Environment & Energy

Related: About this forumOil at $30 Is No Problem for Some Cost-Cutting Bakken Drillers

The lower bar for profitability is one reason why U.S. oil production has remained near a 40-year high even as crude prices fell more than 50 percent over the past year to the lowest level since March 2009.

...snip...

Bakken oil production in North Dakota has fallen less than 2 percent from its peak in December, while the number of oil rigs in the state has fallen by 60 percent. EOG Resources Inc., the largest shale driller, says it can make a 30 percent after-tax return on $50 oil in its best plays. Whiting Petroleum Corp., the largest Bakken producer, said it’s preparing to be able to grow production at $40 to $50 prices.

“A single break-even price doesn’t actually exist,” Foiles said in a presentation. “Rather, what the model indicates is that at a realized oil price of $29.42, half of wells will generate returns exceeding 10%. This price is considerably lower than the $70 breakeven estimated by industry watchers at the start of the oil price slump.”

http://www.bloomberg.com/news/articles/2015-08-12/oil-at-30-is-no-problem-for-some-cost-cutting-bakken-drillers?cmpid=yhoo

yeoman6987

(14,449 posts)jaysunb

(11,856 posts)I just paid $ 4.10, and that's down .35 from last week. sheesh !!

stillwaiting

(3,795 posts)FBaggins

(28,673 posts)$2.20/gal here (and sub $1.90 in parts of SC).

Keep in mind that the $30 is probably a wellhead price in the Bakken, not nationally or globally. They still don't have a cheap way to bring that to market, so they get significantly less than market averages.

Kelvin Mace

(17,469 posts)because environmental laws are being ignored.

happyslug

(14,779 posts)That is what this story is about. The Recent drop in the price of oil, is below the cost of Drilling the well and pumping the oil out. The problem is the drilling was the big cost and it was a "sunk" cost i.e. already spent when the well came in. The actual pumping of the well is much cheaper. The price of PUMPING the oil is what they are talking about NOT the cost of DRILLING the well.

The old rule in business was to Maximize profit, and if that can NOT be done, minimize loss. Since the price of oil today can NOT pay for the cost of drilling the well, that cost is ignored, and the talk is concentrated on the profit from pumping the oil. The cost of drilling the well is either written off as a cost of production OR just ignored.

On top of these two costs, most of these wells are "Leases" which requires payment on a per month basis to the owner of the property. These payments MUST be made whether any oil is pumped or NOT, thus to get money to pay the leases, oil must be pumped, even if it is at a loss, for without pumping the oil, the well would have an even greater loss.

This is the result of excess drilling and excessive buying of leases in the 2008-2014 period. Now these leases have to by paid, so the wells are drilled and oil pumped to minimize the loss do to the required payment to the land owners. Driller stopped buying these leases around 2013 but had to drill some wells into 2015 to meet their lease agreements. Between the lease payments required in oil leases AND the high cost of drilling, these wells are losing money, but since they are drilled and that money is spent (and the leases must be PAID, whether oil is pumped or not) the oil is pumped as long as the price of oil exceeds the cost of pumping.

From what I have read this will continue till about 2017, but some think it will be sooner, a few as soon as the end of 2015. The reason for this is no one is drilling any new wells, and the older Fracking Wells generally produce only for about five years (and peak within 18 months of reaching oil). Thus come 2017, oil production in the US will drop, and the price of oil will go up and we will see another fracking boom due to the jump in oil prices. We will see more and more of this unless someone grabs control over the production of oil to keep the price stable (Standard Oil did this from the late 1860s till it was broken up in 1912, then the Texas Railroad Commission did this from the 1920s till 1969, when Texas was no longer the "Swing" world wide oil producer, Saudi Arabia picked up the duty from 1974, after the Arab Oil Embargo til about 2002 when Arabian Oil production could NOT be increased enough to drop the price of oil).

Given it does NOT look like anyone will be able to control the price of oil, the oil market will reflect what the coal market was from the 1600s onward, prices up and down depending on demand (When prices are high demand will drop, when prices are low demand will increase) and Supply (When prices are high, supply will increase, when prices are low, supply will increase). It will be possible for oil to go from $10 a gallon to $2 a gallon in less then a year, then within six months go back to $10 a gallon (prices go up, generally twice as fast as prices fall). This is what the future will hold, the days of stable oil prices are behind us unless someone steps in and controls the price by controlling production. Right now no one has the production capacity to drive almost every other oil producer bankrupt and that was the main power of Standard Oil, then The Texas Railroad Commission and finally Saudi Arabia. As long as that is the case we will have a system like the old coal supply of the 1800s, prices going up and down in short bursts and busts as demand exceeds supply and then supply exceeds demand.

