Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Crewleader

Crewleader's Journal

Crewleader's Journal

March 28, 2014

With global bank profits soaring near all-time highs, today the top trends forecaster in the world spoke with King World News about banker suicides, cover-ups, and a criminal syndicate of banks. Celente warned the suicides and criminal activities are a “recipe for disaster.” Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this powerful interview.

Celente: “The only reason we are having a recovery of any sort is because of the unprecedented tens of trillions of dollars, pounds, euros, yen, and yuan being dumped into the system. And now with interest rates going up there is a lot of fear out there....

Continue reading the Gerald Celente interview below...

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/27_Banker_Suicides%2C_Cover-Ups_%26_A_Criminal_Syndicate_Of_Banks.html

Banker Suicides, Cover-Ups & A Criminal Syndicate Of Banks

March 27, 2014With global bank profits soaring near all-time highs, today the top trends forecaster in the world spoke with King World News about banker suicides, cover-ups, and a criminal syndicate of banks. Celente warned the suicides and criminal activities are a “recipe for disaster.” Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this powerful interview.

Celente: “The only reason we are having a recovery of any sort is because of the unprecedented tens of trillions of dollars, pounds, euros, yen, and yuan being dumped into the system. And now with interest rates going up there is a lot of fear out there....

Continue reading the Gerald Celente interview below...

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/27_Banker_Suicides%2C_Cover-Ups_%26_A_Criminal_Syndicate_Of_Banks.html

March 27, 2014

Government Backing for Toxic Mortgage Securities?

The Economic Scam of the Century

by Mike Whitney

The leaders of the U.S. Senate Banking Committee, Sen. Tim Johnson (D., S.D.) and Sen. Mike Crapo (R., Idaho), released a draft bill on Sunday that would provide explicit government guarantees on mortgage-backed securities (MBS) generated by privately-owned banks and financial institutions. The gigantic giveaway to Wall Street would put US taxpayers on the hook for 90 percent of the losses on toxic MBS the likes of which crashed the financial system in 2008 plunging the economy into the deepest slump since the Great Depression. Proponents of the bill say that new rules by the Consumer Financial Protection Bureau (CFPB) –which set standards for a “qualified mortgage” (QM)– assure that borrowers will be able to repay their loans thus reducing the chances of a similar meltdown in the future. However, those QE rules were largely shaped by lobbyists and attorneys from the banking industry who eviscerated strict underwriting requirements– like high FICO scores and 20 percent down payments– in order to lend freely to borrowers who may be less able to repay their loans. Additionally, a particularly lethal clause has been inserted into the bill that would provide blanket coverage for all MBS (whether they met the CFPB’s QE standard or not) in the event of another financial crisis. Here’s the paragraph:

“Sec.305. Authority to protect taxpayers in unusual and exigent market conditions….

If the Corporation, the Chairman of the Federal Reserve Board of Governors and the Secretary of the Treasury, in consultation with the Secretary of Housing and Urban Development, determine that unusual and exigent circumstances threaten mortgage credit availability within the U.S. housing market, FMIC may provide insurance on covered securities that do not meet the requirements under section 302 including those for first loss position of private market holders.” (“Freddie And Fannie Reform – The Monster Has Arrived”, Zero Hedge)

In other words, if the bill passes, US taxpayers will be responsible for any and all bailouts deemed necessary by the regulators mentioned above. And, since all of those regulators are in Wall Street’s hip-pocket, there’s no question what they’ll do when the time comes. They’ll bailout they’re fatcat buddies and dump the losses on John Q. Public.

If you can’t believe what you are reading or if you think that the system is so thoroughly corrupt it can’t be fixed; you’re not alone. This latest outrage just confirms that the Congress, the executive and all the chief regulators are mere marionettes performing whatever task is asked of them by their Wall Street paymasters.

http://www.counterpunch.org/2014/03/26/the-economic-scam-of-the-century/

The Economic Scam of the Century by Mike Whitney

March 26, 2014Government Backing for Toxic Mortgage Securities?

