Octafish

Octafish's JournalAttorney General Robert F. Kennedy believed President Kennedy was killed by a conspiracy.

That's what his son and daughter, Robert F. Kennedy, Jr. and Rory Kennedy, reported in an interview with Charlie Rose last weekend in Dallas.

It's also what author and Salon founder David Talbot reported, when he called Robert F. Kennedy the "first conspiracy theorist" in 2007.

Here's why the news from Robert and Rory is so important:

RFK called the Warren Commission report "shoddy workmanship."

Attorney General Kennedy knew about the Ruby-Mafia connections immediately, which is vital when considering the Mafia were hired by Allen Dulles and the CIA during Eisenhower's administration to murder Fidel Castro -- an operation which the CIA failed to inform the president and attorney general.

The interview with Charlie Rose marked the first time members of the immediate Kennedy family have voiced the attorney general's doubts about the Warren Commission and its lone gunman theory.

Those are the facts we learned Friday, Jan. 11, 2013. It's called history.

Would that I knew, Downwinder.

Washington's Blog does remind us about who foamed the runway:

Proof Positive that Government’s “Homeowner Relief” Programs Are Disguised Bank Bailouts … Not Even AIMED at Helping Homeowners

Posted on August 16, 2012 by WashingtonsBlog

Government Was Just Trying to “Foam the Runway” to Help Giant Banks

We pointed out last year:

Huffington Post notes, in a story entitled “New Obama Foreclosure Plan Helps Banks At Taxpayers’ Expense “:

A key new condition in the plan would shift the financial liability for refinanced loans from Wall Street banks to the American taxpayer.

***

The newly expanded program would expunge legal liabilities associated with mortgages refinanced through the program for the original lenders of the mortgages. Each time a bank sent a loan to Fannie and Freddie, it certified that the loan met Fannie and Freddie’s safe lending criteria. But many loans sent to the mortgage giants did not, in fact, meet those criteria. Currently, when borrowers default on those ineligible loans, the mortgage giants can “put back” the resulting losses onto the banks that pushed the loans.

Under the modified plan, “put back” liability at banks will be erased for any underwater mortgage that is refinanced through HARP, eliminating Fannie and Freddie’s ability to sack lenders with losses in the event that the mortgage does not pan out.

If borrowers go through HARP, but decide after several months that the modest monthly savings do not outweigh owing tens of thousands of dollars more than their home is worth, taxpayer-owned Fannie and Freddie will have to take the full loss. Even if the original loan was sent to Fannie and Freddie with false or fraudulent guarantees from the bank — promises that may directly be tied to the borrower’s current financial problems — banks will be immune from liability. Fannie and Freddie plan to charge banks “a modest fee” to extinguish this liability, but the administration has yet to determine what that fee will be.

“In most cases people would probably be better off walking,” said economist Dean Baker, co-director of the Center for Economic Policy and Research.

CONTINUED...w links:

http://www.washingtonsblog.com/2012/08/proof-positive-that-governments-homeowner-relief-programs-are-really-aid-to-banks-and-not-aimed-at-helping-homeowners.html

Geithner foamed the runway to save the banks.

Looked like a professional job.

Here's DU and my two-cents:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.

The above was posted on DU on Sept. 21, 2008. Lots of info from DUers.

As you ask, nc4bo: What's changed to protect we the taxpaying mopes since then?

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

Government Strategy in 2008 Bank Bailout was to Cover Up the Truth

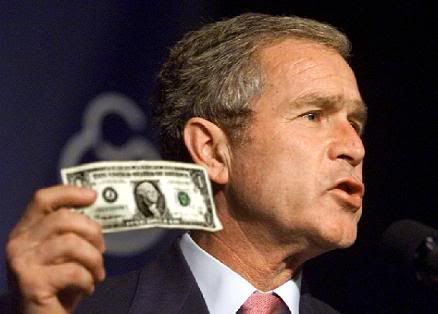

"It’s complicated, and we’re going to make sure whatever we do is done in a deliberative fashion." -- George W Bush, Oct. 3, 2008

Washington's Blog provides details n links:

The Government Lied When It Said It Only Bailed Out Healthy Banks … 12 of the 13 Big Banks Were Going Bust

Posted on January 11, 2013 by WashingtonsBlog

The Government’s Entire Strategy Was to Cover Up the Truth

We noted in 2011 that the Geithner, Bernanke and Paulson lied about the health of the big banks in pitching bailouts to Congress and the American people:

The big banks were all insolvent during the 1980s.

