2016 Postmortem

Related: About this forumIf you want to learn WHY Bill and Hillary Clinton are so close to Wall Street...

...helped repeal Glass-Steagall, became empathetic with those in natural gas and fracking and other mineral extraction industries, and seemed content with irregular international banking practices a la BCCI; then check out this article from the great Barbara Demick, once of The Philadelphia Inquirer, which ran three days before the inauguration of President Clinton in 1993:

Clinton's Wealth Of Support

An Arkansas Family Has Been A Backer,

And A Source Of Controversy.

By Barbara Demick

PHILADELPHIA INQUIRER STAFF WRITER, January 17, 1993

EXCERPT...

Early in the game, the Stephenses raised $100,000 in Arkansas to get Clinton's candidacy up and running. Then last spring, when Clinton was trailing both George Bush and Ross Perot, Worthen Bank supplied the cash- starved campaign with a $3.5 million line of credit.

SNIP...

The centerpiece of the family's $1 billion empire is Stephens Inc., one of the largest investment banking firms off Wall Street. In addition to its 38 percent interest in Worthen Bank, the family owns stakes in oil and natural gas, utilities, nursing homes, waste management, diamond mining and hog farming.

SNIP...

The Stephens businesses are often represented by the Rose law firm, where Hillary Clinton has been a partner. Until the mid-1980s, they owned Arkla Inc., the Shreveport, La., natural-gas utility from which Clinton tapped chairman Thomas F. "Mack" McLarty as his White House chief of staff. Their investment firm serves as business manager to Linda Bloodworth-Thomason and Harry Thomason, the Hollywood couple who helped choreograph Clinton's public image.

SNIP...

In 1978, federal securities regulators alleged that Stephens, along with Lance, helped Middle Eastern investors linked to BCCI secretly buy up shares in a Washington bank. Stephens and the others settled the civil lawsuit by signing a consent decree in which they neither admitted nor denied wrongdoing.

SNIP...

The Stephenses have extensive holdings in natural gas, a resource strongly supported by Clinton. They, along with Bradbury, have been vocal proponents of easing banking regulations - in particular the limits on interstate banking and the Glass-Steagal Act, which separates banks from brokerage firms.

CONTINUED...

http://articles.philly.com/1993-01-17/news/25959645_1_worthen-bank-stephens-family-bill-clinton

The whole article is worth reading if you want to understand Ms. Clinton and where she's coming from -- and where she will lead.

dchill

(42,660 posts)Octafish

(55,745 posts)By Zaid Jilani

AlterNet, May 26, 2015

EXCERPT...

On Jan. 16, 1991, the Persian Gulf War began, as the United States and its allies began one of the largest bombing campaigns in U.S. history, aimed at settling a militia dispute between Kuwait and Iraq. At the time, the press was almost universal [3]in its support for the war, and Congress offered little opposition to President George H.W. Bush's request to violently settle the issue, despite pleas from many for a diplomatic solution [4] using sanctions and international mediation.Yet one day into the bombing campaign, Sanders stood alone [5]on the House floor to issue a warning against the cheers for war.

In his speech, he warned that while the United States would be able to crush the vastly inferior Iraqi army, the destruction and bitterness the war would cause would “lay the groundwork for more and more wars for years to come.” He denounced our attentiveness to war and our inattentiveness to basic human needs, such as child starvation abroad and homelessness at home:

"We should make no mistake about it, today is a tragic day for humanity, for the people of Iraq, for the people of the United States, and for the United Nations as an institution. It is also a tragic day for the future of our planet and for the children, 30,000 of whom in the Third World will starve to death today as we spend billions to wage this war – and 25 percent of whom in our own country live in poverty in our country because we apparently lack the funds to provide them with a minimal standard of living. ...

"Despite the fact that we are now aligned with such Middle Eastern dictatorships such as Syria, a terrorist dictatorship, Saudi Arabia and Kuwait, feudalistic dictatorships, and Egypt, a one-party state that receives seven billion dollars in debt forgiveness to wage this war with us, I believe that in the long run, the action unleashed last night will go strongly against our interests in the Middle East. Clearly the United States and allies will win this war, but the death and destruction caused, will in my opinion, not be forgotten by the poor people of the Third World and the people of the Middle East in particular. ...

"I fear that one day we will regret that decision and that we are in fact laying the ground work for more and more wars for years to come."

The senator's warnings were prescient. The Persian Gulf War seems never to have ended, as the United States continued to bomb Iraq continually through 2003, as well as enacting a sanctions regime so harsh it led to the deaths of over half a million Iraqi children [6]. In 2003, the United States and its allies invaded Iraq, enacting a harsh occupation and then igniting a civil war. That civil war, alongside the violence in Syria, gave birth to ISIS, which is currently ripping the country apart.

Many of the other allied countries Sanders condemned in his address – Syria and Egypt – went through their own repression-inspired tumultuous revolutions, and Saudi Arabia is largely blamed for financing the rise of Wahabbi-inspired terrorism.

Watch his speech:

SOURCE: http://www.alternet.org/news-amp-politics/bernie-sanders-predicted-invading-iraq-would-cause-more-wars-years-come-1991-watch

CorporatistNation

(2,546 posts)Experience vs JUDGEMENT? I'll take JUDGEMENT EVERY TIME!

nolabels

(13,133 posts)Almost like trying to separate the wet from water. From what i can see when it comes to the "Experience vs JUDGEMENT" is that the stuff all the fools that came earlier did worked well enough, so it should still work now. At least that seems to be the thinking those trying to cheerlead the way and those that would want to fund it. That is not anything rational to me, that seems only to be postponing the day of reckoning by compounding it. All that shit that Bill Clinton did with triangulation with the republicans is now coming back to bite everybody in the ass (except the wealthy, as of course, they are just collecting the dividends off it).

