Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 13 May 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 13 May 2015[font color=black][/font]

SMW for 12 May 2015

AT THE CLOSING BELL ON 11 May 2015

[center][font color=red]

Dow Jones 18,068.23 -36.94 (-0.20%)

S&P 500 2,099.12 -6.21 (-0.29%)

Nasdaq 4,976.19 -17.38 (-0.35%)

[font color=green]10 Year 2.25% -0.05 (-2.17%)

30 Year 3.02% -0.05 (-1.63%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

12 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH -- Wednesday, 13 May 2015 (Original Post)

Tansy_Gold

May 2015

OP

Greece Authorizes €750 Million Payment to IMF Despite Failing to Get Concession Sought

Demeter

May 2015

#1

Wolf Richter: How Soaring Housing Costs Impoverish a Whole Generation and Maul the Real Economy

Demeter

May 2015

#5

War Threat Rises As Economy Declines By Paul Craig Roberts THE REAL STATE OF THE UNION

Demeter

May 2015

#11

As Russia's Stock Market Soars, Ukraine Stuck In 'Frozen Conflict' Kenneth Rapoza

Demeter

May 2015

#12

Demeter

(85,373 posts)1. Greece Authorizes €750 Million Payment to IMF Despite Failing to Get Concession Sought

http://www.nakedcapitalism.com/2015/05/greece-authorizes-e750-million-payment-to-imf-despite-failing-to-get-concession-sought.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Today, Greece blinked. Despite leaks that suggested the government had decided to take a tougher line with the Eurogroup and was prepared to make a voluntary default on its €750 million payment to the IMF due tomorrow, Greek officials relented and told the central bank to send the funds onward. However, as we discuss at the end of the post, based on a tweet after we launched our post, that Greece might have gotten some eyewash.

We had indicated in our post earlier today that Greece may have made a tactical error, in that by saying that it had enough funds available, it was making clear that any failure to pay was elective. The reason is that the ruling coalition is getting close to the point of not having sufficient cash to meet salary and pension payments.

And even if Greece manages to make its end of May pension and salary payments in full, it’s hard to see how the government gets through June, when it has €1.5 billion coming due to the IMF with the first payment, €300 million, falling on June 5. If forced to resort to paying its citizens in funny money, it runs the dual risk of deepening the contraction and denting domestic support. However, Greece, like the Eurozone, has made an art form of pulling rabbits out of hats.

Nothing seems to have changed today, save exposing that the bluster in the Greek media and to friendly foreign reporters like Ambrose Evans-Pritchard, was not matched by action. Perhaps that reflects a pattern that we’ve seen before, that the messaging to the ruling coalition’s domestic audience is far more aggressive than what the government is prepared to do in practice. We’ve seen more than once how Greek negotiators, including Tsipras, will raise issues with creditors, then take a conciliatory line, but later make more defiant statements at home, seemingly walking back the position taken with counterparties.

According to the Financial Times report:

Greece failed to get the statement from the Eurogroup that it wanted, to allow the ECB to give it more room to borrow. Since it is to the negotiating advantage pthe creditors is to keep Greece in the sweatbox, it seemed unlikely that they’d relent. That is how things played out today:

If this account is correct, this explains the veering back and forth in stories out of Greece regarding the government’s plans. As we’ve pointed out, the ruling coalition is boxed in by Syriza’s left wing, which holds 1/3 of Syriza’s seats and is thus able to bring down the government. But that also means that leaks about government plans or even statements by officials (since Greece’s ministers have a habit of not singing from the same hymnal) need to be calibrated, and that’s well nigh impossible if the story is based on anonymous sources. Tsipras himself is a moderate, as is Varoufakis, and by all accounts Tsipras is still very much in charge of final decisions...MORE

I'M GLAD I'M NOT GREEK...I DON'T THINK I COULD STAND SUCH A GOVERNMENT. HARD TO BELIEVE THERE'S ONE WORSE THAN OUR OWN.

Today, Greece blinked. Despite leaks that suggested the government had decided to take a tougher line with the Eurogroup and was prepared to make a voluntary default on its €750 million payment to the IMF due tomorrow, Greek officials relented and told the central bank to send the funds onward. However, as we discuss at the end of the post, based on a tweet after we launched our post, that Greece might have gotten some eyewash.

We had indicated in our post earlier today that Greece may have made a tactical error, in that by saying that it had enough funds available, it was making clear that any failure to pay was elective. The reason is that the ruling coalition is getting close to the point of not having sufficient cash to meet salary and pension payments.

And even if Greece manages to make its end of May pension and salary payments in full, it’s hard to see how the government gets through June, when it has €1.5 billion coming due to the IMF with the first payment, €300 million, falling on June 5. If forced to resort to paying its citizens in funny money, it runs the dual risk of deepening the contraction and denting domestic support. However, Greece, like the Eurozone, has made an art form of pulling rabbits out of hats.

Nothing seems to have changed today, save exposing that the bluster in the Greek media and to friendly foreign reporters like Ambrose Evans-Pritchard, was not matched by action. Perhaps that reflects a pattern that we’ve seen before, that the messaging to the ruling coalition’s domestic audience is far more aggressive than what the government is prepared to do in practice. We’ve seen more than once how Greek negotiators, including Tsipras, will raise issues with creditors, then take a conciliatory line, but later make more defiant statements at home, seemingly walking back the position taken with counterparties.

According to the Financial Times report:

Greece failed to get the statement from the Eurogroup that it wanted, to allow the ECB to give it more room to borrow. Since it is to the negotiating advantage pthe creditors is to keep Greece in the sweatbox, it seemed unlikely that they’d relent. That is how things played out today:

Some members of the governing hard-left Syriza party had pushed ministers to withhold the payment until eurozone finance ministers meeting in Brussels agreed to endorse progress made by bailout negotiatorsin recent days.

Athens has lobbied furiously for such a statement, which officials believe would allow the European Central Bank to lift the ceiling on its issuance of short-term debt, which would provide more breathing room for the cash-strapped government…

Ministers had only a perfunctory debate over the Greek programme, and issued a statement that was far more lukewarm than Athens had hoped — welcoming the improved atmosphere in the talks but warning that “more time and effort are needed to bridge the gaps”.

Such language is not expected to give the ECB the leeway it would need to lift its restrictions on Athens’ ability to sell treasury bills, which are almost exclusively purchased by Greek banks.

Athens has lobbied furiously for such a statement, which officials believe would allow the European Central Bank to lift the ceiling on its issuance of short-term debt, which would provide more breathing room for the cash-strapped government…

Ministers had only a perfunctory debate over the Greek programme, and issued a statement that was far more lukewarm than Athens had hoped — welcoming the improved atmosphere in the talks but warning that “more time and effort are needed to bridge the gaps”.

Such language is not expected to give the ECB the leeway it would need to lift its restrictions on Athens’ ability to sell treasury bills, which are almost exclusively purchased by Greek banks.

If this account is correct, this explains the veering back and forth in stories out of Greece regarding the government’s plans. As we’ve pointed out, the ruling coalition is boxed in by Syriza’s left wing, which holds 1/3 of Syriza’s seats and is thus able to bring down the government. But that also means that leaks about government plans or even statements by officials (since Greece’s ministers have a habit of not singing from the same hymnal) need to be calibrated, and that’s well nigh impossible if the story is based on anonymous sources. Tsipras himself is a moderate, as is Varoufakis, and by all accounts Tsipras is still very much in charge of final decisions...MORE

I'M GLAD I'M NOT GREEK...I DON'T THINK I COULD STAND SUCH A GOVERNMENT. HARD TO BELIEVE THERE'S ONE WORSE THAN OUR OWN.