The Economic Scam of the Century

by Mike Whitney

The leaders of the U.S. Senate Banking Committee, Sen. Tim Johnson (D., S.D.) and Sen. Mike Crapo (R., Idaho), released a draft bill on Sunday that would provide explicit government guarantees on mortgage-backed securities (MBS) generated by privately-owned banks and financial institutions. The gigantic giveaway to Wall Street would put US taxpayers on the hook for 90 percent of the losses on toxic MBS the likes of which crashed the financial system in 2008 plunging the economy into the deepest slump since the Great Depression. Proponents of the bill say that new rules by the Consumer Financial Protection Bureau (CFPB) –which set standards for a “qualified mortgage” (QM)– assure that borrowers will be able to repay their loans thus reducing the chances of a similar meltdown in the future. However, those QE rules were largely shaped by lobbyists and attorneys from the banking industry who eviscerated strict underwriting requirements– like high FICO scores and 20 percent down payments– in order to lend freely to borrowers who may be less able to repay their loans. Additionally, a particularly lethal clause has been inserted into the bill that would provide blanket coverage for all MBS (whether they met the CFPB’s QE standard or not) in the event of another financial crisis. Here’s the paragraph:

“Sec.305. Authority to protect taxpayers in unusual and exigent market conditions….

If the Corporation, the Chairman of the Federal Reserve Board of Governors and the Secretary of the Treasury, in consultation with the Secretary of Housing and Urban Development, determine that unusual and exigent circumstances threaten mortgage credit availability within the U.S. housing market, FMIC may provide insurance on covered securities that do not meet the requirements under section 302 including those for first loss position of private market holders.” (“Freddie And Fannie Reform – The Monster Has Arrived”, Zero Hedge)

In other words, if the bill passes, US taxpayers will be responsible for any and all bailouts deemed necessary by the regulators mentioned above. And, since all of those regulators are in Wall Street’s hip-pocket, there’s no question what they’ll do when the time comes. They’ll bailout they’re fatcat buddies and dump the losses on John Q. Public.

If you can’t believe what you are reading or if you think that the system is so thoroughly corrupt it can’t be fixed; you’re not alone. This latest outrage just confirms that the Congress, the executive and all the chief regulators are mere marionettes performing whatever task is asked of them by their Wall Street paymasters.

http://www.counterpunch.org/2014/03/26/the-economic-scam-of-the-century/

March 27, 2014

by Robert Reich

Charles and David Koch should not be blamed for having more wealth than the bottom 40 percent of Americans put together. Nor should they be condemned for their petrochemical empire. As far as I know, they’ve played by the rules and obeyed the laws.

They’re also entitled to their own right-wing political views. It’s a free country.

But in using their vast wealth to change those rules and laws in order to fit their political views, the Koch brothers are undermining our democracy. That’s a betrayal of the most precious thing Americans share.

The Kochs exemplify a new reality that strikes at the heart of America. The vast wealth that has accumulated at the top of the American economy is not itself the problem. The problem is that political power tends to rise to where the money is. And this combination of great wealth with political power leads to greater and greater accumulations and concentrations of both — tilting the playing field in favor of the Kochs and their ilk, and against the rest of us.

http://robertreich.org/post/80717261549

The New Billionaire Political Bosses

Tuesday, March 25, 2014by Robert Reich

Charles and David Koch should not be blamed for having more wealth than the bottom 40 percent of Americans put together. Nor should they be condemned for their petrochemical empire. As far as I know, they’ve played by the rules and obeyed the laws.

They’re also entitled to their own right-wing political views. It’s a free country.

But in using their vast wealth to change those rules and laws in order to fit their political views, the Koch brothers are undermining our democracy. That’s a betrayal of the most precious thing Americans share.

The Kochs exemplify a new reality that strikes at the heart of America. The vast wealth that has accumulated at the top of the American economy is not itself the problem. The problem is that political power tends to rise to where the money is. And this combination of great wealth with political power leads to greater and greater accumulations and concentrations of both — tilting the playing field in favor of the Kochs and their ilk, and against the rest of us.

http://robertreich.org/post/80717261549

March 24, 2014

Sunday, March 23, 2014

We are witnessing a reversion to tribalism around the world, away from nation states. The the same pattern can be seen even in America – especially in American politics.

Before the rise of the nation-state, between the eighteenth and twentieth centuries, the world was mostly tribal. Tribes were united by language, religion, blood, and belief. They feared other tribes and often warred against them. Kings and emperors imposed temporary truces, at most.