2banon

(7,321 posts)Octafish

(55,745 posts)By ALEXANDER COCKBURN

The Philadelphia Inquirer, August 05, 1992

EXCERPT...

The election's "surprise" season has officially opened, with two July events, first Bush's chest-pounding over the U.N. inspectors and second in the July 29 indictment by the U.S. Justice Department of Clark Clifford and Robert Altman for their alleged concealment of BCCI's takeover of First American Bankshares, the financial institution of which they were officers. That second event impinges on Clinton.

Clifford is a man traditionally described as a senior statesman of the Democratic Party. More directly, Clinton's major financial backer in his drive for presidency has been the Little Rock-based Stephens family, notably billionaire Jackson Stephens.

Securities and Exchange Commission documents unearthed at the start of this year's primary season show that Stephens arranged the initial contacts between BCCI and First American, a fact which Republican appointees in the Justice Department will no doubt soon be reminding reporters.

The Clifford/Altman July surprise is one Republican antidote against unwelcome publicity about the financial conduct of Bush's sons, and against democratic "Iraq-gate" disclosures in the months to come. And we can already look forward to a brand-new October surprise now being organized by Secretary of State James Baker.

SNIP...

Imagine an exultant President Bush, flanked by Israelis and Palestinians, announcing on the White House lawn that at last, after a quarter of a century, thanks to his diplomacy, Israel would be able to live within secure borders, at peace with its neighbors, while simultaneously his Justice Department leaks flowcharts showing BCCI, its prime investor the Sheikh of Abu Dhabi, Stephens, Clifford and the Clinton campaign, all on the same piece of paper.

SOURCE: http://articles.philly.com/1992-08-05/news/25988752_1_karen-jansen-saddam-hussein-inspectors

PS: This is where the Buy Partisanship.

islandmkl

(5,275 posts)Octafish

(55,745 posts)astrophuss42

(290 posts)What a convoluted scenario.

Octafish

(55,745 posts)If you have kids or grandkids, or if you just want to leave a better more Democratic world for the people 23 years from now, it's a history important to know.

No offense to Hillary and her supporters, but we need to look at alternatives to capitalism. The money trumps peace and all else crowd have had their chance since Ronald Reagan was new.

Look where it's got us: Wars without end for profits without cease in a world where the richer get richer and everybody else not.

marions ghost

(19,841 posts)--ain't THAT the truth!

Hope the damage they have done can be reversed.

Jitter65

(3,089 posts)Octafish

(55,745 posts)Dr. Black is a forensic economist who helped put thousands of Savings & Loan crooks behind bars in the 80s and 90s for Poppy Bush and Bill Clinton administrations. That Trillion dollar bailout was peanuts compared to the Banksters of '08. Black coined the phenomenon where the CEOs are crooked "Control Fraud." For some reason, no one from the Bush or Obama administrations have called him back to government service. Here's what he reports:

The 11th Lesson We Need to Learn from Charles Keating’s Frauds: Bring back Glass-Steagall

by William Black

New Economic Perspectives, April 15, 2014

On April 2, 2014, as news broke of the death of Charles Keating, the most infamous savings and loan fraud, I posted an article entitled “Ten Lessons We Must Learn from Charles Keating.” (The April 2 date was ironic, because it was the 27th anniversary of the meeting at which the senators who would become known as the “Keating Five” began to seek to intimidate the savings and loan regulators on Keating’s behalf.)

I failed to explain perhaps the most important lesson we should have learned from Keating and Lincoln Savings. One of the subtle aspects of the savings and loan debacle that is often overlooked is that we ran a real world test of the importance of the provisions of the 1933 Banking Act known as the Glass-Steagall Act. Glass-Steagall prohibited “commercial” banks that received federal deposit insurance (created by the same 1933 banking act) from owning equity positions in nearly all financial assets (“investment banking”). With very limited exceptions, a commercial bank could not own real estate, companies, or stock in companies. (Banking regulators, hostile to Glass-Steagall despite its immense success, would later add many exceptions.) The ideas behind Glass-Steagall’s separation of “banking” from “commerce” always made eminent sense from conservative and progressive perspectives. Commercial banks received a federal subsidy through deposit insurance, so it made no sense for them to be allowed to compete against regular businesses that lacked that subsidy. It would distort markets to allow such a subsidy.

SNIP...

Glass-Steagall represented another lesson learned from the Great Depression – conflicts of interest matter. There were obvious potential conflicts of interest in combining commercial and investment banking. If a bank investment in a company was going bad, the temptation would be to loan the company large amounts of money to try to delay or prevent its failure. Similarly, if a loan customer was experiencing a liquidity problem and could not repay its loan the temptation could be for the bank to buy newly issued stock in the company.