Demeter

(85,373 posts)8. A look at what Greece has to pay in coming weeks

http://www.cnbc.com/id/102667914

Greece faces a tough debt repayment schedule in 2015, adding pressure on it to reach a deal with bailout lenders.

Here's a look at payments due, including to the International Monetary Fund, until June 30. All figures are based on current exchange rates.

May 12 — 757 million euros ($844 million) to IMF

May 30 — 1.5 billion euros ($1.7 billion) in pensions, salaries

June 5 — 303 million euros ($337 million) to IMF

June 12 — 341 million euros ($380 million) to IMF

June 16 — 568 million euros ($633 million) to IMF

June 19 — 341 million euros ($380 million) to IMF

June 30 — 1.5 billion euros ($1.7 billion) in pensions, salaries

Source: IMF, Greek government.

Greece faces a tough debt repayment schedule in 2015, adding pressure on it to reach a deal with bailout lenders.

Here's a look at payments due, including to the International Monetary Fund, until June 30. All figures are based on current exchange rates.

May 12 — 757 million euros ($844 million) to IMF

May 30 — 1.5 billion euros ($1.7 billion) in pensions, salaries

June 5 — 303 million euros ($337 million) to IMF

June 12 — 341 million euros ($380 million) to IMF

June 16 — 568 million euros ($633 million) to IMF

June 19 — 341 million euros ($380 million) to IMF

June 30 — 1.5 billion euros ($1.7 billion) in pensions, salaries

Source: IMF, Greek government.

Demeter

(85,373 posts)10. The Greek Endgame: Time to Choose between Default and Defeat By Jerome Roos

http://www.informationclearinghouse.info/article41816.htm

If the leftists are adamant on overturning austerity measures they must stop spending their scarce resources on repaying external creditors.

For five years now, financial markets, European policymakers and the international media have been obsessed with the risk of an impending Greek default. Today, three months after Syriza's rise to power and five years after the passage of the first bailout memorandum in Parliament, it looks like the endgame is finally here. As Greece's left-led government remains locked in an insurmountable standoff with its international creditors, D-Day is fast approaching.

For the first time since the start of the crisis, state coffers are now really running on empty – and this time around, the deadlock in Greece's debt negotiations with the Eurogroup means that there is no immediate prospect of access to emergency credit. The Troika of foreign lenders, which despite official statements to the contrary remains very much alive, is still refusing to release the final 7.2 billion tranche of its second 110 billion euro bailout. As a result, Greece has not received any of its bailout money since August – nor has it been able to borrow on private markets.

A nearly-botched pension payout last week revealed just how critical the government's fiscal position has now become. After effectively seizing the idle deposits and cash reserves of lower-level administrations, municipalities, hospitals, universities and other public entities to obtain sufficient resources for the monthly transfers, officials still struggled to meet the deadline. The payment was eventually made with several hours' delay and conveniently blamed on a technical glitch.

It is unclear, however, if the government will be able to make its next round of pension and wage payments by the end of May. Two weeks ago, Deputy Finance Minister Dimitris Mardas declared that he expects the state to run about 400 million euros short of the amount needed to effect the transfers. Meanwhile, the BBC reports that an undeclared domestic default is already taking hold, affecting government subcontractors, public institutions and private businesses. While public sector wages are still being paid, overtime work for hospital personnel, for instance, has been put on hold....MORE

GOOD SUMMARY OF WHERE THINGS STAND IN GREECE

If the leftists are adamant on overturning austerity measures they must stop spending their scarce resources on repaying external creditors.

For five years now, financial markets, European policymakers and the international media have been obsessed with the risk of an impending Greek default. Today, three months after Syriza's rise to power and five years after the passage of the first bailout memorandum in Parliament, it looks like the endgame is finally here. As Greece's left-led government remains locked in an insurmountable standoff with its international creditors, D-Day is fast approaching.

For the first time since the start of the crisis, state coffers are now really running on empty – and this time around, the deadlock in Greece's debt negotiations with the Eurogroup means that there is no immediate prospect of access to emergency credit. The Troika of foreign lenders, which despite official statements to the contrary remains very much alive, is still refusing to release the final 7.2 billion tranche of its second 110 billion euro bailout. As a result, Greece has not received any of its bailout money since August – nor has it been able to borrow on private markets.

A nearly-botched pension payout last week revealed just how critical the government's fiscal position has now become. After effectively seizing the idle deposits and cash reserves of lower-level administrations, municipalities, hospitals, universities and other public entities to obtain sufficient resources for the monthly transfers, officials still struggled to meet the deadline. The payment was eventually made with several hours' delay and conveniently blamed on a technical glitch.

It is unclear, however, if the government will be able to make its next round of pension and wage payments by the end of May. Two weeks ago, Deputy Finance Minister Dimitris Mardas declared that he expects the state to run about 400 million euros short of the amount needed to effect the transfers. Meanwhile, the BBC reports that an undeclared domestic default is already taking hold, affecting government subcontractors, public institutions and private businesses. While public sector wages are still being paid, overtime work for hospital personnel, for instance, has been put on hold....MORE

GOOD SUMMARY OF WHERE THINGS STAND IN GREECE

Demeter

(85,373 posts)2. How Much Longer Can The Oil Age Last?

NEVER ANSWERS THE QUESTION, BUT THIS ARTICLE BEATS THE BUSHES FOR DATA

GOOD READ ON ENERGY: http://www.nakedcapitalism.com/2015/05/how-much-longer-can-the-oil-age-last.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Demeter

(85,373 posts)9. China Has Become the World’s Biggest Crude Oil Importer for the First Time

http://time.com/3853451/china-crude-oil-top-importer/

The news reflects both China's soaring energy consumption and America's shale revolution

NOT TO MENTION THE HOLLOWING OUT OF US ECONOMY BY OFF-SHORING MANUFACTURING

China is now the largest importer of crude oil in the world. In April, it surpassed the U.S., which has traditionally held the slot, with imports of 7.4 million barrels per day (bpd) or 200,000 more than the U.S., according to the Financial Times.

The news comes as a surprise because the Chinese economy has been slowing and just this weekend, in an effort to stimulate growth, the People’s Bank of China cut interest rates for the third time in 6 months.

Over the next few months, the U.S. and China may be in and out of the top spot, but because American imports dropped by about 3 million bpd in the last decade (thanks in large part to shale extractions) and because China’s purchases have boosted seven-fold, the Chinese should be the top crude oil importer on a long term basis.

China overtook the United States as the world’s top energy consumer in 2010 and is already the number one purchaser of many commodities, such as coal, iron ore and most metals.

The news reflects both China's soaring energy consumption and America's shale revolution

NOT TO MENTION THE HOLLOWING OUT OF US ECONOMY BY OFF-SHORING MANUFACTURING

China is now the largest importer of crude oil in the world. In April, it surpassed the U.S., which has traditionally held the slot, with imports of 7.4 million barrels per day (bpd) or 200,000 more than the U.S., according to the Financial Times.

The news comes as a surprise because the Chinese economy has been slowing and just this weekend, in an effort to stimulate growth, the People’s Bank of China cut interest rates for the third time in 6 months.

