO THEIR HEADS...

...The change by the banks emerged this week in Federal Bankruptcy Court in White Plains, where the two banks, along with Citigroup and Synchrony Financial, formerly GE Capital Retail Finance, face lawsuits accusing them of deliberately ignoring bankruptcy discharges to fetch more money when they sell off pools of bad debt to financial firms.

The lawsuits accuse the banks of engineering what amounts to a subtle but ruthless debt collection tactic, effectively holding borrowers’ credit reports hostage, refusing to fix the mistakes unless people pay money for debts that they do not actually owe.

It is not the only pressure. Lawyers with the United States Trustee Program, an arm of the Justice Department, are investigating the banks, said several people briefed on the inquiry, about whether the banks are deliberately flouting federal bankruptcy law...

MUCH MORE AT LINK

Demeter

(85,373 posts)There was plenty of fanfare last August when Bank of America agreed to a record $16.7 billion settlement with the Justice Department over dubious mortgage practices. Prosecutors crowed about the deal, which required the bank to provide $7 billion of consumer relief — including such things as loan modifications — over the ensuing four years.

But now that the settlement has faded from the public eye, questions are arising about whether the promised assistance is actually getting to the right people and whether the bank will be allowed to claim credit for consumer relief that far exceeds its actual value.

The details are complex, but worth delving into, given the importance of the issue. As outlined in the settlement, Bank of America is required to make a wide array of loans more affordable for borrowers. The bank was expected to forgive or reduce the amounts owed on the first and second mortgages it held. In exchange, the bank would receive credit for these reductions in dollar amounts outlined in the settlement.

But Bank of America, in pursuing its goals, has told a number of borrowers that it intends to “forgive” some loans that have been discharged in borrowers’ bankruptcies. That debt has already been forgiven....

PICKY, PICKY, PICKY! MUCH MORE AT LINK

Demeter

(85,373 posts)There she grows!

A picky plant found in West Africa may grow only on top of mineral deposits often loaded with diamonds, according to research soon to be published in the journal Economic Geology. Stephen Haggerty, a professor at Florida International University in Miami and the chief exploration officer of Youssef Diamond Mining Company, said the discovery could be a game changer for the region.

The thorny plant, Pandanus candelabrum, only grows atop deposits of kimberlite, a type of volcanic rock found in giant underground "columns" around the world. Diamonds, formed hundreds of kilometers deep by intense heat and pressure, are pushed upward with the kimberlite during subterranean volcanic activity, resulting in gem-rich veins of rock.

Until recently, there was no reliable way to locate these concentrated deposits of diamonds, which can be just a few acres in size and buried in thick, remote parts of the jungle.

Haggerty made the discovery in the bush of Liberia after venturing to the country in 2010 to continue research he began in the 1970s. He told The Huffington Post that Liberia, infamous for its trade in so-called "blood diamonds," had extensive mining operations in place, but the miners had no real way of knowing where to look for the gems. The region is covered in dense forest "so inaccessible, you can't see more than 10 feet in front of you," he said.

MORE

Demeter

(85,373 posts)MetLife Inc.’s lawsuit challenging its designation by regulators as critical to the economy should be thrown out, U.S. Justice Department lawyers said without making public their arguments to the judge.

MetLife on January 13 became the first nonbank to challenge a decision by a panel of regulators, led by the Treasury secretary, that it is a systemically important financial institution, or SIFI, subject to stricter oversight. The phrase more commonly used to describe such institutions is “too big to fail.” The insurer argued that it’s already subject to comprehensive supervision on the state level and that enhanced federal oversight will raise the cost of financial protection for consumers.

In a federal court filing Friday in Washington, the Justice Department asked that the case be dismissed. The U.S. filed its supporting reasons for the request under seal.

MetLife was the fourth company other than banks to receive the SIFI label from the Financial Stability Oversight Council. The label means that regulators think the company’s failure could pose risks to the financial system, though it doesn’t imply that the firms currently face difficulty.

In response to a request by the judge in the case, the Federal Reserve and the Federal Deposit Insurance Corp. in March extended by six months, to Dec. 31, 2016, MetLife’s deadline to file a so-called living will which details how if would unwind itself in a bankruptcy. U.S. District Judge Rosemary Collyer asked for the delay because she wants to rule on early motions for dismissal or summary judgment before MetLife has to spend time and money preparing the will, according to filings in the case.

MetLife lowered its 2016 return on equity forecast on Thursday, in part because of the lack of clarity over what a SIFI designation will mean for capital requirements...

The three other nonbanks labeled systemically important are insurers American International Group Inc., Prudential Financial Inc., and General Electric Co.’s finance arm.