S&Ls, however, could operate under radically different rules during the 1980s. State chartered S&Ls had the investment powers permitted by the states, while remaining eligible for federal deposit insurance. Texas led the Nation in a type of investment, the acquisition, development, and construction (ADC) loan. While ADC loans were nominally structured as loans, it was the norm in Texas that they were in economic substance (and for accounting purposes) properly classified as “investments” rather than “loans.” I will not explain the details of ADC loans in this column. I will note briefly only several implications of ADC lending. First, ADC loans (that were actually “investments”) were the single greatest cause of losses in the S&L debacle. Second, Keating’s unholy jihad against our reregulation of the industry was concentrated on our effort to regulate “direct investments” that included direct ownership positions and most ADC loans. Third, the accounting for ADC loans was a classic example of a “Gresham’s” dynamic in which “bad ethics drives good ethics out of the profession.” The accounting profession tried repeatedly (the EITF issued three notices to practitioners) to end the rampant false classification of ADC loans as true “loans” rather than “investments.” Each of these efforts failed because the fraudulent S&L and bank CEOs were almost invariably able to find an audit partner at a top tier audit firm to bless ADC deals as a “loans” even when they were obviously investments. Fourth, when classified, improperly, as loans the worst ADC “loans” were the nearly perfect “ammunition” for accounting control fraud. If they were classified properly as “investments” they would have been a far poorer fraud scheme. Fifth, banks, particularly in Texas, made enormous amounts of ADC loans that were improperly classified as “loans.” This allowed them to evade Glass-Steagall.

Dick Pratt, the Chairman of the Federal Home Loan Bank Board, was a theoclassical economist so he had the agency’s econometricians’ study which state’s S&Ls reported the highest profits so he could use that state’s asset powers as the model for federal deregulation. He led the drafting of the Garn-St Germain Act of 1982, which used Texas as its model for federal deregulation. Texas led the nation in deregulating ADC loans. Pratt, like all good theoclassical economists, ignored fraud (except when he was leading it – see the chapter in my book on “goodwill” accounting). He failed to understand that Texas S&Ls reported the highest earnings because ADC loans were such ideal fraud ammunition.

Pratt also failed to understand the implications of the regulatory “race to the bottom” that he would trigger through federal deregulation. California responded to Garn-St Germain with the Nolan Act (Nolan, fittingly, would later be convicted of corruption). The Nolan Act allowed a California chartered S&L to place 100% of its assets in direct investments. Hundreds of real estate developers, including Charles Keating (who infamously called the Nolan Act “a license to steal”), rushed to get a California S&L charter through merger (Keating’s purchase was funded entirely by Michael Milken’s Drexel Burnham Lambert) or the grant of a new (de novo) charter.

CONTINUED...

http://neweconomicperspectives.org/2014/04/11th-lesson-need-learn-charles-keatings-frauds-bring-back-glass-steagall.html#more-8091

So remember, Jitter65: Just because people say something over and over doesn't make it so. The rest of the article fills in the details on Why keeping the Wall Street out of the casino matters to the US taxpayer. We the People, thanks to S&L deregulation and no Glass Steagall, have had to pick up their bill twice.

noiretextatique

(27,275 posts)By the time Glass-Steagal was actually apppealed, it has already been stripped toothless. So though you are technically correct, you are omitting the most important reason why you are technically correct.

GeorgiaPeanuts

(2,353 posts)Octafish

(55,745 posts)...got poisoned by the BCCI Octopus. Favors and such for connected big wigs and pols was the way the bank operated.

Lance Admits Playing Key BCCI Role

The former Carter Administration official says he advised the bank's founder on how to expand operations into the United States.

October 24, 1991|OSWALD JOHNSTON | LOS ANGELES TIMES STAFF WRITER

EXCERPT...

Lance said he first asked his Washington counsel, Clark M. Clifford, to determine Abedi's integrity. After a quick inquiry turned up no apparent problems, Lance proposed that Clifford and his protege, Robert Altman, become legal advisers to Abedi and BCCI in their prospective U.S. operations.

BCCI then proceeded with its attempt to acquire the Washington-based bank holding company, Financial General Bankshares, Lance said. It succeeded in acquiring the company, renamed First American Bankshares, through intermediaries three years later.

Clifford and Altman, who resigned under pressure last August as chairman and president of First American, have steadfastly insisted that they had no idea BCCI was the actual owner of their bank. Both are scheduled to testify before the subcommittee today.

Lance also testified that Abedi, whom he said he admired in those early years as a banker with an abiding commitment to Third World development, put him in touch with Saudi millionaire Ghaith Pharaon as a buyer for his own bank, National Bank of Georgia, of which Lance was a 12% shareholder. The Federal Reserve has since charged that Pharaon acquired the bank while acting as a front man for BCCI.

Lance said Clifford and Altman were closely involved with Pharaon's acquisition of NBG and the attempt by BCCI to acquire Financial General, an effort that was challenged in 1978 by the Securities and Exchange Commission and the Federal Reserve Board on grounds that intermediaries were being used to complete the sale. When many of those same intermediaries secretly acquired First American, Clifford and Altman assured the Fed that BCCI had no role in the acquisition.

The subcommittee made public a Jan. 30, 1978, cable to Abedi from Abdus Sami, one of his top aides, outlining how Clifford had been consulted on acquisition strategy from the start of BCCI's move into U.S. banking. It said "our friend"--Lance--recommended Clifford as "chief counsel" and added: "Accordingly, I met Mr. Clark Clifford and explained to him our strategy and goals. He was happy to know the details and has blessed the acquisition."

CONTINUED...

http://articles.latimes.com/1991-10-24/business/fi-455_1_united-states

Of course, with lawyers racking up $400 an hour tabs, Just Us would be served, small fish fried and big fish got to eat another day, and BCCI slipped into the dustbin of forgotten lore.

amborin

(16,631 posts)it's shameless, blatant corruption

Octafish

(55,745 posts)

By Greg Palast

Reader Supported News, September 16, 2013

Joseph Stiglitz couldn't believe his ears. Here they were in the White House, with President Bill Clinton asking the chiefs of the US Treasury for guidance on the life and death of America's economy, when the Deputy Secretary of the Treasury Larry Summers turns to his boss, Secretary Robert Rubin, and says, "What would Goldman think of that?"