Over the next few months, the U.S. and China may be in and out of the top spot, but because American imports dropped by about 3 million bpd in the last decade (thanks in large part to shale extractions) and because China’s purchases have boosted seven-fold, the Chinese should be the top crude oil importer on a long term basis.

China overtook the United States as the world’s top energy consumer in 2010 and is already the number one purchaser of many commodities, such as coal, iron ore and most metals.

Demeter

(85,373 posts)3. Sovereignty For International Investors (Trans-Pacific Partnership (TPP))

http://www.nakedcapitalism.com/2015/05/sovereignty-for-international-investors-trans-pacific-partnership-tpp.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

By Patrick Durusau, who consults on semantic integration and edits standards. Durusau is convener of JTC 1 SC 34/WG 3, co-editor of 13250-1 and 13250-5 (Topic Maps Introduction and Reference Model, respectively), and editor of the OpenDocument Format (ODF) standard at OASIS and ISO (ISO/IEC 26300). Originally published at Another Word for It.

Elizabeth Warren makes a compelling case against the Trans-Pacific Partnership in The Trans-Pacific Partnership clause everyone should oppose, where she says:

…

I understand Senator Warren’s focus on the United States, but it diverts her from a darker issue raised by the TPP.

The TPP gives international investors sovereignty equivalent to national governments.

Without the TPP and similar agreements, an international investor with a dispute with Australia, Brunei Darussalam, Canada, Chile, Malaysia, Mexico, Peru, Singapore,United States, Vietnam, or New Zealand, has to sue in the courts of that country.

With the TPP, international investors being equal sovereigns with those countries, can use Investor-State Dispute Settlement (ISDS) to bring a national government before privately selected arbiters, in possibly secret proceedings, because of laws or regulations they find objectionable.

Is that scare mongering?

Why don’t you ask:

Australia. Phillip Morris is suing Australia over legislation to regulate tobacco packaging. The Australian government has assembled all the public documents from that process at: Tobacco plain packaging—investor-state arbitration. The proceedings are based on: (Hong Kong – Australia treaty) (I have read predatory agreements before but nothing on this scale. There are no limits on the rights of investors. None at all.)

Or,

Uruguay. Phillip Morris is suing Uruguay because of laws that has been reducing smoking by 4.3% a year.

(Philip Morris Sues Uruguay Over Graphic Cigarette Packaging) Not in court, a Investor-State Dispute Settlement (ISDS) proceeding. This proceeding is based on: (The Swiss Confederation – Uruguay Bilateral Trade Agreement)

The Uruguay agreement provides in part:

That sounds like a public health exception to me.

If the United States and the other countries are daft enough to confer sovereignty on international investors, are there any limits to their rights?

MORE AMMO FOR THE FIGHT TO RETAIN NATIONAL SOVEREIGNTY AT LINK

Yves here. This post provides another vantage on one of the very worst features of the pending, mislabeled trade deals, the Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership. Both are up for what is the critical vehicle for their passage, so-called Fast Track Authority, this week. The Senate vote is scheduled for today, May 12.

IT WAS FILIBUSTERED!

If you have not done so yet, PLEASE call your Senators as soon as you can to voice forceful disapproval. E-mail friends and post reminders on Facebook (one readers suggested alumni groups, an option to add if you’ve neglected that route so far). You can find your Senators phone numbers here. After you’ve given them a piece of your mind, be sure to call your Representative (numbers here).

It’s been striking to see how the Administration and Obama personally have stooped to personal slurs and failed to make substantive responses to criticism. Even the normally measured Robert Reich and Dean Baker have come as close to calling Obama a liar as card-carrying members of the elite dare to in public discourse.

While this may be Obamas’s of entitlement getting long in the tooth, it may also result from his team recognizing all too well that any honest discussion on the merits will not go well for them.

This post provided a good overview of the dangers of the so-called investor state dispute settlement panels, which might more accurately be called “turn over America to multinational rule” panels.

For additional background, see these posts:

Gaius Publius: What’s Wrong with Wyden-Hatch-Ryan’s Fast Track Bill – The Specifics

The Administration’s Dishonest Response to Elizabeth Warren’s Attack on Secret Investor Arbitration Panels in Trade Deals

Thoughts About the Trans-Pacific Partnership

Wikileaks on the Trans-Pacific Partnership Environment Chapter: “Toothless Public Relations Exercise” LINKS AT ORIGINAL ARTICLE

IT WAS FILIBUSTERED!

If you have not done so yet, PLEASE call your Senators as soon as you can to voice forceful disapproval. E-mail friends and post reminders on Facebook (one readers suggested alumni groups, an option to add if you’ve neglected that route so far). You can find your Senators phone numbers here. After you’ve given them a piece of your mind, be sure to call your Representative (numbers here).

It’s been striking to see how the Administration and Obama personally have stooped to personal slurs and failed to make substantive responses to criticism. Even the normally measured Robert Reich and Dean Baker have come as close to calling Obama a liar as card-carrying members of the elite dare to in public discourse.

While this may be Obamas’s of entitlement getting long in the tooth, it may also result from his team recognizing all too well that any honest discussion on the merits will not go well for them.

This post provided a good overview of the dangers of the so-called investor state dispute settlement panels, which might more accurately be called “turn over America to multinational rule” panels.

For additional background, see these posts:

Gaius Publius: What’s Wrong with Wyden-Hatch-Ryan’s Fast Track Bill – The Specifics

The Administration’s Dishonest Response to Elizabeth Warren’s Attack on Secret Investor Arbitration Panels in Trade Deals

Thoughts About the Trans-Pacific Partnership

Wikileaks on the Trans-Pacific Partnership Environment Chapter: “Toothless Public Relations Exercise” LINKS AT ORIGINAL ARTICLE

By Patrick Durusau, who consults on semantic integration and edits standards. Durusau is convener of JTC 1 SC 34/WG 3, co-editor of 13250-1 and 13250-5 (Topic Maps Introduction and Reference Model, respectively), and editor of the OpenDocument Format (ODF) standard at OASIS and ISO (ISO/IEC 26300). Originally published at Another Word for It.

Elizabeth Warren makes a compelling case against the Trans-Pacific Partnership in The Trans-Pacific Partnership clause everyone should oppose, where she says:

ISDS [Investor-State Dispute Settlement] would allow foreign companies to challenge U.S. laws — and potentially to pick up huge payouts from taxpayers — without ever stepping foot in a U.S. court. Here’s how it would work. Imagine that the United States bans a toxic chemical that is often added to gasoline because of its health and environmental consequences. If a foreign company that makes the toxic chemical opposes the law, it would normally have to challenge it in a U.S. court. But with ISDS, the company could skip the U.S. courts and go before an international panel of arbitrators. If the company won, the ruling couldn’t be challenged in U.S. courts, and the arbitration panel could require American taxpayers to cough up millions — and even billions — of dollars in damages.

If that seems shocking, buckle your seat belt. ISDS could lead to gigantic fines, but it wouldn’t employ independent judges. Instead, highly paid corporate lawyers would go back and forth between representing corporations one day and sitting in judgment the next. Maybe that makes sense in an arbitration between two corporations, but not in cases between corporations and governments. If you’re a lawyer looking to maintain or attract high-paying corporate clients, how likely are you to rule against those corporations when it’s your turn in the judge’s seat?

