Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 1 June 2015

[font size=3]STOCK MARKET WATCH, Monday, 1 June 2015[font color=black][/font]

SMW for 29 May 2015

AT THE CLOSING BELL ON 29 May 2015

[center][font color=red]

Dow Jones 18,010.68

S&P 500 2,107.39

Nasdaq 5,070.03

[font color=red]10 Year 2.12% +0.01 (0.47%)

30 Year 2.88% +0.02 (0.70%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)It's a balmy 48F this evening, and the furnace is roaring away.....the rains have stopped, if not the flooding. We will see Thursday if Michigan's Abnormally Dry condition has been alleviated this weekend, as Texas' drought was the week before.

Unfortunately, the total lack of common sense in Europe, Washington, and various other communities around the globe will continue for the duration. I guess I'm becoming accustomed to it, to the betrayal of the promise of the 60's. One can become accustomed to anything, if it goes on long enough. Perhaps that is the problem with our problems...people get comfortable with them, instead of solving them.

Not to say that all problems are solvable. But the economic ones are.

Demeter

(85,373 posts)Pushing tax cuts for the masses instead of cuts for the rich isn't "progressive" — it's left-Reaganism. Here's why...President Obama’s proposals to help the middle class in his State of the Union message, like the recent tax proposals offered by Rep. Chris Van Hollen, are being hailed by progressives and denounced by conservatives as marking a dramatic turn toward “populism” by the Democratic Party. They are nothing of the kind. On the contrary, they show the extent to which even “populist” and “progressive” Democrats remain trapped inside the intellectual cage of Reaganomics. Reaganomics is tax-cut Keynesianism for the classes. Cut the taxes of the rich, the theory goes, and prosperity will trickle down to the masses, as the rich invest in economy-expanding businesses and pay higher taxes, in absolute terms, at lower rates.

The Democratic answer to this is tax-cut Keynesianism for the masses. Cut the taxes of middle-class and working-class Americans, and this will at once expand the middle class and bolster aggregate consumer demand, to the benefit of mass-market industries. The revenue lost by middle-income tax cuts will be made up by higher taxes on the rich, who are more likely to save their money or gamble with it than to spend it. Because of its emphasis on the demand side, the Democratic version of tax-cut Keynesianism is more plausible than the Republican version when it comes to macroeconomics. But in its approach to public policy, it is essentially left-Reaganism. It represents a continuity with the neoliberalism or “Rubinomics” of the Clinton administration (named after Clinton’s Treasury Secretary Robert Rubin), symbolized by proposals for little, gimmicky tax cuts, to the exclusion of direct interventions in labor and product markets or expansions of social insurance. And it represents a break with the New Deal economics that created the first mass middle class in history in mid-twentieth century America.

The New Dealers did not create a mass middle class by tinkering at the margins with the tax code for short-term electoral gain, treating “the middle class” as one of many narrowly targeted constituencies. The New Deal-era architects of middle-class America boldly used all the tools in the arsenal of the modern mixed economy: labor market regulation, social insurance, public utility regulation and state capitalism.

- Labor market regulation. The Fair Labor Standards Act of 1938 created the federal minimum wage and enacted maximum hours and overtime regulations. Limited immigration—a labor market policy that the New Deal Democrats inherited from the 1920s and supported until the 1960s—ensured a tight labor market at the bottom of the income scale. The combination raised wages between the 1940s and the 1970s, even after Southern and Western conservatives managed to thwart drives toward nationwide unionization.

- Social insurance. With a few exceptions, today’s defeatist Democrats have internalized right-wing ideological support for private, tax-favored savings accounts as a public policy tool. But providing for retirement, health care and college by means of pre-funded, tax-favored savings accounts is stupid. Universal, tax-funded social insurance is far more efficient than 300 million pre-funded private savings accounts. Social insurance means you don’t have to pre-fund your retirement and your episodes of unemployment and disability and family leave. You pay modest, recurrent social insurance taxes, such as payroll taxes, instead of amassing huge piles of cash or stocks and bonds. In the same way, thanks to private insurance, you pay monthly premiums, instead of frantically saving hundreds of thousands of dollars in advance so you will be prepared if your house burns down or your car is wrecked. And unlike pre-funded savings accounts, social insurance programs like Social Security and Medicare provide the same benefits, no matter whether the stock market is up or down when you need them.

