Celerity

Celerity's JournalK & R for visibility

Here is how the Nicki Minaj story was covered on CNC3 Television in Port of Spain, Trinidad.

I assure you this is worth all 2:20 and it's probably better than any U.S. network covered the storyhttps://twitter.com/bubbaprog/status/1438194219269689352

Good news, the prescription drug plan passed Ways & Means, despite Problem Solver Stephanie Murphy's

No vote.

This means that despite the 3 centrists killing it off in the Energy and Commerce Committee, it still can be part of the final bill.

The hard part of that is you now have 4 Dems on record against it, so they now have the votes to scupper the entire bill on final vote if the drug price negotiation part is in it.

More here:

Three Democrats block drug pricing bill in health panel

Failed vote won’t stop policy agenda, House leaders say

(Updates throughout with results of House Ways and Means vote.)

https://about.bgov.com/news/drug-pricing-bill-in-jeopardy-as-moderates-vote-against-it-1/

House leaders vowed to press ahead with their health-care agenda Wednesday, even though enough Democrats oppose a key drug-pricing proposal to sink its chances in the House.

Reps. Kurt Schrader (D-Ore.), Scott Peters (D-Calif.) and Kathleen Rice (D-N.Y.) joined Republicans in opposing a bill to allow the government to demand lower prices from drugmakers and cap price increases on some medicines at the rate of inflation. The measure failed to advance in the House Energy and Commerce Committee on a 29-29 tied vote.

“We have to lower out-of-pocket costs for patients and preserve the American system of private investment in innovation,” said Peters. He, Schrader, and Rice sought passage of a similar but narrower drug pricing measure. A similar drug pricing proposal advanced later in the day at the House Ways and Means Committee on a 24-19 vote but was opposed by Rep. Stephanie Murphy (D-Fla.).

The Democratic opposition raises questions about whether party leaders have enough support from their own members for a domestic policy package that includes drug pricing provisions. The drug proposal is meant to offset some of the cost of Democrats’ broader health agenda, which includes expanding Medicare and the Affordable Care Act.

George Takei: Overheard: The vote was so lopsided, it's basically Elder abuse.

https://twitter.com/GeorgeTakei/status/1437990316737323008George Takei

@GeorgeTakei

I did my own research. And wow it's crazy but Larry Elders's victory was stolen in California because Nikki Minaj's cousin's testicles are swollen. Don't bully.

https://twitter.com/GeorgeTakei/status/1437994778344312834

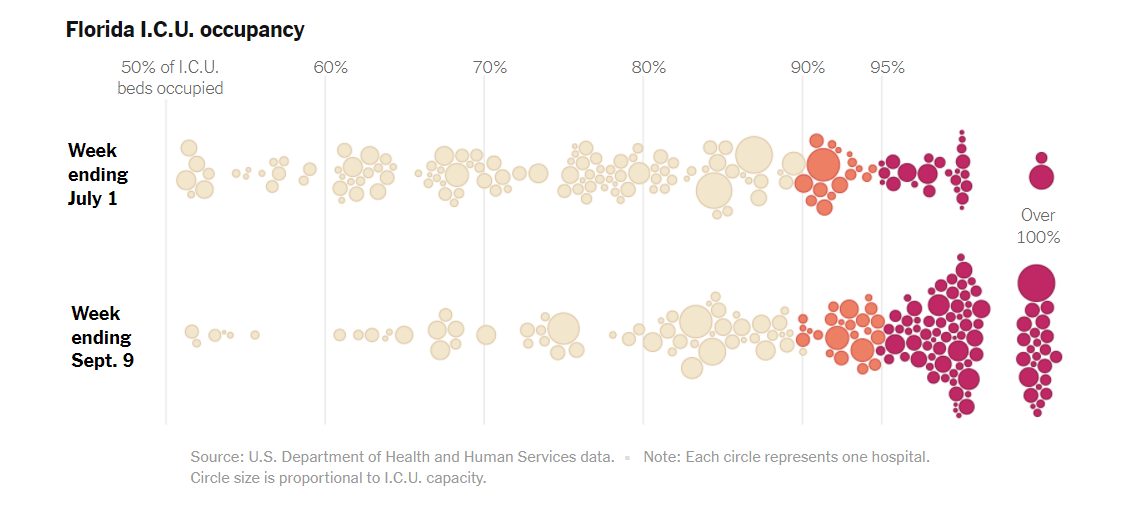

Tales of Paste & Madness in Dumbfuckistan: Covid Hospitalizations Hit Crisis Levels in Southern ICUs

