The Recent drop in the price of oil, is below the cost of Drilling the well and pumping the oil out.

For some plays, that's no doubt the true... but not in the cases discussed in the article.

The price of PUMPING the oil is what they are talking about NOT the cost of DRILLING the well.

All evidence to the contrary.

On top of these two costs, most of these wells are "Leases" which requires payment on a per month basis to the owner of the property. These payments MUST be made whether any oil is pumped or NOT, thus to get money to pay the leases, oil must be pumped, even if it is at a loss, for without pumping the oil, the well would have an even greater loss.

On top of these two costs, most of these wells are "Leases" which requires payment on a per month basis to the owner of the property. These payments MUST be made whether any oil is pumped or NOT, thus to get money to pay the leases, oil must be pumped, even if it is at a loss, for without pumping the oil, the well would have an even greater loss.

Sorry. That's incorrect. The word "lease" may be the confusion in this case, but the vast majority of shale leases are single up-front payment and then they pay royalties on the oil extracted. The carrying cost of the "lease" is tiny ($25-50/acre/

year)

And don't forget the "fracklog". Those are wells that are drilled and then not completed so that the supply doesn't hit the market while prices are down (essentially a new form of contango).

From what I have read this will continue till about 2017, but some think it will be sooner, a few as soon as the end of 2015.

Of course that's "What you've read". And those same POTB (Peak Oil True Believer) sources have been saying the same thing for years and will continue to (even as their numbers shrink faster than drilling rig counts). The only difference is that rather than "2015 to 2017 at the latest" it's really "this year to a couple years down the road at the latest". You forget that those same sources didn't think that shale plays would ever do what they have clearly done.

The reason for this is no one is drilling any new wells

Sorry. You're not entitled to your own reality. The rig count has fallen, but there are hundreds of operating rigs drilling new wells. Note that the article is talking about producers who have plants to increase production with $40-50 prices.

prices up and down depending on demand (When prices are high demand will drop, when prices are low demand will increase) and Supply (When prices are high, supply will increase, when prices are low, supply will increase).

A peak oiler discovers the law of supply an demand?

What did you think was impacting oil prices all along?

the days of stable oil prices are behind us

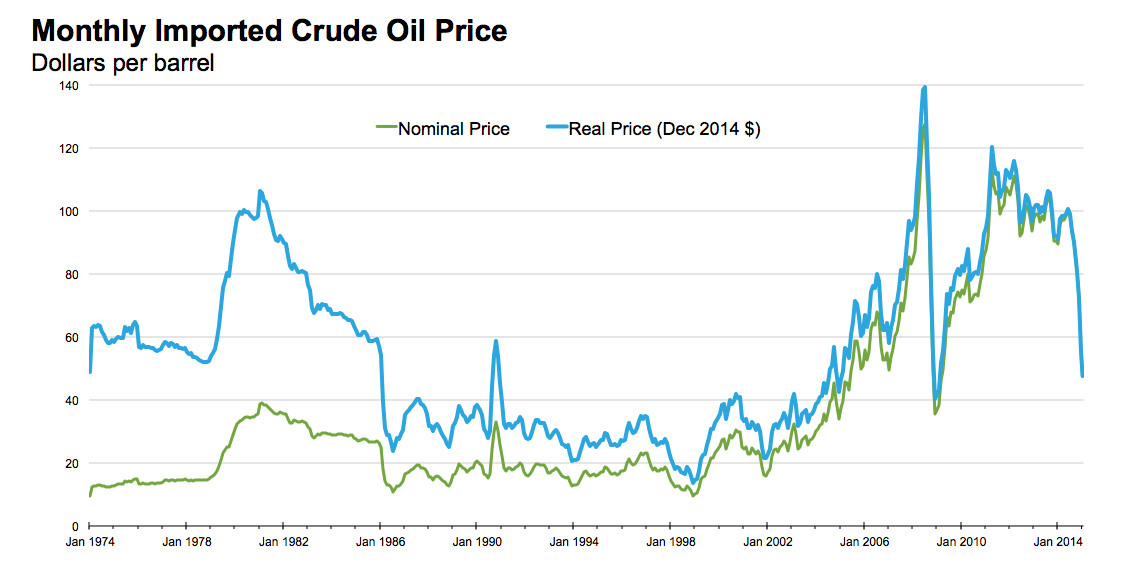

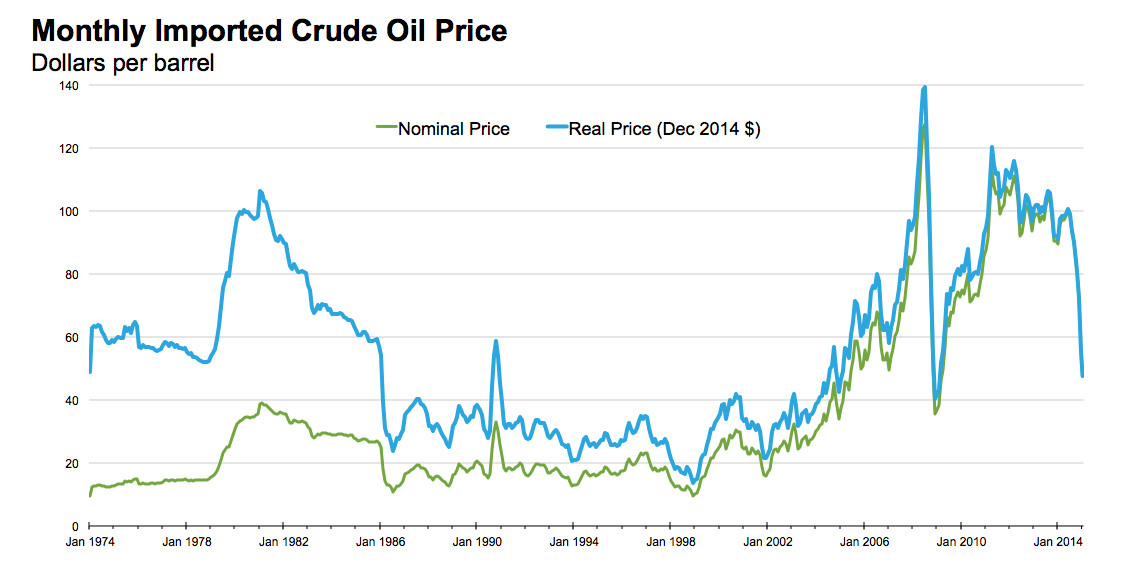

Can you point to those days on the chart below?

prices go up, generally twice as fast as prices fall

Again... please review the data. That hasn't been the case.

prices going up and down in short bursts and busts as demand exceeds supply and then supply exceeds demand.

prices going up and down in short bursts and busts as demand exceeds supply and then supply exceeds demand.

Well... I suppose that's at least progress. Until a few years ago, the average POTB couldn't type that sentence. It would have to be that prices go up until demand is destroyed and then collapse as economies decline... then they go back up as supply continues to slide, continuing the collapse as demand painfully shrinks with collapsing supply.

The lesson that the POTBs still need to learn is the one that they missed with shale all along: Technological advances often lower the price of production (which, in turn, increases reserves and supply at a given price point).

= new reply since forum marked as read

= new reply since forum marked as read