- Public utility regulation. The New Dealers understood that certain industries provide “merit goods”—goods that we want everyone citizen to have, even if they cannot afford to purchase them in the private market. In the New Deal era, these merit goods included basic food, water and electricity, telephone service and banking. The New Dealers also understood that the methods by which these merit goods should be provided to all citizens depends on the structures of particular merit-good industries. Where there are competitive markets—for example, in the food industry—vouchers (food stamps) can be provided to the needy, without any danger of driving up the cost of the merit good. However, where a merit-good industry is a natural oligopoly or monopoly, like water or sewer service, subsidies in the form of vouchers or tax credits are likely to be captured by greedy providers, who will jack up their prices by the amount of the subsidies. To avoid such predatory pricing, merit-good industries with monopoly/oligopoly structure should be price-regulated utilities under public or private ownership. In the New Deal era, public utility regulation was extended to electricity and water service, telephone service (the regulated AT&T monopoly, in which the rich and business cross-subsidized middle-class phone use), and the tightly regulated banking industry.

The greatest mistake of the Great Society legislation of the 1960s was expanding federal subsidies to health care and higher education, without at the same time converting higher education and medicine into price-regulated public utilities. The predictable result was an explosion of college costs and medical costs, as predatory providers used the market power of their concentrated industries to extract rents or excess payments from taxpayers and private purchasers alike. No similar cost explosions occurred in countries that controlled higher education prices as well as the prices that can be charged by drug companies, hospitals and physicians. In other words, unlike New Deal utility regulation, the Great Society reforms of the 1960s–student loans, Medicare and Medicaid–inadvertently encouraged price-gouging by greedy universities, drug companies, hospitals and physicians, not by being too statist, but by not being statist enough. - State capitalism. The New Dealers believed that the correct term for modern economies was “the mixed economy,” not “capitalism.” In reality, there are no “free market” or “free enterprise” or purely “capitalist” economies in the world. Even in relatively anti-statist countries like the U.S. and the U.K., the economy is a blend of capitalism, socialism and the nonprofit sector. There are no libertarian countries. The tech revolution of the late twentieth century was the result of investment not only by the private sector but also the public sector (chiefly the Defense Department) and the nonprofit sector (research universities like MIT and Stanford), with the public sector acting as the chief catalyst. In the case of breakthrough innovations like the transistor and the satellite and nuclear energy, private venture capitalists have been supporting actors, not stars.

Merely rehearsing this history shows how pitifully timid the range of proposals made by today’s Democrats have become. President Franklin Roosevelt would be as forgotten today as President Franklin Pierce, if his chief response to the crisis of the Great Depression and the second industrial revolution had been a laundry list of minor tax credits.

What would a bold neo-Rooseveltian agenda look like today?

- Making the minimum wage a living wage—a labor market regulation favored by President Obama and a growing number of Democrats—would be one step.

- So would an immigration policy that creates a tight labor market at the bottom by bringing in mostly educated workers while restricting the number of low-wage, less-educated workers. (If Latino immigrants voted overwhelmingly for conservative Republicans, one suspects that Democratic immigration policy might be different).

- Then there is social insurance. Trying to expand tax-favored private retirement savings for middle- and low-income Americans, as the Van Hollen plan does, is a terrible idea, for reasons of policy and politics. It is bad policy, because it would herd more middle-class and low-income Americans like sheep into the stock market, to be fleeced by Wall Street money managers using the shears of hidden and excessive fees. And it is bad politics, too, because universalizing private retirement savings accounts will give Republicans and centrist Democrats yet another excuse to cut Social Security in the future. The more efficient and popular policy when it comes to retirement would be to simply expand Social Security and tax the rich to pay for the expansion. This proposal is overwhelmingly popular with voters, if not with the One Percent donor class that funds both parties. According to a 2014 poll by Lake Research Partners, “support for having wealthy Americans pay the same Social Security rate as everyone else in order to cover the cost of an increase in Social Security benefits is strong among both Republicans and Democrats. More than seven out of 10 Republicans support this proposal (73 percent). Nine out of 10 Democrats (90 percent) support it.”

- Public utility regulation? As I have noted already, the higher education and health care industries in America are antisocial, predatory monopolies and oligopolies, quite as parasitic in their own ways as the worst offenders on Wall Street. These price-gouging industries need to be reined in either by public options or price regulation.

- In the case of higher education, President Obama’s plan to provide two years of free community college might simply lead to tuition price hikes if it is not accompanied by tuition price controls.