https://www.nytimes.com/interactive/2021/09/14/us/covid-hospital-icu-south.html

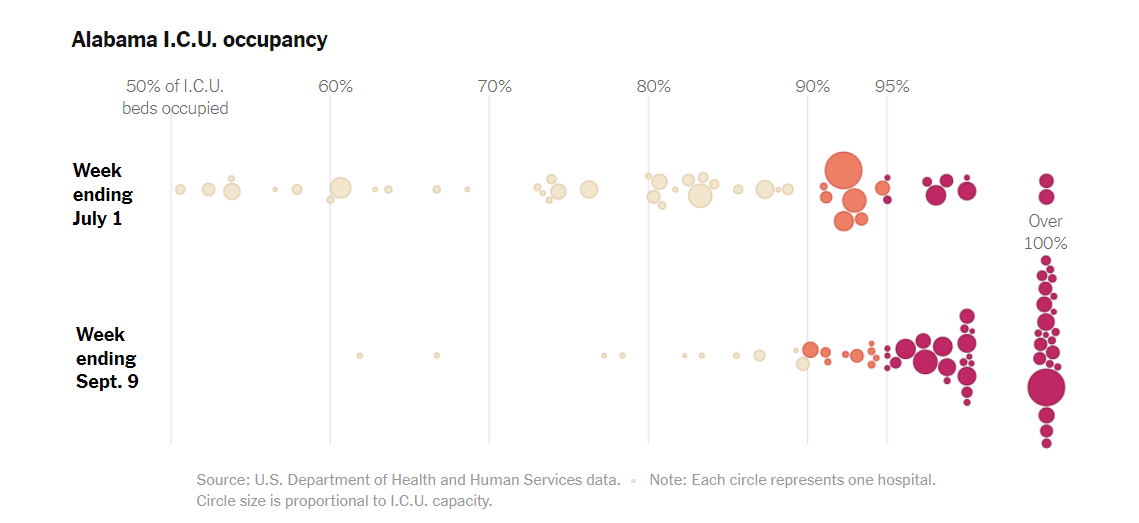

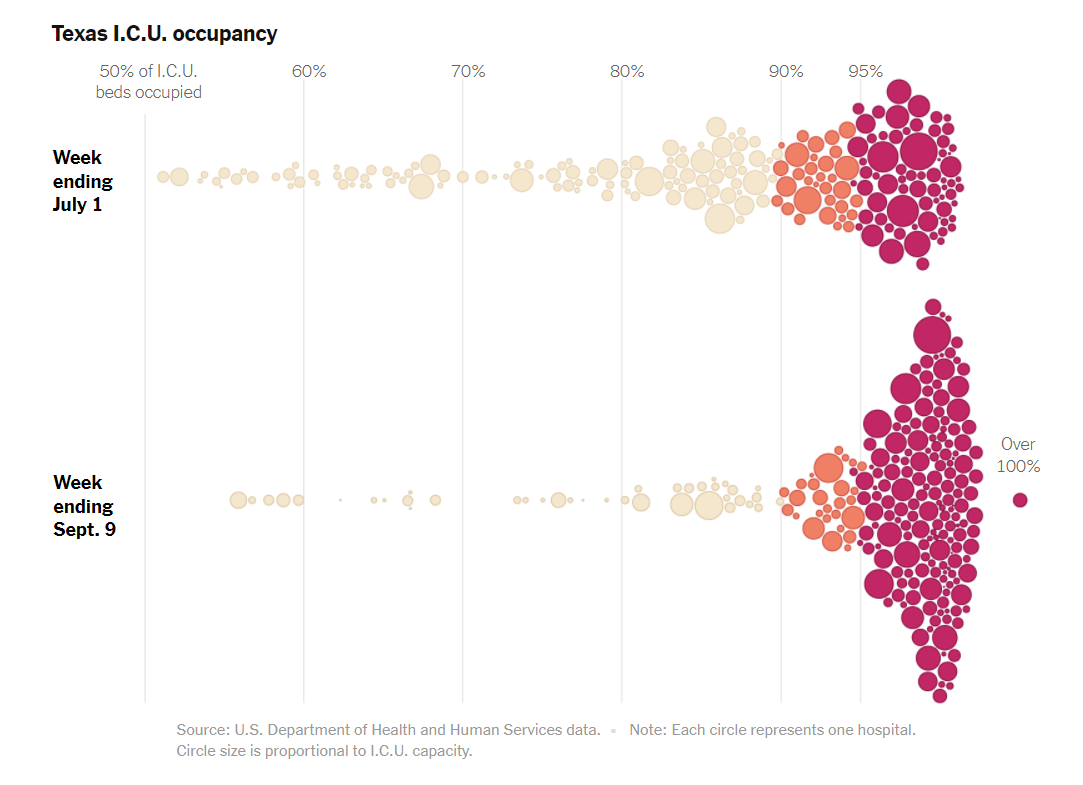

Hospitals in the southern United States are running dangerously low on space in intensive care units, as the Delta variant has led to spikes in coronavirus cases not seen since last year’s deadly winter wave. One in four hospitals now reports more than 95 percent of I.C.U. beds occupied — up from one in five last month. Experts say it can become difficult to maintain standards of care for the sickest patients in hospitals where all or nearly all I.C.U. beds are occupied. In June, when Covid-19 cases were at their lowest level, less than one in 10 hospitals had dangerously high occupancy rates.

In Alabama, all I.C.U. beds are currently occupied. In recent days, dozens of patients in the state have needed beds that were not available, according to data published by the Department of Health and Human Services. “It means they’re in the waiting room, some are in the back of ambulances, things of that nature,” said Jeannie Gaines, a spokesperson for the Alabama Hospital Association.

In Texas, 169 hospitals have I.C.U.s that are more than 95 percent full, up from 69 in June. There are only about 700 intensive care beds remaining across the entire state, according to recent data. Hospitals in Houston constructed overflow tents last month to handle the influx of patients, and the rate of hospitalizations in the state is now 40 percent higher than when the tents were built.

Twenty-four hospitals in Florida reported having more I.C.U. patients last week than available beds. During past surges, hospitals have been forced to improvise by having staff care for more patients than usual or by setting up temporary intensive care beds in other wings of the hospital. Patients with critical conditions besides Covid, like heart attacks or strokes, can also have worse health outcomes when most beds are full.