And they all became insolvent again in 2008. See this and this (busted link at WB).

The bailouts were certainly rammed down our throats under false pretenses.

But here’s the more important point. Paulson and Bernanke falsely stated that the big banks receiving Tarp money were healthy, when they were not. They were insolvent.

Tim Geithner falsely stated that the banks passed some time of an objective stress test but they did not. They were insolvent.

CONTINUED...

Who knows? Perhaps some of this information will finally make it into my local noosepaper. For some reason, it hasn't been on the television screen.

Getting desperate, Dude.

The important issue is that he and his sister reported their father said about the assassination of President Kennedy:

A conspiracy was behind the assassination.

The Warren Commission report was "shoddy workmanship."

Attorney General Kennedy knew about the Ruby-Mafia connections immediately.

It is difficult to imagine why that would elicit your attack on RFK, Jr.'s character, siddithers.

ABC’s Marquardt fumbles JFK facts

Corporate McPravda continues to, ah, fumble JFK assassination reportage.

Regarding Robert F. Kennedy and Rory Kennedy's interview in which they expressed their father's thinking on the assassination of President Kennedy:

Fact check: ABC’s Marquardt fumbles JFK facts

Jefferson Morley

January 13, 2013

ABC News correspondent Alexander Marquardt made two factual mistakes in his Good Morning America report today on Robert Kennedy Jr.’s remarks that his father believed “rogue CIA agents” may have been involved in uncle’s assassination.

Marquardt stated, “Now for the first time ever we’re learning that JFK’s own brother and Attorney General RFK was quote ‘fairly convinced’ that Lee Harvey Oswald did not act alone.”

That is not accurate. RFK’s views had been reported twice previously by credible sources.

SNIP...

ABC News then erred by quoting historian Robert Dallek about the JFK assassination controversy without context. On camera the UCLA historian said that the assassination has been “investigated, re-investigated, investigated again and again and no one’s ever come up with highly credible evidence” to contradict the theory that Oswald acted alone.

CONTINUED...

http://jfkfacts.org/assassination/fact-check/fact-check-abcs-marquardt-fumbles-jfk-facts/#more-2351

PS: Founded by Jefferson Morley and Rex Bradford, www.JFKFacts.org is a new website that DUers and everyone interested in learning the truth about Dallas should know about.

A historic day...

Law professor Wilkes reviews di Eugenio:

DESTINY BETRAYED:

THE CIA, OSWALD, AND

THE JFK ASSASSINATION

Published in Flagpole Magazine, p. 8 (Dec. 7, 2005).

Author: Donald E. Wilkes, Jr., Professor of Law, University of Georgia School of Law.

In place of the strong sense of faith in man and mankind, we now have a heavy feeling of a failed mission, of destiny betrayed and unfulfilled. – Rav Alex Israel

The deepest cover story of the CIA is that it is an intelligence organization. – Bulletin of the Federation of American Scientists

Today, 42 years after President John F. Kennedy was assassinated in Dealey Plaza in Dallas, Texas, on November 22, 1963, few responsible researchers who have studied JFK’s murder accept the Warren Commission’s main conclusion that Lee Harvey Oswald, acting alone, committed the crime. (The Warren Commission was the body appointed by President Lyndon B. Johnson to investigate the Kennedy assassination; it released its Report in September 1964.) As these researchers have shown again and again in scores of books and articles, evidence available to the Commission but improperly evaluated, erroneously rejected, or simply not pursued by that body, together with new evidence unavailable to the Commission, discredits the principal finding of the Warren Report. JFK’s death was, these researchers believe, carried out by a conspiracy; it was not the act of a lone assassin. Different researchers, however, have different conspiracy theories. Conspiracy theorists also disagree about Oswald: some maintain that he was simply one of the conspirators; others claim that, while he was a member of the conspiracy, he was also unknowingly a dupe of the other conspirators who intended for him to be the fall guy; and still other theorists think that Oswald was a wholly innocent person set up by the conspirators as the patsy. Furthermore, the theorists who regard Oswald as a conspirator disagree as to whether he fired any of the shots in Dealey Plaza.

