2016 Postmortem

Related: About this forumHere it is: Bernie's Single Payer Healthcare Plan

https://berniesanders.com/issues/medicare-for-all/Similar to his 2013 proposal. Check it out for yourselves.

Some Highlights:

The United States currently spends $3 trillion on health care each year—nearly $10,000 per person. Reforming our health care system, simplifying our payment structure and incentivizing new ways to make sure patients are actually getting better health care will generate massive savings. This plan has been estimated to save the American people and businesses over $6 trillion over the next decade.

The typical middle class family would save over $5,000 under this plan.

Last year, the average working family paid $4,955 in premiums and $1,318 in deductibles to private health insurance companies. Under this plan, a family of four earning $50,000 would pay just $466 per year to the single-payer program, amounting to a savings of over $5,800 for that family each year.

Businesses would save over $9,400 a year in health care costs for the average employee.

The average annual cost to the employer for a worker with a family who makes $50,000 a year would go from $12,591 to just $3,100.

A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year.

A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.

This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.

A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

Progressive income tax rates.

Revenue raised: $110 billion a year.

Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

Taxing capital gains and dividends the same as income from work.

Revenue raised: $92 billion per year.

Warren Buffett, the second wealthiest American in the country, has said that he pays a lower effective tax rate than his secretary. The reason is that he receives most of his income from capital gains and dividends, which are taxed at a much lower rate than income from work. This plan will end the special tax break for capital gains and dividends on household income above $250,000.

Limit tax deductions for rich.

Revenue raised: $15 billion per year

Under Bernie’s plan, households making over $250,000 would no longer be able to save more than 28 cents in taxes from every dollar in tax deductions. This limit would replace more complicated and less effective limits on tax breaks for the rich including the AMT, the personal exemption phase-out and the limit on itemized deductions.

The Responsible Estate Tax.

Revenue raised: $21 billion per year.

This provision would tax the estates of the wealthiest 0.3 percent (three-tenths of 1 percent) of Americans who inherit over $3.5 million at progressive rates and close loopholes in the estate tax.

Savings from health tax expenditures.

Revenue raised: $310 billion per year.

Several tax breaks that subsidize health care (health-related “tax expenditures”) would become obsolete and disappear under a single-payer health care system, saving $310 billion over ten years.

Most importantly, health care provided by employers is compensation that is not subject to payroll taxes or income taxes under current law. This is a significant tax break that would effectively disappear under this plan because all Americans would receive health care through the new single-payer program instead of employer-based health care.

Kentonio

(4,377 posts)"THE PLAN WOULD BE FULLY PAID FOR BY:

A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year.

A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.

This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.

A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

Progressive income tax rates.

Revenue raised: $110 billion a year.

Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)"

No co-pays and no deductibles. The system America deserves.

Autumn

(48,869 posts)Uncle Joe

(64,562 posts)Thanks for the thread, HerbChestnut.

darkangel218

(13,985 posts)Go Bernie!!!

![]()

![]()

![]()

![]()

thereismore

(13,326 posts)and for Hillary to parrot it at the debate. Note to Hillary: don't go there.

arcane1

(38,613 posts)By which I mean "deliberately being dishonest about it".

Agschmid

(28,749 posts)Just trying to figure that out.

Also my current plan has zero copays but I do pay at the pharmacy if I need perscriptions, will I pay under this plan for prescriptions?

HerbChestnut

(3,649 posts)I'd say that any tax the employers pay is taken out of their employee's salaries. The same thing happens currently with insurance premiums. It's one of the reasons salaries have remained stagnant for the last 20-30 years.

Agschmid

(28,749 posts)I wonder what that will do to salaries, can't imagine much since companies already pay some portion of premium costs.

How far into his term does he think this could happen?