Unvaccinated Americans are 10 times more likely to be hospitalized with Covid than the vaccinated, according to a recent study by the Centers for Disease Control and Prevention. Several of the states with the highest rates of I.C.U. occupancy, including Alabama and Mississippi, are also among those with the lowest vaccination rates. “Our biggest concerns are our low vaccination rates,” said Dr. Scott Harris, Alabama’s state health officer. “That’s the reason we’re in the situation that we’re in. Virtually all of our deaths are people who are unvaccinated.” Hospitalizations among children under 18 are also higher than ever during this wave of the virus, driven largely by surges among children in the least vaccinated states.

snip

The Rock That Ended the Dinosaurs Was Much More Than a Dino Killer

In seeking the origin story of the Chicxulub impactor, scientists hope to also unlock secrets about the origin of life itself.https://www.nytimes.com/2021/09/13/science/chicxulub-dinosaur-extinction.html

The first cave art. The dawn of agriculture. While these are among the most crucial moments in humankind’s beginnings, our most dramatic origin story starts 66 million years ago. It was the apocalyptic instant when a rock from outer space slammed into Earth, terminating the age of dinosaurs and eventually offering a bountiful new world to our mammalian ancestors. For 40 years, scientists have studied the tale of this catastrophic object, known now as the Chicxulub impactor. Today, the impactor represents more than just one bad day on Earth; instead, it has become a kind of Rosetta Stone that can decipher deeper riddles about the origins of life and the future of human civilization, both on our planet and in other worlds across the galaxy. “The Chicxulub impact event completely modified the geologic and biologic evolution of planet Earth,” said David Kring, a planetary geologist who leads the Center for Lunar Science and Exploration in Houston and who was part of the team that announced the discovery of the Chicxulub impact crater beneath Mexico’s Yucatán Peninsula in 1991. “That is such a big scientific story with popular appeal because it extinguished dinosaurs and cleared the slate, if you will, for mammalian evolution that led to humans, it’s going to captivate both the scientific community and the public for years to come.”

