Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

July 24, 2015

Passengers who ride the Muni Metro subway lines at night will have to hop on the bus for six months beginning July 31.

Work to replace the system's outdated radio and emergency telephone communications systems will shut down the Market Street Subway and Twin Peaks Tunnel, eliminating rail service between Embarcadero and West Portal stations.

Muni will replace the subway service with shuttle buses scheduled to depart every 8 minutes along the length of the subway. Regular Muni Metro service is scheduled to resume at about 5 a.m. daily.

During the subway shutdown, shuttles will run from the Embarcadero to St. Francis Circle from 9:30 p.m. to 1:30 a.m. Riders can board shuttles at the island F-line stops near the Market Street subway stations. Muni Metro rail service outside of the tunnels will run on normal schedules. ....................(more)

http://www.masstransitmag.com/news/14045949/muni-subway-to-be-closed-at-night-starting-july-31-for-six-months

San Francisco: Muni Subway to be Closed at Night Starting July 31 for Six Months

Passengers who ride the Muni Metro subway lines at night will have to hop on the bus for six months beginning July 31.

Work to replace the system's outdated radio and emergency telephone communications systems will shut down the Market Street Subway and Twin Peaks Tunnel, eliminating rail service between Embarcadero and West Portal stations.

Muni will replace the subway service with shuttle buses scheduled to depart every 8 minutes along the length of the subway. Regular Muni Metro service is scheduled to resume at about 5 a.m. daily.

During the subway shutdown, shuttles will run from the Embarcadero to St. Francis Circle from 9:30 p.m. to 1:30 a.m. Riders can board shuttles at the island F-line stops near the Market Street subway stations. Muni Metro rail service outside of the tunnels will run on normal schedules. ....................(more)

http://www.masstransitmag.com/news/14045949/muni-subway-to-be-closed-at-night-starting-july-31-for-six-months

July 24, 2015

WASHINGTON -- In the early campaign money race for the 2016 presidential election, executives and employees of big bank institutions are lining up behind three candidates: Democrat Hillary Clinton and Republicans Jeb Bush and Marco Rubio.

Clinton, the former secretary of state and New York senator, leads all candidates, with $432,610 from big banks' executives, employees and their spouses. This includes banks like JPMorgan Chase, Bank of America, Goldmans Sachs, Morgan Stanley, Citigroup, UBS, Barclays, Credit Suisse and Deutsche Bank.

Bush, whose fundraising is somewhat obscured by the fact that he raised $100 million for his super PAC until June 15, was close behind, with $353,150 for his official campaign. When his super PAC numbers, to be reported on July 31, are taken into account, Bush likely will have raised millions from these bank executives. In third place, Rubio pulled in $105,669. No other candidate cracked six figures.

Fundraising from Wall Street banks is watched closely among political actors as a signal of how well-funded a particular candidate will be and how much establishment support they will have. Lower Manhattan is the Mecca of political money, as candidates from both parties make repeat pilgrimages to raise cash for their campaigns. The broader financial sector, which encompasses hedge funds, investment firms and private equity aside big Wall Street banks, is the single largest source of funds for all federal political campaigns, providing more than $2 billion since the 2008 election, according to the Center for Responsive Politics. ...........(more)

http://www.huffingtonpost.com/entry/wall-street-is-putting-money-behind-these-presidential-candidates_55b143e7e4b08f57d5d414ad?

Wall Street is buyi..., err, putting its money behind these presidential candidates

WASHINGTON -- In the early campaign money race for the 2016 presidential election, executives and employees of big bank institutions are lining up behind three candidates: Democrat Hillary Clinton and Republicans Jeb Bush and Marco Rubio.

Clinton, the former secretary of state and New York senator, leads all candidates, with $432,610 from big banks' executives, employees and their spouses. This includes banks like JPMorgan Chase, Bank of America, Goldmans Sachs, Morgan Stanley, Citigroup, UBS, Barclays, Credit Suisse and Deutsche Bank.

Bush, whose fundraising is somewhat obscured by the fact that he raised $100 million for his super PAC until June 15, was close behind, with $353,150 for his official campaign. When his super PAC numbers, to be reported on July 31, are taken into account, Bush likely will have raised millions from these bank executives. In third place, Rubio pulled in $105,669. No other candidate cracked six figures.