HerbChestnut

(3,649 posts)This plan would likely save employers a ton of money so it's possible salaries will go up (depends on the employer, obviously). As for when it can happen? Tough to say. A lot of that depends on folks like you and me becoming more active in politics and demanding it from our representatives. And a Democratic majority in either of the houses wouldn't hurt either.

uponit7771

(93,504 posts)... premiums while kicking the deductible to the employee making 50,000 a year

Most companies now offer health coverage that requires employees to pay an annual deductible before insurance kicks in, and the size of that deductible has soared in the past decade, according to a survey released Tuesday by the Kaiser Family Foundation and Health Research & Educational Trust.

gwheezie

(3,580 posts)I just had to pay 1k for a deductible on a ct scan.

Warren Stupidity

(48,181 posts)6.2% will lower employer costs for most workers.

Recursion

(56,582 posts)So, if he has $50,000 budgeted for your salary, he instead pays you $47,080, which with the 6.2% tax he's also paying comes to $50,000 total for you.

jeff47

(26,549 posts)FlatBaroque

(3,160 posts)grasswire

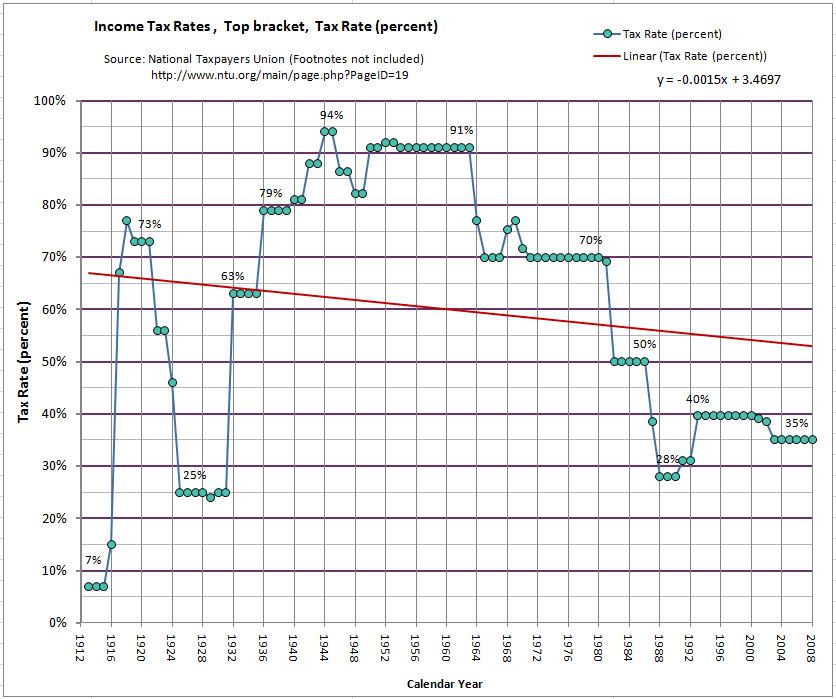

(50,130 posts)All those lunkheads who listen to talk radio and believe that Bernie will tax them at 90 percent?

Same as it is now?

HerbChestnut

(3,649 posts)questionseverything

(11,676 posts)This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.

A family of four making $50,000 a year taking the standard deduction would only pay $466 this year.

uponit7771

(93,504 posts)... will be passed to employers in a split second.

So 8.4 increase in payroll taxes on someone making 50000 a year along with the 466 is almost the same damn thing they were paying in premiums...

HerbChestnut

(3,649 posts)Might be true in some cases, but that's hardly a reason to criticize this plan. And you're math is terrible.

uponit7771

(93,504 posts)... that's not terrible math that's fact.

Either way, I'm thinking were saving a lot more than a 20 - 30 a month on HCI premiums...

this stinks... no wonder the for profits have been in business

HerbChestnut

(3,649 posts)You're against it. We get it. The numbers disagree with you, but hey, gotta stick up for your candidate at all costs right?

uponit7771

(93,504 posts)... avg payer pays a year.

I'm expecting less than half... OUT OF POCKET... not just moved over to another category called tax.

HerbChestnut

(3,649 posts)I'll let you figure out the mistake.

uponit7771

(93,504 posts)... mistake.