For decades, scientists argued about the cause of the dinosaurs’ deaths. Volcanic eruptions and other exotic hypotheses were proposed, but the scientific consensus settled on a rock from space being the killer. The Chicxulub theory now reigns so supreme that scientists have pieced together detailed timelines of what transpired on that fateful day, and other researchers are writing what could be called the prequel, seeking the extraterrestrial origins of the event to which we partially owe our existence. As more advanced tools and techniques become available, scientists have been able to extract new and precise insights about this epic wipeout on our planet, and what it may mean for the beginnings of life itself. The latest find comes from a study published in July in the journal Icarus that sought the original home of the Chicxulub impactor. It did this by leveraging the immense processing power of a NASA supercomputer to model the motions of roughly 130,000 asteroids in the main belt between the orbits of Mars and Jupiter. “Ultimately we want to solve big questions, and this kind of work allows us to get after some of them,” said Bill Bottke, a co-author of the study and director of the department of space studies at the Southwest Research Institute in Boulder, Colo.

The Icarus study is part of a constant stream of ideas about the impact that can be dazzling in their creativity, often to the point of controversy. Earlier this year, for instance, a Harvard University team revived the possibility that the impactor was a comet, sparking pushback from many scientists in the field. Another scientist, Lisa Randall of Harvard University, even zoomed out to present a galactic view of the Chicxulub event. In her 2015 book “Dark Matter and the Dinosaurs,” Dr. Randall proposes that the Milky Way contains a layer of dark matter, a mysterious hypothetical substance, that can help nudge outer solar system comets toward Earth. Though this explanation has not gained a significant following, it demonstrates how Chicxulub attracts prismatic perspectives from the worlds of cosmology, computational science, astrobiology and other fields. To that point, Dr. Bottke said that access to NASA’s Pleiades supercomputer was a “game changer” for his team, enabling the researchers to run simulations of a huge asteroid population over the course of hundreds of millions of years.

This Big Data technique helped to match the strong geological evidence that the impactor was a carbonaceous asteroid — and not a comet — with a possible origin in the outer asteroid belt. This distant region between Mars and Jupiter contains many miles-wide carbonaceous asteroids similar to the Chicxulub impactor. But these rocks aren’t gravitationally hoisted into collision courses with planets as frequently as asteroids in the inner region of the belt, where there are fewer objects that match Chicxulub’s composition. “We were not finding an obvious solution to where one of the largest impactors that has hit Earth over recent time came from,” Dr. Bottke said. “Essentially, a lot of the possibilities we had tried just weren’t panning out. It was really frustrating and it seemed like we were missing something.” The team’s supercomputer approach revealed that Chicxulub-like asteroids escape from the outer belt about 10 times more frequently than implied by previous models. That boosts the odds that the dinosaur-killing rock may have originated there. “This is confirmation of a really cool idea, and I think it helps me understand a lot more about how the asteroid belt may be influencing the Earth over billions of years,” Dr. Bottke said.

snip

The PSL-Lover's Guide to the Pumpkin Spice-Flavoured Treats

Behold: Inventive and delicious pumpkin spice snacks you didn’t know you neededhttps://www.thrillist.com/shopping/nation/best-pumpkin-spice-flavored-snacks-to-buy

Get out your Ugg boots and infinity scarves: it’s pumpkin spice season. Every time September rolls around, we feel morally obligated to tell you that it is now time to infuse cinnamon, nutmeg, and ginger into every breakfast, beverage, and baked good possible. Sure, the outside temperature is still caught somewhere between summer and fall, but we’re pretty sure you can manifest the onset of cooler weather with the perfect blend of autumnal spices. Pumpkin spice is popular for a reason—don’t let the haters convince you otherwise. It’s comforting, it hits the right notes of sweet and spicy, and it perfectly embodies the cosy yet spooky spirit of fall. Of course, the classic vehicles for pumpkin spice are homemade pumpkin bread or the tried-and-true Pumpkin Spice Latte (affectionately, the PSL). But if you don’t feel like running to the grocery store for pumpkin purée or Starbucks just isn’t your thing, you are by no means limited. In fact, small businesses online are leading the game when it comes to inventive and delicious pumpkin spice treats. We’ve compiled a list of treats guaranteed to satisfy any sweet tooth with some autumnal flair. Whether you’re looking for themed party favours, unique Halloween giveaways for trick-or-treaters, or just a yummy afternoon snack, we’ve got you covered with options ranging from gummy candies to hot chocolate bombs. Read on to find the pumpkin spice treats you didn’t know you needed.