Huh?

Then, at another meeting, Summers said it again: What would Goldman think?

A shocked Stiglitz, then Chairman of the President's Council of Economic Advisors, told me he'd turned to Summers, and asked if Summers thought it appropriate to decide US economic policy based on "what Goldman thought." As opposed to say, the facts, or say, the needs of the American public, you know, all that stuff that we heard in Cabinet meetings on The West Wing.

[font color="green"]Summers looked at Stiglitz like Stiglitz was some kind of naive fool who'd read too many civics books. [/font color]

CONTINUED...

http://www.gregpalast.com/larry-summers-goldman-sacked/

Money.

closeupready

(29,503 posts)K&R, thanks, Octafish.

Octafish

(55,745 posts)Looking back now, the reasons why become crystal clear. And it also is interesting to see how amazingly LITTLE follow up there was on this article's main points over the last 23 years by the nation's news media -- which shrank in number as they grew in size to a handful beholden only to money and its owners.

Most importantly: You are most welcome, closeupready! Thank you for grokking why knowing matters for Democracy.

closeupready

(29,503 posts)doing your part in keeping the cold, hard truth alive. God knows those in DC who say things like, "money trumps peace" or "it'd be so much better if I were a dictator" hate us for it, and like FDR, we should welcome that sort of hatred, lol.

Hell Hath No Fury

(16,327 posts)Now, more than ever, I am grateful for the Internet and the ability to access info like this and to look behind the bullshit being peddled.

I believe the availability of information access has directly contributed to the high levels of resistance to the PTB around the world. It is my hope that, in the new age of Information, there will be nowhere for the Bullshitters to hide.

noiretextatique

(27,275 posts)So many seem to be snowed because of the rw witchhunt. That became the perfect refuge for scoundrels.

Hell Hath No Fury

(16,327 posts)Last edited Wed Mar 30, 2016, 05:11 PM - Edit history (1)

I defended them right and left, was one of the first signers of the original MoveOn petition, and even wished it was Hillary who had been running instead of Bill.

I look back and see two big problems:

1) I was strictly a Party person who believed the Democratic Party was the Party of my youth (Bobby Kennedy, MLK) and my location (liberal SF).

2) I only had to go by the information I was presented in the limited media I accessed (broadcast TV, local papers).

And then I discovered the Internet. And DU. ![]()

Once I was introduced to new information on them and the Party under them, I was forced to reconsider my views. It was a process, one that took many years.

I think that there are some here that are just in various stages of their own "process" on the Clintons. Others who are neoliberals/cons who actually agree with the Clinton worldview. And others who put their fingers in their ears and refuse to believe anything outside of their fantasy of the Clintons.

For me, the Clinton bell can't be unrung -- I see them for what they are and I, in good conscience, cannot support them.

![]()

![]()

nashville_brook

(20,958 posts)marions ghost

(19,841 posts)The Future is to the FLEXIBLE.

There is so much that goes on behind the scenes that people never know about. Big Media has let everybody down, since most people don't have time to be researchers--but the internet has been critical in shedding light into dark corners. If we didn't have it we'd be sunk.

I happen to know someone who was pivotal in the formation of the DLC (an associate who I don't respect) and I also know someone who worked in the Clinton White House (a friend). Let's just say I know a little too much. So although I voted for Bill/Hill--have never been a fan. Their latest attempt to win back the Presidency disgusts me. They should have quit while they were ahead after 2008 failed, made their pile, and moved on to do good works. Their sense of entitlement knows no bounds. If they get in again, may heaven help us.

Great post, thanks.

Octafish

(55,745 posts)Truth is what Democracy needs to survive. Founders understood the concept and put it at the top of the Bill of Rights -- at a time when pens needed to be dipped in ink and pictures were engraved on brass plates for reproduction, one copy at a time.

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the government for a redress of grievances.

That didn't go too well with the conservatives wanted to keep up their banking, pollution and wars for personal profit. So, they worked to turn the watchdogs into lapdogs.

The Powell Memo (also known as the Powell Manifesto)

The Powell Memo was first published August 23, 1971

Introduction

In 1971, Lewis Powell, then a corporate lawyer and member of the boards of 11 corporations, wrote a memo to his friend Eugene Sydnor, Jr., the Director of the U.S. Chamber of Commerce. The memorandum was dated August 23, 1971, two months prior to Powell’s nomination by President Nixon to the U.S. Supreme Court.

The Powell Memo did not become available to the public until long after his confirmation to the Court. It was leaked to Jack Anderson, a liberal syndicated columnist, who stirred interest in the document when he cited it as reason to doubt Powell’s legal objectivity. [font color="green"]Anderson cautioned that Powell “might use his position on the Supreme Court to put his ideas into practice…in behalf of business interests.”[/font color]

Though Powell’s memo was not the sole influence, the Chamber and corporate activists took his advice to heart and began building a powerful array of institutions designed to shift public attitudes and beliefs over the course of years and decades. The memo influenced or inspired the creation of the Heritage Foundation, the Manhattan Institute, the Cato Institute, Citizens for a Sound Economy, Accuracy in Academe, and other powerful organizations. Their long-term focus began paying off handsomely in the 1980s, in coordination with the Reagan Administration’s “hands-off business” philosophy.

Most notable about these institutions was their focus on education, shifting values, and movement-building — a focus we share, though often with sharply contrasting goals.* (See our endnote for more on this.)

