Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

December 11, 2015

from the WaPo:

The new highway bill being celebrated on Capitol Hill could cost Amtrak $95 million and may delay the settlement of claims made by victims of a fatal Amtrak derailment in Philadelphia this year.

The new law increases a cap on payments a railroad can make to accident victims from $200 million to $295 million. It makes the higher limit retroactive, a nod to the families of eight people killed and more than 200 injured — 11 of them critically — in the May 12 derailment of an Amtrak train bound from Washington to New York.

“There are two of my clients with medical bills that exceed $1 million already and are approaching or have hit $2 million,” said Robert Mongeluzzi, a lawyer in Philadelphia. He says it’s too early to know for certain, “but based upon the extent of the damage that we know, the number of dead and the number of catastrophically injured, we believe [the claims] will exceed the $295 million cap.”

The crash has resulted in 98 cases filed against Amtrak, with more said to be coming. Some lawyers question whether Amtrak will challenge Congress’s decision to make the cap increase retroactive. ...............(more)

https://www.washingtonpost.com/local/trafficandcommuting/amtrak-faces-95-million-hit-as-congress-celebrates-new-highway-bill/2015/12/10/1a33379c-9a8f-11e5-8917-653b65c809eb_story.html

Amtrak faces $95 million hit as Congress celebrates new highway bill

from the WaPo:

The new highway bill being celebrated on Capitol Hill could cost Amtrak $95 million and may delay the settlement of claims made by victims of a fatal Amtrak derailment in Philadelphia this year.

The new law increases a cap on payments a railroad can make to accident victims from $200 million to $295 million. It makes the higher limit retroactive, a nod to the families of eight people killed and more than 200 injured — 11 of them critically — in the May 12 derailment of an Amtrak train bound from Washington to New York.

“There are two of my clients with medical bills that exceed $1 million already and are approaching or have hit $2 million,” said Robert Mongeluzzi, a lawyer in Philadelphia. He says it’s too early to know for certain, “but based upon the extent of the damage that we know, the number of dead and the number of catastrophically injured, we believe [the claims] will exceed the $295 million cap.”

The crash has resulted in 98 cases filed against Amtrak, with more said to be coming. Some lawyers question whether Amtrak will challenge Congress’s decision to make the cap increase retroactive. ...............(more)

https://www.washingtonpost.com/local/trafficandcommuting/amtrak-faces-95-million-hit-as-congress-celebrates-new-highway-bill/2015/12/10/1a33379c-9a8f-11e5-8917-653b65c809eb_story.html

December 11, 2015

The Port Authority of New York and New Jersey wants to encourage 21st Century Fox and News Corp. to move their headquarters to the yet-to-be-built 2 World Trade Center. And at its meeting on Thursday, the board unanimously approved what it called a $9 million subsidy to convince the companies to relocate. But critics wonder whether those corporate giants should be given this kind of carrot by the Port — a public agency.

Margaret Donovan is with the Twin Towers Alliance, a group which has long battled with the agency and developer Larry Silverstein about the World Trade Center site. "You can and should tell Larry Silverstein and Rupert Murdoch to figure it out without us," she said. "They can well afford it."

The Murdoch-owned companies are considering renting about 1.5 million square feet. Agency chairman John Degnan said giving them a "modest" rent break made sense, because the proposed deal would help spur the construction of the building by landing a name-brand anchor tenant. ......................(more)

http://www.wnyc.org/story/port-authority-approves-subsidies-murdoch/

Rupert Murdoch, welfare queen

The Port Authority of New York and New Jersey wants to encourage 21st Century Fox and News Corp. to move their headquarters to the yet-to-be-built 2 World Trade Center. And at its meeting on Thursday, the board unanimously approved what it called a $9 million subsidy to convince the companies to relocate. But critics wonder whether those corporate giants should be given this kind of carrot by the Port — a public agency.

Margaret Donovan is with the Twin Towers Alliance, a group which has long battled with the agency and developer Larry Silverstein about the World Trade Center site. "You can and should tell Larry Silverstein and Rupert Murdoch to figure it out without us," she said. "They can well afford it."

