Economy

Related: About this forumWeekend Economists Volvemos a Puerto Rico May 22-25, 2015

As promised, the survey of La Isla del Encanto continues...

Christopher Columbus put Puerto Rico on the map, so to speak. He brought disease, slavery, Catholicism and Capitalism to the tribes that had lived forever without them.

But in 1898, Republican President William McKinley declared war on Spain (the Spanish-American War) and Puerto Rico, long desired by the Navy as a fueling station, was one of the plums of that victorious conquest....

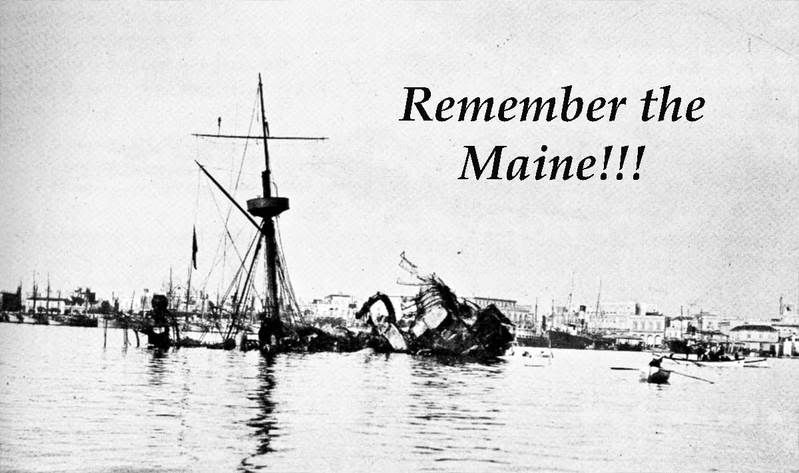

Revolts against Spanish rule had occurred for some years in Cuba. There had been war scares before, as in the Virginius Affair in 1873. In the late 1890s, US public opinion was agitated by anti-Spanish propaganda led by journalists such as Joseph Pulitzer and William Hearst which used yellow journalism to criticize Spanish administration of Cuba. After the mysterious sinking of the US Navy battleship Maine in Havana harbor, political pressures from the Democratic Party and certain industrialists pushed the administration of Republican President William McKinley into a war he had wished to avoid. Compromise was sought by Spain, but rejected by the United States which sent an ultimatum to Spain demanding it surrender control of Cuba. First Madrid, then Washington, formally declared war.

Although the main issue was Cuban independence, the ten-week war was fought in both the Caribbean and the Pacific. US naval power proved decisive, allowing expeditionary forces to disembark in Cuba against a Spanish garrison already brought to its knees by nationwide Cuban insurgent attacks and further wasted by yellow fever. Numerically superior Cuban, Philippine, and US forces obtained the surrender of Santiago de Cuba and Manila despite the good performance of some Spanish infantry units and fierce fighting for positions such as San Juan Hill. With two obsolete Spanish squadrons sunk in Santiago de Cuba and Manila Bay and a third, more modern fleet recalled home to protect the Spanish coasts, Madrid sued for peace.

The result was the 1898 Treaty of Paris, negotiated on terms favorable to the US, which allowed it temporary control of Cuba, and ceded indefinite colonial authority over Puerto Rico, Guam and the Philippine islands from Spain. The defeat and collapse of the Spanish Empire was a profound shock to Spain's national psyche, and provoked a thorough philosophical and artistic revaluation of Spanish society known as the Generation of '98. The United States gained several island possessions spanning the globe and a rancorous new debate over the wisdom of expansionism.

The war began exactly fifty-two years after the Mexican–American War began, and was one of only five US wars to have been formally declared by Congress.

And things have been downhill ever since....our Instant Empire!

Demeter

(85,373 posts)but check back later. I've been taken by surprise before, and Mercury is retrograde.

Demeter

(85,373 posts)

more of His light; and I saw things that he

who from that height descends, forgets or can

not speak.

As Cristoforetti spun around the globe at the rate of seventeen thousand miles an hour, her reading was beamed back to earth and shown in a movie theater in Florence. Ten days later, the actor Roberto Benigni recited the last canto of Paradiso in the Italian Senate. His selection included the poem’s famous closing lines:

desire and will were moved already like

a wheel revolving uniformly by

the Love that moves the sun and the other stars.

The senators gave the comedian a standing ovation. That same day, Pope Francis made some brief remarks about the poet, officially joining what he called the “chorus of those who believe Dante Alighieri is an artist of the highest universal value.” He can, the Holy Father added, help us “get through the many dark woods we come across in our world.”

Dante’s seven-hundred-and-fiftieth birthday is sometime in the coming month—he was born, he tells us in Paradiso, under the sign of Gemini—and, to mark the occasion, well over a hundred events are planned. These include everything from the minting of a new two-euro coin, embossed with the poet’s profile, to a selfie-con-Dante campaign. (Cardboard cutouts of the poet are being set up in Florence, and visitors are encouraged to post pictures of themselves with them using the hashtag #dante750.) There’s talk of extending the celebrations to 2021, the seven-hundredth anniversary of the poet’s death.

I teach Dante to American undergraduates, and I struggle to convey to them his place in Italian culture. The obvious comparison is to Shakespeare, but this is like trying to make sense of Mozart by means of Coltrane: the number of centuries that divide Dante from Shakespeare is practically as large as the number that separates Shakespeare from us...Italian kids first encounter Dante at school, when they’re in the equivalent of seventh grade. They return to him in the eleventh grade to study the Inferno in more depth. In twelfth grade, they work on the Purgatorio. Secondary school—liceo—lasts five years, and so in what might be considered the thirteenth grade, the text for the year is the Paradiso. I recently asked the high-school-aged son of an Italian friend of mine about the experience. “It’s annoying, boring, and it never ends,” he told me. “But then you get to like it.” At the college level, the study of Dante ratchets up by slowing down. In the late nineteen-eighties, I spent a semester in Florence, where I sat in on a Dante course at the university. The entire term was devoted to the analysis of a single canto. As it happened, the canto was Inferno 19, which is devoted to simony. Dante reserves a special hole in the third sub-circle of the eighth circle of Hell for corrupt Popes; they are stuffed into it, one after another, headfirst. Their feet are then lit on fire. Among the issues the class discussed at length was how, exactly, new Popes could be accommodated. Had space been left open for all those that would come along? Or did each new arrival compress his predecessor into some kind of pontifical pesto?

Either because of or despite this pedagogical program, Italians, to a surprising degree, stick with Dante. Since 2006, Benigni has been staging hepped-up variations on the traditional lectura dantis, a form that goes back all the way to the fourteenth century, to Boccaccio, who lectured on the poem in Florence’s Santo Stefano church. A typical lectura opens with a detailed gloss of a particular canto, followed by a dramatic reading of it. Benigni’s performances in Rome, Florence, Verona, and other cities have been watched live by more than a million people. Millions more have tuned into them on TV. Similar, if stodgier, lectures are delivered all over Italy at societies set up expressly to foster appreciation of the Divine Comedy. In Rome, for example, the Casa di Dante sponsors a lectura dantis every Sunday at 11 A.M. Owing to holidays and long summer breaks, six years of Sundays are required to get through the poem, at which point the whole process starts over again. It’s not unusual for two hundred Romans to attend. Some are liceo students, perhaps there under duress, but most are middle-aged and beyond. After one recent session at the Casa di Dante, I asked the white-haired gentleman sitting next to me what everyone was doing there. “I don’t know about the others,” he said. “I always come.” There are, of course, many possible explanations for Dante’s hold on Italy, including, after seven hundred and fifty years, sheer momentum. Language, too, clearly plays a part. When Dante began work on the Comedy, none of the different dialects spoken in Italy’s many city-states had any particular claim to preëminence. Latin, meanwhile, was the language of the Church and of institutions such as the courts and universities. (Dante wrote “De Vulgari Eloquentia,” his defense of the vernacular, in Latin.) Such was the force and influence of the Comedy that the Tuscan dialect became Italy’s literary language and, eventually, its national one. The fact that people in Venice and Palermo could understand Cristoforetti as she read from the Paradiso in space was due, in a quite literal sense, to the poem that she was reading.