JonLeibowitz

(6,282 posts)uponit7771

(93,504 posts)... and I'm mostly talking abut the 2.2 + 6.2 payroll tax increase that the emploYEE has to pay...

Cause we all know dog on well the emploYER wont be paying the 6.2 increase and it's not a fair trade of premium seeing they've passed that already to employees via higher deductibles

JonLeibowitz

(6,282 posts)when computing the Revenue Raised figures. We will of course need to see more details of computations.

I was just correcting why your figures seemed off.

uponit7771

(93,504 posts)... going to pay those... they're going to pass them off like they have been

Most companies now offer health coverage that requires employees to pay an annual deductible before insurance kicks in, and the size of that deductible has soared in the past decade, according to a survey released Tuesday by the Kaiser Family Foundation and Health Research & Educational Trust.

http://bigstory.ap.org/article/d1b60cf0c7554e0aa7360597c1273275/study-shows-employers-shifting-more-medical-costs-workers

Under the ACA companies with 50 or more employees already cover healthcare. So no, it would not get passed on. It would not cost more. It's not even close. It would save middle class Americans a ton.

uponit7771

(93,504 posts)... into HCI have continually been passing the cost to employees and there's' no reason to think they're not going to pass that 6.2% increase which right now most employers don't pay 6.2% of salary into HCI premiums

http://bigstory.ap.org/article/d1b60cf0c7554e0aa7360597c1273275/study-shows-employers-shifting-more-medical-costs-workers

Most companies now offer health coverage that requires employees to pay an annual deductible before insurance kicks in, and the size of that deductible has soared in the past decade, according to a survey released Tuesday by the Kaiser Family Foundation and Health Research & Educational Trust.

pinstikfartherin

(500 posts)That the average percentage of compensation that private employers spend on health care is 7.7% as of the end of 2015. Some pay more and some pay less, of course.

http://www.bls.gov/news.release/ecec.nr0.htm

Previous year information:

https://www.ebri.org/publications/benfaq/index.cfm?fa=hlthfaq7

http://kff.org/health-costs/issue-brief/snapshots-employer-health-insurance-costs-and-worker-compensation/

uponit7771

(93,504 posts)... a year.

Sanders plan stays in this 50,000 range so I'm staying in that range too...

That 6.2% sticks out like a sore thumb

George II

(67,782 posts)This is a shell game. And he drops this an hour or two before the debate? He's starting to show his true stripes.

uponit7771

(93,504 posts)... time to comb over it.

If it was on the up and up and something that was a game changer I'd release it last week and let HRC stew...

It's not a game changer, for those making 50,000 a year there's no way the employer isn't going to kick that 6.2% down to them like they've been doing for the last 10 years via higher deductibles.

Warren Stupidity

(48,181 posts)Employers are currently paying an average of 16k per worker for insurance premiums. They will instead be paying 6.2%.

That's $6200 for a worker making 100,000.

Was your point that for employees making around 300,000 their employers will be paying more?

uponit7771

(93,504 posts)... and most of the employers are NOT paying 6.2% avg for a 50k a year salary... that's nearly 3,000 yearly.

They're passing the cost to employees not via the deductions and lowering premium cost since 2006

INdemo

(7,024 posts)$50,000 income X 2.2% =$1,100 Annual tax on employee or $91.66 per month

$50,000 income X 6.2% = $3,100 Annaual tax employer or $258.34 per month

I think you might have has the decimal point in the wrong place

Ok

uponit7771

(93,504 posts).. and no one in their right mind believes the employers will STOP passing the cost of HCI premiums off to employees like they have been doing in the last 10 years.

That 6.2 gets passed to the 50,000 a year worker...

None of those guys pay an extra 3100 a year per employee for a 50,000 yr job... they pay the least they can in preimiums and then make the employee pay the high deductible.

INdemo

(7,024 posts)What are you talking about extra. $3100 is the amount employers will pay with the tax rate of 6.2%

I think you are forgetting that there is no extra anything because private insurance wont exist.

