True Crime

Related: About this forumNY Times Burying Story of Goldman Sachs Crimes; Taibbi's Forgotten Vexing of Sorkin

You can Google/Bing about the Goldman Sachs Tapes and find articles by ProPublica.org, Reuters, NY Post, US Today; and on and on and on. However, add in the keywords New York Times and/or DealB%k and see if you come up with anything (much less an "Ah ha, we got'cha).

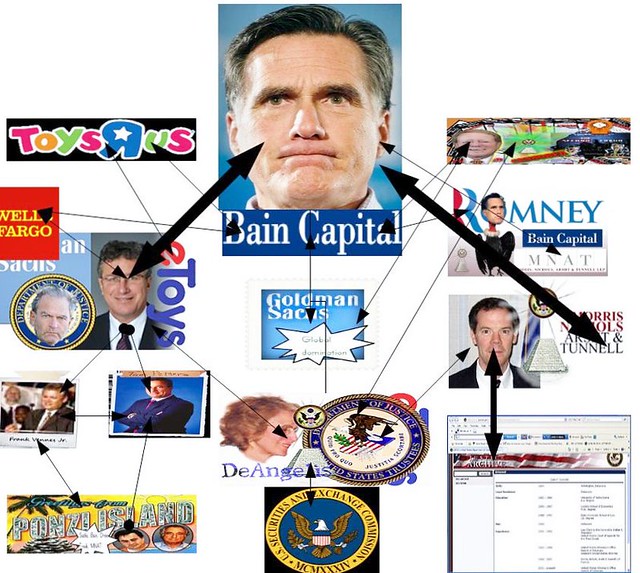

As it turns out, everyone else is now learning what this activist has known for more than a decade. Goldman Sachs is considered Above the Law; because our federal agents/agencies won't dare touch a hair on their nefarious head. An issue now made clear by the many discussions (and the pic below by the DailyBail.com); Goldman Sachs runs our federal agencies (right into the proverbial corruption grounds).

It doesn't matter how much evidence one has, when it is against political/financial powerhouses; unless those bad faith acts are reported by someone else significantly more important than the whistleblower (such as the New York Times, Wall Street Journal). In the recent reporting of Goldman Sachs tapes, it was first detailed by a Propublica.org; which has credibility due to the fact that its head guy was the former editor of the Wall Street Journal .

It is a fact that, if no one reported on Snowden and/or Assange; now one else would care.

But various outlets reported on such; and BOOM - changed happened!

I'm just sayin......

[br][hr][br]

Rolling Stone's Matt Taibbi Scolds NYT DealB%k for ties to Goldman Sachs

Long before his departure from Rolling Stone, Matt Taibbi lambasted NY Times DealB%k's Andrew Ross Sorkin (key guy at NYT DealB%k) for taking money from the likes of Goldman Sachs . Now, it would seem, the NYT is continuing its protection of Goldman Sachs (though I did get some hint of relief from an OpEd by Joe Nocera in March 2013 "Rigging the I.P.O. Game"

As Taibbi stated in his June 2011 opine "Andrew Ross Sorkin gives Goldman Sachs a rubdown" -

Taibbi stipulated that;

The Sorkin piece reads like it was written by the bank's marketing department, which may not be an accident. In November of last year, the New York Times announced that "Dealbook" was entering into a sponsorship agreement with a variety of companies, including ... Goldman, Sachs. This is from that announcement last year:

DealBook will also feature news and insights on deal-related topics from Business Day's well-known roster of leading business reporters, which includes recent hires in addition to a veteran stable of Wall Street's most highly-regarded journalists.

Barclays Capital, Goldman Sachs, Sotheby's and Tata Consultancy Services are charter advertisers for the relaunch of DealBook.

This thing of a publication taking money from a (major) target of whom it would report upon; is an issue of "Conflict of Interest". Clear as the sky is blue Andrew Ross Sorkin exacerbated his "conflicted" position, by defending Goldman Sachs; without pointing out the fact that DealB%k is beholden to Goldman Sachs's financial support.

The NY Times continues to protect Goldman Sachs & its Wall Street cronies to this very day!