- The Affordable Care Act has expanded health insurance coverage, but has not addressed the main problem. Even if American medical prices don’t grow faster than the economy in the future, they are already far higher than medical prices in comparable countries. For example, as Vox notes, Nexium for heartburn costs $23 in the Netherlands and $215 in the U.S. The U.S. thus needs to go beyond merely containing future health care cost increases in order to cut many American medical prices down to European, Canadian and Japanese levels. All-payer price regulation—that is, medical price controls imposed by government–is the system used by every other developed country, including small-government, free-market-oriented countries like Switzerland, to restrain predatory pricing by greedy pharma companies, greedy hospitals and greedy physicians. Higher education and medicine do not have to be provided by government, but they should be turned into low-profit, price-regulated public utilities.

- In the area of state capitalism, there is already a surprising degree of bipartisan consensus. The business wing of the Republican party agrees with centrist and progressive Democrats that the private sector would benefit from increased public investment in basic R&D and infrastructure—where possible, by means that leverage private capital, like infrastructure banks. The opposition to productivity-enhancing public investment is limited to libertarian ideologues and neo-Confederate localists on the far right.

Not only would neo-Rooseveltism be more efficient than a timid, slightly-more-liberal version of Reaganomics, it would also be more popular with voters. As David Frum observes: “Democrats embarrass Republicans when they champion benefits that Americans regard as earned: Social Security and Medicare above all. Minimum wage increases? Super-popular.”

Modest, complicated tax credits? Not so much.

Yes, left-Reaganism is better than right-Reaganism. But neo-Rooseveltism would be better than either.

Michael Lind is the author of Land of Promise: An Economic History of the United States and co-founder of the New America Foundation.

Demeter

(85,373 posts)Yves here. This is an important element of why income inequality is becoming institutionalized in the US. And notice the difference in impact by gender.

By Melissa S. Kearney, Professor at the Department of Economics, University of Maryland and Phillip B. Levine, A. Barton Hepburn and Katherine Coman Professor of Economics, Wellesley College. Originally published at VoxEU

Compared to other developed countries, the US ranks high on income inequality and low on social mobility. This could be particularly concerning if such a trend is self-perpetuating. In this column, the authors argue that there is a causal relationship between income inequality and high school dropout rates among disadvantaged youth. In particular, moving from a low-inequality to a high-inequality state increases the likelihood that a male student from a low socioeconomic status drops out of high school by 4.1 percentage points. The lack of opportunity for disadvantaged students, therefore, may be self-perpetuating.

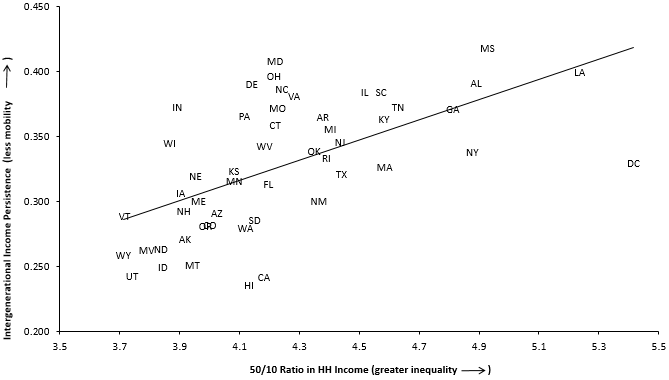

High Inequality and Low Social Mobility: The Great Gatsby Curve

Compared to other developed countries, the US ranks high in income inequality and low in social mobility. International comparisons suggest that these measures are related; highly unequal countries tend to have low social mobility, as measured by intergenerational income persistence (Corak 2006). Alan Krueger, a former chairman of the Council of Economic Advisers, popularised this relationship as the ‘the Great Gatsby curve’. Combining our own data with data from Chetty et al. (2014), we construct a similar Great Gatsby curve for states in the US, shown in Figure 1, which resembles the international pattern (Kearney and Levine 2014a).

Figure 1. The Great Gatsby curve in the US

Notes: Income persistence is the relative mobility measure obtained from Chetty, et al. (2014). The 50/10 ratios are calculated by the authors.

If equality of opportunity were to prevail in a society, one would expect to see high social mobility, all else equal. There is reason for concern, then, that the US ranks poorly on the Great Gatsby curve, casting some doubt on the proposition that a child’s chances of success are independent of her family background.

