n2doc

n2doc's JournalIn U.S., Waistlines Keep Expanding

It’s well known that the U.S. has grappled with growing obesity levels, and a new Gallup poll confirms that Americans just keep getting larger. The report finds 27 percent of Americans had a body mass index (BMI) that classified them as obese in 2013, compared with 25.5 percent in 2008.

Only 2 percent of Americans are considered underweight, with a BMI of under 18.5. That percentage has remained steady in the last five years.

Hawaiians currently have the lowest rate of obesity, but that’s still a whopping 19 percent of the state’s population. Mississippi has the highest number of residents who are obese: 35.2 percent.

The report also looked at population trends and found obesity increased most among people over 65 years old, from 23.4 percent in 2008 to 27.4 percent in 2013. Middle-age adults (ages 45 to 64), Midwesterners, women and whites were the next fastest growing populations when it comes to unhealthy weight gain. The report also reflects the trend that people who are obese tend to have lower incomes.

more

http://www.newsweek.com/us-waistlines-keep-expanding-336874

Whoops! A creationist museum supporter stumbled upon a major fossil find.

By Rachel Feltman

Canadian Edgar Nernberg isn't into the whole evolution thing. In fact, he's on the board of directors of Big Valley’s Creation Science Museum, a place meant to rival local scientific institutions. Adhering to the most extreme form of religious creationism, the exhibits "prove" that the Earth is only around 6,000 years old, and that humans and dinosaurs co-existed.

Unfortunately, Nernberg just dug up a 60-million-year-old fish.

¯\_(ツ![]() _/¯

_/¯

Local outlets report that the man is far from shaken by the bony fish, which he found while excavating a basement in Calgary.

Because here's the thing: He just doesn't believe they're that old. And he's quite the fossil lover.

“No, it hasn’t changed my mind. We all have the same evidence, and it’s just a matter of how you interpret it,” Nernberg told the Calgary Sun. “There’s no dates stamped on these things."

more

http://www.washingtonpost.com/news/speaking-of-science/wp/2015/05/28/whoops-a-creationist-museum-supporter-stumbled-upon-a-major-fossil-find/?tid=sm_fb

Breaking Up the NSA

The NSA has become too big and too powerful. What was supposed to be a single agency with a dual mission -- protecting the security of U.S. communications and eavesdropping on the communications of our enemies -- has become unbalanced in the post-Cold War, all-terrorism-all-the-time era.

Putting the U.S. Cyber Command, the military's cyberwar wing, in the same location and under the same commander, expanded the NSA's power. The result is an agency that prioritizes intelligence gathering over security, and that's increasingly putting us all at risk. It's time we thought about breaking up the National Security Agency.

Broadly speaking, three types of NSA surveillance programs were exposed by the documents released by Edward Snowden. And while the media tends to lump them together, understanding their differences is critical to understanding how to divide up the NSA's missions.

The first is targeted surveillance.

This is best illustrated by the work of the NSA's Tailored Access Operations (TAO) group, including its catalog of hardware and software "implants" designed to be surreptitiously installed onto the enemy's computers. This sort of thing represents the best of the NSA and is exactly what we want it to do. That the United States has these capabilities, as scary as they might be, is cause for gratification.

more

https://www.schneier.com/blog/archives/2014/02/breaking_up_the.html

Welcome to the Red State HIV Epidemic

It wasn’t supposed to happen here. Not in Austin, a one-doctor-and-an-ice-cream-shop town of 4,200 in southeastern Indiana, nestled off Interstate 65 on the road from Indianapolis to Louisville, where dusty storefronts sit vacant and many residents, lacking cars, walk to the local market. Not in rural, impoverished Scott County, which had reported fewer than five new cases of HIV infection each year, and just three cases in the past six years. Not in a state where, of the 500 new cases reported annually, only 3 percent are linked to injection drug use.

But it did. And it could happen in many more backwoods towns just as unprepared as Austin.

As the largest HIV/AIDS outbreak in Indiana’s history roils this Hoosier hamlet, it reflects the changing face of the epidemic in the U.S., as a disease that once primarily afflicted gays and minorities in deep-blue cities rises in rural red states. This new evolution of HIV is also forcing a new generation of Republican policymakers to confront its orthodox opposition to remedies such as government-funded needle-exchange programs.

Over the past decade, the virus cascaded from urban cities like San Francisco, New York and Washington, D.C., into poor, rural swaths of red states in middle America—opening a new front in the national fight against the spread of HIV. “It started in the coastal states among middle-class white gay men, and then the epidemic evolved into affecting more and more minorities in the South,” says Carlos del Rio, an AIDS researcher at Emory University in Atlanta. “Obviously, now the epidemic is changed. Now, what we're seeing is it impacting the rural communities.”

In this Indiana burg, the virus is not spreading among networks of gay men, but in rapid, cluster-like fashion within jobless white families who inject prescription painkillers with dirty needles.