For the last nine months, I’ve been living in Rome, and the experience has helped me to appreciate another, more subversive side to Dante’s appeal. Though he may be force-fed to seventh graders, applauded in the Senate, and praised by the Holy See, Dante is, as a writer, unmistakably anti-authoritarian. He looks around and what he sees is hypocrisy, incompetence, and corruption. And so he strikes out, not just at the Popes, whom he turns upside down and stuffs in a hole, but also at Florence’s political leaders, whom he throws into a burning tomb, and his own teacher, whom he sets running naked across scorching sand. In 2015, this sort of frustration still feels fresh. Earlier this month the latest World Expo opened in Milan, on the edifying theme of “feeding the planet.” All spring, the papers have been filled with stories of bid-rigging and extortion. Just the other day, the Expo’s procurement manager and six other officials were arrested for graft. “No one should be surprised,” Milan’s Corriere della Sera editorialized. To express their anger over the billions in public funds lavished on Expo, students went on strike and cars were burned in the streets of Milan. It’s hard to know what Dante would have made of flaming Fiats, but it seems likely that he would have sympathized with the protesters: for the abuse of public trust, he prescribed swimming in boiling pitch, and for avarice, an eternity spent rolling stones in circles.

John Kleiner is a professor of English at Williams College.

Demeter

(85,373 posts)Greg Palast is a New York Times bestselling author and fearless investigative journalist whose reports appear on BBC Television Newsnight and in The Guardian. Palast eats the rich and spits them out. Catch his reports and films at www.GregPalast.com, where you can also securely send him your documents marked, "confidential".

President Who? All I knew about this Hugo Chavez guy was that he was an Latin-American jefe, led a bungled coup and was filled with a lot of populist bullshit and a lot of oil.

And I also knew that no one at BBC Newsnight was going to blow the budget for me to fly to South America to talk about a nation that 92 percent of our viewers couldn’t find on a map and wouldn’t want to.

“Send me an email.”

“There will be a coup. March 15.”

“The Ides of March. I like that. Aren’t there always coups down there?”

“They’ll kill him, undo everything. He needs you to stop it, he wants to explain it to you because he knows you understand.”

Actually, you’d be surprised at the amount I don’t understand at all. “So talk.”

She did – for four hours – and wore me down into submission. But back at Newsnight I looked like an idiot when March 15 came and went with just a little gunfire in Caracas.

Three weeks later, the President of Venezuela, Hugo Chavez, was kidnapped and held hostage by the head of Venezuela’s Chamber of Commerce. Suddenly the BBC had to get me on a plane.

When I got to the Presidential Palace, Chavez was already back at his desk, though the bullet holes in the palace’s walls weren’t yet filled in.

Chavez told me that he'd agreed to be taken hostage by gunmen on the condition that his staff and their trapped children would be allowed to escape. He was bundled into a helicopter, and when it swerved out to sea he assumed he would be pushed out: “I was calm. I was ready.”

So who was behind it?

Chavez gave me information on US military attachés who had met with the plotters. While I couldn’t verify any specific US directive to seize him, I didn’t have to: I had grinning photos of George W Bush’s new US Ambassador, Charles Shapiro, congratulating Chavez’ kidnappers. The question was, why? Why the need to eliminate Chavez, by coup, by bullet, by propaganda, embargo, or, as we later discovered, by screwing with Venezuela’s vote count?

No doubt that for Bush’s oil-o-crats, Chavez’ doubling the royalties paid by Exxon and Chevron was worth the price of a bullet; but it was no more than the amount that Sarah Palin would seize from the oil companies when she ruled Alaska. So what was it? The answer was in the movie Network.

“It is ebb and flow, tidal gravity. You are an old man who thinks in terms of national and peoples. THERE ARE NO NATIONS. There are no peoples. There is only ONE HOLISTIC SYSTEM OF SYSTEM, one vast and immense, interwoven, interacting, multi-variate, multi-national dominion of dollars. Petro-dollars. Electro-dollars. Multi-dollars. IT IS THE INTERNATIONAL SYSTEM OF CURRENCY which determines the totality of life on this planet. Am I getting through to you?”

Chavez had defied gravity, overpowered the tide. Venezuela earned billions in petro-dollars from the USA – but then, Chavez refused to “give it back”. Third World nations are not supposed to keep the dollars paid to suck out their oil and mineral blood. For every dollar US consumers pay the Saudis for their oil, about $1.24 is given back as Saudis return the funds by purchasing US Treasury debt or hunks of US banks, CitiCorp for one.

Above: World Capital Flow 2005, from Armed Madhouse by Greg Palast

In 2005, the US spent $227 billion in Latin America, sapping its properties and resources. But the money turned right around and, added to the funds sent to Miami by Latin America’s elite, immediately became a $379 million loan to the US Treasury and financiers. Argentina leant the US at 4 percent interest, then had to borrow its own money back at 16 percent – the whirring wheel, this grinder, left school teachers in Buenos Aires hunting in garbage cans for food. Riots followed and – in Peru, Ecuador, Argentina and elsewhere – this led to tanks in the street, currency collapse, crisis and the “rescue” by the IMF. Rescue meant forcing the mass sell-off of state industries, from oil to water systems, to the crushing of labour unions and to swallowing the whole bottle of poisons kept by the elite of the Northern Hemisphere for just such occasions...And that was the plan. Literally. I've held the proof in my hands, about five thousand pages of financial agreements, all labelled “confidential” and “not to be distributed except by authorised persons”, which bore benign titles like “World Bank Poverty Reduction Strategy, Argentina.”

Why would the IMF, World Bank and the bankers not want to make their wonderful plans for reducing poverty public? It was for the same reason the finance ministers who signed the documents didn’t even tell their own presidents: they were in fact “reduce-to-poverty” plans, complete resource surrender. For these deliberately bankrupted nations, it was sign or starve. Until Hugo Chavez came along. Early on, Chavez withdrew $20 billion of Venezuela’s money leant to the US Federal Reserve, to create a giant micro-lending programme for his citizens. Then he went a step too far, establishing what the Wall Street Journal called, “a tropical IMF”. In 2000 and after, when the IMF and banks moved to financially strangle these nations by making their debts unsalable, Hugo Chavez would roll up in his oil-gilded chariot. He effectively underwrote Argentina’s debt, providing 250million dollars worth of loans, and assistance to Ecuador. After Enron seized Argentina’s water system and Occidental seized Ecuador’s oil fields, Argentina’s President Nestor Kirchner, followed by Ecuador’s Correa, told US banks to go fuck themselves. And the IMF, too.

Then there was the big one: Brazil. The World Bank/IMF “Poverty Reduction Strategy” for Brazil required the nation to close its publicly-owned banks, to sell off its vast oil properties, to give away its power industry and, to please the new foreign owners, slash wages and pensions. But with Chavez prepared to back up its new President, Lula Ignacio de Silva, the mighty little man from the Socialist Workers Party could tell the IMF to stick it where the free market don’t shine. For the first time in contemporary history, resource states refused to give back the money received for their resource. At Chavez’ funeral, Lula, former President Ignacio de Silva of Brazil, praised this as Chavez’ most revolutionary act.

Now, instead of billions flowing North, Latin American capital was staying in Latin America. It is delicious irony that the European and American financiers, fleeing from the economic conflagration they’d ignited in their home countries, are loading their loot onto planes for Brazil. And that Venezuela’s central bank made a mint on its intra-continental loans.

And so, a coup was called for.

In 2002, Chavez’ oil company chief, Ali Rodriguez, told me: “America can’t let us stay in power. We are the exception to the New Globalisation Order. If we succeed, we are an example to all the Americas.”

That you were, Hugo Chavez. That you are, Venezuela. And all the Americas are ready.

VIVA PARA SIEMPRE, CHAVEZ!

Demeter

(85,373 posts)ONE GOOD PALAST DESERVES ANOTHER

http://www.vice.com/en_uk/read/larry-summers-and-the-secret-end-game-memo

Demeter

(85,373 posts)Jim Hamilton is defending his recent work calling into question the sustainability of the US debt load. Brad DeLong takes a first shot at Hamilton's post here. I take issue with this paragraph:

This ignores the possibility of financial repression - meaning that the government can force yields on its own debt lower, thereby ensuring that inflation, even anticipated inflation, decreases real interest rates. Back to another post by DeLong:

Let me spell (e) out a little bit. If investors start to fear that the U.S. debt trajectory is truly unstable, the immediate consequence is a fall in the dollar and an export boom, with somewhat higher domestic inflation. Because the U.S. government regulates the financial system, it can set reserve requirements where it likes--it can thus use its reserve requirements to force banks to hold Treasuries, and if it doesn't like the interest rate at which banks are holding Treasuries, it can up reserve requirements some more.

