I am retired and 73 years old, where can you park

cash safely and get income? My bank pays around .30%

the MM funds pay nothing. I have thought about a mutual fund in income stocks. But this is the longest bull market in history, it has to drop some day but at my age I may never recover the loss. Any sugestions.

marble falls

(71,557 posts)doc03

(39,005 posts)marble falls

(71,557 posts)... All joking aside, at 73 (like me), this is the time to contemplate cutting back from investment/risk and start looking at pure wealth retention and starting to prepare for a simple handing of assets over to your heirs after you've had the use of your wealth.

One thing I was told by my first broker many years ago was any investment vehicle that "guarantees" returns without an asterix and disclaimer, should be looked at very closely. Even bonds can dump. More return always requires more risk.

The closest I can get to it is annuities.

doc03

(39,005 posts)marble falls

(71,557 posts)drray23

(8,695 posts)If you have significant retirements funds, I recommend you talk to an advisor to figure it out. Doing it yourself will lead to disaster. In some instances, you can talk to an advisor where you 401K is parked for little to no cost.

Stocks are relatively safe if the portfolio is designed to be diversified and with a mix of stuff that gives you dividends and some other that is more high yield. Any advisor worth his or her salt can do that.

Obviously, as you are retired, they will probably suggest that most of your assets be parked in stuff with guaranteed returns (typically around 3 percent if you park it for several years) and some in a money marker (for 1 year of expense ). As it goes, the guaranteed stuff gets sold and replenish the money market for day to day.

NoRethugFriends

(3,714 posts)The best 5 year CD rates are 1.3%

drray23

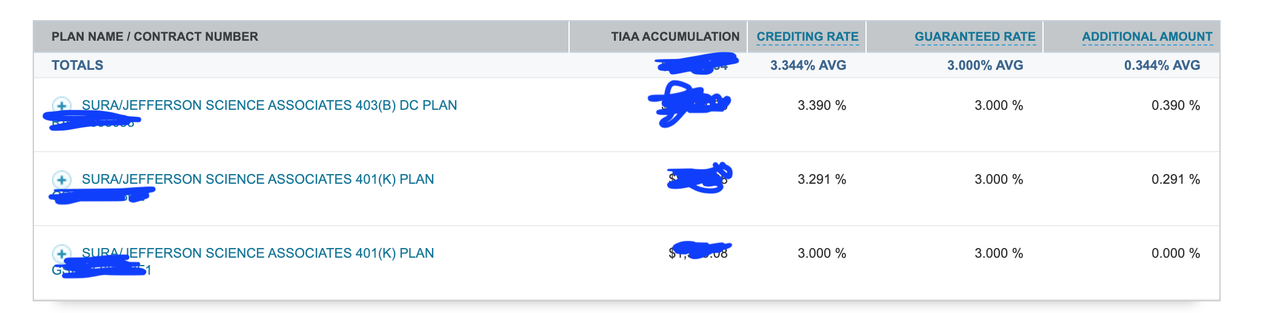

(8,695 posts)There is a lot more out there than just CDs but many of these are accessible only via financial brokerage firms. Here is a subset of some of my accounts. I grayed out the account #s and $ for privacy. Look at the guaranteed returns.

Those are financial instruments (annuities) managed by the financial firm where my money is parked. Basically they guarantee to pay out 3 % and some years if it goes well you get more (like right now, you can see two of those accounts have additional yields)

Abnredleg

(1,252 posts)My wife is in academia and has Traditional. Yes, they do pay 3% but it is a very unique investment that I haven’t seen elsewhere.

drray23

(8,695 posts)I have 90% of it in stocks etc.. and 10 % parked in a safer traditional. As I get older I will get them to shift my more "risky" investments towards the safer ones.

drray23

(8,695 posts)Basically, they build a pot with a bunch of low risk stocks that are primarily returning dividends mixed in with some that are more into growth . They balance it out so that they generate in average a set amount (like 3 %). Some firms call that annuities.

Obviously if you have knowledge you can accomplish the same building your portfolio and likely make more (because you wont have the fees) but its much easier and safer to buy a financial instrument that already has it all packaged.

Tomconroy

(7,611 posts)But from your description it sounds like it is a fair bit out on the risk spectrum. And over the last decade or more if it's exposure is to stocks and it is only paying 3%, somebody other than the customer is making a lot of money.

drray23

(8,695 posts)For that you can invest in traditional stocks. They make money out of it but in return you are buying peace of mind that if the bottom falls out, you will get your 3 %.