The Murdoch-owned companies are considering renting about 1.5 million square feet. Agency chairman John Degnan said giving them a "modest" rent break made sense, because the proposed deal would help spur the construction of the building by landing a name-brand anchor tenant. ......................(more)

http://www.wnyc.org/story/port-authority-approves-subsidies-murdoch/

December 11, 2015

from the Electronic Frontier Foundation:

How the TPP Will Affect You and Your Digital Rights

The Internet is a diverse ecosystem of private and public stakeholders. By excluding a large sector of communities—like security researchers, artists, libraries, and user rights groups—trade negotiators skewed the priorities of the Trans-Pacific Partnership (TPP) towards major tech companies and copyright industries that have a strong interest in maintaining and expanding their monopolies of digital services and content. Negotiated in secret for several years with overwhelming influence from powerful multinational corporate interests, it's no wonder that its provisions do little to nothing to protect our rights online or our autonomy over our own devices. For example, everything in the TPP that increases corporate rights and interests is binding, whereas every provision that is meant to protect the public interest is non-binding and is susceptible to get bulldozed by efforts to protect corporations.

Below is a list of communities who were excluded from the TPP deliberation process, and some of the main ways that the TPP's copyright and digital policy provisions will negatively impact them. Almost all of these threats already exist in the United States and in many cases have already impacted users there, because the TPP reflects the worst aspects of the U.S. Digital Millennium Copyright Act (DMCA). The TPP threatens to lock down those policies so these harmful consequences will be more difficult to remedy in future copyright reform efforts in the U.S. and the other eleven TPP countries. The impacts could also be more severe in those other countries because most of them lack the protections of U.S. law such as the First Amendment and the doctrine of fair use.

General Audience

• Excessive copyright terms deprive the public domain of decades of creative works. They also worsen the orphan works problem, which arises when obtaining permission to use works is impossible because the rightsholder is unknown, deceased, or is nowhere to be found, and using them without permission is legally risky.

• Lose autonomy and control over legally purchased devices and content because it is a crime to remove its digital locks or Digital Rights Management (DRM). This means modifying, repairing, recycling, or otherwise tinkering with a digital device or its contents could be banned or is at least legally risky.

• If you post a personal video that contains someone's copyrighted song, video, or image online without permission, it may get taken down or the user may be forced to pay a penalty no matter how insignificant that copyrighted content is to the whole of the video. Their account may also be suspended or restricted permanently or for a prolonged amount of time. If it happens to go viral they may be held criminally liable because it's arguably available at a "commercial scale."

....(snip)....

Innovators and Business Owners

• DRM is often used for anti-competitive purposes. It can block innovators from building interoperable services or products to be used with existing platforms, and prevents third-party repair services. More fundamentally, it blocks tinkering and experimentation which is critical to open innovation.

• Small web-based businesses and platforms may not have the legal resources or expertise to deal with excessive or faulty copyright takedowns. ................(more)

https://www.eff.org/deeplinks/2015/12/how-tpp-will-affect-you-and-your-digital-rights

How the TPP Will Affect You and Your Digital Rights

from the Electronic Frontier Foundation:

How the TPP Will Affect You and Your Digital Rights

The Internet is a diverse ecosystem of private and public stakeholders. By excluding a large sector of communities—like security researchers, artists, libraries, and user rights groups—trade negotiators skewed the priorities of the Trans-Pacific Partnership (TPP) towards major tech companies and copyright industries that have a strong interest in maintaining and expanding their monopolies of digital services and content. Negotiated in secret for several years with overwhelming influence from powerful multinational corporate interests, it's no wonder that its provisions do little to nothing to protect our rights online or our autonomy over our own devices. For example, everything in the TPP that increases corporate rights and interests is binding, whereas every provision that is meant to protect the public interest is non-binding and is susceptible to get bulldozed by efforts to protect corporations.

Below is a list of communities who were excluded from the TPP deliberation process, and some of the main ways that the TPP's copyright and digital policy provisions will negatively impact them. Almost all of these threats already exist in the United States and in many cases have already impacted users there, because the TPP reflects the worst aspects of the U.S. Digital Millennium Copyright Act (DMCA). The TPP threatens to lock down those policies so these harmful consequences will be more difficult to remedy in future copyright reform efforts in the U.S. and the other eleven TPP countries. The impacts could also be more severe in those other countries because most of them lack the protections of U.S. law such as the First Amendment and the doctrine of fair use.