Currently, the conspiracy theories most worthy of consideration are these: (1) the Mafia did it; (2) the CIA did it; (3) the anti-Castro Cubans–that is, opponents of Cuba’s communist leader, Fidel Castro–did it; (4) white-supremacist racists and right-wing extremists did it; and (5) the conspiracy consisted of persons who were affiliated with the Mafia, the CIA, or various anti-Castro or extreme rightist groups, but who were acting as individuals (albeit perhaps with some connivance from the organizations with which they had affiliations). Although still the subject of lively discussion in JFK assassination literature, conspiracy theories that the assassination was attributable to the FBI or the Secret Service, to the Soviet Union, to Fidel Castro’s Cuba and pro-Castroites, or to Kennedy’s vice president, Lyndon B. Johnson (and Johnson’s supporters), appear less credible with the passing of each year.

The theory that JFK’s murder was engineered by the CIA (or by persons affiliated with the CIA), and that the CIA covered up its connections to the murder, warrants serious consideration and should not be peremptorily rejected. In the 1960’s the CIA more resembled an untouchable crime syndicate than a legitimate government entity. Lavishly but secretly funded, unrestrained by public opinion, cloaked in secrecy, conducting whatever foreign or domestic clandestine operations it wished without regard to laws or morals, and specializing in deception, falsification, and mystification, the CIA was riddled at all levels with ruthless, cynical officials and employees who believed that they were above the law, that any means were justified to accomplish the goals they set for themselves, and that insofar as their surreptitious activities were concerned it was justifiable to lie with impunity to anyone, even presidents and legislators. Many of these individuals, thinking he was soft on communism, that he would reduce the size of the military industrial complex, and that he was to blame for the Bay of Pigs disaster (the failed CIA-sponsored invasion of Cuba in 1961), hated and despised Kennedy. The CIA routinely circumvented and defied attempts by the executive and legislative branches to monitor its activities. It was involved in innumerable unlawful or outrageous activities. It illegally opened the mail of Americans. It interfered with free elections in foreign countries and arranged to destabilize or overthrow the governments of other countries. It plotted the murder of various foreign leaders. It arranged to hire the Mafia to help with some of these proposed murder plots. It unlawfully stored–in quantities, UGA political science professor Loch K. Johnson notes, sufficient “to destroy the population of a small city”–exotic toxic agents, including cobra venom and shellfish toxin, for the purpose of committing murders. It manufactured and used sinister lethal weaponry, including what Prof. Johnson calls “the ultimate murder weapon,” an electric handgun (the CIA called it a “noise-free disseminator”) with a telescopic sight which could noiselessly and accurately fire poison-tipped darts (the CIA called them “nondiscernible microbioinoculators”) up to a distance of 250 feet. It undoubtedly carried out multiple secret murders and other heinous crimes which it successfully kept hidden. Furthermore, it is now firmly established that after the JFK assassination the CIA simultaneously lied to, and withheld important information from, the Warren Commission.

One of the first serious investigators to raise credible claims that CIA operatives or ex-CIA operatives were involved in the JFK assassination was Jim Garrison, who served as the district attorney in New Orleans, Louisiana from 1962 to 1974. (A brief chronology of Garrison’s life and investigation is set forth at the end of this article.) Garrison and his office investigated the assassination for about five years, from late 1966 until early 1971. His investigation led Garrison to believe that, regardless of whoever actually fired the shots in Dealey Plaza, the assassination was the result of a plot hatched in New Orleans by persons with CIA connections. Furthermore, Garrison concluded, following the assassination the CIA engaged in a coverup to protect itself and the assassins. Garrison brought to trial the only criminal proceeding in which someone was actually charged with involvement in the JFK assassination. Garrison wrote two important books, the first published in 1970, the second in 1988, in which he recounted his investigation and shared the important new facts he had discovered.