So did Powell’s political views influence his judicial decisions? The evidence is mixed. [font color="green"]Powell did embrace expansion of corporate privilege and wrote the majority opinion in First National Bank of Boston v. Bellotti, a 1978 decision that effectively invented a First Amendment “right” for corporations to influence ballot questions.[/font color] On social issues, he was a moderate, whose votes often surprised his backers.

CONTINUED...

http://reclaimdemocracy.org/powell_memo_lewis/

This story continues through today, where we have Chief Justice John Roberts shepherding corporate friendly law through the court, let alone appointing nothing but BFEE-friendly pukes to the FISA Court, and the press working mightily to move on to the next shiny object. Of course, Congress and the Administration do their bit to advance the interests of Corporate America, Wall Street, and War Inc, unchecked by public awareness.

That's where We the People come in, Hell Hath No Fury. We are the ones who must tell the truth -- even when unpleasant -- because it always is needed. Thank you for understanding. Thank you for caring.

mariawr

(348 posts)Octafish

(55,745 posts)On the etymology of "fracking."

The 1993 Philadelphia Inquirer story in the OP names natural gas and mineral extraction as important concerns for Stephens Inc., clients of the Rose Law Firm.

The centerpiece of the family's $1 billion empire is Stephens Inc., one of the largest investment banking firms off Wall Street. In addition to its 38 percent interest in Worthen Bank, the family owns stakes in oil and natural gas, utilities, nursing homes, waste management, diamond mining and hog farming.

-- http://articles.philly.com/1993-01-17/news/25959645_1_worthen-bank-stephens-family-bill-clinton

Mr. Dick Cheney was instrumental in protecting the fracking bidniss:

-- Scientific American, Nov. 2011, "Safety First, Fracking Second"

Don't think he's interested in lifting his foot off the gas, either.

About all that can stop them is democracy. That's where we come in, mariawr. As long as there's two of us left, we got a chance.

felix_numinous

(5,198 posts)Add it to the giant pile so many will not look at, their blinders must weigh a ton by now.

Octafish

(55,745 posts)Seems a certain class of individual gets ahead in Wall Street-on-the-Potomac during times of Austerity, the already wealthy:

Michael Froman and the revolving door

By Felix Salmon December 11, 2009

Michael Froman is one of those behind-the-scenes technocrats who never quite makes it into full public view. But according to Matt Taibbi, he’s one of the most egregious examples — up there with Bob Rubin, literally — we’ve yet seen of the way the revolving door works between business and government generally, and between Citigroup and Treasury in particular.

I’m not sure how much of this information is new, but a lot of it was new to me, especially the bit about Froman “leading the search for the president’s new economic team” — while he was still pulling down a multi-million-dollar salary at Citigroup, no less. Apologies for quoting at length:

Leading the search for the president’s new economic team was his close friend and Harvard Law classmate Michael Froman, a high-ranking executive at Citigroup. During the campaign, Froman had emerged as one of Obama’s biggest fundraisers, bundling $200,000 in contributions and introducing the candidate to a host of heavy hitters — chief among them his mentor Bob Rubin, the former co-chairman of Goldman Sachs who served as Treasury secretary under Bill Clinton. Froman had served as chief of staff to Rubin at Treasury, and had followed his boss when Rubin left the Clinton administration to serve as a senior counselor to Citigroup (a massive new financial conglomerate created by deregulatory moves pushed through by Rubin himself).

Incredibly, Froman did not resign from the bank when he went to work for Obama: He remained in the employ of Citigroup for two more months, even as he helped appoint the very people who would shape the future of his own firm. And to help him pick Obama’s economic team, Froman brought in none other than Jamie Rubin, a former Clinton diplomat who happens to be Bob Rubin’s son. At the time, Jamie’s dad was still earning roughly $15 million a year working for Citigroup, which was in the midst of a collapse brought on in part because Rubin had pushed the bank to invest heavily in mortgage-backed CDOs and other risky instruments…

On November 23rd, 2008, a deal is announced in which the government will bail out Rubin’s messes at Citigroup with a massive buffet of taxpayer-funded cash and guarantees… No Citi executives are replaced, and few restrictions are placed on their compensation. It’s the sweetheart deal of the century, putting generations of working-stiff taxpayers on the hook to pay off Bob Rubin’s fuck-up-rich tenure at Citi. “If you had any doubts at all about the primacy of Wall Street over Main Street,” former labor secretary Robert Reich declares when the bailout is announced, “your doubts should be laid to rest.”

It is bad enough that one of Bob Rubin’s former protégés from the Clinton years, the New York Fed chief Geithner, is intimately involved in the negotiations, which unsurprisingly leave the Federal Reserve massively exposed to future Citi losses. But the real stunner comes only hours after the bailout deal is struck, when the Obama transition team makes a cheerful announcement: Timothy Geithner is going to be Barack Obama’s Treasury secretary!

Geithner, in other words, is hired to head the U.S. Treasury by an executive from Citigroup — Michael Froman — before the ink is even dry on a massive government giveaway to Citigroup that Geithner himself was instrumental in delivering. In the annals of brazen political swindles, this one has to go in the all-time Fuck-the-Optics Hall of Fame.

Wall Street loved the Citi bailout and the Geithner nomination so much that the Dow immediately posted its biggest two-day jump since 1987, rising 11.8 percent. Citi shares jumped 58 percent in a single day, and JP Morgan Chase, Merrill Lynch and Morgan Stanley soared more than 20 percent, as Wall Street embraced the news that the government’s bailout generosity would not die with George W. Bush and Hank Paulson.