FBaggins

(28,673 posts)For some plays, that's no doubt the true... but not in the cases discussed in the article.

The price of PUMPING the oil is what they are talking about NOT the cost of DRILLING the well.

All evidence to the contrary.

On top of these two costs, most of these wells are "Leases" which requires payment on a per month basis to the owner of the property. These payments MUST be made whether any oil is pumped or NOT, thus to get money to pay the leases, oil must be pumped, even if it is at a loss, for without pumping the oil, the well would have an even greater loss.

Sorry. That's incorrect. The word "lease" may be the confusion in this case, but the vast majority of shale leases are single up-front payment and then they pay royalties on the oil extracted. The carrying cost of the "lease" is tiny ($25-50/acre/year)

And don't forget the "fracklog". Those are wells that are drilled and then not completed so that the supply doesn't hit the market while prices are down (essentially a new form of contango).

From what I have read this will continue till about 2017, but some think it will be sooner, a few as soon as the end of 2015.

Of course that's "What you've read". And those same POTB (Peak Oil True Believer) sources have been saying the same thing for years and will continue to (even as their numbers shrink faster than drilling rig counts). The only difference is that rather than "2015 to 2017 at the latest" it's really "this year to a couple years down the road at the latest". You forget that those same sources didn't think that shale plays would ever do what they have clearly done.

The reason for this is no one is drilling any new wells

Sorry. You're not entitled to your own reality. The rig count has fallen, but there are hundreds of operating rigs drilling new wells. Note that the article is talking about producers who have plants to increase production with $40-50 prices.

prices up and down depending on demand (When prices are high demand will drop, when prices are low demand will increase) and Supply (When prices are high, supply will increase, when prices are low, supply will increase).

A peak oiler discovers the law of supply an demand?

the days of stable oil prices are behind us

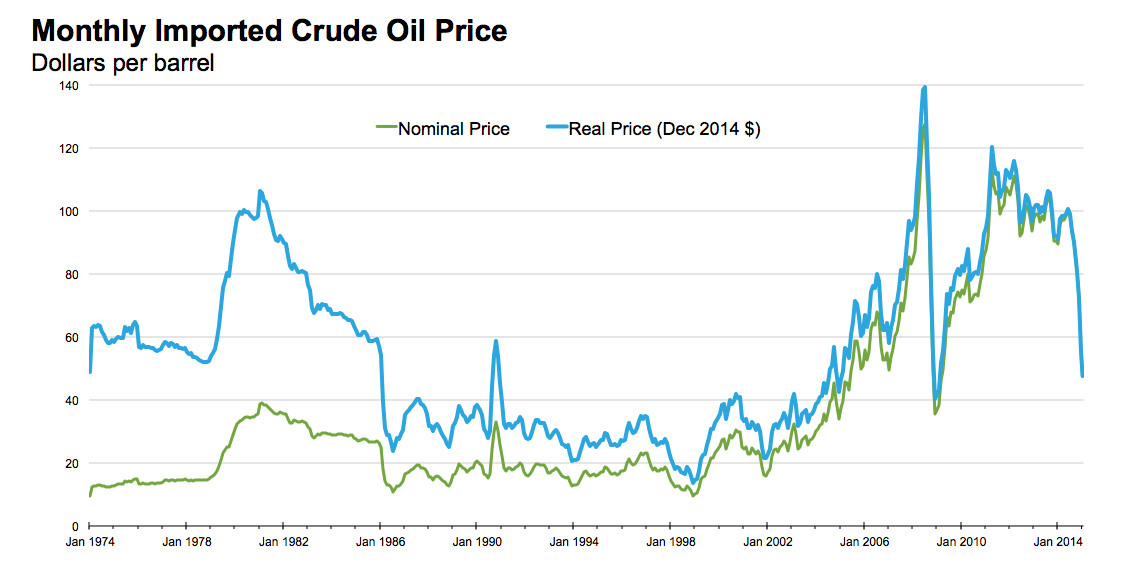

Can you point to those days on the chart below?

prices go up, generally twice as fast as prices fall

Again... please review the data. That hasn't been the case.

prices going up and down in short bursts and busts as demand exceeds supply and then supply exceeds demand.

Well... I suppose that's at least progress. Until a few years ago, the average POTB couldn't type that sentence. It would have to be that prices go up until demand is destroyed and then collapse as economies decline... then they go back up as supply continues to slide, continuing the collapse as demand painfully shrinks with collapsing supply.

The lesson that the POTBs still need to learn is the one that they missed with shale all along: Technological advances often lower the price of production (which, in turn, increases reserves and supply at a given price point).