Fundraising from Wall Street banks is watched closely among political actors as a signal of how well-funded a particular candidate will be and how much establishment support they will have. Lower Manhattan is the Mecca of political money, as candidates from both parties make repeat pilgrimages to raise cash for their campaigns. The broader financial sector, which encompasses hedge funds, investment firms and private equity aside big Wall Street banks, is the single largest source of funds for all federal political campaigns, providing more than $2 billion since the 2008 election, according to the Center for Responsive Politics. ...........(more)

http://www.huffingtonpost.com/entry/wall-street-is-putting-money-behind-these-presidential-candidates_55b143e7e4b08f57d5d414ad?

July 24, 2015

Industrial Pollution Is Threatening Our Drinking Water: A Dispatch From Los Angeles County

By Daniel Ross, Truthout | Report

Though water use has been cut by 29 percent in the state over the last two years, with summer temperatures already hovering around triple digits, a question being asked with greater frequency and not a little more urgency is this one: If, as some experts ominously predict, the drought continues well into the foreseeable future, where's the county's drinking water going to come from?

Currently, LA County relies on water from three main sources: northern California, the Colorado River and groundwater beneath the county's feet. And while groundwater is the most accessible of the three, it's far from the cleanest. Indeed, no other county in the state is more reliant than LA County on groundwater that has been deemed contaminated at one time or another.

That's not to say that the problem has gone unheeded. Since the 1980s, billions of dollars have been pumped into cleaning the county's four main water basins: the San Fernando, San Gabriel, Central and West Coast Water Basins. But all these years later, a losing battle is still being waged in some areas against the continued migration of contamination into clean aquifers, a toxic legacy from decades of heavy industrial pollution in the region. And the situation is reaching a watershed.

Experts predict that, unless further drastic measures are taken within five to eight years to tackle groundwater pollution in the San Fernando Basin alone, contaminated plumes will become so dense and permanent that the rest of the wells in that area will need to be shut down. ..............(more)

http://www.truth-out.org/news/item/32031-industrial-pollution-is-threatening-our-drinking-water-a-dispatch-from-los-angeles-county

Industrial Pollution Is Threatening Our Drinking Water: A Dispatch From Los Angeles County

Industrial Pollution Is Threatening Our Drinking Water: A Dispatch From Los Angeles County

By Daniel Ross, Truthout | Report

Though water use has been cut by 29 percent in the state over the last two years, with summer temperatures already hovering around triple digits, a question being asked with greater frequency and not a little more urgency is this one: If, as some experts ominously predict, the drought continues well into the foreseeable future, where's the county's drinking water going to come from?

Currently, LA County relies on water from three main sources: northern California, the Colorado River and groundwater beneath the county's feet. And while groundwater is the most accessible of the three, it's far from the cleanest. Indeed, no other county in the state is more reliant than LA County on groundwater that has been deemed contaminated at one time or another.

That's not to say that the problem has gone unheeded. Since the 1980s, billions of dollars have been pumped into cleaning the county's four main water basins: the San Fernando, San Gabriel, Central and West Coast Water Basins. But all these years later, a losing battle is still being waged in some areas against the continued migration of contamination into clean aquifers, a toxic legacy from decades of heavy industrial pollution in the region. And the situation is reaching a watershed.

Experts predict that, unless further drastic measures are taken within five to eight years to tackle groundwater pollution in the San Fernando Basin alone, contaminated plumes will become so dense and permanent that the rest of the wells in that area will need to be shut down. ..............(more)

http://www.truth-out.org/news/item/32031-industrial-pollution-is-threatening-our-drinking-water-a-dispatch-from-los-angeles-county

July 24, 2015

(In These Times) The state of Illinois stands at a crossroads. Our elected officials must fix the state’s structural deficit estimated to be in the range of $3.3 to $6.1 billion. This deficit is usually attributed to a history of corruption, irresponsible spending and political patronage, which places the blame squarely at the doorstep of shortsighted politicians. But this argument misses the big picture.

The hard truth is that it costs money to educate our children, maintain our infrastructure, provide a basic social safety net and make other critical investments in the common good, and for far too long our elected officials have failed to raise the revenue to make these investments that most Illinoisans believe are important.

The state’s flat income tax rate, one of the most regressive in the United States, ensures that the wealthy pay far less, proportionally, than middle and lower income earners.

Corporate tax policy ensures that corporations pay little to no taxes on the vast bulk of their profits. Fully two thirds of Illinois corporations pay no income taxes to the state.