snip

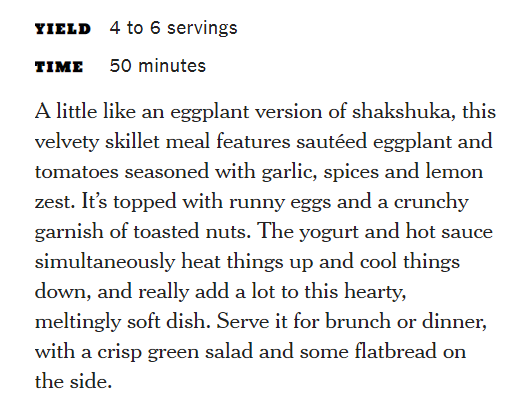

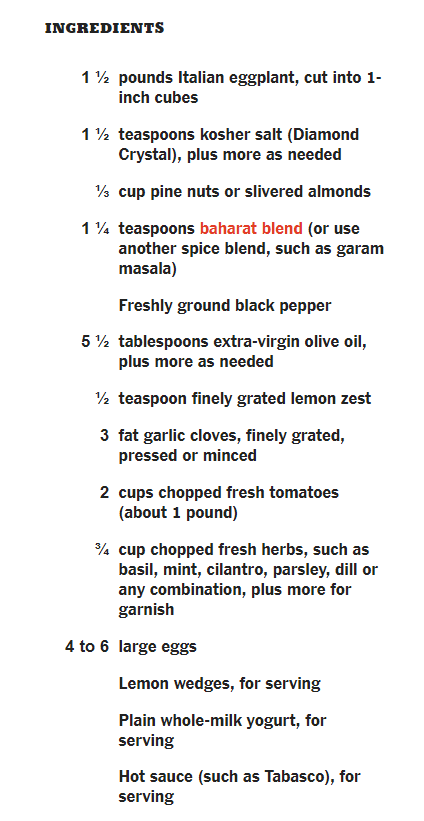

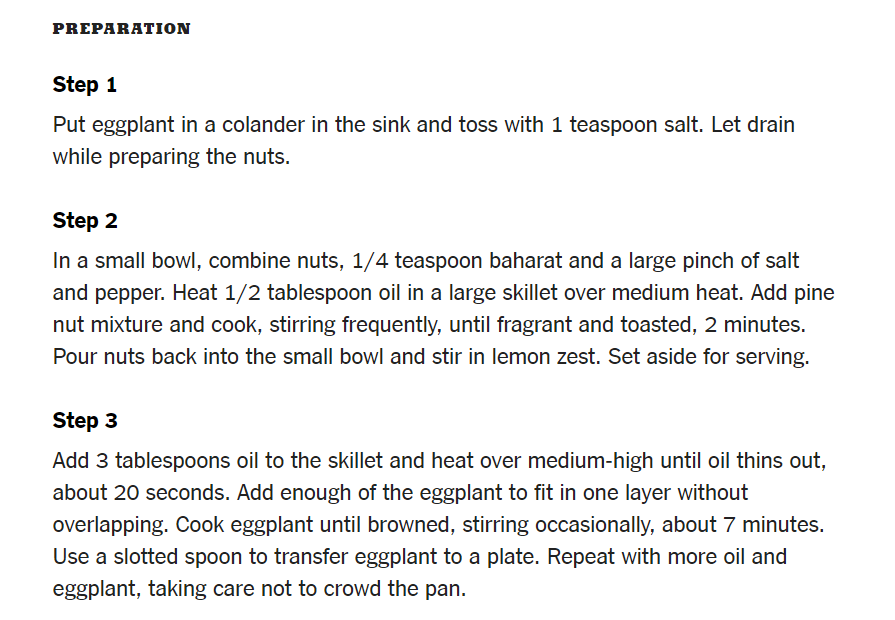

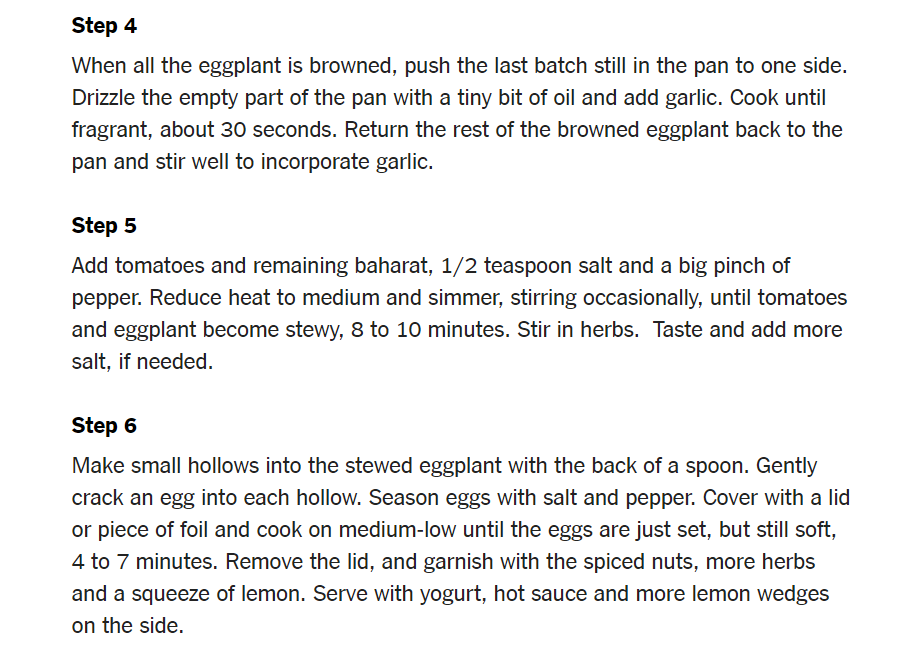

Spiced Eggplant and Tomatoes With Runny Eggs

https://cooking.nytimes.com/recipes/1022511-spiced-eggplant-and-tomatoes-with-runny-eggs

Featured in: When Eggplant Meets Eggs.

In a new review, some FDA scientists & others say boosters aren't needed for the general population

https://www.nytimes.com/2021/09/13/health/covid-vaccine-booster-lancet.htmlNone of the data on coronavirus vaccines so far provides credible evidence in support of boosters for the general population, according to a review published on Monday by an international group of scientists, including some at the Food and Drug Administration and the World Health Organization.

The 18 authors include Dr. Philip Krause and Dr. Marion Gruber, F.D.A. scientists who announced last month that they will be leaving the agency, at least in part because they disagreed with the Biden administration’s push for boosters before federal scientists could review the evidence and make recommendations. The Biden administration has proposed administering vaccine boosters eight months after the initial shots. But many scientists have opposed the plan, saying the vaccines continue to be powerfully protective against severe illness and hospitalization. A committee of advisers to the F.D.A. is scheduled to meet on Friday to review the data.

In the new review, published in The Lancet, experts said that whatever advantage boosters provide would not outweigh the benefit of using those doses to protect the billions of people who remain unvaccinated worldwide. Boosters may be useful in some people with weak immune systems, they said, but