Read more: http://www.politico.com/magazine/story/2015/05/red-state-hiv-epidemic-drug-use-republican-governors-118379.html#ixzz3bXGQ0G00

Paul Krugman- The Insecure American

America remains, despite the damage inflicted by the Great Recession and its aftermath, a very rich country. But many Americans are economically insecure, with little protection from life’s risks. They frequently experience financial hardship; many don’t expect to be able to retire, and if they do retire have little to live on besides Social Security.

Many readers will, I hope, find nothing surprising in what I just said. But all too many affluent Americans — and, in particular, members of our political elite — seem to have no sense of how the other half lives. Which is why a new study on the financial well-being of U.S. households, conducted by the Federal Reserve, should be required reading inside the Beltway.

Before I get to that study, a few words about the callous obliviousness so prevalent in our political life.

I am not, or not only, talking about right-wing contempt for the poor, although the dominance of compassionless conservatism is a sight to behold. According to the Pew Research Center, more than three-quarters of conservatives believe that the poor “have it easy” thanks to government benefits; only 1 in 7 believe that the poor “have hard lives.” And this attitude translates into policy. What we learn from the refusal of Republican-controlled states to expand Medicaid, even though the federal government would foot the bill, is that punishing the poor has become a goal in itself, one worth pursuing even if it hurts rather than helps state budgets.

But leave self-declared conservatives and their contempt for the poor on one side. What’s really striking is the disconnect between centrist conventional wisdom and the reality of life — and death — for much of the nation.

more

http://www.nytimes.com/2015/05/29/opinion/paul-krugman-the-insecure-american.html?smid=re-share&_r=0

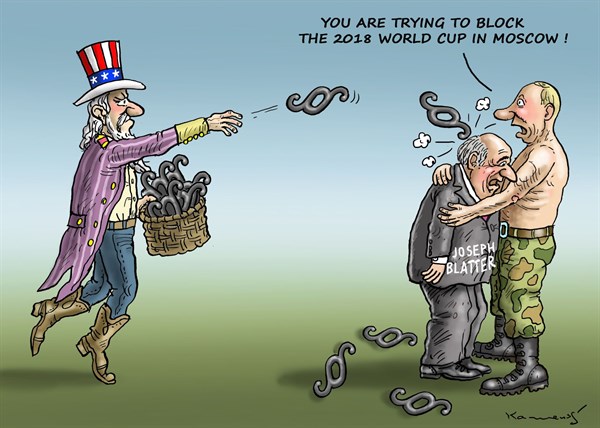

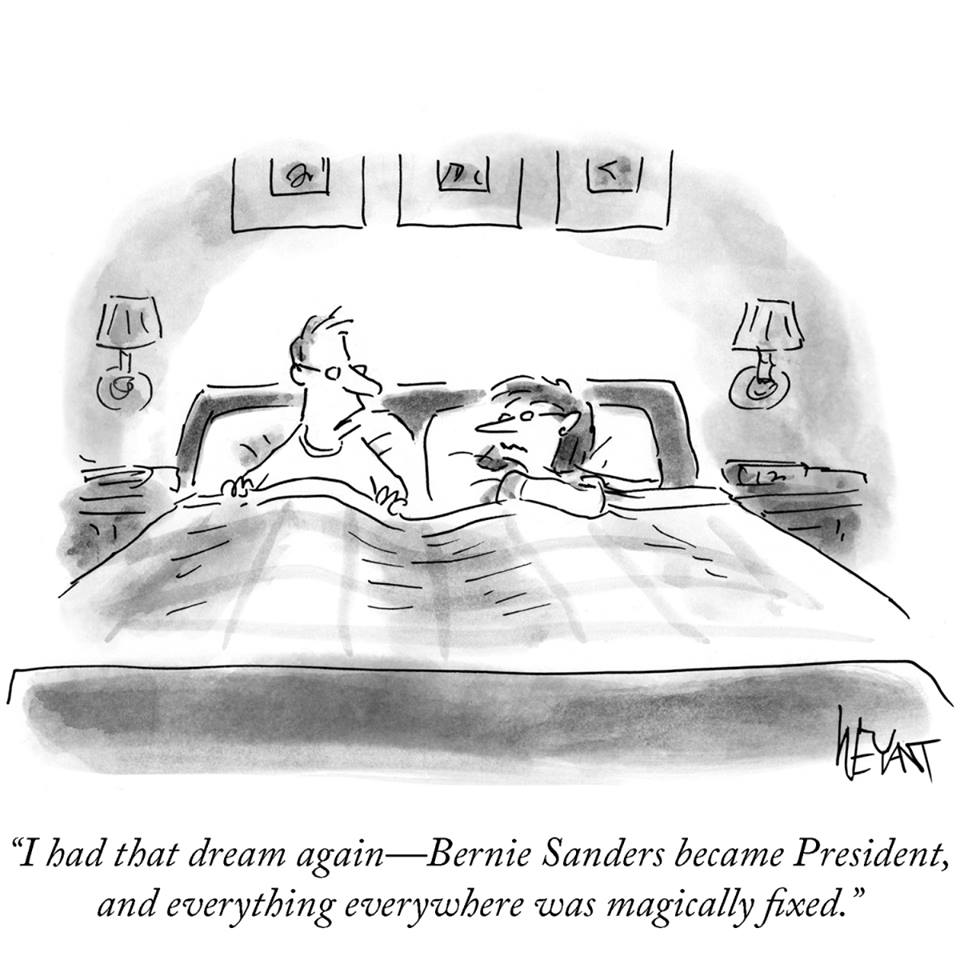

Friday TOON Roundup 3 - The Rest (warning graphic Mr. Fish Toon)