Tomconroy

(7,611 posts)that over two centuries stocks have returned a near average of 9 per cent per annum and if they only have to pay out an average of 3 per cent they have found a profitable business model.They can afford to weather a few bear markets. It is not designed for the benefit of the investor. See my posts about what US savings bonds are paying these days.

A HERETIC I AM

(24,872 posts)Last edited Mon May 24, 2021, 12:47 AM - Edit history (1)

The first "A" in "TIAA" stands for Annuities. The firm specializes in them. The reason they are successful is because they can pay out a guaranteed amount over the life of the annuitant and that has appeal and utility for a large number of teachers who do not make 6 figure annual salaries for decades on end.

You are insinuating that they are making nine percent a year and only paying out 3%. Nothing could be further from the truth.

rickford66

(6,058 posts)drray23

(8,695 posts)See my post #6. The OP did write 0.3 % for the returns from his savings in a bank.

There are plenty of safe investments yielding way more than 0.3. My 3% is an example, others have pointed out elsewhere in the threat that bonds and such can yield even more.

NBachers

(19,359 posts)I have everything in extremely safe and conservative, but I’m still pretty happy with the returns and occasional little dividends. You are welcome to check them out if you’d like.

Yes, it is spelled with three o’s

A HERETIC I AM

(24,872 posts)I'm curious about the way you worded your title line;

Am I correct in understanding that your 401(k) is with the custodial firm your employer, past or present, is using, and then you are using Blooom to give advice on allocation?

Are you still employed with the same company? Or have you left them? If it is the former, is the 401(k) representative from the financial company not able to give guidance? If it is the latter, have you not considered doing a rollover to an IRA?

I'm not sure I see the value of adding another layer of advisors to an account like a 401(k). After all, you are already paying for it with the first firm.

Tomconroy

(7,611 posts)said US savings bonds were paying something like 3.75%.If that's true it's not bad. I think the article said they came with some inflation protection. Can't get any safer than that. A little farther out on the risk spectrum would be a bond fund from a place like Vanguard. Not risk free. Bonds very occasionally drop in value, but nothing like the stock market. I think recently those types of investments have been returning between 4 and 5 %. When I retired I moved some of my money into a T Rowe Price income fund that is a mixture of 80% made up of their bond funds and 20% of their equity income fund which invests in dividend paying stocks. It's been doing decently the last five years.

At the age of 66 I still have significant exposure to stocks. I like to think I am still a long term investor. At least I can hope so.

multigraincracker

(37,351 posts)About 10 years ago I started to put my savings in good quality dividend stocks. Has paid off and I have a nice $400 to $500 check per month. Most of my stocks have grown in price at the same time.McDonalds I bought at $72 and it is now at about $230 and pays about 2.30

Southern Co I bought in at $28 and now at $62 and pays 4.11 %, I've bought this over a longer period.

General Mills I bought at $37 and now at $61 and pays 3.32%

A bunch more like Verizon and AT&T. Some up and a couple down. Never more than 200 units, except Ford which is now not paying any dividend but way up from the $1,89 I paid. Put my eggs in lots of different basket.

Just me, but you might look into it.

Best of luck

Chainfire

(17,757 posts)I will invest it for you. You can trust me I am a Republican. ![]()

Tomconroy

(7,611 posts)Is currently 3.54% with an index to inflation. That should allow you to sleep safe at night.

The financial mavens will tell you at your age you should be 25% in stocks, 75% in bonds. No Bitcoin for you, or for anyone else, for that matter.

doc03

(39,005 posts)which have done very well. The savings I have outside of my IRA is money accumulated from my

RMDs. I don't want to have my cash tied up in any long term thing like CDs or Savings bonds. I have thought

of some dividend stocks such as Southern Company, AEP and AT&T but what if we have a 2008 style crash? In todays

market I may be better off putting cash in my safe deposit box or burying it in my yard since I get no income from savings in the bank. Just joking.

Tomconroy

(7,611 posts)I don't believe there is any penalty for doing so. I have the same worries about a crash. There are great books about how to invest for retirement. I don't know of any that tell you what to do once you are retired. I do think a low cost bond fund is your answer. Even dividend paying stocks are going to be really ugly in a crash.

marble falls

(71,557 posts)multigraincracker

(37,351 posts)Crashes, just left them alone and it all came back better than before.

progree

(12,880 posts)Last edited Fri May 21, 2021, 12:13 PM - Edit history (2)

I found this on EE savings bonds:

MAXIMUM PURCHASE: $10,000 each calendar year for each Social Security Number.

