Dr. Housing Bubble 04/10/15 [View all]

The broke first time home buyer: 66 percent of first time buyers purchase homes with low down payment mortgages.

There is a reason why new home sales still remain in a slump. New home sales cater to an economy where most family income is rising to support the cost of higher priced homes. In many markets, new homes cater to first time buyers. But the first time home buyer market is mired in problems. In more expensive metro areas you have younger people simply unable to afford rents let alone the cost of a crap shack. In many other parts of the US families are simply dealing with an economy that isn’t seeing across the board wage increases. Low interest rates have to remain to keep the monthly payment static. At least that is what the Fed is hoping for. There was some recent data showing that first time home buyers continue to make up a small portion of all sales. Contrary to some false narrative, many first time home buyers are coming in with low down payments, not suitcases of cash. And for the most part, this is being driven because Americans overall don’t have much in savings and barely enough to cover a dinner at Taco Tuesday with a side order of guacamole if you are being a big spender.

Low down payments and low percentage of all sales

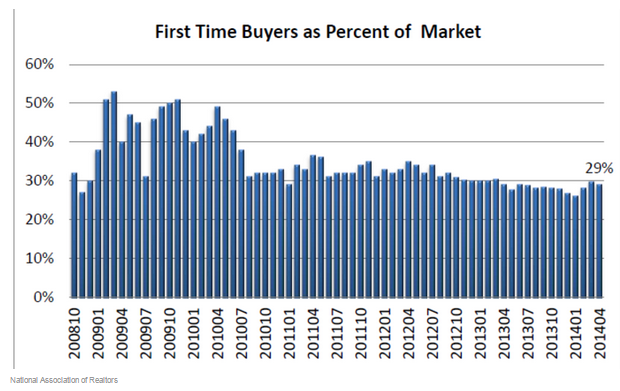

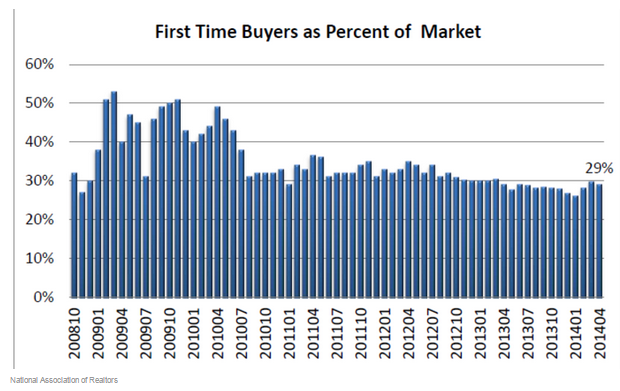

The first point we should look at is that the percent of first time home buyers is still near historical lows. First time home buyers as you would expect come from younger families. Younger Americans came of age during the epic tech bubble and the even more dramatic housing/debt bubble. Across a span of 20 years wages have remained stagnant yet the cost of debt financed items has ballooned (i.e., housing, college tuition, and even glamorous cars). But with housing, much of the growth is dependent on government backed low rate loans.

Take a look at the percentage of first time home buyers:

http://www.doctorhousingbubble.com/broke-first-time-home-buyer-first-time-buyer-down-payment/

http://www.doctorhousingbubble.com/broke-first-time-home-buyer-first-time-buyer-down-payment/