No, financial repression is not ideal. But it is not a disaster like a collapse of confidence in the debt and the currency....

Arguably, we are currently witnessing a real-time example in Japan's Abenomics policy mix. The Yen has depreciated significantly, consistent with expectations of inflation. And there is even growing evidence that wages are responding as well. From FT Alphaville:

And actually, it might be catching on. The FT’s Ben McLannahan wrote in early February that the decision by convenience store chain Lawson Inc to raise wages of two-thirds of its staff by 3 per cent could be quite significant..

According to Hamilton, if we have higher anticipated inflation, we should see higher nominal interest rates on government debt, thereby debt sustainability is deteriorating. But alas:

http://economistsview.typepad.com/.a/6a00d83451b33869e2017ee94545e4970d-500wi

Time and time again, Japan sticks out like a sore thumb that those preaching the unsustainability of government debt want to sweep under the rug with the "Japan is a special case" story (a country fixed effect). But it seems more likely that Japan's economy is behaving exactly as you might expect given that it issues debt in its own currency. In other words, Japan is just a normal case pushed to the extreme.

Demeter

(85,373 posts)To justify the president's War on Terror policies, the Washington Post columnist spreads a demonstrable myth...

Charles Krauthammer's Washington Post column MARCH 14, 2013, which calls on Congress to enact new legislation authorizing and regulating Obama's drone attacks, is actually worth reading. That's because it highlights the central fact about the Obama legacy when it comes to US militarism, war, and civil liberties. Referencing the monumental shift in how Democrats think about such matters now as compared to the Bush years, he writes:

"Necessity having led the Bush and Obama administrations to the use of near-identical weapons and tactics, a national consensus has been forged. Let's make it open."

That Obama has ushered in a "bipartisan consensus" for these policies - transforming them from the divisive symbols of right-wing extremism into the unchallenged framework of both parties' establishments - is indisputable, one of the most consequential aspects of his presidency. But Krauthammer's real purpose with this column is to mock and excoriate Rand Paul's anti-drone filibuster. As the New York Times describes, there is an increasingly acrimonious split in the GOP about the policies of militarism and civil liberties enacted in the 9/11 era, and neocons like Krauthammer are petrified that the (relative) anti-war and pro-due-process stances articulated by Paul will gain traction. Krauthammer notes that, contrary to the claims of many progressives, Paul's opposition was not merely to killing Americans on US soil, but was broader: it was about assassinating citizens without due process anywhere they may be found. Referencing a Washington Post Op-Ed in which Paul declared that "no American should be killed by a drone without first being charged with a crime," Krauthammer writes: "note the absence of the restrictive clause: 'on American soil'". Here's how Krauthammer describes Paul's real purpose in launching the filibuster:

That Paul became the first US Senator on the Senate floor to utter the name "Abdulrahaman Awlaki" - the 16-year-old US-born citizen killed by a US drone in Yemen - bolsters Krauthammer's claim that the Paul filibuster was about more than just the use of force on US soil, but rather posed a challenge to the War on Terror premises generally. That is precisely why Krauthammer - along with all other neocons and, notably, many Democratic Party Obama-supporters - are desperate to discredit the Paul filibuster and the sentiments it stoked: regardless of Paul's motives, the filibuster called into question both the wisdom and legality of the entire Endless War approach to Terrorism. But to discredit this, Krauthammer makes a claim about the US Constitution that is so patently false as to be retraction-worthy. He writes (emphasis added):

That italicizied claim from Krauthammer - that "outside American soil, the Constitution does not rule" - is a very common assertion and thus widely believed. But it is factually false. And there can be no reasonable dispute about this. To begin with, think about what it would mean if Krauthammer's claim were true: does anyone think it would be constitutionally permissible under the First Amendment for the US government to wait until an American critic of the Pentagon travels on vacation to London and then kill him, or to bomb a bureau of the New York Times located in Paris in retaliation for a news article it disliked, or to indefinitely detain with no trial an American who travels to Beijing or Lima or Oslo and who is suspected of committing a crime? Anyone who believes what Charles Krauthammer said this morning - "Outside American soil, the Constitution does not rule" - would have to take the patently ludicrous position that such acts would be perfectly constitutional.

But to see how false is Krauthammer's claim, it's unnecessary to engage in that kind of reasoning. The law is crystal clear on this matter. In 1957, the US Supreme Court decided the case of Reid v. Covert in which this exact question was conclusively decided: does the Bill of Rights restrict what the US Government does to US citizens on foreign soil? The Court answered the question as decisively and unambiguously as the English language permits (emphasis added):

How can any Washington Post editor read what the Supreme Court said and not compel a retraction of Krauthammer's claim?

MORE RIGHTEOUS RAGE AND CITATIONS AT LINK

Demeter

(85,373 posts)President Lyndon Johnson knew of a plan by Richard Nixon to disrupt Vietnam War peace talks through 'treason,' but ultimately decided not to speak out about it, White House recordings have revealed.

The tapes, dating back to Johnson's last months in office between May 1968 and January 1969, show that Johnson was onto Nixon, who at the time was the Republican nominee for president.

According to the tapes, Johnson learned through FBI wiretaps that Nixon had played a role in getting South Vietnam to withdraw from peace talks in Paris that would effectively end the Vietnam War, and was therefore guilty of treason.

Read more: http://www.dailymail.co.uk/news/article-2294821/Lyndon-Johnson-White-House-tapes-reveal-knew-Richard-Nixons-treason.html#ixzz3auSMQnLB

Demeter

(85,373 posts)But, we do have 3 days to fill....it can't all be sunbathing and BBQ (especially if it rains constantly, as promised).

And it is interesting to look back on newsletters from 2 years ago to see which issues became inflamed, and which were quenched by subsequent events, and which plague us today and see where they came from....

Demeter

(85,373 posts)http://www.businessinsider.com/cyprus-bailout-risks-europe-bank-runs-2013-3#ixzz3auTlEqUa

You can be forgiven for thinking that you don't need to give a hoot about what's going on in Cyprus this weekend. After all, it's just a little island somewhere in the Mediterranean. But what's going on in Cyprus could actually matter — not just to the rest of Europe, but to the rest of the world. Here's the short version of what's happening:

Cyprus's government tried to explain this deal by observing that it was better than the alternative: Immediate bankruptcy and closure of the major banks. In that scenario, depositors would lose a lot more of their money. Businesses would go bankrupt. And tens of thousands of people would be instantly thrown out of work. But, still, not surprisingly, news that deposits in Cyprus's banks would be seized triggered an immediate run on the banks. Depositors rushed to ATMs and tried to withdraw their money before it could be seized. But the ATMs weren't working. And the government has now made it impossible to transfer money out of the country. So, assuming Cyprus's government approves the deal (still pending), depositors will have some of their money seized on Tuesday morning.

Now, half of these depositors are said to be Russian oligarchs and other non-residents. And unless you happen to have the misfortune of having an account in a Cyprus bank, you may not care much whether these depositors have their money seized. After all, that was the risk they took for storing their money in bankrupt banks, right? Well, yes, that was the risk they took. But ever since the Great Depression wiped out a big percentage of the world's banks, vaporizing the bank depositors' savings in the process, banking system regulators have tried to do everything they can to protect bank depositors. And they are smart to do so. Because the moment depositors think that there is risk to their savings, they rush to banks to yank their money out. That's called a run on the bank. And since no bank anywhere has enough cash on hand to pay off all its depositors at once, runs on the bank cause banks to go bust.

That's what happened to hundreds of banks in the Great Depression.

And it's what happened to Bear Stearns, Lehman Brothers, and other huge banks during the financial crisis (though, with Bear and Lehman, the folks who yanked their money out weren't mom and pop depositors but other big financial institutions). It's what threatened to bring the entire U.S. financial system to its knees. And it's why the U.S. and European governments have been frantically bailing out banks ever since. But now, thanks to Eurozone's bizarre decision in Cyprus, the illusion that depositors don't need to yank their money out of threatened banks because they'll be protected has been shattered. Depositors in Cyprus banks will lose some of their deposits. They will be furious about this. And they will, rightly, feel that it is grossly unfair — because depositors in the bailed-out banks in Ireland, Greece, etc. didn't lose their money. And they will feel like fools for not having taken their money out.

And ... here's the important part ...