MORE: https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eeratesandterms_eebondsissued052005andafer.htm

So two very big bummers: 0.10% interest rate unless you hold it for 20 years. Then yes, it guarantees that one will get double back, which works out to a 3.526% annualized rate of return. Otherwise, peanuts.

1.03526^20 = 2.0 (a doubling over 20 years)

And then one is limited to purchasing $10,000/year, so somebody looking to invest a reasonable retirement nest egg will have to look elsewhere (according to Fidelity, a 65 year old couple can expect to pay an average of $300,000 out of pocket over their lifetimes, including on Medicare premiums).

I'm still trying to figure out the I bonds (the ones with the inflation adjust) and if one has to hold them for decades to get the 3.54% interest rate. I haven't been able to find a clear answer to that at the Treasury site, but doing a Google, it kind of seems my suspicion is right,.

I bonds at a glance: https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm

Series I Savings Bonds Rates & Terms: Calculating Interest Rates: https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_iratesandterms.htm

Edited to add 1:04 PM ET -

This one makes the I-bond look like the real deal.

https://www.depositaccounts.com/blog/inflation-treasury-series-i-savings-bonds/

They:

Can't be redeemed within 12 months of issue date

Lose 3 months interest if redeemed within 5 years

(but no other holding time requirements other than these that result in losing interest)

But: Maximum purchases per year and per social security number is $10,000 in TreasuryDirect and $5,000 in paper bonds purchased with IRS tax refunds (This excludes trust/business purchases)

Tomconroy

(7,611 posts)Unless you are doing planning to go on Medicaid. Then they can be a planning device.

A HERETIC I AM

(24,872 posts)They can be complicated and difficult to completely understand, but they are not inherently bad investments.

PoindexterOglethorpe

(28,493 posts)I am absolutely not an expert, buy my financial advisor got me into two different ones nearly ten years ago. I started taking payments about a year and a half ago. They are incredibly safe, are paying out far more than those bonds or savings bonds being discussed. They are not my only investments or sources of income.

I have an excellent financial advisor.

progree

(12,880 posts)Some of an annuity's yield (the regular monthly or quarterly or annual payments when one begins to collect payments) is return of principal.

Whereas with a bond (or CD), the yield is the interest part only. The entire principal is available (without penalty) at the end of the term.

I know you understand this, but I fear some might decide between annuities and other fixed income investments based largely on which has the higher yield.

The yield on an annuity, and especially a deferred annuity is and should be a lot higher than bond and CD yields --

Speaking of the simplest annuity, a simple fixed income annuity that ends with the annuitants death (the life-only option) --

For example, for a 65 year old female, and using Fidelity's annuity estimator, which is based on insurance companies' quotes, the yield for an immediate annuity (payments begin a month after purchase) is 5.63%

Currently (May 2021 dividend), the Vanguard Long-Term Corporate Bond Index Fund Admiral (VLTCX) is yielding 3.26%

Yeah! annuities win, and bonds suck eggs.

But not so fast. The bond's yield is just the interest part.

Whereas the annuity's yield effectively includes return of principal, since with such an annuity (Life-only option), there's no return after death of any of the initial cost.

Unlike a bond, where one's entire initial principal -- like in the case of a new bond that is held to maturity -- you get your entire initial outlay back (less commissions).

(I'm comparing to long-term bonds, since an annuity is inherently a long-term investment because of heavy surrender charges. I know I'm not supposed to call an annuity an "investment", since it's an insurance product. But plunking down tens or hundreds of thousands of dollars up front on an annuity sure seems a lot like an investment to me).

(In this post, I use the term "yield" or "annual yield" for just the regular annual payments from the annuity or the bond (Or the monthly payments times 12). If the yield is given as a percentage, it’s the annual yield as a percent of the initial $100,000 investment. Similar to the dividend yield of a stock. It is *not* a total return or annualized total return number -- that (in dollars) would be the annual yield times the number of years the regular annual payments are received PLUS whatever one gets back at the end).

A deferred annuity's yield should be even higher than an immediate annuity's yield -- a lot higher. For example, for a 65 year old female, and using Fidelity's annuity estimator, based on insurance companies' quotes (obtained June 6), the yield for an immediate annuity (payments begin a month after purchase) is 5.63% as stated previously.