How much influence did Froman have over the appointment of Geithner as Treasury secretary? Geithner, who wanted to become Treasury secretary and who as New York Fed president was a central (if not the central) figure in orchestrating the massive Citigroup bailout just after the election, knew what Froman’s job was in the Obama transition team, and knew that Froman was a senior executive at Citigroup.

CONTINUED...

http://blogs.reuters.com/felix-salmon/2009/12/11/michael-froman-and-the-revolving-door/

One person I'd hire is the guy who Iceland hired to help put their banksters behind bars, William K. Black. The forensic economist has a great resume, working for the US Treasury to put the S&L crooks behind bars in the early 90s, but he has not heard from Uncle Sam since, apart from testifying about Control Fraud.

Octafish

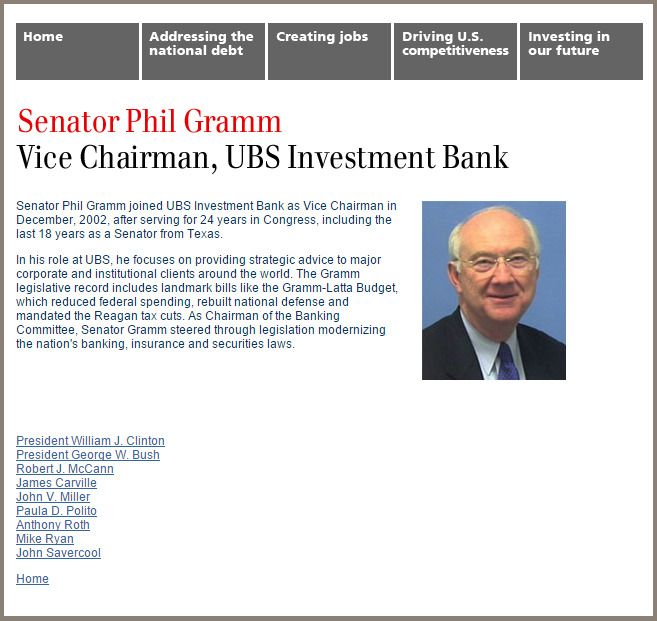

(55,745 posts)Which is especially nice, as her husband worked there with former Sen. Phil Gramm in a spirit of Buy Partisanship. Old news to you, Wilms. A shocker for 99-percent of Americans.

After his exit from the US Senate, Phil Gramm found a job at Swiss bank UBS as vice chairman. He later brought in former President Bill Clinton to the Wealth Management team. What a coincidence, they are the two key figures in repealing Glass-Steagal. Since the New Deal it was the financial regulation that protected the US taxpayer from the Wall Street casino. Oh well, what are a few hundred million in speaking fees compared to a $16 trillion bailout among friends?

It's a Buy-Partisan Who's Who:

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

One of my attorney chums doesn't like to see his name on any committees, event letterhead or political campaign literature. These folks, it seems to me, are past caring.

Some of why DUers and ALL voters should care about Phil Gramm.

The fact the nation's "news media" don't bring this up AT ALL should be of great concern to all who care about Democracy.

BernieforPres2016

(3,017 posts)But they didn't show up until after that story when the Clintons finally released their tax returns from the 1980's. One of those tax returns revealed that Hillary had somehow magically turned $1000 into over $80,000 in a few months "trading commodities", then closed the account, withdrew the money and never traded again. And for many of the alleged trades, Hillary's account didn't have enough money in it to meet the margin requirement to make the trade. In those days, there was an easy way to make that work. Put in a written trade ticket with the account number blank. If the trade becomes profitable, put Hillary's account number on it after the fact. In the trade is a loser, fill in the account number of the person who had agreed to kick money to her.

Octafish

(55,745 posts)By Angie Cannon, Frank Greve

Knight-Ridder Newspapers: AP: Washington Post: Los Angeles Times: Newsday

WASHINGTON - The disclosure that Hillary Rodham Clinton parlayed $1,000 into nearly $100,000 through highly speculative commodities trading may create political embarrassment for the Clintons, who have sharply criticized a national culture of greed during the Reagan and Bush years in the White House.

But the information released yesterday by the White House covering investments in 1978 and 1979 also appears to support the couple's contention that they had done nothing illegal or unethical in the trades.

As a presidential candidate, Bill Clinton had decried the speculative wealth-building of the rich during the Reagan and Bush years as "a gilded age of greed and selfishness, of irresponsibility and excess and of neglect."

Mrs. Clinton, whose commodity trading came during the early years of her husband's political career and before Ronald Reagan was elected president, was guided through the risky trades by James Blair, a friend and top lawyer for one of Arkansas' most powerful companies, Tyson Foods Inc. She also "talked to other people" and read the Wall Street Journal to research her trades, a White House official said yesterday.

Commodities trading, which involves anticipating the future value of a commodity, is done on margin - meaning that it takes only a small amount of money to control a large contract. Mrs. Clinton made dramatic gains by investing in live cattle futures, which are contracts linked to an anticipated future value of 40,000 pounds of slaughter-ready beef cattle.

CONTINUED...

http://community.seattletimes.nwsource.com/archive/?date=19940330&slug=1902853

PS: A truly amazing amount of money. Takes me five years of digging ditches to earn it.

Trust Buster

(7,299 posts)Then reality struck him. Outside special interests were planning on spending up to a billion dollars to beat him. Those are the rules of the road as dictated by the Citizens United decision. Therefore, President Obama had no choice but to reverse course and accept Super PAC support. I want the Democratic nominee to match the Republican nominee dollar for dollar in the upcoming election. Being penny wise and pound foolish at this point in time would be counterproductive. If the money flowing to the Republican nominee propels him to victory, than a Right leaning Supreme Court will cement Citizens United into our political system for a generation.