WHICH IS WHY GE IS GETTING OUT OF FINANCE, I'LL WAGER...

Demeter

(85,373 posts)MORE THAN YOU WILL EVER WANT TO KNOW ABOUT CHICKENS, AND POULTRY IN GENERAL

http://www.wired.com/2015/05/vaccines-might-not-stop-midwest-bird-apocalypse/

Twenty-four million dead birds on over 120 farms across 13 states. US poultry banned in at least eight countries. Three governor-declared states of emergency. Right now, the United States is experiencing the worst avian influenza epidemic in its history, and all farmers can do about it, at least for the moment, is kill infected birds by the barn.

Government officials, to their credit, are looking beyond the present, scrambling to develop a vaccine that they hope can stop the virus in its tracks. But that may not be enough—and some experts, in fact, worry that vaccinating will only make things worse for the economic and physical health of America’s poultry industry. The outbreaks of avian flu across the country are actually of two distinct varieties. The more virulent one, H5N2, emerged quietly, first showing up in a few backyard chickens near Boise, Idaho in January. But since March it has been throttling the Midwest, and on March 4 it was detected on a farm of 1.1 million birds in southern Minnesota. The USDA has been working on a vaccine for H5N2, and it will begin testing its effectiveness in live animals this month. But bird flus mutate quickly—so quickly that they can outpace vaccines. Vaccines are de-clawed versions of viruses: harmless invaders that teach an immune system how to identify and attack the harmful virus. When that vaccine isn’t perfectly targeted, though, bits of virus can hang around. “When vaccinated birds do not have 100 percent immunity against a particular virus strain, the birds may still be able to infect others with the virus,” says Henry Wan, an influenza virologist at Mississippi State University.

A vaccinated chicken could even become a so-called silent carrier, able to pass along the virus without showing any symptoms. “Because it has some level of immunity, the bird will not show any clinical signs,” says Wan, “but it can still shed viruses.” This becomes a bigger problem if the rate of vaccination isn’t high enough. If vaccinators don’t get enough of the poultry population, viral strains can get passed along into the environment. Endemic flus then become a persistent—and ever-evolving—threat to every new bird hatched or brought onto the farm. The viruses could become stronger and more diverse, turning vaccine development into a long-term game of whack-a-mole, in which the moles keep digging new holes, and each mallet only works once. But flocks of vaccinated ghost carriers aren’t the only fear. There’s another, more economic problem: A vaccinated bird’s blood looks like an infected bird’s blood, at least to food safety officials in countries that are trade partners with the US. Without knowing for sure, nobody’s going to want to import the billions of American birds raised for overseas customers each year. That problem arises because of the way vaccines work: Vaccines create the same antibodies as viruses. To a foreign quality control inspector doing a blood test, it makes it impossible to know whether a bird is infected or not. “You don’t want anything to mask the virus, so you can prove they are disease free,” says Carol Cardona, a veterinary viral disease specialist at the University of Minnesota.

This creates a catch-22. Which is better: A bird that’s unvaccinated? Or a vaccinated bird that foreign buyers don’t want because they can’t tell if it is vaccinated, or not yet showing symptoms for a deadly disease? Vaccines, in other words, could be worse for the poultry business than killing sick birds by the millions. New vaccine methods could potentially circumvent both of these worries, though, says Cardona. Disease specialists can make vaccines that attack multiple viral strains. And administering the vaccines wouldn’t necessitate millions of needles going into chicken legs, little chicken band-aids, and mealworm-flavored suckers. Vaccines could be put into the water, feed, or even dusted onto a bird’s feathers. “Then the bird just ingests it when they preen,” says Cardona. As for the trade problem, novel vaccine methods are also capable of introducing marker proteins that can alert inspectors to a vaccinated—not viral—bird.

For now, though, there’s only one other way to stop a virus from spreading: Kill every last infected bird. (As humanely as possible. The American Veterinary Medical Association publishes guidelines on ethical animal euthanasia, aimed to reduce suffering.) Usually, the chickens or turkeys are gassed to death where they lived. “The idea is to keep them in that barn and, once the birds are dead, they compost the carcasses in that same building so they are reducing the spread,” says Cardona. It’s a pretty symbiotic system: The decomposing bird bodies, turned over several times over the course of composting to even the rot, breed bacteria that kill off influenza viruses. Meanwhile, the barn is kept tightly locked, so foxes, flies, or rodents can’t sneak in for a meal and sneak out to spread the disease further.