[br]

[hr][br]

GOLDMAN SACHS eToys Fraud Schemes

Your truly sued Romney, Bain Capital and Goldman Sachs on October 18, 2013 - for Racketeering. For those of you who don't know (and most likely misunderstand), Congress created the RICO Act of 1970 (sardonically signed into Law by Nixon), to address the issues of "Prosecutorial Gaps". Much like the way Capone couldn't be brought down for his organized crimes, because no one in Illinois would touch him (City, State and/or Federal) and dear ole Al was brought down for tax evasion by an outsider; Congress designed the RICO Act to fill in the "Prosecutorial Gaps" - by making ordinary citizens into "Private Attorney Generals". (See U.S. Supreme Court Sedima v Imrex - HERE).

In 1999, Goldman Sachs took eToys.com public, where the stock went to $85; but eToys.com only received less than $20. This is now known as a "Spinning" pump-n-dump stock scheme and was reported on (much belatedly) by Joe Nocera's New York Times OpEd of March 2013, in his article "Rigging the I.P.O. Game".

As is par for the course, I reached out to Joe Nocera (who has his direct email upon his own Blog); but there was never any answer. I wanted to point out to him the more serious crimes that he missed. How the law firm of MNAT.com lied under oath to become eToys bankruptcy Debtor's counsel and then destroyed eToys Books & Records. And/or how that crooked law firm hand picked a crony to prosecute Goldman Sachs in the New York Supreme Court case of eToys (renamed ebc1) v Goldman Sachs (case number 601805/2002).

[br][hr][br]

[br]

Goldman Sachs arranges for a MNAT law firm partner to become U.S. Attorney

How Goldman Sachs has gotten away with rigging the eToys IPO, bankruptcy case and New York Supreme Court case (among other things like Petters Ponzi in MN & Fingerhut), is that Goldman Sachs knows how to even rig the Department of Justice.

If you look at the picture above, you will see Colm Connolly's face and MNAT. In the eToys bankruptcy case, we were able to compel MNAT to confess it lied about Goldman Sachs; but the judge in that case (illegally) permitted Goldman Sachs's law firm of MNAT to keep the keys to the vault it is fleecing.

Much didn't matter - in a weird sense; because - if the judge had referred the matter to the U.S. Attorney - she would have been referring it to Colm Connolly. As anyone can now see (thanks to some decent people in Washington D.C. permanently archiving his Resume); Colm Connolly was a partner of MNAT from 1999 to August 2001 (coincidentally the same exact period of time Mitt Romney claims to be "retroactively" retired from Bain Capital).

See Colm Connolly's Resume at the DOJ's Office of Legal Policy

http://www.justice.gov/archive/olp/colmconnollyresume.htm

It wasn't until 2007 that we learned of the corruption of the Delaware U.S. Attorney's office by Colm Connolly. I then reported it to the Public Corruption Task Force in Los Angeles (as that is where eToys was housed); but that issue too - became tainted by federal corruption refusing to prosecute.

I filed my complaint against the corruption on December 7, 2007;

and then in March 2008 - the Public Corruption Task Force was SHUT DOWN

and career federal agents were reportedly Threatened.

(see Los Angeles Times "Shake-up roils federal prosecutors"

[br][hr][bfr]

Maybe now, after the report of Goldman Sachs controlling the Federal Reserve, we can get others to pay attention to the fact that Goldman Sachs is able to avoid federal revenue by any and all means possible. As anyone can see by my chart above; there's NO 6 degrees of separation between the bad faith parties. At the barest of minimums, I have to make the 9th Circuit aware of this recent evidence; which corroborates the fact there are "Prosecutorial Gaps" concerning Goldman Sachs.

And that is why I sued Romney, Bain Capital and Goldman Sachs for Racketeering!

[br][hr][br]

As I was one of the sources for Matt Taibbi to look into Romney Stage Stores, Kay Bee and eToys issues, before he wrote the September 2012 Rolling Stone cover story "Greed and Debt"; I bombarded him with facts when he departed RS to start the new venture. He begged me to wait, as there's nothing he can do until he gets the new online magazine going.

If only he would fill in the gaps - NOW - of his Greed & Debt story; with the eToys questions that beg.

WOW! Will Senate and/or Conressional hearings occur?