Octafish

(55,745 posts)by Matt Taibbi

EXCERPT...

How did we get here? It started just moments after the election - and almost nobody noticed.

'Just look at the timeline of the Citigroup deal," says one leading Democratic consultant. "Just look at it. It's fucking amazing. Amazing! And nobody said a thing about it."

Barack Obama was still just the president-elect when it happened, but the revolting and inexcusable $306 billion bailout that Citigroup received was the first major act of his presidency. In order to grasp the full horror of what took place, however, one needs to go back a few weeks before the actual bailout - to November 5th, 2008, the day after Obama's election.

That was the day the jubilant Obama campaign announced its transition team. Though many of the names were familiar - former Bill Clinton chief of staff John Podesta, long-time Obama confidante Valerie Jarrett - the list was most notable for who was not on it, especially on the economic side. Austan Goolsbee, a University of Chicago economist who had served as one of Obama's chief advisers during the campaign, didn't make the cut. Neither did Karen Kornbluh, who had served as Obama's policy director and was instrumental in crafting the Democratic Party's platform. Both had emphasized populist themes during the campaign: Kornbluh was known for pushing Democrats to focus on the plight of the poor and middle class, while Goolsbee was an aggressive critic of Wall Street, declaring that AIG executives should receive "a Nobel Prize - for evil."

But come November 5th, both were banished from Obama's inner circle - and replaced with a group of Wall Street bankers. Leading the search for the president's new economic team was his close friend and Harvard Law classmate Michael Froman, a high-ranking executive at Citigroup. During the campaign, Froman had emerged as one of Obama's biggest fundraisers, bundling $200,000 in contributions and introducing the candidate to a host of heavy hitters - chief among them his mentor Bob Rubin, the former co-chairman of Goldman Sachs who served as Treasury secretary under Bill Clinton. Froman had served as chief of staff to Rubin at Treasury, and had followed his boss when Rubin left the Clinton administration to serve as a senior counselor to Citigroup (a massive new financial conglomerate created by deregulatory moves pushed through by Rubin himself).

Incredibly, Froman did not resign from the bank when he went to work for Obama: He remained in the employ of Citigroup for two more months, even as he helped appoint the very people who would shape the future of his own firm. And to help him pick Obama's economic team, Froman brought in none other than Jamie Rubin who happens to be Bob Rubin's son. At the time, Jamie's dad was still earning roughly $15 million a year working for Citigroup, which was in the midst of a collapse brought on in part because Rubin had pushed the bank to invest heavily in mortgage-backed CDOs and other risky instruments.

CONTINUED...

http://www.commondreams.org/news/2009/12/13/obamas-big-sellout-president-has-packed-his-economic-team-wall-street-insiders

NCjack

(10,297 posts)that is where the money is. That's why the Clintons are who they are, instead of being like the Carters, who are national treasures.

Octafish

(55,745 posts)Where the money is.

How Corrupt Is the American Government?

See For Yourself

Posted on January 5, 2016 by WashingtonsBlog

Government corruption has become rampant:

Senior SEC employees spent up to 8 hours a day surfing porn sites instead of cracking down on financial crimes

Nuclear Regulatory Commission workers watch porn instead of cracking down on unsafe conditions at nuclear plants

SNIP...

A high-level Federal Reserve official says quantitative easing is “the greatest backdoor Wall Street bailout of all time”

SNIP...

Congress recently told the courts that Congress can’t be investigated for insider trading

SNIP...

The Bush White House worked hard to smear CIA officers, bloggers and anyone else who criticized the Iraq war

CONTINUED...

http://www.washingtonsblog.com/2016/01/corrupt-american-government.html

tex-wyo-dem

(3,190 posts)Thanks, Octafish!

Octafish

(55,745 posts)Seems our CIA handlers know a good thing for population control when they see one:

The author was a Chicago Boy helping implement the scam for Pinochet:

President Clinton and the Chilean Model.

By José Piñera

Midnight at the House of Good and Evil

"It is 12:30 at night, and Bill Clinton asks me and Dottie: 'What do you know about the Chilean social-security system?'” recounted Richard Lamm, the three-term former governor of Colorado. It was March 1995, and Lamm and his wife were staying that weekend in the Lincoln Bedroom of the White House.

I read about this surprising midnight conversation in an article by Jonathan Alter (Newsweek, May 13, 1996), as I was waiting at Dulles International Airport for a flight to Europe. The article also said that early the next morning, before he left to go jogging, President Bill Clinton arranged for a special report about the Chilean reform produced by his staff to be slipped under Lamm's door.

That news piqued my interest, so as soon as I came back to the United States, I went to visit Richard Lamm. I wanted to know the exact circumstances in which the president of the world’s superpower engages a fellow former governor in a Saturday night exchange about the system I had implemented 15 years earlier.

Lamn and I shared a coffee on the terrace of his house in Denver. He not only was the most genial host to this curious Chilean, but he also proved to be deeply motivated by the issues surrounding aging and the future of America. So we had an engaging conversation. At the conclusion, I ventured to ask him for a copy of the report that Clinton had given him. He agreed to give it to me on the condition that I do not make it public while Clinton was president. He also gave me a copy of the handwritten note on White House stationery, dated 3-21-95, which accompanied the report slipped under his door. It read:

Dick,

Sorry I missed you this morning.

It was great to have you and Dottie here.