Other depositors at weak banks all over Europe, in places like Spain, Italy, and Greece, will rightly wonder whether this is the beginning of a new era of bank bailouts, an era in which bank depositors are going lose some of their money. What do you think those other depositors in Spain, Italy, Greece, etc., are going to feel like doing when they realize that, if their banks ever need a bailout, they might have their deposits seized? That's right. They're going to feel like yanking their money out of their banks. And if some of them yank their money out of their banks, well — then the financial condition of those banks will go from weak to insolvent. And the banks will go rushing to their governments and the Eurozone for help.

And if, god forbid, the Eurozone decides to seize the deposits of more bank depositors ...

Well, then, a good portion of Europe is going to suddenly experience a good old-fashioned bank run. That, to put it mildly, could be a disaster. It could bring the European financial crisis, which has lurched from one flare-up to another for most of the past five years, to a rather sudden head. How much would it cost for the powers-that-be to bail out all of Europe's weak banks at once? A lot. More than the Eurozone has in its emergency lending facilities, certainly. And more than the International Monetary Fund has on hand. So the U.S. would probably have to get involved. And, regardless of whether the U.S. needed to get involved, the European economy would likely suffer the equivalent of a heart attack. That wouldn't be good for the U.S. economy. Or the Chinese economy. Or any other economy that sells things to Europe.

So, you can see, this little decision to seize a little money from bank depositors in the little island of Cyprus could be a much bigger deal than you think. It could conceivably precipitate a run on weak European banks. And a run on weak European banks could hammer the European economy and then the economy of Europe's trading partners. And it could cause global markets to crash. So keep an eye on what's going on over there in Cyprus. It's potentially much more important than it seems.

http://www.businessinsider.com/cyprus-bailout-statement-by-the-president-of-the-republic-mr-nicos-anastasiades-2013-3#ixzz3auVGXWYr

Ekathimerini has this report:

The Cypriot government is preparing the bill to be tabled in Parliament probably on Sunday in an emergency session, as everything will have to be voted by Monday night for Cypriot banks to open on Tuesday.

The stakes are incredibly high. Here's a statement from Cypriot President Nicos Anastasiades warning of total financial collapse and euro exit if there's no deal (via @dsquareddigest).

Full statement from President Anastasiades below the dotted line

-------------------------------------------------------------------------------------------------------

It is well known that the deep economic crisis and the state of emergency in which the country has found itself did not come about in the last fortnight since we have undertaken the administration of the country.

The state of emergency and critical nature of the times do not allow me, as they do not allow anyone, to embark on a blame game.

In the extraordinary meeting of the Eurogroup, we faced decisions that had already been taken and came across faits accomplis through which we were faced with the following dilemmas:

On Tuesday, March 19 we would either choose the catastrophic scenario of disorderly bankruptcy or the scenario of a painful but controlled management of the crisis, which would put a definitive end to the uncertainty and restart our economy.

A possible choice of the catastrophic scenario option would have the following consequences:

1. On Tuesday, March 19, immediately after the holiday weekend, one of the two banks in crisis would cease to operate, since the European Central Bank, following the decision already taken, would terminate the provision of liquidity. The second bank would suspend its work, and neither could avoid collapse. Such a phenomenon would instantly lead 8.000 families to unemployment.

2. The State would be obliged to compensate depositors in response to the obligation regarding guaranteed deposits. The capital required in such a case would amount to about 30 billion euros, which the State would be unable to pay.

3. A proportionate amount corresponding to the deposits of thousands of depositors for deposits over 100.000 Euro, would be led to a vicious cycle of asset liquidation, and these depositors would suffer losses of over 60%.

4. Such an uncontrolled situation would push the whole banking system into collapse with all the attendant consequences.

5. Thousands of small and medium enterprises, and other businesses would be driven to bankruptcy due to their inability to trade.

As a result of the above, the service sector would be led to a complete collapse with a possible exit from the euro. That, in addition to the national weakening of Cyprus, would lead to devaluation of the currency by at least 40%.

The second choice was the controlled management of the crisis, through the decisions taken and which can be summarized as follows:

1. Ensuring the liquidity of the banks and the rescue of the banking system through their recapitalization.

2. Rescuing 8.000 jobs in the banking sector and thousands of others which would be lost as a corollary of not maintaining the operations of banks.

3. Total rescuing of deposits, with just the exchange of a small percentage of savings with shares of the two banks. Currently, these shares do not have their full value, but with the economic recovery they will repay most it not all of the amount that will be cut.

4. This option results in a drastic reduction of public debt, makes it manageable and sustainable and relieves future generations from the burden of repayment.

5. It saves provident and pension funds and avoids taking other tough measures such as wage and pension cuts that were put on the negotiations table.

6. It avoids further recession and the risk of the vicious circle of a second memorandum.

We are not aiming to gloss over the situation. The solution chosen may be painful, but it was the only one that would allow us to continue our lives without adventures. It's a decision that leads to the historic and permanent rescue our economy.

In the next few hours we will all have to take responsibility. Tomorrow I will address the Cypriot people.

Cyprus’ Stability Levy: Another sad euphemism (updated on 18th March)

Posted on March 17, 2013 by Yanis Varoufakis, current finance minister of Greece

They called it a ‘stability levy’, when they meant a tax on Cypriot depositors (including the savings of poor widows and small children) so that they spare the holders of Cypriot government bonds (including hedge funds who are now having a party in Mayfair and New York) as well as minimise potential long-term losses by the European taxpayers. In effect, faced with the prospect of lending to Cyprus a sum equal to its GDP, so as to bail out its banks Ireland-style, the Eurozone balked. They realised, post-Greece and post-Ireland, that something has to give (beyond the minimum working conditions and social welfare provisions of common folk) in order to minimise the size of the aggregate loan. And they chose to hit depositors directly (at a rate of 9.9% if their deposits exceed 100 thousand euros and 6.75% for smaller deposits) before the oncoming austerity-driven plague eats into them instead (as it did in Greece, Ireland and Portugal where savings were used up by stressed households in the daily struggle to survive after jobs and benefits disappeared).

What was astonishing is that, while the peoples of Europe are sick and tired of the gross inequities and regressivity of austerity-fuelled bailouts, they did not set a threshold below which poorer depositors would be untouched. And that they left unaffected the banks’ bondholders (even though the sums involved in these bonds were small, it was utterly unprincipled to spare them). I have no doubt that this decision will haunt them/us for decades.

What alternatives did the Eurogroup ministers have? Several, is the answer. In the context of their own accounting-like logic (i.e. of ‘hitting’ depositors) they could discriminate between bank accounts that are insured by Cypriot law and those which are not: So, any account by a citizen of an EU-member state with less than 100 thousand euros (the maximum account insured by the Cypriot state; the equivalent of the FDIC deposit insurance protection) should be left alone. All the other accounts could then be hit by a percentage that would deliver the sum of six to seven billions EU finance ministers wanted to reduce the bailout loan sum by. If Berlin was serious about its willingness to curtail Cyprus’ banks money laundering activities, while avoiding a tax on the hard earned savings of the poorer Cypriots (that a Lutheran German should see as an ally in restoring puritan ethics), that is what they would have done. But, it is now clear, they were not serious about their own ethics (indeed, had they been serious about Russian money laundering, they would have raised questions about Latvia’s banks, which are awash with mafia funds).

Of course, while hitting uninsured deposits only (as suggested by the previous paragraph) would have been preferable, it would still not be a solution to the Cypriot drama. The Cypriot economy is in the familiar tail spin that we witnessed in Greece, Portugal, Spain, Ireland and now unfolding in Italy. Even if the bank levy, or bail in, were fairer, the recession would still be fuelled by large scale public expenditure cuts and substantial tax hikes which, taken together, will most certainly lead Cyprus to a dead end. But none of this is specific to Cyprus. In this sense, an alternative strategy for dealing with the island’s fall from grace must involve a Gestalt Shift that will allow Europe a different approach throughout the monetary union. Precisely the Shift that Europe seems unwilling to contemplate, thus resorting to ill-conceived decisions like the recent one on Cyprus.

Summary

The Cyprus deal, although marginally better than forcing (Greece/Ireland-style) all of the burden willy-nilly on the taxpayers, is highly destabilising in the medium term. The notion that one sacrifices Cyprus depositors in order to save the depositors in, say, Spain, is of questionable purchase. Moreover, despite the reduction in Cyprus’ new debt (achieved by bailing in depositors), its debt-recessionary cycle will proceed with increasing ferocity as austerity strings (with which the bailout comes attached) begins to bite.