Corruption

Primaries

2016

Anthrax

Texas

Detroit

Race

Rights

Environment

War

The Cost of an Adjunct

LAURA MCKENNA

Imagine meeting your English professor by the trunk of her car for office hours, where she doles out information like a taco vendor in a food truck. Or getting an e-mail error message when you write your former biology professor asking for a recommendation because she is no longer employed at the same college. Or attending an afternoon lecture in which your anthropology professor seems a little distracted because he doesn’t have enough money for bus fare. This is an increasingly widespread reality of college education.

Many students—and parents who foot the bills—may assume that all college professors are adequately compensated professionals with a distinct arrangement in which they have a job for life. In actuality those are just tenured professors, who represent less than a quarter of all college faculty. Odds are that students will be taught by professors with less job security and lower pay than those tenured employees, which research shows results in diminished services for students.

Currently, half of all professors in the country are adjuncts or contingent faculty, according to the American Association of University Professors. They teach all levels within the higher-education system, from remedial writing classes to graduate seminars. Unlike graduate teaching assistants, or TAs, they have the same instructional responsibilities as tenured faculty, including assembling syllabi, ordering textbooks, writing lectures, and grading exams. (The remaining quarter or so of American faculty are professors on temporary contracts who have more regular job arrangements than adjuncts, but are not eligible for tenure.)

Adjunct professors earn a median of $2,700 for a semester-long class, according to a survey of thousands of part-time faculty members. In 2013, NPR reported that the average annual pay for adjuncts is between $20,000 and $25,000, while a March 2015 survey conducted by Pacific Standard among nearly 500 adjuncts found that a majority earn less than $20,000 per year from teaching. Some live on less than that and supplement their income with public assistance: A recent report from UC Berkeley found that nearly a quarter of all adjunct professors receive public assistance, such as Medicaid or food stamps. Indeed, many adjuncts earn less than the federal minimum wage. Unless they work 30 hours or more at one college, they’re not eligible for health insurance from that employer, and like other part-time employees, they do not qualify for other benefits.

more

http://www.theatlantic.com/education/archive/2015/05/the-cost-of-an-adjunct/394091/?utm_source=SFTwitter

When is a Felony Not a Felony? When You’re a Bank!

Good news, America: We can now get guilty pleas from banks!

Bad news, America: That’s only because guilty pleas from banks are now absolutely meaningless.

Last week, JP Morgan, Citigroup, Barclays, and Royal Bank of Scotland pled guilty to felony charges of conspiring to manipulate currency prices, and UBS pled guilty to manipulating benchmark interest rates. Regulators and prosecutors found the misconduct because the traders left extensive, written tracks — in chatrooms called “The Cartel” and “The Mafia.” James Kwak wrote that Stringer Bell from the popular television series The Wire would never have tolerated the brazen, “amateurish behavior” these traders exhibited. But why should traders bother to cover their tracks, when they know they have the absolute best clean-up crew in the business — the financial regulators and law enforcement meant to police them?

When an individual is convicted of a felony, they face years of disenfranchisement — from being denied the right to vote in many states, to facing barriers to finding work, felony convictions have real-world consequences for people. But when it comes to banks, regulators and law enforcement work together to ensure collateral consequences don’t occur.

It’s not supposed to be that way. When a bank is charged with a crime, there are certain penalties that automatically kick in. Here is what the banks were facing as a result of their felonies:

Disqualification from managing mutual funds and exchange-traded funds for RBS, JP Morgan, Citigroup and UBS.

New barriers for issuing securities. All the convicted banks are “well-known seasoned issuers,” which is a special status that lets them quickly raise capital without having to get SEC approval first. A criminal conviction automatically disqualifies a bank from this status.

No more immunity for earnings projections. Since you can’t verify the accuracy of the future, the law gives companies a “safe harbor” that allows them to make forward-looking statements anyway — without fear of lawsuits. The felony pleas would disqualify UBS, Barclays and JP Morgan from this immunity, thus subjecting all of their statements to the normal liability standards for fraud.

UBS and Barclays could no longer raise unlimited amounts of money though the sale of private securities.

How many of these consequences do you think the banks actually faced? If you guessed ZERO out of four, you are correct!

more

https://medium.com/bull-market/when-is-a-felony-not-a-felony-when-you-re-a-bank-232a5371d7c1

Profile Information

Gender: Do not displayMember since: Tue Feb 10, 2004, 01:08 PM

Number of posts: 47,953