General Audience

• Excessive copyright terms deprive the public domain of decades of creative works. They also worsen the orphan works problem, which arises when obtaining permission to use works is impossible because the rightsholder is unknown, deceased, or is nowhere to be found, and using them without permission is legally risky.

• Lose autonomy and control over legally purchased devices and content because it is a crime to remove its digital locks or Digital Rights Management (DRM). This means modifying, repairing, recycling, or otherwise tinkering with a digital device or its contents could be banned or is at least legally risky.

• If you post a personal video that contains someone's copyrighted song, video, or image online without permission, it may get taken down or the user may be forced to pay a penalty no matter how insignificant that copyrighted content is to the whole of the video. Their account may also be suspended or restricted permanently or for a prolonged amount of time. If it happens to go viral they may be held criminally liable because it's arguably available at a "commercial scale."

....(snip)....

Innovators and Business Owners

• DRM is often used for anti-competitive purposes. It can block innovators from building interoperable services or products to be used with existing platforms, and prevents third-party repair services. More fundamentally, it blocks tinkering and experimentation which is critical to open innovation.

• Small web-based businesses and platforms may not have the legal resources or expertise to deal with excessive or faulty copyright takedowns. ................(more)

https://www.eff.org/deeplinks/2015/12/how-tpp-will-affect-you-and-your-digital-rights

