General Discussion

In reply to the discussion: "We are in a depression." [View all]cthulu2016

(10,960 posts)Last edited Thu May 31, 2012, 06:22 PM - Edit history (2)

It sounds like the 10% depression rule was widely taught at some point, and perhaps it still is. I don't know. My impression (which may be wrong) is that most economists do not use any numerical defintion today. If it has faded I support the change because such a statistical rule encourages us to think of recession and depression as points on a continuum, like tropical storm and hurricane.

But they are different animals. I would say that recessions are weather, whereas a depression is climate. All depressions will begin with a recession but few recession lead to depression.

When this thing started people were looking to 1981-1982 for the most comparable recession, because that was the sharpest since the Great Depression. And that comparison had unfortunate effects.

For instance, we can deduce from policy that the Obama administration assumed that the crash of 2008 was a comparable event to 1981 and that Obama would be running in 2012 on "Morning in America' just like Reagan in 1984. And Europe thought the same way, but moreso.

But the initial conditions were radically different.

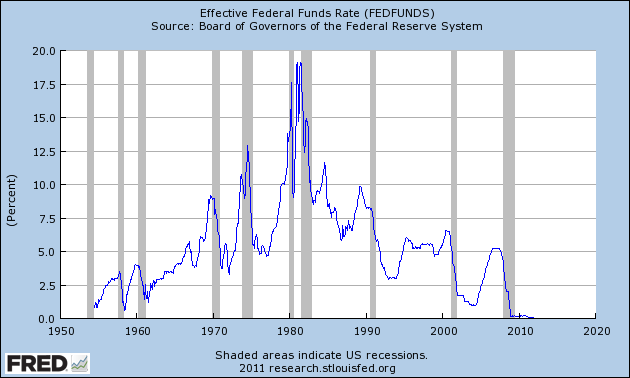

The 1981 recession was induced by Paul Volker to wring inflation out of the economy. Jack the fed funds rate up to 19% until the economy stops and then you have an amazing 19 points of monetary stimulus available to restart it. You can see that the Fed Funds rate was decreased ten points during that recession.

Our recent recession, on the other hand, happened in an already low-inflation environment. The Fed was only able to reduce that rate 4-5 points before hitting zero.

The very same initial GDP drop or unemployment increase in those two environments will play out very differently.

The GHW Bush recession that put Clinton in office was created by Iraq invading Kuwait. By the time that shock worked through the system we had already beat Iraq and come back home... and then the recession came. Ironic for Bush.

That was the product of uncertainty and a commodity shock in oil. The 1981 recession was a product of monetary policy. The Great Depression was the product of a bubble collapse. (The stock market, in 1929). With different origins we shouldn't expect similar results. Bubble collapses tend to take down whole economies.

For some reason, bubble collapses are harder on employment. The market crash of '29 lead to a decade of low employment. The burst of the internet bubble led to Bush's jobless presidency. (Despite incredible levels of fiscal stimulus) And the collapse of the housing market lead to our current job-weak world, without ever recovering from the internet bubble in between.

I would say a depression is the condition you can get from a type of big recession that is not self-repairing (unlike a business inventory cycle or monetary policy or temporary commodity shock recession) and that simple GDP will not identify the difference.

Depressions feature basic psychological changes in the economy. People do not assume a recovery and that becomes a partially self-fulfilling prophecy. In a usual recession half the players are positioning themselves to profit on the recovery. But sometimes the players go hide in a cave.

And I suspect that bubble collapses have a uniquely negative effect on that psychology. Things that were the pillar of the economy a year ago are now trash. We lose trust in the economy itself.

The Japanese lost decade began with a dual collapse of the stock market and housing market.

Are depressions always products of bubble collapse? I don't know, but if so that would be a useful part of a definition.