are not yet needed for the general population. Several studies published by the Centers for Disease Control and Prevention, including three on Friday, suggest that while efficacy against infection with the Delta variant seems to wane slightly over time, the vaccines hold steady against severe illness in all age groups. Only in older adults over 75 do the vaccines show some weakening in protection against hospitalization.

Immunity conferred by vaccines relies on protection both from antibodies and from immune cells. Although the levels of antibodies may wane over time — and raise the risk of infection — the body’s memory of the virus is long-lived. The vaccines are slightly less effective against infection with the Delta variant than with the Alpha variant, but the virus has not yet evolved to evade the sustained responses from immune cells, the experts said. Boosters may eventually be needed even for the general population if a variant emerges that sidesteps the immune response. The experts cautioned that promoting boosters before they are needed, as well as any reports of side effects from booster shots such as heart problems or Guillain-Barre syndrome, may undermine confidence in the primary vaccination. Data from Israel suggest that booster doses enhance protection against infection. But that evidence was collected just a week or so after the third dose and may not hold up over time, the experts said.

snip

House Democrats' Plan to Tax the Rich Leaves Vast Fortunes Unscathed

The House Ways and Means Committee’s proposal to pay for trillions in social spending leaves wealth gains and inheritances largely alone. It focuses instead on a more traditional target: income.https://www.nytimes.com/2021/09/13/us/politics/tax-plan-democrats.html