But deferring the income stream for 8 years results in a 9.54% yield, a 1.69-fold increase, according to the same Fidelity annuity estimator which is based on insurance company quotes. That big increase in yield is because one collects for 8 fewer years of their life. So yeah, anyone with a deferred annuity like that, and looking only at annual yields, is going to beat the pants off the interest rate of any bond.

If comparing an annuity bought in 2011 or 2012 with today's yields, one must remember that interest rates then were about 45% higher than currently (e.g. Vanguard Long Term Corporate Bond Fund yield was about 4.74% then compared to 3.26% in May 2021). So I'm guessing yields on simple fixed income annuities were also 45% higher than currently.

If an annuity has an equity component (e.g. an indexed annuity or variable annuity tied to the performance of the S&P 500), then its yield and performance should be compared to a balanced fund (combination equities + bonds) rather than a pure bond fund.

I realize there are a virtually infinite number of kinds of annuities, e.g. ones that continue paying after death for a set number of years "period certain", to a beneficiary. Or that promise a "refund" if one dies before a certain number of years -- ensuring that at the worst, you and your beneficiaries get back in total what was put in -- the "get back in total" includes payments previously received. Such provisions result in getting quoted a lower yield, but still beating yields of bonds.

Annuities also have a risk factor -- if one dies early (and particularly if it’s a life-only annuity), the return can suck (at least consider getting that period certain or "refund" option so that it isn't a negative return). If gotten when interest rates and annuity yields are low, such an annuity locks in low yields for life. On the other hand, they certainly beat bonds if one way outlives their life expectancy. And annuities function as a kind of longevity insurance -- a considerable benefit.

I have an annuity, so I'm not ideologically opposed. I appreciate the nearly $21,000 annual checks. (It's a charitable gift annuity that I got in return for donating my farm in December 2016. It's yield is 4.7%. (The equivalent on an annuity purchased on the marketplace at that time would have been 6.5%).

I'm also in the "market" to consider an annuity given the catastrophically low yield of one of my bond funds (which is too heavily weighted in low-yielding Treasuries).

These CD-like annuities, "Fixed Annuities" also known as a multi-year guaranteed annuity or MYGA, look pretty good to me:

3 year: 2.40%, 4 year: 2.80%, 5 year: 3.00%, 7 year: 3.10%, 10 year: 3.20% (as of 6/11/21 at https://www.blueprintincome.com/ ). For someone who doesn't want to get locked into today's low rates for decades or life. (But is this going to result in yet more accounts heirs will have to deal with? Or a declining cognitive skills me?)

I'm just cautioning anyone comparing an annuity to a bond or CD that it's an apples and oranges comparison as they are two very different products, and reaching conclusions from just comparing yields (the sizes of the monthly or annual payments) is simply wrong.

The below compares the total return of an immediate annuity yielding 5.63%, and for a deferred annuity (8 year deferral) yielding 9.54%, as a function of "N", the number of years since the purchase until death..

These are quotes for a 65 year old female in Minnesota, per the Fidelity annuity estimator obtained on June 6.

I've checked quotes at USAA and BluePrintIncome.com and IncomeSolutions.com and they are practically the same (except USAA doesn't seem to offer deferred annuities).

All my examples below assume a $100,000 annuity is purchased in year zero.

IMMEDIATE ANNUITY: An income stream of $5,630/year for N years is received. There is no residual amount received in year N at death.

DEFERRED ANNUITY, deferred for 8 years: No income is received for 8 years, and then for the next N - 8 (N minus 8) years, $9,540/years is received. There is no residual amount received in year N at death. So for example, if N=20, then for 8 years, no income is received, and then for the next 12 years, $9,540 is received.

The yields I quoted above for the annuities: 5.63% for the immediate annuity and 9.54% for the deferred annuity were based on simple life-only with no refund guarantee and no fixed period N guarantee (aka "period certain" ).

If I had gotten quotes with either one of these provisions, the quoted yields would have been lower. But since my table starts at N=20, neither of these provisions would have helped: The longest guarantee period I've seen is 20 years, which we've already reached at the beginning of my table.

And as for the "refund guarantee", both of these annuities have paid back the full $100,000 investment in yearly payments by year 20, so the refund guarantee has already been met and exceeded (for the immediate annuity: 20 years * $5,630 = $112,600. For the deferred annuity: 12 years * $9,540 = $114,480).