December 11, 2015

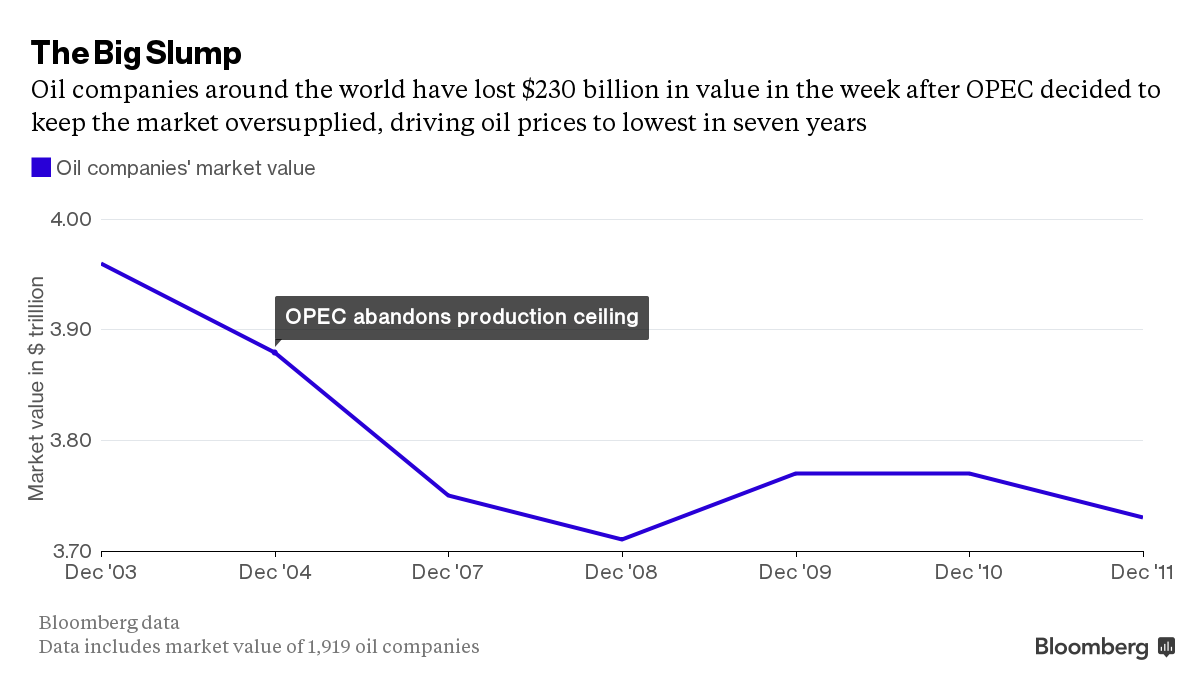

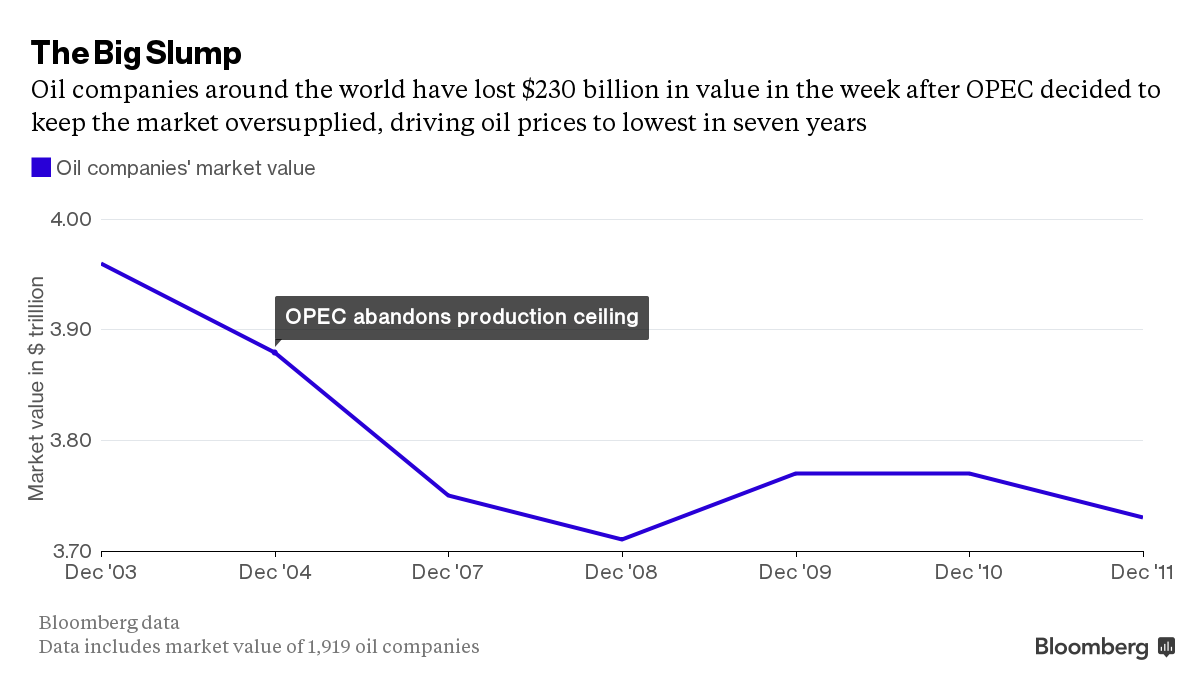

Oil Investors Are $230 Billion Poorer a Week After OPEC Decision

(Bloomberg) Investors around the world have seen $230 billion wiped off the value of oil companies in the week since OPEC sent crude prices plunging to a seven-year low by abandoning its output limit.

Companies producing, refining, piping and exploring for oil, along with those that provide them with services, had a market value of about $3.73 trillion as of Friday, compared with $3.96 trillion on Dec. 3, the day before the Organization of Petroleum Exporting Countries’ meeting in Vienna. Exxon Mobil Corp., the world’s biggest oil company, has lost $11 billion of its value and PetroChina Co. more than $16 billion, according to data compiled by Bloomberg.

Crude’s slump has lasted for more than 18 months, making it one of the longest downturns in decades and forcing companies to slash spending, reduce their workforce and delay projects. Energy companies are the worst performers in the MSCI World Index this year, even below mining companies that have suffered a slump in the price of commodities from iron ore to copper.

“Companies must repeat the same size of cuts they’ve already announced to be able to cope with oil prices this low,” said Alexandre Andlauer, a Paris-based oil industry analyst with AlphaValue SAS. There will be “further lay offs to come with oil at $40 a barrel,” he said. .........................(more)

http://www.bloomberg.com/news/articles/2015-12-11/oil-investors-are-230-billion-poorer-a-week-after-opec-decision

Oil Investors Are $230 Billion Poorer a Week After OPEC Decision

Oil Investors Are $230 Billion Poorer a Week After OPEC Decision

(Bloomberg) Investors around the world have seen $230 billion wiped off the value of oil companies in the week since OPEC sent crude prices plunging to a seven-year low by abandoning its output limit.