Europe seems to have only partly learnt its lessons from Greece and Ireland. Europe’s leaders at least understood that they cannot pile a gigantic loan on an insolvent entity (i.e. an insolvent state that is intertwined with an insolvent banking sector) and expect, through austerity, to stabilise its debt-deflationary spiral. Some haircuts are necessary (although never sufficient) ex ante. What they have not understood is that limiting the bailout loan’s size is insufficient to prevent the free-fall, even if it buys them some extra time in the short run especially when the ‘limiting’ is achieved through sacrificing what bonds of trust remain between the EU and its citizens. That they will have to learn the hard way in the months to come.

In short, the recent decision on Cyprus is a touch more realistic than that which was imposed upon Greece, Ireland and Portugal, in the sense that Europe took some (however unfair and inefficient) steps to reduce the loan’s size. However, by remaining in denial about the true causes of the Eurozone’s (and Cyprus’) instability, and by resorting to euphemisms involving the word ‘stability’, they are giving the Crisis another vicious spin.

Postscript

Last time Europe invoked ‘stability’ in one of its summit decisions was when it created the European Stability Mechanism (ESM). It proved anything but stabilising (as without Mr Draghi’s ECB and its LTRO-OMT interventions, there would be no Eurozone today). Now we have a ‘stability’ levy in Cyprus. Its effect will prove equally destabilising in the medium term. It is high time we take another look at stability in the Eurozone and to do so in terms of a closer look at the ESM and how it should be reconfigured. My next post will address the ESM and how to put the S-for-genuine-stability into it for the first time!

Demeter

(85,373 posts)http://www.nytimes.com/2015/03/17/business/international/as-cyprus-recovers-from-banking-crisis-deep-scars-remain.html

The financial world has pretty much moved on since Cyprus was briefly the epicenter of market anxiety. Two years ago this month, the country's banks failed en masse, A.T.M.s were rationing cash, and the integrity of the eurozone hung in the balance. But after a contentious, internationally brokered “bail-in,’’ in which for the first time many bank depositors were forced to help pay for a eurozone rescue, Europe’s policy makers soon found other things to focus on.

Yet Christos Savvides, managing director of an advertising agency in Nicosia, the once booming capital, does not have the luxury of forgetting. Daily reminders include the rows of downtown shops that once sold luxury clothing brands but now stand empty. At one defunct auto dealership, a Renault Laguna sedan, in a thick layer of dust, is still on display behind dirty windows. Mr. Savvides lost hundreds of thousands of euros that he had deposited in Cyprus banks — money seized in the rescue program to cover bank losses. Two years later, Mr. Savvides’s experience, and that of tens of thousands of other Cypriots caught up in the crisis, offers lessons that could soon apply to Greece if that country is unable to reach agreement with its creditors.

In retrospect, it is clear that European leaders, international creditors and bank regulators could have done more to limit the economic upheaval caused by seizing portions of depositors’ money above the level of 100,000 euros covered by deposit insurance, a threshold equivalent to roughly $105,000 at the current exchange rate. In fact, a new European Union law written after the crisis would probably have exempted Mr. Savvides, since the deposits in his case actually belonged to his clients. But that law comes too late for him and other Cypriots. One surprising lesson may be that capital controls — restrictions on withdrawals and on money transfers out of the country — were not as disruptive as feared, but did help prevent even more money from leaving Cyprus. If anything, some economists say, the restrictions should have been applied sooner, before many of the biggest and most sophisticated investors had already fled. More recently, foreign money has been trickling back into Cyprus, including a big bet by Wilbur L. Ross Jr., the American investor known for his appetite for tough cases.

Cyprus also represents what many Europeans see as insensitivity in Brussels, Frankfurt and Berlin toward the people like Mr. Savvides who must suffer the consequences of eurozone crisis management. Among Cypriots, the feeling is widespread that as a country of fewer than one million people, geographically closer to the Middle East than to Europe and with a reputation as a haven for Russian cash, they were used as lab rats to test new and poorly conceived policies.

“It was an experiment,” said Antonis Paschalides, a Cyprus lawyer and former government minister who is suing the European Commission and the European Central Bank on behalf of Mr. Savvides and others who say their deposits were seized illegally.

“We make an example,” Mr. Paschalides said, describing what he believes was the attitude of European leaders. “‘If worst comes to worst, Cyprus will collapse.’’

The parallels with Greece are not perfect. For one thing, the Greek economy, though small by eurozone standards, is more than 10 times the size of Cyprus’s. And banking played a far bigger role in the Cypriot economy — with assets valued at six times gross domestic product before the crash — than it does in Greece. In Cyprus, eurozone officials argue, the size of the banking system meant that depositors — many of them foreigners — had to share the burden because otherwise the country could not afford it. In Mr. Savvides's case, though, the deposits seized were not even his. They belonged to clients of his agency, Ledra Advertising. When the crisis hit, Mr. Savvides was in the process of using the money to buy local television time on their behalf. Mr. Savvides, whose customers include the consumer products giant Unilever, had to absorb the cost. “The client says, ‘I sent you the money,’” Mr. Savvides said in Nicosia last week. “'What you did with the money was your problem.’”

The financial blow, along with the recession that followed the banking crisis, forced Mr. Savvides to lay off several of his employees, who now number 22. Mr. Savvides said his firm survived only because his clients and creditors were understanding and gave him time to make up the deficit.

Cyprus, too, has managed to survive, and by some measures is doing better than expected. But the economic situation remains dire. Unemployment, though falling from a peak of 16.6 percent in December, is still above 16 percent. The economy shrank 0.7 percent in the fourth quarter of 2014, compared with the previous quarter, the worst performance in the European Union. And more than half the outstanding bank loans in Cyprus are classified as nonperforming — a legacy of the crisis and a huge obstacle to growth.

THE MORTGAGE FORECLOSURE CRISIS HAS YET TO OCCUR.....MORE AT LINK

Demeter

(85,373 posts)...German Finance Minister Wolfgang Schaeuble made it clear in an interview on German television today that for him it was not important where the Cypriots raised the money – as long as they did raise it.

There are two reasons for this unusual conditionality. First, German politicians and many of their European colleagues suspect Cyprus to be a tax haven and a money-laundering site for Russian oligarchs. Of the 68 billion euros stored in Cypriot bank accounts, around 20 billion ($26 billion) belong to Russian account holders. A report compiled last year by the German secret service, the Bundesnachrichtendienst, claims to have found evidence that Cypriot banks or Russian bank branches based in Cyprus are used to launder illegal money.

The second reason is that Germany’s ruling coalition of conservatives and liberals is facing general elections in September, and politicians fear accusations they are sacrificing German tax money to bail out Russian billionaires. “There is a lot of, let’s say, difficult money in Cypriot accounts,” says Mr. Fuchs. “We want this to be taxed.”

The question now is what the rest of the eurozone – and indeed the international financial markets – make of the deal. The verdict seems to be a general thumbs-down. Shares in Europe, particularly those of banks, were down today.

And economists warn the Cypriot example could set a risky precedent. American Nobel prize winner Paul Krugman called it a “dangerous solution” that could cause mass withdrawals in countries like Greece and Italy. And Peter Bofinger, a member of the so-called council of wise men advising the German government on the economy, said in an interview with German magazine Der Spiegel, “From now on Europe’s citizens really have to worry about their money.”

Demeter

(85,373 posts)In around 1890, Captain Alfred Thayer Mahan, a member of the Navy War Board and leading U.S. strategic thinker, wrote a book titled The Influence of Sea Power upon History in which he argued for the establishment of a large and powerful navy modeled after the British Royal Navy. Part of his strategy called for the acquisition of colonies in the Caribbean, which would serve as coaling and naval stations. They would serve as strategic points of defense with the construction of a canal through the Isthmus of Panama, to allow easier passage of ships between the Atlantic and Pacific oceans.

William H. Seward, the former Secretary of State under presidents Abraham Lincoln and Ulysses Grant, had also stressed the importance of building a canal in Honduras, Nicaragua or Panama. He suggested that the United States annex the Dominican Republic and purchase Puerto Rico and Cuba. The U.S. Senate did not approve his annexation proposal, and Spain rejected the U.S. offer of 160 million dollars for Puerto Rico and Cuba.