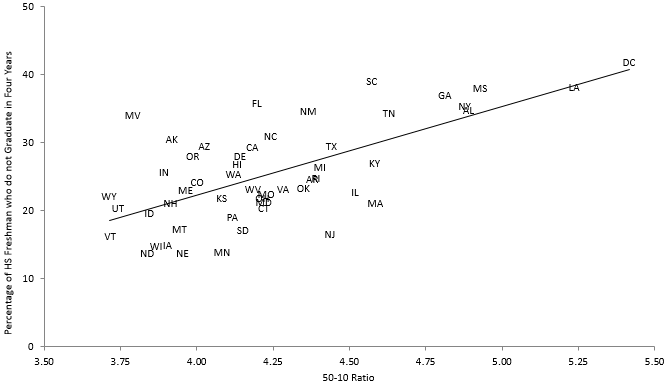

High Income Inequality and School Dropout Rates in the US

There is particular cause for concern, however, if the US’ position on the Great Gatsby curve is somehow self-perpetuating. That is, if high inequality and low mobility affect the behaviour of disadvantaged youth in a way that further diminishes their chances of success, inequality may begin to look something like a vicious circle. This is the question we investigate in this column. In particular, we examine whether high income inequality (as measured as the gap between the bottom and middle of the income distribution) and low social mobility have a causal impact on high school dropout rates among disadvantaged youth—a decision that has important consequences for their ability to climb the economic ladder. Figure 2 shows that income inequality and dropout rates across states are correlated. The purpose of this column is to assess whether this correlation reflects a causal relationship between the two.

Figure 2. Relationship between inequality and rate of high-school non-completion

MUCH MORE ANALYSIS AT LINK

Demeter

(85,373 posts)By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, Americablog, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. This piece first appeared at Down With Tyranny.

...The (MEDIA) “bosses’ illusions” about the Sanders campaign are that it has no chance to succeed, and that it should be given no chance. And they’re doing their best, the chatterers and their bosses, to give it no chance at all. Hendricks on the wave of silence in the press:

http://www.cjr.org/analysis/bernie_sanders_underdog.php

There’s more about this in the article, including similar coverage by those whom Hendricks calls, not euphemistically, Sanders’ “admirers.”

“But He’s Such a Long-Shot…”

Yet Hendricks firmly believes that Sanders could win, that the Sanders campaign could succeed after all. (I share that belief.) In addition to the “Eugene McCarthy in 1968” argument, which Hendricks doesn’t make, there are several strong arguments which Hendricks does make.

First, about those long odds (my emphasis):

Some of these seekers were long shots indeed. Jimmy Carter was a lightly accomplished governor from a trifling state beyond whose borders he was little known and less regarded. A few weeks before he entered the presidential race, the Harris Poll asked voters their thoughts on 35 potential candidates. Carter was not on the list. After a year of campaigning, just a couple of months before the first primary, he routinely polled 1 percent among Democratic voters and finished eighth in the narrowed field of eight Democrats. But he won all the same because the other guys were Washington insiders, and after Watergate and Vietnam, Democratic voters (and eventually the wider electorate) didn’t want another insider, no matter how often journalists told them they did. If you don’t see a parallel to the present moment—a discontented time of Occupy, Black Lives Matter, Moral Monday, Fight for $15, the People’s Climate March, Move to Amend, and other anti-establishmentarian agitation—you’re either asleep or a publisher.

MORE CAUTIOUS OPTIMISM AT LINK

mother earth

(6,002 posts)like Occupy & Black Lives Matter & more, which is exactly WHY Bernie Sanders is the hope of WE THE PEOPLE, and if he's a long shot, they don't get it. They simply don't get it & they never will. The perfect storm delivered by the l% speaks to the urgency of a Sanders win. MSM can choke on their paid talking points.

TPP is the blow to what's left of the working class and the sovereignty of nations, when a "trade deal" can be fast tracked that hands unprecedented power over to multinational corps., its going to take a Bernie Sanders to get us back on the right track again, the USA of oligarchs be damned. I want my country back, I do not support the oligarchy. Give 'em hell, Bernie!

![]()

Demeter

(85,373 posts)QE IS STILL ON, STILL PROPPING UP THE STOCK MARKETS AND REAL ESTATE AROUND THE GLOBE...

