Economy

Related: About this forumIt's just crazy, stocks keep going up. Why?

https://mikesmoneytalks.ca/central-banks-buying-stocks-have-rigged-us-stock-market-beyond-recovery/Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock market via major purchases of the most healthy companies on the market.

The Velveteen Ocelot

(130,187 posts)Wuddles440

(2,062 posts)sucks because Powell has made it so. Il Douche demanded zero interest rates and Powell dutifully complied along with the Fed's historic purchases of corporate debt. This has been solely done to support the stock market which Il Douche uses as a gauge for his performance. If there's even the slightest indication of slippage between now and November, Powell will become more aggressive by making actual stock purchases (probably through a proxy such as Blackrock) and may even resort to negative rates. Their sole focus is to pump to Trump. Of course, expect tremendous "concern" post-election by the GOPpers about the debt and deficit.

The Velveteen Ocelot

(130,187 posts)cayugafalls

(5,960 posts)Expect things to get really bad after November so Trump can say I told you so.

It will get ugly fast.

at140

(6,231 posts)In other words, bonds are guaranteed to reduce your purchasing power.

With stocks you have a chance to make more money than bonds.

progree

(12,890 posts)Woo hoo! I'm gonna lock myself into a 1.20% return for 30 years (before taxes)

There's talk of the entire Treasury yield curve heading to below 1%. We're getting close.

Oh, Juh-Hee-Zus

https://www.macrotrends.net/2521/30-year-treasury-bond-rate-yield-chart

at140

(6,231 posts)Very depressing and annoying. This is the biggest robbery of seniors & savers going on and most don't even realize it.

The only good thing is I turned 80 this year. and won't be here very long to watch my purchasing power go down to zero.

progree

(12,890 posts)rates that were robbing seniors. I called them about it and another DUer closed her account. (He was the Chairman of the Board of Charles Schwab, though not the CEO at the time -- that's still the situation today https://www.aboutschwab.com/leadership ).

Haven't heard a whisper since about low interest rates robbing seniors, though they are at historic lows.

Brainstormy

(2,538 posts)the "economy." It's simply rich people playing with their money.

Cicada

(4,533 posts)The giant firms have resources to outlive the pandemic. But they may have a thousand small firm competitors, not on stock exchanges, who will no longer exist. So the big firms will be able to scoop up customers and raise prices. Is that a possible explanation?

Warpy

(114,547 posts)hog trough is propping up the market, going to stock buybacks. What the hell did we think it was going to do, feed our kids?

It's not going to last. Dividends are falling through the floor, and retirees who used them to supplement Social Security are going to have to sell stock to make ends meet. In fact, earnings are down and that's likely what's happening now, which is why we didn't see the Dow flirting with 30,000 when all that money rushed in after the initial Covid drop.

Republicans are fucking insane. They have now made the next depression impossible to avoid, in order to try to get the worst president in our or anyone else's history back into office.

Shit, he didn't even make the trains run on time.

at140

(6,231 posts)When the stimulus checks began arriving, he noticed flat screen large TV's were disappearing from shelves as fast as the shelves were being stocked.

He has never seen anything like that. Weren't stimulus checks meant to buy necessities such as food, medicine and such?

Warpy

(114,547 posts)after media story about money slated for small businesses being skimmed off by megacorporations.

Silly me.

at140

(6,231 posts)benefited a lot. But point is it is very peculiar large flat screen TV sales at this particular Costco were off the charts at exact same time stimulus checks were distributed.

And so did Walmart and Apple during the pandemic. Their profits are OFF THE CHARTS...NOT FROM Gov't handouts, but from CONSUMER PURCHASES.

Where did consumers get so much extra money to spend with unemployment in double digits? Wasn't the pandemic supposed to cause hardships to bottom 90%?

CaptainTruth

(8,162 posts)That could increase share prices.

progree

(12,890 posts)2017 Q1: 27.46,

2018 Q1: 33.02,

2019 Q1: 35.02,

2020 Q1: 11.88 👀 😲

https://ycharts.com/indicators/sp_500_eps

Ooops, there goes that theory. My bad

Next theory: the market is forward looking:

We don't have the full Q2 earnings yet. But likely to be a lot worse, given that Q1 GDP declined by 5%, and Q2 GDP declined by 32.9% (both on an annualized rate basis. The actual GDP drops were Q1: 1.3%, Q2: 9.5%). So it would be pretty much impossible for Q2 earnings to be anything but a lot worse than Q1 earnings.

Oh well.

They used to say that "earnings drive the market". Not anymore apparently. Now its unlimited borrowing by corporations and unlimited money creation and government spending at deficit-tripling levels, along with FOMO (Fear Of Missing Out) that drives the market.

We'll see how "forward looking" the market is when we eventually have to start unwinding all of this unsustainable stimulus.

at140

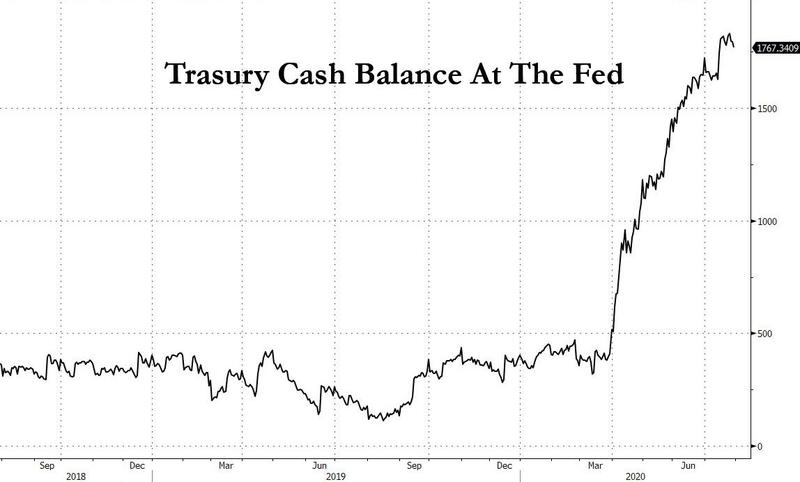

(6,231 posts) ?itok=JYGdR7RL

?itok=JYGdR7RLflamingdem

(40,848 posts)??

at140

(6,231 posts)and climbing national debt.

I have never seen anyone spending on borrowed money like a drunken sailor (credit cards) end up well.