Companies producing, refining, piping and exploring for oil, along with those that provide them with services, had a market value of about $3.73 trillion as of Friday, compared with $3.96 trillion on Dec. 3, the day before the Organization of Petroleum Exporting Countries’ meeting in Vienna. Exxon Mobil Corp., the world’s biggest oil company, has lost $11 billion of its value and PetroChina Co. more than $16 billion, according to data compiled by Bloomberg.

Crude’s slump has lasted for more than 18 months, making it one of the longest downturns in decades and forcing companies to slash spending, reduce their workforce and delay projects. Energy companies are the worst performers in the MSCI World Index this year, even below mining companies that have suffered a slump in the price of commodities from iron ore to copper.

“Companies must repeat the same size of cuts they’ve already announced to be able to cope with oil prices this low,” said Alexandre Andlauer, a Paris-based oil industry analyst with AlphaValue SAS. There will be “further lay offs to come with oil at $40 a barrel,” he said. .........................(more)

http://www.bloomberg.com/news/articles/2015-12-11/oil-investors-are-230-billion-poorer-a-week-after-opec-decision

December 11, 2015

(Bloomberg) “This item may be the product of slave labor.”

Those jarring words could end up on candy bar wrappers, packages of frozen shrimp and even cans of cat food if some California lawyers get their way.

Forced labor permeates supply chains that stretch across the globe, from remote farms in Africa and the seas off Southeast Asia to supermarkets in America and Europe. Almost 21 million people are enslaved for profit worldwide, the UN says, providing $150 billion in illicit revenue every year.

Governments are pushing companies to better police suppliers, including proposed SEC reporting rules in the U.S. But that’s not enough for a group of law firms. They’ve sued name-brand companies doing business in California, like Hershey Co., Mars Inc., Nestle SA and Costco Wholesale Corp., hoping to use the state’s novel consumer protection laws to put the suffering of millions squarely in front of shoppers. ................(more)

http://www.bloomberg.com/news/articles/2015-12-10/these-lawyers-want-you-to-know-slaves-may-be-feeding-your-cat

These Lawyers Want Slave Labor Warnings on Your Cat Food

(Bloomberg) “This item may be the product of slave labor.”

Those jarring words could end up on candy bar wrappers, packages of frozen shrimp and even cans of cat food if some California lawyers get their way.

Forced labor permeates supply chains that stretch across the globe, from remote farms in Africa and the seas off Southeast Asia to supermarkets in America and Europe. Almost 21 million people are enslaved for profit worldwide, the UN says, providing $150 billion in illicit revenue every year.

Governments are pushing companies to better police suppliers, including proposed SEC reporting rules in the U.S. But that’s not enough for a group of law firms. They’ve sued name-brand companies doing business in California, like Hershey Co., Mars Inc., Nestle SA and Costco Wholesale Corp., hoping to use the state’s novel consumer protection laws to put the suffering of millions squarely in front of shoppers. ................(more)

http://www.bloomberg.com/news/articles/2015-12-10/these-lawyers-want-you-to-know-slaves-may-be-feeding-your-cat

December 11, 2015

from the MTA:

Preliminary data shows the Metropolitan Transportation Authority (MTA) reached a new modern record when 6,217,621 customers entered the MTA New York City Transit subway system on Oct. 29. The subway system carried 50,000 more customers that day than at its previous record peak, just one year earlier.

“The relentless growth in subway ridership shows how this century-old network is critical to New York’s future,” said MTA Chairman and CEO Thomas F. Prendergast. “Our challenge is to maintain and improve the subways even as growing ridership puts more demands on the system. We are doing it thanks to the MTA Capital Program, which will allow us to bring meaningful improvements to our customers, such as real time arrival information on the lettered subway lines, cleaner and brighter stations with new technology like Help Points, modern signal systems, and almost 1,000 new subway cars.”