WASHINGTON — House Democrats on Monday presented a plan to pay for their expansive social policy and climate change package by raising taxes by more than $2 trillion, largely on wealthy individuals and profitable corporations. But the proposal, while substantial in scope, stopped well short of changes needed to dent the vast fortunes of tycoons like Jeff Bezos and Elon Musk, or to thoroughly close the most egregious loopholes exploited by high-flying captains of finance. It aimed to go after the merely rich more than the fabulously rich. Facing the delicate politics of a narrowly divided Congress, senior House Democrats opted to be more mindful of moderate concerns in their party than of its progressive ambitions. They focused on traditional ways of raising revenue: by raising tax rates on income rather than targeting wealth itself. Representative Dan Kildee of Michigan, a Democrat on the Ways and Means Committee, which crafted the plan, called it “the boldest common denominator.” “Being for something doesn’t make it law; 218 votes in the House, 50 votes in the Senate and the president’s signature make it law,” he said, adding, “What I don’t want is another noble defeat.”

The proposal includes nearly $2.1 trillion in increased tax revenues, the nonpartisan Joint Committee on Taxation estimated on Monday. Democrats say those increases will go a long way to funding President Biden’s ambitions to expand the federal government’s role in education, health care, climate change, paid leave and more. But the bill dispenses with measures floated by the White House and Senate Democrats to tax wealth or to close off avenues that the superrich have exploited to pass on a lifetime of gains to their heirs tax-free. “It would be a monumental mistake for Congress to pass a bill that really exempts billionaires,” said Senator Ron Wyden of Oregon, the Democratic chairman of the Finance Committee. Key Democrats cautioned on Monday that the House proposal was likely to change — perhaps considerably — as Mr. Biden’s economic agenda wends its way through the House and Senate, where Democrats hold slim majorities and must hold nearly every member of their ideologically diverse caucus together. But White House officials welcomed the Ways and Means plan and said it took important steps toward the president’s vision of a tax code that rewards ordinary workers at the expense of the very rich.

The proposal includes substantial measures to raise taxes on the rich. Taxable income over $450,000 — or $400,000 for unmarried individuals — would be taxed at 39.6 percent, the top rate before President Donald J. Trump’s 2017 tax cut brought it to 37 percent. The top capital gains rate would rise to 25 percent from 20 percent, considerably less than a White House proposal that would have taxed investment gains as income for the richest, at 39.6 percent. Under the committee’s plan, a 3 percent surtax would be applied to incomes over $5 million. The value of estates shielded from estate taxation, which doubled to $24 million for married couples under the Republican tax cuts of 2017, would go back to $12 million at the end of this year, four years earlier than the scheduled expiration. The proposal would also raise taxes in a variety of ways on businesses called pass-through entities — like many law firms and financial companies — that distribute profits to their owners, who then pay individual income taxes on them. Those changes, including the extension of an existing 3.8 percent surtax to include pass-through income, would raise taxes primarily on high earners, generating several hundred billion dollars in revenues, by Democratic estimates. The joint committee estimated on Monday that the changes would raise about $1 trillion from high-income individuals.

Republicans balked at the proposal. Business lobbying groups rejected the package, with the U.S. Chamber of Commerce slamming it as “an existential threat to America’s fragile economic recovery and future prosperity.” “President Biden, Speaker Nancy Pelosi and House Democrats are ramming through trillions of wasteful spending and crippling tax hikes that will drive prices up even higher, kill millions of American jobs and drive them overseas, and usher in a new era of government dependency with the greatest expansion of the welfare state in our lifetimes,” Representative Kevin Brady of Texas, the committee’s ranking Republican, said of the plan. But what is not included is notable. The richest of the rich earn little from actual paychecks (Mr. Bezos’s salary as the founder of Amazon was $81,840 in 2020), so a surtax on income would have little impact. Their vast fortunes in stocks, bonds, real estate and other assets grow largely untaxed each year. “The proposal is extremely modest in the area of structural change,” said Eric Toder, a co-director of the nonpartisan Tax Policy Center in Washington. “Mostly, it is about raising rates on existing tax bases.” In the Senate, Democrats are taking aim directly at accumulated wealth. The Finance Committee has proposed a one-time surtax on billionaires’ fortunes, followed by annual levies on the gains in value of billionaires’ assets, similar to the way property taxes are adjusted each year to reflect gains in housing values.

snip

Profile Information

Gender: FemaleHometown: London

Home country: US/UK/Sweden

Current location: Stockholm, Sweden

Member since: Sun Jul 1, 2018, 07:25 PM

Number of posts: 43,624