Lastly, a variety of ill-advised tax breaks and loopholes, implemented to attract jobs and business to the state, have undeniably failed on this count. Since they were put into place Illinois has continued to steadily lose manufacturing jobs. However, these loopholes have been very effective at draining at least a billion dollars a year out of public funds and redirecting it into idle private profits. Illinois continues to be governed on a “trickle down” economic model that has comprehensively failed over the past 3 decades. .................(more)

The complete piece is at: http://inthesetimes.com/article/18219/revenue-is-the-only-real-solution-to-illinois-budget-deficit

Taxing the Rich is the Only Real Solution to Illinois’ Budget Deficit

(In These Times) The state of Illinois stands at a crossroads. Our elected officials must fix the state’s structural deficit estimated to be in the range of $3.3 to $6.1 billion. This deficit is usually attributed to a history of corruption, irresponsible spending and political patronage, which places the blame squarely at the doorstep of shortsighted politicians. But this argument misses the big picture.

The hard truth is that it costs money to educate our children, maintain our infrastructure, provide a basic social safety net and make other critical investments in the common good, and for far too long our elected officials have failed to raise the revenue to make these investments that most Illinoisans believe are important.

The state’s flat income tax rate, one of the most regressive in the United States, ensures that the wealthy pay far less, proportionally, than middle and lower income earners.

Corporate tax policy ensures that corporations pay little to no taxes on the vast bulk of their profits. Fully two thirds of Illinois corporations pay no income taxes to the state.

Lastly, a variety of ill-advised tax breaks and loopholes, implemented to attract jobs and business to the state, have undeniably failed on this count. Since they were put into place Illinois has continued to steadily lose manufacturing jobs. However, these loopholes have been very effective at draining at least a billion dollars a year out of public funds and redirecting it into idle private profits. Illinois continues to be governed on a “trickle down” economic model that has comprehensively failed over the past 3 decades. .................(more)

The complete piece is at: http://inthesetimes.com/article/18219/revenue-is-the-only-real-solution-to-illinois-budget-deficit

July 24, 2015

from In These Times:

The Other 2016 Presidential Candidates Are Saying Things That Are Basically As Crazy As Donald Trump

Trump is not the only presidential hopeful willing to make utterly mind-boggling statements.

BY DAVID SIROTA

Since announcing his 2016 White House bid, Donald Trump has been the central focus of the campaign—by one estimate, he has garnered almost 40 percent of all election coverage on the network newscasts. Clearly, The Donald’s attempt to turn 1600 Pennsylvania Ave. into Trump White House has attracted so much attention because the candidate is seen as a Bulworthesque carnival barker who will say anything, no matter how hypocritical, factually unsubstantiated or absurd.

....(snip).....

Take Hillary Clinton. Earlier this month, she said, “there can be no justification or tolerance for this kind of criminal behavior” that has been seen on Wall Street. She added that “while institutions have paid large fines and in some cases admitted guilt, too often it has seemed that the human beings responsible get off with limited consequences or none at all, even when they have already pocketed the gains.” Her campaign echoed the message with an email to supporters lauding Clinton for saying that “when Wall Street executives commit criminal wrongdoing, they deserve to face criminal prosecution.”

Clinton’s outrage sounds convincing at first but then, audacity-wise, it starts to seem positively Trump-like when cross-referenced with campaign finance reports, foundation donations and speaking fees.

According to an Associated Press analysis, Clinton has already raked in more than $1.6 million worth of campaign contributions from donors in the same financial sector she is slamming on the campaign trail. Additionally, Clinton’s foundation took $5 million worth of donations from at least nine financial institutions that secured special deals to avoid prosecution—even as they admitted wrongdoing. The Clintons also accepted nearly $4 million in speaking fees from those firms since 2009.

....(snip).....

Then there is Jeb Bush. He recently trekked back to Tallahassee to deliver a speech portraying himself as a clean-government reformer. He asserted that before he became Florida governor, “lobbyists and legislators grew a little too comfortable in each other's company” but he also insisted that he “refused to go along with that establishment” and “wasn’t a member of the club.”

Again, it sounds vaguely convincing, until the facts make the chutzpah involved seem positively Trump-ish. .............(more)

http://inthesetimes.com/article/18234/more-2016-candidates-embrace-the-trump-zeitgeist

David Sirota: Trump is not the only candidate willing to make utterly mind-boggling statements

from In These Times:

The Other 2016 Presidential Candidates Are Saying Things That Are Basically As Crazy As Donald Trump

Trump is not the only presidential hopeful willing to make utterly mind-boggling statements.