In the words of journalist Fred Powledge, who wrote a magazine article on Garrison published in 1967, Garrison thought that “the assassins were CIA employees who were angered at President Kennedy’s posture on Cuba following the Bay of Pigs disaster, and that the CIA was frustrating his investigation, although the agency knew the whereabouts of the assassins.” Philosophy professor Richard H. Popkin, in another magazine article published in 1967, summarized Garrison’s views on the assassination as follows: “The thesis Garrison has set forth is that a group of New Orleans-based, anti-Castroites, supported and/or encouraged by the CIA in their anti-Castro activities, in the late summer or early fall of 1963 conspired to assassinate John F. Kennedy. This group, according to Garrison, included [Clay] Shaw, [David] Ferrie, [Lee Harvey] Oswald, ... and others, including Cuban exiles and American anti-Castroites.... [T]heir plan was executed in Dallas on November 22, 1963. At least part of their motivation ... was their reaction to Kennedy’s decisions at the Bay of Pigs and the changes in U.S. policy toward Cuba following the missiles crisis of 1962.”

In a 1967 interview, Garrison himself phrased his basic conclusions this way: “[A] number of the men who killed the President were former employees of the CIA involved in its anti-Castro underground activities in and around New Orleans.... We must assume that the plotters were acting on their own rather than on CIA orders when they killed the President. As far as we been able to determine, they were not on the pay of the CIA at the time of the assassination.... The CIA could not face up to the American people and admit that its former employees had conspired to assassinate the President, so from the moment Kennedy’s heart stopped beating, the Agency attempted to sweep the whole conspiracy under the rug.... In this respect, it has become an accessory after the fact in the assassination.”

Jim Garrison’s theory of the assassination clashed with that of the Warren Commission, which denied there had been a conspiracy. According to the Warren Report, 24-year old Lee Harvey Oswald, supposedly a twisted, embittered, discontented, hate-filled Marxist and ex-Marine who had once defected to the Soviet Union, assassinated JFK, acting alone and without assistance. Using an old, flimsy, cheap, second-hand bolt-action 6.5 mm Italian carbine, Oswald allegedly fired three shots in less than 10 seconds from a sixth floor window of the Texas School Book Depository at the president’s open limousine, which was moving at an angle, downhill, and away from the Depository. The fatal head shot occurred when Kennedy was 265 feet from the window. (Two days later Oswald, a handcuffed prisoner surrounded by dozens of police officers inside a police station, was shot dead by Jack Ruby, an organized crime figure who operated a Dallas night club and strip joint. Oswald’s murder occurred on live TV and was witnessed by millions.)

President Lyndon B. Johnson, who appointed the Warren Commission, described Lee Harvey Oswald as “quite a mysterious fellow.” Political science professor and JFK assassination authority Philip H. Melanson agrees, noting that “[f]rom the time he was an eighteen-year old Marine until his murder at twenty-four, [Oswald] lived a secret life.” What we know of Oswald’s life from 1959 to 1963, Melanson adds, appears to be “strpouctured by endless coincidences and heavy doses of good and bad luck” and includes a “pattern of mysteries and anomalies” and “frequent and unusual interactions with government agencies” that can hardly be “random and innocent” or the result of “coincidence or happenstance.”

CONTINUED...

http://www.law.uga.edu/dwilkes_more/jfk_22destiny.html

I was going to welcome you to DU, but I see you've returned home.

You did bring up an interesting topic, for those interested in space exploration.

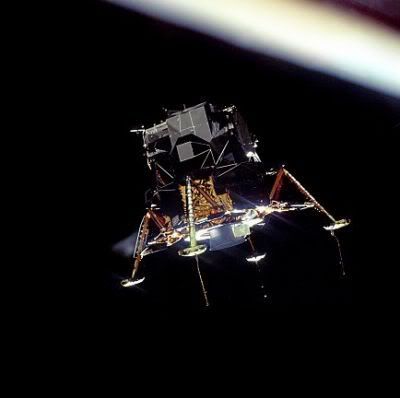

JFK Continued the New Deal as the New Frontier

The peaceful exploration of space was the best thing to happen to jobs in history. At its peak, 400,000 Americans were employed in the Apollo Project.

Imagine if President Kennedy had lived, where the nation would be today? I believe, if we could figure out how to the moon and back, we could face any problem on earth and solve it -- from ending hunger, poverty and ignorance to creating a lasting peace.