The new modern ridership record was set on the last Thursday in October, traditionally one of the system’s busiest days. The previous record of 6,167,165 was set Oct. 30, 2014. The new record day was one of five days in October when ridership exceeded the prior year’s record, and was one of 15 weekdays with ridership above 6 million. Daily subway ridership records have been kept since 1985, but the new record is believed to be the highest since the late 1940s.

October 2015’s average weekday subway ridership of 5.974 million was the highest of any month in over 45 years, and was 1.4 percent higher than October 2014. Approximately 80,000 more customers rode the subway on an average October 2015 weekday than just a year earlier – enough to fill more than 50 fully-loaded subway trains. ...............(more)

http://www.masstransitmag.com/press_release/12148738/mta-records-highest-modern-one-day-subway-ridership

NYC: MTA Records Highest Modern One-Day Subway Ridership

from the MTA:

Preliminary data shows the Metropolitan Transportation Authority (MTA) reached a new modern record when 6,217,621 customers entered the MTA New York City Transit subway system on Oct. 29. The subway system carried 50,000 more customers that day than at its previous record peak, just one year earlier.

“The relentless growth in subway ridership shows how this century-old network is critical to New York’s future,” said MTA Chairman and CEO Thomas F. Prendergast. “Our challenge is to maintain and improve the subways even as growing ridership puts more demands on the system. We are doing it thanks to the MTA Capital Program, which will allow us to bring meaningful improvements to our customers, such as real time arrival information on the lettered subway lines, cleaner and brighter stations with new technology like Help Points, modern signal systems, and almost 1,000 new subway cars.”

The new modern ridership record was set on the last Thursday in October, traditionally one of the system’s busiest days. The previous record of 6,167,165 was set Oct. 30, 2014. The new record day was one of five days in October when ridership exceeded the prior year’s record, and was one of 15 weekdays with ridership above 6 million. Daily subway ridership records have been kept since 1985, but the new record is believed to be the highest since the late 1940s.

October 2015’s average weekday subway ridership of 5.974 million was the highest of any month in over 45 years, and was 1.4 percent higher than October 2014. Approximately 80,000 more customers rode the subway on an average October 2015 weekday than just a year earlier – enough to fill more than 50 fully-loaded subway trains. ...............(more)

http://www.masstransitmag.com/press_release/12148738/mta-records-highest-modern-one-day-subway-ridership

December 11, 2015

It Starts: Junk-Bond Fund Implodes, Investors Stuck

by Wolf Richter • December 11, 2015

[font color="blue"]And the next crisis hasn’t even begun yet.[/font]

We have warned about “open-end” bond mutual funds, particularly those with a lot of high-yield bonds. We know some folks who got burned when Charles Schwab’s $13-billion bond fund SWYSX blew up during the financial crisis and lost 60% or so of its value before its data went offline.

Schwab settled all kinds of class-action and individual lawsuits for cents on the dollar. It got in trouble over other bond funds. And other purveyors of bond funds got in trouble too.

It works like this: When an “open-end” bond fund starts losing money, investors begin to sell it. Fund managers first use all available cash to pay investors. When the cash is gone, they sell the most liquid securities that haven’t lost much money yet, such as Treasuries. When they’re gone, they sell the most liquid corporate paper. As they go down the line, they sell bonds that have already lost a lot of value. By now the smart money is betting against the fund, having figured out what’s happening. They’re shorting the very bonds these folks are trying to sell.

The longer this goes on, the more money investors lose and the more spooked they get. It turns into a run. And people who still have that fund in their retirement account are getting cleaned out. ................(more)

http://wolfstreet.com/2015/12/11/junk-bond-fund-implodes-investors-stuck-focused-credit-fund-by-third-avenue/

It Starts: Junk-Bond Fund Implodes, Investors Stuck

It Starts: Junk-Bond Fund Implodes, Investors Stuck

by Wolf Richter • December 11, 2015

[font color="blue"]And the next crisis hasn’t even begun yet.[/font]

We have warned about “open-end” bond mutual funds, particularly those with a lot of high-yield bonds. We know some folks who got burned when Charles Schwab’s $13-billion bond fund SWYSX blew up during the financial crisis and lost 60% or so of its value before its data went offline.