BY DAVID SIROTA

Since announcing his 2016 White House bid, Donald Trump has been the central focus of the campaign—by one estimate, he has garnered almost 40 percent of all election coverage on the network newscasts. Clearly, The Donald’s attempt to turn 1600 Pennsylvania Ave. into Trump White House has attracted so much attention because the candidate is seen as a Bulworthesque carnival barker who will say anything, no matter how hypocritical, factually unsubstantiated or absurd.

....(snip).....

Take Hillary Clinton. Earlier this month, she said, “there can be no justification or tolerance for this kind of criminal behavior” that has been seen on Wall Street. She added that “while institutions have paid large fines and in some cases admitted guilt, too often it has seemed that the human beings responsible get off with limited consequences or none at all, even when they have already pocketed the gains.” Her campaign echoed the message with an email to supporters lauding Clinton for saying that “when Wall Street executives commit criminal wrongdoing, they deserve to face criminal prosecution.”

Clinton’s outrage sounds convincing at first but then, audacity-wise, it starts to seem positively Trump-like when cross-referenced with campaign finance reports, foundation donations and speaking fees.

According to an Associated Press analysis, Clinton has already raked in more than $1.6 million worth of campaign contributions from donors in the same financial sector she is slamming on the campaign trail. Additionally, Clinton’s foundation took $5 million worth of donations from at least nine financial institutions that secured special deals to avoid prosecution—even as they admitted wrongdoing. The Clintons also accepted nearly $4 million in speaking fees from those firms since 2009.

....(snip).....

Then there is Jeb Bush. He recently trekked back to Tallahassee to deliver a speech portraying himself as a clean-government reformer. He asserted that before he became Florida governor, “lobbyists and legislators grew a little too comfortable in each other's company” but he also insisted that he “refused to go along with that establishment” and “wasn’t a member of the club.”

Again, it sounds vaguely convincing, until the facts make the chutzpah involved seem positively Trump-ish. .............(more)

http://inthesetimes.com/article/18234/more-2016-candidates-embrace-the-trump-zeitgeist

July 24, 2015

By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

Last week Mario Draghi held a press conference following the decision to raise ELA a paltry 900 million dollars for Greek banks. In that press conference he said many things but I’d like to focus on one passage that has gotten no attention:

This is a truly shocking statement. To understand why, we need to go back to the basics of central banking. Banks have accounts at the central bank (I’m going to call the balances in these accounts “settlement balances” in line with non U.S. Conventions) which are primarily used to settle payments with other banks. When you use a debit card issued by one bank to pay someone with a bank account in another bank, your bank has to in turn send a payment using settlement balances to make that payment.

As should be obvious from that description, in order to make that payment your bank has to have sufficient settlement balances in its account at the central bank or the central bank must provide an overdraft. Thus, if the smooth functioning of the payments system is defined as the ability of depository institutions to clear payments, the central bank must ensure that settlement balances are available at some price.

The Federal Reserve explicitly recognizes this in its “Policy on Payment System Risk” by stating that “the Board recognizes that the Federal Reserve has an important role in providing intraday balances and credit to foster the smooth operation of the payment system”. Draghi is arguing that the ECB’s mandate to “promote the smooth functioning of the payments system” is defined differently than the Federal Reserve’s mandate and (as far as I can tell) every other Central Bank’s payment system mandate around the world. I can’t under-emphasize how radical a departure Draghi’s position is from the norms of central banking. Whatever else we may want to criticize the Federal Reserve’s and the government’s response to the financial crisis, they did preserve the the smooth functioning of the payments system with their alphabet soup of lending facilities and ultimately an FDIC guarantee on interbank lending. The problem was that they didn’t put Too Big To Fail banks in a form of receivership and didn’t prosecute bank executives, not that they made sure payments continued to take place. .................(more)

http://www.nakedcapitalism.com/2015/07/mario-draghi-the-ecb-has-no-mandate-to-ensure-checks-clear-or-credit-cards-work.html

Mario Draghi: The ECB Has No Mandate To Ensure Checks Clear Or Credit Cards Work

By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

Last week Mario Draghi held a press conference following the decision to raise ELA a paltry 900 million dollars for Greek banks. In that press conference he said many things but I’d like to focus on one passage that has gotten no attention:

There is an article in the Treaty that says that basically the ECB has the responsibility to promote the smooth functioning of the payment system. But this has to do with the functioning of TARGET2, the distribution of notes, coins. So not with the provision of liquidity, which actually is regulated by a different provision, in Article 18.1 in the ECB Statute: “In order to achieve the objectives of the ESCB, the ECB and the national central banks may conduct credit operations with credit institutions and other market participants, with lending based on adequate collateral.” This is the Treaty provision. But our operations were not monetary policy operations, but ELA operations, and so they are regulated by a separate agreement, which makes explicit reference to the necessity to have sufficient collateral. So, all in all, liquidity provision has never been unconditional and unlimited.