Total Rates of Returns (Annualized) for An Immediate and

a Deferred Annity (deferred by 8 years)

Quoted yields obtained 6/6/21 for a 65 year old woman

N is the number of years since purchase until death.

Methodology: The Excel IRR function was applied to the stream of cash flows. Results were also checked using the Excel NPV and PV and FV functions (net present value, present value, and future value).

The average life expectancy of a 65 year old woman is about 21 years. I realize that an annuity is not an investment, but rather insurance. The yields are quite decent for someone who lives well past their life expectancy, but not eye-popping. Still they are reasonably guaranteed by the strength of the insurance company and the backing of state guaranty funds (check for details for limitations and maximums).

PoindexterOglethorpe

(28,493 posts)Even if I live well into my 90s there will probably be residual value left which will go to my son. And, as I've mentioned already, the payout I'm getting on them is somewhat better than the 4% that's considered a safe amount to take from savings and investments. Not hugely greater, but somewhat so.

I have a very good financial guy. My income, while modest, goes up a little bit every year.

progree

(12,880 posts)them compared to today.

If your yield was 1.45 X today's rate (8.164% instead of 5.63%), I find that the rate of return for the immediate annuity is much better: for example 5.20% for N=20, 7.13% for N=30, and 7.75% for N = 40, quite a lot more than shown in my table:

1.16% for N=20, 3.78% for N=30, and 4.75% for N=40.

Edited to add - I didn't bother doing similar for the deferred annuity, yet.

I wasn't trying to compare to what you bought 10 years or so ago, but rather what's available now at today's rates. As the bond fund yields upthread were today's rates. And I have no idea what you bought, frankly. Just a warning to others that the yield and the rate of return are very different things with income annuities.

The 4% rule that is often quoted as safe is where one takes 4% out the first year. Then each year after the dollar amount that is taken out is increased by the rate of inflation. So if one has a million dollar nest egg, one can safely (if the future is like the past) take out $40,000 the first year, then $41,000 the second year, then $42,025 the 3rd year and so on, By the 20th year one can take out $65,545. By the 30th year, $83,903. My numbers above is an example assuming a 2.5% inflation rate (midway between the 2% of the last 2 decades and the 3% that we averaged before that).

Isn't the amount of residual value in the contract? Or does it depend on the performance of some bond or equity index?

I'm not dissing your financial adviser. Besides emphasizing diversity, you've written that your equities are all in equity funds, the choice of which were designed to have relatively low portfolio volatility. Sounds very sensible to me, but then I am biased. I only have one individual stock - a utility stock (Sempra, SRE) that I inherited. I've thought of selling it for portfolio simplification, but the capital gains tax would be quite large (a first world problem

Thank you for getting me to look into annuities. (So many varieties!)

Edited to add "besides emphasizing diversity" in the 2nd to last paragraph.

PoindexterOglethorpe

(28,493 posts)They were purchased in 2012. They included a guaranteed minimum return, which was locked into the sum used to calculate my payout. That can't go down. (I'll ignore the possibility of something truly catastrophic happening.)

I just ran the numbers using this calculator: https://www.calcxml.com/calculators/how-long-will-my-money-last?skn=#results

If there is no growth whatsoever in the current value of annuity 1, it will last 17 years, at which point they are still obligated to pay my guaranteed benefit. At 6% growth, it would last pretty much forever. Annuity 2 will last 19 years with zero growth, as it's worth slightly more at this point, although the same sum of money was invested in each. Any residual value depends on the performance of each fund while I am still alive. On one hand, it would be nice to live long enough to get into their money, as my financial guy has said, but on the other I wouldn't mind leaving a bit to my son. Although I seriously doubt I will have spent down all my assets by the end of my life, and even if I do there would be a life insurance policy with a reasonable, although not huge payout.

What I don't get about the 4% rule, is increasing your payout each year depending on that year's inflation. I only every few years find a need to slightly increase what I take from my investment portfolio. My investments are in three different accounts. Currently I'm taking money out each month from the largest of the three. Right now the value of that fund is such that my draw is just over 4% of that sum. The other two are a Roth IRA, and a regular retirement account. I'm now doing RMDs from that second one.

Anyone looking at buying an annuity today only needs to be concerned about exactly what you can purchase today, at today's rates. What I could get nine years ago doesn't matter any more. I just want people to understand that all annuities are not a rip-off, which is the sentiment I often see here.