Since 1894, the United States Naval War College had been developing contingency plans for a war with Spain. By 1896, the U.S. Office of Naval Intelligence had prepared a plan that included military operations in Puerto Rican waters. Except for one 1895 plan, which recommended annexation of the island then named Isle of Pines (later renamed as Isla de la Juventud), a recommendation dropped in later planning, plans developed for attacks on Spanish territories were intended as support operations against Spain's forces in and around Cuba. Recent research suggests that the U.S. did consider Puerto Rico valuable as a naval station, and recognized that it and Cuba generated lucrative crops of sugar – a valuable commercial commodity which the United States lacked.

On July 25, 1898, during the Spanish–American War, the U.S. invaded Puerto Rico with a landing at Guánica. As an outcome of the war, Spain ceded Puerto Rico, along with the Philippines and Guam, then under Spanish sovereignty, to the U.S. under the Treaty of Paris. Spain relinquished sovereignty over Cuba, but did not cede it to the U.S.

The United States and Puerto Rico began a long-standing metropolis-colony relationship. In the early 20th century, Puerto Rico was ruled by the military, with officials including the governor appointed by the President of the United States. The Foraker Act of 1900 gave Puerto Rico a certain amount of civilian popular government, including a popularly elected House of Representatives. (The upper house and governor were appointed by the United States; at the time, the US did not have popular election of senators. Until passage of the Seventeenth Amendment in 1913, most US senators were elected by their respective state legislatures.)

Its judicial system was constructed to follow the American legal system; a Puerto Rico Supreme Court and a United State District Court for the territory were established. It was authorized a non-voting member of Congress, by the title of "Resident Commissioner", who was appointed. In addition, this Act extended all U.S. laws "not locally inapplicable" to Puerto Rico, specifying, in particular, exemption from U.S. Internal Revenue laws.

The Act empowered the civil government to legislate on "all matters of legislative character not locally inapplicable," including the power to modify and repeal any laws then in existence in Puerto Rico, though the U.S. Congress retained the power to annul acts of the Puerto Rico legislature. During an address to the Puerto Rican legislature in 1906, President Theodore Roosevelt recommended that Puerto Ricans become U.S. citizens.

In 1914, the Puerto Rican House of Delegates voted unanimously in favor of independence from the United States, but this was rejected by the U.S. Congress as "unconstitutional," and in violation of the 1900 Foraker Act.

U.S. citizenship & Puerto Rican citizenship

In 1917, the U.S. Congress passed the Jones-Shafroth Act, popularly called the Jones Act, which granted Puerto Ricans U.S. citizenship. Opponents, who included all of the Puerto Rican House of Delegates, which voted unanimously against it, said that the US imposed citizenship in order to draft Puerto Rican men into the army as American entry into World War I became likely.

The same Act provided for a popularly elected Senate to complete a bicameral Legislative Assembly, as well as a bill of rights. It authorized the popular election of the Resident Commissioner to a four-year term.

Natural disasters, including a major earthquake and tsunami in 1918, and several hurricanes, and the Great Depression impoverished the island during the first few decades under U.S. rule. Some political leaders, such as Pedro Albizu Campos, who led the Puerto Rican Nationalist Party, demanded change in relations with the United States. He organized a protest at the University of Puerto Rico in 1935, in which four were killed by police.

In 1936 the US Senator Millard Tydings introduced a bill supporting independence for Puerto Rico, but it was opposed by Luis Muñoz Marín of the Liberal Party. (Tydings had co-sponsored the Tydings–McDuffie Act, which provided independence to the Philippines after a 10-year transition under a limited autonomy.) All the Puerto Rican parties supported the bill, but Muñoz Marín opposed it. Tydings did not gain passage of the bill.

In 1937, Albizu Campos' party organized a protest, in which numerous people were killed by police in Ponce. The Insular Police, resembling the National Guard, opened fire upon unarmed and defenseless cadets and bystanders alike. The attack on unarmed protesters was reported by the U.S. Congressman Vito Marcantonio and confirmed by the report of the Hays Commission, which investigated the events. The commission was led by Arthur Garfield Hays, counsel to the American Civil Liberties Union.

Nineteen persons were killed and over 200 were badly wounded, many in their backs while running away. The Hays Commission declared it a massacre and police mob action, and it has since been known as the Ponce Massacre. In the aftermath, on April 2, 1943, Tydings introduced a bill in Congress calling for independence for Puerto Rico. This bill ultimately was defeated.

During the latter years of the Roosevelt–Truman administrations, the internal governance was changed in a compromise reached with Luis Muñoz Marín and other Puerto Rican leaders. In 1946, President Truman appointed the first Puerto Rican-born governor, Jesús T. Piñero.

Since 2007, the Puerto Rico State Department has developed a protocol to issue certificates of Puerto Rican citizenship to Puerto Ricans. In order to be eligible, applicants must have been born in Puerto Rico; born outside of Puerto Rico to a Puerto Rican-born parent; or be an American citizen with at least one year residence in Puerto Rico. The citizenship is internationally recognized by Spain, which considers Puerto Rico to be an Ibero-American nation. Therefore, Puerto Rican citizens have the ability to apply for Spanish citizenship after only two years residency in Spain (instead of the standard 10 years).

Commonwealth

In 1947, the U.S. granted Puerto Ricans the right to democratically elect their own governor. In 1948, Luis Muñoz Marín became the first popularly elected governor of Puerto Rico.

A bill was introduced before the Puerto Rican Senate which would restrain the rights of the independence and nationalist movements in the island. The Senate at the time was controlled by the PPD, and was presided over by Luis Muñoz Marín. The bill, also known as the Gag Law (Ley de la Mordaza in Spanish), was approved by the legislature on May 21, 1948. It made it illegal to display a Puerto Rican flag, to sing a patriotic tune, to talk of independence, or to fight for the liberation of the island.

The bill, which resembled the Smith Act passed in the United States, was signed and made into law on June 10, 1948, by the U.S. appointed governor of Puerto Rico, Jesús T. Piñero, and became known as "Law 53" (Ley 53 in Spanish).

In accordance with this law, it would be a crime to print, publish, sell, exhibit, organize or help anyone organize any society, group or assembly of people whose intentions are to paralyze or destroy the insular government. Anyone accused and found guilty of disobeying the law could be sentenced to ten years of prison, be fined $10,000 dollars (US), or both. According to Dr. Leopoldo Figueroa, a member of the Puerto Rico House of Representatives, the law was repressive, and was in violation of the First Amendment of the US Constitution, which guarantees Freedom of Speech. He asserted that the law as such was a violation of the civil rights of the people of Puerto Rico. The infamous law was repealed in 1957.

In 1950, the U.S. Congress approved Public Law 600 (P.L. 81-600), which allowed for a democratic referendum in Puerto Rico to determine whether Puerto Ricans desired to draft their own local constitution. This Act was meant to be adopted in the "nature of a compact". It required congressional approval of the Puerto Rico Constitution before it could go into effect, and repealed certain sections of the Organic Act of 1917. The sections of this statute left in force were entitled the Puerto Rican Federal Relations Act. U.S. Secretary of the Interior Oscar L. Chapman, under whose Department resided responsibility of Puerto Rican affairs, clarified the new commonwealth status in this manner:

On October 30, 1950, Pedro Albizu Campos and other nationalists led a 3-day revolt against the United States in various cities and towns of Puerto Rico, in what is known as the Puerto Rican Nationalist Party Revolts of the 1950s. The most notable occurred in Jayuya and Utuado. In the Jayuya revolt, known as the Jayuya Uprising, the Puerto Rican governor declared martial law, and attacked Jayuya with infantry, artillery and bombers under control of the Puerto Rican commander. The Utuado Uprising culminated in what is known as the Utuado massacre.

On November 1, 1950, Puerto Rican nationalists from New York City, Griselio Torresola and Oscar Collazo, attempted to assassinate President Harry S Truman at his temporary residence of Blair House. Torresola was killed during the attack, but Collazo was wounded and captured. He was convicted of murder and sentenced to death, but President Truman commuted his sentence to life. After Collazo served 29 years in a federal prison, President Jimmy Carter commuted his sentence to times served and he was released in 1979.

Don Pedro Albizu Campos served many years in a federal prison in Atlanta, for seditious conspiracy to overthrow the U.S. government in Puerto Rico.

The Constitution of Puerto Rico was approved by a Constitutional Convention on February 6, 1952, and 82% of the voters in a March referendum. It was modified and ratified by the U.S. Congress, approved by President Truman on July 3 of that year, and proclaimed by Gov. Muñoz Marín on July 25, 1952. This was the anniversary of the July 25, 1898, landing of U.S. troops in the Puerto Rican Campaign of the Spanish–American War, until then imposed as an annual Puerto Rico holiday.