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

April was “bloody,” he wrote. Negative interest rates in Europe had created a bubble that would end “badly.” He’d been caught on the wrong side on multiple levels:

In hindsight the tail wind that was the leveraged position in the US dollar against Emerging Market currencies in particular, meant that I did not respond quickly enough to the aggressive QE introduced by Draghi in December of last year and the effects of the fall in the oil price two months earlier.

He wasn’t alone. Other bets that had worked for so long suddenly went wrong too.

Andrea Giannotta’s €3.7-billion long-term euro fund at Eurizon Capital had been up 6.7% in the first quarter, benefiting from the surge of long-term bonds as the ECB’s QE pushed down yields. But when the selloff hit, these bonds got whacked and have since given up nearly all of their gains. He expected yields to continue to go up, he told the Wall Street Journal. So there would be more pain.

“Fixed income had a great ride for a long time, but in the last few weeks we have lost a lot of money,” explained Tanguy Le Saout, head of European fixed income at Pioneer Investments. Their €4.9-billion aggregate bond fund lost enough money in April to wipe out most of the 3.1% gain in the first quarter. “People expect fixed-income funds to have a positive return, and the recent selloff is questioning that,” he said.

Euro bonds had surged for years as hedge funds had been front-running the ECB’s long-rumored QE that was finally announced as a €60-billion-a-month bond-buying program in January and implemented in March. They rode it up, driving bond prices to ludicrous levels, pushing yields of many government bonds below zero. But just as ECB President Mario Draghi was declaring victory over we still don’t know what in mid-April, these hedge funds jumped ship – and overnight, German bunds became “the short of a lifetime.” Hedge funds were dumping bonds and shorting them. No one else wanted to buy them, at these minuscule or negative yields. This set off a rout during which €344 billion was lost on Eurozone-government bonds alone, according to Bloomberg, and with additional hefty losses on euro corporate bonds. As all this began to sink in, fund investors yanked nearly €2 billion from euro-bond funds in the past six weeks, the first major outflows in over a year.

“Bloody” as Odey had put it so eloquently.

The ECB rode to the rescue. This sort of turmoil went against everything it had tried to accomplish. So it announced that it would frontload some of its bond-buying spree ahead of the summer, under the pretext that this would avoid having to buy so much debt at a time when European market players would be on vacation and nothing could get done. As far as the markets were concerned, the announcement meant an additional short-term mini-QE. It stopped the bleeding. Bonds recovered some, and yields settled down. By now, the German 10-year yield, after spiking from 0.05% to 0.77% during the weeks of turmoil, has dropped to 0.50%. All this even though the ECB’s QE has barely begun. But it shows how these bouts of QE around the globe have perverted asset pricing mechanisms. The markets front-run QE as rumors and suggestions of QE run wild, and they’re driving up bonds and stocks in the hope of QE, as they have done in Europe, and when QE finally arrives as it did in March, stocks and bonds begin to sink. German stocks, for example, are down 7.4% from their peak in early April, after having shot up nearly 50% since October.

And so central bank jawboning, rumors of QE, suggestions of QE, promises of QE, and finally QE itself work in driving up markets – until someday, they don’t. And that’s when “unexpected” turmoil sets in. Central banks think they’re omnipotent – until they aren’t.

Demeter

(85,373 posts)QE IS RATHER LIKE RIDING ON A TIGER---HOW DO YOU GET OFF WITHOUT GETTING EATEN?

OR A DRUG ADDICTION--HOW DO YOU QUIT WITHOUT KILLING YOURSELF?

http://www.telegraph.co.uk/finance/economics/11637086/ECB-fears-abrupt-reversal-for-global-assets-on-Fed-tightening.html

The global asset boom is an accident waiting to happen as the US prepares tighten monetary policy and the Greek crisis escalates, the European Central Bank has warned.

The ECB’s financial stability report described a “fragile equilibrium” in world markets, with a host of underlying risks and the looming threat of an “abrupt reversal” if anything goes wrong.

Europe's shadow banking nexus has grown by leaps and bounds since the Lehman crisis and has begun to generate a whole new set of dangers, many of them beyond the oversight of regulators.

While tougher rules have forced the banks to retrench, shadow banking has picked up the baton. Hedge funds have ballooned by 150pc since early 2008.

Investment funds have grown by 120pc to €9.4 trillion with a pervasive “liquidity mismatch”, investing in sticky assets across the globe while allowing clients to withdraw their money at short notice. This is a recipe for trouble in bouts of stress. “Large-scale outflows cannot be ruled out,” it said.