This is a truly shocking statement. To understand why, we need to go back to the basics of central banking. Banks have accounts at the central bank (I’m going to call the balances in these accounts “settlement balances” in line with non U.S. Conventions) which are primarily used to settle payments with other banks. When you use a debit card issued by one bank to pay someone with a bank account in another bank, your bank has to in turn send a payment using settlement balances to make that payment.

As should be obvious from that description, in order to make that payment your bank has to have sufficient settlement balances in its account at the central bank or the central bank must provide an overdraft. Thus, if the smooth functioning of the payments system is defined as the ability of depository institutions to clear payments, the central bank must ensure that settlement balances are available at some price.

The Federal Reserve explicitly recognizes this in its “Policy on Payment System Risk” by stating that “the Board recognizes that the Federal Reserve has an important role in providing intraday balances and credit to foster the smooth operation of the payment system”. Draghi is arguing that the ECB’s mandate to “promote the smooth functioning of the payments system” is defined differently than the Federal Reserve’s mandate and (as far as I can tell) every other Central Bank’s payment system mandate around the world. I can’t under-emphasize how radical a departure Draghi’s position is from the norms of central banking. Whatever else we may want to criticize the Federal Reserve’s and the government’s response to the financial crisis, they did preserve the the smooth functioning of the payments system with their alphabet soup of lending facilities and ultimately an FDIC guarantee on interbank lending. The problem was that they didn’t put Too Big To Fail banks in a form of receivership and didn’t prosecute bank executives, not that they made sure payments continued to take place. .................(more)

http://www.nakedcapitalism.com/2015/07/mario-draghi-the-ecb-has-no-mandate-to-ensure-checks-clear-or-credit-cards-work.html

July 23, 2015

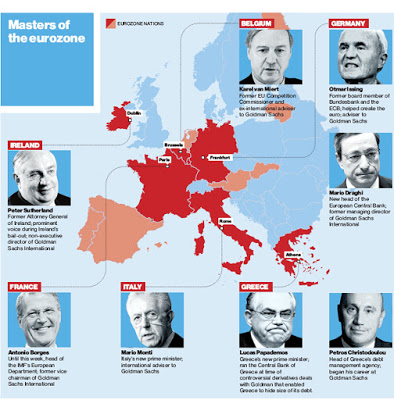

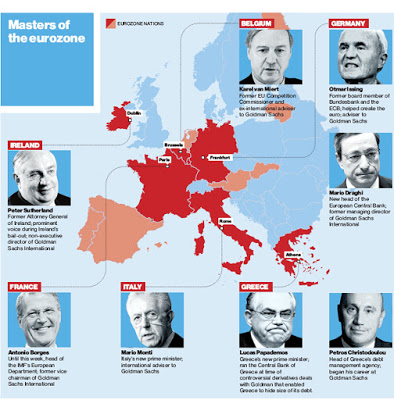

By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. This piece first appeared at Down With Tyranny.

Interesting headline, yes? I have a two-point intro and then the piece.

First, when a “private” group’s chief individuals flow back and forth constantly between government and that group, the group can be said to be “part” of government, or to have “infiltrated” government, or to have been “folded into” government. (Your phrasing will be determined by who you think is the instigator.)

For example, a network of private “security consulting” firms does standing business with the (Pentagon’s) NSA, and by some accounts performs 70% of their work. Are those firms part of the NSA or not? Most would say yes, to a great degree. It’s certain that the NSA would collapse without them, and many of these firms would collapse without the NSA (though many have other … ahem, international … clients, which starts an entirely different discussion).

As another example, the role of mega-lobbying firms as a fourth branch of government was explored here. Same idea.

In the case of the security firms, one might say they have been “folded into” government. In the case of the lobbying firms, one might say they have “infiltrated” government. I hope you notice the difference; both modes of incorporation occur.

Second, consider how in general the “world of money” and the parallel world of “friends of money” — its enablers, adjuncts, consiglieri and retainers — flow in and out of the world of government, of NGOs, of corporate boards, of foundation boards, attends Davos and the modern Yalta (YES) conference, and so on. Now consider how someone like Hillary Clinton — not money per se, though she has a chunk, but certainly a “friend of money” — ticks off most of those boxes (foundation board, corporate board, government, Davos, Yalta, and so on). There are many people like Hillary Clinton; she’s just very front-and-center at the moment.