Sounds like you are doing quite well with your investments. Keeping just the one individual stock makes absolute sense. Especially if it's generating a reasonable income from it. Will it to your children, or whoever, but advise them to sell soon after inheriting it.

![]()

progree

(12,880 posts)They are saying that 4% of the first year amount, and increasing that first year dollar amount by the inflation rate is safe from running out in 30 years, given one has their nest egg invested in 50% stocks and 50% bonds, based on simulations of the past market and inflation history over rolling 30 year periods.

It's not a suggestion or requirement, if one can take out less than that, all the better

It's for people who are really dependent on their nest egg ... if they consistently withdraw much more than the thumb rule allows, then there is a real risk of that nest egg running out before 30 years, based on simulations AAII (American Association of Individual Investors) and others do. (They also look at longer periods and look at different stock-bond allocations too). Some say you can do 4.5% + inflation instead of 4.0% + inflation. Others caution that with stock valuations higher than ever and the bond yields being so dang low, 3.5% + inflation is probably the prudent maximum.

I have no idea what my withdrawal rate was or is, now with the charitable gift annuity (payments began December 2017, on top of Social Security (which began in March 2017) I'm pretty sure I'm putting money in, not taking money out of my investment/retirement accounts.

I'm glad you seem to be experiencing almost zero inflation. But most people I think I can safely say are not -- certainly there are and have been loud lamentations about price increases on DU since I've been around. (EDIT- More broadly, the CPI is based not just on prices of some list of items, but actual sales - i.e. what people actually buy and how much, so in aggregate they are experiencing these price increases).

I know I'm not experiencing near-zero inflation. I keep seeing rising dental bills for the basic cleaning and checkup, property taxes going way up, home owner association dues going way up (80% in 17 years which equates to 3.5%/year), my Medicare Supplement premium up 27% in 4 years (equates to 6.16%/year ). Medicare Part B premiums have increased from $78.20/month in 2005 to 148.50 now, which is a 4.1%/year increase). Car prices ...

According to the experts, the CPI-E for elderly people exceeds the basic CPI, mostly because out of pocket healthcare costs are exceeding the general rate of inflation, and it certainly seems to be true judging from medical premiums.

Fidelity does a study every 2 years on what an elderly 65 year old couple can expect to spend on average on out-of-pocket medical costs including Medicare premiums, and its up to $300,000 now (more specifically the amount they would need to have saved now to cover costs in the future).

May your good luck hold

calguy

(6,124 posts)buying municipal bonds.

progree

(12,880 posts)guaranteed investment. They have a non-negligible default risk. There might be some with interest rates that high, but their credit ratings are very low and their maturities are very long.

And if you don't hold them to maturity, then you get what you can sell them for on the secondary market, depending on market conditions. For example, if overall interest rates go up, the market value of the bond will fall.

Here is what Fidelity has with Highest Yield selected

https://fixedincome.fidelity.com/ftgw/fi/FILanding

5 yr 10 yr 20 yr 30 yr Type

0.86% 1.64% 2.07% 2.32% Municipal (Aaa/AAA)

1.13% 1.95% 2.42% 2.39% Municipal (Aa/AA)

1.18% 2.06% 2.50% 2.75% Municipal (A/A)

1.24% 2.77% 3.00% 3.68% Taxable Municipal*

* Taxable Municipal ratings cover a rating range from Aaa to A3 from Moody's or AAA to A- from S&P.

I only included 5 years and longer because shorter maturities have sub one percent interest rates

calguy

(6,124 posts)I don't claim to be an expert, but I have a chunk of my retirement money in Eaton Vance income funds. These are the yields on some of their municipal bond funds as of this month:

Municipal Bond Funds:

Fund

Ticker

Distribution

Change From Prior Distribution

Closing Market Price – 4/30/21

Distribution Rate at Market Price

Eaton Vance California Municipal Bond Fund

EVM

$0.0419

-

$11.84

4.25%

Eaton Vance Municipal Bond Fund

EIM

$0.0496

-

$13.46

4.42%

Eaton Vance Municipal Income 2028 Term Trust

ETX

$0.0709

-

$22.15

3.84%

Eaton Vance National Municipal Opportunities Trust

EOT

$0.0642

-

$22.70

3.39%

Eaton Vance New York Municipal Bond Fund

ENX

$0.0440

-

$12.43

4.25%

progree

(12,880 posts)It (and the others) appear to be closed end bond funds that were created back when interest rates were much higher. And a new investor can only access on the secondary market at a price that makes the yield much smaller or something ????????? I dunno.