The ECB warned that a rush for crowded exits could set off a wave of forced selling and quickly spin out of control. “Initial asset price adjustments would be amplified, triggering further redemptions and margin calls, thereby fueling such negative liquidity spirals,” it said.

Adding to the toxic mix, the shadow banks are taking on large amounts of “implicit leverage” through swaps and derivatives contracts that are hard to track.

The issuance of high-risk “leveraged loans” reached €200bn last year, nearing the extremes seen just the before the Lehman crisis. Half of all issues this year had a debt/EBITDA ratio of five or higher, implying extreme leverage. The number of junk bonds sold reached a record pace of €60bn in the first quarter.

“A deterioration in underwriting standards is evident in the increasing proportion of highly indebted issuers, below-average coverage ratios and growth in the covenant-lite segment,” the report said, warning that this nexus of debt is primed for trouble if there is an interest rate shock.

Demeter

(85,373 posts)AH, YES, IT'S ALL THE PARENTS' FAULT...ESPECIALLY THE MOMS....

AFTER ALL, IF THEY'D MARRIED BETTER MEN, THEY WOULDN'T BE RAISING CHILDREN ALONE...LET'S COMPLETELY IGNORE THE TIMES OF WAR, WHEN WOMEN WITH MUCH LESS EDUCATION WERE RAISING CHILDREN WITHOUT MALE INFLUENCE BECAUSE THE FATHERS WERE OFF FIGHTING, OR DEAD....

BECAUSE IT'S ALL DIFFERENT, THIS TIME.

IT CERTAINLY IS. THERE'S NEVER BEEN A TIME WHEN CHILDREN AND WOMEN WERE AS DEVALUED AS THIS PRESENT ERA...EVEN THE WHITE ONES!

Demeter

(85,373 posts)Standard financial planning advice presumes that financial emergencies – the loss of a job, an illness or accident, or an unexpected car or household repair - are relatively infrequent for most households. But new research shows that many American households live in a constant state of financial uncertainty, experiencing major monthly swings in their income and expenses.

A recent report from the JPMorgan Chase Institute, which analyzed a sample taken from 2.5 million accounts, finds that volatility is the norm, even at higher incomes. According to the study, as many as 89 percent of Americans see their incomes fluctuate by more than 5 percent from month to month, while 60 percent see changes in spending greater than 30 percent from month to month. Moreover, these figures are roughly the same across all income levels.

Chase estimates that the average American household needs about $4,800 in savings to cope with these monthly shifts without falling into debt or cashing out assets - but it also finds that the vast majority of households fall short of this goal. The Chase analysis found that the typical middle-income household has about $3,000 in liquid assets, which means a shortfall of $1,800.

The report also found that the number one driver of income volatility for most households is labor income, which is perhaps not as stable as many might like to think. While some of the volatility is due to “five Friday months” and December bonuses, these factors still accounted for just 10 percent of monthly income volatility. The rest was due to changes in hours worked, overtime and “other factors not discernible in [the] data.”

The report’s findings reinforce a growing body of research on household income volatility, an important new framework for understanding the current state of Americans’ financial security - or lack thereof. This new research clearly points to the need for new ideas to help households manage the ups and downs of financial volatility without suffering too much hardship....

HARDSHIP MAKES FOR MEANINGFUL CHANGE IN PUBLIC POLICY...OR IN A PINCH, REVOLUTION. NOTHING LESS IS NEEDED IN THIS NATION AND IN THE WEST.

Demeter

(85,373 posts)Billionaire Peter Peterson is spending lots of money to get people to worry about the debt and deficits rather than focus on the issues that will affect their lives. National Public Radio is doing its part to try to promote Peterson's cause with a Morning Edition piece that began by telling people that the next president "will have to wrestle with the federal debt." This is not true, but it is the hope of Peter Peterson that he can distract the public from the factors that will affect their lives, most importantly the upward redistribution of income, and obsess on the country's relative small deficit. (A larger deficit right now would promote growth and employment.)

According to the projections from the Congressional Budget Office, interest on the debt will be well below 2.0 percent of GDP when the next president takes office. This is lower than the interest burden faced by any pre-Obama president since Jimmy Carter. The interest burden is projected to rise to 3.0 percent of GDP by 2024 when the next president's second term is ending, but this would still be below the burden faced by President Clinton when he took office.