Schwab settled all kinds of class-action and individual lawsuits for cents on the dollar. It got in trouble over other bond funds. And other purveyors of bond funds got in trouble too.

It works like this: When an “open-end” bond fund starts losing money, investors begin to sell it. Fund managers first use all available cash to pay investors. When the cash is gone, they sell the most liquid securities that haven’t lost much money yet, such as Treasuries. When they’re gone, they sell the most liquid corporate paper. As they go down the line, they sell bonds that have already lost a lot of value. By now the smart money is betting against the fund, having figured out what’s happening. They’re shorting the very bonds these folks are trying to sell.

The longer this goes on, the more money investors lose and the more spooked they get. It turns into a run. And people who still have that fund in their retirement account are getting cleaned out. ................(more)

http://wolfstreet.com/2015/12/11/junk-bond-fund-implodes-investors-stuck-focused-credit-fund-by-third-avenue/

December 11, 2015

(Bloomberg) Jody Sofia borrowed $92,500 to get a degree from Florida Coastal School of Law. Now she’s in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors.

The companies making those calls are just one part of an ecosystem feeding on federal student loans. There are also debt servicers, refinance lenders, firms that help former students stay out of default and for-profit schools that make money as borrowers try to repay more than $1.2 trillion in government-backed education debt.

Sofia is one of 7 million former students in default on a record $115 billion of federal loans, an amount that has grown almost 25 percent in two years, according to U.S. government data. The mountain of debt, for which taxpayers are on the hook, has provided a stream of revenue to companies at every stage of the process.

“This is not some small cottage industry,” said Rohit Chopra, the former student-loan ombudsman for the U.S. Consumer Financial Protection Bureau, which oversees loan servicers, debt collectors and private student lenders. “There is a large student-loan industrial complex. Rising costs of college and flat family incomes have created enormous business opportunity for every step of the loan process.” .....................(more)

http://www.bloomberg.com/news/articles/2015-12-11/a-144-000-student-default-shows-who-profits-at-taxpayer-expense

Who's Profiting From $1.2 Trillion of Federal Student Loans?

(Bloomberg) Jody Sofia borrowed $92,500 to get a degree from Florida Coastal School of Law. Now she’s in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors.

The companies making those calls are just one part of an ecosystem feeding on federal student loans. There are also debt servicers, refinance lenders, firms that help former students stay out of default and for-profit schools that make money as borrowers try to repay more than $1.2 trillion in government-backed education debt.

Sofia is one of 7 million former students in default on a record $115 billion of federal loans, an amount that has grown almost 25 percent in two years, according to U.S. government data. The mountain of debt, for which taxpayers are on the hook, has provided a stream of revenue to companies at every stage of the process.

“This is not some small cottage industry,” said Rohit Chopra, the former student-loan ombudsman for the U.S. Consumer Financial Protection Bureau, which oversees loan servicers, debt collectors and private student lenders. “There is a large student-loan industrial complex. Rising costs of college and flat family incomes have created enormous business opportunity for every step of the loan process.” .....................(more)

http://www.bloomberg.com/news/articles/2015-12-11/a-144-000-student-default-shows-who-profits-at-taxpayer-expense

December 11, 2015

Economic Elites Will Only Give Up Power and Wealth When Forced to Do So

Thursday, 10 December 2015 00:00

By Les Leopold, Labor Institute Press | Book Excerpt

The following is the introduction to Runaway Inequality: An Activist's Guide to Economic Justice, by Les Leopold:

The United States is among the richest countries in all of history. But if you're not a corporate or political elite, you'd never know it. In the world working people inhabit, our infrastructure is collapsing, our schools are laying off teachers, our drinking water is barely potable, our cities are facing bankruptcy, and our public and private pension funds are nearing collapse. We - consumers, students, and homeowners - are loaded with crushing debt, but our real wages haven't risen since the 1970s.

How can we be so rich and still have such poor services, so much debt and such stagnant incomes?

The answer: runaway inequality - the ever-increasing gap in income and wealth between the superrich and the rest of us.

This isn't the first time that a tiny elite has gained extraordinary control over economic and political life. Ancient Egypt had the Pharaohs. Medieval Europe had feudal lords and kings. We Americans had industrial robber barons.