…

The use of ISDS is on the rise around the globe. From 1959 to 2002, there were fewer than 100 ISDS claims worldwide. But in 2012 alone, there were 58 cases. Recent cases include a French company that sued Egypt because Egypt raised its minimum wage, a Swedish company that sued Germany because Germany decided to phase out nuclear power after Japan’s Fukushima disaster, and a Dutch company that sued the Czech Republic because the Czechs didn’t bail out a bank that the company partially owned. U.S. corporations have also gotten in on the action: Philip Morris is trying to use ISDS to stop Uruguay from implementing new tobacco regulations intended to cut smoking rates.

If that seems shocking, buckle your seat belt. ISDS could lead to gigantic fines, but it wouldn’t employ independent judges. Instead, highly paid corporate lawyers would go back and forth between representing corporations one day and sitting in judgment the next. Maybe that makes sense in an arbitration between two corporations, but not in cases between corporations and governments. If you’re a lawyer looking to maintain or attract high-paying corporate clients, how likely are you to rule against those corporations when it’s your turn in the judge’s seat?

…

The use of ISDS is on the rise around the globe. From 1959 to 2002, there were fewer than 100 ISDS claims worldwide. But in 2012 alone, there were 58 cases. Recent cases include a French company that sued Egypt because Egypt raised its minimum wage, a Swedish company that sued Germany because Germany decided to phase out nuclear power after Japan’s Fukushima disaster, and a Dutch company that sued the Czech Republic because the Czechs didn’t bail out a bank that the company partially owned. U.S. corporations have also gotten in on the action: Philip Morris is trying to use ISDS to stop Uruguay from implementing new tobacco regulations intended to cut smoking rates.

…

I understand Senator Warren’s focus on the United States, but it diverts her from a darker issue raised by the TPP.

The TPP gives international investors sovereignty equivalent to national governments.

Without the TPP and similar agreements, an international investor with a dispute with Australia, Brunei Darussalam, Canada, Chile, Malaysia, Mexico, Peru, Singapore,United States, Vietnam, or New Zealand, has to sue in the courts of that country.

With the TPP, international investors being equal sovereigns with those countries, can use Investor-State Dispute Settlement (ISDS) to bring a national government before privately selected arbiters, in possibly secret proceedings, because of laws or regulations they find objectionable.

Is that scare mongering?

Why don’t you ask:

Australia. Phillip Morris is suing Australia over legislation to regulate tobacco packaging. The Australian government has assembled all the public documents from that process at: Tobacco plain packaging—investor-state arbitration. The proceedings are based on: (Hong Kong – Australia treaty) (I have read predatory agreements before but nothing on this scale. There are no limits on the rights of investors. None at all.)

Or,

Uruguay. Phillip Morris is suing Uruguay because of laws that has been reducing smoking by 4.3% a year.

(Philip Morris Sues Uruguay Over Graphic Cigarette Packaging) Not in court, a Investor-State Dispute Settlement (ISDS) proceeding. This proceeding is based on: (The Swiss Confederation – Uruguay Bilateral Trade Agreement)

The Uruguay agreement provides in part:

…

Article 2 Promotion, admission

(1) Each Contracting Party shall in its territory promote as far as possible investments by investors of the other Contracting Party and admit such investments in accordance with its law. The Contracting Parties recognize each other’s right not to allow economic activities for reasons of public security and order, public health or morality, as well as activities which are by law reserved to their own investors.

…

Article 2 Promotion, admission

(1) Each Contracting Party shall in its territory promote as far as possible investments by investors of the other Contracting Party and admit such investments in accordance with its law. The Contracting Parties recognize each other’s right not to allow economic activities for reasons of public security and order, public health or morality, as well as activities which are by law reserved to their own investors.

…

That sounds like a public health exception to me.

If the United States and the other countries are daft enough to confer sovereignty on international investors, are there any limits to their rights?

MORE AMMO FOR THE FIGHT TO RETAIN NATIONAL SOVEREIGNTY AT LINK

Demeter

(85,373 posts)4. Fast Track Authority for Toxic Trade Deals Fails Key Vote in Senate

http://www.nakedcapitalism.com/2015/05/fast-track-authority-for-toxic-trade-fails-key-vote-in-senate.html

...The Senate gave Obama a decisive defeat by refusing to let fast track authority for the TPP and other pending trade deals advance to the stage of being debated. Thanks to all for your calls, e-mails and letters to Senators, Representatives, and local media. This is one of those rare cases where the process worked.

From Reuters:

Bloomberg bizarrely has the heading for its Fast Track article, on its main page, in red, “Last Minute Rebellion”. Anyone who has been paying attention knows that most Democrat Congressmen opposed the deal; Obama has been trying to win over enough to give Republicans air cover so that they can claim these traitorous deals are “bipartisan”. From the story:

Note that the subtext is that Obama might find a way to surmount this procedural hurdle. However, eight votes is a large margin to overcome, particularly since Obama has been making a full court press. Moreover, the stance of many of the opponents is entirely reasonable: show us the bill. And Obama knows it will not withstand scrutiny.

Notice how Roll Call discussed the vote in a story posted shortly before the vote:

Thus I would not be surprised if we see another effort to get Fast Track passed, particularly since some Senators like Ron Wyden have made is clear they are amendable to a deal. However, such a visible defeat is a big boost to the opponents. Thus while a win has not been secured, it looks increasingly likely.

Obama has already resorted to shameless lies to try to rally support for the bill. It will be instructive to see what he tries next.

I looked for the roll call on the Senate’s site and do not see it up yet. I’m told it was a straight line vote, with the exception of Tom Carper of Delaware, who voted for Fast Track authorization.

Please call your Senators and Representatives, and tell them that this vote today was proof of deep seated opposition to both the President’s refusal to allow proper review of such important legislation and how dangerous they are to American citizens from what we can infer from the sections that have been leaked. This fight is not over till it is over, and it is important to keep pressing after gaining ground.

*********************************************************

Update: I spoke to a Congressional source who said, “This is really bad for Obama” with considerable glee.

The Administration had a ministerial meeting set for the end of the month for TPP with the hope of resolving open issues. The other countries were not willing to make their offer until the Americans had secured Fast Track, so this is an embarrassment internationally and wrecks the planned timetable. Some Senators had been willing to approve Fast Track if the Senate would also pass an amendment that closed a loophole in existing legislation that allowed goods to be imported that used child or forced labor. Another part of a deal that the Senators had wanted was much tougher requirements on designating foreign countries as currency manipulators. Apparently, what happened today was that the Administration tried getting a vote on Fast Track only, and the Senators that were willing to go along if they got the child labor and currency manipulator protections passed rebelled.

The contact said that this development was bad for Obama on every axis. While the Administration could in theory revive the deal by giving in on the child labor and currency manipulator issue, Obama may actually not be willing to concede this point. This finally marks a big victory for Elizabeth Warren, who was the most visible face of this campaign and who the Administration attacked personally.

...The Senate gave Obama a decisive defeat by refusing to let fast track authority for the TPP and other pending trade deals advance to the stage of being debated. Thanks to all for your calls, e-mails and letters to Senators, Representatives, and local media. This is one of those rare cases where the process worked.

From Reuters:

Legislation giving U.S. President Barack Obama authority to speed trade deals through Congress failed a crucial procedural test on Tuesday, delaying a measure that may be key to President Barack Obama’s diplomatic pivot to Asia.

In a setback to the White House trade agenda, the Senate voted 52-45 – eight votes short of the necessary 60 – to clear the way for debate on the legislation, which would allow a quick decision on granting the president so-called fast track authority to move trade deals quickly through Congress.