INdemo

(7,024 posts)You are scrambling to find something that you can use to try and discredit Bernie Sanders with and this plan,Right

Well there is nothing there to use to falsely assume it wont work

If this was Hillary's plan would you approve? Of course you woould

Well in 2008 Hillary was for such a plan as Bernie has proposed. Do you want references?

jkbRN

(850 posts)As a nurse who sees people struggling to make copays or making sure a procedure is covered by their insurance companies, this is awesome and amazing. ![]()

![]()

If you don't want to get sick, you better make sure that the people around you can get the healthcare they need. People not having healthcare puts everyone else at risk--and that goes for things like anti-vaccination advocates (which I know has nothing to do with cost, but still reveals what happens, because diseases and virus are fucking CONTAGIOUS) (lol sorry), as well as the people who may not be able to afford the care they need & deserve.

redwitch

(15,244 posts)As municipalities wouldn't be passing on the cost of insuring their employees.

HerbChestnut

(3,649 posts)Really goes to show just how powerful the insurance lobby is to keep something like this from becoming law sooner.

ChiciB1

(15,435 posts)At least my bouncing ball.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

AND ![]() AND

AND ![]()

hifiguy

(33,688 posts)to get behind Bernie!

![]()

![]()

HerbChestnut

(3,649 posts)How any self-described progressive could be against a single payer program as good as this one is beyond me.

CharlotteVale

(2,717 posts)SmittynMo

(3,544 posts)Can't wait for the debate. The Bern plays a good game. Makes the best of what little coverage he gets. He's good.

Joe the Revelator

(14,915 posts)Gman

(24,780 posts)He may as well say he'll fly around the moon on wings he spontaneously will grow if this happens.

It's a great plan. I would love it. I'll bet employers would love it too. But it's NOT going to happen. It's pie in the sky BS for the sake of putting something out there.

She's going to eat his lunch tonight on thus fantasy.

HerbChestnut

(3,649 posts)Do you support the plan?

Gman

(24,780 posts)I said its s great plan

HerbChestnut

(3,649 posts)That's what happens when you read about 100000 posts in a few minutes. That said, the only way this plan passes is if we pressure congress and elect representatives that support it. The same could be said about a lot of progressive legislation, but such is the reality that we live in. It's no secret that our government doesn't represent us.

Kentonio

(4,377 posts)That's a powerful force to have behind you.

Gman

(24,780 posts)That's a very simple view. Do you not know about the Kochs, big pharma and the health care lobby? The US Chamber will not support it. Wall Street won't support if. Banks won't support it.

So just how are employees, who's rights and voices have been whittled to nothing, and a few businesses beat that?

It's pie in the sky fantasy. Good at getting gullible people to vote for him. But he's promising the impossible.

Response to Gman (Reply #48)

Post removed

uponit7771

(93,504 posts)neverforget

(9,512 posts)bluestateguy

(44,173 posts)He'll just make a few speeches around the country, make a few strongly worded phone calls to members of Congress and poof! It will get done!

At least that's the fantasy world some progressives live in.

uponit7771

(93,504 posts)uponit7771

(93,504 posts)Gman

(24,780 posts)Almost no sarcasm here!

INdemo

(7,024 posts)Senate and will have a huge gain in the House After two years its likely we take back the House

But as long as there is pessimistic people like you they have such one way tunnel vision with Hillary, nothing changes

We will still maintain the Status Quo.

Large Corporations ,Wall St,Big Banks,Insurance Companies,Pharmaceuticals will still own our Democracy

You should understand there is a large percentage of Democrats that will not vote for Hillary if she is the nominee and we will end up with Trump or Rubio or Cruz

And you give me the assumption that if Bernie wins the nomination you wont be voting for him.

Whoever gets the nomination will have a good majority in the Senate. Regardless of cost tails. Democrars will pick up House seats. How many is hard to say as the GOP districts are very well gerrymandered. There's only a small handful of swung districts. It would be nice to say we'll finish the job in 2years but I don't expect it in any event the job needs to be done by 2021 when redistricfing occurs. I'm not optimistic.