.....(snip).....

Now the piece from The Independent (my emphasis). Note that it was written in 2011.

http://www.nakedcapitalism.com/2015/07/gaius-publius-goldman-sachs-masters-of-the-eurozone.html

Goldman Sachs – Masters of the Eurozone

By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. This piece first appeared at Down With Tyranny.

Interesting headline, yes? I have a two-point intro and then the piece.

First, when a “private” group’s chief individuals flow back and forth constantly between government and that group, the group can be said to be “part” of government, or to have “infiltrated” government, or to have been “folded into” government. (Your phrasing will be determined by who you think is the instigator.)

For example, a network of private “security consulting” firms does standing business with the (Pentagon’s) NSA, and by some accounts performs 70% of their work. Are those firms part of the NSA or not? Most would say yes, to a great degree. It’s certain that the NSA would collapse without them, and many of these firms would collapse without the NSA (though many have other … ahem, international … clients, which starts an entirely different discussion).

As another example, the role of mega-lobbying firms as a fourth branch of government was explored here. Same idea.

In the case of the security firms, one might say they have been “folded into” government. In the case of the lobbying firms, one might say they have “infiltrated” government. I hope you notice the difference; both modes of incorporation occur.

Second, consider how in general the “world of money” and the parallel world of “friends of money” — its enablers, adjuncts, consiglieri and retainers — flow in and out of the world of government, of NGOs, of corporate boards, of foundation boards, attends Davos and the modern Yalta (YES) conference, and so on. Now consider how someone like Hillary Clinton — not money per se, though she has a chunk, but certainly a “friend of money” — ticks off most of those boxes (foundation board, corporate board, government, Davos, Yalta, and so on). There are many people like Hillary Clinton; she’s just very front-and-center at the moment.

.....(snip).....

Now the piece from The Independent (my emphasis). Note that it was written in 2011.

What price the new democracy? Goldman Sachs conquers Europe.........................(more)

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By replacing the scandal-surfing Silvio Berlusconi, Italy has dislodged the undislodgeable. By imposing rule by unelected technocrats, it has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic.

http://www.nakedcapitalism.com/2015/07/gaius-publius-goldman-sachs-masters-of-the-eurozone.html

July 23, 2015

By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

Last week Mario Draghi held a press conference following the decision to raise ELA a paltry 900 million dollars for Greek banks. In that press conference he said many things but I’d like to focus on one passage that has gotten no attention:

This is a truly shocking statement. To understand why, we need to go back to the basics of central banking. Banks have accounts at the central bank (I’m going to call the balances in these accounts “settlement balances” in line with non U.S. Conventions) which are primarily used to settle payments with other banks. When you use a debit card issued by one bank to pay someone with a bank account in another bank, your bank has to in turn send a payment using settlement balances to make that payment.

As should be obvious from that description, in order to make that payment your bank has to have sufficient settlement balances in its account at the central bank or the central bank must provide an overdraft. Thus, if the smooth functioning of the payments system is defined as the ability of depository institutions to clear payments, the central bank must ensure that settlement balances are available at some price.

The Federal Reserve explicitly recognizes this in its “Policy on Payment System Risk” by stating that “the Board recognizes that the Federal Reserve has an important role in providing intraday balances and credit to foster the smooth operation of the payment system”. Draghi is arguing that the ECB’s mandate to “promote the smooth functioning of the payments system” is defined differently than the Federal Reserve’s mandate and (as far as I can tell) every other Central Bank’s payment system mandate around the world. I can’t under-emphasize how radical a departure Draghi’s position is from the norms of central banking. Whatever else we may want to criticize the Federal Reserve’s and the government’s response to the financial crisis, they did preserve the the smooth functioning of the payments system with their alphabet soup of lending facilities and ultimately an FDIC guarantee on interbank lending. The problem was that they didn’t put Too Big To Fail banks in a form of receivership and didn’t prosecute bank executives, not that they made sure payments continued to take place. .................(more)

http://www.nakedcapitalism.com/2015/07/mario-draghi-the-ecb-has-no-mandate-to-ensure-checks-clear-or-credit-cards-work.html

Mario Draghi: The ECB Has No Mandate To Ensure Checks Clear Or Credit Cards Work

By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

Last week Mario Draghi held a press conference following the decision to raise ELA a paltry 900 million dollars for Greek banks. In that press conference he said many things but I’d like to focus on one passage that has gotten no attention:

There is an article in the Treaty that says that basically the ECB has the responsibility to promote the smooth functioning of the payment system. But this has to do with the functioning of TARGET2, the distribution of notes, coins. So not with the provision of liquidity, which actually is regulated by a different provision, in Article 18.1 in the ECB Statute: “In order to achieve the objectives of the ESCB, the ECB and the national central banks may conduct credit operations with credit institutions and other market participants, with lending based on adequate collateral.” This is the Treaty provision. But our operations were not monetary policy operations, but ELA operations, and so they are regulated by a separate agreement, which makes explicit reference to the necessity to have sufficient collateral. So, all in all, liquidity provision has never been unconditional and unlimited.