Puerto Rico adopted the name of Estado Libre Asociado de Puerto Rico (literally "Associated Free State of Puerto Rico"

During the 1950s, Puerto Rico experienced rapid industrialization, due in large part to Operación Manos a la Obra ("Operation Bootstrap"

Four plebiscites have been held since the late 20th century to resolve the political status. The most recent, in 2012 showed a majority (54% of the voters) in favor of a change in status, with full statehood the preferred option but it was highly controversial: many ballots were left blank and the results were criticized by several parties. Support for the pro-statehood party, Partido Nuevo Progresista (PNP), and the pro-commonwealth party, Partido Popular Democrático (PPD), remains about equal. The only registered pro-independence party, the Puerto Rican Independence Party (PIP), usually receives 3–5% of the electoral votes.

Demeter

(85,373 posts)I'M TRYING TO IMAGINE RICHARD (NIXON) BURIED IN A PARKING LOT IN DOWNTOWN LA....

OR HENRY (KISSINGER)....TOO BAD HE ISN'T DEAD YET

http://www.theguardian.com/uk-news/2015/may/22/king-henry-i-lies-under-reading-car-park-uk-archaeologists

After the 2015 reburial of King Richard III, experts are suggesting the remains of William the Conqueror’s son, who died in 1135, lie in Reading...The remains of another English king could be lurking underneath a 21st-century car park, archaeologists and historians have said. After the well-publicised exhumation in 2012 of Richard III from beneath a council lot in Leicester, attention has shifted to the possibility that Henry I, the youngest son of William the Conqueror, could be lying in similar circumstances in Reading.

Henry I ruled England for 35 years between 1100 and 1135 and is remembered by historians as an “energetic, decisive and occasionally cruel ruler” who allegedly died after eating too many lampreys – a kind of jawless fish. He was interred in a sarcophagus in Reading abbey, which was largely destroyed during the 16th-century dissolution of the monasteries.

Now a team that includes Philippa Langley, who led the search for Richard III’s remains, and Reading-based husband and wife historians John and Lindsay Mullaney, are spearheading a project to uncover the full extent of the abbey using radar to find out where Henry I’s remains might be – possibly under a playground or a car park. The project has won the support of Historic England, the public body, which has agreed to lend conservation expertise and help with cutting-edge geophysical research. Work starts in 2016...

If remains were dug up, identification could be tough, said Dr Turi King, lecturer in genetics and archaeology at the University of Leicester, who carried out the DNA testing on Richard III. She said the Henry I team would face a tougher challenge verifying his remains, mainly because they will have to trace his ancestry back a further 350 years before Richard III, to 1135 rather than 1485. “We were quite lucky with Richard because of the genealogical evidence, but the further back you go the less reliable it becomes,” she said.

They knew accurately how old Richard III was when he died, so they were able to check the age of his skeleton matched the age they knew about, whereas histories of Henry I are ambiguous about his date of birth, suggesting 1068 or 1069.

kickysnana

(3,908 posts)Requesting original copy of Auntie's $1000 1969 paid up term life insurance policy which they have known about since 2006. The ONLY thing that changed this year is her rent went up $10. She gets SSI and has no other income.

Insane.

Demeter

(85,373 posts)... Social security is now requiring all beneficiaries to set up direct deposit, which means the resulted funds could become available to executing creditors if there are any funds from any other source in the account as well. You might recall my blog about this some time back, which contains cites to some of the relevant law...As my previous blog explains, Federal law provides that Social Security payments are exempt from garnishment from civil creditors. If, for example, a credit card lender sues you and obtains a judgment, that creditor cannot ask Social Security to withhold funds from your government check. While these protections do not apply with equal force to the IRS collecting a tax debt or a creditor collecting child support, all other creditors are not to touch social security funds under any circumstances.

There is however, a rub. Under the applicable law, Social Security money (SSA) that is co-mingled with non-Social Security money may lose this special protection. Here is what Jonathan Ginsberg says recipients should do:

"Social Security recipients can protect themselves by asking their bank to create a sub-account that holds only SSA issued funds. No money other than SSA funds should ever be deposited into this account. This is especially necessary if the recipient has civil judgment creditors looking for a source of funds to levy against.

In my practice, I have represented a number of senior citizen clients who are living with tens of thousands of dollars in credit card debt, have no assets or equity in property, and who survive on Social Security only. In these cases I often discourage bankruptcy and instead write each creditor advising the creditor that my client is judgment proof with no source of funds that can be garnished. At the same time I write the credit card company, I also draft a letter to my client’s bank, putting the bank on notice that it should not honor any garnishment because the sole source of funds is Social Security money. Often, however, I find that my clients are using their “Social Security” account as a regular bank account and they deposit other money, such as funds generated from a garage sale or a gift from a relative. I spend a lot of time explaining to my client that even a few dollars of co-mingled money may jeopardize the protected status of their Social Security bank account.

Now that many more Social Security recipients are entering the electronic banking world, I expect that more than a few will find themselves trying to get money back from a judgment creditor who found a co-mingled account. Sometimes, senior citizens choose to file bankruptcy for the peace of mind benefit, but often a Chapter 7 or Chapter 13 filing is not necessary – instead many creditors and collection agencies will write off your debt and close their files if you can show that you are judgment proof. If you are receiving Social Security money, I urge you to take time now – before a judgment creditor begins collection efforts – to protect your bank accounts."

Demeter

(85,373 posts)In his forthcoming book, Detroit: A Biography, journalist Scott Martelle details how the city – felled by one of the great innovations of the industrial era, a grave lack of official foresight and swirling poverty and prejudice – has come to redefine urban collapse. Martelle starts his story at the beginning, with French naval officer Antoine Laumet de Cadillac beaching his canoe on the north bank of the Detroit River in July 1701 and establishing Fort Pontchartrain.

Economic boom-times arrived with the 1825 opening of the Erie Canal, a key shipping link to the East through which boatloads of iron ore, copper, coal, and lumber from the Lake Superior region passed.

• • • • •

Detroit's population neared 300,000 at the turn of the century, just as Ransom Olds, David Buick, the Packard brothers and Henry Ford began their battle for automobile supremacy. By 1914, Detroit was making half the country's cars. By 1929 it was the fourth largest city in the country, with a thriving economy, a population of 1.6 million (nearly 160,000 working in the auto industry) and impressive new roads and skyscrapers.

Yet it was built on sand. Martelle points to Henry Ford's great innovation, the conveyor belt-driven assembly line. “It was the first critical step in the dehumanization of manufacturing work,” he writes. “Skilled craftsmen lost out to unskilled laborers who performed a single task, day in and day out.” The line became standard across the industry and wages fell, leading to protests and ultimately the creation of the United Auto Workers union. Yet by providing decent-paying jobs to the least skilled, the assembly line dictated that future Detroit workers would rarely need more than a high school education or any skills that might help them find work beyond the most menial jobs. “It drew to Detroit the relatively uneducated, made Detroit a magnet for the lower economic strata, from the South and other parts of Midwest,” says Martelle. “Obviously you need laborers, but this skewed the balance.” And in a free market those jobs would constantly seek out the cheapest labor. General Motors sniffed the changing winds long before most, opening factories as far afield as Europe, South America and, in 1929, that godhead of outsourcing, India.

The Great Depression hit Detroit hard. Auto production fell by three-quarters in just three years, forcing tens of thousands of layoffs and countless foreclosures. Major banks faced insolvency. By 1940 the industry had rebounded, converting plants to build tanks, planes and various other vehicles and spare parts for the war effort. Detroit's economy hummed again, and half a million people arrived looking for work, mostly African-Americans from the South. After the war, the big automakers went back to their old ways. Cars sold in record numbers, driving a booming local and regional economy. Depression-era troubles had failed to convince Detroit officials to diversify.

“It was a lack of imagination,” says Martelle. “The leaders saw people buying cars again, and thought, ‘making cars, that's what this city does best.’” That decision, Martelle argues, played a major role in the city's eventual collapse.

“It's hard to imagine Detroit would be in its current condition if the post-war economy had diversified significantly beyond auto-making,” he writes in the book.

• • • • •

Later opportunities to point the city in a better direction came and went. Martelle chronicles the 1949 election of Mayor Albert Cobo, whose anti-integration, slum-clearing policies helped spur the exodus of whites to the suburbs, the devastation of the 1967 riots and the years of crime, drugs, and gang violence that followed.