And no, there will not be a large percentage of Democrats who will not vote for Hillary. They may have to pass out clothes pins for people to hold their nose with while they vote, but there is not also a large number of Democrats that are that stupid either.

Other than "revolution" yours is the best plan of all responses. But it's not likely. The best strategy is incrementally change the ACA.

INdemo

(7,024 posts)hold their nose and vote but will not get the Progressive Democrats to the polls(17%) There are also those that don't want a Monarchy with the Clinton's or a Bush that wont vote for her.

Do the research

I didn't say it would be done in 2 years after Bernie is elected to get his healthcare plan through . It will take two years ,till(2018) to get the House back.

I said Democrats will pick up House Seats with Bernie, but probably not enough in 2016 if he does, well that's Great for our Country.

There are those that just want to criticize Bernie's Healthcare plan without even knowing how the plan will works You need to read it.

As far as Hillary being so against the plan,well she is being paid to do that. Think about it. Large Insurance Companies and pharmaceuticals own her. If she would have stood there last night and said I agree with Sanders on healthcare,large donors would have probably cut off her funding. http://www.opensecrets.org/industries/indus.php?ind=H

2.5% Employee tax

6.5% Employer Payroll Tax

This reminds me of all the negatives the Republicans used in 2008 against Obama when he was trying to get the ACA through.

100's of non factual negative reasons but the ACA evolved.

Bernie will get his Medicare for All through.

You can come and tell me in two years "Guess Bernie was right and you were right" and I will just say "Thank You"

jeff47

(26,549 posts)The way you get the 60% of the electorate who are too disaffected to show up to the polls in off-year elections is to offer a significant contrast. Not, "We'll do whatever the Republicans say we can do".

This isn't something that will pass in the first 2 hours of a Sanders presidency. The point of plans like this is to rebuild the party from the utter cowardice instilled by the DLC.

Gman

(24,780 posts)So I don't know why you bring them up. Maybe you know something nobody else knows. What you say about contrast was done in Texas with Wendy Davis's and she got her ass kicked. If you can figure out how to get people to quit voting for guns and against abortion because Jesus wants them to, let us know.

And if you find a way to get people off their asses and to the polls for just once, that would help too.

jeff47

(26,549 posts)Yes, the literal group is gone, but the philosophy is not. And as you are well aware, using their name as shorthand for their philosophy is extremely common.

So odd you suddenly forgot that.

fleur-de-lisa

(14,704 posts)in_cog_ni_to

(41,600 posts)We pay $900 A FREAKIN' MONTH for three insurance policies! $900 A MONTH. This is $466 A YEAR!!!!!

---------> a family of four earning $50,000 would pay just $466 per year to the single-payer program, amounting to a savings of over $5,800 for that family each year.<-----------

PEACE

LOVE

BERNIE

Rosa Luxemburg

(28,627 posts)yeoman6987

(14,449 posts)You will pay close to 5 grand a year. Still cheaper then you pay now.

Armstead

(47,803 posts)Sorry but I don;t get how this fits in with healthcare costs. I'm assuming this lumps in all income tax rates, not just healthcare?

Progressive income tax rates.

Revenue raised: $110 billion a year.

Under this plan the marginal income tax rate would be:

37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

Kentonio

(4,377 posts)With the addition of the new healthcare costs. So presumably that would be a final payroll tax figure.

in_cog_ni_to

(41,600 posts)The average annual cost to the employer for a worker with a family who makes $50,000 a year would go from $12,591 to just $3,100.

GO Bernie!

PEACE

LOVE

BERNIE

Old Crow

(2,266 posts)mountain grammy

(28,813 posts)AzDar

(14,023 posts)itsrobert

(14,157 posts)Doesn't seem I get any benefit out of this plan. Looks like I would be worse off. Unless there is an exemption for Employees who are military retirees with earned Military benefits such as Tricare Prime for retirees.

gwheezie

(3,580 posts)Who lose their jobs. I'm still not understanding the plan. Does this eliminate insurance co's? Is health insurance administered by the fed government under expanded Medicare. Is there a part B and who pays the 20% not covered by mcare?