This is a truly shocking statement. To understand why, we need to go back to the basics of central banking. Banks have accounts at the central bank (I’m going to call the balances in these accounts “settlement balances” in line with non U.S. Conventions) which are primarily used to settle payments with other banks. When you use a debit card issued by one bank to pay someone with a bank account in another bank, your bank has to in turn send a payment using settlement balances to make that payment.

As should be obvious from that description, in order to make that payment your bank has to have sufficient settlement balances in its account at the central bank or the central bank must provide an overdraft. Thus, if the smooth functioning of the payments system is defined as the ability of depository institutions to clear payments, the central bank must ensure that settlement balances are available at some price.

The Federal Reserve explicitly recognizes this in its “Policy on Payment System Risk” by stating that “the Board recognizes that the Federal Reserve has an important role in providing intraday balances and credit to foster the smooth operation of the payment system”. Draghi is arguing that the ECB’s mandate to “promote the smooth functioning of the payments system” is defined differently than the Federal Reserve’s mandate and (as far as I can tell) every other Central Bank’s payment system mandate around the world. I can’t under-emphasize how radical a departure Draghi’s position is from the norms of central banking. Whatever else we may want to criticize the Federal Reserve’s and the government’s response to the financial crisis, they did preserve the the smooth functioning of the payments system with their alphabet soup of lending facilities and ultimately an FDIC guarantee on interbank lending. The problem was that they didn’t put Too Big To Fail banks in a form of receivership and didn’t prosecute bank executives, not that they made sure payments continued to take place. .................(more)

http://www.nakedcapitalism.com/2015/07/mario-draghi-the-ecb-has-no-mandate-to-ensure-checks-clear-or-credit-cards-work.html

July 23, 2015

The Chilling Thing China’s Electricity Consumption Just Said about the Economy

by Wolf Richter • July 23, 2015

China has been building what is by now the largest high-speed rail system in the world. Subway systems are growing faster than anyone can imagine anywhere else. Ridership is soaring. High-rise buildings are sprouting up like mushrooms, to be occupied by businesses and consumers that are splurging on tech products, appliances, and air conditioning. All powered by electricity.

China built over 23 million cars, trucks, and buses last year, far more than any other country, in plants that are massive consumers of electricity. It’s producing building materials, solar panels, trains, ships, plastic trinkets, smartphones, and a million other things for its own use and for the rest of the world. All these activities require a lot of electrical power.

China is booming. GDP for the second quarter, despite rumors of a slowdown, came in at a once again astonishing annual rate of 7.0%, just as planned, once again confounding hard-landing gurus. Nothing is going to slow down China. It’s fueled by monetary propellants, endless credit that never turns bad and never has to be paid off, and a stock market run by fiat. So it would seem that electricity consumption would be soaring in parallel.

But no.

Electricity consumption in the first half of 2015 inched up to 2,662.4 billion kWh across the country. Compared to the same period last year, that was up a tiny 1.3%. The flimsiest growth rate in 30 years. ..................(more)

http://wolfstreet.com/2015/07/23/china-electricity-consumption-growth-drops-to-30-year-low/

The Chilling Thing China’s Electricity Consumption Just Said about the Economy

The Chilling Thing China’s Electricity Consumption Just Said about the Economy

by Wolf Richter • July 23, 2015

China has been building what is by now the largest high-speed rail system in the world. Subway systems are growing faster than anyone can imagine anywhere else. Ridership is soaring. High-rise buildings are sprouting up like mushrooms, to be occupied by businesses and consumers that are splurging on tech products, appliances, and air conditioning. All powered by electricity.

China built over 23 million cars, trucks, and buses last year, far more than any other country, in plants that are massive consumers of electricity. It’s producing building materials, solar panels, trains, ships, plastic trinkets, smartphones, and a million other things for its own use and for the rest of the world. All these activities require a lot of electrical power.