The vote marked a big victory for Senate Democratic leader Harry Reid, an outspoken opponent of fast-track.

The failure to garner the necessary votes came after key pro-trade Democrats, including Senator Ron Wyden of Oregon, announced they would vote no on the procedural vote because the measure lacked some trade protections.

In a setback to the White House trade agenda, the Senate voted 52-45 – eight votes short of the necessary 60 – to clear the way for debate on the legislation, which would allow a quick decision on granting the president so-called fast track authority to move trade deals quickly through Congress.

The vote marked a big victory for Senate Democratic leader Harry Reid, an outspoken opponent of fast-track.

The failure to garner the necessary votes came after key pro-trade Democrats, including Senator Ron Wyden of Oregon, announced they would vote no on the procedural vote because the measure lacked some trade protections.

Bloomberg bizarrely has the heading for its Fast Track article, on its main page, in red, “Last Minute Rebellion”. Anyone who has been paying attention knows that most Democrat Congressmen opposed the deal; Obama has been trying to win over enough to give Republicans air cover so that they can claim these traitorous deals are “bipartisan”. From the story:

Senate Democrats staged a last-minute rebellion against one of President Barack Obama’s top legislative priorities by blocking a test vote on a trade measure that didn’t include companion measures they sought.

The vote, 52-45, effectively delays fast-track legislation Obama wants to expedite approval of trade accords. Supporters needed 60 votes to advance the bill to a final vote.

Senate Majority Leader Mitch McConnell said the Democrats’ opposition was “pretty shocking” and vowed to keep working to reach an agreement he could bring back for a vote later.

Obama had sought the trade-promotion authority legislation to help him close a 12-nation deal called the Trans-Pacific Partnership and submit it to Congress for approval without amendments. Obama scratched for every Democratic vote, but after weeks of meetings, telephone calls and personal appeals, the fiercest opponents remained within his party.

The vote, 52-45, effectively delays fast-track legislation Obama wants to expedite approval of trade accords. Supporters needed 60 votes to advance the bill to a final vote.

Senate Majority Leader Mitch McConnell said the Democrats’ opposition was “pretty shocking” and vowed to keep working to reach an agreement he could bring back for a vote later.

Obama had sought the trade-promotion authority legislation to help him close a 12-nation deal called the Trans-Pacific Partnership and submit it to Congress for approval without amendments. Obama scratched for every Democratic vote, but after weeks of meetings, telephone calls and personal appeals, the fiercest opponents remained within his party.

Note that the subtext is that Obama might find a way to surmount this procedural hurdle. However, eight votes is a large margin to overcome, particularly since Obama has been making a full court press. Moreover, the stance of many of the opponents is entirely reasonable: show us the bill. And Obama knows it will not withstand scrutiny.

Notice how Roll Call discussed the vote in a story posted shortly before the vote:

The White House is brushing off what is now expected to be the imminent filibuster of President Barack Obama’s fast-track bill on the Senate floor, with Press Secretary Josh Earnest blaming a “procedural SNAFU” for Democrats planning to vote en masse to block it.

The expected vote could deal a devastating blow to Obama’s ambitious trade agenda, and amounts to perhaps the biggest rebuke of this president by his own party.

But Earnest said Tuesday the president will continue to try and push fast-track authority through the Senate even after pro-trade Senate Democrats indicated they wouldn’t back the bill unless several bills — including one on currency enforcement — would move forward.

The expected vote could deal a devastating blow to Obama’s ambitious trade agenda, and amounts to perhaps the biggest rebuke of this president by his own party.

But Earnest said Tuesday the president will continue to try and push fast-track authority through the Senate even after pro-trade Senate Democrats indicated they wouldn’t back the bill unless several bills — including one on currency enforcement — would move forward.

Thus I would not be surprised if we see another effort to get Fast Track passed, particularly since some Senators like Ron Wyden have made is clear they are amendable to a deal. However, such a visible defeat is a big boost to the opponents. Thus while a win has not been secured, it looks increasingly likely.

Obama has already resorted to shameless lies to try to rally support for the bill. It will be instructive to see what he tries next.

I looked for the roll call on the Senate’s site and do not see it up yet. I’m told it was a straight line vote, with the exception of Tom Carper of Delaware, who voted for Fast Track authorization.

Please call your Senators and Representatives, and tell them that this vote today was proof of deep seated opposition to both the President’s refusal to allow proper review of such important legislation and how dangerous they are to American citizens from what we can infer from the sections that have been leaked. This fight is not over till it is over, and it is important to keep pressing after gaining ground.

*********************************************************

Update: I spoke to a Congressional source who said, “This is really bad for Obama” with considerable glee.

The Administration had a ministerial meeting set for the end of the month for TPP with the hope of resolving open issues. The other countries were not willing to make their offer until the Americans had secured Fast Track, so this is an embarrassment internationally and wrecks the planned timetable. Some Senators had been willing to approve Fast Track if the Senate would also pass an amendment that closed a loophole in existing legislation that allowed goods to be imported that used child or forced labor. Another part of a deal that the Senators had wanted was much tougher requirements on designating foreign countries as currency manipulators. Apparently, what happened today was that the Administration tried getting a vote on Fast Track only, and the Senators that were willing to go along if they got the child labor and currency manipulator protections passed rebelled.

The contact said that this development was bad for Obama on every axis. While the Administration could in theory revive the deal by giving in on the child labor and currency manipulator issue, Obama may actually not be willing to concede this point. This finally marks a big victory for Elizabeth Warren, who was the most visible face of this campaign and who the Administration attacked personally.

Demeter

(85,373 posts)6. How to lose a trade agenda

http://democratherald.com/news/opinion/columnists/how-to-lose-a-trade-agenda/article_a04252a5-06fa-5ce5-9af4-fc16020f9f3d.html

Let's suppose you are trying to bring a friend around to your point of view.

Would you tell her she's emotional, illogical, outdated and not very smart? Would you complain that he's being dishonest, fabricating falsehoods and denying reality with his knee-jerk response?

Such a method of a persuasion is likelier to get you a black eye than a convert. Yet this is how President Obama treats his fellow Democrats on trade — and why he's in danger of losing.

The vast majority of lawmakers in his own party oppose him on trade legislation. Yet rather than accept that they have a legitimate beef, he shows public contempt for them — as he did in an interview with Matt Bai of Yahoo News released over the weekend.

The rhetoric suggests that Obama has given up trying to persuade Democrats to join him in supporting "fast track" approval of the emerging Trans-Pacific Partnership trade deal and that he's lashing out at them in anger. Without Democratic support, the fast-track legislation faces a tough slog on Capitol Hill, especially in the House...

MORE DELICIOUS IRONY AT LINK

Let's suppose you are trying to bring a friend around to your point of view.

Would you tell her she's emotional, illogical, outdated and not very smart? Would you complain that he's being dishonest, fabricating falsehoods and denying reality with his knee-jerk response?

Such a method of a persuasion is likelier to get you a black eye than a convert. Yet this is how President Obama treats his fellow Democrats on trade — and why he's in danger of losing.

The vast majority of lawmakers in his own party oppose him on trade legislation. Yet rather than accept that they have a legitimate beef, he shows public contempt for them — as he did in an interview with Matt Bai of Yahoo News released over the weekend.

"Their arguments are based on fears, or they're fighting NAFTA, the trade deal that was passed 25 years ago — or 20 years ago," he said with a laugh. Sighing, he added, "I understand the emotions behind it, but when you break down the logic of their arguments, I've got to say that there's not much there there."