Furthermore, the reason for the projected rise in the burden is a projection that the Federal Reserve Board is projected to raise interest rates. If the Fed kept interest rates low, then the burden would be little changed over the course of the decade. Of course the Fed's decision to raise interest rates will have a far greater direct impact on people's lives than increasing interest costs for the government. (The president appoints 7 of the 12 voting members of the Fed's Open Market Committee that sets interest rates.) The reason the Fed raises interest rates is to slow the economy and keep people from getting jobs. This will prevent the labor market from tightening, which will prevent workers from having enough bargaining power to get pay increases. In that case, the bulk of the gains from economic growth will continue to go to those at the top end of the income distribution.

The main reason that we saw strong wage growth at the end of the 1990s was that Alan Greenspan ignored the accepted wisdom in the economics profession, including among the liberal economists appointed to the Fed by President Clinton, and allowed the unemployment rate to drop well below 6.0 percent. At the time, almost all economists believed that if the unemployment rate fell much below 6.0 percent that inflation would spiral out of control. The economists were wrong, inflation was little changed even though the unemployment rate remained below 6.0 from the middle of 1995 until 2001, and averaged just 4.0 percent for all of 2000. (Economists, unlike custodians and dishwashers, suffer no consequence in their careers for messing up on the job.) Anyhow, if the Fed raises interest rates to keep the labor market from tightening as it did in the late 1990s, this would effectively be depriving workers of the 1.0-1.5 percentage points in real wage growth they could expect if they were getting their share of productivity growth. This is like an increase in the payroll tax of 1.0-1.5 percentage points annually. Over the course of a two-term president, this would be the equivalent of an 8.0-12.0 percentage point increase in the payroll tax.

That would be a really big deal. But Peter Peterson and apparently NPR would rather have the public worry about the budget deficit.

It is also worth noting that the five think tanks mentioned in this piece that prepared deficit plans were paid by the Peter Peterson Foundation to prepare deficit plans. They did not do it because they considered it the best use of their time.

mother earth

(6,002 posts)current workings and infiltrations of respected media sources, at least that is how I used to feel about NPR (respected source). I will not make that mistake again.

Peter G. Peterson, born June 5, 1926, is a controversial Wall Street billionaire who uses his wealth to underwrite a diversity of organizations and PR campaigns to generate public support for slashing Social Security, Medicare, and Medicaid, citing concerns over "unsustainable" federal budget deficits. In 2007, he made a fortune from the public offering of the private equity firm he co-founded, Blackstone Group, and pledged to spend $1 billion of this money to "fix America's key fiscal-sustainability problems." He endowed this money to the Peter G. Peterson Foundation, which he launched in 2008 (see below for more).[1] His son, Michael A. Peterson, is the President and Chief Operating Officer of the foundation.

According to its website, the foundation's mission is to "increase public awareness of the nature and urgency of key fiscal challenges threatening America's future and to accelerate action on them." [2]

Dean Baker, co-director of the Center for Economic and Policy Research, has been highly critical of the Peterson Foundation, stating that Medicare and Social Security are "under assault at the hands of the Peterson Foundation."[3].

A more complete list of the many organizations, projects and PR stunts funded by Peterson advocating for cuts to Social Security and Medicare can be found on the Sourcewatch Pete Peterson page.

In fiscal year 2010 the Peterson Foundation gave $2,027,470 to the group America Speaks for a series of Town Hall meetings intended to inform the deliberations of the Simpson-Bowles deficit reduction commission. [4] America Speaks sponsored 19 town hall meetings linked by video on the same day, June 26, 2010 while the Simpson-Bowles commission was underway and six months before the chairmen released a report. These "Town Halls for the 21st Century" made headlines when the audience revolted against the message they were being spoon fed and instead backed a series of progressive policy solutions, such as a financial transaction tax. Learn more at America Speaks

We've got some wonderful sounding foundations in this country that are hell bent on serving the l%, but of course it's all for the good of the public, right?

TY, Demeter.

Demeter

(85,373 posts)No breakthrough was achieved in the Greek debt crisis at a G7 meeting in Dresden, Germany, bringing together the finance ministers and central bank chiefs from the seven richest democracies worldwide....G7 finance ministers agreed that another bailout installment of 7.2 billion euros could not be unlocked without substantially more reform-related concessions from the hard-left government in Greece.

BUT--THOR HAS SPOKEN!

At the meeting in Dresden US Treasury Secretary Jacob Lew called on European policymakers to up the ante with a view to reaching a deal with Greece, saying Europe needed to be more flexible.