When we go to single payer, it is not just going to be about how it's paid for. It will change the health insurance industry dramatically, not saying its a bad thing but people are going to lose their jobs.

Beartracks

(14,466 posts)====================

bluestateguy

(44,173 posts)I posed that question some years ago on DU and got a lot of nasty and sarcastic non-answers.

Here: from 2007.

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x1147061

jeff47

(26,549 posts)gwheezie

(3,580 posts)Do you think everyone working for an insurance co owns it. They have secretaries, mail clerks, lots of low wage workers. I don't care what happens to the top level but most if the people actually working are living pay check to pay check.

jeff47

(26,549 posts)In that it does not benefit society. All it does is extract profit from something that should not have a profit motive.

We would be much better off having these workers do something that actually is productive. Yes, they will lose their jobs in the short run. Some of them will gain new jobs in the expanded Medicare system. Others will have to find work elsewhere.

Should we leave private insurance in place just so the IT guy doesn't have to find a new job?

George II

(67,782 posts)Kentonio

(4,377 posts)It saves most people money for gods sake.

Taxes indeed. Did you borrow that off Paul Ryan?

George II

(67,782 posts)....the payroll, they own the company. The only people who are on payrolls are poor and middle class.

Payroll taxes are the second most regressive taxes in the world, only behind sales taxes.

Kentonio

(4,377 posts)While simultaneously covering every single person in America for their entire medical requirements.

It's the kind of deal Americans could only dream of up until now.

George II

(67,782 posts)uponit7771

(93,504 posts)... the employee with the quickness

Beartracks

(14,466 posts)They are quite taxing on my budget. And a mess of copays and deductibles on top of that.

I'd rather pay $500-$1,000 in taxes than burdened by $5,000 in insurance costs.

===============

Spitfire of ATJ

(32,723 posts)HerbChestnut

(3,649 posts)This tax increase ends up saving families thousands of dollars per year.

George II

(67,782 posts)HerbChestnut

(3,649 posts)Read his plan. Families making less than 28,000 per year pay nothing. Middle class families pay a modest payroll tax that ends up saving them thousands of dollars on health insurance. The upper class pays a progressive income tax to cover the rest.

jeff47

(26,549 posts)37 percent on income between $250,000 and $500,000.

43 percent on income between $500,000 and $2 million.

48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

jeff47

(26,549 posts)I'd pay much less under those terrible, terrible tax increases.

Someday, you might understand that whether the money goes to Blue Cross or the money goes to the government, it still leaves my paycheck.

Hoyt

(54,770 posts)make projections based on "savings" that are projected to occur in the future. We'll see. If he's anywhere close, he has a winner assuming GOPers will enact it. They might have trouble obstructing if the plan stands rigorous analysis.

paleotn

(21,836 posts)think of the CEO's and shareholders of.....Cigna, Aetna, United Healthcare, Humana, etc., etc....

After all they've done to gouge, uh I mean deny, ummm...provide health insurance to millions of Americans, and at costs so high as to be unbelievable in the rest of the industrialized world, THIS is the thanks they get. It's NOT a matter of how many yachts they can ski behind, damn it. It's a matter of fairness. Here they have the bulk of America's populous having to come crawling to Big Healthcare for their very lives in some circumstances, and Bernie wants to blow all that up. Damn it, it's downright unAmerican!

![]()

![]()

![]()

You go, Bernie! It's not much of a stretch to think removing the profits, dividends, costly complexity and inefficiency from basic health care will reduce the overall cost to everyone. It simply makes sense. ![]()

99Forever

(14,524 posts)LWolf

(46,179 posts)senz

(11,945 posts)

Duppers

(28,469 posts)where I have to defend Bernie. It's happened twice with total strangers.