Economy

Related: About this forumList of top offshorers revealed in Argentina

Argentine investigative journalist Horacio Verbitsky revealed the names of the top 100 firms, and top 100 individuals, to have offshored funds from Argentina during the 2015-19 Mauricio Macri administration.

The lists, published in Verbitsky's online journal El Cohete a la Luna (Moon Rocket), include over $129 billion - an amount similar to the $125 billion net increase in Argentina's public foreign debt from 2015 to 2019.

Those named include many of the most prominent firms and businesspeople in Argentina, as well as their relatives.

Some were also named in Verbitsky's 2017 publication of a partial list of those taking advantage of Macri's 2016 tax whitewash - including Macri's brother Gianfranco, who 'whitewashed' nearly $40 million.

A record $117 billion in offshore funds were declared in return for a one-time 5%-10% tax. But despite assurances that "$60 billion would be repatriated," all but $8 billion (93%) remained offshore.

Argentina is seeking to restructure $66 billion of a $250 billion foreign currency-denominated public debt, with President Alberto Fernández - who defeated Macri last year - noting that "the country has been bankrupt for over two years."

Deregulation and offshoring

Many of these firms and individuals took advantage of Macri's financial deregulation decrees, which were touted as the solution for the country's sluggish economy - but instead led to a massive debt bubble, a $44 billion IMF bailout in 2018-19, and a deep recession known locally as the "Macrisis."

Topping the list of firms is the nation's largest phone company, Telefónica Argentina ($1.25 billion); and its largest electricity distributor, Pampa Energía ($904 million).

Corporate offshoring totaled $55.7 billion during that four-year period; individuals and families totaled another $73.6 billion.

The list of individuals is led by the Eskenazi family, which offshored $103 million. The Eskenazis' now defunct hedge fund Petersen owned 25% of YPF, the nation's largest energy firm, until its partial renationalization in 2012.

The Ick family, whose Ick Group conglomerate is the largest firm in Santiago del Estero Province (one of the nation's poorest), offshored $43 million.

The Werthein family, probably best known as the top private sponsors of the Argentine Olympic Committee, offshored $24 million.

Claudio Belocopitt, CEO of the country's largest private hospital chain, Swiss Medical Group, offshored $21 million. His firm was hard-hit by Macri's 2019 default on peso-denominated debt - the first in Argentine history.

Large-scale offshoring has long been a drain on Argentina's dollar reserves. The country's private sector is estimated to hold $300 billion in offshore deposits and portfolio investment - dwarfing the $85 billion in domestic bank deposits.

Hernán Arbizu, a former JP Morgan Chase executive, first revealed in 2008 how Argentine firms and wealthy clients annually evade billions in taxes using local banks and exchange houses.

A one-time wealth surtax of 2% on those whose net worth is over $3 million is currently being debated in Argentina's Congress.

At: https://translate.google.com/translate?hl=en&tab=wT&sl=auto&tl=en&u=https%3A%2F%2Fwww.elcohetealaluna.com%2Flos-100-de-macri%2F