That’s an OK system for now. Even though the mass cullings don’t seem to be slowing the spread of the virus between chickens, they’ll at least reduce exposure to humans—important, because even though the USDA says this bird flu outbreak poses no public health risk, that doesn’t mean people are immune. With enough exposure, H5N2 could evolve an affinity for humans, which is why farm workers who work closely with infected birds have been tested for disease markers and are being continuously monitored. In the absence of a vaccine, the USDA, state agriculture agencies, and individual farmers will continue to be exceptionally careful about keeping the virus contained. And if they fail? Well, the CDC is preparing a human vaccine, too.

Demeter

(85,373 posts)In a stunning development in the nearly five-year investigation into the demise of the once-venerable Wilmington Trust Co., four of the bank's former top executives were hit Wednesday with federal allegations they engaged in conduct that hid the true extent of the bank's troubled loans during the economic crisis of the last decade. Robert V.A. Harra Jr., 66, of Wilmington, former bank president and a 40-year veteran of the bank, has been charged with civil fraud and federal securities law violations by the U.S. Securities and Exchange Commission for conduct that fraudulently misled investors concerning the extent of past-due, matured and extended loans in the bank's commercial loan portfolio.

Also charged by the SEC are David R. Gibson, 58, Wilmington Trust's former chief financial officer; Kevyn N. Rakowski, 61, former controller; and William B. North, 55, former chief credit officer. In addition, the Delaware U.S. Attorney criminally indicted Rakowski of Lakewood Ranch, Fla., and North of Bryn Mawr, Pa., for making false statements to the SEC and Federal Reserve concerning the total quantity of past-due loans. The indictment alleges North and Rakowski participated in a practice to not report publicly matured loans that were in the process of extension or being handled by the bank's loan recovery section in October and November of 2009.

Wilmington Trust was required to report in its quarterly filings to the SEC and Federal Reserve how many loans were past due for 90 days or more. This information is used by investors and banking regulators to determine the health of a bank's loan portfolio. The 107-year-old bank founded by du Pont family members was brought to its knees in 2010 with the real estate crash in Kent and Sussex counties. The bank had made a big bet on development in Southern Delaware during the last decade and became a major commercial lender. In an eleventh-hour deal in October 2010, the bank agreed to be sold at a stunning discount to M&T Bank Corp. Without "a strategic transaction" acceptable to regulators, the bank would likely "face significant regulatory actions in the near term, which would likely result in a significant impairment of its business prospects," a 2011 proxy statement reads. The "merger" with M&T went through in early 2011. The deal resulted in shareholders taking huge losses and nearly 1,000 bank employees being cut from the workforce.

According to the SEC complaint, the four executives beginning in the third quarter of 2009 and running through the second quarter of 2010 engaged in conduct that "resulted in a series of materially false and misleading public disclosures in the bank's public filings," including disclosures that understated the amount of such loans by over $300 million," the complaint said. All the while, the executives each knew the true state of the bank's loan portfolio but "knowingly engaged in conduct designed to hide the truth from investors," the complaint said. Harra and Gibson of Wilmington made the "misleading public statements, participated in deceptive conduct concerning the loans, and knew or recklessly disregarded the false and misleading effect of those practices on Wilmington Trust's financial statements and disclosures. Rakowski and North knowingly engaged in conduct critical to, and that they knew would result in, the misleading disclosures," the complaint said.

***************

The U.S. Justice Department has brought eight criminal prosecutions related to Wilmington Trust since 2013. Three of the cases were brought against Wilmington Trust officials in the bank's commercial real estate division. These three former bank employees have pleaded guilty and are cooperating with the investigation. Prosecutors allege officials engaged in a scheme that would cause matured loans to be waived if the loans were current on the interest payments and considered to be in the process of extension. This led to Wilmington Trust not reporting full extent of past-due loans, prosecutors allege. By the end of December 2009, the total amount of matured loans not reported to the Federal Reserve as past due or nonaccrual status – because they were listed as "waived" – was more than $373 million, according to court documents. Of that amount, approximately $330 million in loans were at least 90 days past due with some up to 1,280 days past due, according to the filing.

In September, Wilmington Trust reached an agreement with the SEC to pay $18.5 million to settle charges that it made false and misleading disclosures about its past-due loans over multiple quarters in 2009 and 2010. A separate civil lawsuit filed by shareholders parallels the criminal cases, with investors alleging the officers and directors conspired to fraudulently conceal hundreds of millions of dollars' worth of past-due and non-performing loans at the bank.

CONTROL FRAUD--THE GIFT THAT KEEPS ON GIVING

Demeter

(85,373 posts)I probably won't start thread until Saturday, as it is Euchre Night, and like the sacrificial lamb, I will be slaughtered, as usual, by my friends...