He said one of his Democratic critics' arguments "doesn't make any sense," another is "pure speculation," and others are "made up" or unrealistic. "There's no logic that I think a progressive should embrace that would make you opposed to this deal," he said, accusing those who disagree of taking the "not smart" position of trying to "ignore the fact that a global economy is here to stay" and of acting to "shrink the overall economic pie just because we're mad about some things that have happened in the past."

He said one of his Democratic critics' arguments "doesn't make any sense," another is "pure speculation," and others are "made up" or unrealistic. "There's no logic that I think a progressive should embrace that would make you opposed to this deal," he said, accusing those who disagree of taking the "not smart" position of trying to "ignore the fact that a global economy is here to stay" and of acting to "shrink the overall economic pie just because we're mad about some things that have happened in the past."

The rhetoric suggests that Obama has given up trying to persuade Democrats to join him in supporting "fast track" approval of the emerging Trans-Pacific Partnership trade deal and that he's lashing out at them in anger. Without Democratic support, the fast-track legislation faces a tough slog on Capitol Hill, especially in the House...

MORE DELICIOUS IRONY AT LINK

Demeter

(85,373 posts)5. Wolf Richter: How Soaring Housing Costs Impoverish a Whole Generation and Maul the Real Economy

http://www.nakedcapitalism.com/2015/05/wolf-richter-how-soaring-housing-costs-impoverish-a-whole-generation-and-maul-the-real-economy.html

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

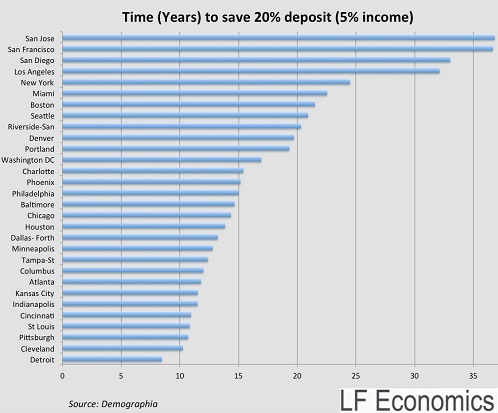

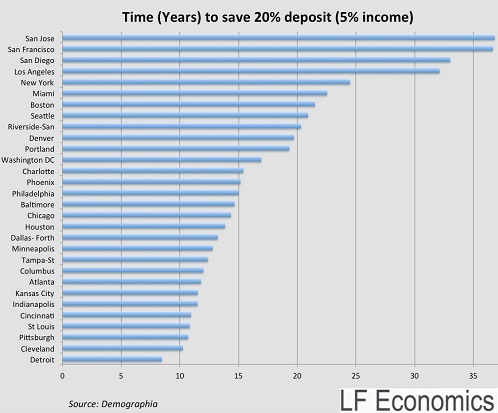

How many years would it take first-time homebuyers, earning a median household income, to save enough money for the standard 20% down payment on a median home? Are you sitting down? An impossibly long time in many cities, Lindsay David of LF Economics (and a contributor on WOLF STREET) found in his report on mortgage stress. He looked at 30 large US cities, using their local median incomes and median home prices. It assumed that young households could accomplish the tough feat of saving 5% of their income, year after year, through bouts of unemployment, illness, shopping sprees, family expansions, or extended vacations. The results are stunning – if just a tad discouraging for first-time buyers.

In my beloved and crazy boom-and-bust town of San Francisco, where a median home (for example, a two-bedroom no-view apartment in a so-so neighborhood) costs $1 million, it would take – are you ready? – 37 effing years. Given its higher median income, San Francisco is only in second place. The winner by a few months is another Bay Area city, San Jose. In San Diego, it would take 33 years. In Los Angeles, 32 years. First-time buyers might be retired before they scrape their theoretical down payment together. Theoretical, because in reality, too many things change, and they’re chasing after a moving target. So lower your expectations and step down to buy a below-median home? Here is what TwistedPolitix found on the market in that price category:

And that 20% down payment would still amount to $130,000. How long would it take first-time buyers with a median household income to save up this much money? About a quarter century!

In New York City, fifth place, it would take just under 25 years, followed by Miami, Boston, and Seattle. In ninth place, Riverside-San Bernardino, CA, just over 20 years. In tenth place, Denver, just under 20 years. This puts five California cities on the list of the top 10 most impossible cities for first-time buyers to buy a home in. Of the 30 cities in the chart from LF Economics, there’s only a handful where a household with a median income, and able to save 5%, can come up with a 20% down payment in about a decade.

It gets easier when people refuse to move out of their parents’ home. If they don’t pay one dime in rent or help with cable TV or whatever, they might be able to squirrel away 30% of their median income. To come up with a 20% down payment in San Francisco or San Jose, it would take them a little over 6 years. But for the hardy folks trying to make it on their own, it’s impossible. They probably can’t even save enough for a 3% down payment, which in San Francisco would set them back by $30,000. Charge it on a credit card? Hardly. So perhaps they can bamboozle mom and dad into helping out.

Driving home prices into the stratosphere has been top priority for the Fed. It’s called the “healing of the housing market.” The higher the home prices, the more they’re “healed.” It was designed to bail out the banks, their stockholders and bondholders, such as Warren Buffett who is the largest investor in the nation’s largest mortgage lender, Well Fargo, and presides over a vast finance and insurance empire. It was part and parcel of the Fed’s successful plan to inflate all asset prices via waves of QE and interest rate repression, come hell or high water. Inflating the prices of stocks and bonds is one thing. People don’t have to live in them. Not so with homes. People have to live somewhere. By inflating home prices, the Fed has inflated the costs of everyday life for all Americans. No big deal for the wealthy. But woe to those on a median income...The effects are pernicious. In its report on housing, California Housing Partnership Corporation has this to say about California, “the largest and wealthiest state” of the US, where housing is particularly, to use the Fed’s term, healed:

If housing costs are factored into poverty rates (which federal measures do not), then the percentage of people living below the poverty line jumps to 22% in California, up from 16.2% mentioned in federal reports. In that respect, according to the report, the worst is Los Angeles County with a poverty rate of 26.9%. Orange Country, one of California’s wealthiest counties, has the second highest housing-adjusted poverty rate, 24.3%.

MORE "GOOD NEWS" AT LINK

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

How many years would it take first-time homebuyers, earning a median household income, to save enough money for the standard 20% down payment on a median home? Are you sitting down? An impossibly long time in many cities, Lindsay David of LF Economics (and a contributor on WOLF STREET) found in his report on mortgage stress. He looked at 30 large US cities, using their local median incomes and median home prices. It assumed that young households could accomplish the tough feat of saving 5% of their income, year after year, through bouts of unemployment, illness, shopping sprees, family expansions, or extended vacations. The results are stunning – if just a tad discouraging for first-time buyers.

In my beloved and crazy boom-and-bust town of San Francisco, where a median home (for example, a two-bedroom no-view apartment in a so-so neighborhood) costs $1 million, it would take – are you ready? – 37 effing years. Given its higher median income, San Francisco is only in second place. The winner by a few months is another Bay Area city, San Jose. In San Diego, it would take 33 years. In Los Angeles, 32 years. First-time buyers might be retired before they scrape their theoretical down payment together. Theoretical, because in reality, too many things change, and they’re chasing after a moving target. So lower your expectations and step down to buy a below-median home? Here is what TwistedPolitix found on the market in that price category:

Yes folks, step right up and get your 700 sq. ft. home in Redwood City, California, heart of the Silicon Valley, for just $649,000! The American Dream! 1 bedroom, 1 bath for just $3,154 per month on a mortgage with super low interest rates if you put down 20%.