Along the same timeline, the Big Three were busy decentralizing their operations. By the early 70s, one out of every three dollars invested in the major automakers was heading overseas.

The 1973 oil embargo, the subsequent race to increase fuel efficiency and the rise of Japanese automakers like Honda proved the straw that broke the city's back. Within two years, U.S. auto production had fallen nearly 30 percent, and Detroit was well on its way to becoming a byword for urban decay.

Martelle intersperses his narrative with a handful of telling resident bios. Michael Farrell buys the century-old, long-neglected Taylor House mansion in Brush Park for $65,000 in 1981. He hopes to revive the neighborhood and achieves modest success until the financial crisis steals his momentum. With no grocery store or retail of any sort, today the area is known mainly for its Victorian “ruins porn.”

“When you lose the commerce, you lose the city,” Farrell tells Martelle in the book. “Detroit has no commerce.”

• • • • •

Demeter

(85,373 posts)Agencies can let out a deep breath of relief for a second year in a row — there will be no budget cuts because of sequestration in fiscal 2015. The Office of Management and Budget sent a letter and report to Congress Jan. 20, detailing why the reductions to agency discretionary budgets will not be necessary as called for under the Budget Control Act.

"OMB estimates that discretionary appropriations are at the defense cap, while non-Defense appropriations are nearly $3.7 billion below the budget authorizations set in the [Budget Control Act]," OMB wrote in the report. OMB stated the defense discretionary budget for 2015 is $585.9 billion, down from $606.3 billion last year. For non-defense discretionary spending, agencies will have $514.1 billion, which is up from $504.8 billion in 2014.

The Bipartisan Budget Act of 2013 called for smaller reductions in the spending caps in 2015 than previously expected. The law reduced the defense cap only by $44.7 billion and the non-defense cap only by $27.6 billion from the original Budget Control Act levels. In 2014, Congress restored $44.8 billion in total to the government's discretionary spending. The administration estimates the discretionary spending to increase in the out years for non-defense spending, and continue the defense budget's decline in 2016, but slowly increase through 2021. This is the second straight year that Congress and the White House approved a budget that will not require additional cuts. In 2014, discretionary budget allocations stayed under the Budget Control Act caps. In 2013, agencies faced an $85 billion budget cut under sequestration, which amounted to a 7.8 percent reduction to defense agencies and a 5 percent decrease to civilian agencies.

Sequestration could return starting in 2016, OMB said, as the Budget Control Act requires reductions to the current discretionary spending rates. OMB told Congress in its August sequestration report that it was concerned about a limited sequester in 2015, but in the end it wasn't needed.

SO THAT IDIOTIC RULE IS STILL IN EFFECT, AND WE ARE ON A STARVATION DIET TO AVOID IT KICKING IN

Demeter

(85,373 posts)It's maddening, and confusing the plant and animal life.

DemReadingDU

(16,002 posts)Just yesterday, I planted a few tomato plants. The temps have dipped into the 40s this week, but so far, no frost.

Demeter

(85,373 posts)On average, a new car buyer in the U.S. keeps the car for more than 11 years. It is rare for a buyer to turn around and sell that new car after just one year. Only about 2.7% of new cars sold in model year 2014 were sold after just one year of ownership. Even with that low turnover percentage, there were seven 2014 models that got dumped at even higher rates after just one year. Automotive research website iSeeCars.com analyzed 5 million new 2014 model year cars sold between September 2013 and March 2014, and then checked back one year later to see what percentage of those cars were sold as used with 10,000 to 15,000 miles on the odometer.

From 24/7 Wall St., here are the seven cars that owners could not wait to get out of:

- Nissan Frontier:A total of 6.9% of the midsize pickup trucks were resold by their original buyers after just one year of ownership. That is 2.6 times the average rate of 2.7%. At the Kelley Blue Book (KBB) website, the 2014 king cab version of the Nissan Frontier has 156 consumer reviews and an overall rating of 8.6 out of a possible 10. The Frontier’s MSRP is $23,435.

- Chevrolet Cruze: Some 7.2% of Chevy Cruze buyers dump the car after just a year of ownership. That is 2.7 times the average rate. The compact sedan was named to KBB’s 2014 list of 10 best sedans costing less than $25,000, and it has received 472 ratings at KBB and an overall rating of 8.4. The Cruze carries an MSRP of $18,345.

- Mercedes-Benz C-Class: This may be a bit of a shocker: 7.4% of the 2014 C-Class cars were resold after just one year. That is 2.8 times average rate of 2.7%. A car with an MSRP of more than $36,000 that has 287 consumer ratings and an overall score of 9.2 is one that buyers cannot wait to sell? KBB’s experts rate the C-Class at an overall 7.3, so there might be a disconnect here.

- Dodge Charger: KBB’s experts rated the Dodge Charger at an overall 7 out of 10, and 7.7% of owners sold the car after just one year of ownership. That is 2.8 times the average rate. The car has 117 ratings at KBB’s website and an overall rating of 9.2. The MSRP on the car is $27,900.

- BMW X1: This BMW X1 crossover SUV carries an MSRP of $31,850 and an overall rating of 7.6 from KBB’s experts. A full 7.8% of owners sold the car after just a year of ownership, which is 2.9 times the average rate of 2.7%. Consumers have posted 47 ratings for the vehicle on the KBB website, and the overall rating is 8.7.

- Chevrolet Sonic: The second GM-built car to make this list had 8.9% of owners sell after just one year, a rate three times the average. The KBB experts rate the car at 7.7, and consumers give it an 8.5 rating, based on 135 total reviews. The MSRP on the car is $14,995.

- Buick Regal: The third GM-made car that owners cannot wait to sell gets resold within one year at a rate of 10.7%, four times the average of 2.7%. The midsize Regal gets a rating of 7.1 from the KBB experts, and 86 consumer ratings yield an overall score of 8.9. The MSRP on the car is $30,615.

iSeeCars notes that all seven cars were ranked as average (three stars) or worse in the J.D. Power 2014 U.S. Initial Quality Study, which surveys consumers after 90 days of ownership. The company’s CEO, Phong Ly, suggests that the presence of the BMW X1 and Mercedes-Benz C-Class vehicles on this list could indicate that the technology does not work as promised or is difficult to use (more likely the latter). The Buick Regal competes with both Lexus and BMW models and may be found wanting in the luxury details that buyers expected. The good news is that consumers looking for one of these cars can often find a bargain. For example, a 2014 Buick Regal with 10,000 to 15,000 miles is currently valued at 32.2% less than its new car price (based on iSeeCars.com’s database of cars for sale). 2014 models of the Dodge Charger and the Mercedes-Benz C-Class with average miles averaged 31% and 28.4% less than their new prices, respectively. Minimum savings for buyers on six of these seven cars is nearly 18%, according to Ly.

I WONDER IF FINANCING MIGHT HAVE SOMETHING TO DO WITH THE TURNOVER, TOO...

http://247wallst.com/autos/2015/05/15/7-cars-buyers-cannot-wait-to-trade-in/

Demeter

(85,373 posts)As of this week, Citicorp, JPMorgan Chase, Barclays and Royal Bank of Scotland are felons, having pleaded guilty on Wednesday to criminal charges of conspiring to rig the value of the world’s currencies. According to the Justice Department, the lengthy and lucrative conspiracy enabled the banks to pad their profits without regard to fairness, the law or the public good. Besides the criminal label, however, nothing much has changed for the banks. And that means nothing much has changed for the public. There is no meaningful accountability in the plea deals and, by extension, no meaningful deterrence from future wrongdoing. In a memo to employees this week, the chief executive of Citi, Michael Corbat, called the criminal behavior “an embarrassment” — not the word most people would use to describe a felony but an apt one in light of the fact that the plea deals are essentially a spanking, nothing more.

As a rule, a felony plea carries more painful consequences. For example, a publicly traded company that is guilty of a crime is supposed to lose privileges granted by the Securities and Exchange Commission to quickly raise and trade money in the capital markets. But in this instance, the plea deals were not completed until the S.E.C. gave official assurance that the banks could keep operating the same as always, despite their criminal misconduct. (One S.E.C. commissioner, Kara Stein, issued a scathing dissent from the agency’s decision to excuse the banks.) Also, a guilty plea is usually a prelude to further action, not the “resolution” of a case, as the Justice Department has called the plea deals with the banks.