I suppose I could create an account and Eaton Vance just to figure out if I could buy it or not (though actually I'd buy their Minnesota municpal one if it also had yields anywhere near like these).

I thought I kind of understood closed end funds (even though I never owned any), now I'm getting more and more confused.

Morningstar only gives it a 2 star rating, for some reason.

https://www.morningstar.com/cefs/xase/evm/quote

At Vanguard

https://investor.vanguard.com/mutual-funds/list#/mutual-funds/asset-class/month-end-returns

the California Long-Term Tax-Exempt fund, for example, VCITX, just has a 1.08% 30 day SEC yield.

But looking at the Distributions tab, the distributions are running around 2.37% annualized, which is better than I thought one can get these days, even with such long maturities.

It's an open-ended bond fund...

calguy

(6,124 posts)Like TDAmeritrade, Fidelity, etc. These funds are traded on the market just like stocks. Talk to any broker and I'm sure they can explain much better than I can in this type of format.

progree

(12,880 posts)and clicked on the "Invest" tab and then "Other Funds" and typed in the ticker EVM

https://investor.vanguard.com/search/?query=evm

and got:

Eaton Vance California Municipal Bond Fund (EVM)

3:10pm CDT 05/21/2021 Buy | Sell

$11.89 $0.04 0.34% AMERICAN STOCK EXCHANGE

Bid—ASE $11.65 Size 16 x 2

Ask—ASE $12.05 Volume 60,466

Open $11.83 Day range $11.83 - $11.89

Prev. Close $11.85 52-week range $10.70 - $12.05

Yield 4.24%

So it looks like I can buy it with no problem (though I'll probably buy their Minnesota fund, but I keep mentioning this California one because its the one I've been doing the deepest dive on so far).

They do talk some on EVM at Eaton Vance of using considerable leverage (which is a risk factor but I'm not opposed to that) and also some of the distribution being return of capital, but I don't see that on this fund as far as I've gotten into it -- looking at:

https://funds.eatonvance.com/california-municipal-bond-fund-evm.php

In the Performance tab I scrolled down to the "Tax Character of Distributions" table and only 2019 has some "nondividend distribution" that is trivial (0.02 out of 0.47 total distributions, and none such in earlier years), so it looks like other than that it's all regular tax-free regular dividend.

I'll read up in closed end funds first ... Nuveen seems to have a lot of basic explanation stuff https://www.nuveen.com/en-us/closed-end-funds/learn-more

Currently I have FIMIX Fidelity Minnesota Municipal Income Fund (an open ended fund) that is only yielding 1.95% in the April dividend (and just a bit over 2% in earlier dividends):

FIMIX - https://fundresearch.fidelity.com/mutual-funds/summary/316412303

Latest monthly dividend $0.019500232 at $12.09 reinvest price ==> 1.95% yield.

And for comparison, Fidelity's only California Municipal fund (that I saw at a quick look) yields 2.26% in the April dividend.

FCTFX Fidelity California Municipal Income Fund https://fundresearch.fidelity.com/mutual-funds/summary/316061209

Latest monthly dividend $0.0250 at $13.40 reinvest price ==> 2.26% yield

bucolic_frolic

(54,791 posts)and this forum as I recall reading, is not about advice. There are weenie amounts of risk, and risk gradually increases. But even cash has risk of theft - physical or inflation. So most people settle on adding some risk to increase income. Paid professionals can do this in mutual funds, income funds (which come in all varieties and risk levels), via their knowledge, experience, and expertise, and there are funds of funds. It's all about risk and risk management, and there are different kinds of risk. Diversification is not a perfect solution to risk, which again gets back to the point of the title: everything has risk of some kind.

PoindexterOglethorpe

(28,493 posts)You could look at mutual funds that invest in dividend paying stocks, or directly by some of those yourself.

Depending on how much money you actually have, putting some of it, no more than half, into an annuity that starts paying immediately could be a good choice. I'm 72, and my wonderful financial advisor got me into two of those nearly a decade ago, and I started collecting from them about two years ago. I still have other investments and other sources of income, but what I am now collecting from those annuities is far above either your bank or even the best of bonds or bond funds.

bif

(26,889 posts)And have for over 30 years. I've done amazingly well.