But in the past three hundred years the idea of nationhood took root in most of the world. Members of tribes started to become citizens, viewing themselves as a single people with patriotic sentiments and duties toward their homeland. Although nationalism never fully supplanted tribalism in some former colonial territories, the transition from tribe to nation was mostly completed by the mid twentieth century.

Over the last several decades, though, technology has whittled away the underpinnings of the nation state. National economies have become so intertwined that economic security depends less on national armies than on financial transactions around the world. Global corporations play nations off against each other to get the best deals on taxes and regulations.

http://robertreich.org/post/80522686347

The New Tribalism by Robert Reich

The New TribalismSunday, March 23, 2014

We are witnessing a reversion to tribalism around the world, away from nation states. The the same pattern can be seen even in America – especially in American politics.

Before the rise of the nation-state, between the eighteenth and twentieth centuries, the world was mostly tribal. Tribes were united by language, religion, blood, and belief. They feared other tribes and often warred against them. Kings and emperors imposed temporary truces, at most.

But in the past three hundred years the idea of nationhood took root in most of the world. Members of tribes started to become citizens, viewing themselves as a single people with patriotic sentiments and duties toward their homeland. Although nationalism never fully supplanted tribalism in some former colonial territories, the transition from tribe to nation was mostly completed by the mid twentieth century.

Over the last several decades, though, technology has whittled away the underpinnings of the nation state. National economies have become so intertwined that economic security depends less on national armies than on financial transactions around the world. Global corporations play nations off against each other to get the best deals on taxes and regulations.

http://robertreich.org/post/80522686347

March 24, 2014

Baby boomers are one of the largest home owners in California. They are also the largest mortgage holders since Californians love using their properties as a virtual ATMs. As time is moving by we are seeing a clash of generations when it comes to buying a home. The days of working at one company for 30 or more years is really a relic of the baby boomer past. Many baby boomers are also seeing their offspring coming back home with student loan debt that already rivals that of a mortgage in other parts of the country. Yet in many cases, their kids are happy and well rounded. I know many offspring of baby boomers and many have no intention of buying. They place a higher value on location, mobility, and having free cash to travel with close friends. The data also shows that the family unit is becoming much smaller and many are opting to have one or no kids. Why the need for a 3/2 then? This isn’t the 1960s where bigger households were common and one income was enough to live a middle class lifestyle. Yet some boomers are trying to assist their kids in buying their first home and in expensive areas, the passing of wealth is occurring in ways that may not be typical.

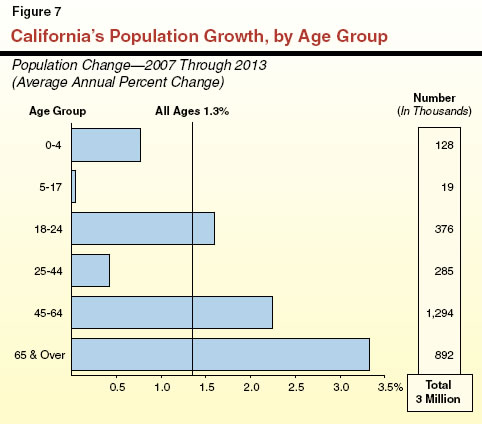

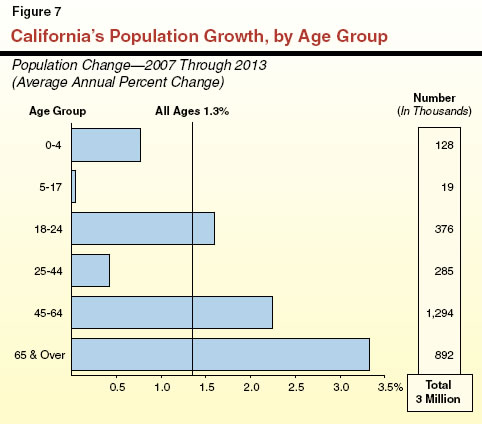

California’s aging population

For many baby boomers, they came of age when the dollar had maximum power and for the most part, housing was affordable across the state. Keep in mind that the California Association of Realtors has an affordability metric that now shows that only one out of three families in the state can actually afford to buy a home at current income and price levels. They factor in mortgage rates into their equation and it isn’t like the C.A.R. is anti-housing.