Problems today's GOP considers intractable (see Poppy Bush inaugural "More will than Wallet"![]() such as joblessness, poverty, crime, would be tackled, instead of ignored, like they've done with public education. And the treasures accumulated since would be used to make life better for everybody on earth instead of sitting in a secret Swiss bank account.

such as joblessness, poverty, crime, would be tackled, instead of ignored, like they've done with public education. And the treasures accumulated since would be used to make life better for everybody on earth instead of sitting in a secret Swiss bank account.

But, no. The conservatives killed the New Deal after LBJ and the Great Society. For the space program, it started with Nixon. Instead, they gave the store away to War Inc, who sank the national treasure into the "Money trumps peace" crowd.

Well, we get to hear from an eyewitness what Attorney General Kennedy thought.

We learned what his father said he really thought about the Warren Commission, a "shoddy piece of craftsmanship."

We also learned his father connected Ruby's telephone calls to organized crime leaders, many of whom were targets of FBI investigators and wondered if his work leading the Department of Justice may've led to the assassination of his brother.

Here's some Old News most Americans, including DUers, don't know: The CIA was doing business with organized crime in order to kill Fidel Castro and who knows what else -- a secret association that began in 1960, when Dulles was DCI and Nixon VP.

How the CIA Enlisted the Chicago Mob to Put a Hit on Castro

Ever wonder about the sanity of America's leaders? Take a close look at perhaps the most bizarre plot in U.S. intelligence history

By Bryan Smith

Chicago Magazine

November 2007

(page 4 of 6)

EXCERPT...

By September 1960, the project was proceeding apace. Roselli would report directly to Maheu. The first step was a meeting in New York. There, at the Plaza Hotel, Maheu introduced Roselli to O'Connell. The agent wanted to cover up the participation of the CIA, so he pretended to be a man named Jim Olds who represented a group of wealthy industrialists eager to get rid of Castro so they could get back in business.

"We may know some people," Roselli said. Several weeks later, they all met at the Fontainebleau Hotel in Miami. For years, the luxurious facility had served as the unofficial headquarters for Mafioso leaders seeking a base close to their gambling interests in Cuba. Now, it would be the staging area for the assassination plots.

At a meeting in one of the suites, Roselli introduced Maheu to two men: Sam Gold and a man Roselli referred to as Joe, who could serve as a courier to Cuba. By this time, Roselli was on to O'Connell. "I'm not kidding," Roselli told the agent one day. "I know who you work for. But I'm not going to ask you to confirm it."

Roselli may have figured out that he was dealing with the CIA, but neither Maheu nor O'Connell realized the rank of mobsters with whom they were dealing. That changed when Maheu picked up a copy of the Sunday newspaper supplement Parade, which carried an article laying out the FBI's ten most wanted criminals. Leading the list was Sam Giancana, a.k.a. "Mooney," a.k.a. "Momo," a.k.a. "Sam the Cigar," a Chicago godfather who was one of the most feared dons in the country—and the man who called himself Sam Gold. "Joe" was also on the list. His real name, however, was Santos Trafficante—the outfit's Florida and Cuba chieftain.

Maheu alerted O'Connell. "My God, look what we're involved with," Maheu said. O'Connell told his superiors. Questioned later before the 1975 U.S. Senate Select Committee on Intelligence (later nicknamed the Church Committee after its chairman, Frank Church, the Democratic senator from Idaho), O'Connell was asked whether there had ever been any discussion about asking two men on the FBI's most wanted list to carry out a hit on a foreign leader.

"Not with me there wasn't," O'Connell answered.

"And obviously no one said stop—and you went ahead."

"Yes."

"Did it bother you at all?"

"No," O'Connell answered, "it didn't."

CONTINUED...

http://www.chicagomag.com/Chicago-Magazine/November-2007/How-the-CIA-Enlisted-the-Chicago-Mob-to-Put-a-Hit-on-Castro/index.php?cparticle=4&siarticle=3

Gee. Organized crime in bed with the nation's spy agency for a secret assassination program. What could go wrong?

Profile Information

Gender: MaleMember since: 2003 before July 6th

Number of posts: 55,745