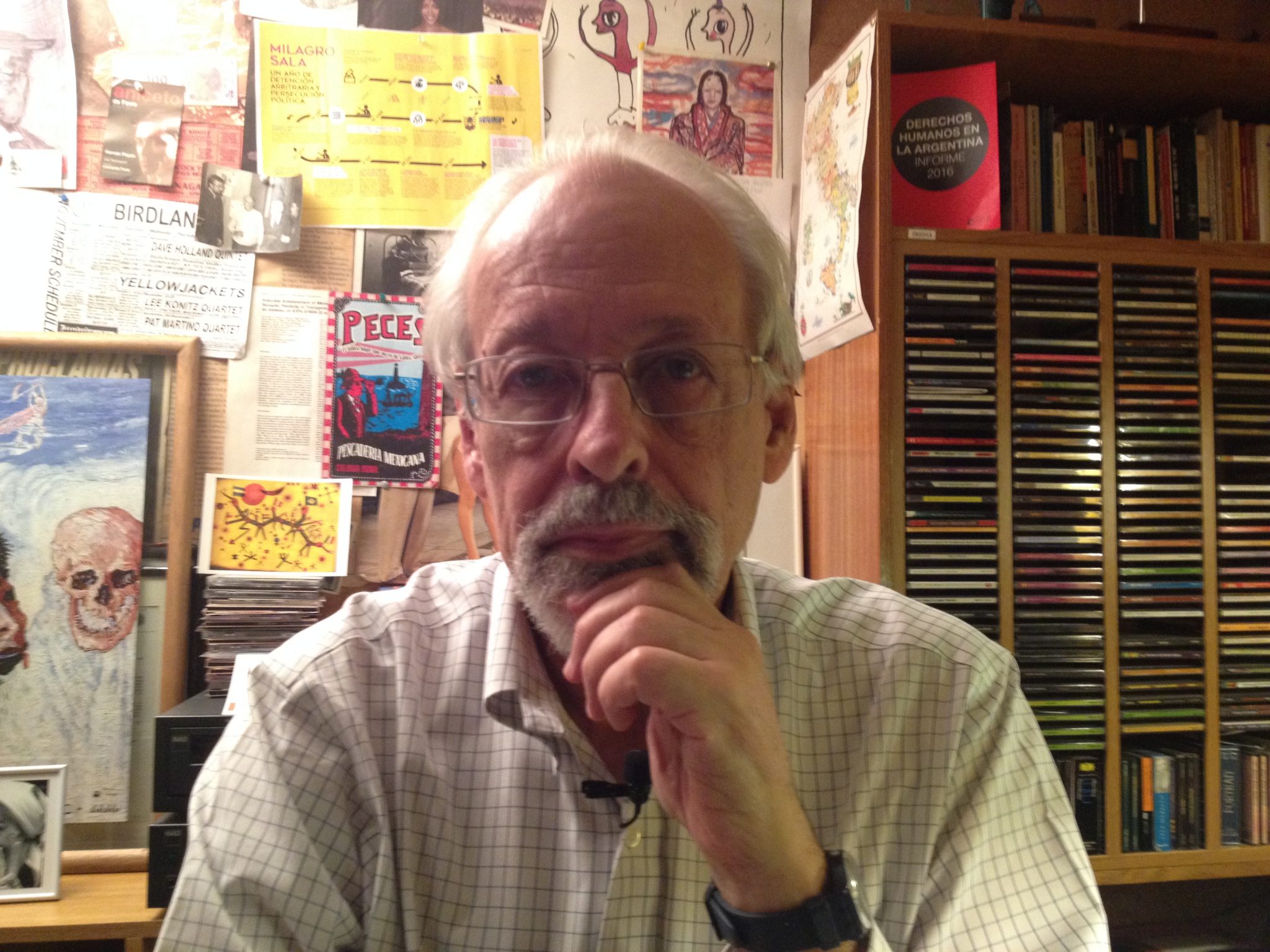

Argentine investigative journalist Horacio Verbitsky, whose lists of large individual and corporate offshorers has helped put names to the face of Argentina's current debt crisis.

The $129 billion in listed funds is similar to the $125 billion net increase in Argentina's public foreign debt from 2015 to 2019.

padah513

(2,708 posts)A lot of devious people with that kind of money will do anything to keep it.

sandensea

(23,187 posts)And he's 78.

He already ran afoul of former President Macri by revealing some of those who took advantage of the 2016 tax 'whitewash' (the deal was: pay a 5% tax, and you're clear).

The very name of his journal (Moon Rocket) comes from one of Macri's rants, in which he reportedly wished he could "send people like Verbitsky (among others) up in a moon rocket!"

They reportedly got him fired from his newspaper - but he's a tough cookie.

Frustratedlady

(16,254 posts)I'm sure most of us suspect there is plenty of US offshore activity.

padah513

(2,708 posts)sandensea

(23,187 posts)Carried interest, and all that.

As for individuals, we know many bank with Paul Singer's NML in the Caymans (including, it was said, the Romneys).

Cheeto himself must have millions, God only knows where.

Frustratedlady

(16,254 posts)he can in the event he suddenly has to "move" to higher ground (as out of the gutter AND country). Besides, he has surely hidden a goodly amount from Melania.

Add to that a large percentage of Repukes and they've got their own foreign bank.

sandensea

(23,187 posts)And then there's Bitchy Mitchy and his in-laws. Those are some very profitable "coal" ships they have there.

Colombian coal.