The fastest growing age group in California is coming from baby boomers:

http://www.doctorhousingbubble.com/baby-boomers-value-real-estate-much-higher-than-their-offspring-baby-boomer-real-estate-buying/

Dr. Housing Bubble 03/24/14

Baby boomers value real estate much higher than their offspring: 6 ways traditional buyers are entering high priced markets with the assistance of baby boomer parents.Baby boomers are one of the largest home owners in California. They are also the largest mortgage holders since Californians love using their properties as a virtual ATMs. As time is moving by we are seeing a clash of generations when it comes to buying a home. The days of working at one company for 30 or more years is really a relic of the baby boomer past. Many baby boomers are also seeing their offspring coming back home with student loan debt that already rivals that of a mortgage in other parts of the country. Yet in many cases, their kids are happy and well rounded. I know many offspring of baby boomers and many have no intention of buying. They place a higher value on location, mobility, and having free cash to travel with close friends. The data also shows that the family unit is becoming much smaller and many are opting to have one or no kids. Why the need for a 3/2 then? This isn’t the 1960s where bigger households were common and one income was enough to live a middle class lifestyle. Yet some boomers are trying to assist their kids in buying their first home and in expensive areas, the passing of wealth is occurring in ways that may not be typical.

California’s aging population

For many baby boomers, they came of age when the dollar had maximum power and for the most part, housing was affordable across the state. Keep in mind that the California Association of Realtors has an affordability metric that now shows that only one out of three families in the state can actually afford to buy a home at current income and price levels. They factor in mortgage rates into their equation and it isn’t like the C.A.R. is anti-housing.

The fastest growing age group in California is coming from baby boomers:

http://www.doctorhousingbubble.com/baby-boomers-value-real-estate-much-higher-than-their-offspring-baby-boomer-real-estate-buying/

March 23, 2014

Unbelievable

Housing: One Chart Says it All

by MIKE WHITNEY

Get a load of this chart from DataQuick’s National Home Sales Snapshot. It’ll tell you everything need to know about housing.

(Note: MSA=metropolitan statistical area)

As you can see, prices are flatlining or drifting lower while sales are sinking like a stone. That’s the whole ball of wax, isn’t it?

Sure, sales will increase in the spring (as they always do), but judging by the sharp dropoff in last year’s hottest markets, this could be the crappiest spring selling season since the crash.

Why?

Because prices are too high, rates are too high, “organic” demand is too weak, credit is too tight, and the pool of potential buyers has shrunk to the size of a walnut, that’s why.

The banks have reduced the percentage of distressed homes (foreclosures and short sales) on the market to roughly 11 percent from 59 percent in 2009. Fewer distressed homes mean higher prices, but higher prices mean fewer sales. It’s a trade-off. The banks get their money, but the market goes to hell. That’s how it works. According to most estimates, there are roughly 4.5 million homes in some stage of foreclosure. That means that –at the present pace–we should get through this Housing Depression a few weeks before Judgment Day. But don’t hold me to that.

Did you catch this gem on Bloomberg last week? It’s about the big private equity guys exiting the market. Take a look:

http://www.counterpunch.org/2014/03/21/housing-one-chart-says-it-all/

Housing: One Chart Says it All by Mike Whitney

Weekend Edition March 21-23, 2014Unbelievable

Housing: One Chart Says it All

by MIKE WHITNEY

Get a load of this chart from DataQuick’s National Home Sales Snapshot. It’ll tell you everything need to know about housing.

(Note: MSA=metropolitan statistical area)

As you can see, prices are flatlining or drifting lower while sales are sinking like a stone. That’s the whole ball of wax, isn’t it?

Sure, sales will increase in the spring (as they always do), but judging by the sharp dropoff in last year’s hottest markets, this could be the crappiest spring selling season since the crash.

Why?

Because prices are too high, rates are too high, “organic” demand is too weak, credit is too tight, and the pool of potential buyers has shrunk to the size of a walnut, that’s why.

The banks have reduced the percentage of distressed homes (foreclosures and short sales) on the market to roughly 11 percent from 59 percent in 2009. Fewer distressed homes mean higher prices, but higher prices mean fewer sales. It’s a trade-off. The banks get their money, but the market goes to hell. That’s how it works. According to most estimates, there are roughly 4.5 million homes in some stage of foreclosure. That means that –at the present pace–we should get through this Housing Depression a few weeks before Judgment Day. But don’t hold me to that.