And today, we've got financial and corporate elites. .................(more)

http://www.truth-out.org/progressivepicks/item/33960-economic-elites-will-only-give-up-power-and-wealth-when-forced-to-do-so

Economic Elites Will Only Give Up Power and Wealth When Forced to Do So

Economic Elites Will Only Give Up Power and Wealth When Forced to Do So

Thursday, 10 December 2015 00:00

By Les Leopold, Labor Institute Press | Book Excerpt

The following is the introduction to Runaway Inequality: An Activist's Guide to Economic Justice, by Les Leopold:

The United States is among the richest countries in all of history. But if you're not a corporate or political elite, you'd never know it. In the world working people inhabit, our infrastructure is collapsing, our schools are laying off teachers, our drinking water is barely potable, our cities are facing bankruptcy, and our public and private pension funds are nearing collapse. We - consumers, students, and homeowners - are loaded with crushing debt, but our real wages haven't risen since the 1970s.

How can we be so rich and still have such poor services, so much debt and such stagnant incomes?

The answer: runaway inequality - the ever-increasing gap in income and wealth between the superrich and the rest of us.

This isn't the first time that a tiny elite has gained extraordinary control over economic and political life. Ancient Egypt had the Pharaohs. Medieval Europe had feudal lords and kings. We Americans had industrial robber barons.

And today, we've got financial and corporate elites. .................(more)

http://www.truth-out.org/progressivepicks/item/33960-economic-elites-will-only-give-up-power-and-wealth-when-forced-to-do-so

December 11, 2015

by Steven W Thrasher

(Guardian UK) The economic hoarding by those at the top has been termed “income inequality”, but that’s neither a strong nor accurate enough phrasing. I have never heard poor people complain about “income inequality”; poor people complain about being screwed out of housing , or about working more hours for less pay or about having to choose between medicine and food.

“Inequality” sounds like something that happens by accident and can be remedied by fiddling around the edges. It is not as if the rich are a little more equal and the poor a little less equal, and if we shift a bit we’ll all come out in the middle. What we’ve been calling “income inequality” might be better understood as a war waged by US political and economic policy on the poor.

A new report from the Institute for Policy Studies issued this week analyzed the Forbes list of the 400 richest Americans and found that “the wealthiest 100 households now own about as much wealth as the entire African American population in the United States”. That means that 100 families – most of whom are white – have as much wealth as the 41,000,000 black folks walking around the country (and the million or so locked up) combined.

Similarly, the report also stated that “the wealthiest 186 members of the Forbes 400 own as much wealth as the entire Latino population” of the nation. Here again, the breakdown in actual humans is broke down: 186 overwhelmingly white folks have more money than that an astounding 55,000,000 Latino people. ......................(more)

http://www.theguardian.com/commentisfree/2015/dec/05/income-inequality-policy-capitalism

Income inequality happens by design. We can't fix it by tweaking capitalism

by Steven W Thrasher

(Guardian UK) The economic hoarding by those at the top has been termed “income inequality”, but that’s neither a strong nor accurate enough phrasing. I have never heard poor people complain about “income inequality”; poor people complain about being screwed out of housing , or about working more hours for less pay or about having to choose between medicine and food.

“Inequality” sounds like something that happens by accident and can be remedied by fiddling around the edges. It is not as if the rich are a little more equal and the poor a little less equal, and if we shift a bit we’ll all come out in the middle. What we’ve been calling “income inequality” might be better understood as a war waged by US political and economic policy on the poor.

A new report from the Institute for Policy Studies issued this week analyzed the Forbes list of the 400 richest Americans and found that “the wealthiest 100 households now own about as much wealth as the entire African American population in the United States”. That means that 100 families – most of whom are white – have as much wealth as the 41,000,000 black folks walking around the country (and the million or so locked up) combined.

Similarly, the report also stated that “the wealthiest 186 members of the Forbes 400 own as much wealth as the entire Latino population” of the nation. Here again, the breakdown in actual humans is broke down: 186 overwhelmingly white folks have more money than that an astounding 55,000,000 Latino people. ......................(more)

http://www.theguardian.com/commentisfree/2015/dec/05/income-inequality-policy-capitalism

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,078