If you pay the mortgage back according to the standard 30-year schedule, in April 2045 you will have paid $1,135,721 for a tiny little [bleep] shack. Brilliant!

If you pay the mortgage back according to the standard 30-year schedule, in April 2045 you will have paid $1,135,721 for a tiny little [bleep] shack. Brilliant!

And that 20% down payment would still amount to $130,000. How long would it take first-time buyers with a median household income to save up this much money? About a quarter century!

In New York City, fifth place, it would take just under 25 years, followed by Miami, Boston, and Seattle. In ninth place, Riverside-San Bernardino, CA, just over 20 years. In tenth place, Denver, just under 20 years. This puts five California cities on the list of the top 10 most impossible cities for first-time buyers to buy a home in. Of the 30 cities in the chart from LF Economics, there’s only a handful where a household with a median income, and able to save 5%, can come up with a 20% down payment in about a decade.

It gets easier when people refuse to move out of their parents’ home. If they don’t pay one dime in rent or help with cable TV or whatever, they might be able to squirrel away 30% of their median income. To come up with a 20% down payment in San Francisco or San Jose, it would take them a little over 6 years. But for the hardy folks trying to make it on their own, it’s impossible. They probably can’t even save enough for a 3% down payment, which in San Francisco would set them back by $30,000. Charge it on a credit card? Hardly. So perhaps they can bamboozle mom and dad into helping out.

Driving home prices into the stratosphere has been top priority for the Fed. It’s called the “healing of the housing market.” The higher the home prices, the more they’re “healed.” It was designed to bail out the banks, their stockholders and bondholders, such as Warren Buffett who is the largest investor in the nation’s largest mortgage lender, Well Fargo, and presides over a vast finance and insurance empire. It was part and parcel of the Fed’s successful plan to inflate all asset prices via waves of QE and interest rate repression, come hell or high water. Inflating the prices of stocks and bonds is one thing. People don’t have to live in them. Not so with homes. People have to live somewhere. By inflating home prices, the Fed has inflated the costs of everyday life for all Americans. No big deal for the wealthy. But woe to those on a median income...The effects are pernicious. In its report on housing, California Housing Partnership Corporation has this to say about California, “the largest and wealthiest state” of the US, where housing is particularly, to use the Fed’s term, healed:

We lead the nation in the number of people experiencing homelessness. We lead the nation in poverty rates. We lead the nation in overcrowded rental homes and severely rent-burdened households. We lead the nation in the largest shortage of affordable rental homes.

If housing costs are factored into poverty rates (which federal measures do not), then the percentage of people living below the poverty line jumps to 22% in California, up from 16.2% mentioned in federal reports. In that respect, according to the report, the worst is Los Angeles County with a poverty rate of 26.9%. Orange Country, one of California’s wealthiest counties, has the second highest housing-adjusted poverty rate, 24.3%.

MORE "GOOD NEWS" AT LINK

Demeter

(85,373 posts)7. Sheldon Adelson faces new scrutiny as documents challenge his testimony

http://www.theguardian.com/us-news/2015/may/09/sheldon-adelson-macau-testimony-las-vegas-sands

Sheldon Adelson, the multibillionaire casino magnate and key Republican party donor, spent four combative days in a Las Vegas court this week defending his gambling empire from accusations of bribery and ties to organised crime.

By the time the hearing was over, Adelson had argued with the judge, contradicted the evidence of his own executives and frustrated his lawyers by revealing more information than he was required to in response to simple yes or no questions. But most importantly, far from laying the allegations against his Las Vegas Sands conglomerate to rest, the billionaire’s answers threw up yet more questions which he is likely to have to return to court to answer.

On the court docket, the case is merely a wrongful dismissal suit. The former CEO of Adelson’s highly profitable casinos in the Chinese enclave of Macau, Steven Jacobs, is suing because he claims to have been sacked for trying to break links to organised crime groups, the triads, and for attempting to halt alleged influence peddling with Chinese officials.

But the extent of what is at stake for Adelson was evident in the form of the Nevada gaming board official monitoring the case from the public gallery...MORE

MAKING THE PIGS SQUEAL

Sheldon Adelson, the multibillionaire casino magnate and key Republican party donor, spent four combative days in a Las Vegas court this week defending his gambling empire from accusations of bribery and ties to organised crime.

By the time the hearing was over, Adelson had argued with the judge, contradicted the evidence of his own executives and frustrated his lawyers by revealing more information than he was required to in response to simple yes or no questions. But most importantly, far from laying the allegations against his Las Vegas Sands conglomerate to rest, the billionaire’s answers threw up yet more questions which he is likely to have to return to court to answer.

On the court docket, the case is merely a wrongful dismissal suit. The former CEO of Adelson’s highly profitable casinos in the Chinese enclave of Macau, Steven Jacobs, is suing because he claims to have been sacked for trying to break links to organised crime groups, the triads, and for attempting to halt alleged influence peddling with Chinese officials.

But the extent of what is at stake for Adelson was evident in the form of the Nevada gaming board official monitoring the case from the public gallery...MORE

MAKING THE PIGS SQUEAL

Demeter

(85,373 posts)11. War Threat Rises As Economy Declines By Paul Craig Roberts THE REAL STATE OF THE UNION

http://www.informationclearinghouse.info/article41811.htm

Paul Craig Roberts, Keynote Address to the Annual Conference of the Financial West Group, New Orleans, May 7, 2015

The defining events of our time are the collapse of the Soviet Union, 9/11, jobs offshoring, and financial deregulation. In these events we find the basis of our foreign policy problems and our economic problems...The United States has always had a good opinion of itself, but with the Soviet collapse self-satisfaction reached new heights. We became the exceptional people, the indispensable people, the country chosen by history to exercise hegemony over the world. This neoconservative doctrine releases the US government from constraints of international law and allows Washington to use coercion against sovereign states in order to remake the world in its own image. To protect Washington’s unique Uni-power status that resulted from the Soviet collapse, Paul Wolfowitz in 1992 penned what is known as the Wolfowitz Doctrine. This doctrine is the basis for Washington’s foreign policy. The doctrine states:

In March of this year the Council on Foreign Relations extended this doctrine to China. Washington is now committed to blocking the rise of two large nuclear-armed countries. This commitment is the reason for the crisis that Washington has created in Ukraine and for its use as anti-Russian propaganda. China is now confronted with the Pivot to Asia and the construction of new US naval and air bases to ensure Washington’s control of the South China Sea, now defined as an area of American National Interests.

9/11 served to launch the neoconservatives’ war for hegemony in the Middle East. 9/11 also served to launch the domestic police state. While civil liberties have shriveled at home, the US has been at war for almost the entirety of the 21st century, wars that have cost us, according to Joseph Stiglitz and Linda Bilmes, at least $6 trillion dollars. These wars have gone very badly. They have destabilized governments in an important energy producing area. And the wars have vastly multiplied the “terrorists,” the quelling of which was the official reason for the wars.