Did you catch this gem on Bloomberg last week? It’s about the big private equity guys exiting the market. Take a look:

http://www.counterpunch.org/2014/03/21/housing-one-chart-says-it-all/

March 23, 2014

A Aries I am

Truly.....![]()

You are adventurous, active and outgoing. Like the charecteristics of the Aries (born between 20 March – 20 April), you are impulsive, which is why your life is often filled with drama. Your ability to live life close to the edge provides you with a wealth of hands-on experience and a lust for life. If you're not an Aries, you should have been!

March 17, 2014

You can’t stop the internet when it comes to real estate data. Zillow is a great example of technology revolutionizing the way people view real estate. Some of you are old enough to remember when the closely guarded MLS was only accessible by your local real estate agent. Unless you were ready to do some digging, finding out what a home sold for took a bit of time. It was also hard to view a list of available homes for sale. That is no longer the case. When Zillow initially came out the housing bubble was still raging. My initial thought was that access to information would only serve to create bigger booms and deeper busts. Keep in mind that the entire housing system is still built upon the appraisal system. Basically each home is only as good as the last few sales. When a market is booming and people are now able to see the boom in real time the temptation to buy can ramp up. When the boom bursts as it did in 2008, you can also see how quickly things will reverse. Things are already slowing down and sales are dropping dramatically in some areas. Does access to data liberate us from the old model of buying and selling real estate?

The real estate information revolution

I love digging around in the housing data. Real estate by far is going to be the biggest purchase most Americans will ever make. In the past, this big buying decision was usually entrusted to those in the industry. It made sense if the only folks with access to the MLS were real estate agents. They held all the cards. Most people had no idea what homes were for sale until an agent drove them around to view target properties. Now, open houses are posted online and many people arrive agent free.

People are still irrational and that is why markets boom and bust. People had access to great information before the tech meltdown in the early 2000s. Zillow was around in 2006 yet the housing market had its first ever nationwide meltdown starting late in 2007 when data started becoming readily available to all. The housing market has become a speculative asset class that captures the attention of the masses. Entire mythologies are built around real estate. Confirmation bias is extreme in the industry even though we have witnessed 7,000,000 foreclosures since this crisis hit.

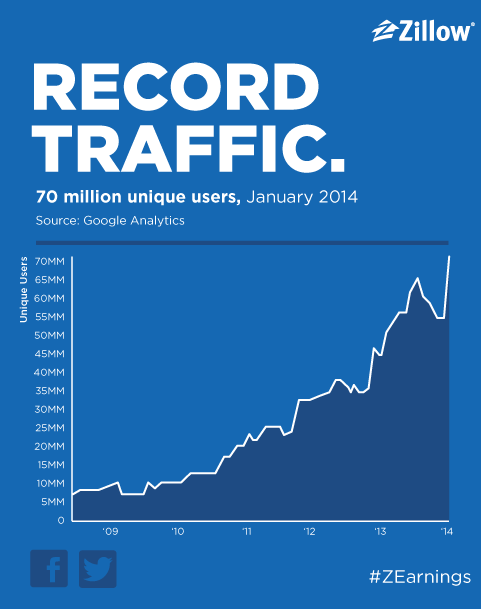

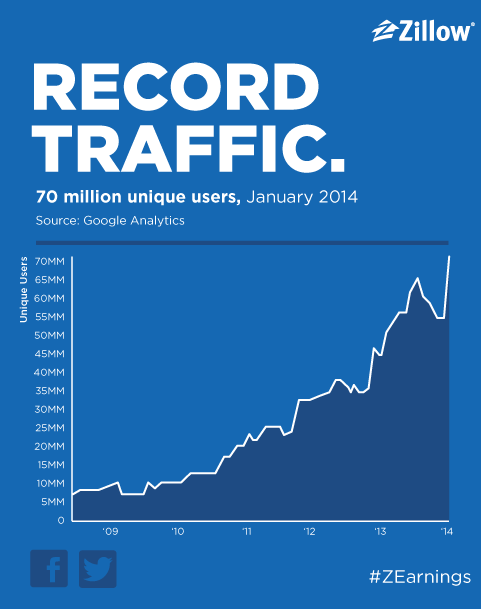

The appetite for real estate information is insatiable:

