Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

In reply to the discussion: Weekend Economists Go Out with a Boom August 24-26, 2012 [View all]Demeter

(85,373 posts)5. Aug 24, 1982: A Wall Street scheme is hatched

http://www.history.com/this-day-in-history/a-wall-street-scheme-is-hatched

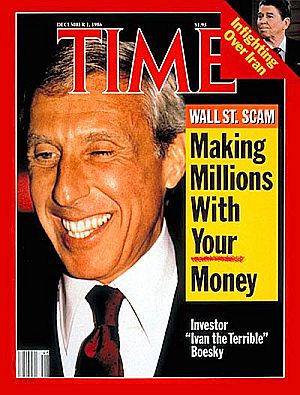

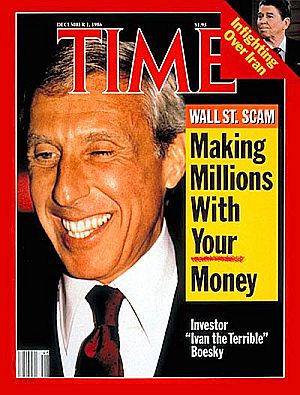

Martin Siegel meets Ivan Boesky at the Harvard Club in New York City to discuss his mounting financial pressures. Arbitrageur Boesky offered Siegel, a mergers-and-acquisitions executive at Kidder, Peabody & Co., a job, but Siegel, who was looking for some kind of consulting arrangement, declined. Boesky then suggested that if Siegel would supply him with early inside information on upcoming mergers there would be something in it for him.

In January 1983, although little information had been exchanged, Boesky sent a courier with a secret code and a briefcase containing $150,000 in $100 bills to be delivered to Siegel at the Plaza Hotel.

Over the next couple of years, Siegel passed inside information to Boesky on several occasions. With Siegel's inside tips, Boesky made $28 million dollars investing in Carnation stock before its takeover. But his success began to fuel investigative inquiries by both the press and the Securities and Exchange Commission. Rumors that Siegel and Kidder, Peabody & Co. were involved in illegal activities began floating around.

Despite the pressure, Siegel and Boesky met at a deli in January 1985, where Siegel demanded $400,000. This time, the cash drop-off was made at a phone booth. Siegel, who was apprehensive about his relationship with Boesky, decided to put an end to it after he had received his money. Still, he continued to trade inside information with other Wall Street executives.

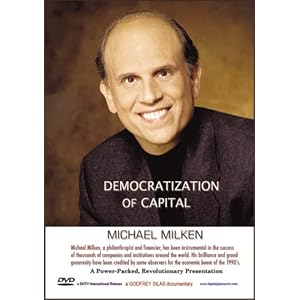

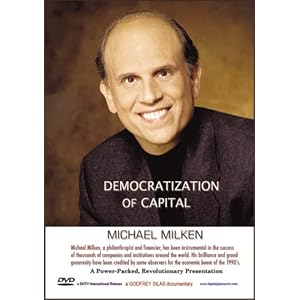

In 1986, the illegal schemes, which by then included many of the biggest traders in the country, came crashing down. Arrests were made up and down Wall Street, and Boesky and Michael Milken, the junk bond king charged with violating federal securities laws, were no exception.

Siegel turned out to be one of the few cooperative witnesses for the government and virtually the only one who showed remorse for his role in the fraud, causing him to be ostracized on Wall Street. Nevertheless, he did fare better than the others: Milken received a 10-year sentence and Boesky received 3 years, but Siegel was only required to return the $9 million he had obtained illegally. The entire incident came to symbolize the era of unfettered greed on Wall Street in the mid-1980s.

Martin Siegel meets Ivan Boesky at the Harvard Club in New York City to discuss his mounting financial pressures. Arbitrageur Boesky offered Siegel, a mergers-and-acquisitions executive at Kidder, Peabody & Co., a job, but Siegel, who was looking for some kind of consulting arrangement, declined. Boesky then suggested that if Siegel would supply him with early inside information on upcoming mergers there would be something in it for him.

In January 1983, although little information had been exchanged, Boesky sent a courier with a secret code and a briefcase containing $150,000 in $100 bills to be delivered to Siegel at the Plaza Hotel.

Over the next couple of years, Siegel passed inside information to Boesky on several occasions. With Siegel's inside tips, Boesky made $28 million dollars investing in Carnation stock before its takeover. But his success began to fuel investigative inquiries by both the press and the Securities and Exchange Commission. Rumors that Siegel and Kidder, Peabody & Co. were involved in illegal activities began floating around.

Despite the pressure, Siegel and Boesky met at a deli in January 1985, where Siegel demanded $400,000. This time, the cash drop-off was made at a phone booth. Siegel, who was apprehensive about his relationship with Boesky, decided to put an end to it after he had received his money. Still, he continued to trade inside information with other Wall Street executives.

In 1986, the illegal schemes, which by then included many of the biggest traders in the country, came crashing down. Arrests were made up and down Wall Street, and Boesky and Michael Milken, the junk bond king charged with violating federal securities laws, were no exception.

Siegel turned out to be one of the few cooperative witnesses for the government and virtually the only one who showed remorse for his role in the fraud, causing him to be ostracized on Wall Street. Nevertheless, he did fare better than the others: Milken received a 10-year sentence and Boesky received 3 years, but Siegel was only required to return the $9 million he had obtained illegally. The entire incident came to symbolize the era of unfettered greed on Wall Street in the mid-1980s.

Edit history

Please sign in to view edit histories.

Recommendations

0 members have recommended this reply (displayed in chronological order):

74 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

SEC to Make the World Safer for Fraudsters, Push Thru JOBS Act Con-Artist-Friendly Solicitation Rul

Demeter

Aug 2012

#3

A Transactional Genealogy of Scandal: From Michael Milken to Enron to Goldman Sachs

Demeter

Aug 2012

#4

Real Remedies for the Foreclosure Crisis Exist: The Game-Changing Implications of Bain v. MERS

Demeter

Aug 2012

#11

George Soros remarks at the Festival of Economics in Trento, Italy on June 2, 2012.

xchrom

Aug 2012

#20

Chris Hedges on 'Empire of Illusion' and a Vignette of The Fall of Berlin 1945

Ghost Dog

Aug 2012

#36