Just as the Soviet collapse unleashed US hegemony, it gave rise to jobs offshoring. The Soviet collapse convinced China and India to open their massive underutilized labor markets to US capital. US corporations, with any reluctant ones pushed by large retailers and Wall Street’s threat of financing takeovers, moved manufacturing, industrial, and trade-able professional service jobs, such as software engineering, abroad. This decimated the American middle class and removed ladders of upward mobility. US GDP and tax base moved with the jobs to China and India. US real median family incomes ceased to grow and declined. Without income growth to drive the economy, Alan Greenspan resorted to an expansion of consumer debt, which has run its course. Currently there is nothing to drive the economy. When the goods and services produced by offshored jobs are brought to the US to be sold, they enter as imports, thus worsening the trade balance. Foreigners use their trade surpluses to acquire US bonds, equities, companies, and real estate. Consequently, interests, dividends, capital gains, and rents are redirected from Americans to foreigners. This worsens the current account deficit.

In order to protect the dollar’s exchange value in the face of large current account deficits and money creation in support of the balance sheets of “banks too big to fail,” Washington has the Japanese and European central banks printing money hand over fist. The printing of yen and euros offsets the printing of dollars and thus protects the dollar’s exchange value.

The Glass-Steagall Act that separated commercial and investment banking had been somewhat eroded prior to the total repeal during the second term of the Clinton regime. This repeal, together with the failure to regulate over the counter derivatives, the removal of position limits on speculators, and the enormous financial concentration that resulted from the dead letter status of anti-trust laws, produced not free market utopia but a serious and ongoing financial crisis. The liquidity issued in behalf of this crisis has resulted in stock and bond market bubbles.

Implications, consequences, solutions:

When Russia blocked the Obama regime’s planned invasion of Syria and intended bombing of Iran, the neoconservatives realized that while they had been preoccupied with their wars in the Middle East and Africa for a decade, Putin had restored the Russian economy and military. The first objective of the Wolfowitz doctrine–to prevent the re-emergence of a new rival–had been breached. Here was Russia telling the US “No.” The British Parliament joined in by vetoing UK participation in a US invasion of Syria. The Uni-Power status was shaken.

This redirected the attention of the neoconservatives from the Middle East to Russia. Over the previous decade Washington had invested $5 billion in financing up-and-coming politicians in Ukraine and non-governmental organizations that could be sent into the streets in protests. When the president of Ukraine did a cost-benefit analysis of the proposed association of Ukraine with the EU, he saw that it didn’t pay and rejected it. At that point Washington called the NGOs into the streets. The neo-nazis added the violence and the government unprepared for violence collapsed. Victoria Nuland and Geoffrey Pyatt chose the new Ukrainian government and established a vassal regime in Ukraine.

Washington hoped to use the coup to evict Russia from its Black Sea naval base, Russia’s only warm water port. However, Crimea, for centuries a part of Russia, elected to return to Russia. Washington was frustrated, but recovered from disappointment and described Crimean self-determination as Russian invasion and annexation. Washington used this propaganda to break up Europe’s economic and political relationships with Russia by pressuring Europe into sanctions against Russia. The sanctions have had adverse impacts on Europe. Additionally, Europeans are concerned with Washington’s growing belligerence. Europe has nothing to gain from conflict with Russia and fears being pushed into war. There are indications that some European governments are considering a foreign policy independent of Washington’s.

The virulent anti-Russian propaganda and demonization of Putin has destroyed Russian confidence in the West. With the NATO commander Breedlove demanding more money, more troops, more bases on Russia’s borders, the situation is dangerous. In a direct military challenge to Moscow, Washington is seeking to incorporate both Ukraine and Georgia, two former Russian provinces, into NATO.

On the economic scene the dollar as reserve currency is a problem for the entire world. Sanctions and other forms of American financial imperialism are causing countries, including very large ones, to leave the dollar payments system. As foreign trade is increasingly conducted without recourse to the US dollar, the demand for dollars drops, but the supply has been greatly expanded as a result of Quantitative Easing. Because of offshored production and US dependence on imports, a drop in the dollar’s exchange value would result in domestic inflation, further lowering US living standards and threatening the rigged, stock, bond, and precious metal markets.

The real reason for Quantitative Easing is to support the banks’ balance sheets. However, the official reason is to stimulate the economy and sustain economic recovery. The only sign of recovery is real GDP which shows up as positive only because the deflator is understated.

The evidence is clear that there has been no economic recovery. With the first quarter GDP negative and the second quarter likely to be negative as well, the second-leg of the long downturn could begin this summer.

Moreover, the current high unemployment (23 percent) is different from previous unemployment. In the postwar 20th century, the Federal Reserve dealt with inflation by cooling down the economy. Sales would decline, inventories would build up, and layoffs would occur. As unemployment rose, the Fed would reverse course and workers would be called back to their jobs. Today the jobs are no longer there. They have been moved offshore. The factories are gone. There are no jobs to which to call workers back.

To restore the economy requires that offshoring be reversed and the jobs brought back to the US. This could be done by changing the way corporations are taxed. The tax rate on corporate profit could be determined by the geographic location at which corporations add value to the products that they market in the US. If the goods and services are produced offshore, the tax rate would be high. If the goods and services are produced domestically, the tax rate could be low. The tax rates could be set to offset the lower costs of producing abroad. Considering the lobbying power of transnational corporations and Wall Street, this is an unlikely reform. My conclusion is that the US economy will continue its decline.

On the foreign policy front, the hubris and arrogance of America’s self-image as the “exceptional, indispensable” country with hegemonic rights over other countries means that the world is primed for war. Neither Russia nor China will accept the vassalage status accepted by the UK, Germany, France and the rest of Europe, Canada, Japan and Australia. The Wolfowitz Doctrine makes it clear that the price of world peace is the world’s acceptance of Washington’s hegemony.

Therefore, unless the dollar and with it US power collapses or Europe finds the courage to break with Washington and to pursue an independent foreign policy, saying good-bye to NATO, nuclear war is our likely future. Washington’s aggression and blatant propaganda have convinced Russia and China that Washington intends war, and this realization has drawn the two countries into a strategic alliance. Russia’s May 9 Victory Day celebration of the defeat of Hitler is a historical turning point. Western governments boycotted the celebration, and the Chinese were there in their place. For the first time Chinese soldiers marched in the parade with Russian soldiers, and the president of China sat next to the president of Russia.

The Saker’s report on the Moscow celebration is interesting. http://thesaker.is/todays-victory-day-celebrations-in-moscow-mark-a-turning-point-in-russian-history/ Especially note the chart of World War II casualties. Russian casualties compared to the combined casualties of the US, UK, and France make it completely clear that it was Russia that defeated Hitler. In the Orwellian West, the latest rewriting of history leaves out of the story the Red Army’s destruction of the Wehrmacht. In line with the rewritten history, Obama’s remarks on the 70th anniversary of Germany’s surrender mentioned only US forces. In contrast Putin expressed gratitude to “the peoples of Great Britain, France and the United States of America for their contribution to the victory.” http://thesaker.is/15865/

For many years now the President of Russia has made the point publicly that the West does not listen to Russia. Washington and its vassal states in Europe, Canada, Australia, and Japan do not hear when Russia says “don’t push us this hard, we are not your enemy. We want to be your partners.”

As the years have passed without Washington hearing, Russia and China have finally realized that their choice is vassalage or war. Had there been any intelligent, qualified people in the National Security Council, the State Department, or the Pentagon, Washington would have been warned away from the neocon policy of sowing distrust. But with only neocon hubris present in the government, Washington made the mistake that could be fateful for humanity.