China is booming. GDP for the second quarter, despite rumors of a slowdown, came in at a once again astonishing annual rate of 7.0%, just as planned, once again confounding hard-landing gurus. Nothing is going to slow down China. It’s fueled by monetary propellants, endless credit that never turns bad and never has to be paid off, and a stock market run by fiat. So it would seem that electricity consumption would be soaring in parallel.

But no.

Electricity consumption in the first half of 2015 inched up to 2,662.4 billion kWh across the country. Compared to the same period last year, that was up a tiny 1.3%. The flimsiest growth rate in 30 years. ..................(more)

http://wolfstreet.com/2015/07/23/china-electricity-consumption-growth-drops-to-30-year-low/

July 23, 2015

from Salon:

“If you don’t want to get shot, just do what I tell you”: American cops are on a dangerous power trip

The defenders of Law enforcement have reacted predictably to the Sandra Bland tragedy -- with bullheaded defiance

HEATHER DIGBY PARTON

The arrest and resultant death of Sandra Bland in Texas after a petty traffic stop has justifiably caught the imagination of the American public. The video of this young woman’s treatment at the hands of police — by all indications for failing to be verbally submissive — is terrifying. National reporters are shocked, and wondering just how something like this could happen in the good old USA.

But those of us who follow these stories all the time know very well that this sort of altercation happens every day in America and often results in tasering, physical violence and worse, as police officers demand total deference in both word and deed in their presence. When citizens attempt to assert their rights, argue with officers or demand justification for being taken into custody, cops move to immediately establish their dominance and often physically force the citizen to comply, regardless of the pettiness of the alleged crime.

Here’s a little reminder of what cops, and many fellow Americans (until it happens to them), believe citizens should do when a police officer is present:

That’s from an op-ed by a former police officer and current criminal justice professor by the name of Sunil Dutta. His argument is, of course, complete nonsense. Yes, on a practical level, knowing what we know about how police behave in this country, one would be wise to just try to get out of any dealings with a cop alive. Here’s a stop that ended with the police breaking a window and tasering a black male passenger inside the car while his kids screamed in the backseat. Here’s one in which the police thought a bike-riding black man (who happened to be a firefighter) was “throwing signs” at them. (He was just waving hello.) In the end, he got lucky. They only threatened to taser him. ...................(more)

http://www.salon.com/2015/07/23/if_you_don%E2%80%99t_want_to_get_shot_just_do_what_i_tell_you_american_cops_are_on_a_dangerous_power_trip/

American cops are on a dangerous power trip

from Salon:

“If you don’t want to get shot, just do what I tell you”: American cops are on a dangerous power trip

The defenders of Law enforcement have reacted predictably to the Sandra Bland tragedy -- with bullheaded defiance

HEATHER DIGBY PARTON

The arrest and resultant death of Sandra Bland in Texas after a petty traffic stop has justifiably caught the imagination of the American public. The video of this young woman’s treatment at the hands of police — by all indications for failing to be verbally submissive — is terrifying. National reporters are shocked, and wondering just how something like this could happen in the good old USA.

But those of us who follow these stories all the time know very well that this sort of altercation happens every day in America and often results in tasering, physical violence and worse, as police officers demand total deference in both word and deed in their presence. When citizens attempt to assert their rights, argue with officers or demand justification for being taken into custody, cops move to immediately establish their dominance and often physically force the citizen to comply, regardless of the pettiness of the alleged crime.

Here’s a little reminder of what cops, and many fellow Americans (until it happens to them), believe citizens should do when a police officer is present:

If you don’t want to get shot, tased, pepper-sprayed, struck with a baton or thrown to the ground, just do what I tell you. Don’t argue with me, don’t call me names, don’t tell me that I can’t stop you.

That’s from an op-ed by a former police officer and current criminal justice professor by the name of Sunil Dutta. His argument is, of course, complete nonsense. Yes, on a practical level, knowing what we know about how police behave in this country, one would be wise to just try to get out of any dealings with a cop alive. Here’s a stop that ended with the police breaking a window and tasering a black male passenger inside the car while his kids screamed in the backseat. Here’s one in which the police thought a bike-riding black man (who happened to be a firefighter) was “throwing signs” at them. (He was just waving hello.) In the end, he got lucky. They only threatened to taser him. ...................(more)

http://www.salon.com/2015/07/23/if_you_don%E2%80%99t_want_to_get_shot_just_do_what_i_tell_you_american_cops_are_on_a_dangerous_power_trip/

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,078