Here's the stuff on Chile I mentioned.

Best,

Bill.

Three months before that Clinton-Lamm conversation about the Chilean system, I had a long lunch in Santiago with journalist Joe Klein of Newsweek magazine. A few weeks afterwards, he wrote a compelling article entitled,[font color="green"] "If Chile can do it...couldn´t North America privatize its social-security system?" [/font color]He concluded by stating that "the Chilean system is perhaps the first significant social-policy idea to emanate from the Southern Hemisphere." (Newsweek, December 12, 1994).

I have reasons to think that probably this piece got Clinton’s attention and, given his passion for policy issues, he became a quasi expert on Chile’s Social Security reform. Clinton was familiar with Klein, as the journalist covered the 1992 presidential race and went on anonymously to write the bestseller Primary Colors, a thinly-veiled account of Clinton’s campaign.

“The mother of all reforms”

While studying for a Masters and a Ph.D. in economics at Harvard University, I became enamored with America’s unique experiment in liberty and limited government. In 1835 Alexis de Tocqueville wrote the first volume of Democracy in America hoping that many of the salutary aspects of American society might be exported to his native France. I dreamed with exporting them to my native Chile.

So, upon finishing my Ph.D. in 1974 and while fully enjoying my position as a Teaching Fellow at Harvard University and a professor at Boston University, I took on the most difficult decision in my life: to go back to help my country rebuild its destroyed economy and democracy along the lines of the principles and institutions created in America by the Founding Fathers. Soon after I became Secretary of Labor and Social Security, and in 1980 I was able to create a fully funded system of personal retirement accounts. Historian Niall Ferguson has stated that this reform was “the most profound challenge to the welfare state in a generation. Thatcher and Reagan came later. The backlash against welfare started in Chile.”

But while de Tocqueville’s 1835 treatment contained largely effusive praise of American government, the second volume of Democracy in America, published five years later, strikes a more cautionary tone. He warned that “the American Republic will endure, until politicians realize they can bribe the people with their own money.” In fact at some point during the 20th century, the culture of self reliance and individual responsibility that had made America a great and free nation was diluted by the creation of [font color="green"] “an Entitlement State,”[/font color] reminiscent of the increasingly failed European welfare state. What America needed was a return to basics, to the founding tenets of limited government and personal responsibility.

[font color="green"]In a way, the principles America helped export so successfully to Chile through a group of free market economists needed to be reaffirmed through an emblematic reform. I felt that the Chilean solution to the impending Social Security crisis could be applied in the USA.[/font color]

CONTINUED...

http://www.josepinera.org/articles/articles_clinton_chilean_model.htm

We the People shouldn't be "managed" -- most especially not by the government we elect to represent us.

mariawr

(348 posts)Octafish

(55,745 posts)Libya has oil. Lots of oil.

"Libya has some of the biggest and most proven oil reserves — 43.6 billion barrels — outside Saudi Arabia, and some of the best drilling prospects."

http://www.medialens.org/index.php/component/acymailing/archive/view/listid-3-alerts-precis/mailid-74-three-little-words-wikileaks-libya-oil.html

Mohammad Gaddafi shared the oil wealth with the Libyan people, not just the one-percent Wall Street types.

For over four decades, Gaddafi promoted economic democracy and used the nationalized oil wealth to sustain progressive social welfare programs for all Libyans. Under Gaddafi’s rule, Libyans enjoyed not only free health-care and free education, but also free electricity and interest-free loans. Now thanks to NATO’s intervention the health-care sector is on the verge of collapse as thousands of Filipino health workers flee the country, institutions of higher education across the East of the country are shut down, and black outs are a common occurrence in once thriving Tripoli.

-- http://www.globalresearch.ca/libya-from-africas-wealthiest-democracy-under-gaddafi-to-us-nato-sponsored-terrorist-haven/5482974

While little reported in the USA, Libya's former leader also used the wealth to better life throughout the poorest nations of Africa.

In 2010 Gaddafi offered to invest $97 billion in Africa to free it from Western influence, on condition that African states rid themselves of corruption and nepotism. Gaddafi always dreamed of a Developed, United Africa and was about to make that dream come true - and nothing is more terrifying to the West than a Developed, United Africa.

-- http://www.reunionblackfamily.com/apps/blog/show/7869956-war-on-libya-is-war-on-entire-africa-

Wall Street-on-the-Potomac prefers to do business with those it can relate to: greedy types.

antigop

(12,778 posts)ibegurpard

(17,077 posts)That 3rd-way Dems use to define the party would be on the table if there was a chance that serious money was at stake. You can take that to the fucking bank.

Avalon Sparks

(2,746 posts)Octafish

(55,745 posts)...Here's some of what she's done closer to that time:

UBS is a Swiss bank that is enjoying better days, thanks to the US taxpayer and a number of key US political leaders.

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

About UBS Wealth Management

It's Buy Partisan

After his exit from the US Senate, Phil Gramm found a job at Swiss bank UBS as vice chairman. He later brought on former President Bill Clinton. What a coincidence, they are the two key figures in repealing Glass-Steagal. Since the New Deal it was the financial regulation that protected the US taxpayer from the Wall Street casino. Oh well, what's a $16 trillion bailout among friends?

It's a Buy-Partisan Who's Who:

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

One of my attorney chums doesn't like to see his name on any committees, event letterhead or political campaign literature. These folks, it seems to me, are past caring.

Some of why DUers and ALL voters should care about Phil Gramm.

Until the Panama Papers, the nation's "news media" didn't much follow this story. Thanks for asking, DanTex!