Lew said that further delaying the Continent's six-month-old talks with Athens was "courting an accident," meaning a Greek default and the country's messy exit from the euro. That might have unpredictable effects not only on the European economies.

THAT TELLS YOU HOW CLOSE WE ARE TO HAVING THE WHOLE GLOBAL ECONOMY IN THE TOILET. THE BANKSTERS' VOICE HAS NOW SPOKEN.

U.S. Treasury Secretary Jack Lew has appealed to the EU to resolve Greece's financial crisis as quickly as possible, warning that a Greek default or exit from the eurozone could harm the global economy. "It would be unwise to think that just because technical contagion has been changed from earlier years, in that debt is now held by sovereigns as opposed to banks, that we know what the full consequence of a financial crisis or the withdrawal of a country from the monetary union of Europe would mean," Lew said at the conclusion of a Group of Seven summit in Germany.

US Lew: Greece Negotiation Delays Raise Risk Of Accident By Steven Arons

https://www.marketnews.com/content/us-lew-greece-negotiation-delays-raise-risk-accident

- US Treasury Secretary Jack Lew issued a strong appeal to his European counterparts Friday to find a quick solution to the ongoing Greek crisis, warning that failure to do so risked a default or a Greek exit from the Eurozone and possible damage to the global economy.

Speaking at the press conference of the US delegation after the conclusion of the G-7 summit in Dresden, Lew called on both sides of the negotiation table to make concessions.

"At some point, there won't be the ability for Greece to pay its bills and that will be the moment when, if it comes, there will be an accident," Lew said. "If you want to avoid that, the sooner the better."

"Waiting until a day or two before whatever the next deadline is is just a way of courting an accident," Lew said.

The US Treasury Secretary stressed that it was not just Greece that would have to move to resolve the current crisis. Even though he suggested that Greece should move first and, above all, present a "credible plan," he also urged the institutions formerly known as troika to be more forthcoming.

"All parties need to move. There needs to be some flexibility on the part of the institutions. There need to be some policy decisions implemented in Greece. One won't happen without the other," Lew said.

Lew also warned Europeans not be complacent about the potential danger of a Greek exit to their economies.

"It would be unwise to think that just because technical contagion has been changed from earlier years, in that debt is now held by sovereigns as opposed to banks, that we know what the full consequence of a financial crisis or the withdrawal of a country from the monetary union of Europe would mean," he said.

"There is no doubt that if there's a crisis, the worst impact will be on Greece," Lew added.

He was particularly critical the perceived tendency of both sides in the Greece negotiations to wait until the very last second before making any concessions.

"You keep raising the risk of an accident if you put off the action until whatever the next deadline is," Lew said, recommending that the negotiators should move away from their aim to reach a comprehensive deal and instead try to achieve a framework agreement first.

"It would be in the best interest of all parties to reach an understanding on a general level and leave some time to work through the details before whatever the next deadline is," Lew said.

MAYBE THE CIA WILL HAVE TO NEUTRALIZE SCHAEUBLE....THEY HAVE MY PERMISSION.

mother earth

(6,002 posts)death via more of the same. A default will have major consequences, but it may be the only way to ever change for the better, a rocky road, but it may just be the road less travelled leads to well...something that makes ALL THE DIFFERENCE, not just for Greece, but for all.

I give you, poetic interlude...

mother earth

(6,002 posts)June 1, 2015

For full article:

http://www.telegraph.co.uk/finance/economics/11643374/Greece-may-need-to-default-to-break-impasse-says-Goldman.html

Mr Pill said: "By nature, sovereign defaults are political processes and, via grace periods and reviews, the rules and procedures governing payments to the IMF and European Central Bank embody a large element of discretion and flexibility. For example, the possibility of bundling June obligations to the IMF into a single endmonth payment has recently been entertained.

"More importantly, euro exit is a political decision. For sure, the Greek authorities could decide to exit in a unilateral manner. But the current Greek government has no mandate to do so: if it announced an intention to leave the euro area preemptively, in our view the government would likely fall. Moreover, there is no process for euro exit defined in the governing European treaties: the practical and legal challenges could not be resolved overnight."

Demeter

(85,373 posts)Last edited Mon Jun 1, 2015, 01:21 PM - Edit history (1)

(I'm lucky it didn't snow)

Go the car 90% clean inside....just the windows left to do, and I call it quits and find some other dreadful task...like....mending. Or the refrigerator. Sigh.