Zillow put out this chart showing the visitors to their site. Back in 2009 Zillow was getting about 5 million unique visitors per month. Today that number is up to 70 million. This is a massive number of people going to a site dedicated to real estate data.

http://www.doctorhousingbubble.com/real-estate-data-liberation-of-housing-search-sites-mls-data/

Dr. Housing Bubble 03/17/14

The liberation of real estate data: does having readily available real estate information encourage the boom and bust cycle? Zillow reaches 70 million unique users per month.You can’t stop the internet when it comes to real estate data. Zillow is a great example of technology revolutionizing the way people view real estate. Some of you are old enough to remember when the closely guarded MLS was only accessible by your local real estate agent. Unless you were ready to do some digging, finding out what a home sold for took a bit of time. It was also hard to view a list of available homes for sale. That is no longer the case. When Zillow initially came out the housing bubble was still raging. My initial thought was that access to information would only serve to create bigger booms and deeper busts. Keep in mind that the entire housing system is still built upon the appraisal system. Basically each home is only as good as the last few sales. When a market is booming and people are now able to see the boom in real time the temptation to buy can ramp up. When the boom bursts as it did in 2008, you can also see how quickly things will reverse. Things are already slowing down and sales are dropping dramatically in some areas. Does access to data liberate us from the old model of buying and selling real estate?

The real estate information revolution

I love digging around in the housing data. Real estate by far is going to be the biggest purchase most Americans will ever make. In the past, this big buying decision was usually entrusted to those in the industry. It made sense if the only folks with access to the MLS were real estate agents. They held all the cards. Most people had no idea what homes were for sale until an agent drove them around to view target properties. Now, open houses are posted online and many people arrive agent free.

People are still irrational and that is why markets boom and bust. People had access to great information before the tech meltdown in the early 2000s. Zillow was around in 2006 yet the housing market had its first ever nationwide meltdown starting late in 2007 when data started becoming readily available to all. The housing market has become a speculative asset class that captures the attention of the masses. Entire mythologies are built around real estate. Confirmation bias is extreme in the industry even though we have witnessed 7,000,000 foreclosures since this crisis hit.

The appetite for real estate information is insatiable:

Zillow put out this chart showing the visitors to their site. Back in 2009 Zillow was getting about 5 million unique visitors per month. Today that number is up to 70 million. This is a massive number of people going to a site dedicated to real estate data.

http://www.doctorhousingbubble.com/real-estate-data-liberation-of-housing-search-sites-mls-data/

March 16, 2014

By Robert Reich

It’s often assumed that people are paid what they’re worth. According to this logic, minimum wage workers aren’t worth more than the $7.25 an hour they now receive. If they were worth more, they’d earn more. Any attempt to force employers to pay them more will only kill jobs.

According to this same logic, CEOs of big companies are worth their giant compensation packages, now averaging 300 times pay of the typical American worker. They must be worth it or they wouldn’t be paid this much. Any attempt to limit their pay is fruitless because their pay will only take some other form.

"Paid-what-you’re-worth" is a dangerous myth.

Fifty years ago, when General Motors was the largest employer in America, the typical GM worker got paid $35 an hour in today’s dollars. Today, America’s largest employer is Walmart, and the typical Walmart workers earns $8.80 an hour.

http://robertreich.org/post/79512527145

The “Paid-What-You’re-Worth” Myth

Thursday, March 13, 2014By Robert Reich

It’s often assumed that people are paid what they’re worth. According to this logic, minimum wage workers aren’t worth more than the $7.25 an hour they now receive. If they were worth more, they’d earn more. Any attempt to force employers to pay them more will only kill jobs.

According to this same logic, CEOs of big companies are worth their giant compensation packages, now averaging 300 times pay of the typical American worker. They must be worth it or they wouldn’t be paid this much. Any attempt to limit their pay is fruitless because their pay will only take some other form.

"Paid-what-you’re-worth" is a dangerous myth.

Fifty years ago, when General Motors was the largest employer in America, the typical GM worker got paid $35 an hour in today’s dollars. Today, America’s largest employer is Walmart, and the typical Walmart workers earns $8.80 an hour.

http://robertreich.org/post/79512527145

Profile Information

Gender: FemaleCurrent location: Florida

Member since: 2001

Number of posts: 17,005